How Are Americans Using Stimulus Checks

The Federal Reserve Bank of New York says that households are spending a smaller percentage of their stimulus checks and saving more. The that households set aside just under 25% of their third-round payments for consumption. This share fell from just over 29% of first-round payments reported in June 2020 and almost 26% of second-round payments reported in January 2021.

The table below is based on all three SCE surveys and breaks down the average percentage of stimulus payments spent, saved and used to pay off debt:

| New York Fed SCE Breakdown of Stimulus Check Spending | |

| Payment Round | |

| 37.4% | 33.7% |

The New York Fed also says that households expect to spend an average 13% of the third stimulus check on essential items and an average 8% on non-essential items.

For a comparison, preliminary data collected by the U.S. Census Bureau from shows that the majority of stimulus recipients are almost three times more likely to use checks to pay down debt than add to their savings.

An earlier showed that the majority of recipients who got the first stimulus check spent their payment on household expenses. Adults with incomes between $75,000 and $99,999 told the Census that they would most likely pay off debt or add to their savings. While adults making less than $25,000 said they would use their stimulus to pay for expenses.

For those households that spent their first stimulus checks, the study says:

How Do I Find The Stimulus Payment Amount I Received

Refer to your Notice 1444 for the payment amounts you were issued. If you don’t have this notice, you may be able to find it in your bank account history.

Most people receive their payments automatically. If you used a bank account for your refund or taxes due on your most recent tax return, your payment was most likely sent by direct deposit to that account. If you chose to receive your refund on a TaxSlayer Visa® Debit Card issued by Green Dot Bank, you may have received it on that card.

Otherwise, they should have been mailed to your last known address.

Will The Stimulus Affect My Taxes For This Year Or Next Year

None of the three stimulus checks are considered income, and therefore arent taxable. They wont reduce your refund or increase what you owe when you file your taxes this year, or next. They also wont affect your eligibility for any federal government assistance or benefits.

Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.File your own taxes with confidence using TurboTax. Just answer simple questions, and well guide you through filing your taxes with confidence.Whichever way you choose, get your maximum refund guaranteed.

