The Stimulus Had Big Economic Benefits But It Also Fueled Inflation

On the one hand, COVID-19 stimulus undoubtedly helped Americans in some very big, tangible ways. Namely, it reduced poverty beyond merely keeping people afloat during the early days of the pandemic.

According to the U.S. Census Bureaus supplemental poverty measure, the stimulus payments moved 11.7 million people out of poverty in 2020 a drop in the poverty rate from 11.8 to 9.1 percent. And the 2021 poverty rate was estimated to fall even further to 7.7 percent, per a July 2021 report from the Urban Institute. We dont know yet whether this came to fruition, but Laura Wheaton, a senior fellow at the Urban Institute and one of the analysts behind the 2021 numbers, told us that it was clear from their analysis that the stimulus checks were driving a dramatic decline in poverty.

More broadly, the stimulus checks also cushioned workers during one of the worst economic crises in modern history, which likely helped the economy bounce back in record time. In April 2020, when Americans were receiving the first round of checks up to $1,200 with the CARES Act the unemployment rate was at a disastrous 14.7 percent. But two years later, its almost returned to its pre-pandemic levels, with many job openings. I hope we dont forget how awesome it was that we supported people so well, and that we recovered as quickly as we did, said Tara Sinclair, a professor of economics at George Washington University.

What If Both My Spouse And I Have Itins And Our Children Have Ssns Can Our Family Get The Third Stimulus Check For Our Children

Yes. For the third stimulus check, any household member that has an SSN qualifies for a payment.

This is different than the first and second stimulus check, where at least one tax filer must have an SSN for the household to claim the stimulus checks. That adult with the SSN and any qualifying children with SSNs will get the stimulus checks.

How Many Stimulus Checks Did Americans Get

In total, Americans received three stimulus checks since 2020.

The first round of checks was authorized under the Coronavirus Aid, Relief, and Economic Security Act, that President Donald Trump signed on March 27, 2020.

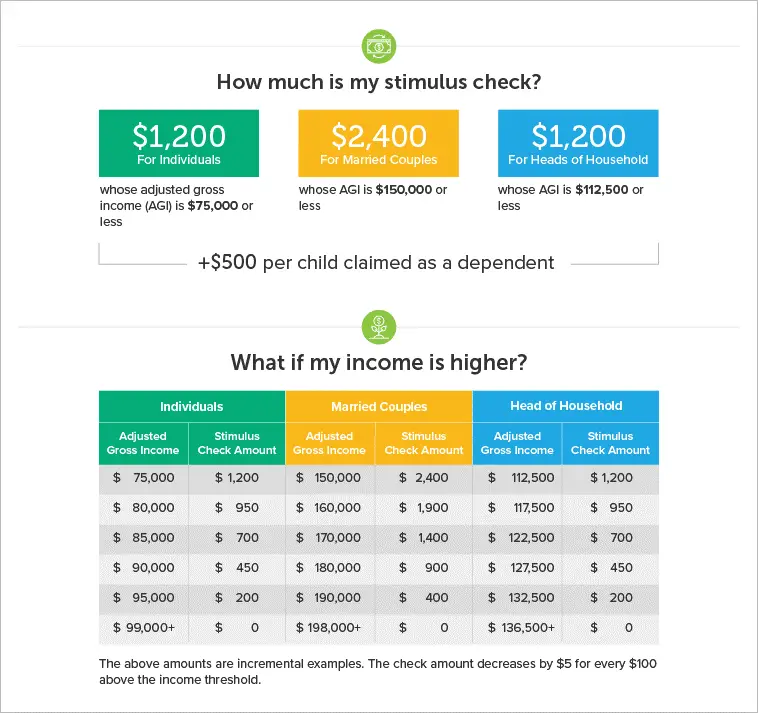

The payments for the first checks were $1,200 per person, or $2,400 for those filing jointly, plus $500 per qualifying child.

In December 2020, the second round of stimulus checks was sent out as part of the Consolidated Appropriations Act.

The payments for the second checks were $600 per person, or $1,200 for married individuals, plus $600 for each qualifying child.

