Long Beach Social Security Disability Attorneys

If you or a loved one is unable to work due to a disabling injury, medical condition or disease our skilled and experienced Social Security Disability Attorneys are here to help you get the maximum SSDDI benefits for which you qualify.

The Law Office of Cantrell Green is a group of highly qualified and experienced disability attorneys who have obtained millions of dollars in Social Security Disability benefits for thousands of clients in Long Beach, Orange County and the greater Los Angeles. Our attorneys care about every client, and fight tirelessly to obtain the benefits you deserve.

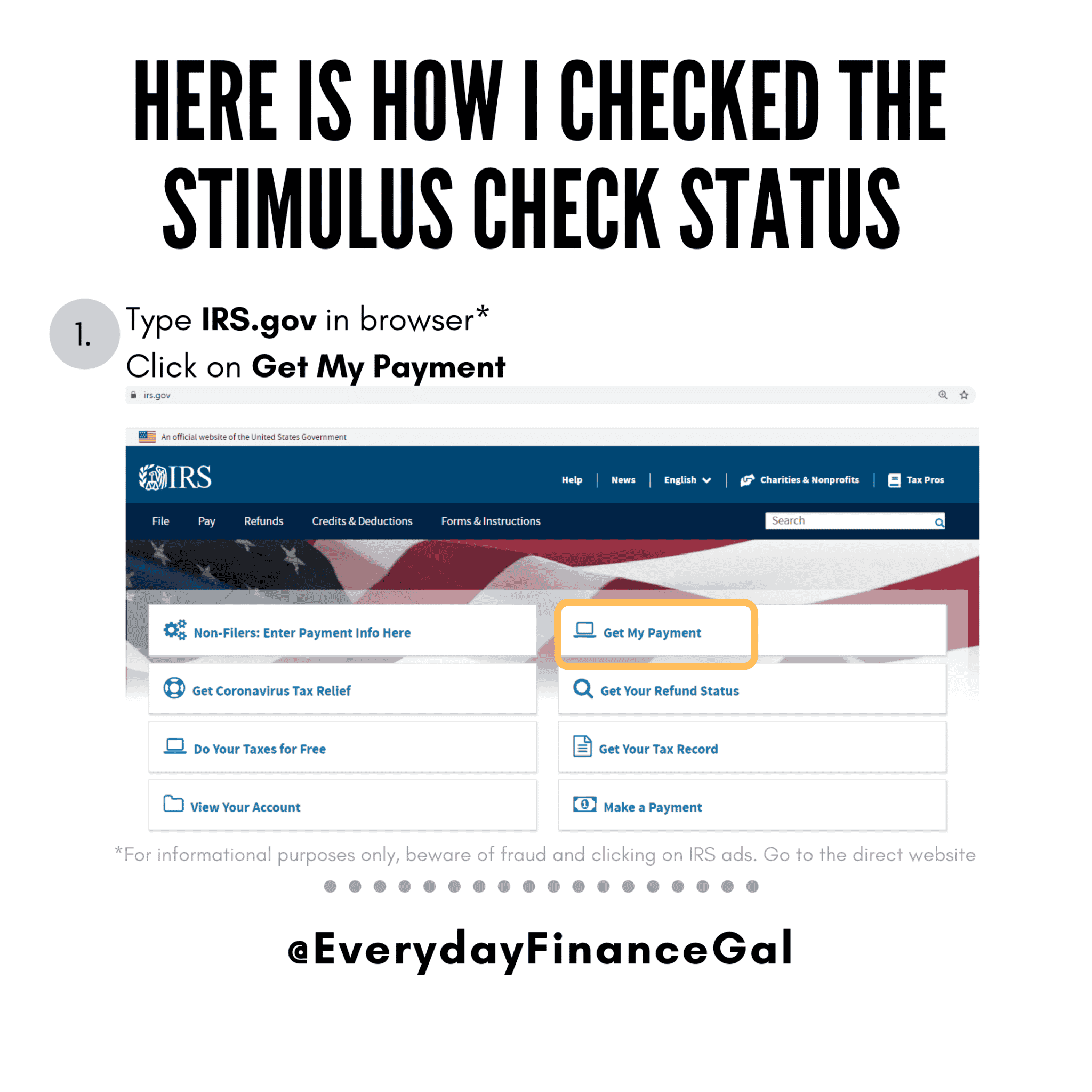

When Will I Receive My Stimulus Check How Do I Track The Status Of My Stimulus Check

Eligible taxpayers who filed a tax return in 2019 or 2018 and chose to receive their refund through direct deposit into their checking or savings account will automatically have their stimulus payment deposited into that account.

