Do Ssdi And Ssi Recipients Have To File A Tax Return

People who receive monthly SSDI or SSI checks who did not file a tax return in 2018 or 2019 are not required to do anything, including filing a simple tax return, unless they have dependents. For those without minor children or other dependents, the IRS will look at Form SSA-1099 benefit statements to get the information it needs to send out the payments automatically.

Parents who have children under 17 or other dependents, who receive monthly SSDI or SSI checks, and who did not file a tax return in 2018 or 2019, however, might need to file a tax return by May 17, 2021 to claim the Recovery Rebate Credit for their minor children or other dependents.

Read Also: Stimulus Check Wheres My Payment

You’re Married And Filed A Joint Tax Return

If you’re married and filed a joint tax return, half of your third stimulus payment might be delayed. That’s because the IRS is sending two separate payments to some joint filers. The first half may come as a direct deposit, which you may have already received. But the other half is then mailed to the address the IRS has on file, which is generally the address on your most recent tax return or as updated through the U.S. Postal Service. The second payment could come the same week as the first oneor it might not arrive for a few weeks.

If you’re a joint filer and only get half of what you should have received, both you and your spouse should check the IRS’s “Get My Payment” tool separately using your own Social Security number to see the status of your payments.

We Outline Some Courses Of Action To Consider If You Have Not Received Your Stimulus Payment After The Irs’ January 15 Deadline

After President Donald Trump signed the $900 billion coronavirus stimulus bill, the IRS has been working as quickly as possible to send out the $600 stimulus check payments before the January 15 deadline that was stipulated in the bill.

With the tight deadline fast approaching, the IRS has sent out more than 80% of the stimulus checks, which is much quicker than the first round of stimulus checks, when it took the 19 days to send about 50% of the checks out.

