What If I Am Eligible For The Stimulus Checks But I Didnt File A 2019 Or 2020 Tax Return And Didnt Use The Irs Non

File your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

You can file a tax return even if you dont have a filing requirement to get other tax credits, such as the Earned Income Tax Credit.

If you didnt get your first or second stimulus check or didnt get the full amount that you are eligible for, file a 2020 federal tax return and claim them as part of your tax refund or use GetCTC.org if you dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2021.

Can I Claim A Stimulus Check For Someone Who Is Deceased

Yes. For the third stimulus check, people who have died on or after January 1, 2021, are eligible to receive the third stimulus check. However, for married military couples, the date of eligibility is expanded. If the person who died was a member of the military and died before January 1, 2021, the surviving spouse can still receive the third stimulus check, even if they dont have an SSN.

For the first and second stimulus check, the IRS has stated that people who died on or after January 1, 2020, are eligible to receive both payments.

If they didnt receive the stimulus payments or didnt receive the full amounts that they are eligible for, spouses or other family members can file a 2020 federal tax return and claim it as part of their tax refund or use GetCTC.org if they dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2021.

What If I Filed My Taxes For The First Time In 2020

First-time taxpayers may face additional delays in receiving their stimulus payments.

Before the IRS can issue these stimulus checks, they must receive and process your 2020 tax return. However, due to new tax codes and more complicated tax filings this year , as well as processing stimulus payments, the IRS is backlogged. There are already 6.7 million returns yet to be processed, which is significantly higher than the nearly 2 million delayed returns at this point last year.

Read More: Best Tax Software of 2021

The IRS has said that it continues to process tax refunds while it processes stimulus payments. If you have not filed your 2020 taxes and anticipate a refund, the IRS recommends filing electronically and providing your direct deposit information. According to the IRS.gov, IRS issues more than 9 out of 10 refunds in less than 21 days.

However, the Washington Post reported that some people who filed on Feb. 12 are still waiting for their returns to be processed.

Also Check: Where Is My 2nd Stimulus Check

Where Did The Irs Get My Bank Information For The Covid

The bank account information in Get My Payment came from one of the following sources:

- Your 2020 tax return.

- Your 2019 tax return if your 2020 return was not processed when the IRS started issuing payments.

- Information you entered on your Non-Filer registration in 2020.

- Information you entered on Get My Payment in 2020.

- A federal agency that provides you benefits, such as: the Social Security Administration, Veteran Affairs or the Railroad Retirement Board.

- Federal records of recent payments to or from the government, where available, for those without direct deposit information on file with the IRS.

What If I Owe Child Support Payments Back Taxes Money To Creditors Or Debt Collectors Or Federal Or State Debt

None of the three stimulus checks can be reduced to pay any federal or state debts and back taxes. Unlike the first stimulus check, your second and third stimulus check cannot be reduced if you owe past-due child support payments.

| Federal or State Debt | |

| Protected | Not protected |

If you are claiming the payments as part of your 2020 tax refund , the payments are no longer protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . In other words, if you receive your first or second stimulus checks as part of your tax refund instead of direct checks, it may be reduced.

Don’t Miss: Who Sends The Stimulus Checks

Why Am I Being Mailed A Direct Deposit For My Stimulus Check Payment

Your payment may have been sent by mail because the bank rejected the deposit. This could happen because the bank information was invalid or the bank account has been closed.

Note: You cant change your bank information already on file with the IRS for your first or second Economic Impact Payment. Dont call the IRS, our phone assistors wont be able to change your bank information, either.

