Here’s What Veterans And Ssi Ssdi Beneficiaries Should Know

The IRS tracking tool Get My Payment is designed to tell you the status of your third stimulus check. People who receive Social Security benefits like SSDI and SSI and veterans who don’t file taxes can also see their payment status in the tracker tool. Tens of millions of Social Security recipients and veterans should have already received their $1,400 payment.

Are 4th Stimulus Checks Really Happening

They arebut theyre not coming from the federal government like the last three stimulus checks did. This time, it all depends on what state you live in. Thats right, these fourth stimulus checks are being given out to some folks at the state and city levels now.

Back when the American Rescue Plan rolled out, all 50 states as a whole were given $195 billion to help fund their own economic recovery closer to home.1 Thats a lot of dough. But heres the catchthey dont have forever to spend that money. The states have to figure out what to spend the money on by the end of 2024, and then they have until the end of 2026 to use up all that cash.2 Those deadlines might sound super far away, but the clock is ticking here.

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Don’t Miss: What Is The Third Stimulus Check

Track Your Stimulus Check

Many of us have seen the financial impacts of COVID-19, and the CARES Act will provide some assistance as soon as this week for most. The Act is a single, one-time payment of $1,200 per adult and $500 per child under the age of 17, up to certain income levels. The IRS will determine what your payment will be by looking at your 2018 or 2019 tax return or Social Security data.

IRS Economic Impact Payments

- Tax filers who have supplied direct deposit information to the IRS have begun receiving payments this week

- If you do not file, you can enter your information here to assure receipt of benefits

- Those receiving Social Security benefits do not need to take any steps to receive their payment

- If you file, but do not provide banking information to the IRS, you will have an opportunity, beginning today according to Treasury Secretary Mnuchin, to enter this information on the IRS website. This will help you receive your funds in an expedited fashion.

- To track the status of your refund, click here.

FAQs

Below are a few of the top questions people are asking, if your question isn’t answered below, the IRS has released a full comprehensive list of FAQs here.

Who is eligible for the economic impact payment?

Eligible taxpayers who filed tax returns for either 2019 or 2018 will automatically receive an economic impact payment of up to $1,200 for individuals or $2,400 for married couples and up to $500 for each qualifying child.

