Will The Irs Take Away My Stimulus Check Money To Cover Other Expenses I Owe Like Federal Taxes

For the second check, the IRS won’t reduce your stimulus payment to cover any past-due child support you owe, and debt collectors can’t garnish your payment either.

However, the protections from the Consolidated Appropriations Act that prevented the IRS from garnishing your stimulus check for unpaid taxes do not apply to people who are claiming their missing stimulus checks on their tax returns.

“If you are an eligible individual who has not yet received your full EIP and you have certain outstanding debts, some or all of your unpaid stimulus payment will be withheld to offset those debts,” the Taxpayer Advocate Service said in a blog post. The IRS is looking into this issue.

Enter $1 For Your Income If You Didnt Earn Anything

If you earned money for the year youre filing for, report that amount. Since your earnings were low enough that you werent required to file a tax return for the year, you shouldnt worry about owing income tax.

And if you didnt earn income? Youd put $1, Allec said. Dont worry. Youre not going to owe taxes on that dollar.

Input Your Direct Deposit Information

Back to that bank account info that you hopefully gathered: Its really important that you input that. The tax filing program you use will ask for that information before you file. If youre manually filling out Form 1040, youll enter it on Line 35.

But if you can submit your return online, youll get it much faster. The IRS has a huge backlog of unprocessed paper returns, which could leave you waiting for months. Meanwhile, the average online return is processed in 21 days or less.

Read Also: Stimulus Check 2022: When Is It Coming

Other Features Of The Bill

How does the aid for small businesses and nonprofits work?

Good news here, as you may be eligible for forgivable loans. Our colleague Emily Flitter covered the details in a separate article. Aides to Senator Marco Rubio, Republican of Florida, also wrote a one-page summary of those provisions.

Will there be damage to my credit report if I take advantage of any virus-related payment relief, including the student loan suspension?

No. There is not supposed to be, at least.

The bill states that during the period beginning on Jan. 31 and continuing 120 days after the end of the national emergency declaration, lenders and others should mark your credit file as current, even if you take advantage of payment modifications.

If you had black marks in your file before the virus hit, those will remain unless you fix the issues during the emergency period.

Credit reporting agencies can make errors. Be sure to check your credit report a few times each year, especially if you accept any help from any financial institution or biller this year.

What if I find black marks anyway?

File a dispute with the credit bureau, but it may take a while to fix them. The Consumer Financial Protection Bureau has told credit bureaus and others that during the pandemic they can take longer than the usual 30 to 45 days to meet the dispute-response deadline, as long as they are making good faith efforts.

Is there any relief for renters in the bill?

How To Claim The Recovery Rebate Credit On A Tax Return

You will need to file your recovery rebate worksheet along with your 2020 or 2021 federal tax return, whichever is applicable. If you file your return using any of the best tax preparation software on the market, the program will guide you through the worksheet.

âWhen you file your 2020 or 2021 tax return, youâll have to report the stimulus checks you received with the recovery rebate credit you are entitled to claim,â says Samantha Hawkins, a certified public accountant and founder of Hawkins CPA Solutions in Upper Marlboro, Maryland.

