Fourth A $1400 Stimulus Check Is To Be Issued

Although various lobbyists have called for the option of issuing a fourth stimulus check, as of July, there is no guarantee that this will happen.

In fact, at this point, we are further away from this fourth check being issued than we were at the beginning of the year when it still seemed a fairly realistic probability. However, there are no indications to suggest that this is the case.

On the other hand, corresponding cost-of-living adjustments will likely continue to accrue throughout the year. It should recall that the cost-of-living adjustment in 2022 increased by 5.9%, one of the highest in the countrys recent history.

Thus, the Social Security Administration has issued estimates that envision the possibility of an increase of even 8% next year, thus meeting the challenge of high inflation. However, we will not know this until 2023.

Therefore, it is complex that will issue a fourth stimulus check. On the other hand, if the third check has not yet been cashed, you should start the claiming process.

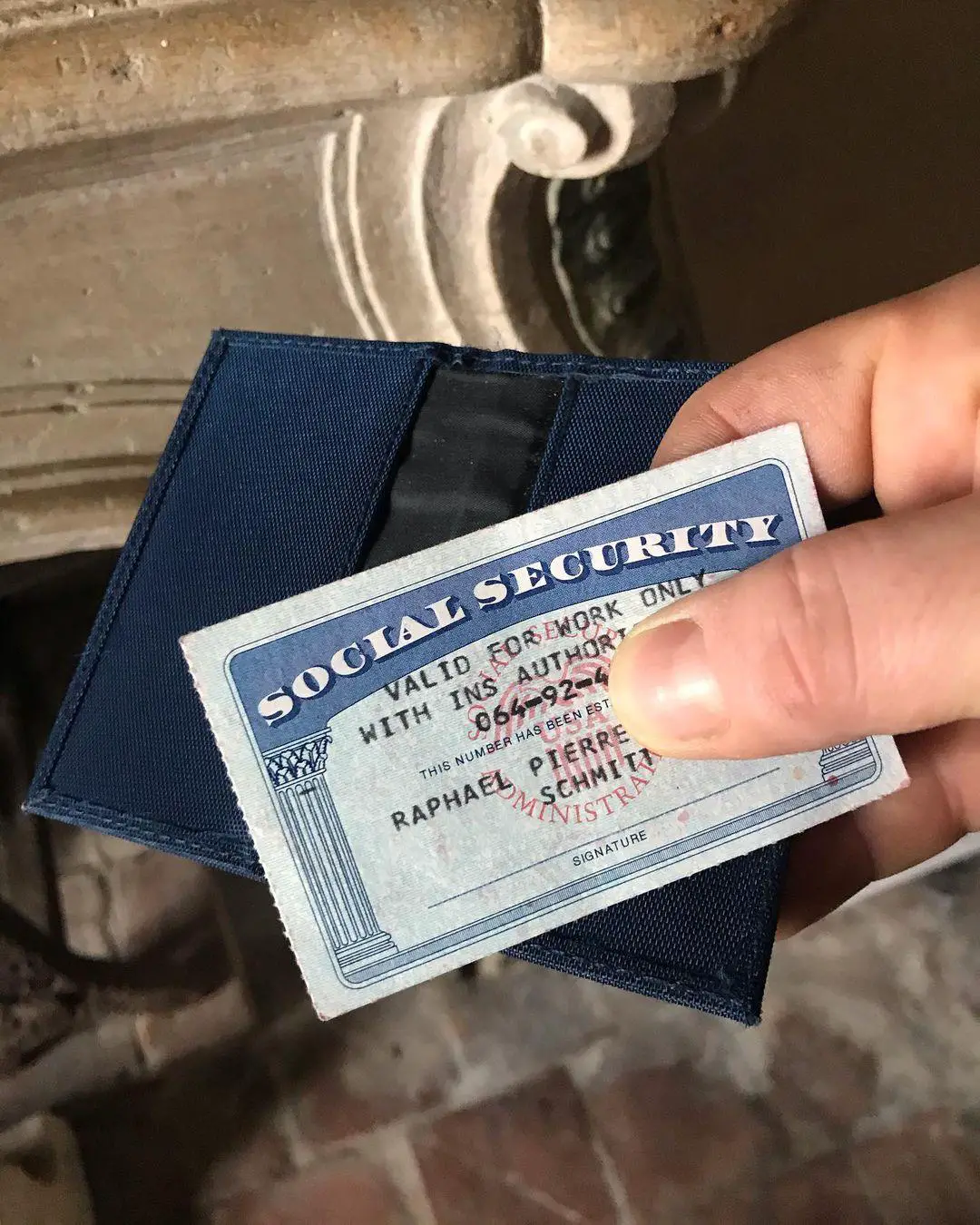

Remember, first of all you should contact the relevant administration. They will likely require documents such as your 2020 tax return .

