Find Out Which Payments You Received

To find the amounts of your Economic Impact Payments, check:

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page.

IRS EIP Notices: We mailed these notices to the address we have on file.

- Notice 1444: Shows the first Economic Impact Payment sent for tax year 2020

- Notice 1444-B: Shows the second Economic Impact Payment sent for tax year 2020

- Notice 1444-C: Shows the third Economic Impact Payment sent for tax year 2021

Letter 6475: Through March 2022, we’ll send this letter confirming the total amount of the third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need the total payment information from your online account or your letter to accurately calculate your Recovery Rebate Credit. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment.

What You Can Expect

Look on the following list for the action you took whether that’s sending us your individual or business tax return or answering a letter from us. Then, open the action to see how long you may have to wait and what to do next.

Filed a Tax Return

The IRS is opening mail within normal timeframes and all paper and electronic individual returns received prior to January 2022 have been processed if the return had no errors or did not require further review.

As of August 26, 2022, we had 8.2 million unprocessed individual returns received in calendar year 2022. These include tax year 2021 returns and late filed tax year 2020 and prior returns. Of these, 1.7 million returns require error correction or other special handling, and 6.5 million are paper returns waiting to be reviewed and processed. This work does not typically require us to correspond with taxpayers but does require special handling by an IRS employee so, in these instances, it is taking the IRS more than 21 days to issue any related refund and in some cases this work could take more than 120 days. If a correction is made to any Recovery Rebate Credit, Child Tax Credit, Earned Income Tax Credit or Additional Child Tax Credit claimed on the return, the IRS will send taxpayers an explanation. Taxpayers are encouraged to continue to check Tax Season Refund Frequently Asked Questions.

Answered a Letter or Notice

Were getting mail, but its taking us longer to process it.

