What If I Didnt Get Some Or All Of My Stimulus Checks

If you think you are eligible and you did not get a check for you or your dependents, you can still get the money by filing your 2020 or 2021 taxes. You may be eligible for free tax preparation help from Maines CA$H Coalition.

If you do not usually file a tax return and didn’t get your stimulus checks, you may still be able to file a tax return this year to get your stimulus checks. You should check with a tax professional. The IRS website also provides information about how to claim your stimulus checks if you didnt get them in 2020 or 2021. You can also call Pine Tree Legal Assistance.

What If I Already Filed A Return But Didn’t Claim The Recovery Rebate

If you qualified for a recovery rebate credit but did not claim it on a 2021 return, the IRS says you will need to file an amended 2021 return.

If you filed the 2021 return electronically, you may be able to e-file Form 1040-X.

But if you filed a paper return, you’d need to submit a paper version of Form 1040-X.

An important note: The IRS says do not file an amended return if you made a mistake and claimed the recovery rebate credit when you already received that money in 2021.

The IRS will correct the amount of the 2021 recovery rebate credit that’s claimed if the records don’t match. And you’d receive a notice identifying the changes made.

And yes, that will delay processing the return. “If the taxpayer agrees with the changes made by the IRS, no response or action is required to indicate they agree with the changes,” the IRS said.

But if you disagree, you’re going to need to call the toll-free number listed on the top corner of the notice of the problem.

ContactSusan Tompor: . Follow her on Twittertompor. To subscribe, please go to freep.com/specialoffer. Read more on business and sign up for our business newsletter.

Code For Americas Getctcorg

Visit GetCTC.org, a simplified tax filing portal, to submit your information to the IRS to claim your Recovery Rebate Credit. This tool is user- and mobile-friendly and is an alternative to the IRS Non-filer Portal. It is also available in Spanish.

You can use GetCTC.org to get missed stimulus checks even if youre not signing up for the Child Tax Credit advance payments. If you use GetCTC.org, the tool will automatically calculate your Recovery Rebate Credit.

This is an example of how to claim the Recovery Rebate Credit through GetCTC.org.

If you didnt receive the amounts you are eligible for, you will be taken through these next steps.

Then, GetCTC.org will automatically calculate the total amount you are owed.

Dont Miss: What Is The Sales Tax In Arkansas

Also Check: Sign Up For Stimulus Check

Your Financial Situation Changed From 2019 To 2020

Any changes to your financial situation in 2020 may affect your payment amount and receipt.

For most people, this will result from job or income loss due to the pandemic. If your income was higher than the phaseout thresholds in 2019, but your hours were cut or you only worked for part of 2020, you can claim the stimulus money you didnt receive using the Recovery Rebate Credit on your 2020 tax return.

If you had a baby in 2020, got married or divorced, you were previously claimed as a dependent, or you have a child who aged out of being claimed as a dependent, you may receive more after claiming the credit as well.

When youre ready to file 2020 federal taxes, an accountant or tax filing service may be helpful to clarify your exact eligibility. If you file on your own, your Form 1040 will include a Recovery Rebate Credit worksheet to help you determine the total amount youre eligible for.

Has The Irs Sent My Stimulus Check

The IRS has issued all first, second and third Economic Impact Payments. … Most eligible people already received their Economic Impact Payments. However, people who are missing stimulus payments should review the information below to determine their eligibility to claim a Recovery Rebate Credit for tax year 2020 or 2021.

You May Like: Is The Homeowners Stimulus Real

What If I Didn’t File My Taxes In 2020

The IRS used the information from 2020 tax returns to send out the third round of EIP. If you didn’t file a 2020 tax return, you may have received a stimulus payment based on information the IRS has from your 2019 tax return or any social security or veterans benefits you receive. If you are entitled to a larger amount than the IRS sends you, you may be able to claim the Recovery Rebate Credit on your 2021 tax return.

How Do I Know If I Get A Stimulus Check 2021

Use the IRS Get My Payment tool to track stimulus money For the third stimulus check: It’s worth visiting the IRS’ online portal designed to track the status of your 2021 payment. Generally, it should tell you when your check will be processed and how you’ll receive it: for example, as a paper check in the mail.

