When Should I Get My Payment

The IRS was given hard and fast deadlines to send the two rounds of Economic Impact Payments out to American families. The first round of payments had to be sent out by December 31, 2020. The second round had to be sent out by January 15, 2021.

What this means: If you have not received the first or second round of payments yet, then you will not be getting them in advance. The good news is that you can still do something to get these payments. Read below.

How You Can Expect To Receive Your Stimulus Payment

The most important thing to remember if youre an adult dependent looking for a stimulus payment: You wont be individually receiving these stimulus payments. Rather, theyll be incorporated in the lump sum that your parent or guardian receives.

The IRS and Treasury Department are delivering stimulus checks through three main methods: direct deposit, as well as mailed physical check or a prepaid debit card. If your household has a bank account and routing number on file with the IRS, the payment will most likely hit your familys bank account, the fastest method of delivery. New to this round, the Treasury Department is also working across government agencies to access any bank accounts that might have been on file for other federal payments, potentially speeding up the delivery process.

Mailed checks or debit cards will likely take longer, potentially adding weeks to the process. Be sure to keep a watchful eye out for any letters or notices that come from the IRS or Treasury Department and hold onto any documents referring to your stimulus payment.

The IRS started delivering the third stimulus check round on March 12 and has now delivered roughly four-fifths of all payments, according to a . The IRS will continue delivering paper checks and debit cards on a weekly basis, a process that started officially on March 19.

Who Is Not Eligible

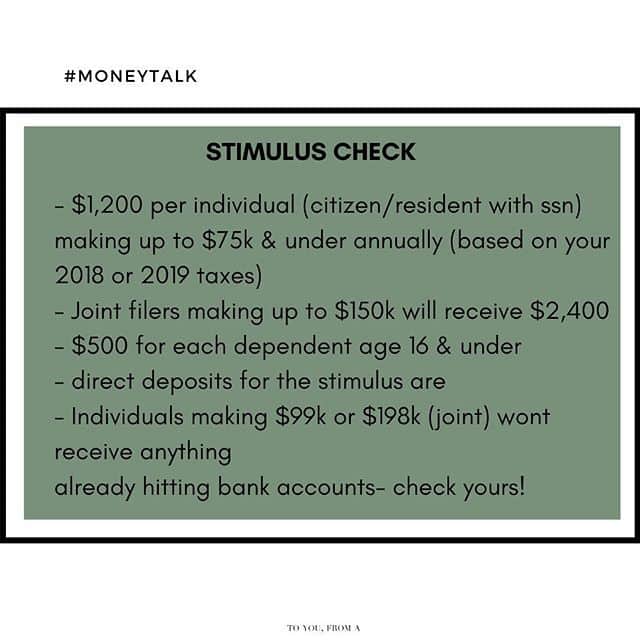

Although some filers, such as high-income filers, will not qualify for an Economic Impact Payment, most will.

Taxpayers likely wont qualify for an Economic Impact Payment if any of the following apply:

- Your adjusted gross income is greater than

- $99,000 if your filing status was single or married filing separately

- $136,500 for head of household

- $198,000 if your filing status was married filing jointly

You May Like: When Were The Three Stimulus Checks Sent Out

When Is The Irs Deadline To Send New Stimulus Checks

At this point, the US treasury and the IRS are working fast to send all the stimulus checks as soon as possible. At the same time, they set a deadline for December 31st, 2021 to send out all of the payments.

In a way, this is good news this means they havent set a compressed deadline, meaning that should an issue appear, you have the time to address it. There is also the reassurance that since it wont be a rushed project, theres a lower chance of payments being missed or problematic.

At the same time, this means that numerous people may have to wait for a fair amount of time before they receive their stimulus check. Certain people have priority, but we have still much to learn about the IRS delivery system. In most cases, all we can do is wait as we track the stimulus check online.

When Will I Get My Stimulus Check

As Mnuchin said, direct payments may begin to hit bank accounts as early as Tuesday evening and continue into next week. Some people may see the direct deposit payments as pending or as provisional payments before Jan. 4, 2021, the official payment date, the IRS said in a statement.

If the IRS doesn’t have your direct deposit information, it will likely take longer for you to get your hands on the money. Paper checks will be mailed beginning Wednesday, Mnuchin said.

You can see the status of your stimulus check using the Get My Payment tool, which will show when and how it sent your first and second payments.

