How To Refinance Second Mortgages

Refinancing a second mortgage requires almost the same steps as refinancing the first mortgage. In most cases, youll have to wait at least 12 months from when you were approved for the second mortgage before refinancing it. Most lenders also require you to have at least 20% equity in your home. If you plan to refinance with a different lender, you may want to check with the lender who holds your second mortgage before pursuing refinancing.

It may be slightly more difficult to find a lender, as refinancing second mortgages carries more risk for the lender. If for any reason your house is foreclosed, the second lender only gets whats leftover after the first lender is paid off. Nonetheless, if you have good credit, a stable income, and youve made your mortgage payments on time, you should be able to find a lender willing to help you refinance your second mortgage.

Before considering refinancing any mortgage, you should do your research, speak with your financial advisor, and calculate whether youll benefit financially by refinancing. Depending on the fees, the cost of refinancing a second mortgage may outweigh the benefits.

Once youve decided that refinancing your second mortgage is the right choice, figure out if you would qualify for favorable interest rates by checking your credit score and assessing your financial situation. Your lender may look at your other debts, so determine your debt-to-income ratio.

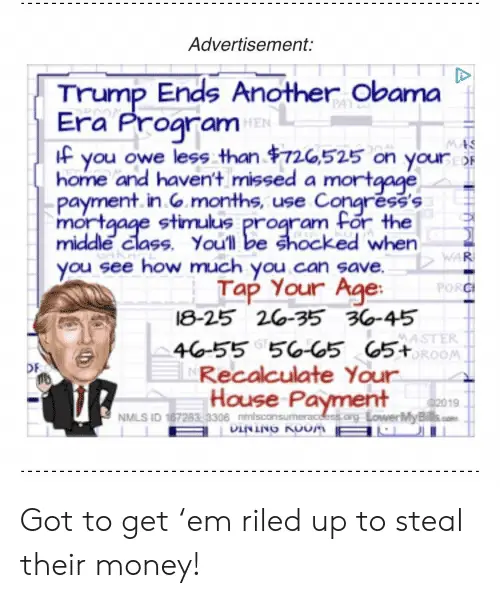

Is Mortgage Stimulus A Real Thing

There is a lot of debate surrounding the idea of mortgage stimulus, with many people wondering if it is a real thing. While there is no definitive answer, it seems that mortgage stimulus could potentially help those who are struggling to make their mortgage payments. By providing additional financial assistance, mortgage stimulus could give people the breathing room they need to stay afloat. However, it is important to remember that mortgage stimulus is not a cure-all and should be used in conjunction with other financial planning.

There has never been a mortgage stimulus program called that. Some federal funds have, however, been made available to assist homeowners. A Homeowner Assistance Fund is a type of loan that is available to homeowners. As a result, the fund provides nearly $10 billion to states, the District of Columbia, and other US territories.

Veteran Mortgage Relief Options

One benefit of a VA loan is that the Department of Veterans Affairs can help you out if youre having trouble making mortgage payments.

Veteran mortgage assistance comes in two forms:

If youre underwater on a VA loan and need to refinance, you may be able to use the VA Streamline Refinance to do so. Like other Streamline programs, the IRRRL requires no income or employment check, and skips the home appraisal so your LTV wont matter.

If youre not sure whether a refinance is right for you, you might take advantage of the other VA relief program.

For VA loan holders as well as veterans with non-VA mortgages, the VA offers access to professional counselors who can help you if youre having trouble making your payment. These people help veterans figure out whether they should refinance, try to restructure their loan, or take another measure to prevent foreclosure.

Even better, the VAs loan technicians work with your lender on your behalf so you dont have to figure out all the logistics of a mortgage relief program yourself.

Don’t Miss: When Did The 1st Stimulus Checks Go Out

Getting The Money May Take Time

The money will be funneled to borrowers through state housing agencies.

At least 60% of the state grants must go to homeowners with incomes that don’t exceed either the local median income or the national median income, whichever is higher.

Russell Graves, executive director of the National Foundation for Debt Management, a multistate housing counseling agency, says he doesnt expect the funds to be made available until early 2022.

“There are so many other things going through these agencies: rental assistance, different kinds of pandemic assistance,” Graves says. “Frankly, we have never put so much money toward housing in history. The numbers are staggering.”

Mortgage Relief: How To Qualify

- You must own your home.

- You must have a mortgage.

- Your mortgage balance in 2021 must be less than $548,250.

- Funds will be available to mortgage borrowers who are struggling to pay off their mortgage.

- At least 60% of the mortgage aid must be allocated to mortgage borrowers who have an income that is less than the national median income or the respective local median income, whichever is higher.

