What Does Aarps Coronavirus Stimulus Check Calculator Do

President Biden signed the American Rescue Plan into law on March 11, 2021. Our calculator provides an estimate of the amount you might receive in a third federal stimulus check, based on the information you enter. This is only an estimate the actual amount you receive, if any, will be determined by the Internal Revenue Service , the government agency in charge of disbursing the third round of stimulus checks, formally known as economic impact payments.

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

How Is The Third Stimulus Check Calculated

The stimulus plan mandates the treasury to rely on 2019 and 2020 tax returns to calculate how much you could get for the third round of stimulus checks.

Congress approved limits based on adjusted gross income ranges. This means that taxpayers making less than the minimum threshold could get the full stimulus check, while those earning above it get reduced payments until they are fully phased out at higher incomes.

You can find your AGI on IRS form 1040. This is calculated by subtracting deductions like student loan interest, health savings account payments, and contributions to a traditional IRA from your gross income.

By contrast, your gross income is the total amount of money that you made during the tax year, including wages, dividends, capital gains, rental property income and other types of revenue.

Your 2019 taxes had to be filed by July 15, 2020. And your 2020 taxes are due by the extended deadline of May 17. You can read more about when to file your tax returns for the third stimulus check, and other IRS requirements in two tax sections below.

Read Also: How Many Irs Stimulus Payments In 2021

What Is The 2021 Stimulus Based On

The amount of the third-round Economic Impact Payment was based on the income and number of dependents listed on an individual’s 2019 or 2020 income tax return. The amount of the 2021 Recovery Rebate Credit is based on the income and number of dependents listed on an individual’s 2021 income tax return.

Was There A Stimulus Check In 2021

Stimulus Update | 2021 $1,400 stimulus payment can be claimed for dead people in 2022. BALTIMORE The American Rescue Plan signed into law by President Joe Biden in March of 2021 delivered $1,400 stimulus checks to most Americans. The money was intended to help people get through the COVID-19 pandemic.

Recommended Reading: How To Recover Stimulus Check

Amount Based On 2019 Or 2020 Tax Return

For third-round stimulus payments, eligibility and amounts were based on either your 2019 or 2020 return. If your 2020 tax return wasn’t filed and processed by the IRS by the time the tax agency started processing your third stimulus payment, then the IRS used information from your 2019 tax return. If your 2020 return was already filed and processed when the IRS was ready to send your payment, then your stimulus check eligibility and amount was based on the information on your 2020 return. If your 2020 return was filed and/or processed after the IRS sent you a third stimulus check, but before December 1, 2021, the IRS sent you a second “plus-up” payment for the difference between what your payment should have been if based on your 2020 return and the payment actually sent based on your 2019 return. As a result, your third stimulus check may have been higher or lower depending on when you filed your 2020 tax return.

Find Out Which Payments You Received

To find the amounts of your Economic Impact Payments, check:

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page.

IRS EIP Notices: We mailed these notices to the address we have on file.

- Notice 1444: Shows the first Economic Impact Payment sent for tax year 2020

- Notice 1444-B: Shows the second Economic Impact Payment sent for tax year 2020

- Notice 1444-C: Shows the third Economic Impact Payment sent for tax year 2021

Letter 6475: Through March 2022, we’ll send this letter confirming the total amount of the third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need the total payment information from your online account or your letter to accurately calculate your Recovery Rebate Credit. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment.

Also Check: How Can I Check For My Stimulus Payment

How Does The Irs Calculate Eligibility For The Third Stimulus Package

To calculate the stimulus payment the IRS will use the information about your income from the 2019 tax return if your 2020 tax return isnt filed and processed yet.

The payment also depends on how many dependents you have, if you file separately or jointly, and on your gross adjusted income .

There is one more thing that the government is trying to do: to target the households that need money the most and to support businesses during the hard times.

What else is new? All dependents can qualify for an additional $1,400 payment. For example, elderly relatives and college students age 23 or younger can qualify for the check.