You May Like: When Will The Stimulus Check Come Out

You Haven’t Filed Taxes For 2018 Or 2019

In most cases, the IRS determines whether someone is eligible for a stimulus check, and how much they’ll get, based on their most recent tax return for 2019, or 2018 if the individual hasn’t filed yet this year. The deadline to file federal taxes has been pushed back from April 15 to July 15 this year, but nonetheless it may be in your best interest to file your taxes sooner than later.

People who have already filed their taxes do not have to do anything to get their checks. However, some people are not required to file taxes, and they could miss out on stimulus payments if they do not take action. Low-income earners with gross income of $12,200 or less do not need to file federal tax returns. For these people to receive a stimulus payment, they must register at the IRS’s “Non-Filers: Enter Payment Info Here” page.

What If I Am Married To Someone Who Owes Child Support Will My Tax Return Be Applied To The Child Support Arrears They May Owe

-

Yes,unless you are eligible for relief. If youdo not owe child support butyouare married tosomeonewhoowes child support,you may need to file an Injured Spouse Claim and Allocation -Form 8379

-

In some instances, the IRS offsets a portion of the payment sent to a spouse who filed an injured spouse claim if it has been offset by the non-injured spouses past-due child support. The FAQ on the IRS stimulus FAQ www.irs.gov/coronavirus/economic-impact-payment-information-center website states: The IRS is aware that in some instances a portion of the payment sent to a spouse who filed an injured spouse claim with his or her 2019 tax return has been offset by the non-injured spouses past-due child support. The IRS is working with the Bureau of the Fiscal Service and the U.S. Department of Health and Human Services, Office of Child Support Enforcement, to resolve this issue as quickly as possible. If you filed an injured spouse claim with your return and are impacted by this issue, you do not need to take any action. The injured spouse will receive their unpaid half of the total payment when the issue is resolved.

Recommended Reading: How To Sign Up For The Stimulus Check

Where Is My 2nd Stimulus Check

Americans may check the status of their payments at https://www.irs.gov/coronavirus/get-my-payment, much as with the first round of stimulus cheques under the CARES Act. The Get My Payment service, which was reopened on Monday, will let you know whether the IRS has issued both your first payment and your second stimulus check.

There’s A Glitch With Your Bank Tax Prep Software Or The Irs

This explanation may be the most frustrating of all for people wondering where the heck their stimulus checks are. But a mistake made by your bank, the IRS, or the tax-prep software you used to file returns could screw up your stimulus payment.

As the Washington Post reported, the stimulus payments for millions of taxpayers may be delayed because of a glitch with tax-prep software firms, such as TurboTax, H& R Block, and Jackson Hewitt. The IRS might not have direct deposit information for you if you used one of these services and received an advance on your tax refund, or if you paid for the service by deducting the fee from your tax refund. And if the IRS doesn’t have your direct deposit info, your stimulus check will be delayed. If you think this situation applies to you, use the IRS Get My Payment app to provide the agency with your direct deposit details.

You May Like: Who Can I Call To Get My Stimulus Check

Is There Any Stimulus For Senior Citizens

There are certain protections for seniors even if it does not include a fourth stimulus check for them. The law makes it simpler for the government to negotiate medication pricing while also extending Medicare to cover hearing services. Although the measure wasnt approved in 2021, theres still hope for it in 2022.

The 2021 Stimulus Payment

On March 11, 2021, the American Rescue Plan was signed into law. It called for sending a third round of stimulus checks to Americans. The American Rescue Plan authorized a $1,400 stimulus payment to eligible people. Learn more about it on the IRS website. Most people already received their payments, which were based on income reported on their 2019 or 2020 tax return.

If you believe you did not get all or part of the $1,400 stimulus from the American Rescue Plan of 2021, you should claim this as a recovery rebate credit on your 2021 tax returnLearn where to get help filing your taxes.

You May Like: What’s Happening With The Stimulus Checks

Do College Students And Adult Dependents Qualify For Stimulus Payments

Yes. Adult dependents, including college students and disabled adults, may receive up to $1,400. But their eligibility for payment and the amount theyll receive will depend on the adjusted gross income of the person who claims them on their taxes. See the question above for income limits and phase-out details.

When Will I Receive My Check

People with direct deposit information on file at the IRS could receive the payment by the end of the week of April 13, according to Vice President Pence.

People without direct deposit information on file at the IRS may not get checks until as late as mid-August or later, according to a memo obtained by The Associated Press.

An IRS spokesperson recently told the Washington Post the first paper check stimulus payments will be issued to people in the lowest-income bracket beginning on April 24.

If you currently do not have direct deposit information on file and want to update your information, the IRS has said a web-portal will be announced in the coming weeks that will allow individuals to provide their banking information to the IRS online, so that individuals can receive payments immediately as opposed to checks in the mail.

