Amount And Status Of Your Payment

To find the amount of the third payment, create or view your online account or refer to IRS Notice 1444-C, which we mailed after sending the payment.

If you are sent a plus-up Economic Impact Payment after your 2020 tax return is processed:

- The amount of your initial third payment will no longer show in your online account. You will only see the amount of your plus-up payment.

- The status of your initial third payment will no longer show in Get My Payment. You will only see the status of your plus-up payment.

You May Like: How Much Does H & R Block Charge For Taxes

Recovery Rebate Credit: What It Is And How To Claim It

The third stimulus payment was technically an advance on the 2021 tax credit. And because the IRS did not yet have access to your 2021 tax information when the advance payments were sent out, they relied on the most recent information they had on file for you to determine how much to send.

When you receive Letter 6475, compare the amount you received against how much you were eligible for based on your 2021 tax information. If you think you received less than you were entitled to, you might be able to recover those funds by claiming the balance via the recovery rebate credit on your 2021 tax return. This could happen if, for example, you welcomed a newborn in 2021 or will be claiming a new qualifying dependent on your 2021 taxes.

On their website, the IRS states that most people who were eligible for the third round of payments have already received the funds. But if for some reason you were eligible for the payment but never received it, you also might be able to recover that money via the recovery rebate credit.

Page 59 of the instructions for Form 1040 has a worksheet to help you calculate how much to claim, and many quality tax-prep software programs will help you to claim the credit if youre eligible. Do make sure you carefully review the information you supply to the IRS math errors or miscalculations can delay your refund.

You May Like: Direct Express Stimulus Check Deposit Date March 2021 Update

Get Your Stimulus Check: File With The Irs

As part of the Coronavirus Aid, Relief and Economic Security Act Americans will be receiving economic impact payments to provide some financial relief during the COVID-19 pandemic.

The IRS has begun to distribute these payments. However, in order to receive these payments individuals and couples must have filed with theInternal Revenue Service .

Also Check: Payable Doordash 1099

Read Also: How Many Stimulus Checks Did I Get In 2021

Why Is The Irs Sending Me Letter 6475

The Economic Impact Payment letters include important information that can help people quickly and accurately file their tax return,the IRS said in a January release, including personal information like your name and address and the total amount sent in your third stimulus payment.

This could include plus-up payments, the additional funds the IRS sent to people who were eligible for a larger amount based on their 2019 or 2020 tax returns, or information received from the Social Security Administration, Department of Veterans Affairs or the Railroad Retirement Board.

You may have already received a Letter 1444-C, which showed the amount you were paid and how it was delivered, but thats not what you want to use to prepare your 2021 return.

Read Also: Is It Too Late To File 2020 Taxes For Stimulus

Most People Who Qualify Under The Cares Act Should Receive Their Payment Automatically But Some May Need To Submit Their Information To The Irs To Receive Their Economic Impact Payment

As a result of the hardships presented by the coronavirus, Economic Impact Payments are being issued by the Internal Revenue Service. While most people will receive their payment automatically, there are some cases where non-filers will need to take action and submit their information to the IRS.

The best way to submit your info to receive the payment is through the IRS Non Filers Enter Payment Info portal. There, youll choose how you want to receive your payment. The fastest way to receive payment is through direct deposit, either to your bank or credit union account, or to an eligible prepaid card.

You May Like: Do You Pay Taxes On Stimulus Checks 2021

First And Second Stimulus Check

You will need to file a tax return for Tax Year 2020 . The deadline to file your taxes this year was May 17, 2021. The tax filing extension deadline is October 15, 2021.

If you missed the filing deadline, you can still file your tax return to get your first and second stimulus checks. If you dont owe taxes, there is no penalty for filing late. If you owe taxes, you may be subject to penalties and fines for not filing or not paying taxes. The government may reduce your tax refund to pay for any taxes you owe and other federal and state debts.

To learn more about your options if you think you owe taxes, read Filing Past Due Tax Returns and What to Do if I Owe Taxes but Cant Pay Them.

Four Deadlines This Month To Get Up To $800 Direct Payments And $150 Gas Cards

You have until October 17 to file a tax return for the 2020 and 2021 tax years.

If you don’t typically file a federal income tax return, this is the step-by-step process you should complete to claim your money.

