Will There Be A Fourth Stimulus Check After The Current Third Round

The long-awaited third stimulus checks for up to $1,400 are finally headed to Americans’ bank accounts and mailboxes, after President Joe Biden last week signed his $1.9 trillion COVID relief package into law. If you need more money for bills and to pay down debt, it’s on the way.

And will that be the end? No more direct payments?

Several members of Congress are arguing for a fourth stimulus check and even more after that, because they point out that many Americans are still struggling more than a year into the pandemic.

But the Biden aid bill won passage with every Republican lawmaker voting no, and it cleared the Senate in a 51-50 squeaker, with Vice President Kamala Harris casting a tiebreaker vote. So is it realistic to hope the president will support further relief payments, and Congress will approve them? Here’s a closer look.

Stimulus Checks For Hundreds Of Dollars

Farmworkers and meatpackers are entitled to up to $600 per person for pandemic health and safety-related costs, including personal protective equipment, child care and expenses related to testing or quarantining, the USDA says.

Approximately $20 million of the $700 million pool of money will be set aside for grocery store employees. However, the amount individuals in that industry will receive is not yet known.

“Our farmworkers, meatpacking workers and grocery workers overcame unprecedented challenges and took on significant personal risk to ensure Americans could feed and sustain their families throughout the pandemic, says Agriculture Secretary Tom Vilsack, in a news release.

“They deserve recognition for their resilience and financial support for their efforts to meet personal and family needs while continuing to provide essential services,” Vilsack says.

When it comes time to apply in 2022, workers must show proof of employment and provide self-certification of their pandemic-related expenses. Itemized receipts wont be necessary, according to Agriculture Department guidance.

Hawaii: $300 Rebate Payments

In June, Hawaiis legislature approved sending a tax rebate to every taxpayer. Taxpayers earning less than $100,000 per year will receive $300, and those earning more than $100,000 per year will receive $100. Dependents are eligible for the rebate, too.

Taxpayers who filed their 2021 state income tax returns by July 31, 2022, should have received their returns in September, and those who requested paper checks should have received them by October 31. Taxpayers who filed their returns after July 31 should receive their check up to 10 weeks after their return is accepted by the tax department.

You May Like: Who Qualify For Third Stimulus Check

Will There Be A Fourth Stimulus Check From The Government

Some lawmakers pushed for a fourth stimulus check to help Americans who were struggling to rebuild after COVID-19 and its economic impact. But that stimulus never happened.

With the economy and jobs both on the upswing after the country started to reopen, another federal stimulus check didnt seem necessary. But some states took matters into their own hands and sent out a fourth stimulus check to their residents.

How To Get A Little More Stimulus Asap

This new round of assistance is narrowly targeted. But if your budget is feeling tight these days because of the pandemic and inflation, or you could just use a little extra spending money, there are several options to help you create your own stimulus.

-

Deal with your debt. Credit may be convenient, but carrying a balance on your card will eventually bury you in expensive interest. Tackle that problem by folding your balances into a single debt consolidation loan. With a lower interest rate, youll not only slash the cost of your debt, but youll also be able to pay it off faster.

-

Trade in your mortgage. Almost half the homeowners who have taken advantage of the pandemic’s historically low mortgage rates are now saving $300 a month or more, according to a recent Zillow survey. If you own your home and haven’t refinanced in the past year, you’re overdue. Thirty-year mortgage rates are hovering around 3%, so compare multiple refinance offers to see how much you might save.

-

Save while you shop. If you’re doing more online shopping, a free browser extension can help you find the lowest prices by automatically scanning thousands of retailers.

-

Turn your pennies into a portfolio. Even if you don’t have much money, you can still earn returns from the stock market. There’s a popular app that can help you invest your “spare change” from everyday purchases to grow a diversified portfolio.

Read Also: How To Cash My Stimulus Check Without Id

What Was The Timeline For The Third Stimulus Check

Once the bill moved through all the hoops, eligible people started seeing their stimulus payments before March 2021 was over.7 The IRS and U.S. Treasury have been quick with delivering past stimulus checksDecember 2020s payments reached most folks by direct deposit within a week of then President Donald Trump signing the legislation.8

California: Up To $1050 Rebate

Payments for Californias Middle-Class Tax Refund started hitting bank accounts and mailboxes at the beginning of October, with the most recent batch sent out on October 24. An estimated 23 million Golden State residents are eligible for these payments. To find out if you qualify, you can check the State of Californias Franchise Tax Board website. The Franchise Tax Board expects 90% of payments to be issued in October.

