How Will The Stimulus Checks Affect My Taxes

The IRS doesnt consider your stimulus checks taxable income. So you will not have to report them on your tax return or pay income taxes for them.

If you are an eligible recipient who didnt get the first or second stimulus check, you can claim a recovery rebate credit to increase your tax refund or lower your tax liability.

This means that if you expect to get money back on your 2020 tax return, you could get a bigger refund depending on how much stimulus money you are owed. And comparatively, if you have to pay a tax bill, you can use the recovery rebate credit to offset it and get a refund for the remaining amount.

Taxpayers this year will look to their tax refunds as another source of extra money during the pandemic. In 2020, the IRS paid out more than $2,500 for the average tax refund. This year, it is expecting over 150 million tax returns to be filed.

The 2021 tax season starts on February 12. You will have to file your 2020 tax return by April 15.

Commercial Paper Funding Facility

On March 17, 2020, the Fed established the Commercial Paper Funding Facility , which purchased short-term debt known as commercial paper to ensure that those markets stay liquid.

On March 23, 2020, the Fed broadened the variety of commercial paper that it would buy to lower the pricing of the debt. This was actually a relaunch of a program that ran during the Great Recession, when many businesses were hurt as liquidity in the commercial paper markets dried up.

While it had no set limit on the amount it purchased, the CPFF stopped purchasing debt on March 31, 2021, and the SPV will continue to be funded until its assets mature. The Treasury Department made a $10 billion equity investment in the CPFF from its ESF.

Do You Report Stimulus Check On Tax Return 2021

They letter explains that if you received advance CTC payments, you’ll need to report that amount in your tax return. … If you’re eligible for RRC, you’ll need to file a 2021 tax return to claim your remaining stimulus amount. You can check the Economic Impact Payment amounts by logging into your IRS online account.

Recommended Reading: Social Security Stimulus Checks Update

Amount And Status Of Your Third Payment

You can no longer use the Get My Payment application to check your payment status.

To find the amount of the third payment, create or view your online account or refer to IRS Notice 1444-C, which we mailed after sending your payment. Were also sending Letter 6475 through March 2022 confirming the total amount of the third Economic Impact Payment and any plus-up payments you were issued for tax year 2021.

You can also securely access your individual tax information with an IRS online account to view your total Economic Impact Payment amounts under the 2021 tax year tab. You will need the total of the third payment and any plus-up payments you received to accurately calculate the 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022.

Was I Eligible To Get A Stimulus Check

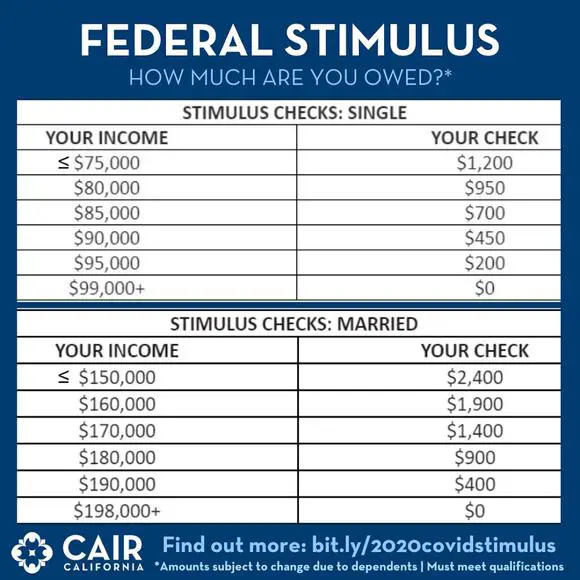

You were eligible to get a stimulus check and should have gotten the full amount if you filed taxes and had an adjusted gross income of:

- up to $75,000 if single or married filing separately.

- up to $112,500 if you filed as head of household

- up to $150,000 if married and you filed a joint tax return.

Also Check: Amount Of All Stimulus Checks

How Many Stimulus Checks Did Americans Receive

- Jennifer Roback

- 16:56 ET, May 13 2021

- Jennifer Roback

MANY AMERICANS suffered financially during the Covid-19 pandemic.

In order to help Americans during the financial difficulties resulting from the pandemic, the government sent out stimulus checks.

Read our stimulus checks live blog for the latest updates on Covid-19 relief…

How Do I Check The Status Of My Payment

Get updates on the status of your next stimulus payment using the IRS “Get My Payment” tool.

