Economist Expectations Remain Mixed

Following the jobs report, some economists noted that low unemployment points to a strong economy and overblown talk of recession.

On the other hand, sinking unemployment coupled with high prices is consistent with an inflationary boom. And the labor markets unusual tightness has remained a focus for Fed policymakers, since the disparities between job openings and worker availability continues to place upward pressure on wages.

Ironically, as these positive factors continue to contribute to inflation, which may force the Fed to remain on its current rate hike schedule, a fact that feeds the recession debate.

While the unemployment rate is low and dropping, GDP which measures the price tag of an economys output has fallen two quarters in a row. Though that meets the technical definition of a recession, both the White House and Fed have indicated that other metrics dont yet add up to recession.

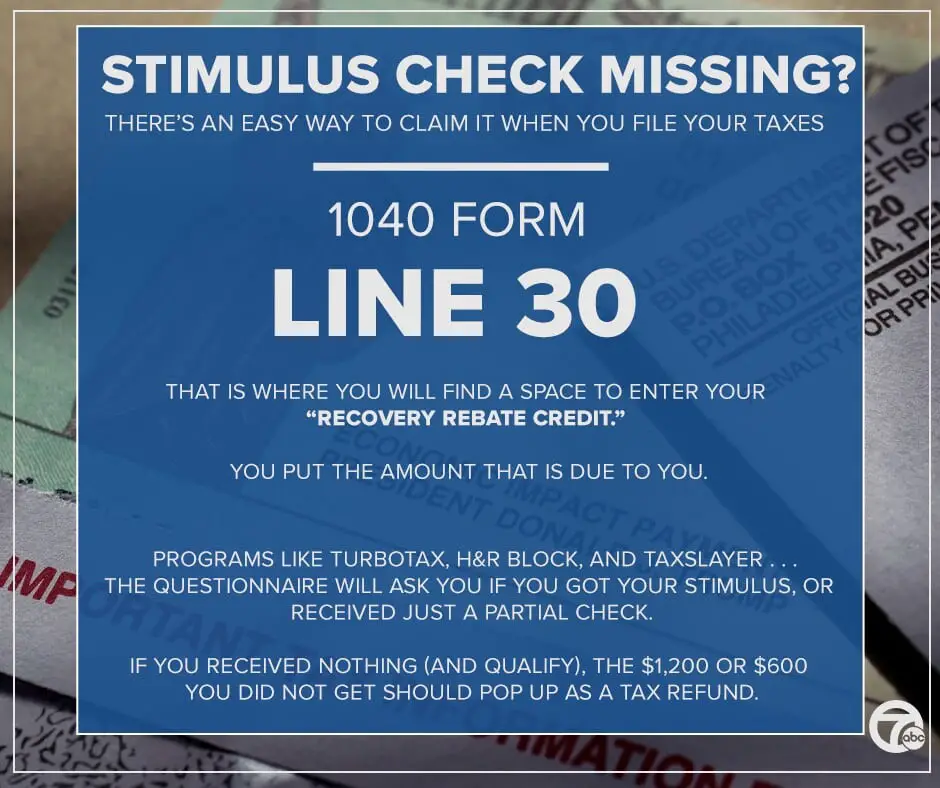

How Can You Check On The Status Of A Missing Stimulus Payment

It’s easy to check the status of your third stimulus check through the Get My Payment tool. You’ll need to request a payment trace if the IRS portal shows your payment was issued but you haven’t received it within the time frame outlined in the chart above.

To use the tool, you need to plug in your Social Security number or Individual Taxpayer Identification Number, date of birth, street address and ZIP or postal code. The portal will show your payment status, if your money has been scheduled and the payment method and date. You might also see a different message or an error.

You Had A Lifestyle Change In 2020 That Wasnt Reflected In Your 2019 Taxes

A lot can change in a year, and its very possible the IRS didnt have enough up-to-date information accurately reflecting your financial situation.

A few circumstances that could qualify you for more money: You had a baby in 2020, or adopted or fostered a child. Less common, say you share joint custody with a child but only rotate that responsibility every other year. You might be eligible for extra money by filing for a credit, and there are instances when your former spouse might pocket extra money as well.

