Eligibility For A Plus

You can estimate how much money the IRS owes your household for the third stimulus check. Just make sure to triple-check that you meet the qualifications, including the income limits.

Because of the overlap with tax season 2020, many people may receive some, but not all, of their allotted amount. If your income changed in 2020, in some cases, the IRS may owe you more money than you received if the income figure used to calculate your payment from your tax returns in 2018 or 2019 is less in 2020. Likewise, if you now have a new dependent, such as a new baby, you may be owed more money.

The IRS is automatically sending plus-up payments to make up the difference. If you dont get one, you may need to claim the missing money another way later in 2021 or even in 2022, since tax season is officially over now.

What If You Have Trouble With The Tool

To use the Get My Payment tool, you must first verify your identity by answering security questions. If the information you enter does not match IRS records, you will receive an error message. To avoid this:

- Double-check the information requested

- Make sure what you enter is accurate

- Try entering your street address in a different way and

- Use the US Postal Services ZIP Lookup tool to look up the standard version of your address, and enter it into exactly as it appears on file with the Postal Service.

If your answers do not match the IRS records three times, youll be locked out of Get My Payment for security reasons. If that happens, you must wait 24 hours and try again. If you cant verify your identity, you wont be able to use Get My Payment. Unfortunately, theres no fix for that: the IRS says not to not contact them.

However, if you verified your identity and received Payment Status Not Available, this means that the IRS cannot determine your eligibility for a payment right now. There are several reasons this could happen, including:

- You didnt file either a 2018 or 2019 tax return or

- Your recently filed return has not been fully processed.

Again, the IRS says theres no fix for that and you should not contact them.

Didnt Get The Full Third Payment Claim The 2021 Recovery Rebate Credit

You may be eligible to claim a Recovery Rebate Credit on your 2021 federal tax return if you didnt get a third Economic Impact Payment or got less than the full amount.

In early 2022, well send Letter 6475 to the address we have on file for you confirming the total amount of your third Economic Impact Payment and any plus-up payments you received for tax year 2021. You will need this information to accurately calculate your 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022.

Recommended Reading: Oregon Stimulus Check Round 2

Don’t Miss: Fourth Stimulus Check For Social Security

Can I Track My California Inflation Relief Check

The short answer: no. But you can probably narrow down your timeline a bit.

If you filed your taxes online and also received the Golden State Stimulus you may have already gotten your relief. If you dont meet both of those criteria, youre going to have to wait longer.

Remember, debit cards are being dispersed based off order of last names, so if youve been blessed with an A-B-C name, you wont have to wait as long as the X-Y-Z crowd.

And if youve changed your banking info since your 2020 return was filed youre in for a long wait. That group will be the last to get their payment.

For a more detailed breakdown, .

The state hopes to have everyones payments sent out by mid-January.

Copyright 2022 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.

How Do I Get It

- The stimulus payments will be processed by the IRS.

- If you have already filed a 2019 tax return, you will get the stimulus payment automatically. You will receive it in the same form as your tax refund. If you requested direct deposit, then the stimulus will be direct deposited. If you requested a paper check, then the stimulus will be mailed to the same address on your 2019 tax return.

- If you entered your information into the IRS non-filer portal earlier in 2020, you will get the stimulus payment automatically. You do not have to do anything.

- If you receive one of the following benefits, you will get the stimulus payment automatically. You do not have to do anything.

- Social Security

- Veterans Affairs

- Railroad Retirement

Dont Miss: What Is Congress Mortgage Stimulus Program

Read Also: Stimulus Checks And Taxes 2021

Citizenship: Does The Irs Consider My Household Mixed

In the $900 billion stimulus package from December, a US citizen and noncitizen spouse were both eligible for a payment as long as they both had Social Security numbers. This has been referred to as a mixed-status household when it comes to citizenship. Households with mixed US citizenship were left out of the first check.

The new stimulus bill includes all mixed-status households where just one member has a Social Security number for a third stimulus check. That potentially includes families with citizen children and noncitizen parents.

In the CARES Act from last March, households with a person who wasnt a US citizen werent eligible to receive a stimulus check, even if one spouse and a child were US citizens.

What Can I Do If I Have Not Received My Eip Money By Those Deadlines

If you have not received all or some portion of your Economic Impact Payments by the deadlines above, you will have to file a 2020 tax return and claim these amounts. You claim them on line 30 of the 2020 Form 1040 as a Recovery Rebate Credit. This is another name for the EIP stimulus payments. If you did not get all or a portion of the EIP payments in advance, then you can claim them on line 30 of your tax return for 2020.

