Irs Free File Open Until November 17

To help get the word out about these tax benefits, the IRS announced on October 13, that it is sending letters to more than nine million individuals and families who appear to qualify for these stimulus benefits but did not claim them by filing a 2021 federal income tax return.

This includes people eligible not only for the 2021 recovery rebate credit and the child tax credit but also the earned income tax credit. The letters should arrive in the coming weeks.

Also, in addition to filing a 2021 tax return at ChildTaxCredit.gov, the IRS says that Free File will remain open for an until November 17, 2022. Thats one month later than the tool is normally available. If your income is $73,000 or less, Free File allows you to file your tax return online at no cost to you.

How To Get 2022 Stimulus Checks

While this is an extension of the American Rescue Act, the 2022 payments arent actually stimulus checks. Instead, Americans who are entitled to the payments will receive the money on their tax returns in 2022. So, those who added new children or dependents over the course of 2021 should file a tax return and claim the money.

To qualify for the full $1400 on their 2022 stimulus checks single tax filers must make less than $75k per year. Those who are married and filing jointly must make less than $150k. Those with higher income levels will see their payments shrink, just like the original American Rescue Act payments earlier this year.

I Need Help Buying Food

I need help buying food.

There is extra money available for food. Find your states SNAP program.

or call: 221-5689

I have kids.

Start accessing this money by filing your taxes with the IRS.*

Recommended Reading: What Was The Third Stimulus Check Amount

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

How Do I Check The Status Of My Stimulus Payment

But waiting on your stimulus check can be an anxiety-ridden process, especially at a time when nearly 10 million Americans are out of work. Use the Treasury Departments tracker:

If youre seeing a payment status not available error message on the platform, the IRS says one of the following issues might be occurring:

The platform is typically updated overnight, meaning you wont see a new message if youre checking for updates more regularly than once a day.

Also Check: Are We Getting More Stimulus Money

If I Still Need To File My 2018 And 2019 Taxes Can I Still Receive The Economic Impact Payment

Yes. The IRS urges anyone with a tax filing obligation and who hasnt yet filed a tax return for 2018 or 2019, to file as soon as they can to receive an Economic Impact Payment. When you file your taxes, include your direct deposit information on the return so that the IRS can send you your payment quickly.

If you are required to file a tax return, there may be free or low-cost options for filing your return. If you need someone to help you to file, its important to choose a reputable tax preparer that will file an accurate return. Mistakes could result in additional costs and complications in the future.

If your 2019 adjusted gross income was less than $69,000, you may be able to find one or more online tools to file your taxes for free. Review each company’s offer to make sure you qualify for a free federal return. Some companies offer free state tax returns, but others may charge a fee.

Keep in mind that the IRS has extended the deadline for filing your 2019 taxes until July 15, 2020. If you are concerned about visiting a tax professional or local community organization in person to get help with your tax return, the IRS indicates the Economic Impact Payments will be available throughout the rest of 2020.

How Will The Irs Send My Payment

If you receive certain social security, retirement, disability, survivors, railroad retirement, or veterans benefits, your payment will be distributed in the same method as your benefits. Learn more to see if this applies to you.

Economic Impact Payments will either be directly deposited into your bank account or a check or prepaid debit card will be mailed to you.

You May Like: Essential Worker Stimulus Check 2021

Who Is Eligible For The Recovery Rebate Credit

According to the IRS, most people who were eligible for the third round of payments have already received their stimulus checks but there are a few situations why someone might not have received it or received the wrong amount. For example:

-

You’re claiming a new dependent in 2021 .

-

Your marital status changed in 2021.

-

Your adjusted gross income from 2019 or 2020 was high enough to make you ineligible for a stimulus check, but your 2021 AGI is now lower and within the qualifying threshold.

-

You did not have a Social Security number but received one by the 2021 tax deadline.

Who’s Eligible For Child Tax Credit

Most families are eligible for CTC, as long as the children are either a US citizen, US national, or a so-called US resident alien.

The children must also have lived with the person who’s claiming for more than half of the tax year and be claimed as a dependent on the tax return.

This can be a son, daughter, stepchild, foster child, brother, sister, stepbrother or stepsister, but may also be a grandchild, niece or nephew.

The credit reduces in value depending on how much you earn.

The full CTC will be available to individuals who earn up to $75,000 and couples earning up to $150,000.

From there, the credit will then be reduced by $50 for every additional $1,000 of adjusted gross income earned.

You can check if you’re eligible for the credit by using an IRS online tool.

To use it, you’ll need to know your filing status, whether you can claim the person as a dependent and the person’s date of birth.