To use it, you’ll need to enter your full Social Security number or tax ID number, date of birth, street address and ZIP code.

For those who are eligible, the tool will show a “Payment Status” of when the payment has been issued and the payment date for direct deposit or mail, according to the IRS’s frequently asked questions.

Before you start entering your information hourly, the IRS says the tool updates once per day, usually overnight and that people should not call the IRS.

“Our phone assistors don’t have information beyond what’s available on IRS.gov, the agency says.

Don’t Miss: Earned Income Tax Credit Stimulus

How Much Was The First Stimulus Check

The first stimulus check was $1,200 per adult and $500 per child.

$1,200 , plus

an amount equal to the product of $500 multiplied by the number of qualifying children ) of the taxpayer.

-SEC. 6428. 2020 RECOVERY REBATES FOR INDIVIDUALS

The first stimulus check was sent out starting around April 11th, 2020.

I Receive Social Security Retirement Disability Survivors Ssi Or Veterans Benefits Do I Automatically Qualify For An Economic Impact Payment

In some cases, if you receive certain benefits, you will automatically receive an Economic Impact Payment. Make sure you read further to know if this applies to you and to know if you need to send the IRS any additional information, and how you will be receiving your payment.

The IRS is working to make it easier for certain beneficiaries to receive the Economic Impact Payment by using information from benefit programs to automatically send payment.

You will qualify for this automatic payment only if:

- You were not required to file taxes in 2018 or 2019 because you had limited income and

- You receive one of the following benefits:

- Social Security retirement, survivors, or disability from the Social Security Administration

- Supplemental Security Income from the Social Security Administration

- Railroad Retirement and Survivors from the U.S. Railroad Retirement Board

- Veterans disability compensation, pension, or survivor benefits from the Department of Veterans Affairs

If you qualify for an automatic payment, you will receive $1200 . You will receive this automatically the same way you receive your benefits, either by direct deposit or by check. You will not need to take any further action to receive this.

No matter how you receive your payment, the IRS will send you a letter in the mail to the most current address they have on file about 15 days after they send your payment to let you know what to do if you have any issues, and contact information for any questions.

Also Check: Stimulus Checks Gas Prices 2022

If I Owe Child Support Will Mytax Return Be Applied Tomychild Supportarrears

-

Maybe.Federal law and regulationsdetermine when federal payments are intercepted and applied to child support arrears.

-

IfTANFhas been received for your child,thetotalamount of past due supportonall ofyourchild support cases must be at least $150

-

IfTANFhasnotbeenreceivedfor your child,thetotalamount of past due supportonall ofyour child support casesmust be at least $500

The Economic Impact Payment Doesnt Affect Eligibility For Income

The Economic Impact Payment is a tax credit. That means it shouldnt be counted as income and shouldnt affect the beneficiarys eligibility for income-tested benefits. As long as the payment is spent down within 12 months of the date it was received, it also wont count against resource limits for Medicaid, Medicare Savings Programs, SSI, SNAP, or Public Housing benefits.

Also Check: 4th Stimulus Checks For Social Security Recipients

What To Do If A Deceased Family Member Received A Stimulus Check

If a deceased family member has received a stimulus check in their name, the IRS has issued guidance stating that the money should be returned immediately. More specifically, anyone who died before payment was received does not qualify for a check. The only exception to this is if a payment was made to joint filers and one of the spouses is still alive. If this describes your situation, you only need to return the decedents half of the money.

According to the IRS, if you need to return payment for a deceased loved one, here are the steps to follow:

- Direct deposit payments, and paper check payments that have not been cashed

- Step 1: Mail a personal check or money order for the correct amount to your states IRS refund inquiry unit.

- Step 2: Make the check or money order payable to U.S. Treasury and write 2020EIP and the decedents Social Security number or individual taxpayer identification number.

- Step 3: In the envelope, include a note that explains why the check is being returned.

Here’s How Much Stimulus Money The Average American Has Received

by Lyle Daly | Published on Aug. 16, 2021

Image source: Getty Images

Americans at almost every income level have collected sizable stimulus funds.

Since the beginning of the COVID-19 pandemic, the U.S. government has offered different types of stimulus money, including checks and tax credits.