Say I filed with Susie Q. in 2019 and I got the stimulus checks for that child, and then my divorced spouse filed with Susie Q. for 2020. She would get the Recovery Rebate Credit as well, says Mark Jaeger, director of tax development at TaxAct. Its a little bit of double dipping, but it is something that is allowed.

Additionally, maybe you got married or divorced. Perhaps you graduated college and started working, meaning youre no longer considered a dependent. And, as is likely the case for millions of Americans, perhaps you had a higher-paying job in 2019 but lost that position in 2020. Even individuals who were working in 2019 but retired in 2020 could be eligible for the credit.

These are just a sampling of circumstances that might mean youre eligible for a stimulus check or a higher amount.

Theres a lot of reasons why you may be due more that are all legitimate, Steber says. Its real money, and its a lot of money.

Recommended Reading: When Will We Get 4th Stimulus Check

Having Payments Made Through Your Us Bank Account

You open a US bank account , for example with the SDFCU or with Wise. Both are accepted by the IRS for electronic payments. You then provide the bank account details to the IRS on your US tax return.

You return the received check to the IRS according to the procedure described below, with an accompanying letter stating that you cannot cash the checks in your country and that you will still claim the amounts as a refund on your tax return.

You then claim your COVID-19 support in your US tax return and the IRS will deposit your refund into your US bank account. You can claim the first and second COVID-19 support payments in the tax return for tax year 2020 it is expected that the third payment can be claimed in the tax return for 2021.

Procedure for returning a check to the IRS:

How To Make Sure You Receive Your Credits As Soon As Possible

The Recovery Rebate Credit worksheet requires that you know the specific amounts you were supposed to receive, according to the IRS. By doing the investigation and calculation work in advance, youll most likely end up getting your stimulus check and tax refund faster.

To get it correct, that cannot be overemphasized, Steber says. These Recovery Rebate Credits are real cash, and they sent out hundreds of millions in the two tranches. If you did in fact receive it and forget about it, it could add weeks to your tax return timeline.

Your tax refund will be passed more quickly and safely if you electronically file and provide a direct deposit, the IRS says.

Typically, the IRS is good at sending out refunds within a couple of weeks within electronically filing, Bronnenkant says.

Not included in 2020s Recovery Rebate Credit is a third stimulus payment worth $1,400 or more, distributed to Americans beginning in mid-March after President Joe Biden signed the $1.9 trillion American Rescue Plan. Taxpayers will most likely have to wait until 2021 to claim those missing relief payments, Jaeger says.

Recommended Reading: Can International Students Get Stimulus Check

Why You May Not Have Gotten All Your Stimmy Money

The third-round stimulus payments, authorized by the American Rescue Plan Act of 2021 and signed into law on March 11, 2021, were sent from March through December last year. Round 3 of the so-called stimmies provided a maximum credit of $1,400 per person, including all qualifying dependents claimed on a tax return.

A married couple with two qualifying dependents, for example, are eligible to receive a maximum credit of $5,600, depending on income limits. And if you brought a baby into the world last year, youll be able to file for up to $1,400 that youre owed for your new family member if you claim the child as a dependent.

The size of the credit, however, gets reduced for single filers with adjusted gross income of more than $75,000 and for married couples filing jointly with earnings of more than $150,000. For heads of household, the credit is reduced between $120,000 and $112,500.

The credit disappears entirely for individuals with AGI above $80,000 and for married couples filing jointly who earn more than $160,000. Heads of household with incomes of more than $120,000 also dont get the stimulus check. Most eligible Americans have already received the payments, according to the IRS.

Who Is Eligible For A Stimulus Check

The vast majority of Michigan residents are eligible to receive a stimulus check from the federal government this year. Even if you have no income, you are still eligible, but need to take action to receive your stimulus payment. This includes individuals with low or no earnings who normally don’t file taxes. Every American adult earning less than $75,000 is eligible for a stimulus check from the federal government this year. While this site is geared toward Michigan residents, the information is applicable nationwide.If you still have questions about your stimulus check after reviewing this website, call the IRS at or, United Way at .

