I Had A Problem With The First Or Second Payment

Some individuals had too much income in 2019 to qualify for the first or second stimulus payment , but their income decreased enough in 2020 for them to qualify. If you fall into this category, you can file a tax return for your 2020 taxes and youll receive a recovery rebate credit as part of your refund .

In other cases, families received stimulus payments by direct deposit but the IRS neglected to add money for one or more of their children. Sometimes there didnt seem to be a reason for this . For other families, it seems the IRS did not update the number of children that taxpayers have, even for families who claimed new children on their 2019 tax returns. Youll be able to claim the rest of the stimulus payment when you file your next tax return.

Where Is My 2nd Stimulus Check

30. As with the first round of stimulus checks from the CARES Act, Americans can check the status of their payments at https://www.irs.gov/coronavirus/get-my-payment. The Get My Payment tool was reopened on Monday, and will confirm if the IRS has sent your second stimulus check, as well as your first payment.

How Can I Check The Status Of My Stimulus Check

Follow these steps to check the status of your stimulus money:

2. Provide the following information:

-

Social security number or individual tax ID number

-

Your date of birth

-

Your street address

-

Note: if you recently moved, use the same information the IRS would have on file from your last tax return

Your 5 digit zip code

3. Hit the continue button for an update on your status

Recommended Reading: When Should I Get My Stimulus Check

What Does The Stimulus Check Portal Do

The updated “Get My Payment” tool lets you:

- Check the status of your stimulus payment

- Confirm your payment type and

- Get a projected direct deposit or paper check delivery date .

For first-round stimulus payments, you could also use the portal to enter or change your bank account information to have your payment directly deposited into your account. However, that feature isn’t included in the current tool . The IRS already has bank account information for millions of Americans from recent tax returns, tax payments, the original “Get My Payment” tool, the non-filers tool used last year, other federal agencies that regularly send out benefit payments , and federal records of recent payments to or from the government. So, the tax agency is generally limiting direct deposit payments to bank accounts that they already have on file. As a result, you can’t change your bank information using the “Get My Payment” tool.

If your payment isn’t deposited directly into your bank account, then you’ll get either a paper check or a debit card in the mail . You could also receive a payment by mail if your bank rejected a direct deposit. This could happen because the bank information was incorrect or the bank account on file with the IRS has since been closed.

Filing A Payment Trace To Find Missing Stimulus Money

You can request an IRS payment trace if you received the confirmation letter from the IRS that your payment was sent , or if the Get My Payment tool shows that your payment was issued but you have not received it within certain time frames. This is the case for all three checks. Check out our guide to requesting an IRS Payment Trace here.

Don’t Miss: When Will The $1400 Stimulus Checks Be Mailed Out

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

Where Is My Stimulus Check

As CARES Act stimulus money is being distributed, the IRS has created a tool for taxpayers to find out when they can expect to receive payment or to enter banking information for direct deposit. To find out if youre eligible for a stimulus check, visit our Recovery Rebate FAQ.

Visit the IRS Get My Payment website to check the status or setup direct deposit. Below we cover the items youll need to have prepared.

Read Also: Are They Sending Out Stimulus Checks

Irs Says You Can Now Check The Status Of Your Stimulus Check With Get My Payment Tool

BRAZIL – 2020/10/09: In this photo illustration the Internal Revenue Service logo seen … displayed on a smartphone.

SOPA Images/LightRocket via Getty Images

The Internal Revenue Service has announced that the Get My Payment tool is now open. Folks looking for information about their stimulus checks can now check the status of both their first and second payments by using the Get My Payment tool, available in English and Spanish only on IRS.gov.

The Get My Payment tool will allow you to confirm that:

- Whether the IRS has sent your second stimulus payment.

- Whether the IRS sent your first stimulus payment. Not that some people received their first stimulus in partial payments if you received partial payments, the tool will show only the most recent.

- Whether to expect your stimulus payment by direct deposit or mail.

