New Mexico: $500 Rebates

In early March, Gov. Michelle Lujan Grisham signed a law to send multiple payments to state taxpayers.

Low-income New Mexico residents could apply for relief payments of at least $400 starting on September 26. The application deadline was October 7, 2022.

The low-income relief payments are part of a $20 million line item in the state budget for economic relief efforts. Application approvals are limited to the budget allotment and the lowest-income families will be paid first.

Another payment, in the form of a refundable income tax rebate, was issued to all taxpayers. Single filers received $500, and joint filers received $1,000. This rebate was split into two equal payments, delivered in June and August 2022. The funds were sent automatically to taxpayers who filed a 2021 state return.

If you dont typically file a state income tax return but do so for 2021 by May 31, 2023, youll receive your rebate by direct deposit or check. If you owe tax from your 2021 return, it will be deducted from your rebate amount.

Read more: New Mexico Families Receive Rebates Of Up To $1,500 In 2022

Claiming This Money Wont Hurt Your Other Benefits

The IRS is stressing that if you claim these 2021 tax credits, it wont change whether youre eligible for other federal benefits for low-income households namely the Supplemental Nutrition Assistance Program , Supplemental Security Income , Temporary Assistance for Needy Families , or the Special Supplemental Nutrition Program for Women, Infants and Children .

So dont worry about that.

If I Sign Up For The Child Tax Credit Will It Affect My Other Government Benefits

No. Receiving Child Tax Credit payments will not change the amount you receive in other Federal benefits like unemployment insurance, Medicaid, SNAP, SSI, TANF, WIC, Section 8, SSDI or Public Housing. The Child Tax Credit is not considered income for any family. So, these programs do not view tax credits as income.

Recommended Reading: Could There Be Another Stimulus Check

Us Retail Sales Fall In May

U.S. retail sales fell more than expected in May, with spending rotating back to services from goods as vaccinations allow Americans to travel and engage in other activities that had been restricted by the covid-19 pandemic.

Retail sales dropped 1.3% last month, the Commerce Department stated. Data for April was revised higher to show sales increasing 0.9% instead of being unchanged as previously reported. Economists polled by Reuters had forecast retail sales declining 0.8%.

During the pandemic, demand shifted to goods like electronics and motor vehicles as millions of people worked from home, switched to online classes and avoided public transportation.

IRS announces that they have noticed a sharp increase in fraud this tax season, which has created delays in their ability to send funds in a timely manner.

Irs Free File Available Today Claim Recovery Rebate Credit And Other Tax Credits

- Do Your Taxes for Free with Free File English | Spanish

IR-2021-15, January 15, 2021

WASHINGTON IRS Free File online tax preparation products available at no charge launched today, giving taxpayers an early opportunity to claim credits like the Recovery Rebate Credit and other deductions, the Internal Revenue Service announced.

Leading tax software providers make their online products available for free as part of a 19-year partnership with the Internal Revenue Service. There are nine products in English and two in Spanish.

As we continue to confront the COVID-19 pandemic, IRS Free File and certain other similar online tax preparation products such as MilTax Tax Services for the Military offered through the Department of Defense offers taxpayers a free way to do their taxes from the safety of their own home and claim the tax credits and deductions they are due, said Chuck Rettig, IRS Commissioner. We encourage eligible taxpayers to take a look at using Free File, MilTax and similar free online tax preparation products this year, to follow the lead of over 4 million people who took advantage of these free services just last year. An IRS tax refund is often the single largest payment families receive during the year. We know how critical that refund is, especially this year.

IRS Free File online products are available to any taxpayer or family who earned $72,000 or less in 2020. MilTax online software will be available on January 19, 2021.

Don’t Miss: Get My Payment Irs Stimulus

Other Work Continues On Economic Impact Payments Watch Mail For Checks Eip Cards

In addition to work for federal benefit recipients, the IRS also continues to prepare and deliver additional Economic Impact Payments for other eligible individuals as well as deliver tax refunds.

For those receiving payments in the mail, the IRS urges these taxpayers to continue to watch their mail for these payments, which could include a paper Treasury check or a special prepaid debit card called an EIP Card.

Taxpayers should note that the form of payment for the third Economic Impact Payment, including for some Social Security and other federal beneficiaries, may be different than earlier stimulus payments. More people are receiving direct deposits, while those receiving payments in the mail may receive either a paper check or an EIP Card which may be different than how they received their previous Economic Impact Payments.