You May Like: 2021 Homeowner Relief Stimulus Program

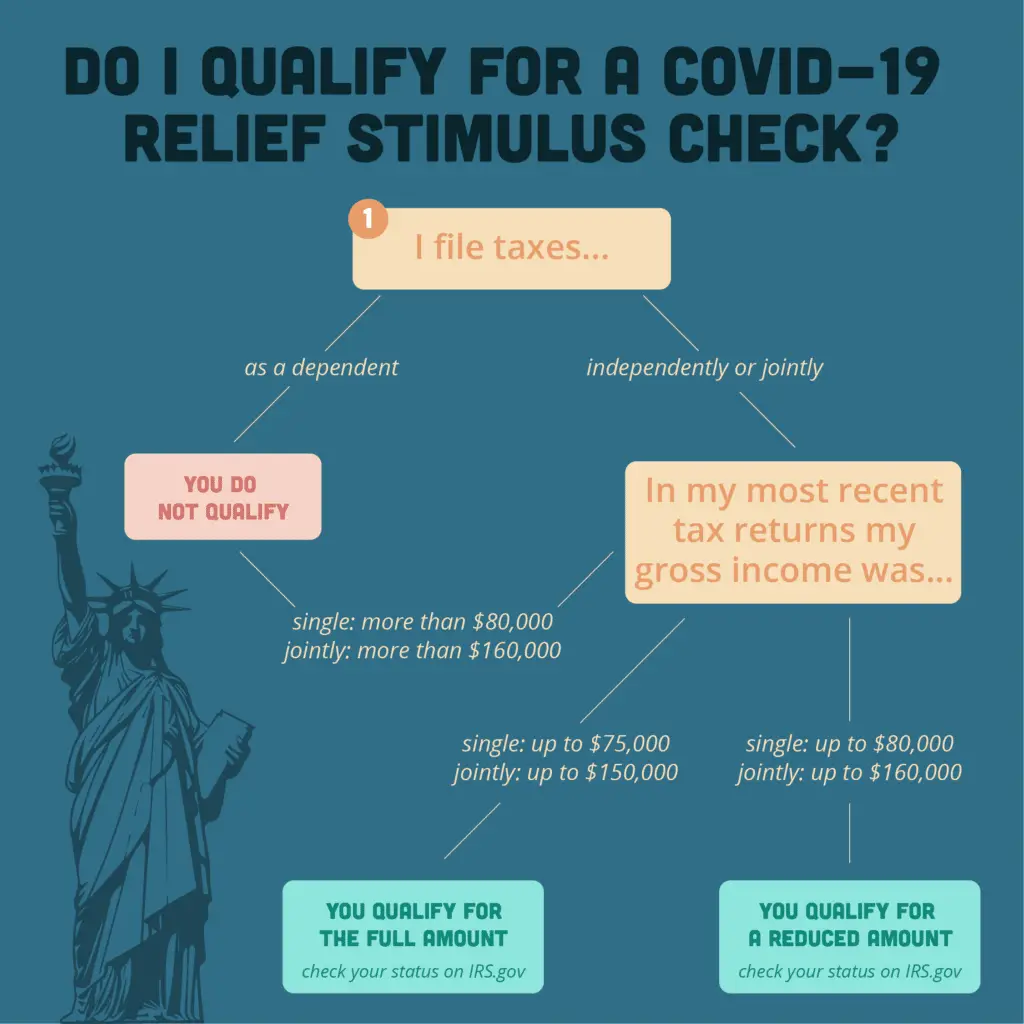

Who Is Eligible For The Third Stimulus Check

While eligibility is similar to the first and second stimulus checks, there are differences. There are four primary requirements:

1. Income: The income requirements to receive the full payment are the same as the first and second stimulus checks. There is no minimum income needed to qualify for the payment. Households with adjusted gross income up to $75,000 for individuals will receive the full payment. The third stimulus payment starts to phaseout for people with higher earnings. The third stimulus checks maximum income limit is lower than the first and second stimulus check. Single filers who earned more than $80,000 in 2020 are ineligible for the third stimulus check.

View the chart below to compare income requirements for the first, second, and third stimulus checks.

| Income to Receive Full Stimulus Payment | First Stimulus Check Maximum Income Limit | Second Stimulus Check Maximum Income Limit | Third Stimulus Check Maximum Income Limit |

| Single Filer | |||

| $120,000 |

2. Social Security Number: This requirement is different from the first and second stimulus check.

Any family member that has a Social Security number or dependent can qualify for the third stimulus check. For example, in a household where both parents have ITINs, and their children have SSNs, the children qualify for stimulus checks, even though the parents dont.

See the chart below for further explanation of how this works.

The Second Round Of Stimulus Checks

The second round of stimulus payments were authorized on December 27, 2020 as part of the Consolidated Appropriations Act, 2021. Those payments typically totaled $600 per person, or $1,200 for married individuals, plus $600 for each qualifying child. The payments began phasing out at the same income levels as the current payments, but the maximum income levels to receive a payment were slightly higher. Taxpayers were ineligible for any payment, unless they had a qualifying child, above the following income levels:

- $87,000 for single taxpayers

- $124,500 for taxpayers filing as head of household

- $174,000 for married couples filing jointly

As of March 5, 2021, about $135 billion of the second round of payments have been sent out overall, such payments are expected to cost a total of $164 billion according to the Congressional Budget Office.

Read Also: What Stimulus Did We Get In 2021

Six Stimulus Checks And Direct Payments Worth Up To $1700 Going Out This Month

The latest round of cash begins to be phased out for individual taxpayers who earn $75,000 a year.

But once you hit the $80,000 annual gross income limit, you won’t be eligible for the help at all.

Like the single-taxpayer cut-off, there’s a $120,000 AGI cap on how much heads of households can earn to be eligible for the help.

A head of household is a single taxpayer who claims a dependent.

How Much Are Stimulus Checks

Eligible individuals with adjusted gross income up to $75,000 will automatically receive the full $1,200 payment. Eligible married couples filing a joint return with adjusted gross income up to $150,000 will automatically receive the full $2,400 payment. Parents also get $500 for each eligible child under 17.

Recommended Reading: Where’s My Stimulus Check Ca

How Does The Irs Determine My Eligibility For The Third Economic Impact Payment

Most eligible people will get the third Economic Impact Payment automatically and won’t need to take additional action. The IRS will use available information to determine eligibility and issue the third payment to the following eligible people who:

- Filed a 2020 tax return.

- Filed a 2019 tax return if the 2020 return has not been submitted or processed yet.

- Did not file a 2020 or 2019 tax return but registered for the first Economic Impact Payment using the special Non-Filers portal last year.

- Are federal benefit recipients as of December 31, 2020, do not usually file a tax return, and received Social Security and Railroad Retirement Board benefits, Supplemental Security Income and Veterans Affairs benefits.

