What If I Didnt Get Some Or All Of My Stimulus Checks

If you think you are eligible and you did not get a check for you or your dependents, you can still get the money by filing your 2020 or 2021 taxes. You may be eligible for free tax preparation help from Maines CA$H Coalition.

If you do not usually file a tax return and didn’t get your stimulus checks, you may still be able to file a tax return this year to get your stimulus checks. You should check with a tax professional. The IRS website also provides information about how to claim your stimulus checks if you didnt get them in 2020 or 2021. You can also call Pine Tree Legal Assistance.

Increase The Child Tax Credit Earned

- For those without children, the American Rescue Plan increased the Earned-Income Tax Credit from $543 to $1,502.

- For those with children, the American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and $3,600 for children under the age of six and raised the age limit from 16 to 17.

- The American Rescue Plan also increased and expanded the Child and Dependent Care Tax Credit, making more people eligible and increasing the total credit to $4,000 for one qualifying individual and $8,000 for two or more.

Second Stimulus Checks & Us Expats: What You Should Know

Q. What was the second stimulus check?

A. The second stimulus check was part of a December 2020 government relief package to provide financial relief to Americans during the pandemic. The relief package included $600 direct payments to each person with a Social Security Number who cannot be claimed as a dependent and earned under a certain amount of income. It also included up to $600 payments for each qualifying child under age 17.

Q. Did I get a second stimulus check if Im an American living overseas?

A. Yes, expats qualified for the second stimulus check. You qualified if you fall within the income threshold, have a social security number, and file taxes even if you live overseas.

Q. Did I need to sign up for it or sign off on it?

A. Most people didnt need to do anything to receive the second stimulus because the IRS based the payments off of 2019 tax returns. If you didnt file a 2019 return, you may be able to claim it on your 2020 tax return as a Recovery Rebate Credit.

Q. If I live abroad, when should I have gotten my second stimulus check if I qualified?

A. All of the second stimulus payments have gone out. Most people got a direct deposit.

Recommended Reading: Is The Fourth Stimulus Check Coming

How Much Is The Massachusetts Tax Rebate For

According to the Massachusetts Department of Revenue, taxpayers will receive a refund equal to about 14% of their personal income tax liability in Massachusetts for Tax Year 2021.That’s because, according to the State Auditor’s report, net state tax revenues exceeded allowable revenues . The percentage was finalized by the Department of Revenue after the filing deadline passed in October.

A website has been launched to help residents get an estimate of their refund, or you can call 877-677-9727.

Millions Of People May Still Be Eligible For Covid

Throughout the pandemic, IRS and Treasury struggled to get COVID-relief payments into the hands of some peopleespecially those with lower-incomes, limited internet access, or experiencing homelessness. Based on IRS and Treasury data, there could be between 9-10 million eligible individuals who have not yet received those payments.

Relief might be in sight for more families and individuals. Individuals with little or no income, and therefore not required to pay taxes, have until to complete a simplified tax return to get their payments. Taxpayers who missed the April 15 deadline have until . These IRS pages, irs.gov/coronavirus/EIP and ChildTaxCredit.gov, have more information on how to complete and submit a tax return.

Todays WatchBlog post looks at our work on COVID-19 payments to individuals, including the Child Tax Credit and next steps for people who may still be eligible to receive theirs.

Who can get a COVID-19 stimulus payment or a Child Tax Credit?