A one-time payment of $350 will go to individual taxpayers who make $75,000 or less. Couples filing jointly will receive $700 if they make no more than $150,000 annually. Eligible households will also receive an additional $350 if they have qualifying dependents.

Taxpayers with incomes between $75,000 and $250,000 will receive a phased benefit with a maximum payment of $250. Those households can get up to an additional $250 if they have eligible dependents.

Eligible recipients who received Golden State Stimulus payments by direct deposit should have seen their Middle Class Tax Refund deposited between October 7 and October 25. All remaining direct deposits were slated to occur between October 28 and November 14.

If you received your California stimulus payments by debit card, youll also receive the Middle Class Tax Refund by debit card between October 24 and December 10. Remaining debit card payments will be sent by January 14, 2023.

Read more: California Residents Receive Another Round of Stimulus Payments

Read Also: I Haven’t Received My Second Stimulus Check

Didn’t Get The Full Third Payment Claim The 2021 Recovery Rebate Credit

You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return.

Individuals can view the total amount of their third Economic Impact Payments through their individual Online Account. Through March 2022, we’ll also send Letter 6475 to the address we have on file for you confirming the total amount of your third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need this information from your online account or your letter to accurately calculate your 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment. All amounts must be considered if filing jointly.

Using the total amount of the third payment from your online account or Letter 6475 when preparing a tax return can reduce errors and avoid delays in processing while the IRS corrects the tax return.

What If My Mailing Address Changed Since I Received My Previous Stimulus Checks How Will I Get My Third Stimulus Check

If you are expecting to receive your third stimulus check by mail, it will be mailed to the last address you filed with the IRS. If your address has changed since then, there are different options you can take to make sure your stimulus check gets to you:

Option 1: File your 2020 federal tax return to update your address. If you havent filed your 2020 tax return yet, this is an easy way to update your address. File a tax return with your current address and your payment will be sent through the mail once the IRS receives your updated address.

Option 2: Provide your banking information in the IRS Get My Payment tool. If the post office was unable to deliver your stimulus check, it will be returned to the IRS. Two to three weeks after the payment has been issued, Get My Payment will display the message Need More Information. You will have the option to have your payment reissued as a direct deposit by providing your banking information.

If you dont provide your banking information, the IRS will mail your payment once your address is updated.

Option 3: Notify the IRS that your address has changed by telephone, an IRS form, or a written statement. It can take 4-6 weeks for the IRS to process your request.

You May Like: Irs Stimulus Payments Phone Number

When And How Are Payments Being Issued

Stimulus payments are being issued by Californiaâs Franchise Tax Board via direct deposit and debit cards.

If you received either of the two previous Golden State Stimulus payments by direct deposit, you should have received your Middle Class Tax Refund by direct deposit between October 7 and October 25.

Otherwise, if you filed your 2020 California tax return electronically and got a refund by direct deposit, you could expect to receive a direct deposit relief payment by November 14.

Debit cards will be used to distribute the remaining payments. If you received the Golden State Stimulus by debit card, you can expect to receive a debit card for the Middle Class Tax Refund. All payments by debit card will be sent by January 15, 2023.

Earlier this fall, the FTB said 90% of payments were expected to be issued in October, and 95% would be distributed by the end of the year.

For the latest updates on when you can expect your payment, if it has not already arrived, visit the Middle Class Tax Refund website.

Will There Be A Recession Stimulus Check

Well, in case you missed the news, the U.S. economy is in a mild recession . So, will Uncle Sam start sending out recession stimulus checks? The answer is, maybe one daybut not now.

It might surprise you, but stimulus checks were actually a thing way before COVID! The government sent out stimulus checks during the 2001 and 2008 recessions to try to boost consumer spending. Most people got $300which is nowhere close to the three big stimulus checks people got during the pandemic.

The idea behind a stimulus check is to help people who are struggling to pay their bills and kick-start consumer spending. But that really wouldnt make sense right now, because giving consumers more money to spend would boost inflationand thats already out of control.

