Who Qualifies For The Third Stimulus Check

Millions of Americans who were eligible for the $600 second stimulus checks could qualify for the third round of stimulus payments up to $1,400. However, many high-earning taxpayers who were eligible for previous stimulus checks are now excluded. The plan narrows income eligibility to exclude individuals earning over $80,000 and couples making over $160,000:

- Singles phase out at AGIs between $75,000 and $80,000.

- Heads of household phase out at AGIs between $112,500 and 120,000.

- Couples phase out at AGIs between $150,000 and $160,000.

Keep in mind that this is different from the sliding scale that was used to determine eligibility for previous stimulus payments. The IRS reduced second stimulus checks by 5% for the total amount made over the AGI limit. This means that payments went down by $5 for every $100 over the limit.

The table below breaks down third stimulus payments based on narrower income ranges for singles and joint tax filers:

| $1,400 Stimulus Checks With Narrower Income Ranges |

| Single AGI |

| $174,000 and up | $0 |

If you want to get a specific breakdown, SmartAssets third stimulus check calculator will give you an estimate based on your filing status, AGI and dependents.

How Will The Child Tax Credit Give Me More Help This Year

The American Rescue Plan, signed into law on March 11, 2021, expanded the Child Tax Credit for 2021 to get more help to more families.

- It has gone from $2,000 per child in 2020 to $3,600 for each child under age 6.

- For each child ages 6 to 16, its increased from $2,000 to $3,000.

- It also now makes 17-year-olds eligible for the $3,000 credit.

- Previously, low-income families did not get the same amount or any of the Child Tax Credit. Under the American Rescue Plan, all families in need will get the full amount.

- To get money to families sooner, the IRS began sending monthly payments this year, starting in July.

- It is broken up into monthly payments, which means payments of up to $300 per child under age 6 and $250 per child ages 6 to 17.

- Youll get the remainder of the credit when you file your taxes next year.

How To Claim Your Missing Third Stimulus Payment On Your 2021 Tax Return

Youâll need to request any missing third stimulus payments on your 2021 tax return by claiming the Recovery Rebate Tax Credit.

This is the case if you received a partial amount or didnât previously qualify for the third stimulus payment.

Letâs say youâre single and your income for the 2020 and 2019 tax years exceeds the threshold . However, you lost your job in 2021, so your income drastically decreased. You can now claim the Recovery Rebate Tax Credit since your earnings fell below the threshold.

Families that added dependents may also be able to claim the credit.

In addition, a few lingering taxpayers who file taxes using ITINs may not have received payments for their eligible dependents who have Social Security numbers.

You need to complete the Recovery Rebate Tax Credit worksheet and submit it along with your 2021 tax return. If you use a tax software program, it should guide you through the process. Keep in mind, the IRS predicted a frustrating and slow tax season this year, so file your return as soon as possible.

Before completing the worksheet, you must know the amount of any third stimulus payments received for you, your spouse, and any dependents. The worksheet will also request your adjusted gross income for the year to determine your eligibility.

The IRS started mailing Letter 6475 to taxpayers in Januaryâthe letter confirms the total amount of the third stimulus payments received for the 2021 tax year.

Don’t Miss: Irs.gov Stimulus Phone Number

What Steps Do I Need To Take To Receive An Economic Impact Payment

If you receive certain social security, retirement, disability, survivors, railroad retirement, or veterans benefits, you may automatically qualify to receive a payment. Learn more to see if this applies to you.

For most people, you will not need to take any action and the IRS will automatically send you your payment. For some people who are eligible for a payment, the IRS will need more information from you first before they can send you money. You will do this using one of two different IRS portals. It is important that you provide this information using the right IRS portal so that the IRS can process your information quickly.

- If you already filed your 2018 or 2019 taxes, go to the IRS Get My Payment portal to check the status of your payment. This portal will let you know if your payment has been processed and let you know if the IRS needs more information before sending you your payment.

- If your payment has already been processed, the IRS does not need any more information from you at this time.

