What Is The Foreign Tax Credit

The foreign tax credit is a non-refundable credit that will reduce your US tax liability dollar-for-dollar for taxes you paid to a foreign country. Simply put, if you paid taxes to a foreign country, you can claim these foreign taxes as a credit against your US taxes. If you paid more taxes to a foreign country, than usually you will owe no US tax on that income.

Applications For Economic Relief Payments For Non

Applications for economic relief payments for non-filers extended until June 10

State to deliver millions in rebates, economic aid this summer

SANTA FE The New Mexico Taxation & Revenue Department and Human Services Department are partnering to deliver income tax rebates and economic relief payments signed into law by Gov. Michelle Lujan Grisham earlier this spring. Applications for non-filers to receive the relief payment are extended until 5 p.m. on June 10, 2022.

Approximately 33,544 applicants are currently eligible for a relief payment and about $18.1 million in relief payments are expected to be issued this July based on the applications approved so far.

In addition to the millions of dollars in automatic rebates allocated to taxpayers, $20 million was appropriated during the 2022 Special Legislative Session for financial relief for New Mexicans who do not file taxes, such as low-income seniors and some individuals with disabilities. New Mexicans who do not file income tax returns are eligible to apply for the economic relief payment.

The deadline to apply for a relief payment was extended to June 10, because there is still approximately $1.9 million in available funding through the program. The original deadline to apply was May 31.

If non-filer funding does run out, a non-filer will still have the option of filing a New Mexico Personal Income Tax return to obtain a rebate as late as May 31, 2023.

Will You Have To Pay Back The Money

Many people have questions about the economic stimulus payments. The CARES Act makes it clear that the stimulus payment is a unique fully refundable tax credit. Recipients are getting this special tax credit in advance.

Tax filers will technically claim the tax credit on their 2020 taxes, provided one earns enough in 2020 that requires filing a tax return. This advance tax credit will basically wash itself out so filers will not be able to benefit from it twice .

The stimulus checks are nontaxable. As such, they will not be included in 2020 as reportable income. They are officially described in the CARES Act as a Recovery Rebate for Individuals.

Caveat: I am not a professional tax preparer or tax attorney.

Read Also: How Can I Get My 3rd Stimulus Check

Millions In State Tax Refunds Heading To Unclaimed Property If Taxpayers Dont Claim Themcontinue Reading

BATON ROUGE Louisiana taxpayers have until Oct. 6, 2022, to claim millions of dollars in state income tax refunds before they become unclaimed property.

The Louisiana Department of Revenue sent letters to 20,400 individual and business taxpayers advising them to claim their refunds before they are transferred by law to the Unclaimed Property Division of the state treasurers office. More than $36 million in unclaimed refunds is due for transfer if not claimed from LDR.

To claim a refund, complete and return to LDR the voucher in the Notice of Unclaimed Property letter dated Aug. 18, 2022. The department will issue paper checks to all taxpayers submitting completed vouchers by the Oct. 6 deadline.

Any refund not claimed by the deadline remains the property of the taxpayer, and can be retrieved from the Unclaimed Property Division.

Social Security Recipients Will Automatically Receive Payments

On April 1st, the U.S. Department of the Treasury and the Internal Revenue Service announced that Social Security beneficiaries who are not typically required to file tax returns will not need to file an abbreviated tax return to receive an Economic Impact Payment. Instead, payments will be automatically deposited into their bank accounts.

Social Security recipients who are not typically required to file a tax return do not need to take any action, and will receive their payment directly to their bank account.

The IRS says it will begin sending electronic payments to those who qualify and have direct-deposit information on file on April 9th. Those who qualify but havent provided the IRS with bank information through a tax return, TurboTaxs online stimulus check web portal, Social Security or railroad retirement benefits tax form will begin receiving paper checks beginning April 24th.

You May Like: File Taxes To Get Stimulus

Theres Still Time To Get Payments

If you havent yet filed your tax return, you still have time to file to get your missed 2021 stimulus payments.

Visit ChildTaxCredit.gov for details.