First, you need to provide the following information:

- Step 1: Full name, current mailing address, and email address.

- Step 2: Date of birth and valid Social Security number.

- Step 3: Bank account number, type, and routing number, if you have one.

- Step 4: Identity Protection Personal Identification Number you received from the IRS earlier this year, if you have one.

- Taxpayers who previously have been issued an Identity Protection PIN but lost it, must use the Get an IP PIN tool to retrieve their numbers.

- Step 5: Drivers license or state-issued ID, if you have one.

- Step 6: For each qualifying child during 2019: name, Social Security number or Adoption Taxpayer Identification Number and their relationship to you or your spouse.

Recommended Reading: How Much Was The Second Stimulus Check

When Will I Get The Recovery Rebate Credit

You will most likely get the Recovery Rebate Credit as part of your tax refunds. If you electronically file your tax return, you will likely receive your refund within 3 weeks. If you mail your return, it can take at least 8 weeks to receive your refund.

Claiming the Recovery Rebate Credit will not delay your tax refund. However, if you dont claim the correct amount of the Recovery Rebate Credit, your refund may be delayed while the IRS corrects the error on your return. The IRS will send you a notice of any changes made to your return.

You can check on the status of your refund using the IRS Check My Refund Status tool.

What If I Owe Child Support Payments Back Taxes Money To Creditors Or Debt Collectors Or Federal Or State Debt

None of the three stimulus checks can be reduced to pay any federal or state debts and back taxes. Unlike the first stimulus check, your second and third stimulus check cannot be reduced if you owe past-due child support payments.

| Federal or State Debt | |

| Protected | Not protected |

If you are claiming the payments as part of your 2020 tax refund , the payments are no longer protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . In other words, if you receive your first or second stimulus checks as part of your tax refund instead of direct checks, it may be reduced.

Recommended Reading: Where’s My Stimulus Check 2021 Tracker

Reconciling Your Covid Stimulus Payment On Your Tax Return

The COVID stimulus payment provided earlier this year brought financial relief to many who were struggling near the beginning of the pandemic. But it also brought some confusion to tax payers about how this stimulus check would be handled when it was time to file taxes. While we have touched on this topic in the past, we wanted to provide you with some more specific information regarding how this income is reported on your return, as well as addressing some other common questions about the stimulus payments.

Do You Need to Report Your Stimulus Payment?

Because your COVID stimulus check was non-taxable income, you do not need to report it on your 2020 tax return. The amount you received was not an advance on your tax refund, and will not reduce any refund you get in 2021 or increase any amount you may owe.

There will be an additional worksheet available for some tax filers this year for reporting your total Economic Impact Payment. However, the IRS has advised that this worksheet is only for those who did not receive a stimulus payment or who received less than the maximum payment amount.

Receiving Additional Stimulus Payments

Fill out the new worksheet and submit it along with Notice 1444. If you qualify for any additional stimulus payments, the Recovery Rebate Credit will be applied to your tax return. Note that, if you owe taxes, this may simply reduce your tax bill otherwise, any extra amount you qualify for will be distributed with your tax refund.

What Do I Do With Letter 6475

Hold onto it until you or your tax preparer are ready to file your 2021 federal return, then use the amount shown on your Recovery Rebate Worksheet to determine if any credit applies.

Having the wrong amount on your return could trigger a manual review,according to the H& R Block website, which could delay a refund for weeks.

Read Also: Irs.gov Stimulus Check Deceased Person

Plans For A $400 Gas Prices Check

As a result of the rising gas prices, local politicians are looking for solutions and Democrats in California are discussing a possible 400 dollar tax rebate stimulus check, which will go to all Californians who pay state income taxes. With this, the idea is that it will offset the extra costs at the pump.

There is still some way to go for this to become a reality, however. Our goal is to be able to do this in the spring, and all the folks here are going to be pushing really, really hard to make that happen, California politician Cottie Petrie-Norris explained.

You can read more here on how the $400 Gas Prices Check would work.

If I Owe Child Support Will Mytax Return Be Applied Tomychild Supportarrears

-

Maybe.Federal law and regulationsdetermine when federal payments are intercepted and applied to child support arrears.

