Stimulus Checks Arent Distributed At The Same Time

Stimulus checks arent distributed all at once. That means your neighbor, cousin or sister may get a stimulus check before you. If you have a bank account on file with the IRS, youre likely to get your stimulus check faster through direct deposit. However, if you dont, then it may take longer to get a paper stimulus check or debit card. Like the first and second stimulus checks, the third stimulus check will be sent in batches over time. If you get Social Security benefits, you also may not have received a stimulus check yet. Why? Until this week, the U.S. Social Security Administration didnt share contact information for 30 million Social Security recipients with the IRS, which has delayed the disbursement of their stimulus checks.

Dont Miss: How To Check On Stimulus Payment For Non Filers

Who Is Eligible For A Stimulus Check

The vast majority of Michigan residents are eligible to receive a stimulus check from the federal government this year. Even if you have no income, you are still eligible, but need to take action to receive your stimulus payment. This includes individuals with low or no earnings who normally don’t file taxes. Every American adult earning less than $75,000 is eligible for a stimulus check from the federal government this year. While this site is geared toward Michigan residents, the information is applicable nationwide.If you still have questions about your stimulus check after reviewing this website, call the IRS at or, United Way at .

After you sign up, make sure to add your account information on the IRS website. If you dont want to sign up for a bank account, you can also link to your prepaid debit card instead.You can also receive your funds through the Cash App, by providing the IRS with the routing and account numbers connected to your Cash App. You can download the Cash App or locate your Cash App account information here.

What if I havent filed taxes?

What if I dont qualify – where else can I get help?

If you dont qualify for the stimulus payment, we recommend reaching out to Michigan 2-1-1. They can connect you to resources in your community.

Will my payment be reduced or offset if I owe tax, have a payment agreement with the IRS, owe other Federal or State debt, or owe other debt collectors?

Who Is Eligible For The Second Stimulus Check

Eligibility is primarily based on four requirements:

1. Income: The income requirements to receive the full payment are the same as the first stimulus check.There is no minimum income needed to qualify for the payment. Households with adjusted gross income up to $75,000 for individuals will receive the full payment. This stimulus payment starts to phaseout for people with higher earnings. The second stimulus check maximum income limit is lower than the first stimulus check. Single filers who earned more than $87,000 in 2019 are ineligible for the second stimulus check.

View the chart below to compare income requirements for the first and second stimulus checks.

| Income to Receive Full Stimulus Payment | First Stimulus Check Maximum Income Limit | Second Stimulus Check Maximum Income Limit |

| Single Filer | ||

| $136,500 | $124,500 |

2. Social Security Number: This requirement differs from the original eligibility for the first stimulus check. Originally under the first stimulus check, if you were married filing jointly, both spouses needed valid Social Security numbers . If one spouse had an Individual Taxpayer Identification Number , then both spouses were ineligible for the stimulus check. For married military couples, the spouse with an SSN could still get the stimulus check for themselves but not the other spouse with an ITIN.

Examples

Former first stimulus check rules:

Second stimulus check rules:

Former first and second stimulus check rules for military filers:

Read Also: When Will We Get 4th Stimulus Check

How Your Return Can Help With A $1400 Stimulus Check

Since March, the government has been deploying new batches of stimulus checks weekly.

Each of those rounds has included payments to people that were prompted by the IRS processing their 2020 tax returns.

That goes for people who do not typically file tax returns, but did so this year in order to get their $1,400 checks. Once those forms were processed, the IRS sent their payments.

In addition, people who already received their third stimulus check, and who are due more money after the IRS completed their latest return, received “plus-up” payments from the agency.

That could happen if their financial circumstances changed since their 2019 return, such as their income declining last year.

Not everyone needs to file a federal return in order to get their stimulus checks. If you receive federal benefits and do not typically file, you should get your payment automatically. However, you may want to file a return in order to submit information on eligible dependents.