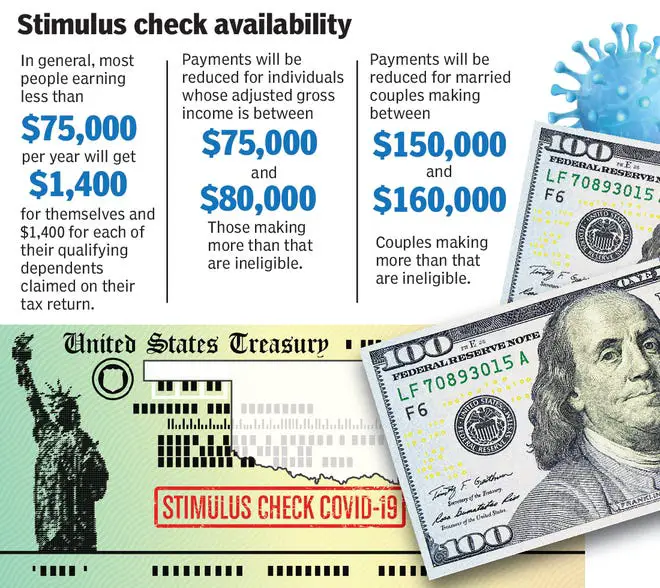

From April 2020 to December 2021, the federal government made direct COVID-19 stimulus payments to individuals totaling $931 billion. Congress authorized three rounds of payments that benefited an estimated 165 million eligible Americans. Generally, U.S. citizens with income below $75,000 or married couples with an income below $150,000 were eligible for all three payments and the full amount of each payment.

What more can Treasury and IRS do to get the word out about how eligible individuals can get their payments?

Recommended Reading: When Did Americans Receive Stimulus Checks

A Breakdown Of The Fiscal And Monetary Responses To The Pandemic

The COVID-19 pandemic, now in its third year, has tremendously impacted the U.S. and global economies. The U.S. government responded to the crisis when it enacted a number of policies to provide fiscal stimulus to the economy and relief to those affected by this global disaster. The Federal Reserve also took a series of substantial monetary stimulus measures to complement the fiscal stimulus.

In this article, we divided stimulus and relief efforts into monetary policy, made by the Fed, and fiscal policy, made by Congress and the Trump and Biden presidential administrations. Although the pandemic persists, many of these programs have since been discontinued.

Should I File My 2020 Taxes Now

The IRS already began issuing stimulus payments based on your latest filed tax return between 2018 and 2019. If you are required to file a tax return and havent filed your 2020 taxes, you may want to consider filing since you may be eligible for a tax refund. Last tax season about 72% of taxpayers received a tax refund and the average tax refund was close to $3,000.

Recommended Reading: Never Received 3rd Stimulus Check

I Need Help Buying Food

I need help buying food.

There is extra money available for food. Find your states SNAP program.

or call: 221-5689

I have kids.

Start accessing this money by filing your taxes with the IRS.*

State And City Stimulus

Some states have also given out extra stimulus payments, including California and Maine, with many using funds from the Rescue Act.

In 2021, California launched two-state stimulus programs: the Golden State Stimulus I and Golden State Stimulus II.

These stimulus checks are worth up to $1,200 and $1,100, respectively.

Furthermore, the state recently issued about 139,000 stimulus checks.

Moreover, California plans to send out up to another 70,000 stimulus checks starting mid-March.

Those getting paper checks need to allow up to three weeks for them to arrive.

Eligible Maine residents received $285 stimulus payments until the end of 2021, and it’s unclear if this will continue into 2022.

Another city in California, Santa Ana, started sending out $300 payments loaded on prepaid Visa debit cards last year.

“So far about 2,700 have been distributed and we plan to give out up to the full 20,000 cards either in person or notifying qualified residents by mail to pick them up,” a Santa Ana official told The Sun in December.

According to a statement by the city, those with poverty rates above the Santa Ana median of 42% will qualify for the support.

Also, thousands of St Louis, Missouri residents were able to claim a $500 stimulus check in December.

However, applications for the moment are paused and the city will keep the public informed on any potential future reopening of its portal.

Oregon is another state that has launched its own stimulus program.

Also Check: Direct Express Pending Deposit Stimulus Check

How Do I Update My Direct Deposit Information With The Irs To Receive My Stimulus Check

The IRS wont have your direct deposit information if you didnt provide it on your 2018 or 2019 tax returns, but you can use the IRS Get My Payment tool to check your payment status and confirm your payment type . If the IRS already has your direct deposit information and IRS Get My Payment tool shows your payment as pending or processed, you cannot use the tool to change your direct deposit information.