Sent a Missing Form or Document

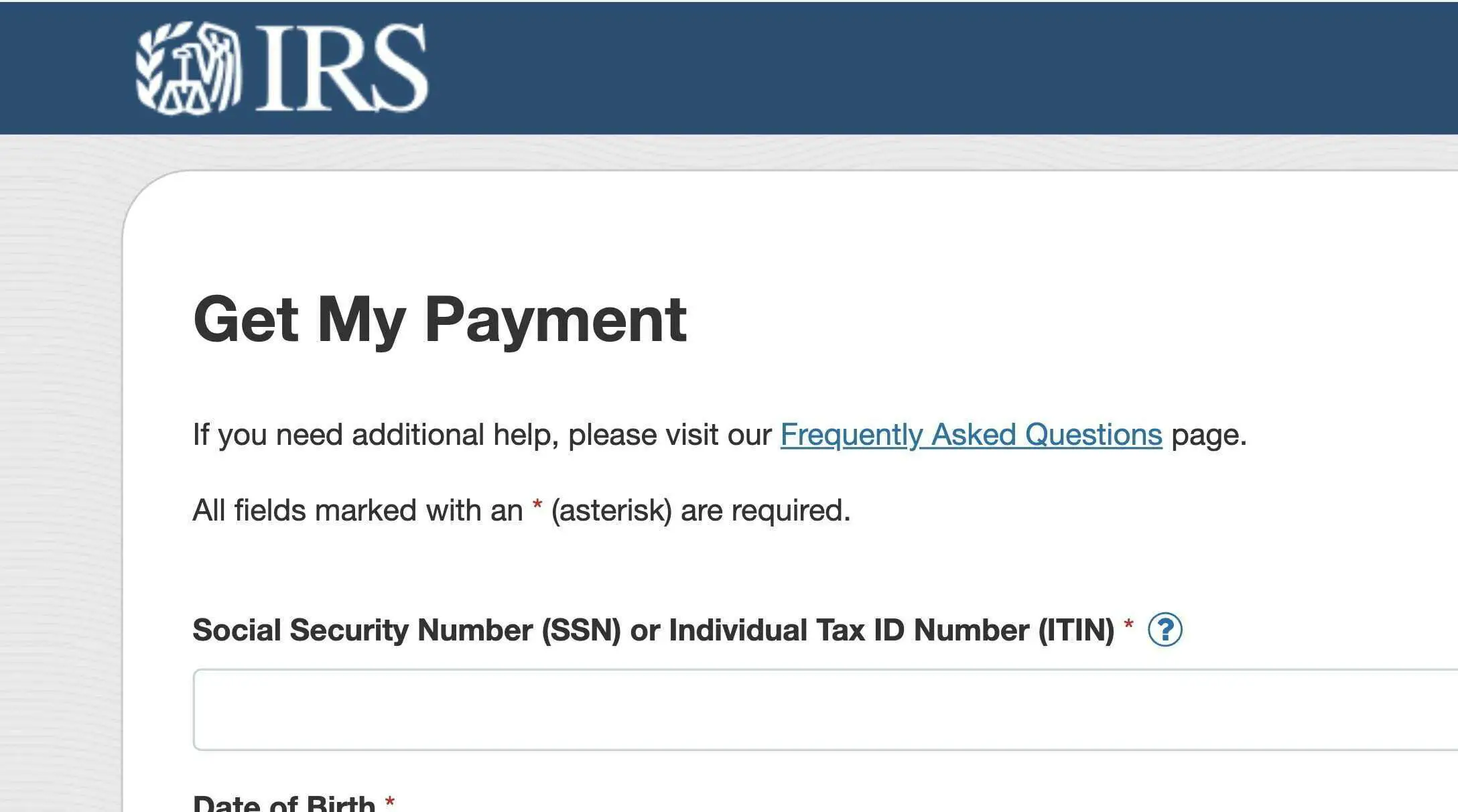

Irs Get My Payment Tool

Most people don’t need to do anything to receive their stimulus checks, which pay out up to $1,200 per adult, and $500 per child under age 17. According to the IRS, 130 million stimulus payments were sent out through the program’s first four weeks, and somewhere between 150 million to 170 million payments will be distributed overall. The payment amounts are based on your adjusted gross income, as calculated in your most recent tax return, and the IRS is paying most checks via direct deposit provided that information is already on file.

Yet in this particularly trying economic climate, where millions have lost their jobs, many people were waiting for the IRS to offer a service letting them track their stimulus checks, similar to the tool allowing you to track your tax refund. Some taxpayers are also unsure how or when they will receive their $1,200 checks, or they seek to provide the IRS with updated direct deposit information so that they can get their checks as soon as possible. The Get My Payment application is supposed to address all of these needs.

Don’t Miss: Amount Of All Stimulus Checks

Scams Targeting Tax Professionals

Increasingly, tax professionals are being targeted by identity thieves. These criminals many of them sophisticated, organized syndicates – are redoubling their efforts to gather personal data to file fraudulent federal and state income tax returns. The Security Summit has a campaign aimed at tax professionals: Protect Your Clients Protect Yourself.

Schemes

Phishing is a scam where fraudsters send e-mail messages to trick unsuspecting victims into revealing personal and financial information that can be used to steal the victims identity.

The IRS has issued several alerts about the fraudulent use of the IRS name or logo by scammers trying to gain access to consumers financial information to steal their identity and assets.

Scam emails are designed to trick taxpayers into thinking these are official communications from the IRS or others in the tax industry, including tax software companies. These phishing schemes may seek information related to refunds, filing status, confirming personal information, ordering transcripts and verifying PIN information.

Be alert to bogus emails that appear to come from your tax professional, requesting information for an IRS form. IRS doesnt require Life Insurance and Annuity updates from taxpayers or a tax professional.

The sites may ask for information used to file false tax returns or they may carry malware, which can infect computers and allow criminals to access your files or track your keystrokes to gain information.

Here Are Some Key Things To Know About This Tool And Who Can Use It

- Before using the tool, people must verify their identity by answering security questions.

