How Do I Check The Status Of My Stimulus Payment

But waiting on your stimulus check can be an anxiety-ridden process, especially at a time when nearly 10 million Americans are out of work. Use the Treasury Departments tracker:

If youre seeing a payment status not available error message on the platform, the IRS says one of the following issues might be occurring:

The platform is typically updated overnight, meaning you wont see a new message if youre checking for updates more regularly than once a day.

Which Of My Dependents Qualify For The Third Stimulus Check

For the third stimulus check, all your dependents qualify, regardless of age. This means that for each child or adult dependent you have, you can claim an additional $1,400.

This is different from the first and second stimulus checks, which only allowed child dependents to get the additional payment.

What If Both My Spouse And I Have Itins And Our Children Have Ssns Can Our Family Get The Third Stimulus Check For Our Children

Yes. For the third stimulus check, any household member that has an SSN qualifies for a payment.

This is different than the first and second stimulus check, where at least one tax filer must have an SSN for the household to claim the stimulus checks. That adult with the SSN and any qualifying children with SSNs will get the stimulus checks.

You May Like: Irs.gov Stimulus Check 4th Round

‘payment Status Not Available’

If you are getting “Payment Status Not Available” from the IRS stimulus check tracker — don’t be alarmed.

According to the IRS, if you receive that message it can mean one of three things:

- You are not eligible for the payment.

- The payment has yet to be processed

- The IRS doesn’t have enough information to issue the payment to you

The agency said it will continue to issue the 2021 Economic Impact Payments throughout 2021.

Tax Relief For College Students

The American Rescue Plan provides relief to students with government and federal student loans by allowing students with forgiven loan debt to exclude the discharged debt from their taxable income for tax years 2021 through 2025.

This provision does not apply to loans made by private lenders.

The Biden Administration has also extended the suspension of federal student loan payments, interest, and collections through December 31, 2022.

The pause includes the following relief for eligible student loans:

- Suspension of loan payments

- 0% interest rate

- Stopped collections on defaulted loans

Note: You do not have to pay a fee to get 0% interest or suspended payments for federal student loans.

Recommended Reading: Are There Any Stimulus Checks Coming

When Will The Third Stimulus Check Be Issued

The government started sending the third stimulus checks on March 12, 2021. The IRS continues to send third stimulus checks as people submit their information to the IRS either by filing a 2020 tax return or using GetCTC.org. The deadline to use GetCTC.org is November 15, 2021.

If you have your banking information on file, the IRS sent your payment via direct deposit. Otherwise, you will receive your payment as a check or debit card via mail. Mailed checks and debit cards may take longer to deliver.

If you dont fall into any of these categories, youll have to wait to receive your third stimulus check. You will need to file a 2020 federal tax return to get the third stimulus check or use GetCTC.org if you dont have a filing requirement.

You can also get the first and second stimulus check as the Recovery Rebate Credit on your tax return or GetCTC.org if you are eligible.

How To Track Your Stimulus Check Online

With the IRS Get My Payment tool, you can get a daily update on your payment status. The online app can also alert you with a message if there’s a problem with your payment that you may need to address. Another option is to create an online account with the IRS, if you haven’t already.

If you get sent a plus-up payment after your 2020 tax return is processed, the amount of your third payment will no longer show up in the tool, according to the IRS. In that case you will only see the status of your plus-up payment.

If you expect your payment to come in the mail, you can use a free tool from the US Postal Service to track your mailed stimulus payment.

Also Check: When Will South Carolina Receive Stimulus Checks

Who Is Eligible For The Recovery Rebate Credit 2021

Single filers who had incomes between $75,000 and $80,000 in 2020 but had lower incomes in 2021 married couples who filed a joint return and had incomes between $150,000 and $160,000 in 2020 but had lower incomes in 2021 and head of household filers who had incomes between $112,500 and $120,000 in 2020 but had lower …

Are Adult Dependents Getting Third Stimulus Checks

The new stimulus plan expands eligibility to adult dependents, including college students, elderly relatives and disabled adults.

The text of the plan redefines the term dependent according to section 152 of the tax code, which includes both qualifying children and adults: Section 152 provides that the term dependent means a qualifying child ) or a qualifying relative ).

While the plan pays out $1,400 for each qualifying dependent, families should keep in mind that the targeted lower income ranges exclude them if they earn over $160,000.