In addition, if you used the IRS online non-filer tool last year, you should not have to resubmit your information.

The non-filer tool has not been reopened this year. Instead, the IRS has urged people who it does not already have on record to file tax returns, which can help the agency evaluate whether or not you may be eligible for other tax credits.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most the best banks, latest rates, different types of accounts, money-saving tips and more so you can feel confident as youre managing your money.

You May Like: Create Irs Account For Stimulus Check

Who May Be Eligible To Receive More Stimulus Money

- Parents of a baby born in 2021 who claim the child as a dependent on their 2021 tax return

- Families who added a dependent, such as a parent, grandchild or foster child, on their 2021 tax return who was not listed as a dependent on their 2020 return

- Single filers who had incomes above $80,000 in 2020 but less than that in 2021 married couples who filed a joint return who earned more than $160,000 in 2020 but made less money in 2021 and head-of-household filers with incomes above $120,000 in 2020 but less than that in 2021

- Single filers who had incomes of between $75,000 and $80,000 in 2020 but earned less in 2021 married couples who file jointly who had incomes of between $150,000 and $160,000 in 2020 but less than that in 2021 and heads of household who had incomes of between $112,500 and $120,000 in 2020 but made less money in 2021

Even if you didnt qualify for the first and second round of stimulus payments in 2020, if you had a tough time financially in 2021 and your income is lower , you will get the credit on your 2021 return, Steber says.

Join today and save 43% off the standard annual rate. Get instant access to discounts, programs, services, and the information you need to benefit every area of your life.

What If Both My Spouse And I Have Itins And Our Children Have Ssns Can Our Family Get The Third Stimulus Check For Our Children

Yes. For the third stimulus check, any household member that has an SSN qualifies for a payment.

This is different than the first and second stimulus check, where at least one tax filer must have an SSN for the household to claim the stimulus checks. That adult with the SSN and any qualifying children with SSNs will get the stimulus checks.

Don’t Miss: When Did The Third Stimulus Check Go Out

Confirm The Irs Has The Correct Direct Deposit Bank Account And Mailing Address

If the IRS sent or is planning to send your payment by direct deposit, youll see the last four digits of the account number. Check this against your own bank account information.

If youre slated to receive a paper check or mailed debit card , you should receive it at the address on file within one to two weeks of mailing.

Should your current bank account not match what the IRS has on file, follow the agencys instructions to update your direct deposit information. To update your mailing address, follow the IRSs change of address instructions.

Free Online Tax Software

Online free tax preparation offers a convenient and reliable way to file your taxes.

If youre comfortable using computers and confident preparing your own taxes, consider using a free online tax software.

MyFreeTaxes is an easy online tool that helps you file your taxes for free. The site offers free step-by-step guidance to filing taxes as well as help through an online chat. Tax filing is free for both federal and state tax filing.

MyFreeTaxes offers a broader range of tax forms than most VITA sites. However, you cannot use this site if you have self-employment income. If youre not comfortable using the website on your own, ask someone you trust to help you.

Another free online option is Free File Alliance, a suite of programs in partnership with IRS. You can find Free File programs on the IRS website. If you choose to use one of these programs, read the fine print carefully. Each program has slightly different criteria for their software. In addition, some companies offer free state tax returns, while others dont.

