What About My Kids

In addition to the amounts for adults, parents would get up to $1,400 more for every child on their tax returns. That includes adult children, like college students, and those with permanent disabilities, unlike last year’s stimulus payments.

So if you’re a family of four with a household income under $150,000, you should get $5,600.

Which Of My Dependents Qualify For The Third Stimulus Check

For the third stimulus check, all your dependents qualify, regardless of age. This means that for each child or adult dependent you have, you can claim an additional $1,400.

This is different from the first and second stimulus checks, which only allowed child dependents to get the additional payment.

New Income Limit Rules For Dependants

If the bill goes forward as it is now and there are no changes, some families will not get a payment for dependants.

With previous stimulus checks, some people recieved partial payments because they have kids even when they were over the income limits and didnt get money themsleves.

Now, the way the third stimulus is being calculated means there will be no payment even a partial one for those who earn above the limit and have dependants.

Dont Miss: Who Qualified For Stimulus Checks In 2021

You May Like: When Was The First Stimulus Checks Sent Out

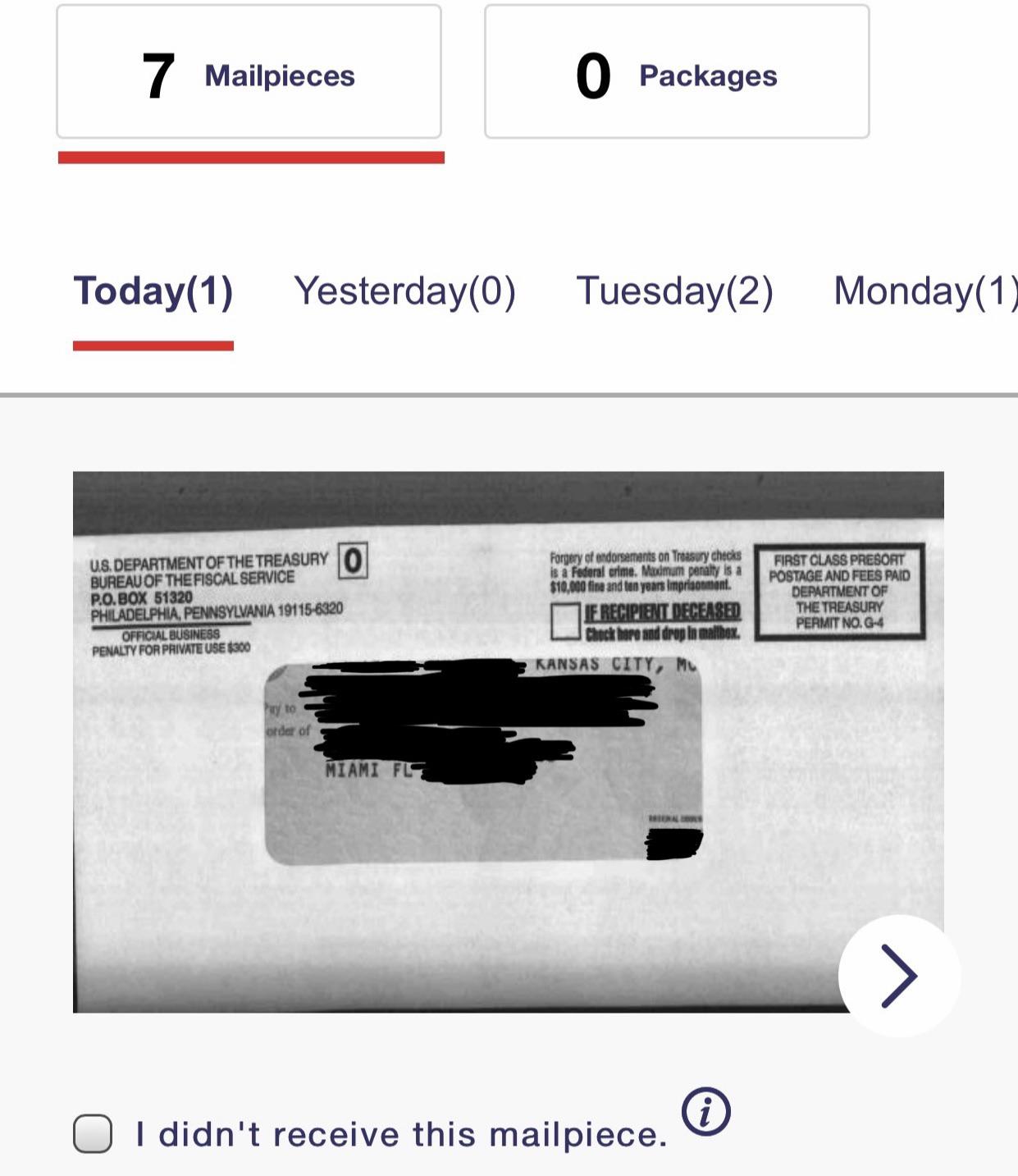

When Will I Get My Stimulus Check

The IRS has begun distributing stimulus payments. The first batch of stimulus payments could arrive as early as this weekend , with more arriving over the coming week. Further batches of payments will arrive during the following weeks.