Don’t Miss: Ssdi Stimulus Checks Deposit Date

How Will Dependents Get Their Stimulus Check

Dependents don’t receive their own stimulus checks, but they add funds to the household’s total. With the third check, dependents of any age will add up to $1,400 each to the family’s check. The total amount of money allocated in the third payment depends on your adjusted gross income, which you can find on your taxes.

How Do I File For The Recovery Rebate Credit On Freetaxusa’s Website

First, create or login to your FreeTaxUSA account. Then, when you get to the Deductions/Credits section of the federal tax return, we’ll ask some questions including if you received the Economic Impact Payment or stimulus checks, and how much you received. We’ll guide you through this section, help calculate the estimated credit, and help you file for the Recovery Rebate Credit as you file for your 2020 and 2021 tax returns.

Read Also: Where’s My Stimulus Check Nj

I Have More Questions About My Situation How Can I Get Help

Vermonters with a low income can contact us at the Vermont Low-Income Taxpayer Clinic by filling out our form or calling 1-800-889-2047.

Video: Second Round of COVID Economic Impact Payments/Stimulus Checks. Watch the video on On January 7, 2021, attorney Zachary Lees of Vermont Legal Aids Low-Income Taxpayer Clinic discussed who is eligible to get the stimulus payments and how they will be sent out. He also answered COVID-related tax questions.

You May Like: How Much Money Should I Save For Taxes Doordash

Its Not Too Late To Claim Your Stimulus Payment: Eligibility Rules For People Previously Claimed As Dependents

During the COVID-19 public health crisis, Congress passed legislation that provided qualifying residents with three rounds of economic impact payments These one-time payments helped individuals afford essentials during the pandemic. But some people had a harder time accessing them due to confusing eligibility rules.

If you were claimed by someone else as a dependent in 2020, but not in 2021, you can be eligible for the third stimulus payment of $1,400even if someone received a payment on your behalf. But if youre eligible, youll need to take action to get the payment. Read on for a breakdown of some of the basic rules you need to know.

You can still file taxes to claim your payment

The 2021 tax filing deadline passed on April 18, 2022. However, if you arent legally required to file a tax return, you can submit a return now without facing a penalty. The Internal Revenue Service typically allows people to file their returns within three years to claim a refund. If you dont usually file a tax return, you can complete a simplified tax return to claim your 2021 stimulus payment using the Code for America simplified filing portal. This tool is available in both English and Spanish, and you dont need any tax documents to complete the form.

Eligibility is tied to whether or not youre considered a dependent

You are considered a dependent if all of the following apply to you:

More details about who can be a dependent

Recommended Reading: What Was The 2021 Stimulus Check

Did I Get A Third Stimulus Payment

Most received third stimulus payments in March 2021. The IRS also issued what were called plus up payments or extra money in addition to the initial direct deposit or stimulus check issued last year for millions but, not all, of taxpayers who qualified for the stimulus money.

The third stimulus payment was viewed as money you received in advance of the Recovery Rebate Credit that you might be eligible to claim on a 2021 federal income tax return.

Recovery Rebate Tax Credit

So, how do you get the third stimulus check money you’re owed by filing your 2021 tax return? On Line 30 of your 2021 return , you’ll see the recovery rebate tax credit. This is where you stake your claim to the stimulus check funds you didn’t get last year.

Third stimulus checks were merely advance payments of the recovery rebate credit. As a result, your credit for the 2021 tax year will be reduced by the total amount of your third stimulus check . Most Americans received the full credit in advance, so their 2021 recovery rebate credit will be zero for them. But if you didn’t receive a third stimulus check or got less than what you should have , then you can claim the difference between the credit amount you’re allowed and what you actually received in advance as a tax credit on your 2021 return. The credit will reduce your tax bill, and for many people trigger a tax refund or boost the refund otherwise due.

There are a number of other scenarios that can trigger a recovery rebate credit on your 2021 return. So, if you didn’t receive the full third stimulus check amount last year, make sure you complete the worksheet to see if you qualify for a credit. For more on this valuable credit, see What’s the Recovery Rebate Credit?

Also Check: Irs Forms For Stimulus Checks

Reconcile Your Advance Payments Total On Your 2021 Tax Return

If you received advance payments of the Child Tax Credit, you need to reconcile the total you received with the amount youre eligible to claim.To reconcile advance payments on your 2021 return:

- Get your advance payments total and number of qualifying children in your online account.

- Enter your information on Schedule 8812 .

You can also refer to Letter 6419.