If you dont want to wait for the web-portal to be announced, TurboTax has partnered with the IRS to offer a stimulus registration program that allows you to register your direct deposit information with the IRS. However, it does require you to create an account with TurboTax.

Don’t Miss: New York Stimulus Check 4

How To Track Your Stimulus Check Online

With the IRS Get My Payment tool, you can get a daily update on your payment status. The online app can also alert you with a message if there’s a problem with your payment that you may need to address. Another option is to create an online account with the IRS, if you haven’t already.

If you get sent a plus-up payment after your 2020 tax return is processed, the amount of your third payment will no longer show up in the tool, according to the IRS. In that case you will only see the status of your plus-up payment.

If you expect your payment to come in the mail, you can use a free tool from the US Postal Service to track your mailed stimulus payment.

I Dont Have A Bank Account How Can I Receive My Stimulus Payment

If youre one of the 14.1 million Americans who dont have a bank account, youll still be able to receive a stimulus payment. The IRS will mail your check to the address it has on file for you. However, it may take a while to arrive.

If you log in to the IRSs online Get My Payment tool with your Social Security number, date of birth and mailing address, youll be able to track your payment. However, if you dont usually file a tax return, the IRS says your data might not be in the system yet.

Individuals without bank accounts could use the paper checks to open up a checking or a savings account. However, as Hasen explains, many people who dont have bank accounts face multiple barriers to opening one some lack an ID, or its hard to access a physical bank location, especially as many are limiting operations during the coronavirus outbreak. In those cases, people can cash their checks at cash checking businesses though they may be subject to a fee or use offerings like Squares Cash App, which allows for direct deposits without a traditional bank account.

Don’t Miss: How Many Stimulus Checks Did We Get In 2020

What About People With Itins

You still need a work-authorizing Social Security Number to be eligible for this stimulus. However, there are important changes since the first round of stimulus checks.

- In the first stimulus rollout, any non-SSN holder on a joint return made everyone on that return ineligible. Big change: The new rounds of stimulus has corrected this problem. If you filed a joint return with a non-SSN holder, you are still eligible for the stimulus. See the below hypotheticals.

- Situation: A single tax filer has an Individual Taxpayer Identification Number but no Social Security number .

- This person is ineligible for the stimulus.

When Will I Get The Recovery Rebate Credit

You will most likely get the Recovery Rebate Credit as part of your tax refunds. If you electronically file your tax return, you will likely receive your refund within 3 weeks. If you mail your return, it can take at least 8 weeks to receive your refund.

Claiming the Recovery Rebate Credit will not delay your tax refund. However, if you dont claim the correct amount of the Recovery Rebate Credit, your refund may be delayed while the IRS corrects the error on your return. The IRS will send you a notice of any changes made to your return.

You can check on the status of your refund using the IRS Check My Refund Status tool.

Recommended Reading: Veterans To Receive Stimulus Payment

Why Won’t The Irs Let Me Sign Up To Receive The Third Payment As A Direct Deposit

Good question, and we don’t have an answer. The IRS opened up direct deposit registration for the first stimulus check in April 2020 and shut down the feature on May 15 that year. The tool wasn’t turned back on for the second checks, when the agency had just over two weeks to complete making payments.

This time, the IRS said it’ll “use data already in its systems to send the third stimulus payments. Taxpayers with direct deposit information on file will receive the payment that way. Those without current direct deposit information on file will receive the payment as a check or debit card in the mail.”

In general, you’ll get your money faster through direct deposit than with a paper check.

The Irs Has The Wrong Bank Info

The IRS is sending payment to the bank account it has on file for you. If you’ve changed banks and closed the account, or the bank number on file with the IRS is wrong, the payment won’t go through, but you’ll still get your money. As the IRS says, “If the account is closed or no longer active, the bank will reject the deposit and you will be issued a check that will be mailed to the address we have on file for you.”