Second Round Of Direct Payments: December 2020

The second round of aid, a $900 billion package which was part of the Coronavirus Response and Relief Supplemental Appropriations Act of 2021 was signed off by Trump on 27 December 2020. It provided a one-off check of up to $600, but this time, households were also able to claim an additional $600 for child dependents aged 16 or under. Those who earned under $75,000 in the 2019 tax year received the full stimulus check, while a steadily smaller figure was given to those on a higher annual income, up to a maximum phase-out limit of $87,000. The first payments, through direct deposit and paper checks with some later payments made by EIP 2 Cards, were issued between 29 December 2020 and 15 January 2021.

Those who didnt receive a stimulus payment either through the CARES Act or the December Covid-19 Relief bill were able to claim for it retroactively when they filed their federal tax returns for 2020 through the IRS Recovery Rebate Credit.

Recommended Reading: Get My 2nd Stimulus Payment

How Will Dependents Get Their Stimulus Check

One major difference between this round of checks and the last two is that dependents of any age are eligible to get money.

But to be clear: Eligibility for a stimulus check lies with the person who claims the dependent on their tax return. In most cases that’s a parent or caregiver. They’re the person who qualifies and gets paid. An additional $1,400 is added to that person’s check for each dependent with a Social Security number who is claimed on their tax return.

According to the IRS, adults who rely on another person for more than half of their expenses can be claimed as a dependent. That includes students up to age 19, or age 24 for full-time college students. Dependent adults can also include disabled people and retirees.

Who Is Eligible For The Third Economic Impact Payment And What Incomes Qualify

Generally, if you are a U.S. citizen or U.S. resident alien, you are eligible for the full amount of the third Economic Impact Payment if you are not a dependent of another taxpayer and have a valid Social Security number and your adjusted gross income on their tax return does not exceed:

- $150,000 if married and filing a joint return or if filing as a qualifying widow or widower

- $112,500 if filing as head of household or

- $75,000 for eligible individuals using any other filing statuses, such as single filers and married people filing separate returns.

Payments will be phased out or reduced — above those AGI amounts. This means taxpayers will not receive a third payment if their AGI exceeds:

- $160,000 if married and filing a joint return or if filing as a qualifying widow or widower

- $120,000 if filing as head of household or

- $80,000 for eligible individuals using other filing statuses, such as single filers and married people filing separate returns.

For example, a single person with no dependents and an AGI of $77,500 will normally get a $700 payment . A married couple with two dependents and an AGI of $155,000 will generally get a payment of $2,800 . Filers with incomes of at least $80,000 , $120,000 and $160,000 will get no payment based on the law.

You May Like: When Should I Get My Stimulus Check

More Money For Certain Families

One big change with third stimulus checks was that an extra $1,400 was tacked on to your payment for any dependent in the family. For the first- and second-round payments, the additional amount allowed $500 for first-round payments and $600 in the second round was only given for dependent children age 16 or younger. As a result, families with older children, including college students age 23 or younger, or with elderly parents living with them, didn’t get the extra money added to their previous stimulus payments. That’s not the case for third-round stimulus checks.

‘a Blessing To’ Category

With the past year being a financially tumultuous one for many, families may want to think about designating a portion of their $5,600 stimulus cash to give back.

Consider looking up a local food pantry or community organization near you that you can use your funds to help out. You can also make a charitable gift to a non-profit or private foundation of your family’s choice.

“This will help the family focus on their own blessings, as well as receive the joy that comes from being able to help someone else out,” Wells says.

You May Like: What’s Happening With The Stimulus Checks

I Didn’t File A 2019 Or 2020 Tax Return And Didn’t Register With The Irsgov Non

Yes, if you meet the eligibility requirements. While you won’t receive an automatic payment now, you can still get all three payments. File a 2020 return and claim the Recovery Rebate Credit.