If Married Filing Jointly

If you received advance payments based on a joint return, each spouse is treated as having received half of the payments, unless one of you unenrolled.

To reconcile your advance payments on your 2021 tax return, add your advance payments total to your spouses advance payments total.

Each of you can find your advance payments total in your online account.

If Letter 6419 Has a Different Advance Payments Total

For the majority of taxpayers, the advance payments total in Letter 6419 will match the total in online account.

If the advance payments total differs between your Letter 6419 and your online account, rely on the total in your online account.

Your online account has the most current advance payment information. Do not rely on Tax Transcripts for the advance payments total.

Keep Letter 6419 for your tax records.

Recommended Reading: Irs Sign Up For Stimulus

How Do I Claim My Third Stimulus Check

To get a payment, you must claim the Recovery Rebate Credit on your tax return. To claim the credit, individuals will need to know the total amount of their third round of economic payments. That amount can be found on your IRS online account or on IRS Letter 6475 that is being sent to American households.

Recommended Reading: Get My 2nd Stimulus Payment

Stimulus Money Can Still Be Claimed By These Four Groups Are You One Of The Millions In Line For Cash

- 9:31 ET, Feb 8 2022

FOUR groups of Americans can still claim up to thousands of dollars in stimulus money during the 2022 tax season.

As millions of Americans file their 2021 tax return, those who have not yet received the third federal $1,400 stimulus check or the $3,600 child tax credit will get the cash with their refund.

Families who did not receive last year’s advanced CTC payment those who added a new dependent in 2021 and Americans whose income dropped will be among those eligible for more cash.

It comes as it looks less likely the advanced child tax credit payments will return in 2022 and as the chances of a fourth federal stimulus check also drop.

How Can Dependents Qualify For Their Stimulus Check

This depends on adjusted gross income in case you are filing taxes separately. But It is important to note that you may not get your stimulus check in case your parents file taxes and strongly claim you as dependents. Then payment of stimulus check will be added to your parents total. When you as dependents earn and partially have to depend on your parents income and fulfill the requirement to get your stimulus check under the IRS rules, you will be eligible to get your stimulus check.