- The IRS is working with these agencies to get updated information for 2021 to assist with stimulus payments at a date to be determined. IRS.gov will have more details.

Three Rounds Of Stimulus Checks See How Many Went Out And For How Much

While you may have heard them referred to as stimulus checks, the Economic Impact Payments were for the most part direct deposited into bank accounts or sent out as bank cards. More than 472 million payments totaling $803 billion in financial relief went to households impacted by the pandemic. The Internal Revenue Service based the amounts that individuals received on income, tax filing status, and number of children .

NOTE: If you did not receive an Economic Impact Payment in 2020 or 2021, or you have questions about the payments, please visit the Internal Revenue Service for more information.

Don’t Miss: New York Stimulus Check 4

Who Gets A Stimulus Check

Stimulus checks are available to eligible U.S. individuals with Social Security numbers. However, eligibility rules vary depending on the checks.

For the first two payments, anyone claimed as a dependent wasnt eligible for their own check. However, individuals who claimed dependents under 17 could receive a payment for them. The third check still prohibits dependents from claiming their own checks. However, individuals who claim dependents can now receive a payment for adult dependents as well as for dependent children over age 17.

There are also income limits. Each of the three checks is available in full to single tax filers with an income under $75,00. Heads of house with an income under $112,500 are also eligible, as are married joint filers with an income under $150,000. However, phase-out rules the level at which high earners lose eligibility for checks differ for each payment, as well discuss in more detail below.

The IRS utilized tax return information from 2018 or 2019 to determine income and eligibility for the first two checks. It will use tax return information from 2019 or 2020 to determine income and eligibility for the third payment. The agency also obtained information from the Social Security Administration and VA to send payments to benefits recipients who dont file tax returns. And it established an online form for non-filers to claim their payments.

State And City Stimulus

Some states have also given out extra stimulus payments, including California and Maine, with many using funds from the Rescue Act.

In 2021, California launched two-state stimulus programs: the Golden State Stimulus I and Golden State Stimulus II.

These stimulus checks are worth up to $1,200 and $1,100, respectively.

Furthermore, the state recently issued about 139,000 stimulus checks.

Moreover, California plans to send out up to another 70,000 stimulus checks starting mid-March.

Those getting paper checks need to allow up to three weeks for them to arrive.

Eligible Maine residents received $285 stimulus payments until the end of 2021, and it’s unclear if this will continue into 2022.

Another city in California, Santa Ana, started sending out $300 payments loaded on prepaid Visa debit cards last year.

“So far about 2,700 have been distributed and we plan to give out up to the full 20,000 cards either in person or notifying qualified residents by mail to pick them up,” a Santa Ana official told The Sun in December.

According to a statement by the city, those with poverty rates above the Santa Ana median of 42% will qualify for the support.

Also, thousands of St Louis, Missouri residents were able to claim a $500 stimulus check in December.

However, applications for the moment are paused and the city will keep the public informed on any potential future reopening of its portal.

Oregon is another state that has launched its own stimulus program.

Also Check: Who Gets The $1400 Stimulus Check

Stimulus Checks: Direct Payments To Individuals During The Covid

GAO-22-106044

The federal government made direct payments to individuals totaling $931 billion to help with COVID-19. However, it was challenging for the IRS and Treasury to get payments to some people.

We found that nonfilers , first-time filers, mixed immigrant status families, and those experiencing homelessness were among those likely to have trouble receiving these payments in a timely manner.

We recommended that Treasury and the IRS tailor their outreach efforts to educate such people about their eligibility for these payments.

In 2020 and 2021, IRS and Treasury issued $931 billion in direct payments to individuals to ease financial stress due to the COVID-19 pandemic. However, some eligible Americans never received payments. We made recommendations to strengthen Treasury and IRSs outreach and communications efforts for the billions of dollars in similar tax credits IRS administers, such as the Earned Income Tax Credit.

Who’s Eligible For The Latest Stimulus Check

THERE is certain criteria that must be met in order to claim your third stimulus check.

You could be entitled to a payment if the following is true:

- You are not a dependent of another taxpayer

- You have a Social Security number valid for employment

Your adjusted gross income must also not exceed:

- $160,000 if married and filing a joint return

- $120,000 if filing as head of household or

- $80,000 for single applicants

Don’t Miss: $600 Stimulus Check Not Received

How Long Does It Take To Get My Stimulus Checks

The IRS announced on December 29 that it has started sending out the second round of stimulus checks to millions of Americans. Treasury Secretary Steven Mnuchin said that direct payments would go out a few days after the President signed the bill, and paper checks will take the longest.