Lets think that, in the case of older people, the mortality rate caused by the pandemic was very high: someone who died in 2020 was not entitled to the stimulus stub for the year 2021.

$2000 Fourth Stimulus Check Update Ssa Ssdi Ssi Va June 2022

$2000 fourth stimulus check update for Monday, June 6, 2022. This is in regards to the low income and fixed income beneficiaries of Social Security, retirement, disability, SSDI survivors, SSI, VA, and RRB. I have all the details and what YouVe been asking for right here on the topic.

All right Now this is a question that Ive Seen down in the comments section a Number of times here. Over the last couple of weeks, some Of you have been reaching out saying Hey, whats going on with the $2,000 4th stimulus check? You havent talked about it in a few weeks. Now Can you give us an update, let Us know where we currently stand, and What is going on with a fourth stimulus check or even a $2,000 for a stimulus check. So thats exactly what were going to Be focusing on right here on this topic.

So I hope this one helps you enjoy your day. have a nice day and Ill catch you in later.

Is Social Security Giving Extra Money This Month 2022

An official with the Social Security Administration said beneficiaries are likely to receive a COLA closer to 8% at the end of 2022 due to the current rate of inflation, CBS News reported. Beneficiaries could see an increase of $132.64 per month in early 2023, bringing the average check to about $1,790.

Don’t Miss: When Do The Stimulus Checks Go Out

How Much Money Could Seniors Receive

The Senior Citizens League wants Social Security recipients to receive a $1,400 emergency stimulus check to help them cope with inflated prices.

The group says the special stimulus could help with increases in health care premiums and higher taxes.

The Social Security Administration said more than 69million people received benefits.

This year, the SSA increased the cost-of-living adjustment to 5.9% to keep pace with inflation.

That boosts the average monthly retirement check by about $92, but it’s not enough for many who live on a fixed income.

New Guidance About Covid

The Treasury Department launched a new web tool allowing quick registration for Economic Impact Payments for eligible individuals who do not normally file a tax return, and also announced that it would begin making automatic payments. However, for some people receiving benefits from the Social Security Administration–specifically those who have dependent children under the age of 17–it is to their advantage to go to this portal to ensure they also get the $500 per dependent Economic Impact Payment. I encourage them to do this as soon as possible, and want to provide the following details:

People who receive Social Security retirement, survivors, or disability insurance benefits and who did not file a tax return for 2018 or 2019 and who have qualifying children under age 17 should now go to the IRSs webpage at www.irs.gov/coronavirus/economic-impact-payments to enter their information instead of waiting for their automatic $1,200 Economic Impact Payment. By taking proactive steps to enter information on the IRS website about them and their qualifying children, they will also receive the $500 per dependent child payment in addition to their $1,200 individual payment. If Social Security beneficiaries in this group do not provide their information to the IRS soon, they will have to wait to receive their $500 per qualifying child.

We will continue to update Social Securitys COVID-19 web page at as further details become available.

You May Like: Check On Status Of Stimulus Check

How Will Ssa Process My Notice Of Appointment While Emergency Procedures Are In Place

Date: March 11, 2021

Beginning March 11, 2021, we have revised our temporary procedures to allow you to use different methods to sign the notice of appointment of a representative and fee agreement, if the fee agreement is submitted with the new notice of appointment, during the current COVID-19 health emergency. During this time, if we receive an appointment document such as the Form SSA-1696, on its own or along with an SSA-8000, SSA-8001, SSA-L2, SSA-820, SSA-821, SSA-827, or SSA-455 form, and your signature appears to be an electronic or digital signature, we will make three attempts to contact you to verify your identity and confirm the signature. If we verify your identity and signature, we will process the appointment as usual. If the first attempt to reach you by telephone is unsuccessful, we also will send a call-in letter to you and the representative you requested. If we cannot reach you and you do not return our call, or do not verify the signature, we will return the paperwork to the person who submitted it without recognizing the appointment.

We also have temporary procedures in place permitting you to verbally appoint a representative during a remote telephone hearing with an administrative law judge, if you submit a written notice of appointment afterwards. In this case, we will accept an electronic signature on the written appointment notice, without needing to call you again.

Inflation Is Now The Problem To Tackle

This and the sky-high inflation the economy has experienced, among other factors, is why there will not be a fourth federal stimulus check. However, those that didnt receive the full amount that they were entitled to can still apply for a Recovery Rebate Credit from the tax year that the stimulus payment in question was sent out.