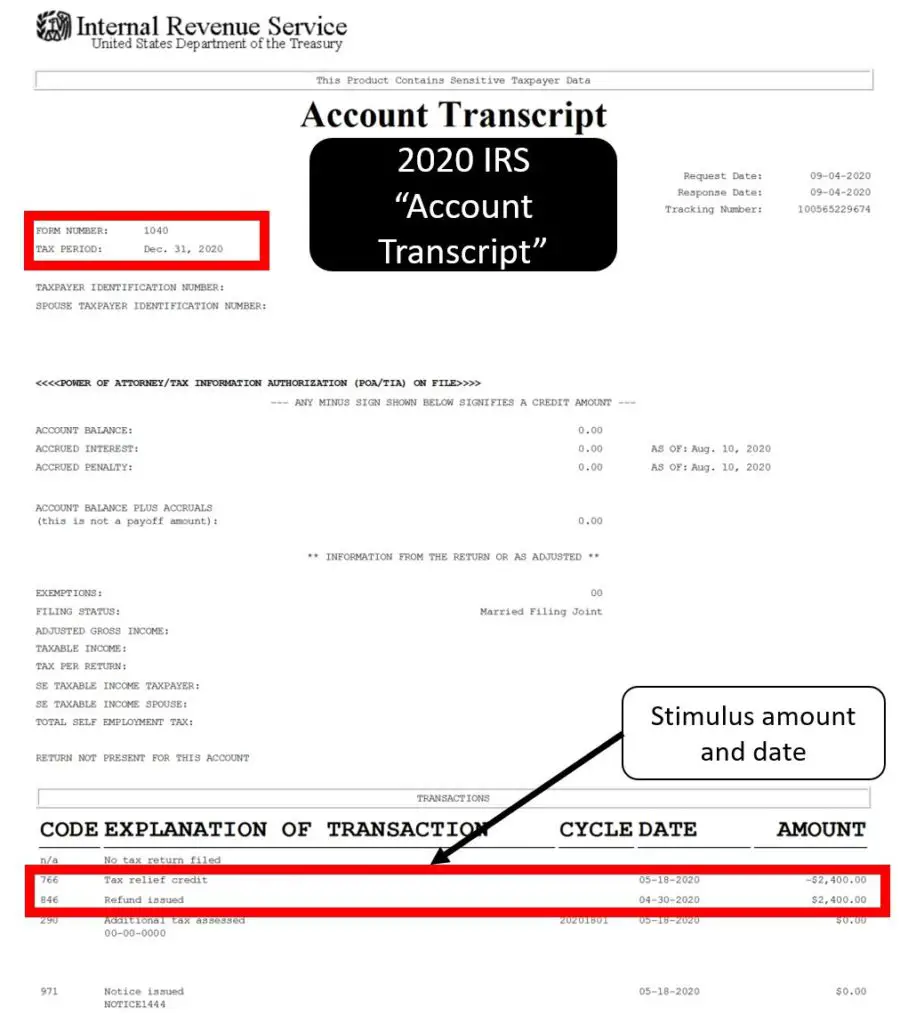

You can find the amount of your first stimulus payment on your Notice 1444, which was mailed by the IRS. The tax agency followed up with a Notice 1444-B for the second stimulus round and Notice 1444-C for the third.

If you donât have the notices, you can create an online account with the IRS to verify the payments you received.

If you got less than the full stimulus payment for any of the rounds, the worksheet asks you questions about your income. In some cases, you may be entitled to claim an additional stimulus payment.

You can claim missing or partial first- and second-round stimulus payments only on your 2020 federal tax return. Any missing or partial third-round stimulus payments can be claimed on your 2021 federal tax return only.

If youâre behind on your returns, you have until Sept. 30 to file your 2020 taxes penalty-free. Taxpayers who got extensions to file their 2021 returns must submit those by Oct. 17.

Also Check: Someone Stole My Stimulus Check

What To Do If A Deceased Family Member Received A Stimulus Check

If a deceased family member has received a stimulus check in their name, the IRS has issued guidance stating that the money should be returned immediately. More specifically, anyone who died before payment was received does not qualify for a check. The only exception to this is if a payment was made to joint filers and one of the spouses is still alive. If this describes your situation, you only need to return the decedents half of the money.

According to the IRS, if you need to return payment for a deceased loved one, here are the steps to follow:

- Direct deposit payments, and paper check payments that have not been cashed

- Step 1: Mail a personal check or money order for the correct amount to your states IRS refund inquiry unit.

- Step 2: Make the check or money order payable to U.S. Treasury and write 2020EIP and the decedents Social Security number or individual taxpayer identification number.

- Step 3: In the envelope, include a note that explains why the check is being returned.