Congress currently isnt considering any recession stimulus check bills, but you never know what those guys are up to.

Don’t Miss: What’s The Latest News On Stimulus Check

Covid+credit: When Will I Get My $1200 Stimulus Check

Reading time: 4 minutes

Americans everywhere have been hit hard by the Coronavirus/Covid-19 pandemic, with much of the economy in a holding pattern amid nationwide efforts to curb the spread of the virus. Fortunately for those in need, some short-term economic relief is coming in the form of federal government stimulus checks.

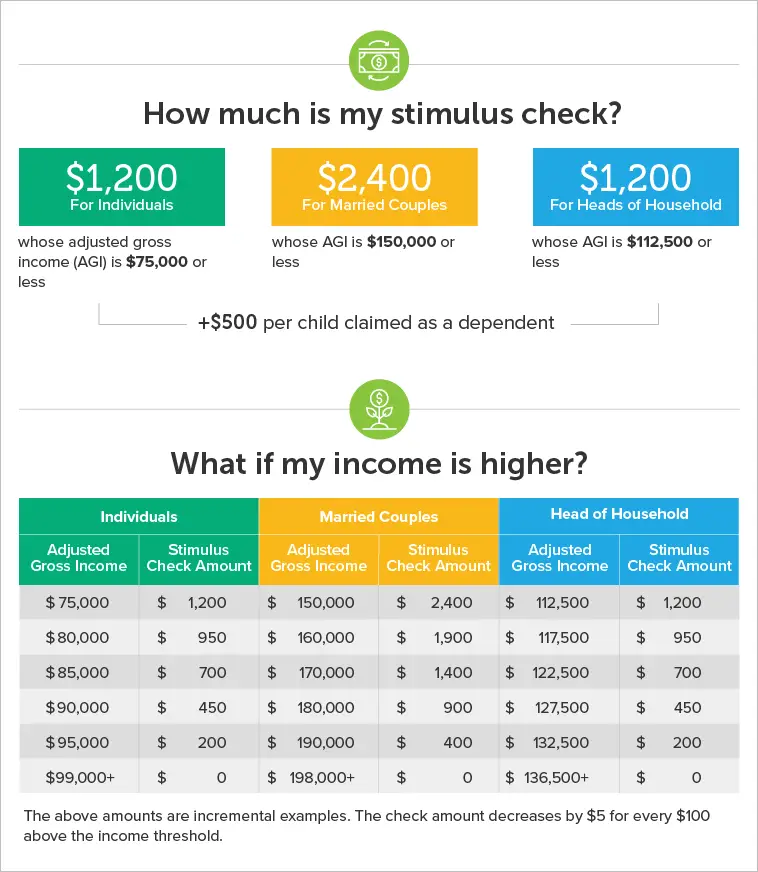

As a part of the record-setting $2 trillion Coronavirus Aid, Relief, and Economic Security Act approved in late March by Congress, most adults will receive a one-time payment of up to $1,200, though the exact amount depends on your income. Adults will receive an additional $500 for every qualifying child age 16 or under, and married couples without children earning below a certain threshold will receive a total of up to $2,400. You do not need to apply to receive a payment.

Now that U.S. government stimulus checks have turned from a dream into a reality, what’s the top question on everyone’s mind? When will I receive my money? The short answer? It’s complicated.

Why Hair Dryers Other Popular Gifts Are Surging In Price This Holiday Season

1 month ago

Voters in five states can expect to see marijuana legalization provisions on their midterm ballot. Though pot remains illegal on a federal level, states continue to inch toward widespread legalization. According to Ballotpedia, there are five states with marijuana-related proposals…

1 month ago

At a time when food prices have reached alarming highs, criminals are stealing SNAP food stamp benefits from the households that need them the most. The United States Department of Agriculture , which oversees SNAP benefits, issued two warnings in…

1 month ago

Also Check: Who Qualified For 3rd Stimulus Check

Fourth Stimulus Check Update

Biden’s American Rescue Plan Act, which created the third stimulus checks, did boost tax credits for most parents with children under 18, but only for the year 2021. Most parents and legal guardians will receive a tax credit of $3,600 for children under six, and $3,000 per child aged six through 17.