To find out when your stimulus check is coming, visit the IRS Get My Payment tool.

If the Get My Payment site says, Payment status not available its for one of the following reasons:

- The IRS hasnt finished processing your 2019 return, Stimulus Registration, or IRS Non-Filers entry.

- Get My Payment doesnt have your data yet.

- If you receive Social Security, VA benefits, SSA or RRB Form 1099 and dont typically file a return, your information isnt available in Get My Payment yet.

- Youre not eligible for a payment.

Get My Payment information is only updated once per day, so if you receive a Payment status not available message check back the following day to see if your status has changed.

What Does ‘payment Status Not Available’ Mean

According the stimulus check FAQ , you might see “Payment Status Not Available” if you are required to file a tax return but haven’t yet, the IRS hasn’t finished processing it if you have, or you’re not eligible.

Be patient and check back in with the Get My Payment app if you’ve recently filed your returns. If you’ve received your tax return payment and still see the “Payment Status Not Available,” message, call 800-919-9835 for the Economic Impact Payment information line.

Looking for more financial resources? Here’s how to file for unemployment online.

- The best all-in-one printers to help keep your paperwork in order

Read Also: How Do I Apply For The 4th Stimulus Check

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

at 1-800-829-1040

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

How To Check The Status Of Your Rebate

According to the states 2022 State of Illinois Tax Rebates website, taxpayers can check on the status of their rebates by using the Wheres My Rebate? application.

To use the Wheres My Rebate? application, you must have:

- Your name and social security number or taxpayer identification number , and

- Your 2021 adjusted gross income amount as reported on your 2021 Form IL-1040, Illinois Individual Income Tax Return, or Form IL-1040-PTR, Property Tax Rebate, or your IL-PIN, which you can obtain using the IL-PIN Inquiry application.

Don’t Miss: Sign Up For Fourth Stimulus Check

Who Is Eligible For A $1400 Stimulus Check

Your stimulus payment amount will be based on information from the most recent tax return you filed with the IRS.

Your eligibility depends on your income level. You will receive a third stimulus check if your income is:

- $75,000 or less for a Single filer

- $150,000 or less for a Married Couple Filing Jointly

NOTE: If you are claimed as a dependent on someone elses tax return, you will not be eligible for a stimulus check. For more information, please visit the IRS Coronavirus Tax Relief and Economic Impact Payments center.

RELATED: Stimulus Check FAQs

The Irs Doesnt Have Your Direct Deposit Info

Many people who filed their taxes in 2019 or 2018and were owed a refundreceived their stimulus checks automatically and did not need to lift a finger. Thats because theyve already given their bank routing information to the IRS. If youve never done that, your stimulus check will probably be sent by mail.

Unfortunately, paper checks are going to take a little bit longer. The IRS will begin sending them later this month and will continue on a weekly basis.

If you still want to try giving the IRS your direct deposit info, you can do that here. There are separate sections for filers and non-filers . Be forewarned, the IRS website has been suffering under the weight of increased traffic, and many visitors are experiencing glitches with these tools.

Read Also: How Much Were The 3 Stimulus Checks

Amount And Status Of Your Third Payment

You can no longer use the Get My Payment application to check your payment status.

To find the amount of the third payment, create or view your online account or refer to IRS Notice 1444-C, which we mailed after sending your payment. Were also sending Letter 6475 through March 2022 confirming the total amount of the third Economic Impact Payment and any plus-up payments you were issued for tax year 2021.

You can also securely access your individual tax information with an IRS online account to view your total Economic Impact Payment amounts under the 2021 tax year tab. You will need the total of the third payment and any plus-up payments you received to accurately calculate the 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022.