The IRS urges people who don’t normally file a tax return and haven’t received any stimulus payments to look into their filing options. The IRS will continue reaching out to non-filers so that as many eligible people as possible receive the stimulus payments they’re entitled to.

The IRS encourages people to file electronically, and the tax software will help figure the correct stimulus amount, which is called the Recovery Rebate Credit on 2020 tax forms. Visit IRS.gov/filing for details about IRS Free File, Free File Fillable Forms, free VITA or TCE tax preparation sites in the community or finding a trusted tax professional.

Where Is My 3rd Stimulus Check

Check for your status at www.irs.gov/coronavirus/get-my-payment. The third round of Economic Impact Payments will be based on a taxpayer’s latest processed tax return from either 2020 or 2019. That includes anyone who used the IRS non-filers tool last year, or submitted a special simplified tax return.

You May Like: How Many Federal Stimulus Checks Were Issued In 2021

Where Did The Irs Get My Bank Information For The Covid

The bank account information in Get My Payment came from one of the following sources:

- Your 2020 tax return.

- Your 2019 tax return if your 2020 return was not processed when the IRS started issuing payments.

- Information you entered on your Non-Filer registration in 2020.

- Information you entered on Get My Payment in 2020.

- A federal agency that provides you benefits, such as: the Social Security Administration, Veteran Affairs or the Railroad Retirement Board.

- Federal records of recent payments to or from the government, where available, for those without direct deposit information on file with the IRS.

Can I Use The Calculator If I Havent Filed A Tax Return For 2020

Yes, you can use your 2019 tax return. The IRS emphasizes that if you use your 2020 return to estimate your payment, dont guess your AGI: File an accurate return first. Adjusted gross income, as the name implies, is your gross income minus certain adjustments such as educator expenses, student loan interest, alimony payments and qualifying contributions to retirement accounts. You can find AGI on line 11 of your 2020 federal 1040 income tax return or line 8b of your 2019 return.

If you werent able to claim your earlier $1,200 or $600 stimulus checks, you can do so on your 2020 tax returns. Use the Recovery Rebate Credit Worksheet and enter the amount from the worksheet onto Line 30 of your 1040.

Recommended Reading: When Did The Stimulus Checks Go Out In 2021

What Are The Eligibility Requirements For A Third Stimulus Check

The details are still being discussed in House committees this week while the Senate is in recess. However, these are the likely basic eligibility requirements based on Bidens American Rescue Plan, which is serving as the template, and the House Ways and Means Committee Recovery Rebates proposal.

All estimates are based on the most recent AGI on file with the IRS and, like the last two checks, up to a maximum ceiling will gradually phase out.