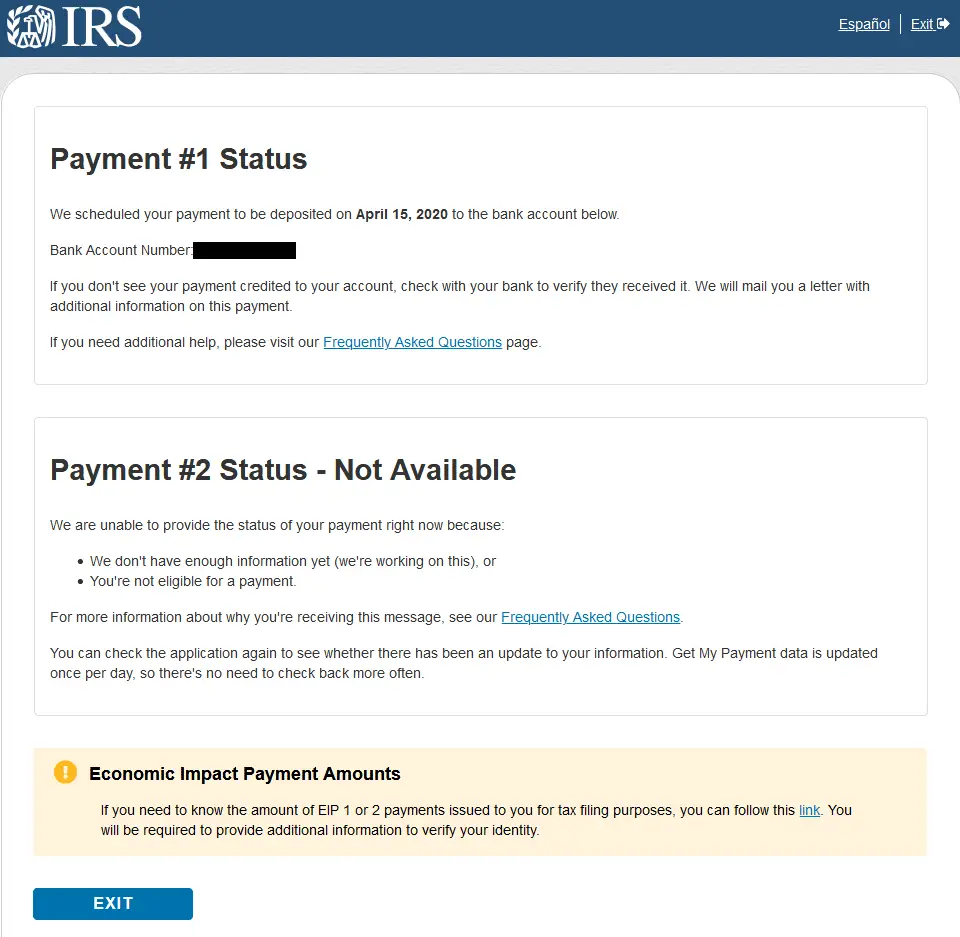

If you still have not received payment be it through direct deposit, a mailed check or a prepaid debit card after January 15, the first thing you must do is use the IRS online Get My Payment tool, where you can find out if your payment was sent and when, and whether you were getting direct deposit, mailed check or debit card.

If you are due to receive a check or debit card in the mail, its probably best to give it some more time to arrive as delays have been caused by postal slow-downs across the country.

If you are you still havent received a check or debit card a week after 15 January, you can contact debit card issuer MetaBank, at 240-8100, to see if there is a record of a payment in your name. If the card never arrives, you can request a new one with no charge.

Don’t Miss: Who Sends The Stimulus Checks

What Do You Do If You Havent Received Your Second Stimulus Check From The Irs By January 15

The new law passed states that by that date the IRS must have sent most of the Economic Impact Payments. The Supplemental Appropriations for Coronavirus Response and Relief Act of 2021 under which the second round of $600 minimum stimulus checks are distributed requires the Internal Revenue Service and the Department of Treasury to distribute most payments by January 15.

But, in case the IRS was unable to process your payment due to lack of beneficiary information, you must claim it by filing a tax return in 2021 as a Refund Recovery Credit using Form 1040 or Form 1040-SR.

Make Sure Correct Information Is On File

If you got your first stimulus payment by direct deposit, the IRS will be using that same bank account information to issue you the second one. You can’t change your payment information, according to the IRS. That means that if your bank information has changed at allsay you had to close that account and open a new onethe bank will return that deposit and the IRS will mail you a check. That means, again, keep an eye on your mail.

For mailed payments, the IRS will generally use the address on your most recent tax return. If thats changed, you need to notify the IRS, which you can do on the phone, in a letter or via Form 8822. Make sure to also let the United States Postal Service know of your address change, so the check will be forwarded to your new address if it goes to your old one. If the IRS gets your payment back because it couldnt be delivered by the postal service, it will hold the payment until it receives the updated address .

Read Also: Were There Any Stimulus Checks In 2021

Youre Not Sure About Eligibility

Payments being sent out this month are largely based on the most recent tax returns the IRS has available, for 2019. The amount you receive as an initial payment will be based on that data, though you may be eligible for more.

Eligible individuals with an adjusted gross income under $75,000, heads of household under $112,500, and married couples filing jointly under $150,000 are eligible for the full $600 payment. After that, payments phase out with reduced payments up to $87,000 in income for individuals, $124,500 for heads of household, and $174,000 for married couples filing jointly. Children under 17 claimed on 2019 federal tax returns each qualify for an additional $600, while children 17 and older and adult dependents are not eligible.

Even if you dont typically file tax returns, you can still receive your stimulus payment. It wont be issued automatically, but you can get it in the form of the Recovery Rebate Credit when you file your 2020 taxes.

In fact, anyone who believes they didnt receive the full payment for which they are eligible can reconcile the lost amount as a Recovery Rebate Credit on 2020 federal tax returns using Form 1040, the basic form most people will use when they file taxes.

Americans To Invest Stimulus Checks In Traditional Assets

According to a new Yahoo FinanceHarris poll finds that 9% of people expecting to get a $1,400 stimulus check plan to invest some of the money in traditional assets such as stocks, while 7% plan to use the money to buy cryptocurrencies such as bitcoin.