Also Check: What Was The 3 Stimulus Checks

If The First Two Stimulus Payments Never Showed Up Do This

The IRS is no longer automatically sending out the first and second payments that were approved in 2020. If you believe you’re still owed money from either of those payment rounds, your best chance of claiming those funds is to file for the Recovery Rebate Credit as part of the 2020 tax season.

If you’re eligible, you’ll need to know the amount of money the IRS allotted you, which you can find out online or from the letter the agency mailed. The IRS said the updated Get My Payment tracker won’t give you information on the first and second checks. Instead, you need to set up and check your IRS account for information on those payments.

Social Security Ssi Ssdi Veterans: What You Need To Know About Eligibility And Your Stimulus Payment

The majority of people who are part of the SSI or SSDI programs qualify for a check — read our guide for details. This time, many will get their payments on their existing Direct Express card, though some may receive stimulus money a different way. Consult our guide for more on what to know and do, including if you need to claim a dependent by filing a tax return for 2020.

Stimulus money for veterans who don’t usually file taxes are expected to receive their stimulus checks in mid-April, after many Social Security recipients. Here’s more to know about veterans and stimulus eligibility.

Recipients of the first check received their payments through a non-Direct Express bank account or as a paper check sent in the mail. In the , these recipients again qualified to receive payments, along with Railroad Retirement Board and Veterans Administration beneficiaries.

Also Check: When Were The Stimulus Payments In 2021

The Irs Has Distributed Three Rounds Of Economic Impact Payments To Date But Not Everyone Has Had The Full Entitlement Heres How To Check How Much You Have Received

During 2020 and 2021 the federal government sent out three rounds of stimulus check payments for eligible households, with a maximum of $3,200 available per person.

Previously it was possible to claim any missing payments using the IRS Get My Payment online portal, but that option has now expired. To request payment of any outstanding stimulus check money you must now claim a Recovery Rebate Credit on your federal tax returns.

If you did not receive the Economic Impact Payments issued in 2020 or 2021, you may be able to claim a Recovery Rebate Credit from #IRS by filing a tax return. Learn more at

Heres how to work out how much you are owed

How to find your stimulus check history online

The easiest way to check which Economic Impact Payments, also known as stimulus checks, you have received is by heading over to the IRS website.

You can view your Online Account using your IRS username or ID.me account, giving you access your payment history. As well as information about the stimulus checks, you can also find your history of advance Child Tax Credit payments and data from your most recently filed tax return.

Recommended Reading: How Much Was 2021 Stimulus Check

How To Use Irs ‘get My Payment’

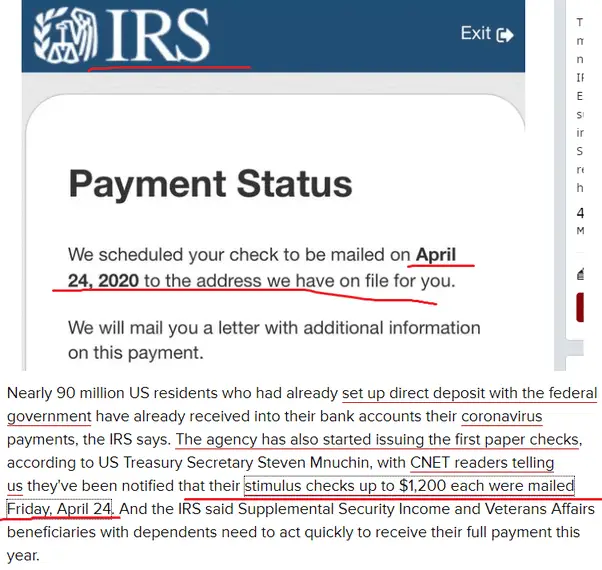

The IRS also updated frequently asked questions Saturday on how to use the “Get My Payment” tool, which requires users to enter their full Social Security number or tax ID number, date of birth, street address and ZIP code.

But before you start entering your information hourly, the IRS says the tool updates once per day, usually overnight and that people should not call the IRS. Our phone assistors don’t have information beyond what’s available on IRS.gov.

The tool will show the status of when a payment has been issued and the payment date for direct deposit or mail, according to the frequently asked questions. Some will get a message that says “Payment Status Not Available.”

“If you get this message, either we have not yet processed your payment, or you are not eligible for a payment,” the IRS said. “We will continue to send the 2021 Economic Impact Payment to eligible individuals throughout 2021.”

And others will get a “Need More Information” message when using the tool if the payment was returned to the IRS because the post office was unable to deliver it for another reason.

If your address has changed the IRS says the easiest way to update is to “file your 2020 tax return with your current address, if you havent already done so. Once we receive your current address, we will reissue your payment.”

