How To Claim The Recovery Rebate Credit

If you did not receive your first or second stimulus payment, or if it was for the wrong amount, youll need to file a tax return for the 2020 tax year . Youll file Form 1040 or Form 1040-SR . Youll need your Notice 1444, Your Economic Impact Payment from the IRS when you file. You should have gotten your first Notice 1444 sometime last spring or summer, and you should have gotten your second one in February 2021. Youll need the amount of the payment in the letter when you file your tax return in 2021.

If you dont receive your third stimulus payment, or if it was for the wrong amount, youll need to file a tax return for the 2021 tax year . Youll file Form 1040 or Form 1040-SR . Youll need your Notice 1444, Your Economic Impact Payment from the IRS when you file. Youll need the amount of the payment in the letter when you file your tax return in 2021.

You can take the Recovery Rebate Credit for any rebate amount that is more than the economic impact payment that you received by completing line 30 of Form 1040 or Form 1040-SR. The instructions for Form 1040 and Form 1040-SR include a worksheet you can use to calculate the amount of the credit you are eligible for.

Also Check: Change Address For Stimulus Check

I Used The 2020 Irs Non

Most likely, the IRS wasnt able to process your 2019 tax return or the information you submitted to the IRS Non-filer tool in time to issue your second stimulus check.

All second stimulus checks were issued by January 15, 2021. If you didnt get a second stimulus check by then , you can claim your second stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