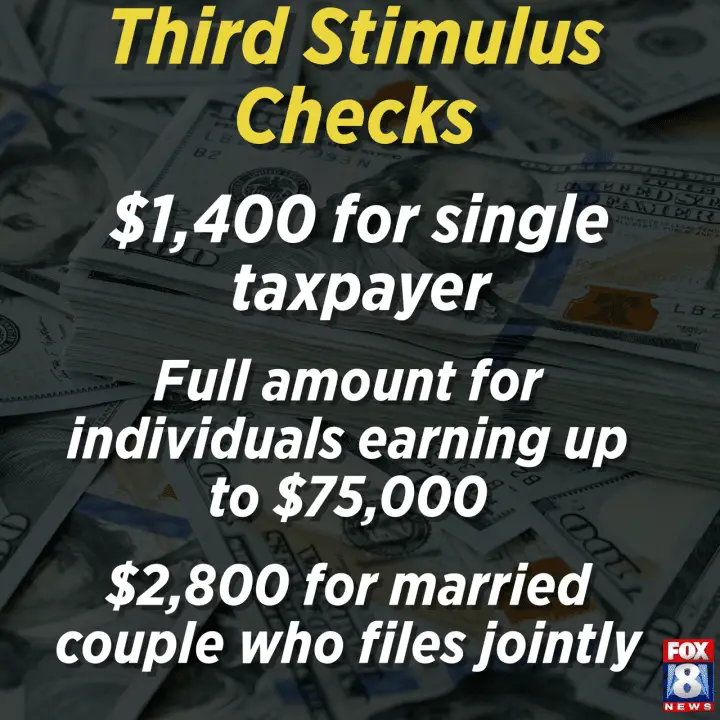

How Much Will The 2021 Stimulus Checks Be

The details have wavered over the past few months, but this is what the U.S. House of Representatives and Senate finally settled on:

-

The government will issue $1,400 relief checks to individuals $2,800 for joint tax returns plus $1,400 multiplied by the number of dependents. An average family of four will receive $5,600.

-

Each recipient generally needs a Social Security number.

-

Payments decrease beginning at adjusted gross incomes over $75,000 for individuals and $150,000 for joint filers or a surviving spouse .

-

Incomes are based on your most recently filed tax return.

Also Check: Who Is Getting The New Stimulus Checks

Things Most Americans Dont Know About Stimulus Checks

When the pandemic struck seemingly out of nowhere, millions of Americans were pushed into unemployment and poverty. We needed help and we needed it bad, which is why the federal government issued three stimulus checks. These payments were used to do everything from cover rent to build up a nest egg.

Anyone following the news coverage of the stimulus rounds likely remembers how complicated the whole affair was. There was always chatter of when and whether we would receive any money at all. In fact, were still having these conversations in 2022.

Though plainly needed, stimulus checks were issued behind a veil of mystery. And there are several facts about them that most Americans may still not know.

Will Social Security Get The Third Stimulus Check

As the COVID-19 pandemic continues, many Americans are wondering if they will receive a third stimulus check. While the answer is not yet clear, there is some speculation that those who receive Social Security benefits may be eligible for additional financial assistance.

As the country continues to grapple with the pandemic, it is important to stay up-to-date on the latest information about stimulus checks. This guide will provide an overview of what is known about the third stimulus check and how it may impact Social Security recipients.

Read Also: How Much Was Stimulus Check

I’m Not A Us Citizen But I Pay Taxes Can I Get A Third Stimulus Check

Under the , non-US citizens, including those who pay taxes, weren’t eligible to receive the $600 payment, unlike with the first round of checks. Under the CARES Act of March 2020, all US citizens and non-US citizens with a Social Security number who live and work in America were eligible to receive stimulus payments. That included people the IRS refers to as “resident aliens,” green card holders and workers using visas such as H-1B and H-2A.

If your citizenship status has changed since you first got a Social Security number, you may have to update the IRS’ records to get your check. US citizens living abroad were also eligible for a first payment.

For the third payment, the new law includes checks for “mixed-status” citizenship families — families with members with different immigration statuses — who were left out of the first two checks.

What counts as income? That depends on your personal circumstances.

Why Did I Only Get Half Of My 3rd Stimulus Check

The IRS says that some married couples filing jointly may have only received half the amount they’re eligible to receive. The IRS is working on getting the remainder out to eligible couples. Your payments may arrive via different methods, so watch the mail in case you get a check or EIP card for the missing amount.

Don’t Miss: How Do I Claim My Third Stimulus Check

How Do I Claim This Last Stimulus Check

If you believe you are owed a third government payment but did not get it, you must fill out the Recovery Rebate Tax Credit worksheet and submit it with your 2021 tax return. The worksheet explains how to calculate the amount of money you are eligible to receive.