Recommended Reading: Is Economic Impact Payment Same As Stimulus

If You’re A Nonfiler How Do You Claim Your Missing Stimulus Money Is It A Free Process

In the first round of stimulus checks, the IRS sent letters to 9 million nonfilers with information on how to file a claim to get their missing stimulus money. The agency instructed nonfilers to use the nonfilers tool to enter their information by Nov. 21, 2020. But if you missed the deadline, you can still claim your money as a Recovery Rebate Credit by filing a 2020 federal income tax return — even if you usually don’t have to:

When you file a 2020 Form 1040 or 1040SR you may be eligible for the Recovery Rebate Credit. Save your IRS letter – Notice 1444 Your Economic Impact Payment – with your 2020 tax records. You’ll need the amount of the payment in the letter when you file in 2021.

If you did use the IRS nonfilers tool, you should have automatically received a second payment. If you didn’t, you can still file for that money as a Recovery Rebate Credit as well.

File for your Recovery Rebate Credit as part of a federal tax return this year, even if you don’t normally do so. The IRS started processing 2020 tax returns on , and the federal tax return deadline was extended to May 17 — but you can still file a tax extension.

To get started, most nonfilers are eligible to use the IRS’ Free File tool . As the name suggests, this tool lets you obtain a free federal tax return and in some cases a free state return as well. It’s available to use now.

You May Like: Irs.gov 2nd Stimulus Check

Remaining 12 Million Eligible People Have Very Low Incomes

By definition, the estimated 12 million people not receiving payments automatically have very low incomes because they arent required to file federal income tax returns. Only people with annual income above the following levels have a legal obligation to file a return for 2020: $12,400 for singles, $18,650 for heads of household , and $24,800 for married couples.

The 12 million group is predominantly non-elderly. Many senior citizens are receiving automatic payments because they receive Social Security, Railroad Retirement, SSI, or veterans pensions or disability benefits. Up to 1 million seniors, though, may be eligible for payments but do not receive them automatically.

The outstanding payments amount to roughly $12 billion nationally, which if delivered and spent would not only reduce hardship but also give state and local economies a much-needed boost.

How To Create An Esignature For Your Pdf Document In The Online Mode

Follow the step-by-step instructions below to eSign your non tax filer form:

After that, your irs non filer form is ready. All you have to do is download it or send it via email. signNow makes eSigning easier and more convenient since it provides users with a range of additional features like Add Fields, Merge Documents, Invite to Sign, and many others. And because of its multi-platform nature, signNow works well on any device, personal computer or smartphone, irrespective of the OS.

Read Also: Are We Getting A Fourth Stimulus Check

Read Also: Washington State Stimulus Checks 2022

How To Get Updates On Your Outstanding Stimulus Check Payments

The IRS is continuing to make stimulus check payments for the rest of 2021, working through the outstanding tax returns to find anyone who may be entitled for another payment. Those who suffered a loss of income during 2020 may find that they are now eligible for a larger payment and a supplementary ‘plus-up’ stimulus check payment could now be on its way.