How To Report A Missing Stimulus Check To The Irs

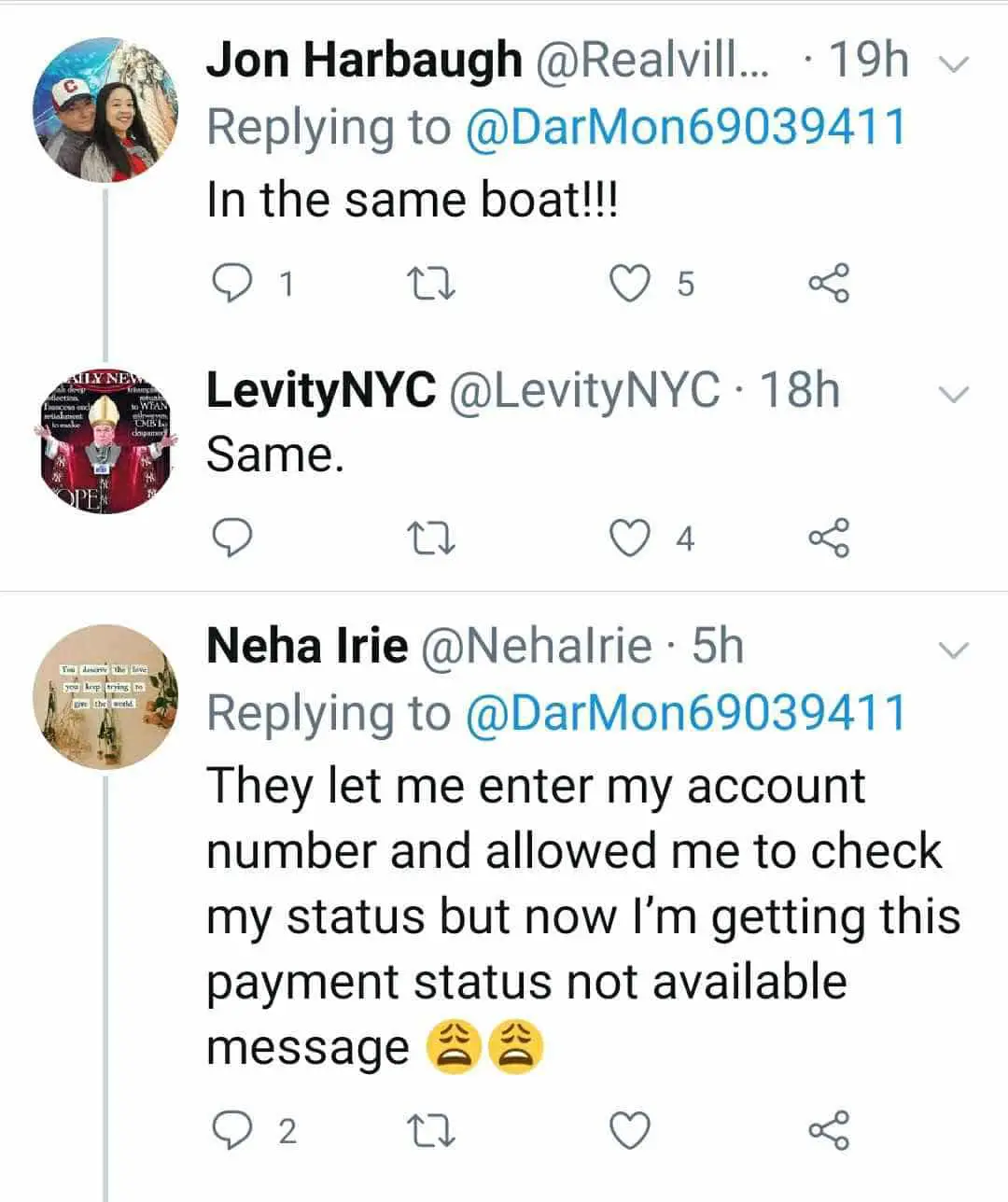

You may still have questions, especially if you havent received a check, or you get the dreaded payment status unavailable notice. To report missing checks or ask other questions, call the IRS at 800-919-9835.

The IRS added 3,500 telephone representatives in May, but dont be surprised if you dont get through immediately. A lot of people have questions. You can go online to find answers to frequently asked questions about Economic Impact Payments and the Get My Payment tool.

One question a lot of people have is whether the stimulus money will affect their 2020 taxes. It wont. It is not considered taxable income, so it wont increase what you owe or reduce your refund when you file next year.

Another question the IRS cant answer: Is a second stimulus check on the way? Possibly. Senate Republicans rejected the plan passed by House Democrats but have said they are drawing up a plan of their own, perhaps to be finished in late July. Stay tuned.

You May Like: Can Stimulus Check Be Taken For Back Taxes

Filing A Payment Trace To Find Missing Stimulus Money

You can request an IRS payment trace if you received the confirmation letter from the IRS that your payment was sent , or if the Get My Payment tool shows that your payment was issued but you have not received it within certain time frames. This is the case for all three checks. Check out our guide to requesting an IRS Payment Trace here.

Also Check: New York Stimulus Check 4

Wheres My Second Stimulus Check

OVERVIEW

As a part of the Coronavirus Response and Relief Supplemental Appropriations Act recently signed into law, the IRS announced that they have begun issuing a second round of stimulus payments to eligible tax filers. Here are answers to some of the top questions you may have about the second stimulus checks.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

As a part of the Coronavirus Response and Relief Supplemental Appropriations Act recently signed into law, the IRS announced that they have begun issuing a second round of stimulus payments to eligible tax filers.

Here are answers to some of the top questions you may have about the second stimulus checks:

If you have an adjusted gross income of up to $75,000 , you could be eligible for the full amount of the recovery rebate $600 for eligible individuals, $1,200 for joint taxpayers, and an additional $600 for each dependent child under 17.

*Note, adjusted gross income is your gross income like wages, salaries, or interest minus adjustments for eligible deductions like student loan interest or your IRA deduction. Your AGI can be found on line 8b of your 2019 Form 1040.

The same eligibility rules apply to the second stimulus payment as the first one. You must have a valid Social Security number, and you cant have been claimed as a dependent on someone elses 2019 tax return.

Recommended Reading: Were There Stimulus Checks In 2021

Never Got Your Stimulus Payment The Irs Is Here To Help

Here’s What You Need to Remember: Fortunately, if your direct deposit never arrived and you never cashed your initial stimulus check, the IRS will mail you a replacement. The agency claims that this will on average take another six weeks, although the offices staffing shortages and the ongoing mailing of stimulus checks and plus-up payments could delay it longer.

It has now been more than two months since the March 2021 American Rescue Plan Act sent out the third round of $1400 stimulus checks.

In this case, it might be useful to request a payment trace from the IRS. Heres how.

1) Make Sure You Qualify

Before engaging the services of the IRS, its helpful to make sure that you qualify for payments.