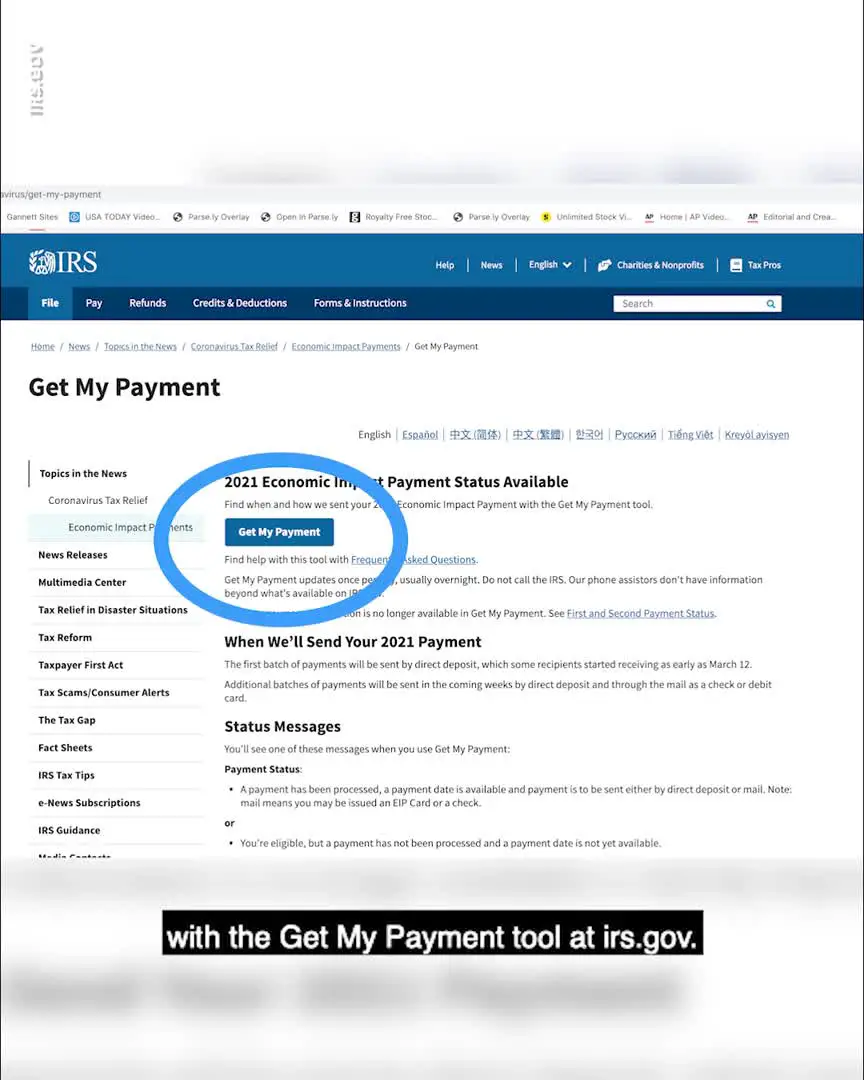

For information on when you can expect your stimulus payment, check the IRS Get My Payment tool, which will be live starting March 15th.

Who Qualifies For The Third Stimulus Payments

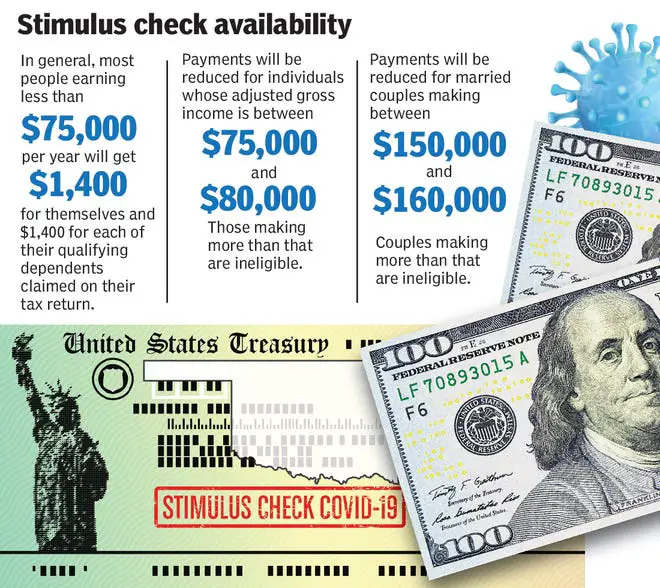

Generally, if youâre a U.S. citizen and not a dependent of another taxpayer, you qualify for the full third stimulus payment. In addition, your adjusted gross income canât exceed:

- $150,000 for married filing jointly

- $112,500 for heads of household

- $75,000 for single filers

A partial payment may be available if your income exceeds the thresholds. However, you will not receive any payment if your AGI is at least:

- $160,000 for married filing jointly

- $120,000 for heads of household

- $80,000 for single filers

The full amount of the third stimulus payment is $1,400 per person and an additional $1,400 for each qualifying dependent.

You May Like: How Much Were The Stimulus Checks In 2021

What If I Filed My Taxes For The First Time In 2020

First-time taxpayers may face additional delays in receiving their stimulus payments.

Before the IRS can issue these stimulus checks, they must receive and process your 2020 tax return. However, due to new tax codes and more complicated tax filings this year , as well as processing stimulus payments, the IRS is backlogged. There are already 6.7 million returns yet to be processed, which is significantly higher than the nearly 2 million delayed returns at this point last year.

Read More: Best Tax Software of 2021

The IRS has said that it continues to process tax refunds while it processes stimulus payments. If you have not filed your 2020 taxes and anticipate a refund, the IRS recommends filing electronically and providing your direct deposit information. According to the IRS.gov, IRS issues more than 9 out of 10 refunds in less than 21 days.

However, the Washington Post reported that some people who filed on Feb. 12 are still waiting for their returns to be processed.

How Do I Get My Third Stimulus Check

You dont need to do anything if:

- You have filed a tax return for tax year 2019 or 2020.

- You are a Social Security recipient, including Social Security Disability Insurance , railroad retiree. Or you are a Supplemental Security Insurance and Veterans Affairs beneficiary.

- You successfully signed up for the first stimulus check online using the IRS Non-Filers tool or submitted a simplified tax return that has been processed by the IRS.

The IRS will automatically send your payment. You can check on the status of your third stimulus check by visiting the IRS Get My Payment tool, available in English and Spanish.

If you are missing your third stimulus check, file your 2020 tax return or use GetCTC.org if you dont have a filing requirement. By submitting your information to the IRS, you will be signed up and automatically sent the third stimulus check.

Read Also: Wa State 4th Stimulus Check

How To Claim Your Missing Third Stimulus Payment On Your 2021 Tax Return

Youâll need to request any missing third stimulus payments on your 2021 tax return by claiming the Recovery Rebate Tax Credit.

This is the case if you received a partial amount or didnât previously qualify for the third stimulus payment.

Letâs say youâre single and your income for the 2020 and 2019 tax years exceeds the threshold . However, you lost your job in 2021, so your income drastically decreased. You can now claim the Recovery Rebate Tax Credit since your earnings fell below the threshold.

Families that added dependents may also be able to claim the credit.

In addition, a few lingering taxpayers who file taxes using ITINs may not have received payments for their eligible dependents who have Social Security numbers.

You need to complete the Recovery Rebate Tax Credit worksheet and submit it along with your 2021 tax return. If you use a tax software program, it should guide you through the process. Keep in mind, the IRS predicted a frustrating and slow tax season this year, so file your return as soon as possible.

Before completing the worksheet, you must know the amount of any third stimulus payments received for you, your spouse, and any dependents. The worksheet will also request your adjusted gross income for the year to determine your eligibility.

The IRS started mailing Letter 6475 to taxpayers in Januaryâthe letter confirms the total amount of the third stimulus payments received for the 2021 tax year.

Enter Your Adjusted Gross Income

Adjusted gross income. Sounds scary, right? Its actually not as scary as it sounds.

It means exactly what it saysyour gross income adjusted.

Heres how to get that number: Add up all the income you earn , then subtractany adjustments or deductions, which could include:

- Student loan interest

- Educator expenses3

Why is your AGI important? Its the number the IRS uses to determine how much of your income is taxable.

If youre worried about having to calculate all these numbers on your own when filing your taxes, dont be! Thats what a good online tax software can do for you!

To quickly find your AGI, you can look at line 8b of your 2019 tax return . Orif youve already filed for 2020, check line 11 of your 2020 tax return.