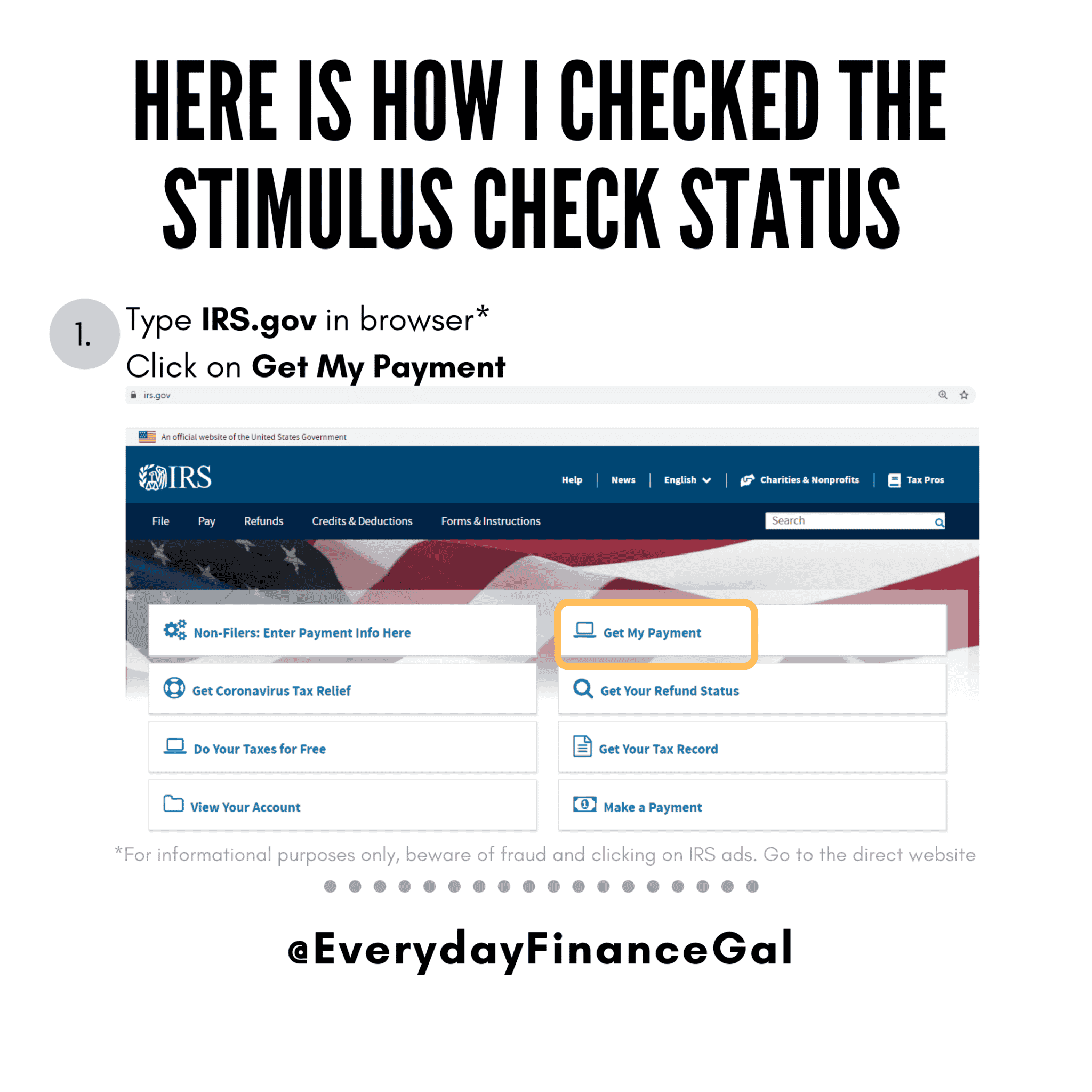

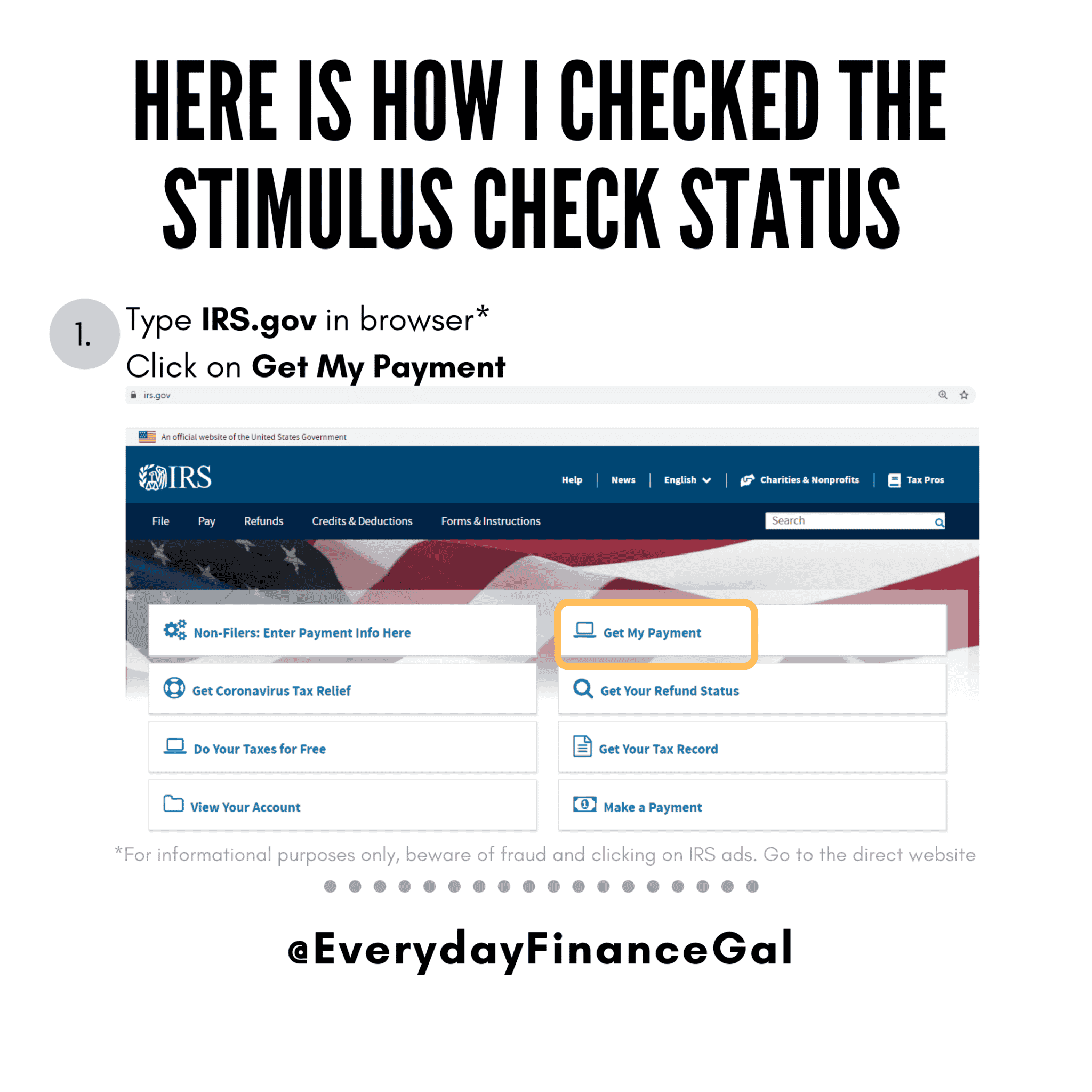

The Irs Has An Online Tool That Lets You Track The Status Of Your Third Stimulus Check

Getty Images IRS.gov

The IRS has already delivered over 100 million third stimulus checks. But if you’re still asking yourself “where’s my stimulus check,” the IRS has an online portal that lets you track your payment. It’s called the “Get My Payment” tool, and it’s an updated version of the popular tool Americans used to track the status of their first- and second-round stimulus checks.

Note that you can’t check the status of your first- or second-round stimulus payments with the updated tool. To find the amounts of these payments, create an online IRS account or refer to IRS Notices 1444 and 1444-B, which the IRS mailed after first- and second-round stimulus checks were issued. If you didn’t get an earlier payment, or your received less than the full amount, you might be able to get what you’re owed by claiming the Recovery Rebate credit on your 2020 tax return. Third-round stimulus payments aren’t used to calculate the 2020 Recovery Rebate credit, but they will be used to figure the credit amount on your 2021 tax return.

The updated “Get My Payment” tool more-or-less works the same way as the portal used for first- and second-round stimulus checks. But here’s a refresher course on what the tool does, what information you need to provide, and what information the tool gives you. Check it out now so you know what to expect before entering the portal on the IRS’s website.

Read Also: Did I Qualify For The Third Stimulus Check

Wondering Where The Latest Economic Impact Payment Is Heres How To Track Your Stimulus Check And What To Do If You Have Problems

Almost everyone who is eligible has received the first and second rounds of the U.S. governmentâs economic impact payments, or âstimulus funds.â But the third roundâpart of the American Rescue Plan Act of 2021âmay provide additional relief to eligible individuals.

The IRS started processing payments in mid-March. Your payment might already be in your account or on its way. But if itâs not, donât worry. The funds could take time to roll out. Hereâs how you can check the status of your payment.

Recommended Reading: File For Missing Stimulus Check

What The Online Get My Payment Tool Cant Tell You

The IRS tool wont give you hourly updates the status information is updated once daily nor will it tell you how much stimulus money youre getting or provide details on the first two stimulus checks approved in 2020. You wont find steps for what to do if you run into payment problems.

The IRS doesnt want you to call if you have payment trouble. The agency says its representatives dont have information beyond whats shown in the tool. Heres what we recommend doing to address a stimulus issue.