Rising prices, due to disruptions in supply chains induced by the pandemic and to a degree the massive financial stimulus, on the other hand have become the issue of the day. To counter the increased cost of living for residents, states have taken measures to ease the financial burden affecting households in their jurisdictions. And depending on the results of the Midterm Elections further federal government measures could be in the offing to assist families with rising costs.

Consumers donât receive the full benefit of gas tax holidays, according to a recent analysis by the nonpartisan Penn Wharton Budget Model, which looked at suspensions in 3 states through mid-May. Instead, they have to share the savings with gas suppliers.

You May Like: How Many Stimulus Checks Have Been Sent

Th Stimulus Check Update And Payment Status In 2022

This article provides updates, income qualification thresholds and FAQs on the approved and proposed stimulus checks, also known as Economic Impact payments.

While multiple rounds of payments have been made over the last two years, many are asking if the government will make another of payments to help folks cope with high inflation and the rising costs of basic goods and services.

Each round of stimulus check payments had slightly different rules so please ensure you review each payment round separately. Click the links below to jump to the relevant stimulus payment.

If you have not received one or more of your stimulus payments, then you will need to claim this as a recovery rebate via your tax filing for the relevant year. This include retroactive stimulus check payments.

Social Security Expedites Decisions For People With Severe Disabilities Agency Adds To Compassionate Allowances List

Andrew Saul, Commissioner of Social Security, today announced five new Compassionate Allowances conditions: Desmoplastic Small Round Cell Tumors, GM1 Gangliosidosis – Infantile and Juvenile Forms, Nicolaides-Baraister Syndrome, Rubinstein-Tybai Syndrome, and Secondary Adenocarcinoma of the Brain. Compassionate Allowances is a program to quickly identify severe medical conditions and diseases that meet Social Securitys standards for disability benefits.

Social Securitys top priority is to serve the public, and we remain committed to improving the disability determination process for Americans, said Commissioner Saul. Our Compassionate Allowances program gets us one step closer to reaching our goals by helping us accelerate the disability process for people who are likely to get approved for benefits due to the severity of their condition.

The Compassionate Allowances program quickly identifies claims where the applicants condition or disease clearly meets Social Securitys statutory standard for disability. Due to the severe nature of many of these conditions, these claims are often allowed based on medical confirmation of the diagnosis alone. To date, more than 600,000 people with severe disabilities have been approved through this accelerated, policy-compliant disability process. Over the last decade, the list has grown to a total of 242 conditions, including certain cancers, adult brain disorders, and a number of rare disorders that affect children.

Recommended Reading: Stimulus Checks For Grocery Workers

Rhode Island: $250 Rebate Per Child

Rhode Island is sending a one-time payment of $250 per child, thanks to a state budget surplus.

Households can receive a payment for up to three dependent children, for a maximum of $750. Those children must have been listed as your dependents on your 2021 federal and state income tax returns.

Taxpayers must earn $100,000 or less to be eligible for the payment.

Child Tax Rebate check distribution began in October. Taxpayers who filed their 2021 state tax returns on extension by October 2022 will receive their rebates starting in December. You can check your rebate status on Rhode Islands Division of Taxation website.

Seniors Worry Most About The Cost Of Food

In particular, the league says, seniors have identified food as their fastest-growing expense.

Since the beginning of the year, nearly one in five seniors have visited a food pantry or applied for the Supplemental Nutrition Assistance Program , formerly known as food stamps, the league reported last month.

Its highly disturbing that such a large number of survey participants have been forced to access food pantries, says Mary Johnson, Social Security policy analyst for the Senior Citizens League. Over the past 12 months, the price of bacon is up 11%, beef up 10.6 % and fresh fish up 8.5%.

As a result, one in four seniors have reported going without meat, poultry, fish and dairy.

Survey participants added their next-biggest financial concerns were housing and medical bills.

At least for now, the Senior Citizens League argues, a $1,400 check would keep people from skipping meals just to afford necessities like home insurance.

Read Also: Amount Of Stimulus Check 2021

Should I Hold Off On Filing My Tax Return

It likely wont make a difference in the longer term other than to update dependent or payment data, but the IRS will only use your 2020 tax return data to determine eligibility for this round of stimulus checks if they have processed your return . If your 2020 return has not been filed and processing, they will use 2019 tax data for payment.

If your 2020 return is filed and/or processed after the IRS sends you a third stimulus check, but before July 15, 2021 the IRS would send you a second payment or require a repayment for the difference between what your payment should have been if based on your 2020 return and the payment actually sent based on your 2019 return.

Will The Measure Be Taken Up By Congress

To garner support and attention, the SCL launched a petition which has gained over one million signatures. The petition reads I want Social Security recipients to receive a $1,400.00 emergency stimulus check to cope during this unprecedented inflationary year. Social Security benefits are one of the few types of income in retirement adjusted for inflation.

