Second Round Of Direct Payments: December 2020

The second round of aid, a $900 billion package which was part of the Coronavirus Response and Relief Supplemental Appropriations Act of 2021 was signed off by Trump on 27 December 2020. It provided a one-off check of up to $600, but this time, households were also able to claim an additional $600 for child dependents aged 16 or under. Those who earned under $75,000 in the 2019 tax year received the full stimulus check, while a steadily smaller figure was given to those on a higher annual income, up to a maximum phase-out limit of $87,000. The first payments, through direct deposit and paper checks with some later payments made by EIP 2 Cards, were issued between 29 December 2020 and 15 January 2021.

Those who didnt receive a stimulus payment either through the CARES Act or the December Covid-19 Relief bill were able to claim for it retroactively when they filed their federal tax returns for 2020 through the IRS Recovery Rebate Credit.

The $19 Trillion Stimulus Law

The American Rescue Plan is the official name of that massive stimulus legislation enacted in March. It kicked the nations stimulus response into high gear.

Not only did it make the third round of payments possible. It also expanded the federal child tax credit, with Americans getting half of it this year as an advance payment. That advance will span six checks, which the IRS has started sending out monthly. All of which is to say, the 478 million figure we noted above is also a little incomplete.

It doesnt, for example, take into account the child tax credit checks that are coming once a month through December. In all, those will give millions of families as much as $1,800 this year for each eligible child. And theyll get the second half of the tax credit next year.

How To Know If Stimulus Check Has Been Sent

Use the IRS Get My Payment tool to track stimulus money For the third stimulus check: It’s worth visiting the IRS’ online portal designed to track the status of your 2021 payment. Generally, it should tell you when your check will be processed and how you’ll receive it: for example, as a paper check in the mail.

Also Check: How Much Was All The Stimulus Checks

Third Economic Impact Payment Information Available On Get My Payment

You can now check the status of your Third Economic Impact Payment or plus-up payment with the Get My Payment tool.

All first and second Economic Impact Payments have been sent and will no longer appear in Get My Payment. If you didnt get a first or second payment or got less than the full amounts, you may qualify for the 2020 Recovery Rebate Credit and must file a 2020 tax return even if you dont normally file.

The following questions are regarding the Get My Payment application.

On this page

Why cant I access Get My Payment?

To use Get My Payment, you must first verify your identity by answering security questions.

If your answers dont match our records multiple times, youll be locked out of Get My Payment for 24 hours for security reasons. If you cant verify your identity, you wont be able to use Get My Payment. Dont contact the IRS for assistance with a lockout IRS assistors cant unlock your account. For more information, see Error Messages/Lockouts.

If you cant get your payment status because youve been locked out, you must wait 24 hours and try again.

If you verified your identity and received Payment Status Not Available, this means either we have not processed your payment yet, we do not have enough information to issue you a payment or you are not eligible for a payment.

Yes, you can use Get My Payment.

In 10 In The Us Has Unclaimed Money

NAUPA reports that 1 in 10 people in the United States has some kind of unclaimed check or property. Unclaimed property is reported to the state in which the business or organization resides. Therefore, it is common to have unclaimed property in various states, especially if you have moved to another state, adds the association.

Like the TikToker, the Office of the Fiscal Service of the federal government of the United States has recommended that citizens use the National Association of Unclaimed Property Administrators to make their inquiries. They have described it as an excellent resource for people.

You May Like: News About The Stimulus Check

When Should I Get My Payment

The IRS was given hard and fast deadlines to send the two rounds of Economic Impact Payments out to American families. The first round of payments had to be sent out by December 31, 2020. The second round had to be sent out by January 15, 2021.

What this means: If you have not received the first or second round of payments yet, then you will not be getting them in advance. The good news is that you can still do something to get these payments. Read below.

If I Owe Child Support Will I Be Notified That My Tax Return Is Going To Be Applied To My Child Support Arrears

-

Yes.You were sent a noticewhenyour case wasinitiallysubmitted for federal tax refund offset.The federal government shouldsend an offset notice toyouwhenyour stimulus rebate paymenthasactuallybeenintercepted. The noticewill tell youthatyourtax returnhas been applied toyour child support debtand to contactthe Child Support Divisionifyoubelieve this was done in error.