You can find the Recovery Rebate Tax Credit worksheet by

Most families received $1,400 per person from the third stimulus check, which included all dependents declared on their tax return. A single person with no dependents would typically earn $1,400, while a family of four would receive $5,600.

If you never received the third stimulus check, you can use the Internal Revenue Service’s “Get My Payment” tool, which is only available on IRS.gov and is available in English and Spanish. It updates once a day, generally throughout the course of the night.

Furthermore, if you’re concerned about the status of your third stimulus payment, you can use “track your payment” to get a tax refund for the amount owing to you.

First Round Of Economic Stimulus Checks: April 2020

The CAREs Act included a provision for a round of stimulus payments eligible tax-paying adults received a check of up to $1,200 while eligible dependents under 16 years of age received $500 each .

The payments were made to everyone earning under the income limits, which were set at Adjusted Gross Income of $75,000 with the stimulus check value reducing in a tapered fashion up to a maximum of $99,000 . The very first stimulus checks were paid into people’s bank accounts over the weekend of the 11 and 12 of April, either via direct deposit into individuals bank accounts, paper checks sent through the post or in some cases, through a prepaid debit card, the Economic Impact Payment Card which were sent out in late May/early June last year.

Recommended Reading: How To Check On Stimulus Payment For Non Filers

What Should I Do If My Unemployment Benefits Payment Was Mailed But The Post Office Was Unable To Deliver It

Once we receive your payment back, you may be able to provide your bank account information in Get My Payment to have your payment reissued as a direct deposit.

If this is the case, then Get My Payment will show Need More Information, usually two to three weeks after the payment is issued. At this point, you can enter a routing and account number for your bank account, prepaid debit card or alternative financial product that has a routing and account number associated with it.

If you do not provide account information, your payment will be reissued when we receive an updated address.

If you need to update your address, the easiest way to do it is by filing your 2020 tax return with your current address, if you havent already done so. The fastest way to file the return and update your address is to file the return electronically.

Second Round Of Direct Payments: December 2020

The second round of aid, a $900 billion package which was part of the Coronavirus Response and Relief Supplemental Appropriations Act of 2021 was signed off by Trump on 27 December 2020. It provided a one-off check of up to $600, but this time, households were also able to claim an additional $600 for child dependents aged 16 or under. Those who earned under $75,000 in the 2019 tax year received the full stimulus check, while a steadily smaller figure was given to those on a higher annual income, up to a maximum phase-out limit of $87,000. The first payments, through direct deposit and paper checks with some later payments made by EIP 2 Cards, were issued between 29 December 2020 and 15 January 2021.

Those who didnt receive a stimulus payment either through the CARES Act or the December Covid-19 Relief bill were able to claim for it retroactively when they filed their federal tax returns for 2020 through the IRS Recovery Rebate Credit.

Don’t Miss: Were There Any Stimulus Checks In 2021

Can You Receive Social Security Benefits If You Are Disabled

There are a few things to know about Social Security and stimulus checks. The first is that you cannot receive Social Security benefits if you are disabled. The second is that, if you are receiving Social Security benefits, you may be eligible for a stimulus check.

The Social Security Administration has said that, in order to receive benefits, you must be able to show us medical evidence that you cannot work. If you cannot work, then you cannot receive Social Security benefits.

However, if you are receiving Social Security benefits, you may be eligible for a stimulus check. The government has said that people who are receiving Social Security benefits will automatically get their stimulus checks.

How Are Married Couples Affected If Only One Spouse Has A Social Security Number

As with EIP2, joint filers where only one spouse has a Social Security number will normally get the third payment. This means that these families will now get a payment covering any family member who has a work-eligible SSN.

For taxpayers who file jointly with their spouse and only one individual has a valid SSN, the spouse with a valid SSN will receive up to a $1,400 third payment and up to $1,400 for each qualifying dependent claimed on the 2020 tax return.

Active Military: If either spouse is an active member of the U.S. Armed Forces at any time during the taxable year, only one spouse needs to have a valid SSN for the couple to receive up to $2,800 for themselves in the third stimulus payment.