You May Like: How To Receive My Stimulus Check

What If I Owe Child Support Payments Back Taxes Money To Creditors Or Debt Collectors Or Federal Or State Debt

None of the three stimulus checks can be reduced to pay any federal or state debts and back taxes. Unlike the first stimulus check, your second and third stimulus check cannot be reduced if you owe past-due child support payments.

| Federal or State Debt | |

| Protected | Not protected |

If you are claiming the payments as part of your 2020 tax refund , the payments are no longer protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . In other words, if you receive your first or second stimulus checks as part of your tax refund instead of direct checks, it may be reduced.

What To Do With Your Stimulus Check

When you receive a check from your state government, its tempting to blow it immediately. And if youre in need, expenses come first.

For instance, you may pay more toward high-interest debts like loans or credit cards, catch up on your mortgage or even buy school supplies. And if your emergency fund is a little bare, it might be worth stashing some of your cash away for a rainy day.

But if you dont need the money for urgent bills, we have another proposition. Thats right: investing.

Recommended Reading: Will Social Security Get The Fourth Stimulus Check

Recommended Reading: Stimulus Checks For Healthcare Workers

Who Is Eligible For The $1400 Third Stimulus Check

$1,400 for an eligible individual with a valid Social Security number ($2,800 for married couples filing a joint return if both spouses have a valid Social Security number or if one spouse has a valid Social Security number and one spouse was an active member of the U.S. Armed Forces at any time during the taxable year …

Whats The Maximum Amount You Can Receive

Individuals will receive up to $1,400, while married couples who file jointly will get up to $2,800. Additionally, dependents will receive as much as $1,400.

Unlike the first two payments, families will get the stimulus checks for all dependents claimed on their tax returns. That includes adult dependents, such as college students and older relatives. Previously, only children under the age of 17 qualified.

However, if youre in debt, you might not see some or even all of that money. Thats because debt collectors can garnish funds from the stimulus checks, something consumers were previously protected against.

Recommended Reading: Haven’t Received Any Stimulus Checks

What If I Am Eligible For The Stimulus Checks But I Didnt File A 2019 Or 2020 Tax Return And Didnt Use The Irs Non

File your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

You can file a tax return even if you dont have a filing requirement to get other tax credits, such as the Earned Income Tax Credit.

If you didnt get your first or second stimulus check or didnt get the full amount that you are eligible for, file a 2020 federal tax return and claim them as part of your tax refund or use GetCTC.org if you dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2022.

Checks Are Rolling In Rhode Island

Rhode Island started issuing child tax rebates of $250 per child to eligible families at the start of this month.

There is a cap of $750 for each family.

In order to qualify, individuals must have filed taxes as either single, married filing separately, head of household, or qualifying widow/widower with an adjusted gross income of $100,000 or less.

Recommended Reading: Will There Be Another Stimulus Check In 2022

This Calculator Tells You Exactly How Big Your Coronavirus Stimulus Check Could Be

You can find your adjusted gross income on line 11 of your Form 1040 of your 2020 tax return. If you havent yet filed your 2020 tax return, the IRS will use your AGI from your 2019 tax return. stimulus package calculator 2020 You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return. Adult dependents, including college students and disabled adults, will receive $1,400.

Most Americans will receive a $600 stimulus check under the new bill, while others will receive an extra $300 for each child dependent under age 17. To check the status of your 2nd stimulus payment, use the IRS Get My Payment tool.

Illinois: $50 And $300 Rebates

There are two rebates available to 2021 Illinois residents.

The first rebate is the individual income tax rebate, available for residents whose adjusted gross income is less than $200,000 per year . Each individual will receive $50, with an additional $100 per eligible dependent .

The second rebate is a property tax rebate, available for residents making $250,000 or less . The rebate is equal to the property tax credit you qualified to claim on your tax return, up to a maximum of $300.

The state started issuing rebates the week of September 12 it will take several months to issue them all, according to the Illinois Department of Revenue.

Also Check: Any Stimulus Checks In 2022

Read Also: When Will We Get 4th Stimulus Check

Virginia Offering $500 Payments

A new guaranteed income program in Virginia will pay hundreds of Americans $500 every month for two years.

Applications for the ARISE program in Alexandria, Virginia, started to be accepted starting on October 31, according to organizers.

The lottery will choose 170 persons at random, per officials, and applications can be filed until November 9.

The first check is anticipated to be sent in January 2023, and the successful candidates will receive installments totaling $500 for 24 months.

There are no restrictions, so beneficiaries are free to use the funds any way they see fit.