Also Check: Are There Any More Stimulus Payments Coming

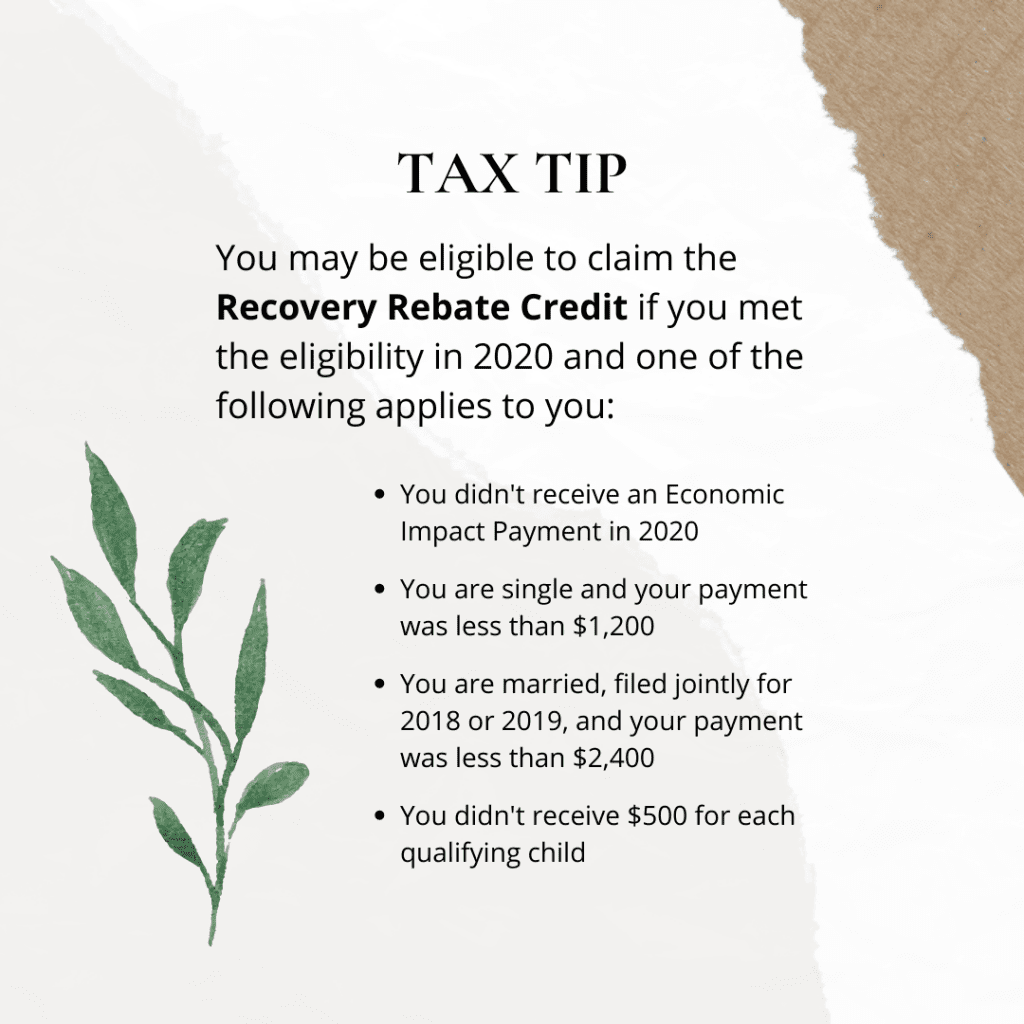

Who Qualifies For Recovery Rebate Credit

US citizens or residents with a social security number who did not receive one or more of the stimulus checks or did not receive the full amount of the checks, may qualify for the Recovery Rebate Credit. You will need to file your 2020 taxes for the first and second payments and your 2021 taxes for the third payment, even if you are not required to, in order to receive the rebate credit.

The Recovery Rebate Credit does start to decrease at $75,000 adjusted gross income . We’ll calculate the correct credit based on your income and any stimulus payments already received.

What Stimulus Is At Stake

The 2021 return addresses shortfalls with the third stimulus payment which was paid out from March through December last year was based on 2019 or 2020 tax return information. “Plus-up” payments were made last year to individuals whose advance payment was initially based on a 2019 return and who later filed their 2020 return that indicated that they qualified for more money.

Look for paperwork and confirmation to see what you were paid before assuming you didn’t get all you deserve.

Look for Notice 1444-C, which the IRS mailed out last year to show you how much was issued for the third stimulus payment.

On top of that, the IRS began issuing what it calls Letter 6475 late in January to help tax filers figure out how much they received for the third stimulus. Married couples filing a joint return received two letters.

You can skip reviewing the recovery rebate credit, for example, if you’re single and already received $1,400 plus another $1,400 for each dependent you had last year.

And you don’t qualify for the recovery rebate credit if you’re filing a joint return and you and your spouse received $2,800 and $1,400 for each dependent you had in 2021.