For reference, the second stimulus checks provided additional $600 payments for qualifying dependents under the age of 17. So a couple filing jointly with three eligible children could get a maximum second payment of $3,000 .

Under the first and second rounds of stimulus checks, children and adult dependents over the age limit could not get an additional payment, and they did not qualify for a stimulus check of their own either.

With the new stimulus plan, however, both joint filers and heads of household get an additional $1,400 payment for each dependent, regardless of age. The table below breaks down the third stimulus checks for heads of household with one dependent:

| Stimulus Checks for Heads of Household & 1 Dependent |

| AGI |

| $120,000 and up | $0 |

Read Also: 4th Stimulus Check For Ssdi

Social Security Stimulus Checks Status

The IRS said a large set of payments for those on Social Security retirement, survivor or disability, Supplemental Security Income, and Railroad Retirement Board will start going out Friday. For those who are receiving the payments electronically, they should show up in accounts on April 7. The Get My Payment tool should be updated this weekend to track these payments, according to the IRS.

The agency still does not have a specific date for when Veterans Affairs beneficiaries will get their stimulus payments, but is targeting mid-April. Those on VA benefits still cannot check the Get My Payment tool.

Tips For Individuals During The Coronavirus Pandemic

- If you dont need to use your stimulus check for anything urgent, consider investing or saving the money. A financial advisor can help you get started if you need help managing your money or investments. SmartAssets free tool can match you with financial advisors in your area in just five minutes. Get started now.

- If you are struggling to keep up with loan or credit card payments, you can take steps to protect your credit score and speak with your bank directly to see whether you can defer loan payments or waive certain fees.

- If you can afford it, investing in index funds during a recession is a safe option. But if youre looking for a slightly more aggressive approach, check out some free investment classes to learn more.

You May Like: When Did The Stimulus Checks Go Out In 2021

Eligible Parents Of Children Born In 2021 And Families That Added Qualifying Dependents In 2021 Should Claim The 2021 Recovery Rebate Credit Most Other Eligible People Already Received The Full Amount And Wont Need To Claim A Credit On Their Tax Return

The third-round Economic Impact Payment was an advance payment of the tax year 2021 Recovery Rebate Credit. The amount of the third-round Economic Impact Payment was based on the income and number of dependents listed on an individual’s 2019 or 2020 income tax return. The amount of the 2021 Recovery Rebate Credit is based on the income and number of dependents listed on an individual’s 2021 income tax return.

Families and individuals in the following circumstances, among others, may not have received the full amount of their third-round Economic Impact Payment because their circumstances in 2021 were different than they were in 2020. These families and individuals may be eligible to receive more money by claiming the 2021 Recovery Rebate Credit on their 2021 income tax return:

- Parents of a child born in 2021 who claim the child as a dependent on their 2021 income tax return may be eligible to receive a 2021 Recovery Rebate Credit of up to $1,400 for this child.

- All eligible parents of qualifying children born or welcomed through adoption or foster care in 2021 are also encouraged to claim the child tax credit worth up to $3,600 per child born in 2021 on their 2021 income tax return.

Avoid Processing Delays When Claiming The 2021 Recovery Rebate Credit

The IRS strongly encourages people to have all the information they need to file an accurate return to avoid processing delays. If the return includes errors or is incomplete, it may require further review while the IRS corrects the error, which may slow the tax refund.

To claim the 2021 Recovery Rebate Credit, individuals will need to know the total amount of their third-round Economic Impact Payment, including any Plus-Up Payments, they received. People can view the total amount of their third-round Economic Impact Payments through their individual Online Account. The IRS will also send Letter 6475 through March to those who were issued third-round payments confirming the total amount for tax year 2021. For married individuals filing a joint return with their spouse, each spouse will need to log into their own Online Account or review their own letter for their portion of their couple’s total payment.

The IRS urges recipients of stimulus payments to carefully review their tax return before filing. Having this payment information available while preparing the tax return will help individuals determine if they are eligible to claim the 2021 Recovery Rebate Credit for missing third-round stimulus payments. If eligible for the credit, they must file a 2021 tax return. Using the total amount of the third payments from the individual’s online account or Letter 6475 when filing a tax return can reduce errors and avoid delays in processing while the IRS corrects the tax return.

