How Much Money Will I Receive

Payments for eligible couples who file jointly may range from $400 to $1,050.

Qualifying individuals may receive $200 to $700.

The amount of the checks depends on two factors: income and number of dependents.

The most generous sums $1,050 may go to married couples who file jointly with $150,000 or less in income and a dependent. A couple in that income category will receive $700 if they have no dependents.

Individual taxpayers with $75,000 or less in income may receive $700 if they have a dependent and $350 if they do not.

The payments are gradually phased out for those with up to $500,00 in income, for married couples, and $250,000, for individuals. California residents with incomes above those thresholds will not receive a stimulus payment.

The income is based on your California adjusted gross income, which can be found on line 17 on the 2020 Form 540 or line 16 on the 2020 Form 540 2EZ.

An online tool can help estimate your payment amount.

Who Is Eligible For The Child Tax Credit 2021

Eligible Americans with income below $75,000, or married couples with income below $150,000, were eligible for the full amount of three rounds of stimulus payments that were made by the federal government in 2020 and 2021. Those stimulus income limitations also applied to the enhanced child tax credit although partial child tax credits were available for people with higher incomes.

Advance payments of the enhanced child tax credits were sent to people from July to December 2021. The monthly payments were up to $250 or $300 per child, for a period of six months.

Other Problems With Your Payment

If you received payment and have a problem, follow these steps:

Recommended Reading: Can I Still Claim My First Stimulus Check

Who Is Eligible For This New California Stimulus Check

Eligibility will depend on your income, as reported on your 2020 tax return whether or not you have at least one dependent. The stimulus amounts are based on three tiers .

Single tax filers:

- $350 if they make less than $75,000 per year and an additional $350 if they have at least one dependent

- $250 if they make between $75,001 and $125,000 per year. Plus an additional $250 if they have at least one dependent

- $200 if they make between $125,001 and $250,000 per year. Plus an additional $200 if they have at least one dependent

Joint tax filers:

- $700 if they make less than $150,000 per year and an additional $350 if they have at least one dependent

- $500 if they make between $150,001 and $250,000 per year. Plus an additional $250 if they have at least one dependent

- $400 if they make between $250,001 and $500,000 per year. Plus an additional $200 if they have at least one dependent

Head of household or surviving spouse:

- $350 if they make less than $150,000 per year and an additional $350 if they have at least one dependent

- $250 if they make between $150,001 and $250,000 per year. Plus an additional $250 if they have at least one dependent

- $200 if they make between $250,001 and $500,000 per year. Plus an additional $200 if they have at least one dependent

Note the additional $350 you get for having at least one dependent isn’t increased for additional dependents.

California stimulus check eligibility is based on the following qualifications:

What If My Income Has Changed

A lot can change in two years. What if you make significantly less now than you did in 2020? Could you qualify for a larger payment?

No, the California Franchise Tax Board tells Nexstar. The Middle Class Tax Refund legislation requires eligibility to be based on a complete filed 2020 California state income tax return.

That means regardless of any change in income lower or higher youre locked into receiving the payment size that corresponds with your 2020 income. There is no way to appeal the Franchise Tax Board for an exception.

Don’t Miss: Didn’t Get Stimulus Payment

Can I Still Get A Stimulus Check

If you think youre eligible for a COVID stimulus payment or the 2021 child tax credit, and didnt already receive those funds, you can file a simple tax return by visiting ChildTaxCredit.gov.

But youll need to move quickly. Thats because if youre not required to file a tax return, this year’s deadline to file a simplified return is November 15. If you are required to file, but missed the April 18 filing deadline, you have until on ChildTaxCredit.gov and see if youre eligible to receive a stimulus payment or child tax credit.

However, if you don’t owe taxes to the IRS, the IRS has said that you can still file your 2021 tax return, and claim the Child Tax Credit for the 2021 tax year, at any point until April 15, 2025. But because that can get confusing, it’s probably best to file for the 2021 tax year as soon as you can.

According to the Government Accountability Office, groups that were most likely to have missed out on pandemic relief stimulus payments or the child tax credit , were people who never filed a tax return or who filed for the first time during the pandemic. The federal government also had difficulty getting stimulus checks and child tax credits to people without bank accounts or reliable internet access, and people who were experiencing homelessness in 2020 and 2021.

Who Qualifies For A Refund

To qualify to receive a payment, you must meet certain requirements.

You must have been a resident of California for six months or more in the 2020 tax year and be a current state resident.