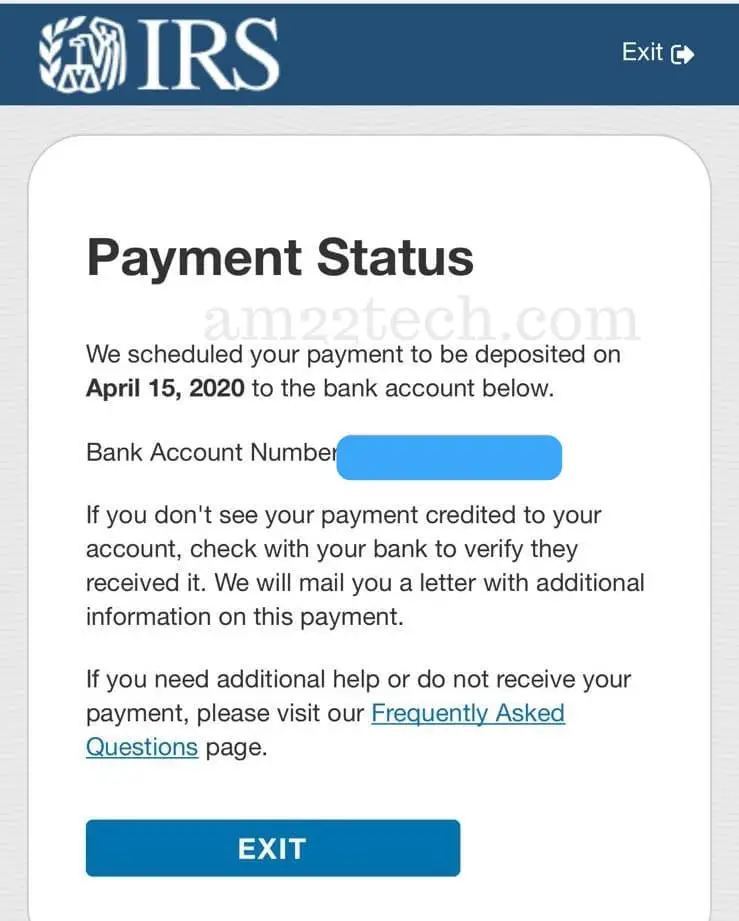

When Will I Get The Payment And What Can I Do If I Dont Get It

The IRS is sending the third round of payments out to American families, but we are not sure how long this will take. We believe the IRS will continue to send the third round of payments until December 2021. Because this third round of stimulus is actually an advance payment of a tax credit for tax year 2021, you should be able to claim this credit on your 2021 tax return if you do not get it by the end of 2021.

You May Like: Irs Gov Stimulus Payment Status

Oregon: Direct Payments Of $600

In March 2022, the Oregon legislature voted to approve one-time $600 payments to some residents. Taxpayers who received the earned income tax credit on their 2020 state tax return, and who lived in Oregon for the last six months of 2020, were eligible to receive one payment per household.

The state used federal pandemic aid to provide these direct payments to low-income residents, and more than 236,000 households received a payment. All payments were distributed by direct deposit or mailed check by July 31, 2022.

New Mexico Offering Stimulus To Those Overlooked By Federal Stimulus Checks

Residents of New Mexico who didnt qualify for federal Economic Impact Payments, better known as stimulus checks, could apply for financial relief from the state beginning 14 June. The New Mexico Human Services Department will started accepting applications Monday which are available at the Yes New Mexico website. All applications must be submitted by 25 June and payments will be issued by the end of July.

The Internal Revenue Service announced on Monday that it has brought back the Non-Filer tool that was first created last year to help taxpayers who dont normally report income claim their $1,200 stimulus check. The updated version will allow those who still havent filed a tax return or used the tool before, to register for the 2021 Child Tax Credit and obtain any stimulus money they havent received yet.

You May Like: When Was The 3rd Stimulus Check 2021

Complete Irs & Tax Representation

How Tax Non-Filers Apply for COVID-19 Stimulus Payment

UPDATE: U.S. residents will receive the Economic Impact Payment, due to the financial domino effects of COVID-19 pandemic. Typically, receiving the payment requires filing a 2019 or 2018 tax return. Here is how to get COVID-19 stimulus payments for people that do not file tax returns.

QUICKLY, THE BASIC RULES

Just a quick refresher on the rules for eligibility, which are basically the same for everyone.You are eligible to receive an amount of up to $1,200 for filing as an individual or head of household, and up to $2,400 for married filing jointly if you are not a dependent of another taxpayer and have a valid Social Security number.

The amount is based on your adjusted gross income. Eligible people will receive some amount of payment if their 2019 AGI fell within the following ranges:

$75,000 and $99,000 for anyone with filing status single or married filing separately 112,500 and $136,500 for anyone with head of household $150,000 and $198,000 for anyone with filing status was married filing jointly.

As we explained in earlier articles, the amount of the reduced payment will be based upon that persons specific adjusted gross income. However, filing status and adjusted gross income is something only identified when you prepare and file a tax return.

WHAT ABOUT PEOPLE THAT DO NOT FILE TAX RETURNS?

CAN STUDENTS QUALIFY FOR A COVID STIMULUS CHECK?

Read Also: The First Stimulus Check Amount

Lower Chamber Passes $2000 Stimulus Checks

The Democratic-led House of Representatives voted 275-134 to meet President Trumpâs demand for $2,000 relief checks on Monday, sending the measure on to an uncertain future in the Republican-controlled Senate.

The House just took a strong, bipartisan vote to pass $2,000 checks.Tomorrow, Iâll move to pass the bill in the Senate.Workers, families, and people are crying out for help.Every Senate Democrat is for this relief.Senate Republicans should not stand in the way.