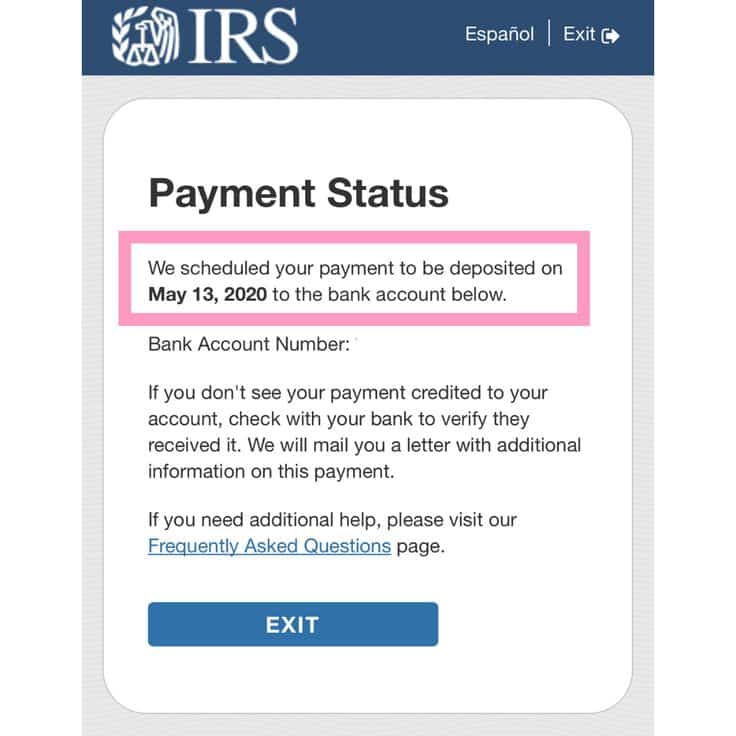

The IRS has issued all first, second and third Economic Impact Payments. You can no longer use the Get My Payment application to check your payment status.

Most eligible people already received their Economic Impact Payments. However, people who are missing stimulus payments should review the information below to determine their eligibility to claim a Recovery Rebate Credit for tax year 2020 or 2021.

Securely access your IRS online account to view the total of your first, second and third Economic Impact Payment amounts under the Tax Records page.

Eip2 Irs Treas 310 Xxtaxeip2

If youve seen IRS Treas 310 or xxtaxEIP2 on your bank statements, know that this refers to the second Economic Impact Payment. Some taxpayers will also receive their stimulus payments as a debit card or a paper check. The US Department of Treasury will issue debit cards first until it runs out and checks will replace debit cards.

Those who received their first stimulus payments as a debit card might receive a paper check this time or the complete opposite.

You May Like: Can I Still Get Stimulus Check

How Do I Get It

- The stimulus payments will be processed by the IRS.

- If you have already filed a 2019 tax return, you will get the stimulus payment automatically. You will receive it in the same form as your tax refund. If you requested direct deposit, then the stimulus will be direct deposited. If you requested a paper check, then the stimulus will be mailed to the same address on your 2019 tax return.

- If you entered your information into the IRS non-filer portal earlier in 2020, you will get the stimulus payment automatically. You do not have to do anything.

- If you receive one of the following benefits, you will get the stimulus payment automatically. You do not have to do anything.

- Social Security

Checks Started Arriving On October 7

Funds began arriving on Friday, Vigliotti noted, with people receiving either a debit card in the mail or a direct deposit to their bank account.

But it could take a few days or weeks for the money to arrive. Still, about 90% of people who receive direct deposits will get their payments by the end of October, according to the California Franchise Tax Board.

On social media, some people said they had received their checks via direct deposit on Friday, while others said they were still waiting.

You May Like: I Still Haven’t Gotten My Stimulus

$300 Check Due To Be Refunded To Taxpayers Today & Direct Payment Tomorrow

Filers cannot be claimed as a dependent of another taxpayer and have an adjusted gross income of $75,000 or less if single.

If you’re head of the household you must have an income of $112,250 or less, $150,000 or less if married filing a joint return.

Reduced payments are available for those who earn more than the above amounts but still earn less than $99,000 per year or less for individuals.

If you’re the head of the household, you must have an income of $136,500 per year or less and $198,000 per year or less for married filing jointly.

Amount And Status Of Your Third Payment

You can no longer use the Get My Payment application to check your payment status.

To find the amount of the third payment, create or view your online account or refer to IRS Notice 1444-C, which we mailed after sending your payment. Were also sending Letter 6475 through March 2022 confirming the total amount of the third Economic Impact Payment and any plus-up payments you were issued for tax year 2021.

You can also securely access your individual tax information with an IRS online account to view your total Economic Impact Payment amounts under the 2021 tax year tab. You will need the total of the third payment and any plus-up payments you received to accurately calculate the 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022.

