When Will The Third Stimulus Check Be Issued

The government started sending the third stimulus checks on March 12, 2021. The IRS continues to send third stimulus checks as people submit their information to the IRS either by filing a 2020 tax return or using GetCTC.org. The deadline to use GetCTC.org is November 15, 2021.

If you have your banking information on file, the IRS sent your payment via direct deposit. Otherwise, you will receive your payment as a check or debit card via mail. Mailed checks and debit cards may take longer to deliver.

If you dont fall into any of these categories, youll have to wait to receive your third stimulus check. You will need to file a 2020 federal tax return to get the third stimulus check or use GetCTC.org if you dont have a filing requirement.

You can also get the first and second stimulus check as the Recovery Rebate Credit on your tax return or GetCTC.org if you are eligible.

Thousands Of Dollars Of Federal Stimulus Money Were Made Available For The 2020 And 2021 Tax Years Even For People Who Don’t Normally File Taxes Credits May Be Claimed For Up To 3 Years After The Original Tax Filing Deadline So Make Sure You Received All Available Funds

The Earned Income Tax Credit and Child Tax Credit were available to more people than ever before in 2021. It’s not too late to claim stimulus money!

The State of Illinois will be issuing rebate checks to taxpayers from July 2022 through October 2022. Make sure you have filed an Illinois 1040 form before October 17, 2022 to receive your check, even if you dont have any income. Checks will be for $50/individual and $100/child up to three children, for a maximum rebate of $400.

If you have children and received a monthly check from the IRS during the second half of 2021, you must file a 2021 tax return to claim the other half of your Child Tax Credit.

Even if you dont have children, you may be eligible for increased money from the Earned Income Tax Credit.

*File for free at GetYourRefund.org/IL or MyFreeTaxes.com or visit GoLadderUp.org

See below to make sure you received all of the federal money you qualified for.

What If I Am Not Required To File A Tax Return Can I Still Track My Stimulus Check

To use the Get My Payment tool to check the payment status of your stimulus check, the IRS needs enough information to verify your identity. The IRS may be unable to verify your identity if:

- You didnt file an income tax return

- You didnt use the IRSs Non-Filers tool by November 21, 2020 to register for a payment or

- You receive federal benefits and the IRS doesnt have enough information.

Also Check: Who Gets Stimulus Checks This Time

You May Like: Student Loan Forgiveness Stimulus Check

You Aren’t Eligible For A Stimulus Payment

If you aren’t eligible for a stimulus check , the Get My Payment app won’t necessarily explain that. Instead, you may simply find yourself staring at the words “Payment Status Not Available.” If this is the case, you may want to take a look at your adjusted gross income on your most recent tax return, to see if you’re eligible for a payment or not.

How Do I Claim These Benefits

The IRS is urging people who believe they are eligible for the tax credits but haven’t filed a tax return to go ahead and file a return with the tax agency, even if they haven’t yet received a letter from the IRS.

“The IRS reminds people that there’s no penalty for a refund claimed on a tax return filed after the regular April 2022 tax deadline,” the IRS said.

There are a few ways people can claim the benefits:

- File a return with Free File before November 17, 2022. Free File is available to people who earn less than $73,000.

- File a simplified 2021 tax return through GetCTC before November 15, 2022.

The IRS said it urges people to file their tax form electronically and to choose direct deposit in order to get their tax credits as soon as possible.

Recommended Reading: When Will Nc Stimulus Checks Arrive 2021

Will The Irs Reload A Prior Pre

Some people who received one or both of their first two stimulus payments on a pre-paid debit card may wonder if the IRS will reload that card with the $1,400 for the latest round of payments. The answer is no, the IRS says.

If the IRS now has bank account information for you, it will send the money via direct deposit. If not, it will either issue a check or a pre-paid debit card, but the latter will come in the form of a new card, the tax agency said.

People should look for a white envelope with the return address Economic Impact Payment Card accompanied by a U.S. Treasury Department seal. The card says Visa on the front, and the issuing bank, MetaBank, on the back.

If I Owe Child Support Will Mytax Return Be Applied Tomychild Supportarrears

-

Maybe.Federal law and regulationsdetermine when federal payments are intercepted and applied to child support arrears.