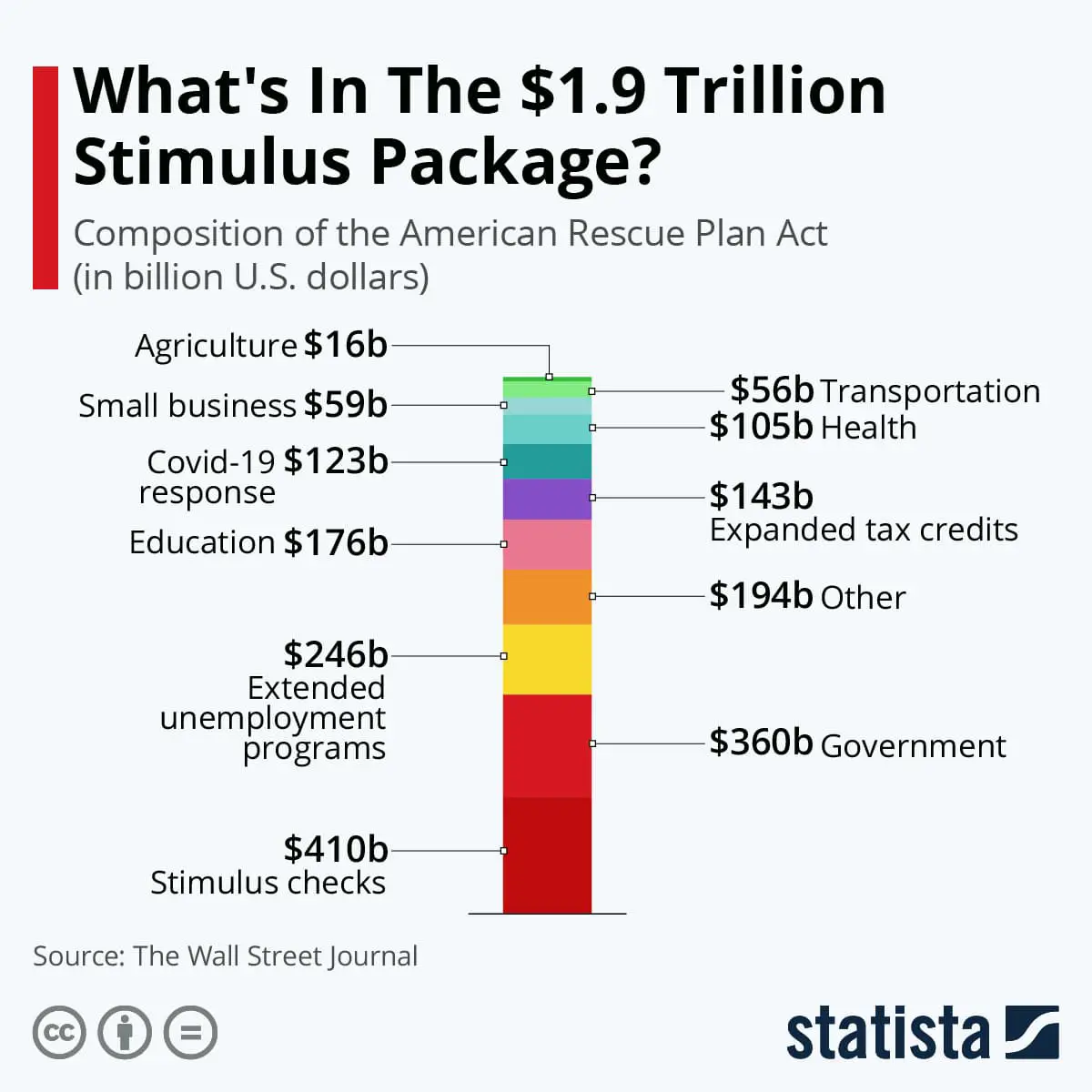

The IRS issued more than 175 million stimulus payments involving the third program, which added up to more than $400 billion to individuals and families nationwide in 2021.

More:IRS Letter 6475 can help you claim any extra stimulus cash owed: 5 things to know

You May Like: Stimulus Checks For Social Security Disability

How Will Stimulus Payments Affect Taxes

As part of economic legislation aimed at mitigating the impact of the coronavirus, millions of individuals and families were eligible to receive stimulus payments, also referred to as economic impact payments by the Internal Revenue Service. The federal government sent out two stimulus payments in 2020, and one in 2021. Many people wonder if those payments are taxable or otherwise affect their taxes.

What Can I Do If I Have Not Received My Eip Money By Those Deadlines

If you have not received all or some portion of your Economic Impact Payments by the deadlines above, you will have to file a 2020 tax return and claim these amounts. You claim them on line 30 of the 2020 Form 1040 as a “Recovery Rebate Credit“. This is another name for the EIP stimulus payments. If you did not get all or a portion of the EIP payments in advance, then you can claim them on line 30 of your tax return for 2020.

Read Also: Who Are Getting Stimulus Checks

How To Get A Stimulus Check If Claimed As Dependents

The IRS and Treasury Department have a program of stimulus checks for the adult-dependent who are paid stimulus payment. There are mainly different ways such as direct deposit, physical mail check, and prepaid debit card.

Direct Deposit: it is one of the fastest methods of payment from the IRS. When your family has a bank account and routing number and has linked with the IRS, the payment is going to hit the familys bank account. Additionally, the Treasury Department also is working to make bank account more accessible and available to make sure the family gets this payment to their account.

Mailed Check: Mailed check is considered a long process of payment that can take even a week. For this, you need to be prepared to get any letters and notifications from the IRS department. At some times, the delivery of this document may be longer and you should contact the IRS if that happens.

Prepaid debit card: the IRS recently started to settle payment through debit card. Even if it takes a week but this has been started officially and the IRS will go on delivery of payment through this payment mode.

A stimulus Check is considered as a refundable tax credit which is also the same as a recovery rebate credit. There are different rounds of stimulus checks and the third stimulus check is completely different from another round.