Read Also: Sign Up For Stimulus Check

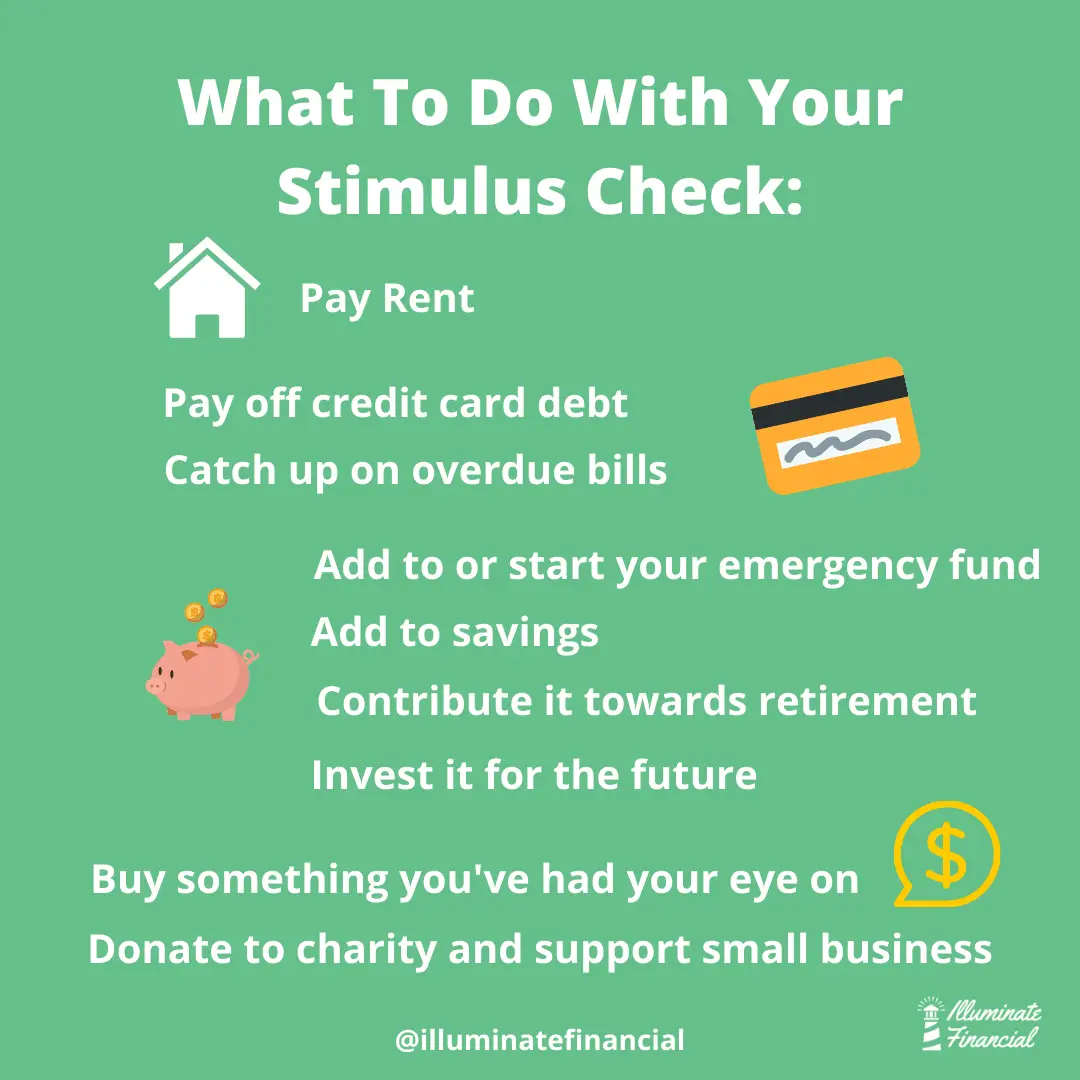

I Get Ssi Should I Spend The Stimulus Money Within A Year What Can I Spend It On

Spend down your CARES Act EIP money before 12 months have passed since receiving the payment. You are not limited in what you can spend the money on. You can spend down on whatever you wish, including on gifts and charitable contributions. If you don’t spend it within 12 months, the Social Security Administration will count the money as a resource.

Four Deadlines This Month To Get Up To $800 Direct Payments And $150 Gas Cards

You have until October 17 to file a tax return for the 2020 and 2021 tax years.

If you don’t typically file a federal income tax return, this is the step-by-step process you should complete to claim your money.

First, you need to provide the following information:

- Step 1: Full name, current mailing address, and email address.

- Step 2: Date of birth and valid Social Security number.

- Step 3: Bank account number, type, and routing number, if you have one.

- Step 4: Identity Protection Personal Identification Number you received from the IRS earlier this year, if you have one.

- Taxpayers who previously have been issued an Identity Protection PIN but lost it, must use the Get an IP PIN tool to retrieve their numbers.

- Step 5: Drivers license or state-issued ID, if you have one.

- Step 6: For each qualifying child during 2019: name, Social Security number or Adoption Taxpayer Identification Number and their relationship to you or your spouse.

Read Also: $600 Stimulus Check Not Received