Residents have been informed that they must be at least 18 years old and earn no more than 50 percent of the Area Median Income.

Dont Miss: Amount Of Stimulus Checks 2021

Minnesota: $488 Payments For Frontline Workers

Some frontline workers received a one-time payment of $488 in October, thanks to a bill signed by Gov. Tim Walz in early May.

Eligible workers must have worked at least 120 hours in Minnesota between March 15, 2020, and June 30, 2021, and werent eligible for remote work.

Workers with direct Covid-19 patient-care responsibilities must have had an adjusted gross income of less than $175,000 between December 2019 and January 2022 workers without direct patient-care responsibilities must have had an adjusted gross income of less than $85,000 annually for the same period. Applications for the payment are now closed.

You May Like: When Were The 2021 Stimulus Checks Issued

You Don’t Have To File A Tax Return To Qualify For A Third Stimulus Check But

Though taxes do play a role in determining stimulus check eligibility, you don’t need to have filed a tax return to qualify for a check. If you’re over age 65, for example, and receive Supplemental Security Income or Social Security Disability Insurance, you could still qualify for a first, second and third stimulus check. But in some cases, you would have needed to take an extra step, and you will now if you’re still waiting on your full payment. If you didn’t receive some or all of the money you were entitled to, people in this group, termed nonfilers, will have to file a tax return to receive any missing stimulus payment.

The best thing to do to ensure that the IRS has your information on file and potentially speed up how fast you get your third check is to file a 2020 tax return now.

Still No Third Stimulus Check Track Your Money Now With This Online Tool

If you’re still missing your third payment, use the IRS Get My Payment tool. It’s easy to use and free for everyone.

Clifford Colby

Managing Editor

Clifford is a managing editor at CNET, where he leads How-To coverage. He spent a handful of years at Peachpit Press, editing books on everything from the first iPhone to Python. He also worked at a handful of now-dead computer magazines, including MacWEEK and MacUser. Unrelated, he roots for the Oakland A’s.

Shelby Brown

Staff Writer

Shelby Brown is a writer for CNET’s services and software team. She covers tips and tricks for apps, operating systems and devices, as well as mobile gaming and Apple Arcade news. Shelby oversees Tech Tips coverage and curates the CNET Now daily newsletter. Before joining CNET, she covered app news for Download.com and served as a freelancer for Louisville.com.

If your third stimulus check hasn’t arrived yet, you’re likely becoming concerned about what’s happened to it. But don’t get too worried yet — start by checking your bank account because it may have a pending deposit.Iit’s also possible the check is stuck en route in the mail. Once you figure out your payment status, you may find that you’re owed a “plus-up” supplemental payment if the IRS didn’t send you enough stimulus money.

You May Like: Do We Supposed To Get Another Stimulus Check

Third Stimulus Check Under Biden Covid Relief Package

Under the now passed $1.9 Trillion Biden COVID Relief Package there are provisions included for another round of stimulus checks. The amounts will be $2800 for couples, $1400 for single adults and $1400 for each eligible dependent per the final bill crafted by the Congressional Democrats.

Based on the income qualification levels, nearly 85 percent of American households would receive a full or partial stimulus payment under the Biden plan. A typical couple with two children making $100,000 annually would receiving about $5,600 with this third round of stimulus check payments.

The full payment will be made to singles filers making less than $75,000 and couples earning less than $150,000 in adjusted gross income . Phase out limits to get a partial stimulus payment are also shown in the table below. To get the dependent check you need to qualify for the adult stimulus payment, and the payment would be sent to the adult recipient claiming the dependent.

| 2019 or 2020 Tax Filing Status | Income Below Which FULL Stimulus is Paid | Maximum Income To Qualify for Partial Stimulus |

|---|---|---|

| Single or Married filing separate | $75,000 |

Also Check: When Will I Get My Stimulus

How Much Was The First Stimulus Check And When Was It Sent Out

The state of California passed a new COVID-19 economic relief package called the Golden State Stimulus. Part of that package granting qualifying individuals and families a one-time stimulus payment of up to $600.

Also, a qualifying child must have an SSN valid for employment or an adoption taxpayer identification number . A child who has an ITIN is not a qualifying child for this payment. He offers career strategies, from dealing with under-employment to transitioning into self-employment, and provides Alt-retirement strategies for the vast majority who wont retire to the beach as millionaires. Hes a regular contributor/staff writer for as many as a dozen financial blogs and websites, including Money Under 30, Investor Junkie and The Dough Roller. And as a head of household filer, you will also receive up to $600 for each eligible child.

Don’t Miss: Stimulus Check Irs Social Security