Depending on your circumstances, you might also qualify for additional payments. The IRS has begun issuing plus-up payments supplementing the regular stimulus check, based on your 2020 tax return. If you had a child during the pandemic, for instance, you probably qualify for a plus-up payment.

2) Use the Get My Payment Tool

The IRS has provided a web tool updating users on the status of their stimulus checks. To use it, you need to enter your Social Security number, your address, and your date of birth. Once this is done, the IRS will display the status of your check and whether it has been dispatched or not.

3) Wait

To keep people from delaying them with unnecessary requests, the IRS has requested that a waiting period be observed before a payment trace is requested.

What Can I Do If I Have Not Received My Eip Money By Those Deadlines

If you have not received all or some portion of your Economic Impact Payments by the deadlines above, you will have to file a 2020 tax return and claim these amounts. You claim them on line 30 of the 2020 Form 1040 as a Recovery Rebate Credit. This is another name for the EIP stimulus payments. If you did not get all or a portion of the EIP payments in advance, then you can claim them on line 30 of your tax return for 2020.

You May Like: Could There Be Another Stimulus Check

How Can You Correct Mistakes

The IRS sends out Notice 1444 by mail within 15 days of making a direct deposit or sending a paper check. That letter will tell you the amount of your stimulus payment and how it was made. The letter also provides instructions on fixing issues with your payment.

Don’t Respond to Telephone Calls or Texts About Your Stimulus Check

The IRS will not call, text, or email you about your stimulus payment. The Federal Trade Commission is warning that thieves are posing as government employees to prey on stimulus payment recipients. These scammers may ask for your personal information or threaten you that if you don’t send the money back in the form of money transfers or gift cards, you’ll lose your drivers’ license. Ignore these communications.

Copyright ©2022 MH Sub I, LLC dba Nolo ® Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

What If I Already Filed My Taxes

An amended return may be needed to claim the credit if IRS records show no payment was issued.

For eligible people who didnt claim a recovery rebate credit on their 2021 tax return , they will need to file a Form 1040-X, Amended U.S. Individual Income Tax Return to claim the remaining amount of stimulus money if IRS records dont show that they were issued a payment.

This includes people who think they didnt get the full amount of their third-round Economic Impact Payment because their circumstances in 2021 were different than they were in 2020.

People trying to figure out if they should amend their original tax return can use this online tool.

More details on claim the 2021 Recovery Rebate Credit can be found here.

Read Also: Where Do I Put Stimulus Money On Tax Return

Who Is Eligible For The Third Stimulus Check

While eligibility is similar to the first and second stimulus checks, there are differences. There are four primary requirements:

1. Income: The income requirements to receive the full payment are the same as the first and second stimulus checks. There is no minimum income needed to qualify for the payment. Households with adjusted gross income up to $75,000 for individuals will receive the full payment. The third stimulus payment starts to phaseout for people with higher earnings. The third stimulus checks maximum income limit is lower than the first and second stimulus check. Single filers who earned more than $80,000 in 2020 are ineligible for the third stimulus check.

View the chart below to compare income requirements for the first, second, and third stimulus checks.

| Income to Receive Full Stimulus Payment | First Stimulus Check Maximum Income Limit | Second Stimulus Check Maximum Income Limit | Third Stimulus Check Maximum Income Limit |

| Single Filer | |||

| $120,000 |

2. Social Security Number: This requirement is different from the first and second stimulus check.

Any family member that has a Social Security number or dependent can qualify for the third stimulus check. For example, in a household where both parents have ITINs, and their children have SSNs, the children qualify for stimulus checks, even though the parents dont.

See the chart below for further explanation of how this works.

What Is A Recovery Rebate Credit

The IRS has lots of different rules, regulations and terms that make things confusing for filers, but pay no attention to the man behind the curtain: The Recovery Rebate Credit is simply just another name for your stimulus check. And if you were one of the lucky Americans who received two EIPs with no problems, you technically just received an advance of that Recovery Rebate Credit.

Americans can claim that credit by filling out a new, special section on their 2020 Form 1040 or 1040-SR if theyre a senior. That also goes for taxpayers who normally dont have to file a tax return, according to the IRS.