According to the IRS, data is updated once per day overnight, so there’s no need to check more than once per day.

The IRS advises folks to use the tool to check on the status of their stimulus payment, but not to call. The IRS phone assistors do not have additional information beyond whats available on IRS.gov and in the Get My Payment tool.

This second round of checks is part of the Coronavirus Response and Relief Supplemental Appropriations Act of 2021, passed by Congress last week and signed into law by President Trump on Sunday night.

Who May Be Eligible To Receive More Stimulus Money

- Parents of a baby born in 2021 who claim the child as a dependent on their 2021 tax return

- Families who added a dependent, such as a parent, grandchild or foster child, on their 2021 tax return who was not listed as a dependent on their 2020 return

- Single filers who had incomes above $80,000 in 2020 but less than that in 2021 married couples who filed a joint return who earned more than $160,000 in 2020 but made less money in 2021 and head-of-household filers with incomes above $120,000 in 2020 but less than that in 2021

- Single filers who had incomes of between $75,000 and $80,000 in 2020 but earned less in 2021 married couples who file jointly who had incomes of between $150,000 and $160,000 in 2020 but less than that in 2021 and heads of household who had incomes of between $112,500 and $120,000 in 2020 but made less money in 2021

Even if you didnt qualify for the first and second round of stimulus payments in 2020, if you had a tough time financially in 2021 and your income is lower , you will get the credit on your 2021 return, Steber says.

Join today and save 43% off the standard annual rate. Get instant access to discounts, programs, services, and the information you need to benefit every area of your life.

Read Also: Who Qualifies For Stimulus Check

Looking To Build Credit Open A Secured Card

For most people, high-interest debt should be the first and last stop for their stimulus checks but debt isnt the source of all credit trouble.

What should be done really depends on the reason their credit needs improvement, Morgan said. If your credit is just poor because of no good accounts or no recent positive activity, the best bet with those funds can be opening a secured credit card.

A secured card requires a cash collateral deposit that you spend as you charge and then refill when you run low. For people with no or very little credit history, secured cards can be excellent ways to build credit.

The deposits are commonly between $250 and $1,000, Morgan said. A common example is that if you provide a $500 deposit to a bank or credit union, the lender will give you a credit card with a limit of $500. This allows you to get a credit card with little risk to the bank. If you miss a payment on the secured credit card, the lender will take the deposit and close your account.

Who Is Eligible For The Third Stimulus Check

While eligibility is similar to the first and second stimulus checks, there are differences. There are four primary requirements:

1. Income: The income requirements to receive the full payment are the same as the first and second stimulus checks. There is no minimum income needed to qualify for the payment. Households with adjusted gross income up to $75,000 for individuals will receive the full payment. The third stimulus payment starts to phaseout for people with higher earnings. The third stimulus checks maximum income limit is lower than the first and second stimulus check. Single filers who earned more than $80,000 in 2020 are ineligible for the third stimulus check.

View the chart below to compare income requirements for the first, second, and third stimulus checks.

| Income to Receive Full Stimulus Payment | First Stimulus Check Maximum Income Limit | Second Stimulus Check Maximum Income Limit | Third Stimulus Check Maximum Income Limit |

| Single Filer | |||

| $120,000 |

2. Social Security Number: This requirement is different from the first and second stimulus check.

Any family member that has a Social Security number or dependent can qualify for the third stimulus check. For example, in a household where both parents have ITINs, and their children have SSNs, the children qualify for stimulus checks, even though the parents dont.

See the chart below for further explanation of how this works.