Don’t Miss: How Much Was The Second Stimulus Check

Where Is My 3rd Stimulus Check

Check for your status at www.irs.gov/coronavirus/get-my-payment. The third round of Economic Impact Payments will be based on a taxpayer’s latest processed tax return from either 2020 or 2019. That includes anyone who used the IRS non-filers tool last year, or submitted a special simplified tax return.

Stimulus And Relief Package 2

The second relief package, the Families First Coronavirus Response Act , or Phase Two, was signed into law on March 18, 2020. The law allocated a budget for relief that included the following:

- Providing money for families who rely on free school lunches in light of widespread school closures

- Mandating that companies with fewer than 500 employees provide paid sick leave for those suffering from COVID-19, as well as providing a tax credit to help employers cover those costs

- Providing nearly $1 billion in additional unemployment insurance money for states, as well as loans to states to fund unemployment insurance

- Funding and cost waivers to make COVID-19 testing free for everyone

Separately, on March 18, 2020, the Federal Housing Administration and the Federal Housing Finance Agency implemented foreclosure and eviction moratoriums for single-family homeowners whose mortgages were FHA-insured or backed by Fannie Mae or Freddie Mac. The eviction moratorium on FHA and other government-backed loans was extended to Sept. 30, 2021. Additionally, the FHFA announced on Sept. 24, 2021, that Fannie Mae and Freddie Mac would continue to offer COVID-19 forbearance to multifamily property owners who were experiencing a financial hardship due to the COVID-19 emergency.

Don’t Miss: How Are Stimulus Checks Distributed

More Money For Certain Families

One big change with third stimulus checks was that an extra $1,400 was tacked on to your payment for any dependent in the family. For the first- and second-round payments, the additional amount allowed $500 for first-round payments and $600 in the second round was only given for dependent children age 16 or younger. As a result, families with older children, including college students age 23 or younger, or with elderly parents living with them, didn’t get the extra money added to their previous stimulus payments. That’s not the case for third-round stimulus checks.

How Do I Get My Third Stimulus Check

You dont need to do anything if:

- You have filed a tax return for tax year 2019 or 2020.

- You are a Social Security recipient, including Social Security Disability Insurance , railroad retiree. Or you are a Supplemental Security Insurance and Veterans Affairs beneficiary.

- You successfully signed up for the first stimulus check online using the IRS Non-Filers tool or submitted a simplified tax return that has been processed by the IRS.

The IRS will automatically send your payment. You can check on the status of your third stimulus check by visiting the IRS Get My Payment tool, available in English and Spanish.

If you are missing your third stimulus check, file your 2020 tax return or use GetCTC.org if you dont have a filing requirement. By submitting your information to the IRS, you will be signed up and automatically sent the third stimulus check.

Recommended Reading: Will We Be Getting Another Stimulus

What To Do If You Cant Find Your Stimulus Check

If your IRS online account shows that you should have received a stimulus payment, but you didnât get it, thereâs a chance it could have been lost in the mail. Or you might have thrown away the prepaid debit card you received.

If you lost your stimulus check or suspect it was stolen, you can request the IRS trace your payment. If the IRS determines your check hasnât been cashed, it will issue a credit to your account. It canât reissue your payment, but you can claim the payment on your 2021 tax return using the Recovery Rebate Tax Credit worksheet.

If a trace is initiated and the IRS determines that the check wasnât cashed, the IRS will credit your account for that payment. However, the IRS canât reissue your payment. Instead, you will need to claim the 2021 Recovery Rebate Credit on your 2021 tax return if eligible.

If you lost your EIP card, a prepaid debit card on which some individuals received their stimulus payment, contact card issuer MetaBank to request a replacement.

What Do I Do With The Stimulus Check Letter

If you are using a professional tax preparer, give them Letter 6475 along with all of your other applicable tax documents. If youâre preparing your own return, use the amount shown in Letter 6475 in the Recovery Rebate Worksheet to determine if any credit applies. Then enter that credit on Line 30 of IRS Form 40.