You May Like: How Much 2021 Stimulus Check

I Think I’m Eligible What Do I Need To Do To Get A Stimulus Check

Nothing. The first two rounds were issued automatically, and the third will be, as well.

The fastest way to get your stimulus check is via direct deposit. Without that information, the IRS will mail you either a debit card or paper check. You can track your money using the IRS Get My Payment tool.

If you believe you qualify for the third stimulus check but don’t receive one â or you believe it’s in the wrong amount â there are options. Either the IRS will send you the money you deserve after you file your 2020 taxes or you’ll be able to claim the Recovery Rebate Credit on your 2021 return, according to The Wall Street Journal.

Can I Get A Stimulus Payment If Someone Claims Me As An Adult Dependent On Their Tax Return

Some older people may count as a dependent on someone else’s taxes, called a “qualifying relative.” For example, you may live with your children. In terms of stimulus check qualifications, the main tax filer would’ve had to claim you as a dependent on their tax form 1040.

A qualifying relative can be any age. To be counted as a qualifying relative on someone’s tax return, the person must meet four criteria. They…

- Don’t count as a qualifying child dependent.

- Live with the family member all year as a member of the household, or count as a relative who doesn’t have to live with the family member all year .

- Must have a gross income for the year of less than $4,200.

- Must have more than half of their support during the year come from the family member.

If you were a dependent on someone else’s taxes and were over the age of 16, you weren’t qualified for any stimulus money at all in the first or second round of stimulus checks. The new law, however, allows dependents of all ages to be eligible to add up to $1,400 to the household’s total payment.

There are a few reasons why some older adults may not have gotten a first or second stimulus check.

Also Check: Telephone Number For Stimulus Check

Can You Get A Recovery Rebate Credit If You Got Your Third Check

In a very specific circumstance, people who receive the third stimulus check may still be able to claim the Recovery Rebate Credit on their taxes. The amount of money each taxpayer received in their Economic Impact Payment was calculated based on the number of dependents in their household on their 2019 taxes. If the household gained a new dependent by the 2020 tax filing season, the taxpayer would be eligible to receive a plus-up payment. This would bring their original check amount in line with what they wouldve been eligible for if their new dependent had been accounted for initially.

For example, a married couple who had a baby in 2020 may have initially received a $2,800 third stimulus check $1,400 for each spouse. They wouldve become eligible for a plus-up payment of $1,400 due to the 2020 birth of their baby. If they didnt receive a plus-up payment by the end of December 2021, they could claim a $1,400 Recovery Rebate Credit on their 2021 taxes.

Many Americans didnt receive third stimulus checks. In some cases, it was because they filed their 2020 taxes late. In other cases, the IRS simply didnt get to them in time. Either way, all eligible taxpayers who havent received third stimulus checks can take action by claiming the 2021 Recovery Rebate Credit on their 2021 taxes.

How Are Americans Using Stimulus Checks

The Federal Reserve Bank of New York says that households are spending a smaller percentage of their stimulus checks and saving more. The that households set aside just under 25% of their third-round payments for consumption. This share fell from just over 29% of first-round payments reported in June 2020 and almost 26% of second-round payments reported in January 2021.

The table below is based on all three SCE surveys and breaks down the average percentage of stimulus payments spent, saved and used to pay off debt:

| New York Fed SCE Breakdown of Stimulus Check Spending | |

| Payment Round | |

| 37.4% | 33.7% |

The New York Fed also says that households expect to spend an average 13% of the third stimulus check on essential items and an average 8% on non-essential items.

For a comparison, preliminary data collected by the U.S. Census Bureau from shows that the majority of stimulus recipients are almost three times more likely to use checks to pay down debt than add to their savings.

An earlier showed that the majority of recipients who got the first stimulus check spent their payment on household expenses. Adults with incomes between $75,000 and $99,999 told the Census that they would most likely pay off debt or add to their savings. While adults making less than $25,000 said they would use their stimulus to pay for expenses.

For those households that spent their first stimulus checks, the study says:

Don’t Miss: N.c. $500 Stimulus Check