Read Also: Wheres My 1st And 2nd Stimulus Check

Read Also: How Many Stimulus Checks Did I Get In 2021

Who Is Eligible For The Child Tax Credit 2021

Eligible Americans with income below $75,000, or married couples with income below $150,000, were eligible for the full amount of three rounds of stimulus payments that were made by the federal government in 2020 and 2021. Those stimulus income limitations also applied to the enhanced child tax credit although partial child tax credits were available for people with higher incomes.

Advance payments of the enhanced child tax credits were sent to people from July to December 2021. The monthly payments were up to $250 or $300 per child, for a period of six months.

Claiming Your Stimulus Check On Your 2020 Expat Tax Return

This article is for US expats who did not receive their Economic Impact Payment . For expats who did not receive a stimulus check yet, we have good news for you! You can still claim your Economic Impact Payment as a refundable credit on your 2020 expat tax return! This is even applicable for expats who dont owe any US tax at all !

Also Check: Are They Sending Out Stimulus Checks

Some Debit Cards Are Eligible To Receive Payments

Debit cards that are used by many tax preparation companies such as H& R Block and Intuits TurboTax as well as the Direct Express programs do qualify to receive these direct payments. Thats because these cards are linked to an actual bank account and all should qualify for the economic stimulus direct payment. This is relatively new information.

Penalty Relief For Certain 2019 And 2020 Returns

To help struggling taxpayers affected by the COVID-19 pandemic, the IRS issued Notice 2022-36PDF, which provides penalty relief to most people and businesses who file certain 2019 or 2020 returns late. The IRS is also taking an additional step to help those who paid these penalties already. To qualify for this relief, eligible tax returns must be filed on or before September 30, 2022. See this IRS news release for more information on this relief.

Read Also: Where My Golden State Stimulus

How Do I Apply To Receive My Stimulus Checks

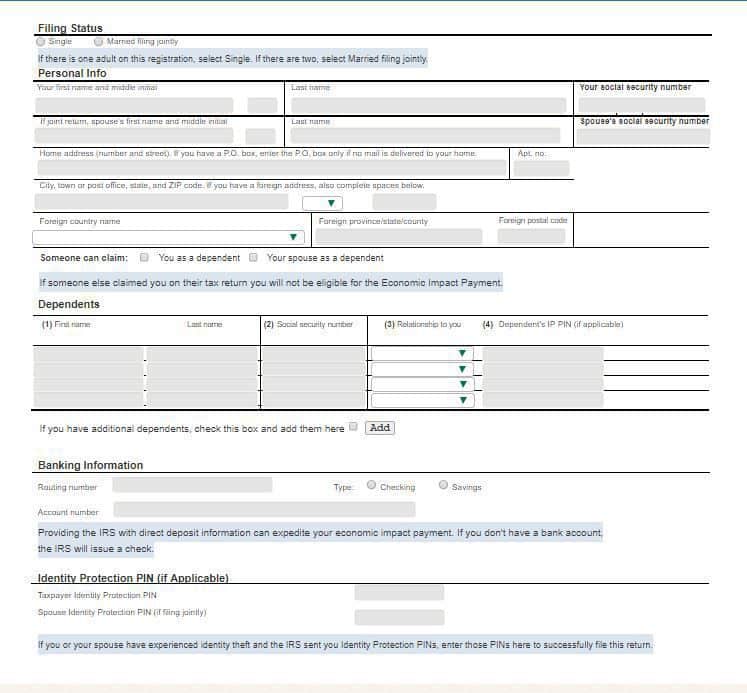

The IRS recommends that individuals with little or no income use its FreeFile program, a resource for low-income Americans to file simplified taxes. The program will be available until mid-November.

To claim missing stimulus funds, people should also visit the Economic Impact Payments website for further instructions to ensure they have all their ducks in a row.

Who Should Use It

This tool is designed for people who didnt file a tax return for 2018 or 2019 and who dont receive Social Security retirement or disability benefits or Railroad Retirement benefits.

Lower income households should also consider using the tool if they havent filed a 2018 or 2019 return because they were under the normal income limits for filing a tax return. This may include single filers who made under $12,200 and married couples making less than $24,400 in 2019.

Supplemental Security Income recipients and those who receive veterans disability compensation, pension or survivor benefits from the Department of Veterans Affairs who did not file a tax return for the 2018 or 2019 tax years can either use the IRSs web portal.