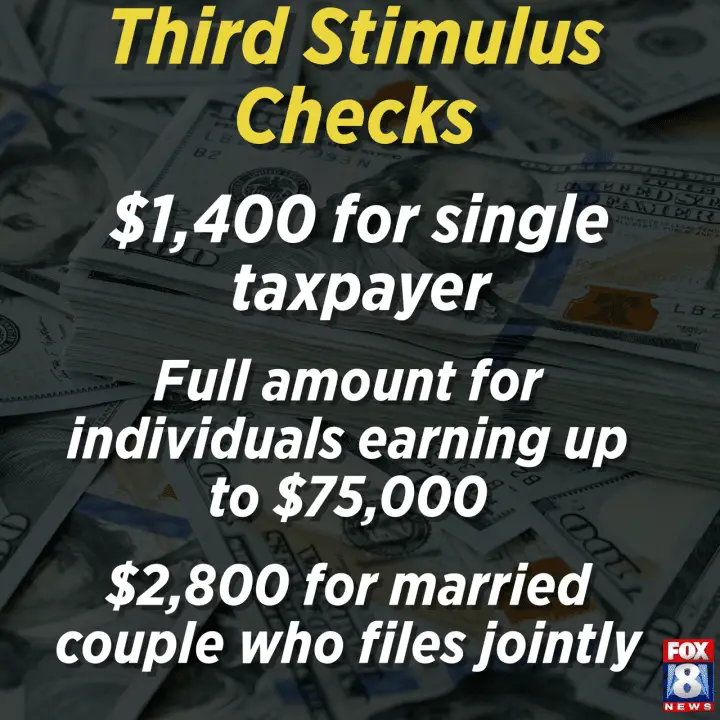

Maximum available amounts for lowest earners

- $1,400 for qualifying individuals

- $2,800 for qualifying couples who file a joint tax return

- $1,400 for each dependent child under the age of 17

- $1,400 for each qualifying adult dependent

Qualifying income thresholds and phase out limits

- Single filers: under $75,000 gets full amount, phase-out begins thereafter. AGI of $100,000 and over gets no check.

- Joint filers: under $150,000 gets full amount, phase-out begins thereafter. AGI of $200,000 and over gets no check.

- Head of household: under $112,000 gets full amount, phase-out begins thereafter. AGI of $150,000 and over gets no check.

Head of household includes those who are single, widowed or divorced and claim a child as a dependent, for instance.

Did I Get A Stimulus Check In 2021

The third round of Economic Impact Payments was authorized by the American Rescue Plan Act of 2021 as an advance payment of the tax year 2021 Recovery Rebate Credit. … The IRS has issued all third Economic Impact Payments and related plus-up payments. Most eligible people already received their Economic Impact Payments.

Don’t Miss: Where’s My Stimulus Money 2021

Third Stimulus Check: Your Next Relief Payment May Not Be $1400

A third stimulus check is part of the $1.9 trillion economic relief package signed into law by President Biden. Aside from the $1,400 payment, the American Rescue Plan also includes extended unemployment benefits, a bigger child tax credit and billions more dollars to stop the spread of COVID-19. These and other programs aim to support millions of Americans dealing with financial troubles brought on by the pandemic. Theyre also designed to support the economy as vaccinations continue.

The third stimulus check polls very well among the public, as does the third stimulus package in general. However, Republicans and some centrist Democrats pushed back against the overall price tag and other specific aspects of the plan. Democrats, who control both houses of Congress, passed the stimulus legislation with narrow majorities. Budget reconciliation let them sidestep the filibuster in the Senate. But the slim majority gave moderate Democrats like Joe Manchin of West Virginia more power to make changes. That led to the elimination of the minimum wage hike and the unemployment benefit increase.

Also Check: How Are Stimulus Checks Distributed

Third Stimulus Check Calculator

President Biden signed the American Rescue Plan Act on March 11, 2021. Provisions in the bill authorized a third round of stimulus checks worth $1,400 for each eligible person , plus an additional $1,400 for each dependent. However, as with the first- and second-round payments, the third-round stimulus checks were reduced or eliminated for people with an income above a certain amount.

If you didn’t receive a third stimulus check, or didn’t receive the full amount, you can get any money you’re entitled to by claiming the recovery rebate tax credit on your 2021 tax return. If you’re wondering if you qualify for the credit, comparing what you should have received to what you actually received is a good place to start .

To see how large your third stimulus payment should have been, answer the three questions in the calculator below and we’ll give you a customized estimate.

You May Like: Who Qualify For Third Stimulus Check

Is There A Deadline To Get My Third Stimulus Check

If you will be filing a full tax return, you have until the IRS closes their tax filing software on November 20, 2021. After this date, you can still claim the third stimulus check in 2022 by filing your taxes for Tax Year 2021.

If youre not required to file taxes, the deadline to use GetCTC.org is November 15, 2021. You can get the Recovery Rebate Credit using GetCTC.org, a simplified tax filing portal for non-filers. GetCTC is an IRS-approved service created by Code for America in partnership with the White House and U.S. Department of Treasury. You can use the portal even if youre not signing up for the Child Tax Credit advance payments.