Fourth Stimulus Check: Are More Payments Coming

Here’s what we know about a possible fourth stimulus check

A fourth stimulus check from the government could take one of two forms: monthly checks in fairly small amounts, or one-time payments of up to $2,000.

Both options have been put forward by legislators in Congress as follow-ups to the third round of pandemic relief payments, which were made possible by the American Rescue Plan Act of March 2021.

The U.S. economy is still recovering, with slow but steady job growth even as unemployment numbers hold steady and the Delta variant of COVID-19 causes hospitalization rates to soar.

The federal moratorium on evictions ended Aug. 26 with a Supreme Court ruling , and millions now face losing their homes. Inflation , however, appears to be on the rise, contributing to fears among economists and lawmakers that further stimulus payments could only fuel more price hikes.

As a result, there’s no legislation in Congress that’s likely to pass that would create a fourth round of stimulus payments, even though some Democratic lawmakers have called on President Joe Biden to consider recurring payments.

The White House has passed back the buck, stating that the president would consider whatever Congress comes up with.

“We’ll see what members of Congress propose,” Psaki added, “but those are not free.”

Should You Opt Out Of The Child Tax Credit Monthly Payments

The first round of payments from the new Child Tax Credit were sent out last week but some families may decide not to receive the monthly support. As is explained here in this report from YahooFinance, taking the monthly payments could leave you forced to repay some of the money if you experience an income gain during the rest of 2021.

One of the most popular, and most expensive, financial relief programmes introduced by the federal government in the last 18 months is the stimulus checks. These direct payments have provided a direct cash injection to help pay for essentials and revive the flailing economy.

The IRS is still in the process of sending out payments as part of the third round of stimulus checks, which is already the largest of the three rounds of payments. But how many stimulus checks have been sent in total?

Fourth Stimulus Check Update: How To Get Another $1400 Direct Payment

Some Americans will be eligible for a $1,400 stimulus check this year even if Congress doesn’t pass any legislation for another round of checks.

Republicans and Democrats fought hard over the issue of stimulus checks after passing the first round in 2020, so most Americans have already received all the money they’re likely to get. However, some Americans will be able to claim additional payments when they file their taxes and they could be eligible for the full $1,400 payment.

One way Americans could be eligible for a full $1,400 payment is if they had a child in 2021. Why? Because the 2021 Economic Impact Payments were based on a person’s 2020 or 2019 return. So, any eligible dependent that came into the family last year wouldn’t have been included in the payment amount.

Those who have a child who qualifies for the Recovery Rebate Credit can claim the dependent when they file their 2021 tax return this year. To be eligible, the child must be under 19 at the end of the year unless they’re a student and a child, brother, sister, foster child, stepsibling, half-brother or half-sister or a descendant of any of them.

Unlike the first two rounds of payments, which limited dependent eligibility to just children, the third stimulus check made accommodations for dependents of all ages. So, a person who adds a parent or grandparent or another eligible dependent to their household could also be eligible for a $1,400 payment.

Also Check: When Was 3rd Stimulus Check Mailed

More Stimulus Payments In The Inflation Reduction Act

President Biden and the Democrat controlled Congress narrowly passed a scaled down version of the Build Build Better act, known as the Inflation Reduction Act .

While this includes funding for several groups and additional taxes for corporations, it does not include another stimulus payment in 2022 or in 2023.

While many individuals and families could have benefited from some form of government support, especially in a high inflation environment, there simply was not enough political support for further payments or tax credit expansions.

Get the latest money, tax and stimulus news directly in your inbox

How To Claim A Missing Payment

You may be eligible to claim a Recovery Rebate Credit on your 2020 or 2021 federal tax return if you didn’t get an Economic Impact Payment or got less than the full amount.

It is important to understand that the Economic Impact Payments applied to different tax years. Depending on whether you missed the first, second or third payment, you will need to file either a 2020 or 2021 tax return to claim a Recovery Rebate Credit.

You May Like: Irs Stimulus Check Tax Return

No Economic Recovery For Others

The pandemic has further highlighted the growing imbalance across the broader economy. While many households have financially flourished during COVID, many others have fallen behind where they were in early 2020. Much of the gap depends on whether wage earners could work remotely during the shutdown or had public-facing jobs that required them to be on-site.

