What Should You Do If You Are A Non

Good question, if you are non filer chances are you will not get the payment until you file the returns.

Good news is there is a tool for non filers to help them getting the payment.

You can use the link given below to provide complete information is required by the IRS for possible payment through stimulus check.

Before providing information Visit this link.

Complete Guide To Irs Stimulus Payments For Non

This post is an extensive guide to IRS stimulus payments for non filers. If you are a non filer and looking for payment through stimuluscheck, read the post for detail updates and guide.

As we know that some residents of the United States received a stimulus check in the first round. Stimulus Check second round is expected in the coming days.

Alert: Only provide information to IRS.gov. Do not provide information to the links not provide by/on IRS website.

Stay Safe and keep your information secure

How Do I Apply For A Stimulus

You can file your taxes online for free at https://www.myfreetaxes.com/ or you can go to https://www.getyourrefund.org/ to get free virtual assistance with filing. Due to the COVID-19 pandemic, Congress passed the CARES Act. Under this Act, most Americans will get an Economic Impact Payment from the IRS.

You May Like: Social Security Stimulus Checks Update

Snap And Medicaid Agencies Can Reach About 9 Million Eligible People Not Receiving Automatic Payments

We estimate that approximately 9 million of the 12 million people who wont automatically receive the payments receive state- or county-administered benefits such as SNAP or Medicaid, a fact that underscores the key role for state government in reaching this group. They have low incomes and are among those who most need the payments to cover essential expenses. The payments for which they qualify, worth a combined $9 billion, represent a significant sum both individually and collectively. In Alabama and North Carolina, for example, their payments total an estimated $209 million and $324 million, respectively, or nine toten times the amount of basic cash assistance those states provide annually through their Temporary Assistance for Needy Families programs , our estimates suggest.

While many SNAP and Medicaid recipients file federal income tax returns and hence will receive their payments automatically, state agencies are the primary organizations able to reach those who dont file. State agencies are uniquely placed to use existing contact information to alert eligible people about the payments and connect them with services to help them obtain their payment.

As state agencies reach out to the 9 million people, the following groups would be useful targets for outreach efforts:

| TABLE 1 | |

|---|---|

| * | * |

Information Required From Non Filers By Irs For Stimulus Payment

- Full name, current mailing address and an email address

- Date of birth and valid Social Security number

- Bank account number, type, and routing number, if you have one

- Identity Protection Personal Identification Number you received from the IRS earlier this year if you have one

- Drivers license or state-issued ID, if you have one

- For each qualifying child: name, Social Security number or Adoption Taxpayer Identification Number and their relationship to you or your spouse