How Could My 2020 Taxes Affect The Amount Of A Third Stimulus Check I Could Get

The amount of your third stimulus check is based on your 2019 or 2020 taxes, whichever the IRS has on file at the time it determines your payment. If your situation changed dramatically between the two years, you could potentially get the full amount, even if the IRS bases the check it sends on your 2019 taxes. You may need to wait till 2022, however, to claim the difference on next year’s taxes. Here’s everything to know about how tax season could affect your third check.

The timeline for sending the third stimulus check is merging with tax season — April 15 is the tax-filing due date — which complicates matters quite a bit, especially since the IRS is already combining makeup stimulus money with your tax refund this year .

Also Check: How Can I Check For My Stimulus Payment

What If I Didnt Get Some Or All Of My Stimulus Checks

If you think you are eligible and you did not get a check for you or your dependents, you can still get the money by filing your 2020 or 2021 taxes. You may be eligible for free tax preparation help from Maines CA$H Coalition.

If you do not usually file a tax return and didnt get your stimulus checks, you may still be able to file a tax return this year to get your stimulus checks. You should check with a tax professional. The IRS website also provides information about how to claim your stimulus checks if you didnt get them in 2020 or 2021. You can also call Pine Tree Legal Assistance.

Read Also: $1 400 Stimulus Check When Is It Coming

Irs Free File Available Today Claim Recovery Rebate Credit And Other Tax Credits

- Do Your Taxes for Free with Free File – English | Spanish

IR-2021-15, January 15, 2021

WASHINGTON IRS Free File online tax preparation products available at no charge launched today, giving taxpayers an early opportunity to claim credits like the Recovery Rebate Credit and other deductions, the Internal Revenue Service announced.

Leading tax software providers make their online products available for free as part of a 19-year partnership with the Internal Revenue Service. There are nine products in English and two in Spanish.

As we continue to confront the COVID-19 pandemic, IRS Free File and certain other similar online tax preparation products such as MilTax Tax Services for the Military offered through the Department of Defense offers taxpayers a free way to do their taxes from the safety of their own home and claim the tax credits and deductions they are due, said Chuck Rettig, IRS Commissioner. We encourage eligible taxpayers to take a look at using Free File, MilTax and similar free online tax preparation products this year, to follow the lead of over 4 million people who took advantage of these free services just last year. An IRS tax refund is often the single largest payment families receive during the year. We know how critical that refund is, especially this year.”

IRS Free File online products are available to any taxpayer or family who earned $72,000 or less in 2020. MilTax online software will be available on January 19, 2021.

Read Also: Never Received 3rd Stimulus Check

Filing A Simple Return

To claim any recovery rebate or child tax credits that you are eligible for, you can file a simple return online by going to GetCTC.org. This online resource is both mobile friendly and available in Spanish.

How Long It Will Take To Get A Stimulus Check After Filing Taxes

The IRS sends out most tax refunds within 21 days, or three weeks, of accepting your return. If your taxes are incomplete, impacted by fraud, require close review or contain errors, you may have to wait a while for your refund.

The fastest way to get your refund and any remaining EIP funds is to file digitally and select direct deposit as your refund method. You can check the Wheres My Refund? page, which refreshes daily, starting 24 hours after sending in an electronic return and four weeks after mailing your paper return.

Recommended Reading: Amount Of All Stimulus Checks

Recommended Reading: 4th Stimulus Check For Single Person

What To Do If You’re Experiencing Homelessness

If you don’t have a permanent address or a bank account, you can still get a stimulus check. “The IRS has been continuing to work directly with groups inside and outside the tax community to get information directly to people experiencing homelessness and other groups to help them receive Economic Impact Payments,” IRS Commissioner Chuck Rettig said.

The IRS recommends using a trusted friend, relative or shelter’s address so the agency can mail your payment if you’re unable to receive direct deposit. The agency also says banks will help a person without an account to open a low-cost or no-cost bank account.

Tools To Help File Your Taxes

If you make $72,000 or less, you can file your federal tax return for free using the IRS’ Free File program. The IRS provides more information on its website on how to claim your stimulus checks if you are not usually required to file a tax return.