Third Round Of Stimulus Checks: March 2021

Barely a week after the second round of stimulus payments were completed, new president Joe Biden entered office and immediately unveiled his American Rescue Plan, which proposed a third of round of payments to Americans, including some of those who might have missed out on the first two rounds.

On Thursday 11 March, Biden signed his $1.9tn American Rescue Plan into law. The third payment provided eligible individual taxpayers for a check of up to $1,400, while couples filing jointly could receive a maximum of $2,800. In addition, families with dependents were eligible for an extra payment of $1,400 per dependent, regardless of the dependents age this time, there was no limit to the number of dependents that could be claimed for.

The first stimulus payments were issued swiftly just hours after Biden has signed the bill, the first batch of 164 million payments, with a total value of approximately $386 billion, arrived by direct deposit in individuals bank accounts. Some received their payments on the weekend of 13/14 March 2021. Since then, payments had been sent on a weekly basis including plus-up payments until the end of the year. Like before, those who didnt get all the EPI3 funds in 2021 due to them will be able to claim them when they file their tax returns in the spring of 2022.

Read Also: How To Get Stimulus Check On Taxes

Filed A Tax Return But Still Didn’t Receive Your Money Here’s What The Issue Could Be

If you filed your taxes this year but still haven’t received your stimulus check or child tax credit money that you’re eligible for, there are some other things that could be holding it up.

- You don’t have a bank account set up.

- It was your first time filing.

- You have a mixed-status household.

- You haven’t updated your address with the IRS or USPS.

- You’re experiencing homelessness.

- You have limited or no internet access.

If none of these reasons apply to you, it may be time to file a payment trace with the IRS either by calling 800-919-9835 or mailing in Form 3911.

Third Stimulus Check Calculator

President Biden signed the American Rescue Plan Act on March 11, 2021. Provisions in the bill authorized a third round of stimulus checks worth $1,400 for each eligible person , plus an additional $1,400 for each dependent. However, as with the first- and second-round payments, the third-round stimulus checks were reduced or eliminated for people with an income above a certain amount.

If you didnt receive a third stimulus check, or didnt receive the full amount, you can get any money youre entitled to by claiming the recovery rebate tax credit on your 2021 tax return. If youre wondering if you qualify for the credit, comparing what you should have received to what you actually received is a good place to start .

To see how large your third stimulus payment should have been, answer the three questions in the calculator below and well give you a customized estimate.

Read Also: Whats The Latest News On Stimulus Check

Read Also: Is It Too Late To Apply For Stimulus Check

How Do I Get My Third Stimulus Check

You dont need to do anything if:

- You have filed a tax return for tax year 2019 or 2020.

- You are a Social Security recipient, including Social Security Disability Insurance , railroad retiree. Or you are a Supplemental Security Insurance and Veterans Affairs beneficiary.

- You successfully signed up for the first stimulus check online using the IRS Non-Filers tool or submitted a simplified tax return that has been processed by the IRS.

The IRS will automatically send your payment. You can check on the status of your third stimulus check by visiting the IRS Get My Payment tool, available in English and Spanish.

If you are missing your third stimulus check, file your 2020 tax return or use GetCTC.org if you dont have a filing requirement. By submitting your information to the IRS, you will be signed up and automatically sent the third stimulus check.

How Do I Get My Stimulus Check

Stimulus checks will be based on information from your most recent tax filings, either tax year 2019 or 2018. If you have not filed your 2019 taxes, the IRS will use information from your 2018 tax return. The IRS will use your adjusted gross income information in the most recent tax return filed to determine the amount of your stimulus payment and will deposit your stimulus payment based on the latest direct deposit information. If your tax return does not indicate a direct deposit account, you will receive a paper check.

If you are not required to file and you dont receive Social Security income or Supplemental Security Income you can provide the IRS with the information they require to issue a stimulus payment using TurboTax Stimulus Registration Product.