- If you paid additional taxes when you filed your tax return, it is possible that the IRS does not have your payment account information to direct deposit your payment. You can provide that directly in the portal so that they can process this information quickly and send you your payment. If the IRS does not have your direct deposit information and you dont provide it to them, your payment will be sent to you by check to the address they have on file.

Are Adult Dependents Getting Third Stimulus Checks

The new stimulus plan expands eligibility to adult dependents, including college students, elderly relatives and disabled adults.

The text of the plan redefines the term dependent according to section 152 of the tax code, which includes both qualifying children and adults: Section 152 provides that the term dependent means a qualifying child ) or a qualifying relative ).

While the plan pays out $1,400 for each qualifying dependent, families should keep in mind that the targeted lower income ranges exclude them if they earn over $160,000.

For reference, the second stimulus checks provided additional $600 payments for qualifying dependents under the age of 17. So a couple filing jointly with three eligible children could get a maximum second payment of $3,000 .

Under the first and second rounds of stimulus checks, children and adult dependents over the age limit could not get an additional payment, and they did not qualify for a stimulus check of their own either.

With the new stimulus plan, however, both joint filers and heads of household get an additional $1,400 payment for each dependent, regardless of age. The table below breaks down the third stimulus checks for heads of household with one dependent:

| Stimulus Checks for Heads of Household & 1 Dependent |

| AGI |

| $120,000 and up | $0 |

Read Also: What’s Happening With The Stimulus Checks

Can I Use The Calculator If I Havent Filed A Tax Return For 2020

Yes, you can use your 2019 tax return. The IRS emphasizes that if you use your 2020 return to estimate your payment, dont guess your AGI: File an accurate return first. Adjusted gross income, as the name implies, is your gross income minus certain adjustments such as educator expenses, student loan interest, alimony payments and qualifying contributions to retirement accounts. You can find AGI on line 11 of your 2020 federal 1040 income tax return or line 8b of your 2019 return.

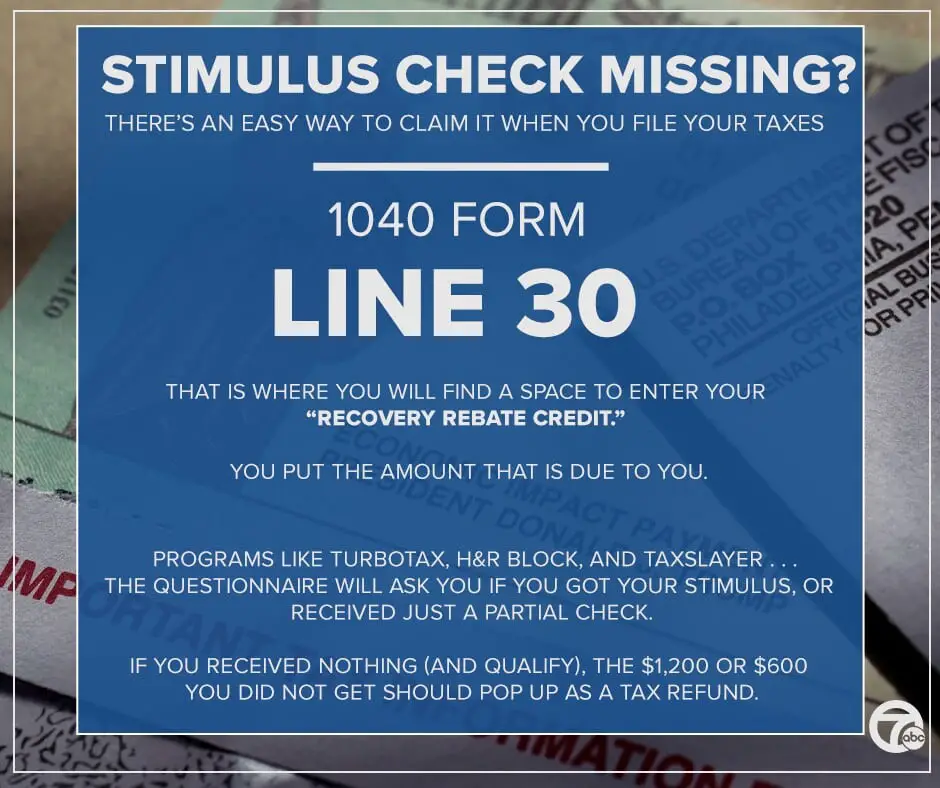

If you werent able to claim your earlier $1,200 or $600 stimulus checks, you can do so on your 2020 tax returns. Use the Recovery Rebate Credit Worksheet and enter the amount from the worksheet onto Line 30 of your 1040.