Find Out Which Payments You Received

To find the amounts of your Economic Impact Payments, check:

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page.

IRS EIP Notices: We mailed these notices to the address we have on file.

- Notice 1444: Shows the first Economic Impact Payment sent for tax year 2020

- Notice 1444-B: Shows the second Economic Impact Payment sent for tax year 2020

- Notice 1444-C: Shows the third Economic Impact Payment sent for tax year 2021

Letter 6475: Through March 2022, we’ll send this letter confirming the total amount of the third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need the total payment information from your online account or your letter to accurately calculate your Recovery Rebate Credit. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment.

You May Like: When Will The $1400 Stimulus Checks Be Mailed Out

What Does The Need More Information Status Mean On The Get My Payment App

Youll receive this if youre eligible for an Economic Impact Payment , but the IRS does not have your direct deposit information to send your direct deposit information electronically. After verifying your identity, provide your bank information on the IRS website. Add the correct routing number, account number, and account type, which can be found on one of your checks, through your online banking website or app, or by contacting your financial institution.

Direct deposit is the fastest way to get your stimulus check, but if you choose not to provide your bank information, the IRS will send your check in the mail to the address on file.

Why Am I Getting An Error Message When Answering The Security Questions

If the information entered does not match the IRS records, you will receive an error message. Be sure you entered the information accurately. Check your most recent tax return or consider a different way to enter your street address and use the help tips provided when entering your personal information. If you enter incorrect information multiple times you will be locked out of Get My Payment for 24 hours.

You May Like: Social Security Disability Stimulus Check 2022

How Much Will I Get

The payments are based on income and family size.

Single taxpayers who earn less than $75,000 a year and couples who file jointly and make less than $150,000 a year will receive $350 per taxpayer.

Taxpayers with dependents will receive an extra $350, regardless of the total number of dependents.

In other words, a couple that earns a combined $125,000 and has two children would qualify for $350 per adult plus $350 for their children, for a total of $1,050.

Fourth Stimulus Check Approval: Here’s What It’ll Take

The White House hasn’t responded to any of the proposals for additional stimulus checks, and the general sentiment is that a fourth stimulus check isn’t likely. Economists have suggested we’ve already moved past the pandemic’s worst financial woes, although there are signs that Americans could still use relief.

Experts certainly seem in agreement that there won’t be a fourth stimulus check. The latest stimulus package, the American Rescue Plan, is “gonna be the last on that front,” Deutsche Bank senior U.S. economist Brett Ryan told Fortune . “No more checks.”

Ed Mills, Washington policy analyst at Raymond James, agreed, telling CNBC recently “I think its unlikely at this time. D.C. has largely started to pivot towards the recovery and an infrastructure bill.”

Many economists and financial experts are worried that the third stimulus checks have contributed to a growing inflation rate. In June 2021, the core inflation rate, stripped of energy and food prices, rose 4.5% at an annual rate vs. the Dow Jones estimate of 3.8%. The overall consumer price index rose at an annualized 5.4% rate in June.

Don’t Miss: What Was The First Stimulus Check Amount

Stimulus Check Status: How To Track Down Your Payment Now

The IRS Get My Payment website can show you the status of your $1,400 stimulus check

Tracking your third stimulus check status online can help you locate your $1,400 payment. As with the first and second stimulus checks, the IRS offers an online tool that can tell you when to expect your share of the $1.9 trillion American Rescue Plan Act of 2021.

Americans who meet the $1,400 third stimulus check eligibility requirements can see the status of their payment right now with the IRS’s Get My Payment portal. Even if you’re not eligible for the full stimulus-check amount, you can get a look at your payment’s standing.

To help people keep tabs through upcoming payment cycles, the IRS has updated the Get My Payment app with information for the latest stimulus check. After you fill out a short form, you should be able to view the status of your stimulus check if you’re due to get one.

Whether you’re getting your check in the mail or direct deposit into your bank account, the Get My Payment app should be able to answer some of your questions. You can also use the IRS stimulus check phone number for more help.