You must have filed a 2020 tax return by Oct. 15, 2021, and have adjusted gross income within the required thresholds.

Additionally, you must not have been claimed as a dependent by someone else.

You May Like: How To Check For Stimulus Checks

California Inflation Relief Payments: When Will I Get My Check

Dan Avery

Writer

Dan is a writer on CNET’s How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

California residents have started receiving onetime “Middle Class Tax Refund” payments.

Why it matters

Eligible taxpayers will receive between $200 and $1,050, either through direct deposit or debit cards.

Inflation-relief payments started going out to California taxpayers this month. The Middle Class Tax Refund, as it’s being billed, can be for as much as $1,050, depending on your income, residency, filing status and household size.The payout is part of Gov. Gavin Newsom’s $12 billion relief effort, which he said “prioritizes getting dollars back into the pockets of millions of Californians grappling with global inflation and rising prices.” As of Oct. 20, nearly 3.5 million Californians already received their payments through direct deposit, according to the Franchise Tax Board.

Here’s what you need to know about California’s inflation relief checks, including who’s eligible, how much they can get and how payments are being distributed.

For more on tax relief, find out which other states are issuing tax refunds and pausing their gas tax.

When Will I Get My Payment Who Gets Paid First

The state is sending out the payments in waves. When you get paid depends on the method with which youre getting paid .

The earliest direct deposits will go out Friday, Oct. 7, to people who received a Golden State Stimulus payment last year by direct deposit.

The last payments should be sent out by Jan. 15, 2023, at the latest, according to the Franchise Tax Board.

Use the chart below to see when you can expect your payment:

| Payment date |

| Taxpayers who dont fall into above categories |

Read Also: Who Can I Call To Get My Stimulus Check

How The Payments Will Work

Eligibility will depend on how much money each California resident earns, as well as how many dependents they have. The amounts are based on three tiers for either single or joint tax filers, per a preliminary summary of the proposed budget:

Single tax filers will receive:

- $350 if they earn less than $75,000 per year

- $250 if they earn between $75,001 and $125,000 per year

- $200 if they earn between $125,001 and $250,000 per year

Joint tax filers will receive:

- $700 if they earn less than $150,000 per year

- $500 if they earn between $150,001 and $250,000 per year

- $400 if they earn between $250,001 and $500,000 per year

If either single or joint filers have at least one dependent, they will receive an additional amount of either $350, $250 or $200, based on their tier.

Checks will be sent via direct deposit or debit card by late October, per a Newsom administration official, as reported by the Sacramento NBC affiliate TV station KCRA.

The state will also suspend the diesel sales tax which is now 23 cents per gallon for 12 months, starting Oct. 1. Money will be set aside for local transportation infrastructure projects, as well as for rent and utility cost relief programs.

Californias $350 Stimulus Checks Are A Make

-

California Democrats approved an aid package that includes $350 stimulus checks for residents.

-

The payments aim to offset the burden of soaring costs, yet they could boost inflation higher.

-

Stimulus tends to fuel increased spending, and high demand has played a big role in the current inflation.

California Gov. Gavin Newsom touted his state’s new round of stimulus checks as a “middle class tax rebate” meant to “help you fill your gas tank and put food on the table.”

The payments could end up worsening the inflation that lifted prices in the first place.

Newsom and Democratic state legislators approved a $17 billion economic aid package on Sunday including a new round of stimulus payments for roughly 23 million Californians. Individual California residents earning $75,000 and below or couples earning $150,000 and under will receive payments of $350 per filer, as well as $350 if the filer has any dependents. That pushes the total possible sum a family can receive to $1,050.

Higher-earning Californians stand to get smaller checks as well. Individuals earning between $75,000 and $125,000 are eligible for a $250 direct payment. The same applies to couples earning between $150,000 and $250,000.

Extra cash in Californians’ pockets can replace some of the funds lost to higher prices, but it doesn’t solve the disparity fueling such high inflation. The payments could even widen the gap by keeping consumer demand elevated.

Read the original article on Business Insider

You May Like: Where’s My Stimulus Check 2021 Tracker

Received A Payment In Error

If you received the Golden State Stimulus payment and believe this is an error, please review the eligibility qualifications above to verify this is an erroneous payment. Once verified, follow the instructions that correspond to the payment received:

Direct deposits:

Paper checks that have not been cashed:

ATTN: Golden State Stimulus FundFranchise Tax Board

Will There Be More Golden State Stimulus Checks

Its hard to know if California will continue to issue more stimulus checks but with the budget set for 2022 2023, its even harder to say. We will keep this updated with any information we find about future stimulus checks out of the state of California.