-

IfTANFhas been received for your child,thetotalamount of past due supportonall ofyourchild support cases must be at least $150

-

IfTANFhasnotbeenreceivedfor your child,thetotalamount of past due supportonall ofyour child support casesmust be at least $500

Also Check: Where My Second Stimulus Check

What Is The Meaning Of Irs Tax Return Status

The IRS has three different messages which can explain your tax return status. If you have received a status, that means the IRS has a tax return, and they are working on it. The second status is approved, which means that your return has been confirmed. And the last one is sand which means your refund is on its way.

When Will I Get The Recovery Rebate Credit

You will most likely get the Recovery Rebate Credit as part of your tax refunds. If you electronically file your tax return, you will likely receive your refund within 3 weeks. If you mail your return, it can take at least 8 weeks to receive your refund.

Claiming the Recovery Rebate Credit will not delay your tax refund. However, if you dont claim the correct amount of the Recovery Rebate Credit, your refund may be delayed while the IRS corrects the error on your return. The IRS will send you a notice of any changes made to your return.

You can check on the status of your refund using the IRS Check My Refund Status tool.

Recommended Reading: Is Another Stimulus Check Coming In 2022

Irs Get My Payment: How To Use The Online Tracker Tool

To get an update on your third stimulus check using Get My Payment, enter your Social Security number, date of birth, street address and ZIP or postal code. The tool will display a message with information about your payment. You can see things like whether your money was sent or is scheduled to be sent, the payment method and the date your stimulus money was issued. The tool may also say it can’t yet determine your status — see more below about error messages.

Still Living Paycheck To Paycheck

Some top economists have called for more direct aid to Americans. More than 150 economists, including former Obama administration economist Jason Furman, signed a letter last year that argued for recurring direct stimulus payments, lasting until the economy recovers.

Although the economy is improving, millions of people continue to suffer from reduced income and have not been able to tap government aid programs, Nasif said. Only 4 in 10 jobless workers actually received unemployment aid, according to a from economist Eliza Forsythe.

Many people never applied for unemployment benefits because they didnt think they were eligible, while others may have given up due to long waits and other issues.

Youll see reports about how the economy is starting to grow, but there are a lot of Americans living paycheck to paycheck, and for a lot of them the government relief programs havent been able to help, said Greg Nasif, political director of Humanity Forward.

Dont Miss: Does Everyone Get A Second Stimulus Check

Recommended Reading: When Are The Next Stimulus Checks Going Out

Estimate Your Check Amount

To estimate the amount you’ll receive, you’ll need information from your 2021 New York State income tax return . If you dont have a copy of your return, log in to the software you used to file to view a copy, or request the information from your tax preparer .

Note: To protect your information, our Contact Center representatives cannot provide amounts from a return you filed.

Empire State child credit additional payment computation table

| If your line 19a amount is | your payment based on your 2021 Empire State child credit is | |

|---|---|---|

| equal to or greater than | but less than | |

| 100% of the credit amount you received. | ||

| $10,000 | 75% of the credit amount you received. | |

| $25,000 | 50% of the credit amount you received. | |

| $50,000 | N/A | 25% of the credit amount you received. |

Example: On Taxpayer B’s return, the line 19a amount is $18,000 and the line 63 amount is $333:

What Is The Earned Income Tax Credit

The American Rescue Plan of 2021 also boosted the Earned Income Tax Credit, which has been available for decades and is aimed at helping low-income workers. Prior to the legislation, childless workers between 25 to 64 could only get up to $538, but the pandemic law boosted that to $1,502.

The law also increased the amount that can be claimed by working families with children, increasing it to as high as $6,728 for parents with three children.

Most people can claim the EITC if they earn under $21,430 for single taxpayers or $27,380 for married people filing jointly.