Contributing: Jessica Menton, USA TODAY

Follow USA TODAY reporter Kelly Tyko on Twitter: @KellyTyko

Recommended Reading: How To File For The Third Stimulus Check

Theres A Glitch With Your Bank Tax Prep Software Or The Irs

This explanation may be the most frustrating of all for people wondering where the heck their stimulus checks are. But a mistake made by your bank, the IRS, or the tax-prep software you used to file returns could screw up your stimulus payment.

As the Washington Post reported, the stimulus payments for millions of taxpayers may be delayed because of a glitch with tax-prep software firms, such as TurboTax, H& R Block, and Jackson Hewitt. The IRS might not have direct deposit information for you if you used one of these services and received an advance on your tax refund, or if you paid for the service by deducting the fee from your tax refund. And if the IRS doesnt have your direct deposit info, your stimulus check will be delayed. If you think this situation applies to you, use the IRS Get My Payment app to provide the agency with your direct deposit details.

How Do I Get Help Filing A 2020 Tax Return To Claim My Eip

The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

Also, you can find Form 1040 and Form 1040 instructions on the IRS website. The instructions for the Recovery Rebate Credit are found on pages 57 59.

Also Check: When Will We Get Our Stimulus Checks

When Will I Get The Recovery Rebate Credit

You will most likely get the Recovery Rebate Credit as part of your tax refunds. If you electronically file your tax return, you will likely receive your refund within 3 weeks. If you mail your return, it can take at least 8 weeks to receive your refund.

Claiming the Recovery Rebate Credit will not delay your tax refund. However, if you dont claim the correct amount of the Recovery Rebate Credit, your refund may be delayed while the IRS corrects the error on your return. The IRS will send you a notice of any changes made to your return.

You can check on the status of your refund using the IRS Check My Refund Status tool.

What To Do If There’s A Direct Deposit Issue

The IRS tracking tool for the third stimulus check doesn’t allow you to add direct deposit information this time unless the IRS can’t deliver your payment. So if you have a problem, what do you do? Your check may have bounced back to the IRS if the agency tried to send your payment to a now-closed bank account or to a temporary prepaid debit card a tax preparer set up for you. If your payment was returned to the IRS, the agency will mail your check to the current address it has on file for you. If that check is returned, then the IRS will let you enter your banking information in the Get My Payment tool, the IRS said.

First, we suggest you call your bank or tax preparer — it never hurts to cover all your bases to confirm that an attempt was made to deposit money into a closed account or debit card.

Unfortunately, you’ll need to wait and monitor the Get My Payment tracker to keep tabs on your check delivery. We also recommend signing up for a free service to track your check to your mailbox.

Recommended Reading: Irs.gov Stimulus Check Sign Up

How Do I Get Help Filing A Tax Return To Claim My Eip

- The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

- You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

- Also, you can find Form 1040 and Form 1040 instructions on the IRS website.

Are My Dependents Eligible With This Check

As a rule, dependents are not eligible for their own checks, but they do contribute to the total your household can receive. In many cases, it can multiple your familys total.

In the third stimulus check, dependents of every age count toward $1,400. If youre a parent of a baby born in 2020, you could be entitled to $1,100 if you never received the first two payments for your new dependent last year. You can also get $1,400 for a baby born in 2021. Note that if your household exceeds the strict income limits, you wont receive any stimulus check money, even if you have dependents.

With the second stimulus check approved in December, each child dependent age 16 and younger added $600 each to the household payment. There was no cap on how many children you could claim a payment. That was an increase in the amount per child from the $500 that was part of the first check approved last March as part of the CARES Act, even as the per-adult maximum decreased from $1,200 per adult to $600 in the December stimulus plan.

The final qualifications for a third stimulus check have been settled.

Read Also: Irs Social Security Stimulus Checks Direct Deposit 2022

You May Like: How Much Were The 3 Stimulus Checks

What Will The Status Report Look Like

For third-round stimulus checks, the Get My Payment tool will display one of the following:

1. Payment Status. If you get this message, a payment has been issued. The status page will show a payment date, payment method , and account information if paid by direct deposit. Note that mail means either a paper check or a debit card. If you dont recognize the bank account number displayed in the tool, it doesnt necessarily mean your deposit was made to the wrong account or that theres a fraud. If you dont recognize the account number, it may be an issue related to how information is displayed in the tool tied to temporary accounts used for refund loans/banking products.

2. Need More Information. This message is displayed if your 2020 return was processed but the IRS doesnt have bank account information for you and your payment has not been issued yet. It could also mean your payment was returned to the IRS by the Post Office as undeliverable. As mentioned above, if your payment is returned, youll have the opportunity to provide the IRS your bank account or debit card information so they can issue a direct deposit payment . If you dont provide any account information, the IRS cant reissue your payment until they receive an updated address.

The portal is updated no more than once daily, typically overnight. As a result, theres no reason to check the portal more than once per day.