One year following the first checks, the third round of stimulus checks was sent out earlier in March under the American Rescue Plan.

The payments for the third checks was $1,400 per person, or $2,800 for married couples, plus an additional $1,400 per eligible child.

Don’t Miss: What Were The Stimulus Amounts

Can The Government Reduce Or Garnish My Economic Impact Payment

Your Economic Impact Payment will not be subject to most types of federal offset or federal garnishment as a result of defaulted student loans or tax debt. However, the payments are still subject to garnishment if youre behind on child support.

The payments may also still be subject to State or local government garnishment and also to court-ordered garnishments.

What Is The Recovery Rebate Credit

The recovery rebate credit is a refundable tax credit that can be claimed on your 2021 return if you did not receive your third stimulus check or received the wrong amount.

An important thing to understand about the third stimulus payment is that it was technically an advance on the 2021 tax credit. Because the IRS did not yet have access to your 2021 tax information when the advance payments were sent out, the agency relied on the most recent information they had on file for you to determine how much to send you based on that year’s income, number of dependents and other qualifying information.

Don’t Miss: Someone Stole My Stimulus Check

Nursing Homes And Assisted

Since the payment doesnt qualify as a resource for Medicaid purposes until 12 months after it was first received, nursing homes and assisted living facilities should not require residents to sign over their payment until this period has passed. If you believe a nursing home or assisted living facility has improperly taken the payment from you or a loved one, file a complaint with your states attorney general.

Stimulus Relief Checks: Whos Getting More Money This Fall

Gas prices and inflation as a whole have come down somewhat in recent weeks. However, prices are still much higher than they were a year ago, and that is leaving Americans feeling short-changed.

Student Loan Forgiveness:

The federal government has not indicated that another stimulus check is on the way, so some states are taking matters into their own hands. As usual, each state has its own approach, with some offering tax rebates while others are simply cutting checks. A handful of states have stimulus relief checks or rebates on the way this fall. Find out if your state is on the list as well as some important dates to keep in mind.

You May Like: Amount Of Third Stimulus Check

You May Like: Are They Sending Out Stimulus Checks

Havent Received Your Third Stimulus Payment Yet

The IRS will continue to send checks via the Treasury. The majority who have received a first or second payment dont need to do anything more to get the third payment, which often will be sent out automatically. Following the model of the second round of checks, payments should be issued automatically to people who:

- Filed 2019 or 2020 federal tax returns. The IRS will use the taxpayers latest processed return.

- Registered for the first round of stimulus payments through the non-filer portal on IRS.gov by Nov. 21, 2020.

- Receive Social Security , Supplemental Security Income , or Railroad Retirement Board or Veterans Affairs benefits.

Those receiving Social Security and other federal benefits will generally receive this third payment the same way as their regular benefits.

The IRS Get My Payment Tool allows you to provide information to the agency for a stimulus check and to track payment status.

If you got your payment based on your 2019 return and find that youre entitled to more based on your 2020 return, the IRS will compute the additional amount owed to you.

Third Payments Differed From Previous Economic Impact Payments

The third payments differed from the earlier payments in several respects:

- Income phaseout amounts changed. Payments were reduced for individuals with adjusted gross income of more than $75,000 . The reduced payments ended at $80,000 for individuals and $160,000 for married filing jointly. People above these levels did not receive any payment.

- Payment amounts are different. Most families received $1,400 per person, including all dependents claimed on their tax return. Typically, this means a single person with no dependents received $1,400, while married filers with two dependents received $5,600.

- Qualifying dependents expanded. Unlike the first two payments, the third payment was not restricted to children under 17. Eligible individuals received a payment based on all of their qualifying dependents claimed on their return, including older relatives like college students, adults with disabilities, parents and grandparents.

You May Like: When Is The Latest Stimulus Check Coming

Do I Qualify And How Much Will I Receive

If you receive certain social security, retirement, disability, survivors, railroad retirement, or veterans benefits, you may automatically qualify to receive a payment. Learn more to see if this applies to you.

For most people, the IRS will use information from your 2019 or 2018 tax return or information that you provide to see if you qualify for an Economic Impact Payment.