Read Also: Get My Stimulus Payment 1400

Biden Coughs Through Omicron Speech After Exposure To Official With Covid

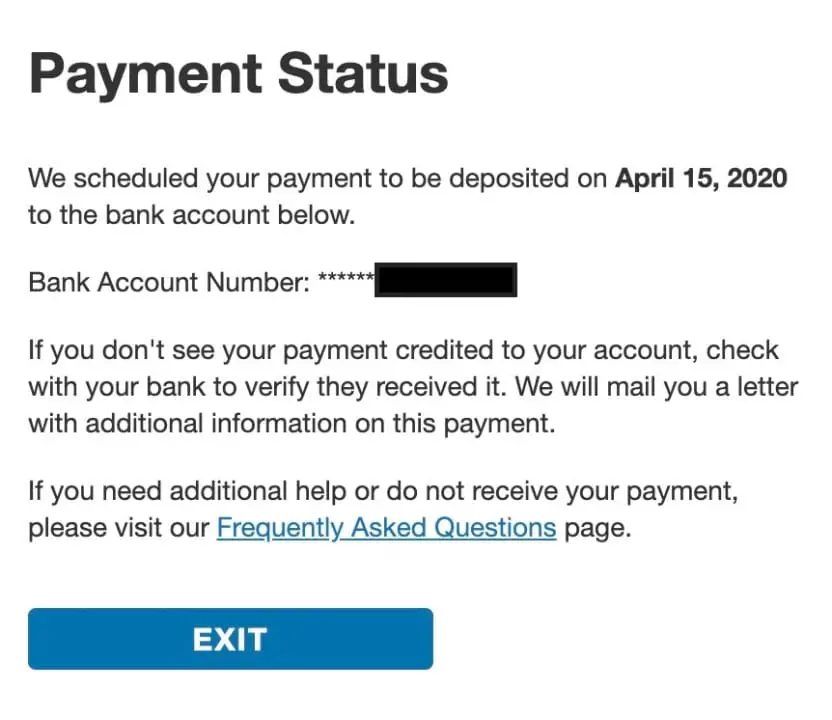

Once youve entered your information, youll get one of two messages:

- If you receive the message Payment Status, this means your check has been processed and will include information such as the payment date and how your check was issued.

- If you receive the message Payment Status Not Available, this means you were either not eligible for a payment, or the IRS wasnt able to issue a payment.

If youve been told your payment status isnt available, heres what to do next.

When Will You Get Your Money

The exact date you’ll receive your money depends on your circumstances, but the IRS has already begun sending electronic payments to millions of Americans.

The speed with which you’ll receive your payment largely depends on how you filed your taxes. The IRS can distribute electronic payments quickly, but they must print and mail paper checks for some recipients, which takes additional time.

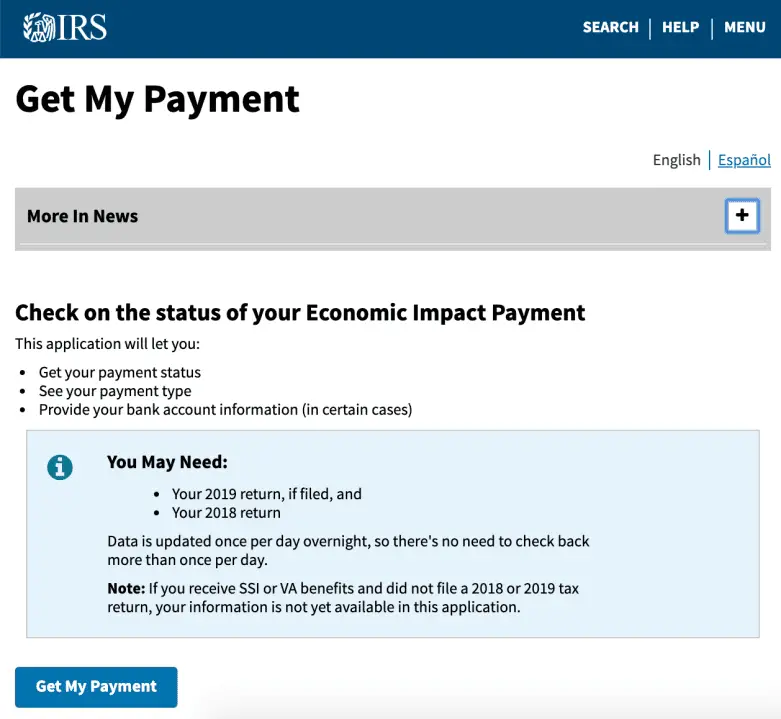

On April 15th, the IRS launched a portal to track the status of your stimulus payment. To track your payment, you’ll need your social security number, your birthday, your address and your zip code provided you filed your 2019 or 2018 tax return. If you are a qualified non-filer, there are additional links on the IRS’s website to input your information so you can still receive your check.