After you sign up, make sure to add your account information on the IRS website. If you dont want to sign up for a bank account, you can also link to your prepaid debit card instead.You can also receive your funds through the Cash App, by providing the IRS with the routing and account numbers connected to your Cash App. You can download the Cash App or locate your Cash App account information here.

What if I havent filed taxes?

What if I dont qualify – where else can I get help?

If you dont qualify for the stimulus payment, we recommend reaching out to Michigan 2-1-1. They can connect you to resources in your community.

Will my payment be reduced or offset if I owe tax, have a payment agreement with the IRS, owe other Federal or State debt, or owe other debt collectors?

You May Like: Did They Pass The Stimulus Check

What If I Didnt Get Some Or All Of My Stimulus Checks

If you think you are eligible and you did not get a check for you or your dependents, you can still get the money by filing your 2020 or 2021 taxes. You may be eligible for free tax preparation help from Maines CA$H Coalition.

If you do not usually file a tax return and didn’t get your stimulus checks, you may still be able to file a tax return this year to get your stimulus checks. You should check with a tax professional. The IRS website also provides information about how to claim your stimulus checks if you didnt get them in 2020 or 2021. You can also call Pine Tree Legal Assistance.

Payment Status Not Available: Why

The IRS says that millions of taxpayers have successfully used the new Get My Payment app to track their stimulus checks and, if needed, add their direct deposit information to get payment faster. So why are countless people complaining on social media that they entered their information at the app only to receive a frustrating Payment Status Not Available message?

In some cases, there could be glitches with the Get My Payment app itself that are preventing people from adding direct deposit information or finding out the expected date for their payments to arrive. Among other quirks, the system may give you a Payment Status Not Available Message if you owed $0 in taxes and received no refund on your most recent tax return, the Washington Post reported, because the IRS form gave an error message for people entering 0 in those corresponding spots.

The Get My Payment app went offline during certain late-night hours on Thursday, April 23, through Saturday, April 25, for planned maintenance. On April 26, the IRS announcedsignificant enhancements to the app, though the agency did not specify which glitches had been fixed. We urge people who havent received a payment date yet to visit Get My Payment again for the latest information, IRS Commissioner Chuck Rettig said in a statement. IRS teams worked long hours to deliver Get My Payment in record time, and we will continue to make improvements to help Americans.

Recommended Reading: How Can I Get My 3rd Stimulus Check

If I Owe Child Support Will Mytax Return Be Applied Tomychild Supportarrears

-

Maybe.Federal law and regulationsdetermine when federal payments are intercepted and applied to child support arrears.

-

IfTANFhas been received for your child,thetotalamount of past due supportonall ofyourchild support cases must be at least $150

-

IfTANFhasnotbeenreceivedfor your child,thetotalamount of past due supportonall ofyour child support casesmust be at least $500

What If I Need To Change My Mailing Address Since I Filed

If you filed a 2019 tax return, the IRS will use the mailing address it has on file from your return. You wont be able to change it.

If youve only filed a 2018 tax return and need to change your mailing address, the IRS recommends filing your 2019 taxes electronically as soon as possible. Thats the only way to let the IRS know your new information.

You May Like: Never Got First Stimulus Check

How You Can Expect To Receive Your Stimulus Payment

The most important thing to remember if youre an adult dependent looking for a stimulus payment: You wont be individually receiving these stimulus payments. Rather, theyll be incorporated in the lump sum that your parent or guardian receives.

The IRS and Treasury Department are delivering stimulus checks through three main methods: direct deposit, as well as mailed physical check or a prepaid debit card. If your household has a bank account and routing number on file with the IRS, the payment will most likely hit your familys bank account, the fastest method of delivery. New to this round, the Treasury Department is also working across government agencies to access any bank accounts that might have been on file for other federal payments, potentially speeding up the delivery process.

Mailed checks or debit cards will likely take longer, potentially adding weeks to the process. Be sure to keep a watchful eye out for any letters or notices that come from the IRS or Treasury Department and hold onto any documents referring to your stimulus payment.