For a comparison, the first stimulus checks already went out to the vast majority of Americans who are eligible for one. The IRS sent out the first electronic stimulus check payments on April 11, with most having arrived by April 15. The recipients of these initial payments were those who qualify for a check and have filed a tax return via direct deposit in either 2018 or 2019.

The first paper stimulus checks were in the mail as of April 24, 2020, with President Donald J. Trump printed on the memo line. This initial round of physical payments is specifically for individuals with an adjusted gross income of $10,000 or less. Each week after this, an additional five million paper checks will be mailed to those with an AGI of $10,000 above the previous weeks limit . Unfortunately, that means that some Americans did not get their checks until late summer or early fall.

Recipients of Social Security retirement benefits, Social Security survivor benefits, Social Security disability benefits, Supplemental Security Income , Railroad Retirement benefits and VA benefits who have their bank account on file with the IRS will automatically get their second stimulus check via direct deposit .

Heres How To Claim The Payment On Your Tax Return

Those who believe they are due more money must file a 2021 tax return, even if they dont usually file taxes, and claim whats called the Recovery Rebate Credit. If a taxpayer is eligible for more money, it will either reduce any tax the personowes for 2021 or be included in a tax refund.

In order to claim the Recovery Rebate Credit, a taxpayer will need information that was sent in a letter from the IRS in the past couple of months. Known as Letter 6475, it confirms whether a taxpayer was sent a third stimulus payment and the amount. Alternatively, that information can be obtained by accessing your IRS online account.

For most taxpayers, the federal tax return filing deadline is April 18, though its a day later for residents of Maine and Massachusetts. Taxpayers having difficulty meeting the deadline can file for an automatic six-month extension by using Form 4868.

Recommended Reading: State Of Maine Stimulus Check

Can I Claim A Stimulus Check For Someone Who Is Deceased

Yes. For the third stimulus check, people who have died on or after January 1, 2021, are eligible to receive the third stimulus check. However, for married military couples, the date of eligibility is expanded. If the person who died was a member of the military and died before January 1, 2021, the surviving spouse can still receive the third stimulus check, even if they dont have an SSN.

For the first and second stimulus check, the IRS has stated that people who died on or after January 1, 2020, are eligible to receive both payments.

If they didnt receive the stimulus payments or didnt receive the full amounts that they are eligible for, spouses or other family members can file a 2020 federal tax return and claim it as part of their tax refund or use GetCTC.org if they dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2021.

The Third Round Of Stimulus Checks

The most recent checks were included in the American Rescue Plan, which was enacted on March 11, 2021. Eligible individuals will receive a payment of $1,400 , plus an additional $1,400 per eligible child. However, those payments phase out quickly for incomes above $75,000 for single taxpayers, above $112,500 for taxpayers filing as head of household, and above $150,000 for married couples filing jointly. Taxpayers would be ineligible for any payment, unless they have a qualifying child, above the following income levels:

- $80,000 for single taxpayers

- $120,000 for taxpayers filing as head of household

- $160,000 for married couples filing jointly

Similar to previous iterations of the payments, most taxpayers will receive the funds by direct deposit. For Social Security and other beneficiaries who received previous payments via debit card, they will receive this third payment the same way. Overall, such payments are expect to cost $411 billion through 2030 according to the Congressional Budget Office.

Recommended Reading: Who Qualified For Stimulus Check 2021

Can I Use The Calculator If I Havent Filed A Tax Return For 2020

Yes, you can use your 2019 tax return. The IRS emphasizes that if you use your 2020 return to estimate your payment, dont guess your AGI: File an accurate return first. Adjusted gross income, as the name implies, is your gross income minus certain adjustments such as educator expenses, student loan interest, alimony payments and qualifying contributions to retirement accounts. You can find AGI on line 11 of your 2020 federal 1040 income tax return or line 8b of your 2019 return.

If you werent able to claim your earlier $1,200 or $600 stimulus checks, you can do so on your 2020 tax returns. Use the Recovery Rebate Credit Worksheet and enter the amount from the worksheet onto Line 30 of your 1040.

How To Dispute A Transaction

What do I do if I have a question or think there is an error on my card?

How do I report a scam?

If you think you may have been scammed, please contact your local police department. You can also submit a fraud claim orfile a report if you do not recognize a recent purchase in your transaction history.

Don’t Miss: How To Set Up Direct Deposit For Stimulus Check