It also argues that the COLA increases are not sufficient, saying, In 2021 Social Security benefits increased by just 1.3 percent raising the average benefit by only about $20 a month. But about 86 percent of Social Security recipients surveyed say their expenses increased by much more than that amount.

To date, no lawmakers have responded to the petition or brought up the measure. As negotiations over infrastructure, the reconciliation bill, and the debt ceiling suck up all the air in the Capitol, it is unlikely this measure makes it onto the legislative agenda.

You May Like: Who Is Getting The New Stimulus Checks

Why Did I Get An Extra Payment From Social Security This Month

The extra payment compensates those Social Security beneficiaries who were affected by the error for any shortfall they experienced between January 2000 and July 2001, when the payments will be made. Who was affected by the mistake? The mistake affected people who were eligible for Social Security before January 2000.

Recipients Of Disability Benefits Who Have Other Sources Of Income

If you receive social security disability benefits and other sources of income that bumps your total income over $75,000, expect a reduction in the amount you receive via a Coronavirus stimulus check. If you are married and filed a joint tax return, expect a similar reduction in the amount of the stimulus check if you and your spouses income exceed $150,000.

The stimulus payments are steadily reduced for individuals and married couples with incomes in excess of $75,000 or $150,000 . In addition, the stimulus payments are phased out entirely for individuals earning in excess of $87,000 and married couples who earned in excess of $174,000.

The income thresholds in the new legislation are much stricter and less generous in comparison to the income thresholds used pursuant to the CARES Act. In the first Coronavirus relief legislation, individuals earning less than $99,000 remained eligible to receive a stimulus check and married couples earning less than $198,000 were able to get a stimulus check.

Recommended Reading: How To Check Status Of Stimulus Check

What States Are Paying A Fourth Stimulus Check

There likely wont be another stimulus check from the federal government coming anytime soon. But a number of states have approved a fourth stimulus check for their residents welcome news amid rampant inflation. And more states could do the same in months to come. Lets break down which states are paying a fourth stimulus check and how much you could get.

For help with managing stimulus payments or with any other financial questions, consider working with a financial advisor.

Why Is That A Bad Thing

The bigger checks going forward may be too little, too late. Higher prices have been savaging seniors bank accounts for a while, the league says, and last years bump only amounted to an extra $20 a month for the average recipient.

Many seniors are now deep in debt, and a boost matching the rate of inflation next year will only maintain the status quo.

Cost-of-living adjustments also do a poor job of keeping pace with health care hikes and federal taxes, notes a recent report from the Center for Retirement Research at Boston College.

Medicare part B premiums, which are deducted automatically from Social Security benefits, have risen twice as fast as the COLA over the past 20 years. And the threshold at which Social Security benefits get taxed $25,000 for single taxpayers isnt regularly adjusted, meaning more and more recipients are getting taxed over time.

When the taxation of benefits was first introduced in 1983, only 8% of eligible families paid taxes on their benefits. Today, the estimate is that 56% of beneficiary families pay taxes on their benefits, the researchers say.

Lastly, some low-income seniors are worried that a boost to their taxable income could affect their access to food benefits, rental subsidies and other forms of support. A stimulus check would be one way to feed them consequence-free cash.

Don’t Miss: H& r Block Stimulus Check

Why Did I Get Two Social Security Checks This Month

MILLIONS of Supplemental Security Income claimants will see two checks this month as the holidays approach. This will apply to the 8million people that are projected to receive SSI in 2022, according to the Social Security Administration. … Further, the more you earn the less your SSI benefit will be.

How Can I Communicate With My Local Hearing Office

Date: December 14, 2021

You must have a scheduled hearing to enter a hearing office. You can communicate with your local hearing office by telephone, fax, and e-Fax.

Via telephone:

Our hearing office employees continue to answer our general inquiry lines during regular business hours for local hearing offices and can help you with the following matters:

- Confirming your availability for a hearing

- Confirming your agreement to a telephone or online video hearing

- Updating your records to ensure we have the appropriate telephone number and address and

- Providing status for your pending case.

You can find your local hearing office phone number by accessing our Hearing Office Locator.

Via fax or e-Fax:

Claimants and representatives can send us documents by fax machine or by their own e-fax solution. Sending documents to us via fax delivers a secure, electronic copy to the specific hearing offices designated email inbox. To submit documents electronically via fax, simply use the toll-free fax number with area code 833 assigned to the servicing hearing office. You can find your local hearing office phone number by accessing our Hearing Office Locator.

You May Like: Someone Stole My Stimulus Check