Don’t Miss: What Were The Stimulus Amounts

What To Do If You’re Missing Money From The First Two Stimulus Checks

Plus-up payments are going out weekly along with the third round of checks, but they may not be the only money you’re due. For money missing from the first two checks, you need to claim that on your 2020 taxes. We suggest making sure you know how to find out your adjusted gross income. You may be eligible to claim the 2020 Recovery Rebate Credit for claiming missing money from the first two checks.

Also, last week, the IRS launched a new online for familes that don’t file taxes called the “Non-filer Sign-up Tool.” Its purpose is to help eligible families who don’t normally file a tax return enroll in the monthly child tax credit advance payment program, which is slated to begin July 15. However, the tool is also for those who did not file either a 2019 or 2020 tax return and did not use the previous nonfilers tool last year to register for stimulus payments.

In other words, individuals who experience homelessness or make little or no income can use this tool to enter their personal details for the IRS’ records so as to receive the $1,400 stimulus checks or claim the recovery rebate credit for any amount of the first two rounds of payments that might have been missed. Tax nonfilers may need to be proactive about claiming a new dependent, too.

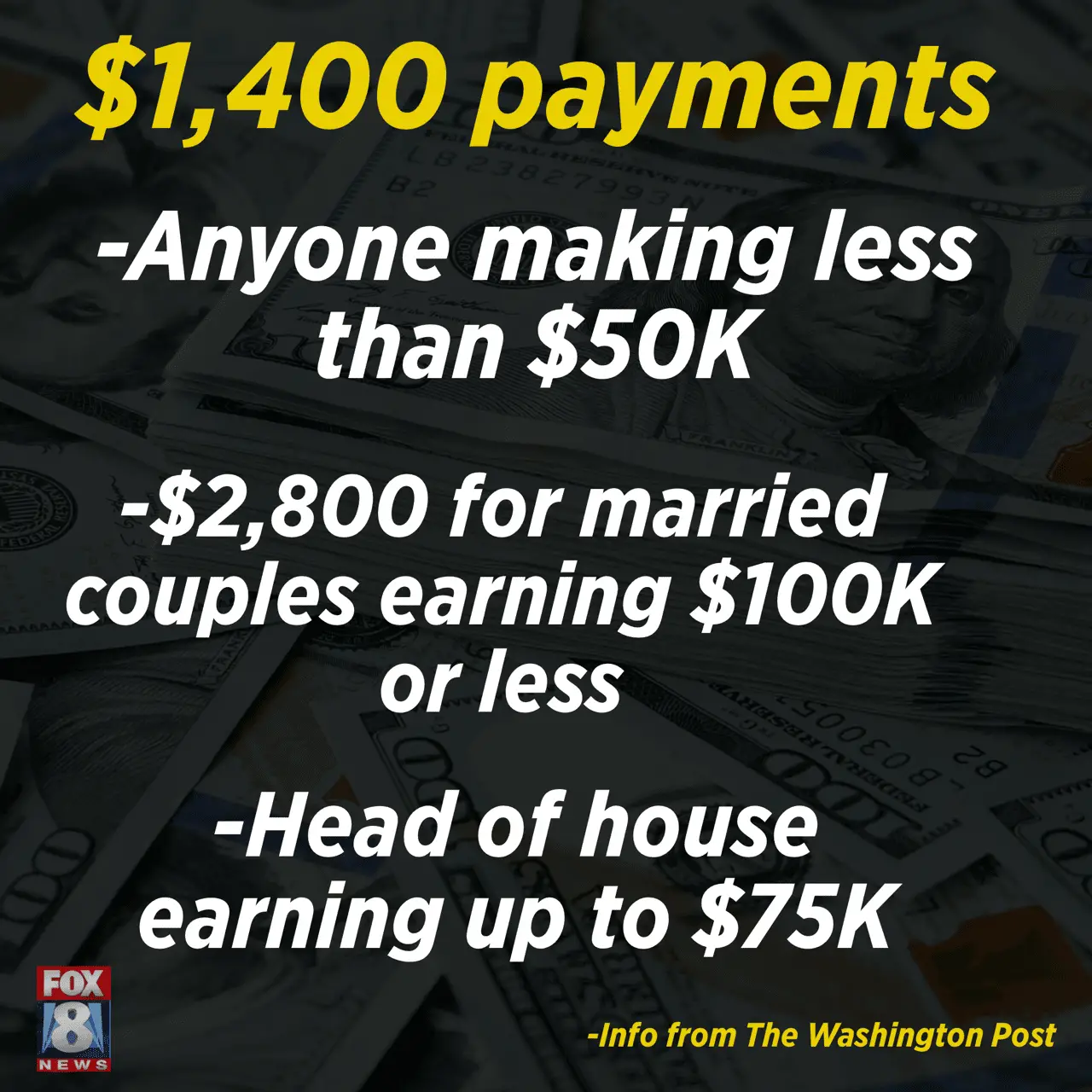

Who Would Be Eligible For The Third Stimulus Check

Families earning less than $150,000 a year and individuals earning less than $75,000 a year should get the full $1,400 per person. Families earning up to $160,000 per year and individuals earning up to $80,000 per year will receive prorated stimulus checks for less than $1,400 max.

Unlike the previous two rounds, you will receive stimulus payments for all your dependents, including adult dependents and college students.

You also dont need a permanent address, a bank account, or even a job to get these payments. Individuals may qualify for this money if they have a Social Security number and are not being supported by someone else who can claim them as a dependent.

Recommended Reading: Where Do I Put Stimulus Money On Tax Return

How Do I Get My Third Stimulus Check

You dont need to do anything if:

- You have filed a tax return for tax year 2019 or 2020.

- You are a Social Security recipient, including Social Security Disability Insurance , railroad retiree. Or you are a Supplemental Security Insurance and Veterans Affairs beneficiary.

- You successfully signed up for the first stimulus check online using the IRS Non-Filers tool or submitted a simplified tax return that has been processed by the IRS.

The IRS will automatically send your payment. You can check on the status of your third stimulus check by visiting the IRS Get My Payment tool, available in English and Spanish.