Don’t Miss: Irs Sign Up For Stimulus

Who Receives A Stimulus Check Payment

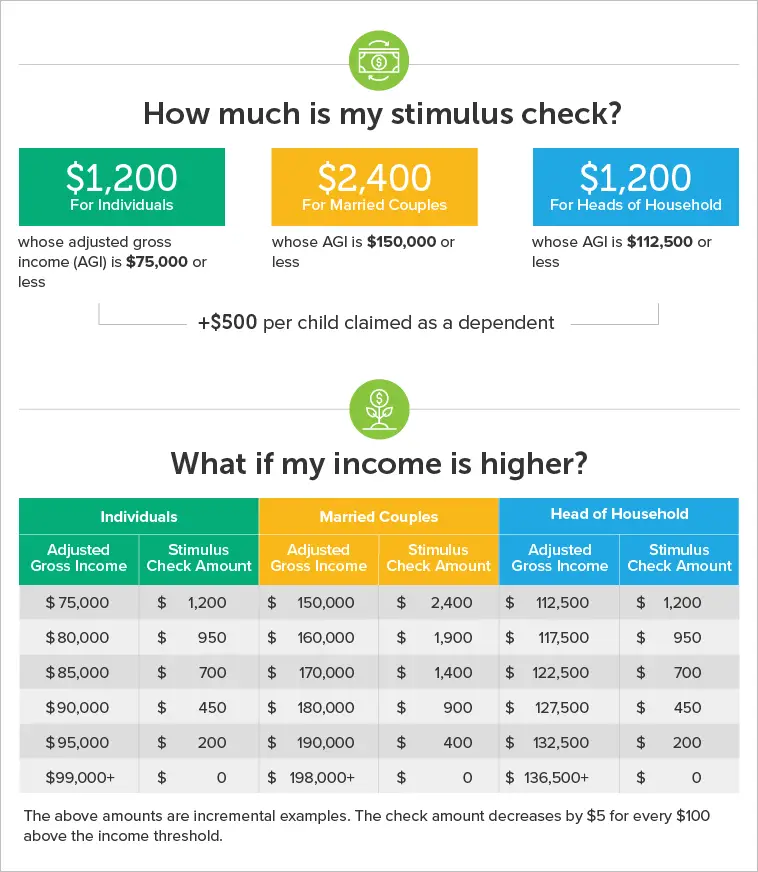

If you fall within the Adjusted Gross Income thresholds shown below and have a Social Security number, you are eligible for each economic impact payment. Those who do not qualify for payments include non-resident aliens, dependents, and estates/trusts.

The amount of payment or credit you qualify for depends on your Adjusted gross income and the number of qualified children with a Social Security Number or Adoption Tax Identification Number you can claim.

For 2020, youll qualify for up to $1,800 in credits for yourself and qualified dependents can increase the amount youre eligible to get by up to $1,100 per qualified dependent . Unfortunately, adult dependents didnt qualify for the first and second stimulus payments.

For 2021, youll qualify for $1,400 in advance credits for yourself and qualified dependents will increase the taxpayers EIP by $1,400 so far. However, adult dependents do qualify the taxpayer to receive additional amounts on the third check.

You can see a detailed breakout of the income limits here:

Recommended Reading: Who Qualifies For Golden State Stimulus

Yes Your Third Check Might Be Seized To Pay Certain Debts Here’s Why

Under the bill governing the second stimulus check, your funds could not be garnished to pay debts like child support, banks or private creditors. However, part of this rule changed with the third check.

The bill authorizing the third payout was pushed through using a process called budget reconciliation. Congressional Democrats used this legislative tool to more quickly pass the new COVID-19 relief bill and the third stimulus check that comes with it, since it allowed them to pass it with fewer votes. But because this process was used, the third checks aren’t protected from all garnishment, although lawmakers are moving to fix this now.

There are three types of unpaid debt that could be paid through garnishment: unpaid IRS tax debt, other government debt like child support payments or private debt, according to Garrett Watson, a senior policy analyst at the Tax Foundation. Your third stimulus payment will be protected from outstanding tax debt and child support, but not from private debts, such as debt accrued due to a civil judgment, ranging from civil damages to consumer debt in default, Watson said.

Several banking groups sent a letter to Congress on March 9 asking lawmakers to pass stand-alone legislation to prevent the third check from being garnished for private debts.