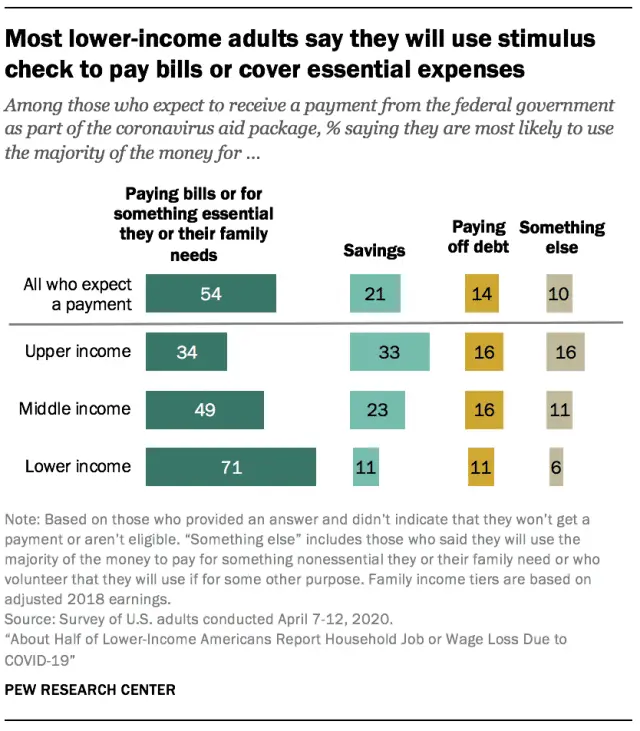

But how much stimulus money has the average American received so far? We know the answer thanks to research from the Institute on Tax and Economic Policy. According to that data, most Americans got over $3,000 in federal funds, and lower-income Americans benefited the most.

Read Also: 4th Stimulus Check For Single Person

Primary Dealer Credit Facility And Money Market Mutual Fund Liquidity Facility

On March 20, 2020, the Fed relaunched a Great Recession-era program: the Primary Dealer Credit Facility , which has given loans to primary dealers backed by a wide variety of securities as collateral. There was no set limit to the amount of credit issued.

To add more liquidity to money markets, the Fed announced the Money Market Mutual Fund Liquidity Facility on March 18, 2020. This program lent money to financial institutions so that they could buy money market mutual funds. Like the PDCF, it did not have a specific lending limit, either.

The Treasury Department gave the MMLF $10 billion of debt credit protection for the program. On May 5, 2020, the central bank said that participation in the MMLF wouldnât affect the liquidity coverage ratio of participating banks.

This program was similar to the Asset-Backed Commercial Paper Money Market Fund program launched in 2008 after the collapse of Lehman Brothers caused a major money market fund to fail. The AMLF ended on Feb. 1, 2010.

Both the PDCF and the MMLF expired on March 31, 2021.

I Dont Have A Social Security Number Can I Still Get An Economic Impact Payment

In almost all cases, a person is only eligible to receive an Economic Impact Payment if they have a Social Security number .

One exception to this is if youre a member of the military and file a married filing jointly tax return. Your spouse isnt required to have an SSN for you to get the Economic Impact Payment.

Another exception is you have dependent child under the age of 17 who is adopted and has an Adoption Taxpayer Identification Number , you will receive the $500 child payment.

Also Check: Who Gets The Stimulus Checks

When Can We Expect The Next Stimulus Check

The third stimulus check passed through a process called “budget reconciliation,” which allowed Democrats to push the legislation through with a simple majority vote in the Senate. The bill did not get any Republican support.

There is a limit on the number of times reconciliation can be used. Democrats are now focused on other priorities and Republicans have made it clear they’re not interested in providing additional COVID relief. As such, it’s unlikely a fourth stimulus check will be authorized. This is especially true as states ease lockdowns and vaccinations ramp up.

Amount Based On 2019 Or 2020 Tax Return

For third-round stimulus payments, eligibility and amounts were based on either your 2019 or 2020 return. If your 2020 tax return wasn’t filed and processed by the IRS by the time the tax agency started processing your third stimulus payment, then the IRS used information from your 2019 tax return. If your 2020 return was already filed and processed when the IRS was ready to send your payment, then your stimulus check eligibility and amount was based on the information on your 2020 return. If your 2020 return was filed and/or processed after the IRS sent you a third stimulus check, but before December 1, 2021, the IRS sent you a second “plus-up” payment for the difference between what your payment should have been if based on your 2020 return and the payment actually sent based on your 2019 return. As a result, your third stimulus check may have been higher or lower depending on when you filed your 2020 tax return.