Recommended Reading: What’s The Update On The 4th Stimulus Checks

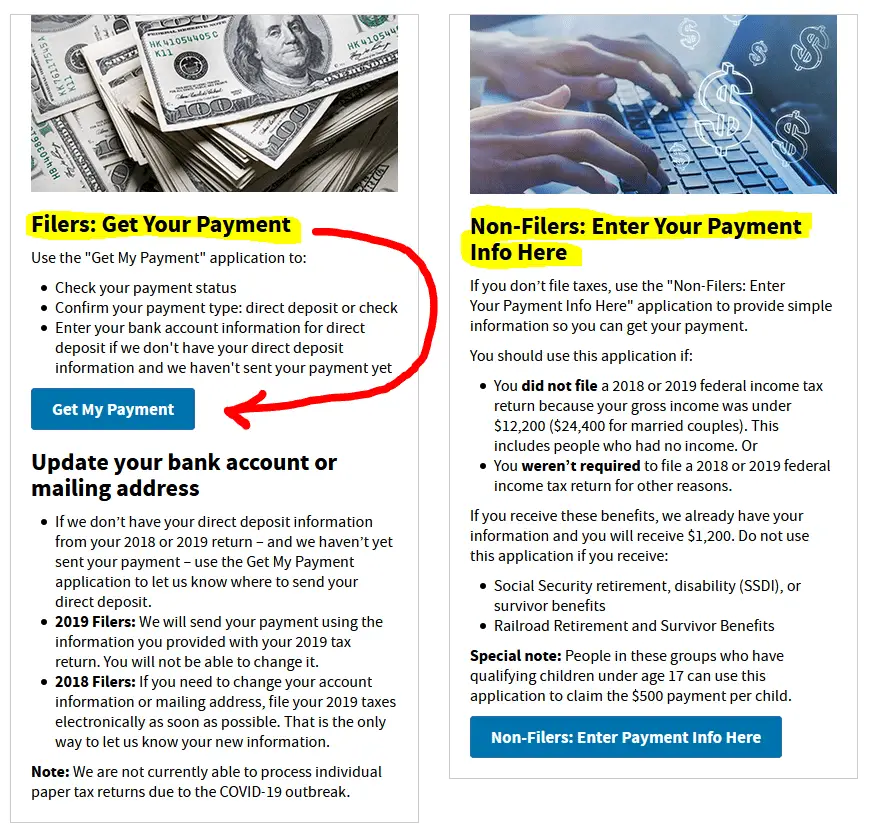

Who Should Not Use The Non

Anyone who already filed either a 2018 or 2019 return does not qualify to use this tool. Similarly, anyone who needs to file either a 2018 or 2019 return should not use this tool, but instead they should file their tax returns. This includes anyone who files a return to claim various tax benefits, such as the Earned Income Tax Credit for low-and moderate-income workers and working families.

The IRS also has seen instances where people required to file a Form 1040 for 2019 are trying to use the Non-Filers tool. The IRS urges people with a filing requirement to avoid complications later with the IRS, and file properly without using the Non-Filer tool.

Students and others who file a return only to receive a refund of withheld taxes should also not use this tool. In addition, students and others claimed as dependents on someone else’s tax returndon’t qualify for an Economic Impact Payment and are not eligible to use the Non-Filers tool.

For more Information on Economic Impact Payments, including answers to frequently-asked questions and other resources, visit IRS.gov/coronavirus.

What Are The Next Steps

Click or tap on Non-Filers: Enter Payment Info on irs.gov.

Provide your name, address, Social Security number and that of dependents.

If available, enter bank account information. This will allow the IRS to deposit directly into the account otherwise, payment will be mailed to the address provided.

Don’t Miss: How Many Stimulus Checks Did We Get In 2020

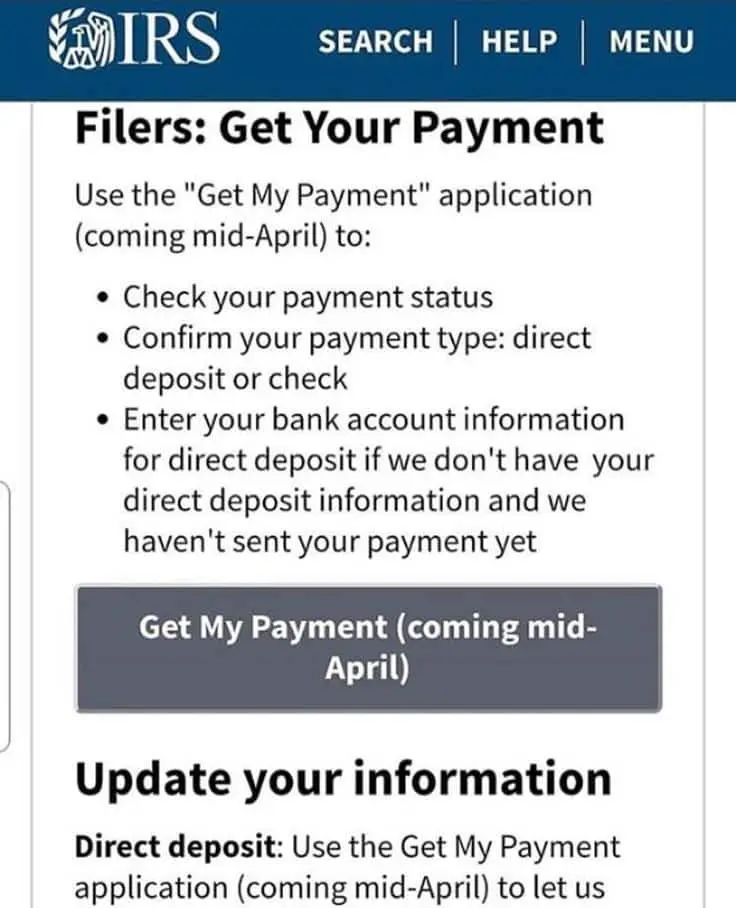

Irsgov Feature Helps People Who Normally Don’t File Get Payments Second Tool Next Week Provides Taxpayers With Payment Delivery Date And Provide Direct Deposit Information

IR-2020-69, April 10, 2020

WASHINGTON To help millions of people, the Treasury Department and the Internal Revenue Service today launched a new web tool allowing quick registration for Economic Impact Payments for those who dont normally file a tax return.