Young investors are even more willing to gamble. Among 18- to 24-year-olds, 19% plan to put stimulus money into traditional investments, and 10% plan to buy cryptocurrencies with the cash. The numbers are higher still for millennials aged 25 to 40: 20% are putting stimulus money into traditional investments and 15% are buying crypto. Above the age of 40, the portion planning to use the money for each type of investment drops to single digits.

The numbers come from a survey of 1,052 US adults conducted March 1215.

Also Check: Who Can I Call To Get My Stimulus Check

I Still Havent Gotten Paid What Do I Do

You can always check on the status of your payment at the IRS.gov website, which will tell you when the check was sent out if it was.

If the check was sent out but you never received it, you can check out the payment trace tool, where you can try to find where, exactly, your check got lost in the process.

If you never get your money, you can use the Recovery Rebate tool on your 2022 tax return to get your cash.

If you are owed a plus-up payment because you got too small of a stimulus check, you can file your tax return ASAP, and the IRS will send you the money it owes you based on their calculations.

Related Articles:

Do I Have To Return Money I Received But Dont Qualify For

If you got more money than you should have if your income went up in 2020 and you wouldnt have qualified based on your 2020 income, for example then you dont owe any money back because of that, Bronnenkant says.

Another scenario, Erb says, could be those who receive payment for a dependent child who turned 17 in 2020, aging out of eligibility. But again, you dont need to repay the money received in that case. If it turns out that you got more than you deserved, then you dont have to pay it back, she says.

Also Check: How Do I Get The 3rd Stimulus Check

Eligibility For A ‘plus

You can estimate how much money the IRS owes your household for the third stimulus check. Just make sure to triple-check that you meet the qualifications, including the income limits.

Because of the overlap with tax season 2020, many people may receive some, but not all, of their allotted amount. If your income changed in 2020, in some cases, the IRS may owe you more money than you received if the income figure used to calculate your payment from your tax returns in 2018 or 2019 is less in 2020. Likewise, if you now have a new dependent, such as a new baby, you may be owed more money.

The IRS is automatically sending “plus-up payments” to make up the difference. If you don’t get one, you may need to claim the missing money another way later in 2021 or even in 2022, since tax season is officially over now.

When And How Will I Get My Stimulus Payment

Direct deposit payments are being made by the IRS first, with paper checks and prepaid cards to follow. Estimated dates for delivery arent yet available, but since the IRS is already busy processing 2020 tax returns, a somewhat slower rollout than with the second stimulus check is possible.

- If youve supplied direct deposit information to the IRS , your Economic Impact Payment will be deposited directly into your bank account on file with the IRS.

- If you havent supplied direct deposit info to the IRS, a paper stimulus check or prepaid EIP card will be mailed to you.

Not sure if the IRS has your account information?

Visit the Get My Payment site at IRS.gov to find out. You can also check the status of your payment.

Also Check: How Much Is The Next Stimulus

Don’t Miss: Will There Be Another Stimulus Package

File Your Tax Return As You Normally Would Unless Your Income Increased In 2020

Not all stimulus-eligible Americans are required to file federal income tax returns under normal circumstances.

For example, those for whom Social Security Disability Insurance benefits account for most or all income, and those with no or very low income generally arent expected to file.

However, the IRS may require stimulus-eligible Americans to file information tax returns that confirm their identity, income, and residence. If youre not required to file income taxes and didnt file an information tax return in 2019 or 2020, file an information return as soon as you can.

If your income is high enough that you must file a federal income tax return, youll need to file a return for the 2020 tax year before the final mid-October deadline .

Depending on your income, you may qualify to file for free with an IRS Free File Alliance partner or a free tax preparation software provider likeH& R Block.

Whether you should file as soon as possible or wait depends on how your income changed in 2020. If your income decreased significantly, youll want to file immediately because you could be entitled to a bigger stimulus payment than your 2019 income allows.

However, if you dont file in time, you may be eligible to claim the difference between your actual stimulus payment and the higher amount you would have been entitled to on your 2021 return.