- If the answers do not match IRS records after multiple attempts, the user will be locked out of the tool for 24 hours. This is for security reasons. Those who can’t verify their identity won’t be able to use Get My Payment. If this happens, people should not contact the IRS.

- If the tool returns a message of “payment status not available,” this may mean the IRS can’t determine the person’s eligibility for a payment right now. There are several reasons this could happen. Two common reasons are:

- A 2018 or 2019 tax return is not on file and the agency needs more information or,

- The individual could be claimed as a dependent on someone else’s tax return.

You May Like: What Is The Third Stimulus Check

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. TOP will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

What’s The First Step To Take

The IRS said you can no longer use the Get My Payment application to check your payment status.

To find the amount of the third stimulus payment, you will need to create or view your online account or refer to IRS Notice 1444-C, which was mailed after sending your payment.

You can also securely access your individual tax information with an IRS online account to view your total economic impact payment amounts under the 2021 tax year tab.

Also Check: New Home Purchase Stimulus Program

State Stimulus Checks 202: See If Your State Is Mailing Out Payments This Month

Several states are issuing tax rebates and inflation relief payments in October and November.

Dan Avery

Writer

Dan is a writer on CNET’s How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

While the federal government is unlikely to issue another stimulus check, state governments are continuing to send taxpayers financial relief. Millions of California taxpayers started receiving a “middle-class tax refund” last week, with payments of up to $1,050 being sent out through January.

Other states are issuing one-time payments to help residents grapple with the bumpy economy: Colorado taxpayers have already started getting $750 tax refund checks, while eligible Virginians should receive a $250 rebate by Halloween, and Massachusetts will start disseminating tax rebates in November.

Is your state sending out tax refunds or stimulus checks? How much money could you get? Read on to find out.

For more on economic relief, check out plans for statewide child tax credits, as well as gas rebate checks and gas tax holidays across the US.

Heres How To Get The Status Of An Economic Impact Payment

COVID Tax Tip 2020-128, September 29, 2020

Eligible individuals can visit IRS.gov and use the Get My Payment tool to find out the status of their Economic Impact Payment. This tool will show if a payment has been issued and whether the payment was direct deposited or sent by mail.

In certain situations, this tool will also give people the option of providing their bank account information to receive their payment by direct deposit. Information is updated once a day, usually overnight, so there’s no need to check it more than once a day.

Also Check: Irs Stimulus Check Tax Return

What Irs Stimulus Payments Constitute

Here are the list of credits that you can claim and that may result in refund check for you.

What Are The Major Tax Refunds This Year

After the first spread of the novel coronavirus in the United States of America, the federal government announced several tax reforms and new financial reliefs.

Nowadays, there are several things that you can track for your tax refund this year. As usual, if you have overpaid your taxes in the year 2021, then you are eligible to receive that money back as a tax refund.

Apart from that, if you are a parent, you could also receive child tax credit money. The government announced that they are going to release 3600 U.S. dollars per child.

You can also expect reimbursements for the money you spent on childcare-related expenses last year. Many people also missed their third stimulus payment, which can also be claimed in your tax refund.

These are the few major tax refunds that you can expect this year. Other than that, if you are eligible for an unemployment insurance claim, then you can also expect that in your tax refund.

Read Also: When Are The Next Stimulus Checks Going Out

Irs Begins Delivering Third Round Of Economic Impact Payments To Americans

IR-2021-54, March 12, 2021

WASHINGTON The Internal Revenue Service announced today that the third round of Economic Impact Payments will begin reaching Americans over the next week.

Following approval of the American Rescue Plan Act, the first batch of payments will be sent by direct deposit, which some recipients will start receiving as early as this weekend, and with more receiving this coming week.

Additional batches of payments will be sent in the coming weeks by direct deposit and through the mail as a check or debit card. The vast majority of these payments will be by direct deposit.

No action is needed by most taxpayers the payments will be automatic and, in many cases, similar to how people received the first and second round of Economic Impact Payments in 2020. People can check the Get My Payment tool on IRS.gov on Monday to see the payment status of the third stimulus payment.