-

IfTANFhas been received for your child,thetotalamount of past due supportonall ofyourchild support cases must be at least $150

-

IfTANFhasnotbeenreceivedfor your child,thetotalamount of past due supportonall ofyour child support casesmust be at least $500

Don’t Miss: Who’s Eligible For 3rd Stimulus Check

How To Claim Your Recovery Rebate Credit

A reminder: The IRS will not automatically calculate any Recovery Rebate Credit amount for which you may be entitled when you file.

“Individuals must claim the 2021 Recovery Rebate Credit on their 2021 income tax return in order to get this money,” the IRS said in its fact sheet.

To see if you are eligible for a payment, you can find more information on the Recovery Rebate Credit on the agency’s website.

If you have no income or up to $73,000 in income, you can file your federal tax return for free using the IRS’ Free File program.

For people who already received their third stimulus checks, there is no need to include information on those payments in their 2021 returns, according to the IRS.

If you are still missing a first or second stimulus check that was sent by the government in 2020, you will have to file a 2020 tax return rather than claim that money on your 2021 return, according to the IRS.

Was I Eligible To Get A Stimulus Check

You were eligible to get a stimulus check and should have gotten the full amount if you filed taxes and had an adjusted gross income of:

- up to $75,000 if single or married filing separately.

- up to $112,500 if you filed as head of household

- up to $150,000 if married and you filed a joint tax return.

Read Also: What Is The Third Stimulus Check

How To Claim Stimulus Funds In Your 2021 Tax Return

The third round of stimulus payments is worth up to $1,400 per person if your adjusted gross income is $75,000 or less as a single filer, or $160,000 or less as a joint filer. Families are entitled to $1,400 per dependent for dependents of any age.

Before claiming the funds, make sure they weren’t sent to you already. You can confirm the amount of the third payment and whether it was sent to you by logging into your IRS online account or the Get My Payment app. You can also refer to a letter sent to you by the IRS, known as Notice 1444-C, which will tell you how much is owed to you.

If you lost your stimulus check or suspect it was stolen, you can request the IRS to trace your payment and get the amount automatically reimbursed to you as a tax refund. If you’re filing your 2021 tax return before your trace is complete, do not include the payment amount on the Recovery Rebate Credit Worksheet, the IRS says.