But with a massive budget, never say never!

Also Check: When Did The First Stimulus Check Come Out

Who Will Get A Debit Card In The Mail

Taxpayers who included their addresses but no bank account data will receive a debit card. Others who will receive a debt card include:

- People who filed paper tax returns.

- Those who owed taxes from their 2020 returns.

- Taxpayers who received a direct deposit for their 2020 refunds but who have since changed their bank accounts or switched banks.

- People who received an advance payment from their tax service provider, or who paid their tax preparer fees using their tax refund.

Deadline For Stimulus Payment In Delaware

Delaware paid $300 in relief rebates to taxpayers who submitted their 2020 federal tax forms. The budget surplus made the one-time payment conceivable. For joint tax returns, couples received $300 apiece.

Most Delaware citizens who qualified for payments received them in May 2022. If you are entitled but havent yet received a reimbursement, you can submit an online application starting November 1. The application deadline will end on November 30, 2022, and it will only endure 30 days.

A legitimate Delaware residential postal address, an active Delaware drivers license granted before December 31, 2021, and the applicants Social Security number are requirements.

Following the end of the application period and the evaluation of all applications, payments will be made to qualified applicants, reports Washington Examiner.

Read Also: Irs Sign Up For Stimulus

Other Benefits For California Residents

The budget contains a handful of additional measures to try to relieve inflations impact on residents:

- $1.95 billion for emergency rental assistance for qualified low-income tenants who requested assistance before March 31

- $1.4 billion in funds to help residents cover past-due utility bills

The budget also includes a $14.8 billion, infrastructure and transportation package, as well as more than $200 million in additional funding that will go toward reproductive health care services.

Californias new budget also provides universal access to health coverage for low-income residents aged 26 to 49, regardless of immigration status, becoming the first state to do so.

When Will The Inflation

Eligible California residents should begin receiving payments starting in October of 2022. Some payments could arrive as late as January 2023. These payments will be issued via direct deposit or debit card.

Those who filed their income taxes electronically and got their 2020 tax refund via direct deposit will get their payment the same way.

Recommended Reading: When Will We Get 4th Stimulus Check

Is There A Stimulus Check For 2022

In addition to the pandemic relief stimulus payments and the 2021 child tax credit, you may have heard about so called 2022 stimulus checks. The 2022 stimulus checks are essentially rebates coming from various statesnot pandemic stimulus payments from the federal government.

Why are states sending rebate checks? Because of pandemic relief funding, many states have extra cash on hand, and so are sending rebate checks to their residents in 2022. Some states like Virginia, and California, are sending those payments out now. But several other states will send rebates or have already sent them.

Who Qualifies For An Inflation Relief Payment

Roughly 23 million California residents are eligible for the rebate plan, which has been set up in three tiers based on the adjusted gross income on your 2020 California state tax return. Residents who filed individually and made $250,000 or less or couples who filed jointly and made $500,000 or less qualify for a refund.In addition to income requirements, though, residents must have filed their 2020 tax refund by Oct. 15, 2021. You must have lived in the state of California for at least half of the 2020 tax year and still be a California resident on the date the payment is issued. Individual filers who earned over $250,000 and couples who made more than $500,000 combined in 2020 aren’t eligible, nor is anyone claimed as a dependent by someone else in the 2020 tax year.

Read Also: Can H& r Block Help With Stimulus Checks

Eligibility For The California Middle Class Tax Refund

Besides meeting the California adjusted gross income limits mentioned above there are other some other requirements to receive the Middle Class Tax Refund.

These include having filed a 2020 California tax return by 15 October 2021. As well, in the 2020 tax year you were not eligible to be claimed as a dependent and were a resident of California for at least six months that year. Finally, you must be a California resident on the date the payment is issued.