Don’t Miss: What Does The Stimulus Debit Card Look Like

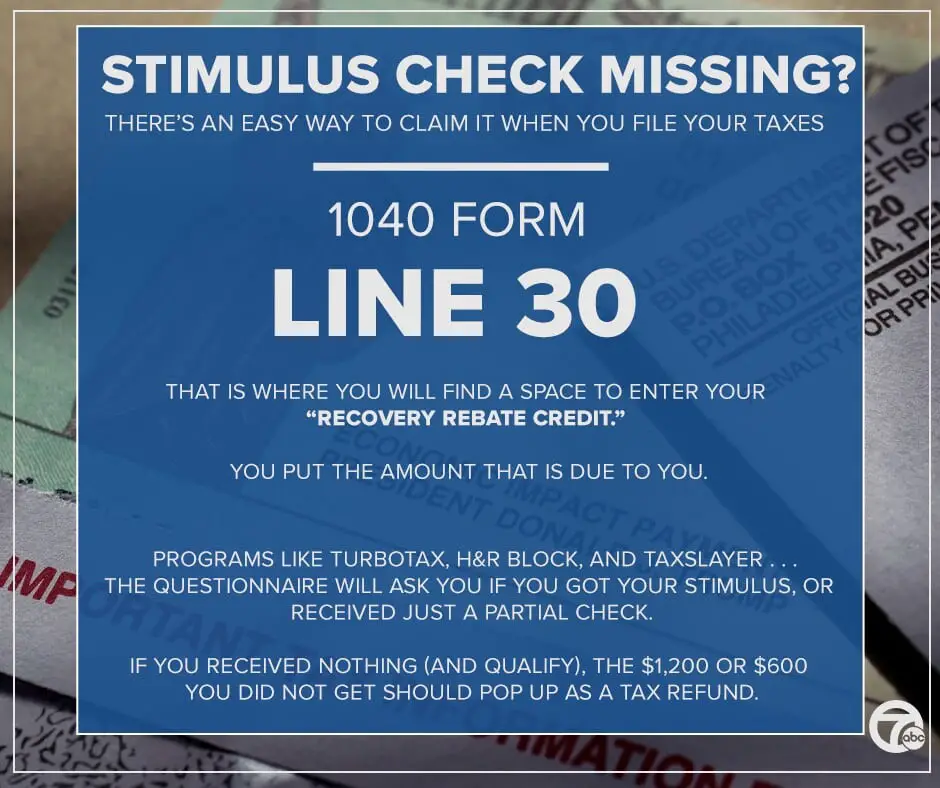

Where Is My Second Stimulus Check

All second stimulus checks were issued by January 15, 2021. If you didnt get a second stimulus check by then , you can claim your second stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

You can request a trace of your stimulus check. You should only request a payment trace if you received IRS Notice 1444-B showing that your second stimulus check was issued or if your IRS account shows your payment amount and you havent received your second stimulus check.

Learn more about requesting a payment trace here.

Child Tax Credit For Non

Americans have struggled during the pandemic, especially people with kids. The Child Tax Credit is here to help.

The deadline to sign up for monthly Child Tax Credit payments is November 15. The Administration collaborated with a non-profit, Code for America, who has created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish.

Heres a link to the Code for America non-filer sign-up tool:

Most families are already signed up! If youve filed tax returns for 2019 or 2020, or if you signed up with the Non-Filer tool last year to receive a stimulus check from the Internal Revenue Service, you will get the monthly Child Tax Credit automatically. You do not need to sign up or take any action.

If you arent already signed up, you can still sign up to get the Child Tax Credit. You wont lose your benefits if you do. These payments do not count as income for any family. So, signing up wont affect your eligibility for other federal benefits like SNAP and WIC.

You are also eligible to apply for the Recovery Rebate Credit, also known as stimulus payments, as part of this process.

Heres a list of things you will need to complete the process.

- Social Security Social Security numbers for your children and Social Security Numbers for you and your spouse

- A reliable mailing address

- E-mail address or phone number

- Your bank account information .

Heres a link to the Code for America non-filer sign-up tool:

You May Like: When Did The First Stimulus Check Go Out

Q How Much Will My Third Stimulus Check Be For

A. Your third stimulus check depends on your 2020 or 2019 income .

| Qualifying group | |

| An AGI of $150,500 or less | An AGI $160,000 or more |

| Dependents of all ages: $1,400 | $1,400 apiece, no cap — but only if caretakers make under the above limits |

| * This framework by the IRS was designed for taxpayers who are living and working in the U.S., so expats should ensure theyre looking at their AGI and not their gross income when determining their eligibility, especially if theyre claiming the foreign earned income exclusion. |

Additional Payments: If your third stimulus payment is based on their 2019 return and your 2020 return makes you eligible for a larger payment, the IRS will redetermine your eligibility and issue a supplementary payment later this summer.