Another way to find out more info on your third payment is to create an IRS account online. If you are sent a plus-up payment after your 2020 tax return is processed, you should see the amount of your plus-up payment with your online account.

Also Check: When Did The First Stimulus Check Go Out

Read Also: Wheres My Stimulus Check.gov

How To Claim A Missing Payment

You may be eligible to claim a Recovery Rebate Credit on your 2020 or 2021 federal tax return if you didn’t get an Economic Impact Payment or got less than the full amount.

It is important to understand that the Economic Impact Payments applied to different tax years. Depending on whether you missed the first, second or third payment, you will need to file either a 2020 or 2021 tax return to claim a Recovery Rebate Credit.

Can I Change My Stimulus Payment Method

The IRS is using information from your last filed tax return to send your stimulus payment.

If you arent sure how the IRS will be sending your stimulus, you can use the IRS Get My Payment tool to check. If they havent sent your stimulus payment yet, you can update your direct deposit information. If they already sent your payment, theres nothing you can do to change your payment method.

Recommended Reading: Amount Of Third Stimulus Check

The Irs Has Outdated Bank Information On File

Could it be that your check was sent to your old bank? Possibly: This is another problem being reported on social media, and apparently a common one if Twitter searches are to be believed. According to USA Today, the likely scenario is that the IRS would just revert to a paper check, but if you switched banks since last year, you should check to see that the information the IRS has on file is current.

How To Track The Status Of Your Stimulus Check

The IRS has created a Get My Payment portal so you can learn the status of your payment. It provides updates on whether the IRS is processing your check or has already scheduled your payment whether your payment will be made by a paper check, prepaid debit card or through direct deposit to your bank account and whether there are problems holding up your payment.

To use this portal, you must input your Social Security number or Individual Taxpayer Identification Number along with your date of birth, street address and postal code. The IRS updates its status tracking information daily. You should get a letter about 15 days after the IRS issues your payment telling you how much you received and how you received it.

After using the IRS tracker, you may sign up for a free service from the post office that tells you exactly when your stimulus check will arrive in the mail.

Also Check: Essential Worker Stimulus Check 2021

What If I Am Eligible For The Stimulus Checks But I Didnt File A 2019 Or 2020 Tax Return And Didnt Use The Irs Non

File your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

You can file a tax return even if you dont have a filing requirement to get other tax credits, such as the Earned Income Tax Credit.

If you didnt get your first or second stimulus check or didnt get the full amount that you are eligible for, file a 2020 federal tax return and claim them as part of your tax refund or use GetCTC.org if you dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2021.

Tax Tip Tuesday: How To Check The Status Of Your Refund Or Stimulus Check

If youve had problems with your mail, or you moved without updating your address, you may have missed stimulus checks or tax refunds from the IRS. Heres how to request a replacement from the IRS if you missed a payment you were expecting.

Recommended Reading: Irs Forms For Stimulus Checks

Also Check: Stimulus Checks Gas Prices 2022

How Can I Check The Status Of My Stimulus Check

The IRS has created a portal for Americans to use to determine when and where stimulus checks will be deposited. Track your payment here.

If the portal says “Payment Status Not Available” or any other error message, please refer to the IRS Economic Impact Payment information center.

Please remember that Extraco Banks is unable to troubleshoot issues related to receiving these stimulus payments as they come directly from the United States Treasury. Please refer to the official IRS website for any questions regarding your payment.

The Irs Tool Might Say Your Payment Was Sent To You

If the IRS’ online tool says the agency has issued your stimulus money, but you have no record of it in your bank account and it never arrived in your mailbox, you may need to take one of these steps, including possibly filing a stimulus check payment trace. You’ll need to have the letter the IRS sent you.

Recommended Reading: Earned Income Tax Credit Stimulus

You May See A ‘payment Status Not Available’ Message

Don’t be alarmed if the Get My Payment tool gives you a message that says “Payment Status Not Available.” You may see this message until your payment is processed, according to the IRS. So you may not have to do anything.