Don’t Miss: Are We Getting More Stimulus Money

Qualifications For A Mortgage Stimulus

Related Articles

Youve been laid off from your job, and you must use the money you saved for a family vacation, a new car or even retirement to feed your family and pay overdue bills. Youre now contemplating applying for a mortgage stimulus package that provides temporary relief from your biggest monthly payment without the fear of losing your home. The coronavirus has affected millions of Americans who never thought theyd be in such a dire financial condition. The United States Congress has already enacted programs that provide relief until the pandemic has passed and life returns to normal.

Tip

If you already have mortgage forbearance, you can apply to extend your mortgage stimulus relief for another 180 days.

During The Wait Forbearance Will Be Key

Graves recommends that homeowners in need call their lenders or servicers the companies that manage loans and send out statements to discuss options, including beginning or extending forbearance.

Forbearance allows you to postpone your mortgage payments without getting slammed with late fees or taking a hit to your credit score.

Those with federally backed loans some 70% of the U.S. mortgage population have been able to apply for forbearance in the pandemic. The deferred payments are typically tacked onto the end of the mortgage term. The enrollment window for forbearance was recently extended and now ends June 30.

If youre in the remaining 30%, you dont have the same flexibility, Graves says. He suggests calling a housing counseling agency approved by the Department of Housing and Urban Development . Congress has provided $100 million so those agencies can assist homeowners.

Read Also: Where My Golden State Stimulus

What Is Us Congress Mortgage Stimulus Program

The United States Congress Mortgage Stimulus Program is a federal program that was created in response to the COVID-19 pandemic. The program provides funding for mortgage assistance for homeowners who are struggling to make their payments. The program is administered by the Department of Housing and Urban Development and is available to homeowners who are at risk of foreclosure.

Q: Does The Exclusion For Qualified Principal Residence Indebtedness Apply To Amounts Discharged Under A Pra Principal Reduction

A4: The exclusion for qualified principal residence indebtedness may apply to a discharge of indebtedness under a PRA principal reduction if the amount discharged meets the criteria for qualified principal residence indebtedness. Under current law, this exclusion does not apply to discharges that occur after Dec. 31, 2013. For further discussion of the qualified principal residence exclusion, see the questions and answers on The Mortgage Forgiveness Debt Relief Act and Debt Cancellation page.

Don’t Miss: Who’s Eligible For 3rd Stimulus Check

Streamline Refinance Eligibility: Lower Your Interest Rate Quickly And Affordably

You may be eligible for a Streamline Refinance if:

- You have an FHA, VA or USDA loan

- You will benefit demonstrably from the refinance, such as by a lower mortgage rate or monthly payment

- No missed payments in the last 6 months

If you meet these conditions you are very likely to have access to lower rates but you need to act now before rates go up. Speak with your mortgage lender about your personal finances and relief options.

Mortgage Aid: How It Works

- The Homeowners Assistance Fund can help you pay not only your mortgage, but also your taxes, insurance, utilities and common charges like monthly homeowners association dues.

- The U.S. Treasury Department is sending money to states to distribute direct financial assistance through state housing agencies.

- The amount of mortgage aid depends on each states number of late mortgage payments, foreclosures and unemployment statistics, for example.

- States must spend this Covid-19 mortgage relief by September 30, 2025.

- Contact your state housing agency to learn more about Covid-19 mortgage relief in your state.

You May Like: Amount Of All Stimulus Checks

What Has President Biden Been Doing To Offer Mortgage Relief

According to a White House press release: “Shortly after taking office, the Biden-Harris Administration extended the foreclosure moratorium and mortgage forbearance enrollment period for homeowners with government-backed mortgages to provide relief to struggling homeowners.” Additionally, as part of President Biden’s American Rescue Plan $9.961 has been provided for the Homeowner Assistance Fund, encouraging loan modifications and payment reduction options on all federally backed mortgages.

What If You Have A Non

Federal regulators believe most non-government-backed lenders and loan servicers will adopt policies similar to those mandated by the CARES Act and subsequent legislation. To find out, contact your loan servicer, ask what programs it has in place to provide mortgage relief to homeowners impacted by the coronavirus outbreak, and follow any instructions you are given.

Although the CARES Act does not require private lenders to offer mortgage assistance, if you and your lender come to any type of loan modification agreement, then the law regarding not reporting reduced or paused payments to does apply to you.

If your mortgage forbearance is set to expire soon, then you may be able to request an extensionbut you must apply before forbearance ends.

Recommended Reading: H& r Block Stimulus Tracker

Eligibility For An Fha Loan

To qualify for a loan from the federal housing administration, you need to have an attractive credit score. This will make you eligible for getting a loan with an FHA-approved lender. Additionally, the cost of the home you would like to insure, and its location must be within the loan limit stipulated by the FHA in that location.

As long as you comply with these requirements, you can apply for an FHA loan. The loan is useful for homeowners and is the best form of stimulus for anyone that wants to purchase a new home.