Also Check: Telephone Number For Stimulus Check

State Stimulus Checks 202: See If Your State Is Mailing Out Payments This Month

Several states are issuing tax rebates and inflation relief payments in October and November.

Dan Avery

Writer

Dan is a writer on CNET’s How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

While the federal government is unlikely to issue another stimulus check, state governments are continuing to send taxpayers financial relief. Millions of California taxpayers started receiving a “middle-class tax refund” last week, with payments of up to $1,050 being sent out through January.

Other states are issuing one-time payments to help residents grapple with the bumpy economy: Colorado taxpayers have already started getting $750 tax refund checks, while eligible Virginians should receive a $250 rebate by Halloween, and Massachusetts will start disseminating tax rebates in November.

Is your state sending out tax refunds or stimulus checks? How much money could you get? Read on to find out.

For more on economic relief, check out plans for statewide child tax credits, as well as gas rebate checks and gas tax holidays across the US.

Can I Track My Stimulus Check

Yes. Just like the IRS typically allows you to track your tax refund, you can now know where your stimulus payment is.

On April 15, the IRS launched the Get My Payment application. With Get My Payment, people are able to check their payment status, confirm whether they’re getting it via direct deposit or check, and enter their bank account information. In order to track the payment, you’ll need to input your Social Security number, date of birth, street address and zip code.

If the Get May Payment app returns a message about how your payment status is not available, it may not have your information uploaded, the IRS may not have processed your 2019 tax return, or you may not be eligible for a stimulus check.

Get My Payment is updated once a day with fresh data.

You May Like: Free File Taxes For Stimulus

How Do I Get Help Filing A Tax Return To Claim My Eip

- The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

- You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

- Also, you can find Form 1040 and Form 1040 instructions on the IRS website.

What If You Have Trouble With The Tool

To use the Get My Payment tool, you must first verify your identity by answering security questions. If the information you enter does not match IRS records, you will receive an error message. To avoid this:

- Double-check the information requested

- Make sure what you enter is accurate

- Try entering your street address in a different way and

- Use the US Postal Services ZIP Lookup tool to look up the standard version of your address, and enter it into exactly as it appears on file with the Postal Service.

If your answers do not match the IRS records three times, youll be locked out of Get My Payment for security reasons. If that happens, you must wait 24 hours and try again. If you cant verify your identity, you wont be able to use Get My Payment. Unfortunately, theres no fix for that: the IRS says not to not contact them.

However, if you verified your identity and received Payment Status Not Available, this means that the IRS cannot determine your eligibility for a payment right now. There are several reasons this could happen, including:

- You didnt file either a 2018 or 2019 tax return or

- Your recently filed return has not been fully processed.

Again, the IRS says theres no fix for that and you should not contact them.

Read Also: N.c. $500 Stimulus Check

How To Check The Status Of My Stimulus Payment

President Biden Signed The American Rescue Plan Into Law On Thursday, March 11th. Checks Could Start Being Sent This Coming Weekend. The First Group Of Checks Will Be Issued To Those That Have Their Bank Information Registered With The IRS.

The Internal Revenue Service Will Allow Qualified Americans To Check The Status Of Their Third Economic Impact Payment . The One-Time Payment Of $1400 For Individuals, And $2800 For Couples. The Income Threshold Is $180,00 For Married Couples And $80,000 For Individual Filers. There Is Also A Child Tax Credit Of Up To$3,600 per child.

If You filed A 2019 Or 2020 Tax Return.

- The IRS Portal Will Allow Taxpayers To Check the Status Of Their Stimulus Payments.

- Confirm Your Payment Type .

- Ability To Enter Bank Account Information.

If You Did Not File A 2019 Or 2020 Tax Return

For Eligible Non-Filers

- You Did Not File a 2018 Or 2019 Federal Income Tax Return Because Your Gross Income Was Under $12,200 .

- You Werent Required To File A 2019 or 2020 Federal income Tax Return For Other Reasons.

Website Info