Who’s Eligible For The Latest Stimulus Check

THERE is certain criteria that must be met in order to claim your third stimulus check.

You could be entitled to a payment if the following is true:

- You are not a dependent of another taxpayer

- You have a Social Security number valid for employment

Your adjusted gross income must also not exceed:

- $160,000 if married and filing a joint return

- $120,000 if filing as head of household or

- $80,000 for single applicants

Recommended Reading: How Do I Apply For The 4th Stimulus Check

What About People With Itins

You still need a work-authorizing Social Security Number to be eligible for this stimulus. However, there are important changes since the first round of stimulus checks.

- In the first stimulus rollout, any non-SSN holder on a joint return made everyone on that return ineligible. Big change: The new rounds of stimulus has corrected this problem. If you filed a joint return with a non-SSN holder, you are still eligible for the stimulus. See the below hypotheticals.

- Situation: A single tax filer has an Individual Taxpayer Identification Number but no Social Security number .

- This person is ineligible for the stimulus.

Child Tax Credit: December End

Some families received another form of stimulus aid when the IRS in July deposited the first of six monthly cash payments into bank accounts of parents who qualify for the Child Tax Credit . Families on average received $423 in their first CTC payment, according to an analysis of Census data from the left-leaning advocacy group Economic Security Project.

Eligible families received up to $1,800 in cash through December, with the money parceled out in equal installments over the six months from July through December. The aid was due to the expanded CTC, which is part of President Joe Biden’s American Rescue Plan.

Families who qualify received $300 per month for each child under 6 and $250 for children between 6 to 17 years old. Several families that spoke to CBS MoneyWatch said the extra money would go toward child care, back-to-school supplies and other essentials.

While progressives and some Democrats urged lawmakers to continue the enhanced CTC, it appears stalled at the moment. That means families won’t receive a CTC payment in January or beyond.

Recommended Reading: When Did I Receive My Stimulus Check

What If My Mailing Address Changed Since I Received My Previous Stimulus Checks How Will I Get My Third Stimulus Check

If you are expecting to receive your third stimulus check by mail, it will be mailed to the last address you filed with the IRS. If your address has changed since then, there are different options you can take to make sure your stimulus check gets to you:

Option 1: File your 2020 federal tax return to update your address. If you havent filed your 2020 tax return yet, this is an easy way to update your address. File a tax return with your current address and your payment will be sent through the mail once the IRS receives your updated address.

Option 2: Provide your banking information in the IRS Get My Payment tool. If the post office was unable to deliver your stimulus check, it will be returned to the IRS. Two to three weeks after the payment has been issued, Get My Payment will display the message Need More Information. You will have the option to have your payment reissued as a direct deposit by providing your banking information.

If you dont provide your banking information, the IRS will mail your payment once your address is updated.

Option 3: Notify the IRS that your address has changed by telephone, an IRS form, or a written statement. It can take 4-6 weeks for the IRS to process your request.

State And City Stimulus

Some states have also given out extra stimulus payments, including California and Maine, with many using funds from the Rescue Act.

In 2021, California launched two-state stimulus programs: the Golden State Stimulus I and Golden State Stimulus II.

These stimulus checks are worth up to $1,200 and $1,100, respectively.

Furthermore, the state recently issued about 139,000 stimulus checks.

Moreover, California plans to send out up to another 70,000 stimulus checks starting mid-March.

Those getting paper checks need to allow up to three weeks for them to arrive.

Eligible Maine residents received $285 stimulus payments until the end of 2021, and it’s unclear if this will continue into 2022.

Another city in California, Santa Ana, started sending out $300 payments loaded on prepaid Visa debit cards last year.