The Recovery Rebate Worksheet is included in the instructions for IRS Form 1040 and calculated automatically by tax preparation software.

âHaving the wrong amount on your return could trigger a manual review,âaccording to the H& R Block website, which could delay a refund for weeks.

You May Like: Stimulus Check Who Gets It

What Steps Do I Need To Take To Receive An Economic Impact Payment

If you receive certain social security, retirement, disability, survivors, railroad retirement, or veterans benefits, you may automatically qualify to receive a payment. Learn more to see if this applies to you.

For most people, you will not need to take any action and the IRS will automatically send you your payment. For some people who are eligible for a payment, the IRS will need more information from you first before they can send you money. You will do this using one of two different IRS portals. It is important that you provide this information using the right IRS portal so that the IRS can process your information quickly.

- If you already filed your 2018 or 2019 taxes, go to the IRS Get My Payment portal to check the status of your payment. This portal will let you know if your payment has been processed and let you know if the IRS needs more information before sending you your payment.

- If your payment has already been processed, the IRS does not need any more information from you at this time.

- If you paid additional taxes when you filed your tax return, it is possible that the IRS does not have your payment account information to direct deposit your payment. You can provide that directly in the portal so that they can process this information quickly and send you your payment. If the IRS does not have your direct deposit information and you dont provide it to them, your payment will be sent to you by check to the address they have on file.

How To Claim Your Recovery Rebate Credit

A reminder: The IRS will not automatically calculate any Recovery Rebate Credit amount for which you may be entitled when you file.

âIndividuals must claim the 2021 Recovery Rebate Credit on their 2021 income tax return in order to get this money,â the IRS said in its fact sheet.

To see if you are eligible for a payment, you can find more information on the Recovery Rebate Credit on the agencyâs website.

If you have no income or up to $73,000 in income, you can file your federal tax return for free using the IRSâ Free File program.

For people who already received their third stimulus checks, there is no need to include information on those payments in their 2021 returns, according to the IRS.

If you are still missing a first or second stimulus check that was sent by the government in 2020, you will have to file a 2020 tax return rather than claim that money on your 2021 return, according to the IRS.

Read Also: Update On Ssdi Stimulus Check

Read Also: Irs Social Security Stimulus Checks Direct Deposit

Stimulus And Relief Package 4

On Dec. 21, 2020, Congress passed the CAA, a 900 billion stimulus and relief bill, attached to the main omnibus budget bill. Then-President Trump signed the bill on Dec. 27, 2020, but urged Congress to increase the direct stimulus payments from $600 to $2,000. Its contents, as of Dec. 28, 2020, included:

If you were eligible for stimulus payments and missed out on getting them, you can file for a Recovery Rebate Credit. You can claim this refundable tax credit when you file your 2021 tax return, and 2020 as wellâif you havenât yet filed for that year.

Why Cant I Get On The Get My Payment Site

The IRS said this can happen if people dont provide security answers that match the tax agencys information over the course of several attempts to log in. The IRS asks for personal information such as a Social Security number, birthdate and address.

If you cant verify your identity, you wont be able to use Get My Payment, the IRS said. Dont contact the IRS for assistance with a lockout IRS assisters cant unlock your account.

However, the site will allow you to try again after 24 hours.

Don’t Miss: Sign Up For Stimulus Check

If You Provided Information Using The Irs Non

If you provided your personal information to the IRS using the non-filers portal, your money will be direct deposited into the bank or credit union account or prepaid card that you provided when you submitted your information. If you did not provide payment account information, a check will be mailed to you to the address you provided.

No matter how you receive your payment, the IRS will send you a letter in the mail to the most current address they have on file about 15 days after they send your payment to let you know what to do if you have any issues, including if you havent received the payment.