You can estimate your own payment amount with H& R Blocks Stimulus Check Calculator.

Q. Will I have to pay back my stimulus check?

A. No, you will not have to pay back any amount of your Recovery Rebate Credit, even if you experience a pay hike in 2021.

Q. Will this round of stimulus checks affect my tax return this year?

Q. Will I owe tax on this third stimulus check in 2022 or have to pay it back?

A. No, the third stimulus payment is considered a 2021 tax credit , not income, so you will not need to pay taxes on it or pay it back.

Q. Do I need to sign up for the third stimulus check it or sign off on it?

Q. If I live abroad, when will I get my third stimulus check if I qualify?

What Is The Stimulus Check

As part of several different COVID-19 relief packages, the federal government issued three payments – by check or direct deposit to millions of income-qualified Americans. This is what we mean by stimulus check or stimulus payment. The purpose of the payments was to help people cover basic needs when many people were told to stay home and lost income because of the pandemic.

Recommended Reading: Stimulus Check 2022 Who Qualifies

Most Undocumented Immigrants Are Ineligible

Before proceeding with any application to the IRS, one point to consider is that undocumented immigrants are not eligible for stimulus checks unless they are married to a citizen. Also, children of these couples with valid Social Security numbers would receive the payment.

The current $1,400 stimulus check law and the previous $600 stimulus check law provide for undocumented married spouses who have permission to be in the country to also receive the funds. However, the payment would be credited to the person with valid Social Security.

As part of the changes in the stimulus laws for the second and third rounds, this group was included, but other undocumented populations remain excluded from assistance.

For taxpayers who file jointly with a spouse and only one person has a valid SSN, the spouse with a valid SSN will receive up to a $1,400 payment and up to $1,400 for each qualifying dependent claimed on the 2020 tax return, the IRS states on its website.

As part of the first round, this group, both documented and undocumented, were excluded from assistance.

What To Do If You Have Not Received Any Of The 3 Stimulus Checks While Eligible For Payments

Americans who have not received stimulus payments under the three laws passed in Congress are most likely low-income non-filers and will have to do additional paperwork with the IRS.

If you are one of the Americans who have not yet received any of the three stimulus checks distributed by the federal government through the Internal Revenue Service while you were eligible, you are most likely among the low-income people for whom the agency does not have information to process the payment.

Many of the cases of beneficiaries who have not yet received coronavirus stimulus checks are low-income individuals who are not required to file IRS tax returns. This means that the agency does not have the information on file to process the so-called Economic Impact Payments for this population.

The agency has recommended in these instances that individuals file a tax return as soon as possible even if they are not required to do so and claim the amount or amounts owed for stimulus checks through a Refund Recovery Credit.

In cases where the IRS provided an underpayment or without the extra dependent credits, taxpayers can also claim this money through the referred credit on the return this year.

In fact, the IRS reported this week that it is processing payments applicable to tax returns of individuals who filed their tax information this season for the first time because of the above reason.

Read Also: How Do I Know If I Got My Stimulus Check

First And Second Stimulus Check

You will need to file a tax return for Tax Year 2020 . The deadline to file your taxes this year was May 17, 2021. The tax filing extension deadline is October 15, 2021.

If you missed the filing deadline, you can still file your tax return to get your first and second stimulus checks. If you dont owe taxes, there is no penalty for filing late. If you owe taxes, you may be subject to penalties and fines for not filing or not paying taxes. The government may reduce your tax refund to pay for any taxes you owe and other federal and state debts.

To learn more about your options if you think you owe taxes, read Filing Past Due Tax Returns and What to Do if I Owe Taxes but Cant Pay Them.