The IRS started delivering the third stimulus check round on March 12 and has now delivered roughly four-fifths of all payments, according to a . The IRS will continue delivering paper checks and debit cards on a weekly basis, a process that started officially on March 19.

Where Are My Stimulus Checks

If you havent gotten your stimulus checks by now, you will need to file your federal tax return to claim them as the Recovery Rebate Credit. You will need to file a 2020 tax return to get the first and second stimulus checks and a 2021 tax return to get the third stimulus check..

Information about the first, second, and third stimulus checks is no longer available on the IRS Get My Payment tool. To check the amount of issued stimulus checks, you can refer to IRSNotice 1444,Notice 1444-B, and Notice 1444-C that were mailed to you to see the amounts of these payments or check your bank statements if your checks were direct deposited.

You can also view the amounts by creating an account onIRS.gov/account. To create an account, you will need:

Once youve created your account, you can check if you received the Recovery Rebate Credit:

Read Also: How Much Was The Second Stimulus Check

Will Claiming The Recovery Rebate Credit Increase My Taxes

No, your taxes wont increase due to reconciliation. Theres a lot of fear, Erb says. Reconciling the credit on your 1040 is not a bad thing, its not a trap, its not intended to trick you into paying more money.

The Recovery Rebate Credit is designed to reconcile the money you are eligible for versus what you actually received. Claiming it will only increase the amount of your tax refund or reduce the amount you owe on your 2020 federal taxes.

Can I Still Get A Stimulus Check

If you think youre eligible for a COVID stimulus payment or the 2021 child tax credit, and didnt already receive those funds, you can file a simple tax return by visiting ChildTaxCredit.gov.

But youll need to move quickly. Thats because if youre not required to file a tax return, this year’s deadline to file a simplified return is November 15. If you are required to file, but missed the April 18 filing deadline, you have until on ChildTaxCredit.gov and see if youre eligible to receive a stimulus payment or child tax credit.

However, if you don’t owe taxes to the IRS, the IRS has said that you can still file your 2021 tax return, and claim the Child Tax Credit for the 2021 tax year, at any point until April 15, 2025. But because that can get confusing, it’s probably best to file for the 2021 tax year as soon as you can.

According to the Government Accountability Office, groups that were most likely to have missed out on pandemic relief stimulus payments or the child tax credit , were people who never filed a tax return or who filed for the first time during the pandemic. The federal government also had difficulty getting stimulus checks and child tax credits to people without bank accounts or reliable internet access, and people who were experiencing homelessness in 2020 and 2021.

Read Also: Check On Status Of Stimulus Check

What If You Got An Irs Letter In The Mail But No Payment

About 15 days after the IRS sends your third stimulus check , you should get a letter from the agency confirming your payment. The IRS is still sending these letters for the third payment.

If you received this letter — also called Notice 1444, Your Economic Impact Payment — but you never got your payment, you’ll need to request a payment trace. Make sure you keep the letter because you’ll need the information to file your claim. The same is true for the first and second stimulus checks as well.

What If I Need To Change My Bank Account Information Since I Filed

The Get My Payment tool doesnt allow people to change their bank account information already on file with the IRS, in order to help protect against potential fraud, the IRS website says. The Get My Payment tool also does not allow people to update their direct deposit information once their Economic Impact Payment has been scheduled for delivery.

However, people who did not use direct deposit on their last tax return to receive a refund, or when their direct deposit information was inaccurate and resulted in a refund check, will be able to provide that information and speed their payment with a deposit into their bank account, the IRS website says.

If the bank account you used on your tax return has since been closed, the IRS says the bank will reject the deposit and you will be issued your payment to the address we have on file for you.

If you split your tax refund between multiple accounts, the IRS will send your stimulus payment to the first account you listed on Form 888. If your direct deposit is rejected, your payment will be mailed to the address we have on file for you, the IRS says.

If youve had to make an electronic payment to the IRS in the past which includes Direct Debit Installment Agreements the IRS will not use that account information to send your stimulus payment. Instead, the IRS says you must fill out your direct deposit information through the Get My Payment app or wait for your payment to come in the mail.

Also Check: Contact Irs About Stimulus Check