But it could also mean you’re not eligible for a payment. So you may want to double-check your eligibility and plug your numbers in our stimulus check calculator to see whether you’re due money.

Who Is Eligible For A $1400 Stimulus Check

Your stimulus payment amount will be based on information from the most recent tax return you filed with the IRS.

Your eligibility depends on your income level. You will receive a third stimulus check if your income is:

- $75,000 or less for a Single filer

- $150,000 or less for a Married Couple Filing Jointly

NOTE: If you are claimed as a dependent on someone elses tax return, you will not be eligible for a stimulus check. For more information, please visit the IRS Coronavirus Tax Relief and Economic Impact Payments center.

Recommended Reading: How Much Was The Stimulus Payments In 2021

You May Like: How Do I Know If I Got My Stimulus Check

Track 4th Stimulus Check

The IRS has already sent out more than 156 million third stimulus checks, worth approximately $372 billion. President Joe Bidens American Rescue Plan pays individual taxpayers earning less than $80,000 a maximum of $1,400 and couples making under $160,000 up to $2,800. Lets break down what this means for you who is eligible for the third stimulus.

right triangle trig word problems kuta

Click Get my Payment Tool and enter your Social Security number, date of birth, street address, and zip code. This tool tells you if youre eligible (some income limits and dependent age. Calculate how much money you’ll get from the third stimulus check. The legislation offers full $1,400 payments to individuals with adjusted gross income of up to $75,000, $112,500 for heads of household, and $150,000 for married couples who file a joint tax return. You’ll also be eligible to receive $1,400 per each qualifying dependent.

WASHINGTON, D.C. Ohio residents are eagerly anticipating a payment expected as part of a $2 trillion federal economic relief package intended to mitigate the financial and economic fallout caused by the new coronavirus pandemic. Some payments have begun arriving a new website has been launched to track the status of your money if you have.

The IRS stimulus check tracker is now online, earlier than planned, and the first wave of payments are expected to hit some bank accounts this weekend. The IRS says it’s started processing the.

The Irs Doesnt Have Your Direct Deposit Info

Many people who filed their taxes in 2019 or 2018and were owed a refundreceived their stimulus checks automatically and did not need to lift a finger. Thats because theyve already given their bank routing information to the IRS. If youve never done that, your stimulus check will probably be sent by mail.

Unfortunately, paper checks are going to take a little bit longer. The IRS will begin sending them later this month and will continue on a weekly basis.

If you still want to try giving the IRS your direct deposit info, you can do that here. There are separate sections for filers and non-filers . Be forewarned, the IRS website has been suffering under the weight of increased traffic, and many visitors are experiencing glitches with these tools.

Recommended Reading: Get My 2nd Stimulus Payment

When Will I Receive My Stimulus Check How Do I Track The Status Of My Stimulus Check

Eligible taxpayers who filed a tax return in 2019 or 2018 and chose to receive their refund through direct deposit into their checking or savings account will automatically have their stimulus payment deposited into that account.

To find out when your stimulus check is coming, visit the IRS Get My Payment tool.

If the Get My Payment site says, Payment status not available its for one of the following reasons:

- The IRS hasnt finished processing your 2019 return, Stimulus Registration, or IRS Non-Filers entry.

- Get My Payment doesnt have your data yet.

- If you receive Social Security, VA benefits, SSA or RRB Form 1099 and dont typically file a return, your information isnt available in Get My Payment yet.

- Youre not eligible for a payment.

Get My Payment information is only updated once per day, so if you receive a Payment status not available message check back the following day to see if your status has changed.

What If My Turbo Card Account Is Closed

If your Refund Advance or Turbo Visa Debit Card account is closed or no longer active, the bank will reject the stimulus payment deposit and return the money to the IRS. The IRS will then mail a check to the address on your 2019 or 2018 tax return, or the address on file with the U.S. USPS, whichever is more current.

According to the IRS, your Get My Payment status may have inaccurately said that your payment was being sent to the same account for the second time. Your payment is actually being mailed and the IRS will be updating Get My Payment accordingly.

Recommended Reading: Irs Stimulus Check Tax Return