The IRS also offers tax preparation programs including Tax Counseling for the Elderly, as well as Volunteer Income Tax Assistance, or VITA. The VITA program is available to people who have $57,000 or less in income, or who have disabilities or limited ability to speak English. Although many sites offering those services are temporarily closed due to Covid-19, the IRS offers a locator tool on its website.

Don’t Miss: Irs.gov Stimulus Check 4th Round

What If My Mailing Address Changed Since I Received My Previous Stimulus Checks How Will I Get My Third Stimulus Check

If you are expecting to receive your third stimulus check by mail, it will be mailed to the last address you filed with the IRS. If your address has changed since then, there are different options you can take to make sure your stimulus check gets to you:

Option 1: File your 2020 federal tax return to update your address. If you havent filed your 2020 tax return yet, this is an easy way to update your address. File a tax return with your current address and your payment will be sent through the mail once the IRS receives your updated address.

Option 2: Provide your banking information in the IRS Get My Payment tool. If the post office was unable to deliver your stimulus check, it will be returned to the IRS. Two to three weeks after the payment has been issued, Get My Payment will display the message Need More Information. You will have the option to have your payment reissued as a direct deposit by providing your banking information.

If you dont provide your banking information, the IRS will mail your payment once your address is updated.

Filing A Full Tax Return

Depending on your circumstances, you may want to consider filing a full tax return. There are a few reasons to consider this option:

To file a full tax return online go to MyFreeTaxes.com.

Read Also: Irs Tax Stimulus Checks Second Round

An Example 2020 Recovery Rebate Credit

Alex and Samantha each filed as single on their 2019 tax returns. They got married in January 2020 and had a child named Ethan in November 2020. Alexs 2019 adjusted gross income was $100,000 and Samanthas was $25,000. Neither had qualifying children in 2019.

Alex s income in 2019 kept him from receiving any of the economic impact payments. Samantha received the full amount for both the $1,200 and $600 stimulus payments for a total of $1,800 total.

Alex and Samantha file their 2020 tax return as married filing jointly claiming Ethan as their child and have a combined AGI of $125,000. Assuming that all three meet all of the requirements for the credit, their maximum 2020Recovery Rebate Credit is $4,700.

- This is made up of $2,900 for the first stimulus payment and $1,800 for the second stimulus payment.

- Their $4,700 maximum credit is reduced by the $1,800 Economic Impact Payments that Alex received. They are able to claim a 2020 Recovery Rebate Credit of $2,900 on their 2020 tax returns.

TurboTax has you covered with up-to-date information on stimulus checks and your taxes. Our COVID-19 Tax Center and Stimulus Check resources have the latest information on changes to taxes, stimulus check eligibility, tax breaks and more so you can feel confident in your taxes, no matter what situation youre in.

If You’re A Nonfiler How Do You Claim Your Missing Stimulus Money Is It A Free Process

In the first round of stimulus checks, the IRS sent letters to 9 million nonfilers with information on how to file a claim to get their missing stimulus money. The agency instructed nonfilers to use the nonfilers tool to enter their information by Nov. 21, 2020. But if you missed the deadline, you can still claim your money as a Recovery Rebate Credit by filing a 2020 federal income tax return — even if you usually don’t have to:

When you file a 2020 Form 1040 or 1040SR you may be eligible for the Recovery Rebate Credit. Save your IRS letter – Notice 1444 Your Economic Impact Payment – with your 2020 tax records. You’ll need the amount of the payment in the letter when you file in 2021.

If you did use the IRS nonfilers tool, you should have automatically received a second payment. If you didn’t, you can still file for that money as a Recovery Rebate Credit as well.

File for your Recovery Rebate Credit as part of a federal tax return this year, even if you don’t normally do so. The IRS started processing 2020 tax returns on , and the federal tax return deadline was extended to May 17 — but you can still file a tax extension.

To get started, most nonfilers are eligible to use the IRS’ Free File tool . As the name suggests, this tool lets you obtain a free federal tax return and in some cases a free state return as well. It’s available to use now.

Read Also: How Much Stimulus Check 2021