If you are missing your third stimulus check, file your 2020 tax return or use GetCTC.org if you dont have a filing requirement. By submitting your information to the IRS, you will be signed up and automatically sent the third stimulus check.

More Dependents Are Included This Time

The $1.9 trillion stimulus bill opens the qualifications to roughly 13.5 million more dependents for a third stimulus payment — for $1,400 apiece — than the first two payments did by expanding the definition of a dependent. With the new check, any dependent — child or adult — would count toward a payment. With the first check and the second, Congress included children age 16 and under but excluded dependents 17 and older.

You May Like: I Still Haven’t Gotten My First Stimulus Check

Who Qualifies For The Third Stimulus Payments

Generally, if youâre a U.S. citizen and not a dependent of another taxpayer, you qualify for the full third stimulus payment. In addition, your adjusted gross income canât exceed:

- $150,000 for married filing jointly

- $112,500 for heads of household

- $75,000 for single filers

A partial payment may be available if your income exceeds the thresholds. However, you will not receive any payment if your AGI is at least:

- $160,000 for married filing jointly

- $120,000 for heads of household

- $80,000 for single filers

The full amount of the third stimulus payment is $1,400 per person and an additional $1,400 for each qualifying dependent.

What To Do If You Cant Find Your Stimulus Check

If your IRS online account shows that you should have received a stimulus payment, but you didnât get it, thereâs a chance it could have been lost in the mail. Or you might have thrown away the prepaid debit card you received.

If you lost your stimulus check or suspect it was stolen, you can request the IRS trace your payment. If the IRS determines your check hasnât been cashed, it will issue a credit to your account. It canât reissue your payment, but you can claim the payment on your 2021 tax return using the Recovery Rebate Tax Credit worksheet.

If a trace is initiated and the IRS determines that the check wasnât cashed, the IRS will credit your account for that payment. However, the IRS canât reissue your payment. Instead, you will need to claim the 2021 Recovery Rebate Credit on your 2021 tax return if eligible.

If you lost your EIP card, a prepaid debit card on which some individuals received their stimulus payment, contact card issuer MetaBank to request a replacement.

You May Like: Who Qualified For Third Stimulus Check

Where Is My 3rd Stimulus Check

Check for your status at www.irs.gov/coronavirus/get-my-payment. The third round of Economic Impact Payments will be based on a taxpayer’s latest processed tax return from either 2020 or 2019. That includes anyone who used the IRS non-filers tool last year, or submitted a special simplified tax return.