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

You May Like: When Did Americans Receive Stimulus Checks

Also Check: What States Are Getting Stimulus Check

Is There A Deadline To Get My Second Stimulus Check

All second stimulus checks were issued by January 15, 2021. If you didnt get a second stimulus check by then , you can claim your second stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

If youre required to file taxes:

The deadline to file your 2020 tax return was May 17, 2021. The tax filing extension deadline is October 15, 2021. Many tax filing software programs close after this date. If you can find an online tax filing program that is still accepting 2020 tax returns, you can file a tax return to get your stimulus checks even though the deadline has passed.

If you dont owe taxes, there is no penalty for filing late. If you owe taxes, you may be subject to penalties and fines for not filing or not paying taxes. The government may reduce your tax refund to pay for any taxes you owe and other federal and state debts.

To learn more about your options if you think you owe taxes, read Filing Past Due Tax Returns and What to Do if I Owe Taxes but Cant Pay Them.

If youre not required to file taxes:

The deadline to use GetCTC.org is November 15, 2021. You can get the Recovery Rebate Credit using GetCTC.org, a simplified tax filing portal for non-filers. GetCTC is an IRS-approved service created by Code for America in partnership with the White House and U.S. Department of Treasury. You can use the portal even if youre not signing up for the Child Tax Credit advance payments.

How Will I Know When My Stimulus Payment Has Been Deposited

As always, you can use online banking or the U.S. Bank Mobile App to monitor your account balance and transactions as often as you wish.

To be notified in real time, we recommend setting up a transaction alert . You can choose to be notified by text1 or email whenever a deposit or withdrawal is made on your account.

Visit the Get My Payment site at IRS.gov to monitor the status of your payment.

Recommended Reading: Is Stimulus Check Taxable Income

Also Check: Who Qualified For Stimulus Check 2021

Havent Received Your Second Stimulus Check Request A Payment Tracking From The Irs

If you have not received the second stimulus check, you must do this action to find out what happened to it. There are several reasons why the second stimulus check may not have reached you.

If you should have received it, but havent yet, you may need to contact the IRS to request a Payment Tracker to trace that money.

You should request a Payment Tracker if the Get My Payment tool shows that your payment was issued, but you have not received it within the following time frames:

-5 days from the date of deposit shown in Get My Payment and if your bank says it has not received it.-4 weeks from when it was mailed to your home address.-6 weeks from when it was mailed and you have a forwarding address on file at your local post office.-9 weeks since it was mailed and you have an overseas address.

To request a Payment Tracker, you must call the IRS at 800-919-9835 or mail or fax a completed Form 3911. Find out where to mail or fax that form in the state where you live on the IRS website.

Note that you should not send in a Form 3911 if you have already requested a telephone tracing. And you should not request a Payment Tracking to determine if you are eligible for a check or to confirm the amount you should receive.

What To Do If You’re Still Waiting For A Stimulus Check

The IRS has created a specific tax credit for eligible taxpayers who didn’t get the stimulus money that was owed to them according to legislation that passed in 2020 . It’s called the Recovery Rebate Credit. You’ll find it on line 30 of your 2020 tax return.

For the fastest processing, the IRS encourages citizens to file 2020 tax returns electronically. The agency has not yet announced when you can start filing 2020 tax returns. As the situation unfolds, more information may become available.

Don’t Miss: Who Qualified For Third Stimulus Check

Why Can’t I Claim My Second Stimulus Check Now

With the first round of stimulus checks, qualified individuals who were waiting for their payment could request their money right away through an IRS portal. One commonly asked question is why this isn’t the case this time around.

With the first stimulus check, the Treasury Department and IRS sent payments automatically to taxpayers for whom bank account information was on file and created an online portal that allowed everyone else to register for and receive the payment. People could still claim and receive their initial $1,200 stimulus check months after most of the payments had been given out.

There’s a good reason the government decided to do this. At the time the first stimulus check was granted as part of the CARES Act, the majority of Americans had already filed their tax returns, so there wasn’t any other mechanism in place to get deserving U.S. residents their money.

With the second stimulus check, it just so happens that 2020 tax season is right around the corner. In fact, the IRS recently announced that tax season will start on Feb. 12, so the best course of action if you’re entitled to a second stimulus payment but didn’t get it would be to file your 2020 tax return as soon as possible on or after that date — making sure to claim your Recovery Rebate Credit, of course.