On April 2, Treasury Secretary Steve Mnuchin said that eligible Americans who have signed up for direct deposit payments should receive them within two weeks, a process which is already underway. A spokesperson for the Treasury Department expects 50 million to 70 million Americans to receive their checks via direct deposit by April 15, according to The Washington Post.

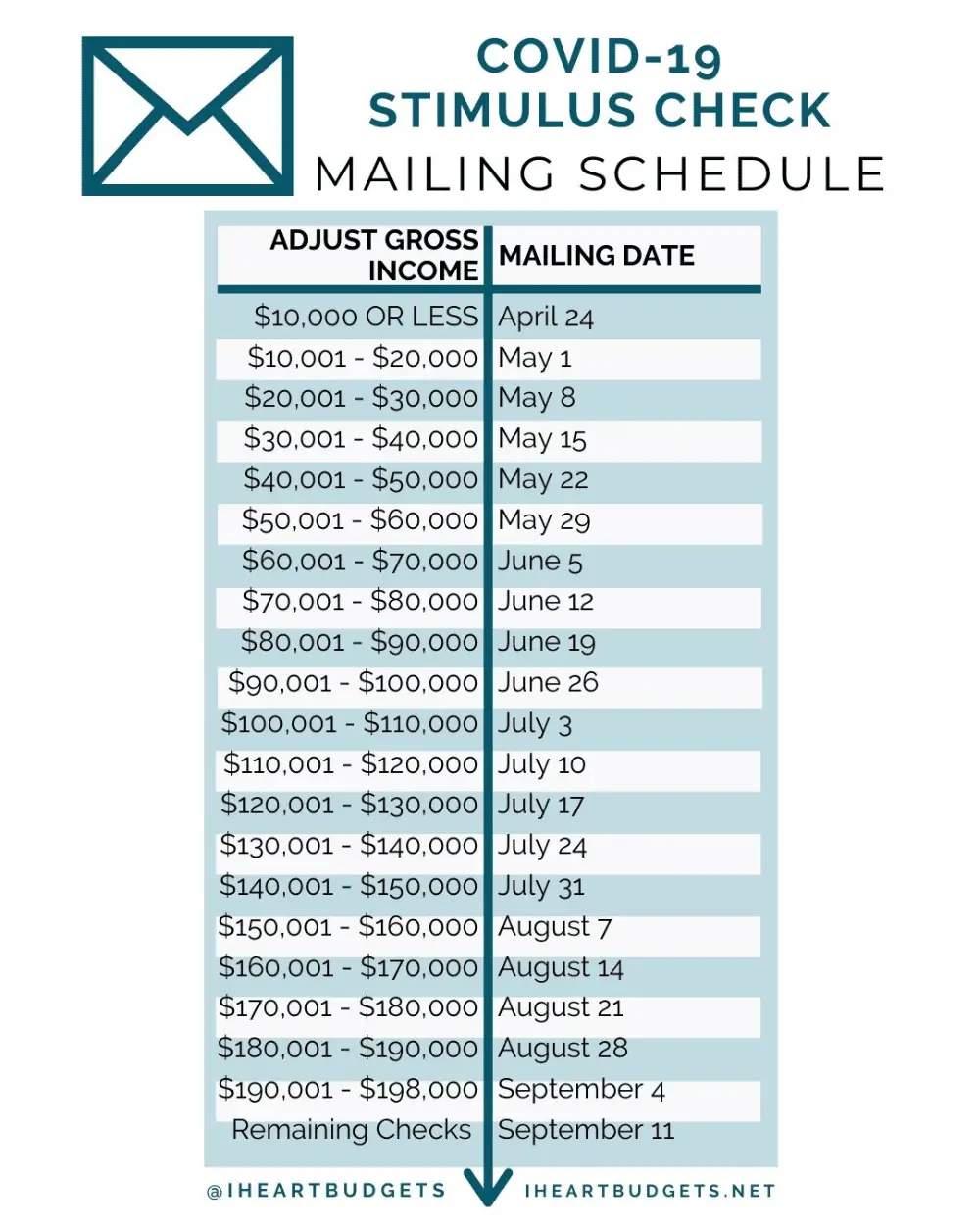

However, if you didn’t sign up for direct deposit when filing your tax return and require a paper check, you might experience some delays. In fact, because the government lacks banking information for millions of Americans, $30 million in paper checks won’t begin distribution until April 24, or longer.