The non-filer tool, developed in partnership between the IRS and the Free File Alliance, provides a free and easy option designed for people who don’t have a return filing obligation, including those with too little income to file. The feature is available only on IRS.gov, and users should look for Non-filers: Enter Payment Info Here to take them directly to the tool.

“People who don’t have a return filing obligation can use this tool to give us basic information so they can receive their Economic Impact Payments as soon as possible,” said IRS Commissioner Chuck Rettig. “The IRS and Free File Alliance have been working around the clock to deliver this new tool to help people.”

The IRS reminds taxpayers that Economic Impact Payments will be distributed automatically to most people starting next week. Eligible taxpayers who filed tax returns for 2019 or 2018 will receive the payments automatically. Automatic payments will also go in the near future to those people receiving Social Security retirement, survivors, disability , or survivor benefits and Railroad Retirement benefits.

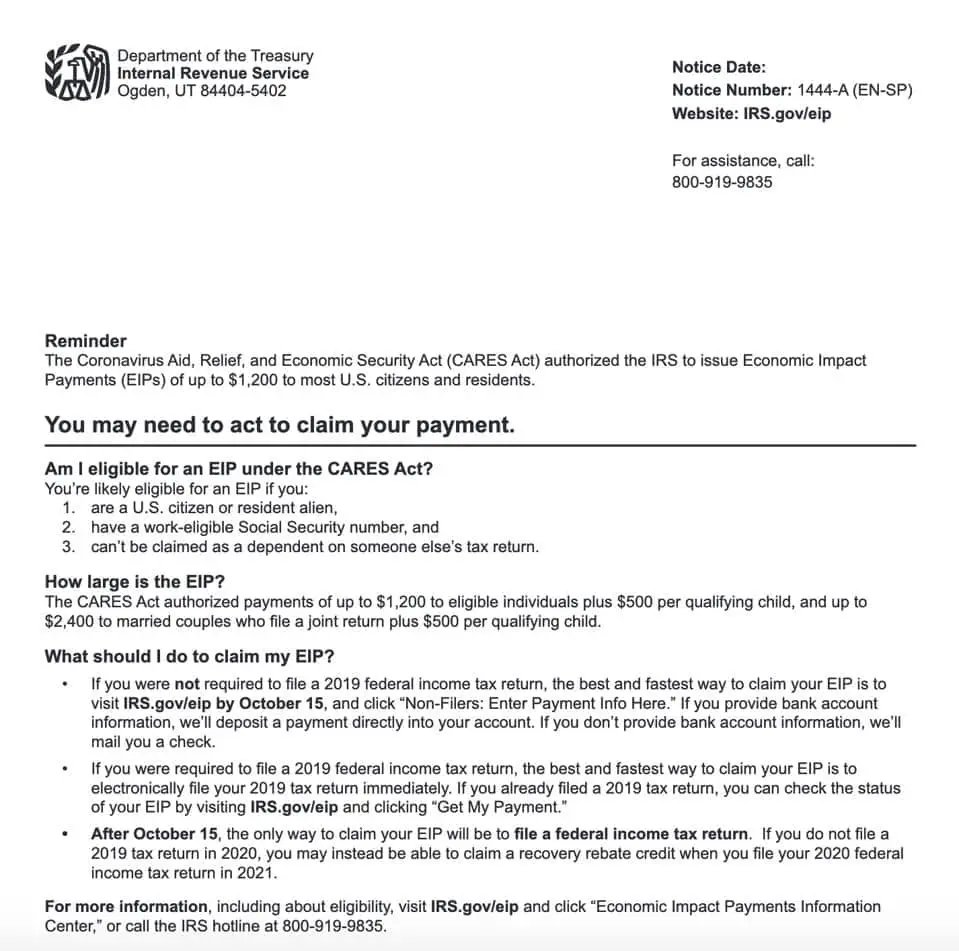

Most People Who Qualify Under The Cares Act Should Receive Their Payment Automatically But Some May Need To Submit Their Information To The Irs To Receive Their Economic Impact Payment

As a result of the hardships presented by the coronavirus, Economic Impact Payments are being issued by the Internal Revenue Service. While most people will receive their payment automatically, there are some cases where non-filers will need to take action and submit their information to the IRS.