Reminder: Unless you’re exempt, you’ll need to have filed your taxes for 2019 or 2020 before the IRS can send you a relief payment.

Here’s how to use the IRS Get My Payment online tool to track your third stimulus check status right now.

Irs Get My Payment: How To Use The Online Tracker Tool

To get an update on your third stimulus check using Get My Payment, enter your Social Security number, date of birth, street address and ZIP or postal code. The tool will display a message with information about your payment. You can see things like whether your money was sent or is scheduled to be sent, the payment method and the date your stimulus money was issued. The tool may also say it can’t yet determine your status — see more below about error messages.

Also Check: New Home Purchase Stimulus Program

When We Issue A Refund We Will Deliver One Of The Following Messages

- Your return has been processed. A direct deposit of your refund is scheduled to be issued on . If your refund is not credited to your account within 15 days of this date, check with your bank to find out if it has been received. If its been more than 15 days since your direct deposit issue date and you havent received it yet, see Direct deposit troubleshooting tips.

- Your refund check is scheduled to be mailed on . If you have not received your refund within 30 days of this date, call 518-457-5149.

Who Is Eligible For The Third Stimulus Check

If youre trying to track your stimulus check, youll first want to know if youre eligible to receive one information that the Get My Payment tool wont explicitly inform you when you go track your check.

One good rule of thumb for determining if you qualify: If you were eligible to receive the full amount before, youll be eligible again. Income requirements for receiving full stimulus checks are the same for both individual and married tax filers, while income information is based on your most recently processed tax return .

If you earned up to $75,000 youre slated to get the full relief check worth $1,400. Married couples will thus receive $2,800 as long as their combined AGI doesnt top $150,000.

But the point at which payments completely phase out for Americans happens sooner on the income scale, a move meant to appease more deficit-minded lawmakers and shrink the size of the overall relief package.

Individuals total payments decrease by $28 per every $100 over the income threshold. Single filers and married couples who make $80,000 and $160,000 or more a year, respectively, wont receive a check at all.

Eligible U.S. adults will see $1,400 per each individual in their household, including adult dependents, such as college students.

If youre ineligible for a stimulus payment but currently out of work, heres how to apply for unemployment benefits.

You May Like: Free File Taxes For Stimulus

How Much Will I Get In My Second Stimulus Check If I Am Receiving Social Security Disability

In December new stimulus payments in the amount of $600 were signed into law.

In December there was also a lot of talk by congress-people of $2,000 payments. But those are not happening, as of January 1, 2020 because the last Senate didnt vote on any bill to replace the $600 stimulus check with a $2,000 payment. A new Senate and House will be sworn in Jan. 3 so there is still a possibility that a third stimulus check will happen in early 2021.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Read Also: $2 000 Monthly Stimulus Check Update

The Irs Has The Wrong Bank Info

The IRS is sending payment to the bank account it has on file for you. If you’ve changed banks and closed the account, or the bank number on file with the IRS is wrong, the payment won’t go through, but you’ll still get your money. As the IRS says, “If the account is closed or no longer active, the bank will reject the deposit and you will be issued a check that will be mailed to the address we have on file for you.”

How Can I Check The Status Of My Stimulus Payment

-

Send any friend a story

As a subscriber, you have 10 gift articles to give each month. Anyone can read what you share.

Give this articleGive this articleGive this article

You can track the status of your payment via the I.R.S.s Get My Payment tool. Be aware that the volume of users sometimes overwhelms the site.

Read Also: The First Stimulus Check Amount

First And Second Stimulus Check

You will need to file a tax return for Tax Year 2020 . The deadline to file your taxes this year was May 17, 2021. The tax filing extension deadline is October 15, 2021.

If you missed the filing deadline, you can still file your tax return to get your first and second stimulus checks. If you dont owe taxes, there is no penalty for filing late. If you owe taxes, you may be subject to penalties and fines for not filing or not paying taxes. The government may reduce your tax refund to pay for any taxes you owe and other federal and state debts.

To learn more about your options if you think you owe taxes, read Filing Past Due Tax Returns and What to Do if I Owe Taxes but Cant Pay Them.