California Stimulus Checks: Final Round Being Distributed

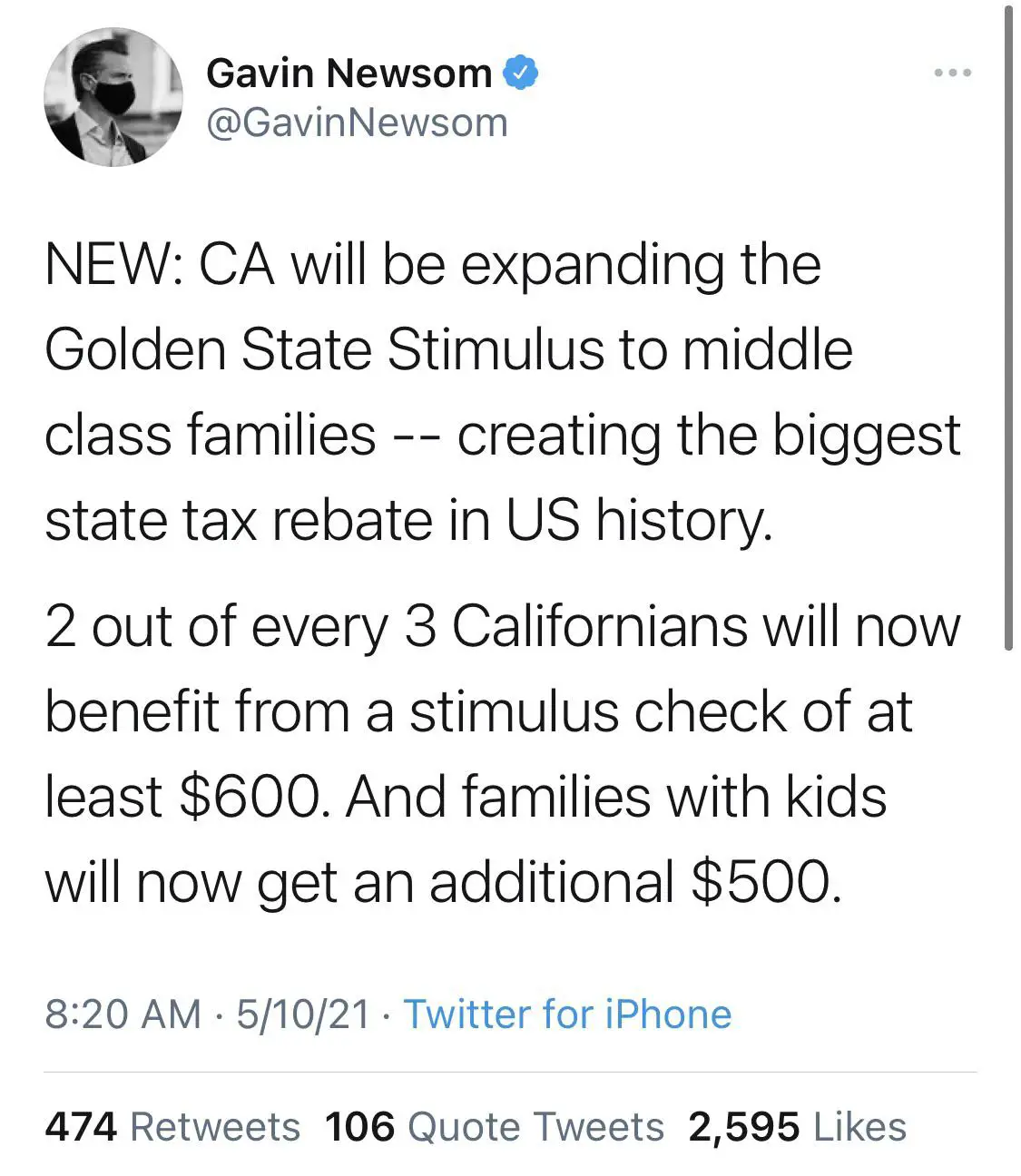

The final round of the Golden State Stimulus II payments is being mailed out to qualifying California residents. Families that met the eligibility requirements receive $600 plus $500 for dependents.

With this final round of payments, California has now issued more than 8 million checks and deposits, valued at more than $5.9 billion.

The second round of stimulus checks for California residents was part of Gov. Gavin Newsom‘s $100 billion budget that he signed into law in July. As part of the plan, the state expected to provide billions in coronavirus relief to 15.2 million California households or about two-thirds of the state’s taxpayers.

“The Golden State Stimulus is key to lifting up those hit hardest by the pandemic and supporting Californias economic recovery, putting money directly in the hands of folks who will spend it on basic needs and within their local communities,” Newsom said in a statement at the time.

Get your top stories delivered daily! . And, get breaking news alerts in the FOX 11 News app. Download for iOS or Android.

Eligible recipients include current California residents who lived in the state for more than half of the 2020 tax year and individuals who earned $75,000 or less in 2020.

Taxpayers filing with an Individual Taxpayer Identification Number who have applied for but have not received their ITIN by October 15, 2021, have until February 15, 2022, to file their return and still be eligible for GSS I and GSS II.

Read Also: How Many Stimulus Checks Were There In 2020