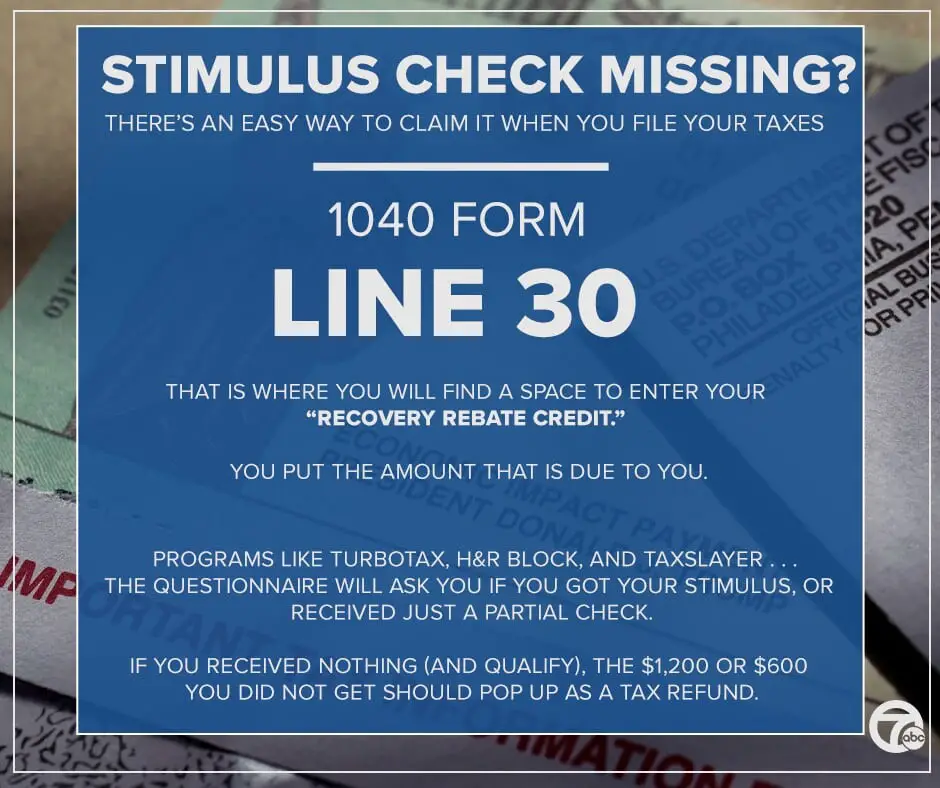

Otherwise, you’ll need to complete the Recovery Rebate Tax Credit worksheet and submit it as part of your 2021 tax return. The worksheet will help you calculate how much you can claim. Then, claim it on line 30 in Form 1040 or Form 1040-SR of your 2021 tax return.

Tax software will also guide you through this process and automatically add all the information to your tax return.

And remember, you can file your tax return for free if your income is $73,000 or less, using the IRS Free File Program.

Consumer Protections And Scams: What Should I Know About The Economic Impact Payment Or Stimulus Check If I Do Not Regularly File Taxes

Who does NOT regularly have to file taxes and is considered a non-filer for purposes of the stimulus payments?

Non-filers include all of the following groups of people:

- Anyone who receives IRS Form SSA-1099

- Anyone who receives Form RRB-1099

- Anyone whose only income is Supplemental Security Income

- Anyone who receive veterans disability compensation, pension or survivor benefits from the Department of Veterans Affairs and did not file a tax return for the 2018 or 2019 tax years

- Anyone who earned income under $12,200 if single or $24,400 if married during the 2019 tax year

What is the purpose of the economic impact payment, also knows as a stimulus check?

On March 27, 2020, the Coronavirus Aid, Relief and Economic Stimulus CARES Act became law. This law created a one-time payment to many people in the United States from the federal government. The reason for the payment is to help people financially who face economic hardships caused by the coronavirus pandemic. The government also wants to boost spending power and spur economic activity.

Who is eligible for the economic impact payment?

Any individual in the United States is eligible for the payment except someone who is a nonresident alien or a person who can be claimed as someone elses dependent.

How much is the payment?

- Individuals who report adjusted gross income up to $75,000 on their tax returns will receive $1,200.

- Parents or caregivers may receive up to $500 for each qualifying child claimed as a dependent.

You May Like: Irs.gov Stimulus Phone Number

Where To Enter Information

Non-taxpayers will need to visit the IRS dedicated webpage for COVID-19 stimulus checks, click on the blue button that says Non-Filers: Enter Payment Info Here, and the same button on the succeeding page.

The link will access the Free File Fillable Forms website, which is a partner of the IRS, and where people will need to create an account before they can fill out a form.

The form will require several pieces of information, including the persons full name, current mailing address, email address, birthday, Social Security number, bank account, details of qualifying children, and if available, the Identity Protection Personal Identification Number issued by the IRS and a state-issued ID such as a drivers license.

An email will be sent to acknowledge the submission of the form, or to flag a problem with the information and how to fix it.

Stimulus Checks And Other Payments: Irs Sending Letters To Millions As Deadline Looms

If you receive a letter from the Internal Revenue Service dont panic, it could mean there is money waiting to be claimed.

The IRS announced in mid-October that it is trying to contact over 9 million people who are still owed stimulus payments, the Earned Income Tax Credit, or the Child Tax Credit.

The IRS wants to remind potentially eligible people, especially families, that they may qualify for these valuable tax credits, said IRS Commissioner Chuck Rettig. We encourage people who havent filed a tax return yet for 2021 to review these options. Even if they arent required to file a tax return, they may still qualify for several important credits. We dont want people to overlook these tax credits, and the letters will remind people of their potential eligibility and steps they can take.

The IRS is keeping its free filing tool open for an extra month this year, extending the deadline to Nov. 17. You can also use ChildTaxCredit.gov to file a 2021 tax return and claim the credit even if you dont have children.

The easy file tool streamlines the process, especially for people who dont usually file, but people who miss the November deadline can still file a 2021 tax return. Typically there is a three-year period for tax filers to claim credits they are eligible for, according to CNBC.

Read Also: Who Receives Third Stimulus Checks