“Even though the tax season is in full swing, IRS employees again worked around the clock to quickly deliver help to millions of Americans struggling to cope with this historic pandemic,” said IRS Commissioner Chuck Rettig. “The payments will be delivered automatically to taxpayers even as the IRS continues delivering regular tax refunds. We urge people to visit IRS.gov for the latest details on the stimulus payments, other new tax law provisions and tax season updates.”

Find The Status Of Your Economic Impact Payment Using The Irs Get My Payment Tool

Eligible individuals can visit IRS.gov and use the Get My Payment tool to find out the status of their Economic Impact Payment. This tool will show if a payment has been issued and whether the payment was direct deposited or sent by mail.

In certain situations, this tool will also give people the option of providing their bank account information to receive their payment by direct deposit. Information is updated once a day, usually overnight, so there’s no need to check it more than once a day.

Also Check: When Will Nc Stimulus Checks Arrive 2021

How To Use Irs ‘get My Payment’

The IRS also updated frequently asked questions Saturday on how to use the “Get My Payment” tool, which requires users to enter their full Social Security number or tax ID number, date of birth, street address and ZIP code.

But before you start entering your information hourly, the IRS says the tool updates once per day, usually overnight and that people should not call the IRS. Our phone assistors don’t have information beyond what’s available on IRS.gov.

The tool will show the status of when a payment has been issued and the payment date for direct deposit or mail, according to the frequently asked questions. Some will get a message that says “Payment Status Not Available.”

“If you get this message, either we have not yet processed your payment, or you are not eligible for a payment,” the IRS said. “We will continue to send the 2021 Economic Impact Payment to eligible individuals throughout 2021.”

And others will get a “Need More Information” message when using the tool if the payment was returned to the IRS because the post office was unable to deliver it for another reason.

If your address has changed the IRS says the easiest way to update is to “file your 2020 tax return with your current address, if you havent already done so. Once we receive your current address, we will reissue your payment.”

Contributing: Jessica Menton, USA TODAY

Follow USA TODAY reporter Kelly Tyko on Twitter: @KellyTyko

Watch The Mail For Paper Checks And Eip Cards

Paper checks will arrive by mail in a white envelope from the U.S. Department of the Treasury. For those taxpayers who received their tax refund by mail, this paper check will look similar, but will have Economic Impact Payment in the memo field.

The EIP Card will also come in a white envelope prominently displaying the seal of the U.S. Department of the Treasury. The card has the Visa name on the front and the issuing bank, MetaBank, N.A. on the back. Information included with the card will explain that this is an Economic Impact Payment. Each mailing will include instructions on how to securely activate and use the card.

EIP cards issued for any of the three rounds of payments are not reloadable. Recipients will receive a separate card and will not be able to reload funds onto an existing card.

Also Check: Status On 4th Stimulus Check

I Received An Irs Letter That Confirmed My Stimulus Payment But I Have Not Received The Payment What Should I Do

The IRS sends a notice by mail to your last known address within 15 days after issuing the payment to confirm the delivery. The notice contained information like when and how the payment was made. If you have not received the payment like the notice set, then you can report it back to the Internal Revenue Service.

Child Tax Credit Payments

There have been important changes to the Child Tax Credit that will help many families. The American Rescue Plan Act of 2021 expands the CTC for tax year 2021 only. The 2021 Child Tax Credit is up to $3,600 for each qualifying child.

Eligible families, including families in Puerto Rico, can claim the credit through April 15, 2025, by filing a federal tax returneven if they don’t normally file and have little or no income.

See the Advance Child Tax Credit 2021 webpage for the most up-to-date information about the credit and filing information. Families in Puerto Rico can check eligibility rules and find more information at Resources and Guidance for Puerto Rico families that may qualify for the Child Tax Credit.

Recommended Reading: What Is Congress Mortgage Stimulus Program