Mortgage Relief In 2021

Most mortgage relief programs, such as HARP and FMERR, have expired. One program does exist, though, if your mortgage is backed by Fannie Mae. The High Loan-to-Value Refinance Program is a mortgage refinance program aimed at homeowners who have high interest rate loans and little equity in their homes. The property can even be under water or of lesser value than the outstanding mortgage. You can apply if you qualify:

- Your loan-to-value is at or above 97.1 percent.

- The loan originated on or after October 1, 2017.

- Youve made your payments on time with no late payments in the past nine months.

- You can prove a valid reason for the refinance.

The Mortgage Reports writes that while the CARES Act offers temporary help, the HIRO reconfigures your loan for the life of the loan without penalties or payback. Two other loan packages are available for FHA and VA loans and are known as “streamline refinancing.”

Also Check: How Much Was All The Stimulus Checks

Mortgage Assistance Programs: Covid

Several mortgage relief options may be offered. The type of loan you have, the owner or investor requirements of those backing the loan, and the servicer all factor in when determining the agreement youre offered.

- Pause Payment Agreement: Your payments are suspended for up to 180 days but must be paid back in full when payments resume.

- Mortgage Payment Reduction: The servicer agrees to reduce the monthly payment for several months. Once full payments resume, you have a specific period of time to repay the amount that was reduced. Interest accrues until the delinquent amount is paid in full.

- Payback at End of Mortgage: The amounts that were paused are tacked on to the end of your mortgage loan period. Or, the lender issues a second loan for the amount delinquent and considers the repayment a balloon payment. Both loans are due in full at the end of the mortgage period or when the property sells.

Mortgage Advertising And Servicing

The FTC also works to protect consumers from illegal practices in the mortgage lending industry, with emphasis on the subprime market. Our cases have targeted deceptive and unfair practices by entities who work with consumers throughout the mortgage cycle including advertisers, lenders, and loan servicers. In 2011, the FTC also issued the Mortgage Acts and Practices Rule which bans advertisers from misrepresenting mortgage terms.

Cases

Read Also: Stimulus Checks For Social Security Disability

Pros And Cons Of Refinancing

Like with any loan, there are some pros and cons when it comes to an FHA cash-out refinance. This type of loan may benefit some, but it could be the wrong option for others.

Pros:

- Using an FHA cash-out refinance, your home equity can be turned into cash that can be used to put you in a competitive financial position.

- An FHA cash-out refinance is a great option if you plan to reinvest it into your home by doing renovations or making improvements.

- It can be a great way to consolidate your high-interest debts, such as credit card debt, student debt, or car loans.

- Since FHA cash-out refinance requirements are more lenient than those of conventional loans, FHA loans are more accessible, especially to those with low credit. The official minimum credit score to qualify for an FHA cash-out refinance is 500. However, be aware that lenders may look for a higher credit score. These loans also provide a higher maximum LTV than conventional loans.

- FHA loans are assumable, meaning that they can be transferred from an existing owner to another buyer after evaluation by the lender.

Cons:

Is There A Mortgage Stimulus Program

Theres no current mortgage stimulus program from Congress with that exact name, but federal funds have been made available to help homeowners.

This is known as the Homeowner Assistance Fund , which was part of President Joe Bidens American Rescue Act.

The fund provides nearly $10billion for states, the District of Columbia, as well as other US territories.

Read Also: Social Security Disability Stimulus Check 2022

How Do I Apply

The National Council of State Housing Agencies has a map where you can find out where to apply in your state. Some states are still in the process of opening their programs.

At the start of March, 24 states, Puerto Rico and Guam had already done so, and almost all programs have been approved by the Treasury Department.

“We expect virtually all programs will be open by June,” Williams said.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Don’t Miss: $600 Stimulus Check Not Received

No Extra Penalties Interest Or Late Fees

During any forbearance period granted to you, your servicer cannot charge any penalties, interest, or fees that would not have been charged if you had made your payments on time and in full. Landlords may not charge tenants any fees or penalties for late payment of rent during any forbearance period granted to the landlord.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: Recovery Rebate Credit Second Stimulus

How To Request Forbearance

As a homeowner with a federally-backed mortgage loan, you will need to contact your loan servicer to request forbearance. You do not need to submit extensive documentation, mainly only affirmation of your financial hardship, which can be done over the phone. Your initial forbearance can be for up to 180 days. Depending on when your initial forbearance began, you can extend forbearance an additional 180 or even 360 days.

Landlords of multi-family units must have been current on payments as of Feb. 1, 2020, to be approved for forbearance relief. If applicable, landlords should submit an oral or written request to their servicer who can approve the initial 30-day forbearance, with subsequent extensions of up to an additional 60 days.

Dont Miss: Who Has The Best Mortgage Loan Rates