Also Check: Will There Be Another Stimulus Check In 2020 To

No Matter How You File Block Has Your Back

Discuss The Economic Impact Payment With The Beneficiary

A representative payee is only responsible for managing Social Security or SSI benefits. The Economic Impact Payment is not an SSA benefit and belongs to the beneficiary. Discuss the payment with the beneficiary, and if they request access to the funds, youre obligated to provide it.

You May Like: Will We Be Getting Another Stimulus

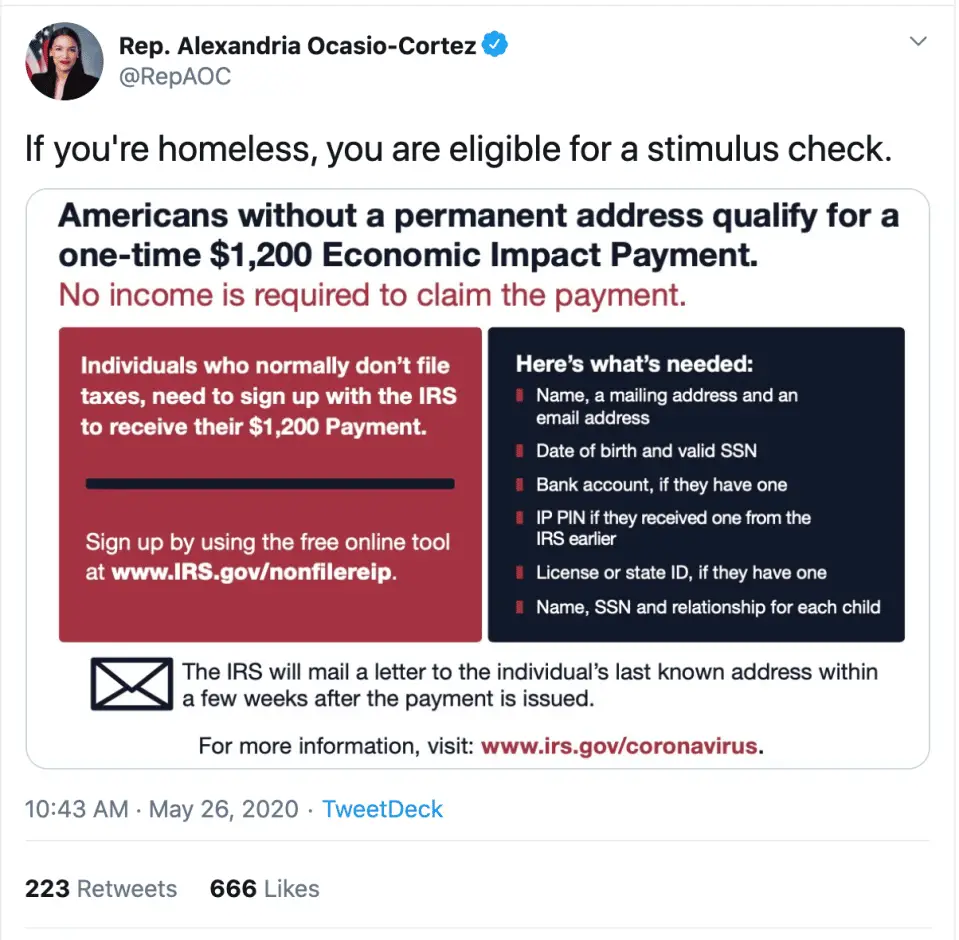

Stimulus Checks: No Taxable Income Or Address

Q. Im a single person that has a valid SSN, but I do not file a tax return because I do not have any taxable income. What should I do if I didnt receive any stimulus money?

A. For the first two rounds of economic impact payments, the taxpayer will need to file a 2020 tax return with the IRS and claim the recovery rebate credit. Eligible taxpayers who did not receive the maximum amount of advance payments and taxpayers who missed receiving the first or second stimulus payments altogether can claim a credit on their tax return for the amount they qualified for but did not receive as an advance payment. For example, a single taxpayer who was eligible for but did not receive either economic impact payment would be eligible to claim a recovery rebate credit in the amount of $1,800 .

If this same eligible taxpayer did not receive the third economic impact payment, they should receive that from the IRS after their 2020 tax return is processed. Once the IRS processes the taxpayers 2020 tax return, the IRS will use the information from the 2020 tax return to determine eligibility for the third round of payments. In this case, if the IRS determines the taxpayer is eligible for the full third economic impact payment and no payment has been made to that taxpayer, the IRS will issue an additional $1,400 to that individual. The FAQs available on this IRS webpage help explain the process someone should follow in this situation to complete their tax return.

I Receive Social Security Retirement Disability Survivors Ssi Or Veterans Benefits Do I Automatically Qualify For An Economic Impact Payment

In some cases, if you receive certain benefits, you will automatically receive an Economic Impact Payment. Make sure you read further to know if this applies to you and to know if you need to send the IRS any additional information, and how you will be receiving your payment.