“So far about 2,700 have been distributed and we plan to give out up to the full 20,000 cards either in person or notifying qualified residents by mail to pick them up,” a Santa Ana official told The Sun in December.

According to a statement by the city, those with poverty rates above the Santa Ana median of 42% will qualify for the support.

Also, thousands of St Louis, Missouri residents were able to claim a $500 stimulus check in December.

However, applications for the moment are paused and the city will keep the public informed on any potential future reopening of its portal.

Oregon is another state that has launched its own stimulus program.

You May Like: Veterans To Receive Stimulus Payment

Comedian Chugs Beer Thrown At Her By Pro

President Trump on Sunday signed a $2.3 trillion COVID-19 relief and government funding bill that includes $600 stimulus checks for most Americans, after refusing to accept the deal for days.

The nearly 5,600-page bill passed the House and Senate by overwhelming margins Monday night, just hours after its text was released.

Trump signed it several days after saying the legislation was a disgrace and calling on Congress to up the relief payments to $2,000 and scale back spending.

In a statement Sunday night, the president said he would ask for millions of dollars in spending to be removed from the bill.

I will sign the Omnibus and Covid package with a strong message that makes clear to Congress that wasteful items need to be removed, Trump said.

While the president insisted he would send Congress a redlined version with items to be removed under the rescission process, those are merely suggestions to Congress. The bill, as signed, would not necessarily be changed.

The bill authorizes direct checks of $600 for people earning up to $75,000 per year. The amount decreases for higher earners, and people who make over $95,000 get nothing.

Theres an additional $600-per-child stimulus payment.

In his statement, Trump said Congress on Monday would vote on a separate bill to increase payments to individuals from $600 to $2,000.

Therefore, a family of four would receive $5,200, the president said about the increase, which would require Republican approval.

Who Isn’t Eligible For The Third Stimulus Check

Besides high-income earners, the only other individuals who aren’t eligible for the stimulus check are those without Social Security numbers , those who are claimed as dependents on someone else’s tax return, and possibly those who are incarcerated.

This time, an individual who is married to an immigrant without a Social Security number can get the stimulus check, though the spouse with only an individual taxpayer identification number still will not receive a check.

What about children? Parents should get an extra $1,400 for each child that they claimed as a dependent on their 2020 tax return. This is a change from the first and second stimulus checks, where only children who hadn’t reached age 17 could qualify for the stimulus money.

What about people who don’t pay taxes? There is no requirement that you paid taxes or filed a tax return in 2020. This means that even those people whose only source of income is Social Security retirement or disability benefits, Supplemental Security Income , or veterans benefits are eligible for the $1,400 payment.

Those who receive monthly Social Security benefits, Railroad Retirement benefits, SSI, or veterans benefits should automatically receive the stimulus check whether they filed tax returns or not.

What about people receiving unemployment? Those collecting unemployment benefits are eligible to receive the stimulus payment.

Recommended Reading: Irs Phone For Stimulus Checks

Who Is Eligible For A Stimulus Check

The vast majority of Michigan residents are eligible to receive a stimulus check from the federal government this year. Even if you have no income, you are still eligible, but need to take action to receive your stimulus payment. This includes individuals with low or no earnings who normally don’t file taxes. Every American adult earning less than $75,000 is eligible for a stimulus check from the federal government this year. While this site is geared toward Michigan residents, the information is applicable nationwide.If you still have questions about your stimulus check after reviewing this website, call the IRS at or, United Way at .

After you sign up, make sure to add your account information on the IRS website. If you dont want to sign up for a bank account, you can also link to your prepaid debit card instead.You can also receive your funds through the Cash App, by providing the IRS with the routing and account numbers connected to your Cash App. You can download the Cash App or locate your Cash App account information here.

What if I havent filed taxes?

What if I dont qualify – where else can I get help?

If you dont qualify for the stimulus payment, we recommend reaching out to Michigan 2-1-1. They can connect you to resources in your community.

Will my payment be reduced or offset if I owe tax, have a payment agreement with the IRS, owe other Federal or State debt, or owe other debt collectors?