The best way to submit your info to receive the payment is through the IRS Non Filers Enter Payment Info portal. There, youll choose how you want to receive your payment. The fastest way to receive payment is through direct deposit, either to your bank or credit union account, or to an eligible prepaid card.

Read Also: Federal Stimulus Pays Off Mortgage

State Stimulus Payments 202: These States Are Sending Out Checks In September

Numerous states are issuing tax refunds and stimulus payments this fall. Find out if yours is one of them.

Dan Avery

Writer

Dan is a writer on CNET’s How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

After a soft launch on Friday, the Virginia Department of Taxation began sending out some 3.2 million tax rebates worth up to $500 this week. At the same time, Illinois residents should start receiving income tax rebates worth up to $100 and a property tax refund of up to $300.

Hawaiians who earned under $100,000 got a $300 rebate earlier this month, while many Colorado taxpayers should get a $750 refund check by Sept. 30, thanks to the state’s Taxpayer’s Bill of Rights Amendment.

Which other states are issuing payments in September and beyond? How much money can eligible taxpayers get? Read on to find out.

For more on economic relief, check out plans for statewide child tax credits, as well as gas rebate checks and gas tax holidays across the US.

Other Work Continues On Economic Impact Payments Watch Mail For Checks Eip Cards

In addition to work for federal benefit recipients, the IRS also continues to prepare and deliver additional Economic Impact Payments for other eligible individuals as well as deliver tax refunds.

For those receiving payments in the mail, the IRS urges these taxpayers to continue to watch their mail for these payments, which could include a paper Treasury check or a special prepaid debit card called an EIP Card.

Taxpayers should note that the form of payment for the third Economic Impact Payment, including for some Social Security and other federal beneficiaries, may be different than earlier stimulus payments. More people are receiving direct deposits, while those receiving payments in the mail may receive either a paper check or an EIP Card which may be different than how they received their previous Economic Impact Payments.

Recommended Reading: Is Economic Impact Payment Same As Stimulus

How Does Non Filers Get Stimulus Check

The best way to submit your info to receive the payment is through the IRS Non Filers Enter Payment Info portal . There, you’ll choose how you want to receive your payment. The fastest way to receive payment is through direct deposit, either to your bank or credit union account, or to an eligible prepaid card.

Some Federal Benefit Recipients Already Have Received An Economic Impact Payment

The IRS emphasizes that federal benefit recipients in these groups who file tax returns already started to receive Economic Impact Payments earlier this month, along with other taxpayers.

Because some federal benefit recipients do not file tax returns, the IRS did not have in its tax systems the current information needed to generate the Economic Impact Payments. Last year, the IRS took the unprecedented step to receive and review data from other federal agencies and use that data to deliver payments automatically to these recipients. This action which had never occurred in previous stimulus efforts minimized risk and burdens for the American public during the pandemic. Due to regular changes in the federal benefits population, the IRS needed to receive updated information this month from other government agencies. With these critical updates, eligible federal benefit recipients who don’t normally file an income tax return will get a payment automatically in the next few weeks.

Making these automatic payments to federal beneficiaries involves a complex, multi-step process to handle recipient data from the other agencies. For the first round of Economic Impact Payments last year, recipients in these groups received payments within four to six weeks after the CARES Act was signed into law. For the American Rescue Plan signed March 11, the IRS projects that it is on track to deliver Economic Impact Payments to federal beneficiaries at the same or faster speed.

Also Check: 4th Stimulus Check For Single Person

Many Families Have Had Complicated Experiences Receiving Their Stimulus Checks Sometimes Receiving Some Payments But Not Others And Many Are Unsure How Much More They Deserve Or How To Get The Rest

Policymakers and advocates often assume that receipt of benefits like the stimulus is binary filers and federal beneficiaries received the EIPs, and non-filers did not. In practice, there is often much more ambiguity, with families having received some payments and not others, or not being sure exactly which payments they did or did not receive. While some of these cases are based on families imperfect understanding of eligibility rules and procedures, others are genuinely ambiguous, and there is no substitute for clearer reporting and better direct customer service.