Financial insecurity is still widespread, and the loss of a job and the loss of hours have been some of the main reasons over the course of the pandemic. Nine percent of American adults reported a shortage of food in their household over the previous week, according to a Center on Budget and Policy Priorities analysis of U.S. Census survey data from late August. Approximately 15 percent of renters have fallen behind on their rent, including 22 percent of renters with children in their household. The federal eviction moratorium, which has been extended until October 3, doesn’t forgive rent that is owed, it pushes the debt into the future. And evictions continue in some parts of the country regardless. Meanwhile, only a fraction of the $46 billion Congress allocated for rental assistance has actually made it to tenants and landlords. As of late August, over a quarter of American adults reported some difficulty keeping up with expenses in the prior week.

Will There Be A Fourth Stimulus Check From The Government

Some lawmakers pushed for a fourth stimulus check to help Americans who were struggling to rebuild after COVID-19 and its economic impact. But that stimulus never happened.

With the economy and jobs both on the upswing after the country started to reopen, another federal stimulus check didnt seem necessary. But some states took matters into their own hands and sent out a fourth stimulus check to their residents.

Read Also: Stimulus Checks For Social Security Disability

Fourth Stimulus Check Amount

The fourth stimulus check amount depends on several factors. If passed, it would probably look similar to the previous checks, although that’s not guaranteed.

For reference, the first stimulus check amounted to as much as $1,200, while the second stimulus check brought $600 to eligible Americans. The third stimulus check, which the IRS is still in the process of distributing, is worth up to $1,400 per person, although the eligibility requirements are narrower.

All three checks gave the full amounts to taxpayers who made up to $75,000 a year, according to their most recent tax returns. Couples filing jointly got the full payment if they had a joint total income of $150,000 or less.

With the first two checks, those making up to $99,000 alone or $198,000 as a couple received prorated payments. With the third check, individuals who earned more than $80,000 per year or $160,000 per year as joint filers got nothing. Our guide to thestimulus check calculator can show you what your own eligibility looks like.

New Mexico: $500 Rebates

In early March, Gov. Michelle Lujan Grisham signed a law to send multiple rebates to state taxpayers.

Taxpayers earning under $75,000 annually received a rebate of $250 . The rebate was issued in July and sent automatically to taxpayers who filed a 2021 state return.

Another rebate was issued to all taxpayers. Single filers received $500, and joint filers received $1,000. This rebate was split into two equal payments, delivered in June and August 2022. The funds were sent automatically to taxpayers who filed a 2021 state return.

A taxpayer earning under $75,000 annually could potentially receive up to $750 with the combined rebates.

Residents who dont file income tax returns should have received a rebate in July. Single individuals without dependents received $500 households with married couples or single adults with dependents received $1,000.

If you file your 2021 state income tax return by May 31, 2023, youll receive your rebate by direct deposit or check. If you owe tax from your 2021 return, it will be deducted from your rebate amount.

Read more: New Mexico Residents To Receive Tax Rebate Of Up To $500

You May Like: Stimulus Check 2022 Who Qualifies

Stimulus Check Payout Schedule

The IRS has confirmed that the distribution of economic impact payments has started and millions of Americans should have their stimulus check payment by now. Note that this will likely only apply to those receiving the payment via direct deposit . You can see the status of your stimulus check payment on the IRS Get My Payment portal.

- Direct Deposit payments will generally be deposited 2 to 3 days after the IRS confirms income eligibility for the payout.

- Physical checks will take at least 6 to 8 weeks to be mailed out.

Social Security Retirees and Disability recipients who are eligible for the payment will get the stimulus checks/payments deposited the same way they currently get their payments.

Given over 120 million Americans could be eligible for the payment, it will take a while to process the stimulus checks.

Get the latest money, tax and stimulus news directly in your inbox

What If I Was Underpaid Or Overpaid

First, double-check how much money you should be getting and make sure the amount you think youre supposed to get is right. You can do this on the IRSs Child Tax Credit Eligibility Tool or by checking to see what amount is on the letter that the IRS sent to you at the beginning of July .

If it still looks a little weird to you guys, then head over to the IRS Portal and make sure they have your latest information.