Chuck Schumer

Trump last week threatened to block massive pandemic aid and spending package if Congress did not boost stimulus payments from $600 to $2,000 and cut other spending. He backed down from his demands on Sunday as a possible government shutdown brought on by the fight with lawmakers loomed.

The bill not only strikes off â$600â from the previous one and replacing it with â$2,000â also includes provisions for overriding Trumpâs veto of the annual defence-policy bill.

Recommended Reading: What Was The Last Stimulus Check

Looking Out For Direct Payments In The Mail

Payment sent through the mail will come in the form of either a paper check or a debit card, the latter of which is intended to speed up the delivery to people. As the IRS noted, the form of payment may differ from the previous two rounds of stimulus checks.

The debit card, known as the Economic Impact Payment Card, will have the Visa name on the front and MetaBank, N.A. on the back. It will come in a white envelope with the U.S. Department of the Treasury seal prominently displayed. More information can be found at EIPcard.com.

Low Expectations As Biden And Putin Meet

U.S. President Joe Biden and Russian President Vladimir Putin square up on Wednesday for their first meeting since Biden took office with deep disagreements likely and expectations low for any breakthroughs.

Both have said they hope their talks in a lakeside Geneva villa can lead to more stable and predictable relations, even though they remain at odds over everything from arms control and cyber-hacking to election interference and Ukraine.

“We’re not expecting a big set of deliverables out of this meeting,” a senior U.S. official told reporters aboard Air Force One as Biden flew to Geneva, saying the two are expected to talk for four or five hours starting at around 13.30 CEST/ 07:30 ET.

“I’m not sure that any agreements will be reached,” said Putin’s foreign policy adviser Yuri Ushakov.

Relations have deteriorated for years, notably with Russia’s 2014 annexation of Crimea from Ukraine, its 2015 intervention in Syria and U.S. charges – denied by Moscow – of its meddling in the 2016 election that brought Donald Trump to the White House.

They sank further in March when Biden said he thought Putin was a “killer”, prompting Russia to recall its ambassador to Washington for consultations. The United States recalled its ambassador in April.

You May Like: Who’s Getting Another Stimulus Check

More Than 32000 Delawareans May Be Eligible For Stimulus Payments

Non-filers have until October 15th to register State Treasurer Colleen Davis urges Delawareans not typically required to file federal income tax returns to watch their mail for a letter from the Internal Revenue Service saying they may qualify for a federal Economic Impact Payment . The letter urges recipients to visit the special Non-Filers:

Child Or Dependent Qualification For The $500 Payment

Several readers have asked questions around the $500 child dependent additional stimulus payment. To get this payment you must have filed a 2018 or 2019 tax return and claimed the child as dependent ANDthe child must be younger than 17-years-old at the end of 2020. They must also be related to you by blood, marriage, or adoption . There is no limit to the number of dependents who can qualify for the additional $500 in one household.

This age limit is much younger than what is used by the IRS in the qualifying child test where a child must be younger than 19 years old or be a student younger than 24 years old as of the end of the calendar year. Hence the confusion being caused by this. So just remember if your child or eligible dependent is 17 or over you cannot claim the stimulus payment for them.

College Kids and High School Seniors

The younger than 17 yr old requirement has ruled out several thousand college students and high school kids who are older than 17, but still being claimed as a dependent by their parents on their federal tax return.

However if you are a college student AND filed a recent tax return you can qualify for a standard/adult stimulus check per the above eligibility rules. But note as soon as you file a return you cannot be claimed as a dependent by others, which means they lose certain other tax benefits and credits.

Read Also: When Were Third Stimulus Checks Sent Out

Effective March 17 2020 Social Security Offices Will Only Offer Phone Service ** Online Services Remain Available **

All local Social Security offices will be closed to the public for in-person service starting Tuesday, March 17, 2020. This decision protects the population we serveolder Americans and people with underlying medical conditionsand our employees during the Coronavirus pandemic. However, we are still able to provide critical services.

Our secure and convenient online services remain available at www.socialsecurity.gov. Local offices will also continue to provide critical services over the phone. We are working closely with the Centers for Disease Control and Prevention , state and local governments, and other experts to monitor COVID-19 and will let you know as soon as we can resume in-person service.

If you need help from Social Security:

To get more Social Security news, follow the Press Office on Twitter @SSAPress.