To qualify for a payment, you must:

- Be a U.S. citizen or U.S. resident alien

- Not be claimed as a dependent on someone elses tax return

- Have a valid Social Security Number . Or if you or your spouse is a member of the military, only one of you needs a valid SSN

- Have an adjusted gross income below a certain amount that is based on your filing status and the number of qualifying children under the age of 17. If you are not required to file taxes because you have limited income, even if you have no income, you are still eligible for payment.

You may be eligible based on the criteria below, even if you arent required to file taxes. If you qualify, your Economic Impact Payment amount will be based on your adjusted gross income, filing status, and the number of qualifying children under age of 17. You will receive either the full payment or a reduced amount at higher incomes.

Direct Payments Round : December 2020

President Trump signed a $900 billion assistance package into law on December 27, 2020, as part of the Coronavirus Response and Relief Supplemental Appropriations Act of 2021. It offered a lump-sum payment of up to $600, with an extra $600 available for households with children under the age of 16 who were dependents.

People making less than $75,000 received the full stimulus payment, but those making more than that received a gradually lower amount, up to a maximum phase-out limit of $87,000 for 2019. Direct deposit and paper checks were the primary methods of payment, with EIP 2 Cards being used for certain subsequent payments. Payments were made between December 29, 2020, and January 15, 2021.

If you didnt get a stimulus payment from either the Covid-19 Relief bill in December or the CARES Act, you can claim it retroactively when you file your federal tax returns for 2020.

Recommended Reading: When Do We Get The Next Stimulus Checks

Also Check: How To Recover Stimulus Check

Where Is My 3rd Stimulus Check

Check for your status at www.irs.gov/coronavirus/get-my-payment. The third round of Economic Impact Payments will be based on a taxpayer’s latest processed tax return from either 2020 or 2019. That includes anyone who used the IRS non-filers tool last year, or submitted a special simplified tax return.

Can A Nursing Home Or Assisted Living Facility Take The Payment From Me

No. If you qualify for a payment, its yours to keep. If a loved one qualifies and lives in a nursing home, residential care home or assisted living facility, its theirs to keep. The facility may not put their hands on it or require somebody to sign it over to them. Even if that somebody is on Medicaid.

You May Like: Where My Golden State Stimulus

Third Stimulus Check Calculator

President Biden signed the American Rescue Plan Act on March 11, 2021. Provisions in the bill authorized a third round of stimulus checks worth $1,400 for each eligible person , plus an additional $1,400 for each dependent. However, as with the first- and second-round payments, the third-round stimulus checks were reduced or eliminated for people with an income above a certain amount.

If you didn’t receive a third stimulus check, or didn’t receive the full amount, you can get any money you’re entitled to by claiming the recovery rebate tax credit on your 2021 tax return. If you’re wondering if you qualify for the credit, comparing what you should have received to what you actually received is a good place to start .

To see how large your third stimulus payment should have been, answer the three questions in the calculator below and we’ll give you a customized estimate.

The Third Round Of Stimulus Checks

The most recent checks were included in the American Rescue Plan, which was enacted on March 11, 2021. Eligible individuals will receive a payment of $1,400 , plus an additional $1,400 per eligible child. However, those payments phase out quickly for incomes above $75,000 for single taxpayers, above $112,500 for taxpayers filing as head of household, and above $150,000 for married couples filing jointly. Taxpayers would be ineligible for any payment, unless they have a qualifying child, above the following income levels:

- $80,000 for single taxpayers

- $120,000 for taxpayers filing as head of household

- $160,000 for married couples filing jointly

Similar to previous iterations of the payments, most taxpayers will receive the funds by direct deposit. For Social Security and other beneficiaries who received previous payments via debit card, they will receive this third payment the same way. Overall, such payments are expect to cost $411 billion through 2030 according to the Congressional Budget Office.

Read Also: Free File Taxes For Stimulus

Can I Claim A Stimulus Check For Someone Who Is Deceased

Yes. For the third stimulus check, people who have died on or after January 1, 2021, are eligible to receive the third stimulus check. However, for married military couples, the date of eligibility is expanded. If the person who died was a member of the military and died before January 1, 2021, the surviving spouse can still receive the third stimulus check, even if they dont have an SSN.