Half of that credit is coming in the form of monthly advance payments to parents beginning July 15 $300 per month for younger kids, and $250 for older ones. That’s similar to the monthly recurring checks that some legislators have called for.

The same law also retroactively exempted a large chunk of unemployment benefits paid out in 2020 from federal income tax. People who collected unemployment in 2020 and paid tax on it are getting thousands of dollars in tax-refund checks.

The American Rescue Plan Act also offers tax credits that cover all or most of the cost of a “Silver” health-insurance plan for six months under the Affordable Care Act, aka Obamacare. You’re eligible for this if you filed for unemployment benefits at any time in 2021, and if you don’t currently get health insurance through Medicare, Medicaid or someone else’s health plan.

Biden’s American Families Plan, which is separate from the American Jobs Plan, will seek to extend those tax credits, including the advance payments, through the end of 2025.

The American Families Plan would also mandate up to 12 weeks of paid parental leave and subsidies for childcare.

Where Is My Third Stimulus Check

You can track the status of your third stimulus check by using the IRS Get My Payment tool, available in English and Spanish. You can see whether your third stimulus check has been issued and whether your payment type is direct deposit or mail.

When you use the IRS Get My Payment tool, you will get one of the following messages:

Payment Status, which means:

- A payment has been processed. You will be shown a payment date and whether the payment type is direct deposit or mail or

- Youre eligible, but a payment has not been processed and a payment date is not available.

Payment Status Not Available, which means:

- Your payment has not been processed or

- Youre not eligible for a payment.

Need More Information, which means:

- Your payment was returned to the IRS because the post office was unable to deliver it. If this message is displayed, you will have a chance to enter your banking information and receive your payment as a direct deposit. Otherwise, you will need to update your address before the IRS can send you your payment.

Recommended Reading: When Was The Third Stimulus Check Sent Out In 2021

Why Are States Giving Out A Fourth Stimulus Check

It all started back when the American Rescue Plan rolled out. States were given $195 billion to help fund their own local economic recovery at the state level.1 But they dont have forever to spend this moneystates have to figure out what to use it on by the end of 2024, and then they have until the end of 2026 to spend all that cash.2That might sound like forever, but the clock is ticking here.

Some states have given out their own version of a stimulus check to everyone, and others are targeting it at specific groups like teachers. And other states? Well, they havent spent any of it yet.

Some states like Colorado, Maryland and New Mexico are giving stimulus checks to people who make less than a certain amount of money or who were on unemployment. So far, California is the only state to give out a wide-sweeping stimulus check.3 Other states like Florida, Georgia, Michigan, Tennessee and Texas are putting the money toward $1,000 bonuses for teachers.

If I Owe Child Support Will Mytax Return Be Applied Tomychild Supportarrears

-

Maybe.Federal law and regulationsdetermine when federal payments are intercepted and applied to child support arrears.

-

IfTANFhas been received for your child,thetotalamount of past due supportonall ofyourchild support cases must be at least $150

-

IfTANFhasnotbeenreceivedfor your child,thetotalamount of past due supportonall ofyour child support casesmust be at least $500

Don’t Miss: When Will The Stimulus Checks Be Sent Out

Middle Class Tax Refund Eligibility

Twenty-three million residents are expected to qualify for the Middle Class Tax Refund.

To qualify, you must have filed your 2020 state tax return by October 15, 2021 and been a California resident for at least six months in 2020. You must not be listed as a dependent on someone elseâs return for the 2020 tax year, and you must be a California resident on the date your payment is issued.

The payments are offered on a sliding scale, based on income and tax-filing status. Low-income tax filers with at least one dependent stand to receive the highest payouts.

Like the two previous Golden State Stimulus payments, individuals who earn more than $75,000 will not receive the full benefit but other details have changed.

Hereâs a breakdown of eligibility for the maximum payout:

- $350: Individuals who earn less than $75,000 per year

- $700: Couples who file jointly and earn less than $150,000 per year

- $350: Additional payout for the above families who have at least one dependent

Income limits to qualify for the minimum payout are as follows:

- $200: Individuals who earn up to $250,000 per year

- $400: Couples who file jointly and earn less than $500,000 per year

- $200: Additional payout for the above families who have at least one dependent