Read Also: How Many Stimulus Checks Did We Get In 2020

How To Use The $1200 Stimulus Calculator

The CARES Act allowed Americans to claim child dependents for $500 each, as long as they’re 16 years old or younger . Here are exceptions to the current rules regarding when someone who’s 17 to 24 years old can claim a stimulus check. If you don’t typically file taxes, or have different circumstances, this provides more information.

Who Qualifies For An Eip3

As with EIP2, U.S. citizens, permanent residents, or qualifying resident aliens who are not claimed as dependents on another taxpayers return generally qualify for EIP3. Married couples filing jointly with only one SSN can qualify too, but only the spouse with the valid SSN will qualify for a stimulus payment . For example, a married couple with two kids would qualify for up to $4,200 if only one spouse has an SSN.

Nonresident aliens, adult dependents, deceased taxpayers before 2020, and individuals without an SSN will not qualify for EIP3.

A missing EIP3 can be claimed when you file your taxes via the Recovery Rebate Credit.

You May Like: How Much Was All The Stimulus Checks

What Can I Do If I Have Not Received My Eip Money By Those Deadlines

If you have not received all or some portion of your Economic Impact Payments by the deadlines above, you will have to file a 2020 tax return and claim these amounts. You claim them on line 30 of the 2020 Form 1040 as a “Recovery Rebate Credit“. This is another name for the EIP stimulus payments. If you did not get all or a portion of the EIP payments in advance, then you can claim them on line 30 of your tax return for 2020.

Nursing Homes And Assisted

Since the payment doesnt qualify as a resource for Medicaid purposes until 12 months after it was first received, nursing homes and assisted living facilities should not require residents to sign over their payment until this period has passed. If you believe a nursing home or assisted living facility has improperly taken the payment from you or a loved one, file a complaint with your states attorney general.

You May Like: $600 Stimulus Check Not Received

Who’s Eligible For The Latest Stimulus Check

THERE is certain criteria that must be met in order to claim your third stimulus check.

You could be entitled to a payment if the following is true:

- You are not a dependent of another taxpayer

- You have a Social Security number valid for employment

Your adjusted gross income must also not exceed:

- $160,000 if married and filing a joint return

- $120,000 if filing as head of household or

- $80,000 for single applicants

How Can I Check My Stimulus Check Status

The IRS has created a website where you can check the status of your stimulus payment.

The Get My Payment tool is no longer updating for either the first or second stimulus check. However, you can use it to see the status of your third check.

- If your payment has been processed. the IRS will specify its status including whether it has been sent, the date issued, and whether the money will be directly deposited or mailed.

- If your status reads “Payment Not Available.” The IRS either hasn’t yet processed your payment or you aren’t eligible for one.

- If it reads “Need More Information.” Your check was returned to the IRS after an attempted delivery. Give the IRS your bank information to receive your money.

If you did not get your first or second check, you’ll need to file a 2020 tax return to get the payment.

Also Check: Is Texas Giving Stimulus Money

What If I Am Married To Someone Who Owes Child Support Will My Tax Return Be Applied To The Child Support Arrears They May Owe

-

Yes,unless you are eligible for relief. If youdo not owe child support butyouare married tosomeonewhoowes child support,you may need to file an Injured Spouse Claim and Allocation -Form 8379

-

In some instances, the IRS offsets a portion of the payment sent to a spouse who filed an injured spouse claim if it has been offset by the non-injured spouses past-due child support. The FAQ on the IRS stimulus FAQ www.irs.gov/coronavirus/economic-impact-payment-information-center website states: The IRS is aware that in some instances a portion of the payment sent to a spouse who filed an injured spouse claim with his or her 2019 tax return has been offset by the non-injured spouses past-due child support. The IRS is working with the Bureau of the Fiscal Service and the U.S. Department of Health and Human Services, Office of Child Support Enforcement, to resolve this issue as quickly as possible. If you filed an injured spouse claim with your return and are impacted by this issue, you do not need to take any action. The injured spouse will receive their unpaid half of the total payment when the issue is resolved.