For the first and second stimulus check, the IRS has stated that people who died on or after January 1, 2020, are eligible to receive both payments.

If they didnt receive the stimulus payments or didnt receive the full amounts that they are eligible for, spouses or other family members can file a 2020 federal tax return and claim it as part of their tax refund or use GetCTC.org if they dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2021.

Who Is Eligible For The Third Stimulus Check

While eligibility is similar to the first and second stimulus checks, there are differences. There are four primary requirements:

1. Income: The income requirements to receive the full payment are the same as the first and second stimulus checks. There is no minimum income needed to qualify for the payment. Households with adjusted gross income up to $75,000 for individuals will receive the full payment. The third stimulus payment starts to phaseout for people with higher earnings. The third stimulus checks maximum income limit is lower than the first and second stimulus check. Single filers who earned more than $80,000 in 2020 are ineligible for the third stimulus check.

View the chart below to compare income requirements for the first, second, and third stimulus checks.

| Income to Receive Full Stimulus Payment | First Stimulus Check Maximum Income Limit | Second Stimulus Check Maximum Income Limit | Third Stimulus Check Maximum Income Limit |

| Single Filer | |||

| $120,000 |

2. Social Security Number: This requirement is different from the first and second stimulus check.

Any family member that has a Social Security number or dependent can qualify for the third stimulus check. For example, in a household where both parents have ITINs, and their children have SSNs, the children qualify for stimulus checks, even though the parents dont.

See the chart below for further explanation of how this works.

Recommended Reading: When Can Social Security Recipients Expect The Stimulus Check

Fourth Stimulus Check Update

Bidens American Rescue Plan Act, which created the third stimulus checks, did boost tax credits for most parents with children under 18, but only for the year 2021. Most parents and legal guardians will receive a tax credit of $3,600 for children under six, and $3,000 per child aged six through 17.

Half of that credit is coming in the form of monthly advance payments to parents beginning July 15 $300 per month for younger kids, and $250 for older ones. Thats similar to the monthly recurring checks that some legislators have called for.

The same law also retroactively exempted a large chunk of unemployment benefits paid out in 2020 from federal income tax. People who collected unemployment in 2020 and paid tax on it are getting thousands of dollars in tax-refund checks.

The American Rescue Plan Act also offers tax credits that cover all or most of the cost of a Silver health-insurance plan for six months under the Affordable Care Act, aka Obamacare. Youre eligible for this if you filed for unemployment benefits at any time in 2021, and if you dont currently get health insurance through Medicare, Medicaid or someone elses health plan.

Bidens American Families Plan, which is separate from the American Jobs Plan, will seek to extend those tax credits, including the advance payments, through the end of 2025.

The American Families Plan would also mandate up to 12 weeks of paid parental leave and subsidies for childcare.

Stimulus Check 1 2020

This is when the first stimulus check was delivered:

- The CARES Act, which authorized the payment, was signed into law.

- The IRS began making direct deposits to those with bank information on file. Most were delivered by April 15.

- Paper stimulus checks started going out at a rate of around 5 million per week. Payments continued through early summer.

- End of April: Beneficiaries of certain benefits, such as Social Security retirement benefits, began receiving payments at the end of April via direct deposit.

- May: SSI beneficiaries began receiving checks, as did Social Security beneficiaries who use representative payees to manage their benefits.

- May 18: IRS started to send payments via prepaid debit card, also known as Economic Impact Payment Cards.

- Eligible individuals in U.S. territories started to receive stimulus payments.

- Individuals who used the Get My Payment tool to report eligible dependents prior to May 17 began to receive checks if they’d missed out on dependent funds.

- Mid-September: Individuals who lost payments because spouses owed past-due child support began receiving catch-up stimulus checks.

- Extended deadline for non-filers to use online tool to register and get their stimulus payment by Dec. 31, 2020.

You May Like: Third Stimulus Check File Taxes