Social Security, Social Security Disability Insurance and Railroad Retirement beneficiaries will automatically receive $1,200 payments. Those in this group who have qualifying children under age 17 may use the tool to claim the $500 payment per child.

Read Also: Where’s My Stimulus Check Nj

How Does The Recovery Rebate Credit Work

If you did not receive a stimulus check, then to claim your economic impact payment you simply need to file your 2020 US expat tax return. If you are eligible, then you can claim the Recovery Rebate Credit and a refund will be sent to you automatically.

Taxpayers who received a stimulus check, but for an amount smaller than what they were entitled to , can claim the remainder of the Economic Impact Payment by filing their 2020 expat return.

Why You May Not Have Gotten All Your Stimmy Money

The third-round stimulus payments, authorized by the American Rescue Plan Act of 2021 and signed into law on March 11, 2021, were sent from March through December last year. Round 3 of the so-called stimmies provided a maximum credit of $1,400 per person, including all qualifying dependents claimed on a tax return.

A married couple with two qualifying dependents, for example, are eligible to receive a maximum credit of $5,600, depending on income limits. And if you brought a baby into the world last year, youll be able to file for up to $1,400 that youre owed for your new family member if you claim the child as a dependent.

The size of the credit, however, gets reduced for single filers with adjusted gross income of more than $75,000 and for married couples filing jointly with earnings of more than $150,000. For heads of household, the credit is reduced between $120,000 and $112,500.

The credit disappears entirely for individuals with AGI above $80,000 and for married couples filing jointly who earn more than $160,000. Heads of household with incomes of more than $120,000 also dont get the stimulus check. Most eligible Americans have already received the payments, according to the IRS.

You May Like: Amending Taxes For Stimulus Check

How To Claim Your Cash

Eligible Americans will be able to request a Recovery Rebate Credit at tax time to get their money they are owed from the IRS.

To be eligible for the full amount on the third round of checks, individuals need to have an adjusted gross income of $75,000 or less and married couples filing jointly need to have an AGI of $150,000 or less.

Those who qualify will be able to claim the child on your 2021 tax return – which will be filed in 2022.

Other Ways To Get Cash

Although not an offer of government support, there are other ways to supplement one’s income.

Some include a cash-back program that allows people to receive credit for purchasing goods.

For example, major cashback site Ibotta claims its average user earns $150 each year from online purchases and groceries.

And TopCashback claims it gives its average member $345 in cash back.

Other incentives come through banks offering huge sign-up bonuses during the pandemic.

There are even sign-up bonuses for getting a job during the nationwide labor shortage.

Given that there is a massive labor shortage, some companies are paying thousands in hiring bonuses in an effort to lure workers in.

In Florida, for instance, teachers and principals will receive $1,000 in stimulus cash for their commitment to educating during the pandemic.

Other states are running similar programs for the education sector and other industries.

Also Check: Is North Carolina Getting Another Stimulus Check

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

at 1-800-829-1040

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

First Round Of Cares Act Stimulus Checks: What Expats Should Know

Q. What did the CARES Act 2020 Coronavirus stimulus check mean for U.S. expats?

A. The CARES Act stimulus check expats got in 2020 was technically a 2020 tax credit in advance.

It was part of the CARES Act Coronavirus stimulus package, which was designed to help get the economy back on its feet while we navigate the COVID-19 pandemic. In it are a variety of benefits for both individuals and corporations to ease the financial burden of the shutdowns and shelter-in-place orders. For the average American, the main benefits are cash payments and a variety of other debt relief options. The amount each taxpayer got depends on a variety of factors.

Q. Did I qualify for a CARES Act stimulus check if I live overseas?

A. Yes, expats qualified for the CARES Act stimulus checks. You qualified if you fell within the income threshold, had a social security number, and filed taxes even if you lived overseas. If you didnt get it, you can still apply for it retroactively as a tax credit on your 2020 tax return.

Q. What is the Recovery Rebate Credit?

A. If you didnt get the full amount you were owed, you may be able to apply for the Recovery Rebate Credit. Any eligible individual who did not receive the full amount of the recovery rebate as an advance payment, also known as an Economic Impact Payment, can claim the Recovery Rebate Credit on a 2020 Form 1040 or Form 1040-SR.

Q. How much was the CARES Act stimulus check for?

Q. Did I have to pay back the amount I got?

A. No

Recommended Reading: Free File Taxes For Stimulus