But rest assured: Receiving a stimulus check wont come back to bite you. The IRS says that the credit will only increase the amount you receive as a tax refund or decrease the amount you owe, rather than subtract from the refund youre entitled to. Your stimulus check also isnt considered taxable income.

Also Check: Stimulus Check 1 And 2

Didn’t Get The Full Third Payment Claim The 2021 Recovery Rebate Credit

You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return.

Individuals can view the total amount of their third Economic Impact Payments through their individual Online Account. Through March 2022, we’ll also send Letter 6475 to the address we have on file for you confirming the total amount of your third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need this information from your online account or your letter to accurately calculate your 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment. All amounts must be considered if filing jointly.

Using the total amount of the third payment from your online account or Letter 6475 when preparing a tax return can reduce errors and avoid delays in processing while the IRS corrects the tax return.

To Complete The Form 3:

- Write EIP1, EIP2 or “EIP3” on the top of the form to identify which payment you want to trace.

- Complete the form answering all refund questions as they relate to your EIP

- When completing item 7 under Section 1:

- Check the box for Individual as the Type of return

- Enter 2020 (if this is for the first or second stimulus payment, or enter “2021” if this is for the third stimulus payment as the Tax Period

- Do not write anything for the Date Filed

Also Check: $600 Stimulus Check Not Received

Can A Nursing Home Or Assisted Living Facility Take The Payment From Me

No. If you qualify for a payment, its yours to keep. If a loved one qualifies and lives in a nursing home, residential care home or assisted living facility, its theirs to keep. The facility may not put their hands on it or require somebody to sign it over to them. Even if that somebody is on Medicaid.

Confirm The Money Was Sent

The federal government mailed paper notices to all first and second-round stimulus check recipients after issuing their payment. Letters are also being mailed for the third round of stimulus.

The letter states the amount of the payment and method of delivery. One side is in English and the other is in Spanish. There is a notice date and number listed in the upper right corner.

If you did not get this letter , then you should create an IRS online account. The account will show the payment amount issued to you by the IRS, if any .

Read Also: How Much Was All The Stimulus Checks

File For A Recovery Rebate Credit

Should you be unable to get a status update on the stimulus checks, there still are other options, like filing for a Recovery Rebate Credit.

If you didn’t get the first or second payment – or you received less than the full amount that you’re eligible for – you can claim the credit on your 2020 tax returns, even if you don’t normally file.

This means you need to add up the amount of payments you did receive in order to determine the credit you would have otherwise been eligible for on your returns.

How To Determine If You Have Money Coming To You

Starting in late January, the IRS began sending out information via what it dubs Letter 6475. Its something for taxpayers to watch out for, Steber says. At the top of the letter, which the IRS says it will send through March, youll see the words Your Third Economic Impact Payment. The letter, which the agency did not send out last year, provides details about the total amount you received in third-round stimulus payments in 2021 and includes all payments, even if they were issued at separate times.

Keep in mind that the third-round EIPs were advance payments of the 2021 Recovery Rebate Credit. This letter will help Economic Impact Payment recipients determine if they are entitled to and should claim the Recovery Rebate Credit on their 2021 tax returns when they file in 2022, the IRS announced in a.

Also Check: When Did The First Stimulus Check Come Out

I Received A Second Payment But My Spouse Didn’t

There have been cases where a couple submit their tax returns as “married filing jointly,” and both spouses are eligible for a $1,400 stimulus check, but one spouse received a payment and the other did not . This is an error on the IRS’s part. Unfortunately, the spouse who didn’t receive a check will have to claim a Recovery Rebate Credit on his or her 2020 tax return. See below for instructions on claiming the rebate on your tax return.

Who Is Eligible For The Child Tax Credit 2021

Eligible Americans with income below $75,000, or married couples with income below $150,000, were eligible for the full amount of three rounds of stimulus payments that were made by the federal government in 2020 and 2021. Those stimulus income limitations also applied to the enhanced child tax credit although partial child tax credits were available for people with higher incomes.

Advance payments of the enhanced child tax credits were sent to people from July to December 2021. The monthly payments were up to $250 or $300 per child, for a period of six months.

Read Also: Do We Get Another Stimulus Check This Month