You May Like: Apply For Fourth Stimulus Check

How To Check Your Tax Refunds

As you are already aware, the federal government of the United States, with the help of the Internal Revenue Service, initiates tax refunds to all eligible Americans who file income tax returns.

Apart from that, the federal government also announced some relief during the pandemic in the years 2020 and 2021. All of these reliefs are supposed to be processed by the Internal Revenue Service.

All Americans are well aware of its tax refunds and returns. That is why the Internal Revenue Service launched two portals for all Americans to check their tax refunds.

Why Did My Stimulus Check Increase After My Tax Return

This includes those who have received due diligence on their 2019 tax returns, but are now eligible to receive more money after processing their 2020 tax returns, CNBC told CNBC. As the IRS told CNBC, the increase could be due to a drop in income or the emergence of a new dependent. What if you qualify but havent received your payment yet?

You May Like: H& r Block Stimulus Tracker

Stimulus Check Irs Phone Number: Where To Call

The IRS Economic Impact Payment phone number is 800-919-9835. You can call to speak with a live representative about your stimulus check.

Be prepared to sit on hold, though. If the automated responses cant answer your questions and youd like to talk to a live operator, you may join a long waiting list. Some people say they havent even been able to get through.

Thats why the IRS recommends using its dedicated stimulus check portal for fast assistance. It also reminds those who are eligible for a stimulus check but arent required to file a tax return to use the Non-Filers tool to register for their payment.

Looking for more information about stimulus checks? Check out our stimulus check FAQ page for answers to common payment questions.

Read Also: How To Change Your Bank Account For Stimulus Check

How Do I Check On The Status Of My Payment

The IRS created an online tool, called Get My Payment, that can be used to check on the status of your money. It launched Wednesday and is available on the IRS website.

Youll need to enter your Social Security number, date of birth and mailing address in order to track your payment, the Treasury Department said.

Some people who used the tool on Wednesday received a message that their payment status was not available. The Treasury Department suggested checking again because it only updates the tool once daily, usually overnight.

Also Check: Federal Stimulus Pays Off Mortgage

If I Owe Child Support Will I Be Notified That My Tax Return Is Going To Be Applied To My Child Support Arrears

-

Yes.You were sent a noticewhenyour case wasinitiallysubmitted for federal tax refund offset.The federal government shouldsend an offset notice toyouwhenyour stimulus rebate paymenthasactuallybeenintercepted. The noticewill tell youthatyourtax returnhas been applied toyour child support debtand to contactthe Child Support Divisionifyoubelieve this was done in error.

Find Out Which Payments You Received

To find the amounts of your Economic Impact Payments, check:

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page.

IRS EIP Notices: We mailed these notices to the address we have on file.

- Notice 1444: Shows the first Economic Impact Payment sent for tax year 2020

- Notice 1444-B: Shows the second Economic Impact Payment sent for tax year 2020

- Notice 1444-C: Shows the third Economic Impact Payment sent for tax year 2021

Letter 6475: Through March 2022, we’ll send this letter confirming the total amount of the third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need the total payment information from your online account or your letter to accurately calculate your Recovery Rebate Credit. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment.

You May Like: 4 Stimulus Check For Social Security

Stimulus Checks 202: How To Track Payments And Claim Money

If you are an American and paid your taxes earlier this year. It could take months to get back your refund.

However, due to the inconvenience, the IRS inaugurated a tool for all taxpayers who want to track their payments.

The Internal Revenue Service mentioned they processed around 143 million tax returns in the current year. As a taxpayer, you have a high possibility of receiving your money after the established date.

Still Havent Received Your First Or Second Stimulus Check

You may still be eligible. Learn more about eligibility on our website. You can still receive the first and/or second stimulus check by filing your 2020 taxes and claiming the Recovery Rebate Credit to receive any amount owed for you, your spouse, and dependent children under age 17. Check our Tax Help page for more resources on filing taxes.

Entering a bank account when you file taxes will help you receive your stimulus check faster. Learn more on our Banking Help page.

You may be eligible for even more money.

If you plan to file taxes to get your first or second stimulus check, you may be eligible for additional money! Congress has made changes to the Earned Income Tax Credit and Child Tax Credit this year that mean more money for some people. Learn more on our Tax Help page.

Read Also: First Second And Third Stimulus Checks