Recommended Reading: How Do I Get The 3rd Stimulus Check

If I Owe Child Support Will Mytax Return Be Applied Tomychild Supportarrears

-

Maybe.Federal law and regulationsdetermine when federal payments are intercepted and applied to child support arrears.

-

IfTANFhas been received for your child,thetotalamount of past due supportonall ofyourchild support cases must be at least $150

-

IfTANFhasnotbeenreceivedfor your child,thetotalamount of past due supportonall ofyour child support casesmust be at least $500

How Much Money You Could Be Getting From Child Tax Credit And Stimulus Payments

Enhanced child tax credit: Up to $3,600 per child, or up to $1,800 per child if you received monthly payments in 2021.

First stimulus check: $1,200, sent in April 2020

Second stimulus check: $600, sent in December 2020

Third stimulus check: $1,400, sent in March 2021

Note that if you filed your taxes in 2021, you should’ve already received your money from the first two stimulus checks.

Recommended Reading: 3rd Stimulus Check 2021 Amount

When Will The Third Stimulus Check Be Issued

The government started sending the third stimulus checks on March 12, 2021. The IRS continues to send third stimulus checks as people submit their information to the IRS either by filing a 2020 tax return or using GetCTC.org. The deadline to use GetCTC.org is November 15, 2021.

If you have your banking information on file, the IRS sent your payment via direct deposit. Otherwise, you will receive your payment as a check or debit card via mail. Mailed checks and debit cards may take longer to deliver.

If you dont fall into any of these categories, youll have to wait to receive your third stimulus check. You will need to file a 2020 federal tax return to get the third stimulus check or use GetCTC.org if you dont have a filing requirement.

You can also get the first and second stimulus check as the Recovery Rebate Credit on your tax return or GetCTC.org if you are eligible.

What Was The Third Stimulus Check For

How the Third Stimulus Check Became Law. The American Rescue Plan was signed into law on March 11, authorizing a third round of stimulus checks that pay a maximum of $1,400 for millions of Americans. Targeted income limits, however, exclude individuals earning over $80,000 and joint tax filers making more than $160,000 …

Recommended Reading: Irs 3rd Stimulus Check 2021

Where Is My 2nd Stimulus Check

30. As with the first round of stimulus checks from the CARES Act, Americans can check the status of their payments at https://www.irs.gov/coronavirus/get-my-payment. The Get My Payment tool was reopened on Monday, and will confirm if the IRS has sent your second stimulus check, as well as your first payment.

What Can I Do If I Have Not Received My Eip Money By Those Deadlines

If you have not received all or some portion of your Economic Impact Payments by the deadlines above, you will have to file a 2020 tax return and claim these amounts. You claim them on line 30 of the 2020 Form 1040 as a “Recovery Rebate Credit“. This is another name for the EIP stimulus payments. If you did not get all or a portion of the EIP payments in advance, then you can claim them on line 30 of your tax return for 2020.

Read Also: Update On Ssdi Stimulus Check

How To Use Irs Get My Payment

The IRS also updated frequently asked questions Saturday on how to use the Get My Payment tool, which requires users to enter their full Social Security number or tax ID number, date of birth, street address and ZIP code.

But before you start entering your information hourly, the IRS says the tool updates once per day, usually overnight and that people should not call the IRS. Our phone assistors dont have information beyond whats available on IRS.gov.

The tool will show the status of when a payment has been issued and the payment date for direct deposit or mail, according to the frequently asked questions. Some will get a message that says Payment Status Not Available.

If you get this message, either we have not yet processed your payment, or you are not eligible for a payment, the IRS said. We will continue to send the 2021 Economic Impact Payment to eligible individuals throughout 2021.

And others will get a Need More Information message when using the tool if the payment was returned to the IRS because the post office was unable to deliver it for another reason.

If your address has changed the IRS says the easiest way to update is to file your 2020 tax return with your current address, if you havent already done so. Once we receive your current address, we will reissue your payment.

Contributing: Jessica Menton, USA TODAY

Follow USA TODAY reporter Kelly Tyko on Twitter: @KellyTyko