Of our 11 interviewees, four received payments with no issues. Of the remaining seven, five were such ambiguous edge cases and even the other two reported some irregularities:

Two other interviewees got their own payments in relatively good order, but told us stories about others who had confusing experiences that cannot be easily collapsed into receipt or non-receipt:

Complete Irs & Tax Representation

How Tax Non-Filers Apply for COVID-19 Stimulus Payment

UPDATE: U.S. residents will receive the Economic Impact Payment, due to the financial domino effects of COVID-19 pandemic. Typically, receiving the payment requires filing a 2019 or 2018 tax return. Here is how to get COVID-19 stimulus payments for people that do not file tax returns.

QUICKLY, THE BASIC RULES

Just a quick refresher on the rules for eligibility, which are basically the same for everyone.You are eligible to receive an amount of up to $1,200 for filing as an individual or head of household, and up to $2,400 for married filing jointly if you are not a dependent of another taxpayer and have a valid Social Security number.

The amount is based on your adjusted gross income. Eligible people will receive some amount of payment if their 2019 AGI fell within the following ranges:

$75,000 and $99,000 for anyone with filing status single or married filing separately 112,500 and $136,500 for anyone with head of household $150,000 and $198,000 for anyone with filing status was married filing jointly.

As we explained in earlier articles, the amount of the reduced payment will be based upon that persons specific adjusted gross income. However, filing status and adjusted gross income is something only identified when you prepare and file a tax return.

WHAT ABOUT PEOPLE THAT DO NOT FILE TAX RETURNS?

CAN STUDENTS QUALIFY FOR A COVID STIMULUS CHECK?

Read Also: The First Stimulus Check Amount

Remaining 12 Million Eligible People Have Very Low Incomes

By definition, the estimated 12 million people not receiving payments automatically have very low incomes because they arent required to file federal income tax returns. Only people with annual income above the following levels have a legal obligation to file a return for 2020: $12,400 for singles, $18,650 for heads of household , and $24,800 for married couples.

The 12 million group is predominantly non-elderly. Many senior citizens are receiving automatic payments because they receive Social Security, Railroad Retirement, SSI, or veterans pensions or disability benefits. Up to 1 million seniors, though, may be eligible for payments but do not receive them automatically.

The outstanding payments amount to roughly $12 billion nationally, which if delivered and spent would not only reduce hardship but also give state and local economies a much-needed boost.

Can You Get A Stimulus Check If You File Married Filing Separately

A: The amount of your rebate or stimulus payment is based on your adjusted gross income . … So, if you’re single or married filing separately and your AGI is more than $99,000 you do not qualify for a stimulus payment. If you earn more than $136,500 and file as head of household, you do not qualify for a payment.

Also Check: How Much Third Stimulus Check

Special Reminder For Those Who Don’t Normally File A Tax Return

People who don’t normally file a tax return and don’t receive federal benefits may qualify for these Economic Impact Payments. This includes those experiencing homelessness, the rural poor, and others. For those eligible individuals who didn’t get a first or second Economic Impact Payment or got less than the full amounts, they may be eligible for the 2020 Recovery Rebate Credit, but they’ll need to file a 2020 tax return. See the special section on IRS.gov: Claiming the 2020 Recovery Rebate Credit if you aren’t required to file a tax return.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Read Also: Contact Irs About Stimulus Payment

What If I Dont Have A Permanent Address

You can receive monthly Child Tax Credit payments even if you dont have a permanent address. You can list a trusted address where you would like to temporarily receive your monthly checks, such as the address of a friend, relative, or trusted service provider like a shelter, drop-in day center, or transitional housing program.

Who Is Eligible To Use The Tool

This free resource is designed for:

-

People whose gross income from their 2018 or 2019 federal income tax return was under $12,200 for single filers or $24,400 for married couples

-

People who arent required to file a 2018 or 2019 federal income tax return for other reasons

-

People who receive Social Security, Social Security Disability Insurance or Railroad Retirement benefits and have children younger than 17

Don’t Miss: Federal Mortgage Relief Stimulus Program

Can A Non Taxpayer Get Stimulus

If you didn’t get any payments or got less than the full amounts, you may qualify for the credit, even if you don’t normally file taxes. See Recovery Rebate Credit for more information. … You may be eligible to claim the credit by filing a 2020 1040 or 1040-SR for free using the IRS Free File program.