Don’t Miss: Get My 2nd Stimulus Payment

Do I Have To Pay Taxes On My Stimulus Payment

No. Since the stimulus check is considered a refundable tax credit, it is not classified as earned income. Hence not considered taxable income you will have to report in your 2020 tax return . It also wont affect your income for purposes of determining eligibility for federal government assistance or benefit programs.

This payment also does not have to be paid back if any over payment happens or your gross income in 2020 changes. This includes your income rising to above the qualifying thresholds. If you unexpectedly got the payment, congratulations! You get to keep it now.

Returning Incorrect Stimulus Check Payments

A few people have commented that a spouse, relative or child who died since they filed a 2018 or 2019 tax return received a stimulus check payment. The IRS has provided official guidance on this issue which states that any payments made to someone who died before receipt of the payment should be returned to the IRS in full. The exception to this is for payments made to joint filers and one spouse who had not died before receipt of the Payment, in which case, you only need to return the portion of the Payment made on account of the decedent

What Is The New Child Tax Credit Amount

Heres how the numbers break down: The American Rescue Plan bumps the Child Tax Credit up to $3,000 for children ages 617 and $3,600 for children under age 6.3 Expecting a baby in 2021? First of all, congrats! And heres some more good news for youbabies born in 2021 will qualify for the full $3,600. Have a college student? Parents can receive a one-time payment of $500 for each full-time college kid ages 1824.4

So, for a family that has three children , heres how it all breaks down:

Lets say they have three kids that are ages 12, 7 and 4 and a household income of $72,000 a year. Their new Child Tax Credit would be $9,600.

But remember, instead of applying the full amount of the credit to income taxes they might owe or getting a refund after they file their taxes, parents can get the credit up front in monthly payments of $250 for each qualifying child .5 So that family of three in our example would get $800 a month from July through December. Wow!

Right now, this change would be only for 2021but theres talk in Congress and the White House to make it a permanent thing for the next five years under Bidens American Families Plan. Yep, there are a lot of plans and acts to keep straight these days.

Also Check: What Were The Three Stimulus Payments

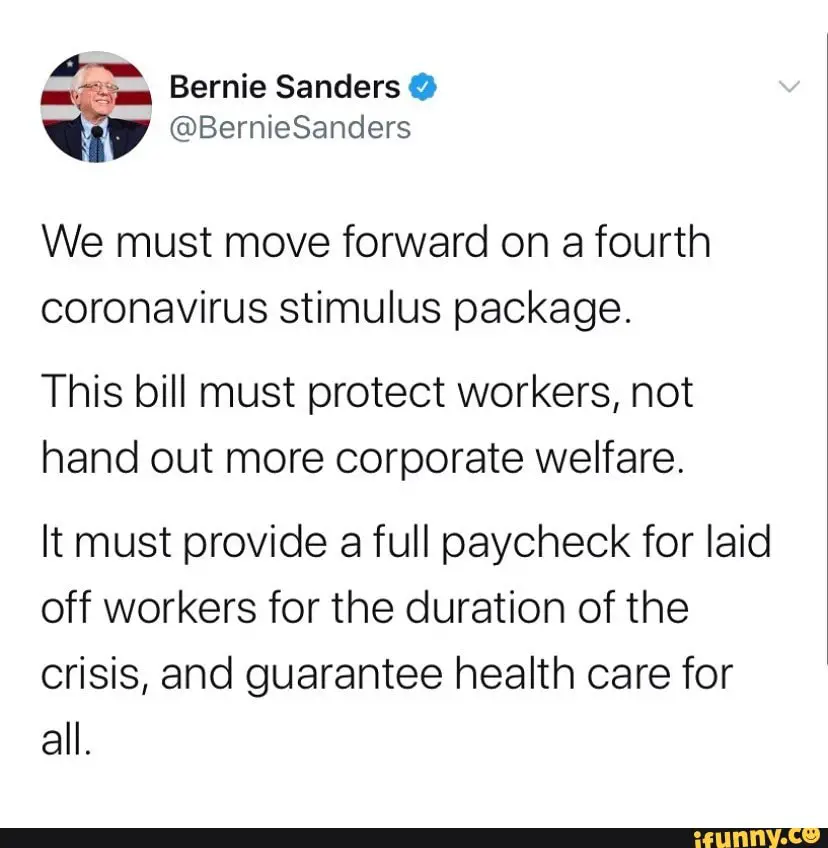

Support For A Fourth Stimulus Check

A group of Democratic Senators, including Ron Wyden of Oregon, Elizabeth Warren of Massachusetts and Bernie Sanders of Vermont, sent a letter to President Joe Biden at the end of March requesting “recurring direct payments and automatic unemployment insurance extensions tied to economic conditions.”