The IRS is working to make it easier for certain beneficiaries to receive the Economic Impact Payment by using information from benefit programs to automatically send payment.

You will qualify for this automatic payment only if:

- You were not required to file taxes in 2018 or 2019 because you had limited income and

- You receive one of the following benefits:

- Social Security retirement, survivors, or disability from the Social Security Administration

- Supplemental Security Income from the Social Security Administration

- Railroad Retirement and Survivors from the U.S. Railroad Retirement Board

- Veterans disability compensation, pension, or survivor benefits from the Department of Veterans Affairs

If you qualify for an automatic payment, you will receive $1200 . You will receive this automatically the same way you receive your benefits, either by direct deposit or by check. You will not need to take any further action to receive this.

No matter how you receive your payment, the IRS will send you a letter in the mail to the most current address they have on file about 15 days after they send your payment to let you know what to do if you have any issues, and contact information for any questions.

Recommended Reading: Date Of Stimulus Check 2021

How A Life Change Affects Your Stimulus Check/payment Eligibility

With the third stimulus check dispersal under way, millions have already received their third stimulus payments. But the more Americans get their checks, the more questions arise specifically about how life changes affect your stimulus payment.

The first, second and now third economic impact payment or stimulus payments can be paid in advance. Your eligibility and amount is based off your most recently filed tax return but what if that information is incorrect?

For example, what if you havent filed taxes yet but got married in July 2020? Or had a baby? What if youre dealing with the aftermath of a divorce or the recent death of a loved one? What if you already received your first and second stimulus checks, but it was for the wrong amount? What if you graduated from college in 2020 and arent a dependent anymore?

For the first and second stimulus payments, if your situation changed, youll claim the rest youre owed through the Recovery Rebate credit on your 2020 return. For the third , youll wait to claim the credit on your 2021 tax return.

The IRS understood the need to get stimulus payments out quickly. As a result, some taxpayers have found differences in the amount they should have received due to tax filing changes and income changes.

Below, well clear things up about who is eligible for a stimulus checks, payment, and the credit and how life changes affect your eligibility.

First And Second Stimulus Check

You will need to file a tax return for Tax Year 2020 . The deadline to file your taxes this year was May 17, 2021. The tax filing extension deadline is October 15, 2021.

If you missed the filing deadline, you can still file your tax return to get your first and second stimulus checks. If you dont owe taxes, there is no penalty for filing late. If you owe taxes, you may be subject to penalties and fines for not filing or not paying taxes. The government may reduce your tax refund to pay for any taxes you owe and other federal and state debts.

To learn more about your options if you think you owe taxes, read Filing Past Due Tax Returns and What to Do if I Owe Taxes but Cant Pay Them.

Don’t Miss: When Did Stimulus 3 Go Out

Nonfilers: You May Need To File Your 2020 Tax Return This Year To Get The Right Stimulus Check Amount

With the second payment, the IRS used your 2019 tax returns to determine eligibility. Nonfilers, who weren’t required to file a federal income tax return in 2018 or 2019, may still be eligible to receive the first stimulus check under the CARES Act. And this group will qualify again. Here are reasons you might not have been required to file:

- You’re over 24, you’re not claimed as a dependent and your income is less than $12,200.

- You’re married filing jointly and together your income is less than $24,400.

- You have no income.

- You receive federal benefits, such as Supplemental Security Income or Social Security Disability Insurance. See below for more on SSDI.

How Do I Get My Third Stimulus Check

You dont need to do anything if:

- You have filed a tax return for tax year 2019 or 2020.

- You are a Social Security recipient, including Social Security Disability Insurance , railroad retiree. Or you are a Supplemental Security Insurance and Veterans Affairs beneficiary.

- You successfully signed up for the first stimulus check online using the IRS Non-Filers tool or submitted a simplified tax return that has been processed by the IRS.

The IRS will automatically send your payment. You can check on the status of your third stimulus check by visiting the IRS Get My Payment tool, available in English and Spanish.

If you are missing your third stimulus check, file your 2020 tax return or use GetCTC.org if you dont have a filing requirement. By submitting your information to the IRS, you will be signed up and automatically sent the third stimulus check.

Don’t Miss: Who’s Eligible For 3rd Stimulus Check

When Will The Second Stimulus Checks Be Delivered

The IRS is already delivering stimulus funds. Some individuals have already received theirs via direct deposit. And more funds go out each day. If you have direct deposit information on file with the IRS, they will deposit funds directly into that account. If you dont have current direct deposit information on file with the IRS but who are eligible, a check or a debit card will be sent by mail. You can claim the Economic Impact Payments on your 2020 tax return in 2021 if you are eligible but dont receive them.