Who May Still Be Eligible For More Money

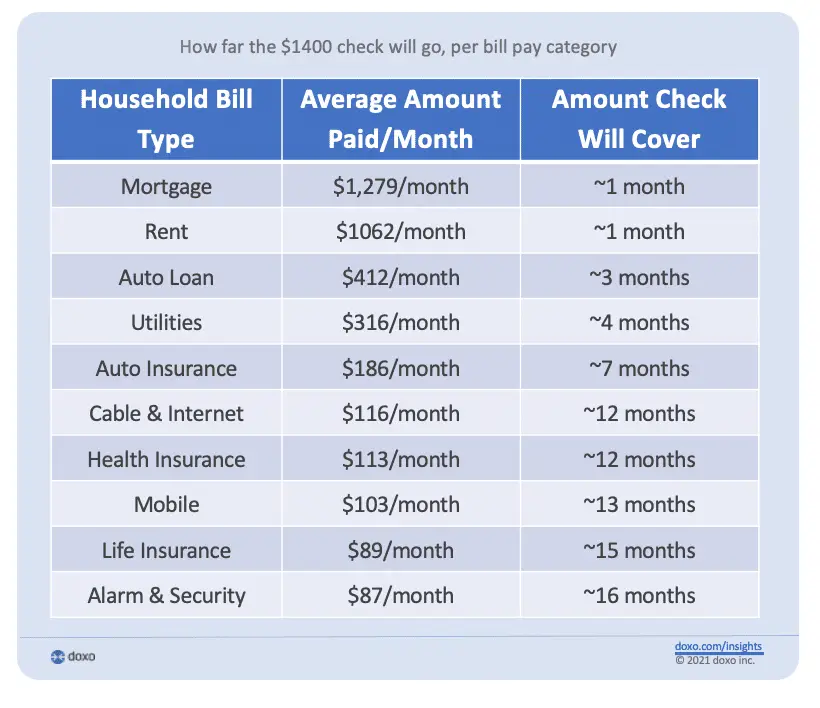

There may be people who are eligible for the full $1,400 payments, or additional partial payments, particularly if their circumstances have changed.

Parents who added a child to their family in 2021 may be eligible for a $1,400 payment. Additionally, families who added a dependent to their family in 2021, such as a parent, niece or nephew or grandchild, may also be eligible for $1,400 on their behalf.

Additionally, people whose incomes have fallen may now be eligible for the money if their 2021 adjusted gross incomes are below the thresholds for full payments. If their incomes are in the phase-out thresholds, they could be eligible for partial payments.

People who do not typically file tax returns, and have not yet done so, need to file this year in order to receive the any potential payments.

The Recovery Rebate Credit money for which you are eligible will either reduce the amount of federal taxes you owe or be included in your refund.

Don’t Miss: Stimulus Checks Gas Prices 2022

How Many Stimulus Checks Did Americans Receive

- Jennifer Roback

- 16:56 ET, May 13 2021

- Jennifer Roback

MANY AMERICANS suffered financially during the Covid-19 pandemic.

In order to help Americans during the financial difficulties resulting from the pandemic, the government sent out stimulus checks.

Read our stimulus checks live blog for the latest updates on Covid-19 relief…

Are Adult Dependents Getting Third Stimulus Checks

The new stimulus plan expands eligibility to adult dependents, including college students, elderly relatives and disabled adults.

The text of the plan redefines the term dependent according to section 152 of the tax code, which includes both qualifying children and adults: Section 152 provides that the term dependent means a qualifying child ) or a qualifying relative ).

While the plan pays out $1,400 for each qualifying dependent, families should keep in mind that the targeted lower income ranges exclude them if they earn over $160,000.

For reference, the second stimulus checks provided additional $600 payments for qualifying dependents under the age of 17. So a couple filing jointly with three eligible children could get a maximum second payment of $3,000 .

Under the first and second rounds of stimulus checks, children and adult dependents over the age limit could not get an additional payment, and they did not qualify for a stimulus check of their own either.

With the new stimulus plan, however, both joint filers and heads of household get an additional $1,400 payment for each dependent, regardless of age. The table below breaks down the third stimulus checks for heads of household with one dependent:

| Stimulus Checks for Heads of Household& 1 Dependent |

| AGI |

| $0 |

Recommended Reading: Irs Stimulus Check Sign Up