As the Senators reasoned in their letter, “this crisis is far from over, and families deserve certainty that they can put food on the table and keep a roof over their heads. Families should not be at the mercy of constantly-shifting legislative timelines and ad hoc solutions.”

An earlier letter to President Biden and Vice President Kamala Harris from 53 Representatives, led by Ilhan Omar of Minnesota, carved out a similar position. “Recurring direct payments until the economy recovers will help ensure that people can meet their basic needs, provide racially equitable solutions, and shorten the length of the recession.”

Additional co-signers included New York’s Alexandria Ocasio-Cortez and Michigan’s Rashida Tlaib, two other notable names among House Progressives. The letter didn’t place a number on the requested stimulus payments. But a tweet soon after put it at $2,000 per month for the length of the pandemic.

$2,000 monthly payments until the pandemic is over.

Ilhan Omar

Do People Need A Fourth Stimulus Check

According to CNBC , there is a case for a fourth stimulus check that goes beyond the calls from lawmakers. The Economic Security Project, a progressive organization that advocates for guaranteed income no matter what the state of the economy, says there’s a need for more stimulus checks.

We need at least one more check, said Adam Ruben.

Ruben, the campaign director at the Economic Security Project, also said that stimulus checks should be “automatic,” and not stalled as they were last summer when second stimulus check negotiations caused a long gap between the $1,200 and $600 payments.

There are signs of recovery, though. The June jobs report showed a gain of 850,000, which was better than expected, according to The New York Times . That’s the strongest one-month gain since last summer.

Likewise, the Commerce Department said that gross domestic product had grown at an annualized rate of 6.5% for April through June of 2021, surpassing the figure it had reached before the pandemic, the Washington Post reported. However, that was less than the 8% GDP growth some economists had forecast.

Regardless, certain lawmakers are pushing for relief.

This unprecedented moment demands an unprecedented response. People dont only need relief, they need stability, certainty, and predictability and the ABC Act delivers them exactly that,” said Rep. Pramila Jayapal .

However, Senate Minority Leader Mitch McConnell, R-Kentucky, didn’t appear to agree.

You May Like: How To Check On Stimulus Payment For Non Filers

Child Or Dependent Qualification For The $500 Payment

Several readers have asked questions around the $500 child dependent additional stimulus payment. To get this payment you must have filed a 2018 or 2019 tax return and claimed the child as dependent ANDthe child must be younger than 17-years-old at the end of 2020. They must also be related to you by blood, marriage, or adoption . There is no limit to the number of dependents who can qualify for the additional $500 in one household.

This age limit is much younger than what is used by the IRS in the qualifying child test where a child must be younger than 19 years old or be a student younger than 24 years old as of the end of the calendar year. Hence the confusion being caused by this. So just remember if your child or eligible dependent is 17 or over you cannot claim the stimulus payment for them.

College Kids and High School Seniors

The younger than 17 yr old requirement has ruled out several thousand college students and high school kids who are older than 17, but still being claimed as a dependent by their parents on their federal tax return.

However if you are a college student AND filed a recent tax return you can qualify for a standard/adult stimulus check per the above eligibility rules. But note as soon as you file a return you cannot be claimed as a dependent by others, which means they lose certain other tax benefits and credits.

Scammers Are Targetting Your Irs Tax Refund

Since the start of the pandemic the federal government has introduced various forms of financial relief to help Americans through the pandemic. After the stimulus checks and additional unemployment benefits came a new tax break which exempted jobless support recipients from paying tax.

Much of that money is now being sent out in the form of a tax refund but criminals are attempting to scam the rightful beneficiaries out of that cash. Here, the IRS runs through some of the most common scams…

Also Check: Is There Another Stimulus Check Coming In 2022