Which Tax Return Is Used For My Third Stimulus Check

The IRS uses 2019 or 2020 tax returns to determine eligibility for your third stimulus check. You should note that if your income fell in the 2020 tax year, filing your tax return earlier could help you qualify for a bigger third stimulus check. The new stimulus plan targets lower income ranges to exclude higher-earning taxpayers from getting a payment.

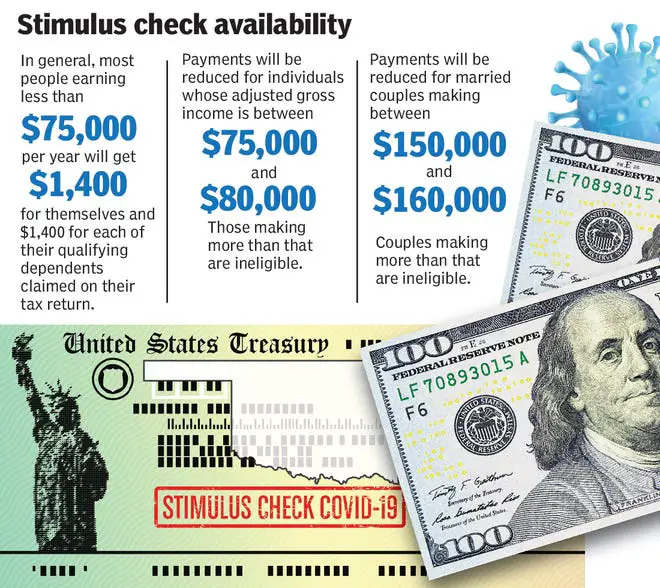

As we pointed out before, individuals making under $75,000 get the maximum stimulus payment of $1,400 . But payments are capped at $80,000 for single filers and $160,000 for couples. So filing at the beginning of the tax season with a lower income may help you qualify for a bigger check. But, if your income went up in tax year 2020, then you may want to delay filing so that eligibility is determined by your lower 2019 income.

You might also want to file early if the size of your family increased in 2020. The new stimulus plan includes a child tax credit that pays up to $3,600 for each qualifying child under 6 years old, and $3,000 for every child between ages 6 and 17. This means that if you became a parent during the tax year, you could get an additional payment by claiming your child as a dependent earlier.

SmartAssets child tax credit calculator will help you figure out how much you could get for each child.

You can use SmartAssets tax return calculator to figure out your 2021 tax refund or tax bill.

Dont Miss: Do You Pay Taxes On Stimulus Checks 2021

Who Would Be Eligible For The Third Stimulus Check

Families earning less than $150,000 a year and individuals earning less than $75,000 a year should get the full $1,400 per person. Families earning up to $160,000 per year and individuals earning up to $80,000 per year will receive prorated stimulus checks for less than $1,400 max.

Unlike the previous two rounds, you will receive stimulus payments for all your dependents, including adult dependents and college students.

How Do I Know If I’m Eligible For A Third Stimulus Payment

For the first and second stimulus checks, whether you were eligible for any stimulus money depended on whether you were considered a dependent and the amount of your AGI from your federal tax filing. Your AGI is your gross income minus any eligible adjustments that you may qualify for. Since the tax deadline has been extended to May 17, the IRS is likely to use your 2019 tax return, if you file taxes.

If you have a pension or investments that are taxable, those will affect your AGI, and therefore your eligibility for a stimulus check. The same is true for interest from a bank account. Interest from tax-exempt bonds isn’t included in your AGI, however, so it wouldn’t affect your stimulus payment eligibility.

For the third stimulus check, some of the eligibility rules changed in the final version of the bill — read on for more, and use our third stimulus check calculator to see if you qualify based on income limits. Here are stimulus calculators for the first and second checks, respectively.

Don’t Miss: How To Sign Up For The Stimulus Check

I’m Not A Us Citizen But I Pay Taxes Can I Get A Third Stimulus Check

Under the , non-US citizens, including those who pay taxes, weren’t eligible to receive the $600 payment, unlike with the first round of checks. Under the CARES Act of March 2020, all US citizens and non-US citizens with a Social Security number who live and work in America were eligible to receive stimulus payments. That included people the IRS refers to as “resident aliens,” green card holders and workers using visas such as H-1B and H-2A.

If your citizenship status has changed since you first got a Social Security number, you may have to update the IRS’ records to get your check. US citizens living abroad were also eligible for a first payment.

For the third payment, the new law includes checks for “mixed-status” citizenship families — families with members with different immigration statuses — who were left out of the first two checks.

What counts as income? That depends on your personal circumstances.

What If I Am Eligible For The Stimulus Checks But I Didnt File A 2019 Or 2020 Tax Return And Didnt Use The Irs Non

File your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

You can file a tax return even if you dont have a filing requirement to get other tax credits, such as the Earned Income Tax Credit.

If you didnt get your first or second stimulus check or didnt get the full amount that you are eligible for, file a 2020 federal tax return and claim them as part of your tax refund or use GetCTC.org if you dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2022.

Recommended Reading: Get My 2nd Stimulus Payment

Contribute To A Traditional Ira

If your AGI is a bit too high, contributing to a traditional individual retirement account might be the key to getting a third stimulus checkâif you donât have a retirement plan like a 401 through your job.

You can contribute up to $6,000, or $7,000 if youâre 50 or older, to a traditional IRA before April 15, 2020. If you donât have a retirement plan through work, you can deduct the full amount of your contributions from your taxable income.

If youâre single and took home $81,000 in gross income in 2020, contributing $6,000 to a traditional IRA would lower your AGI to $75,000 and earn you a full stimulus check.

As an added bonus, if your spouse didnât earn income in 2020, they can still contribute to a spousal IRA, which could allow you to deduct up to another $6,000 , depending on your income level.

⢠Potential Income Reduction Amount: $6,000 to $14,000, depending on marital status, age, income level and access to workplace retirement plan.

⢠If youâre self-employed, check out a notes Julie Welch, managing partner and director of taxation at Meara Welch Browne, P.C. This could let you deduct up to $57,000 of your income in 2020 and allows you to contribute up until April 15, 2021, as well.

Who Is Not Eligible For The Recovery Rebate Credit

If you received your full amount in advance through the third stimulus payment, you would not qualify for any more money when you filed the return and you do not claim the Recovery Rebate Credit. Filing incorrectly for the credit could also delay your tax refund.

Dont Miss: Are The Stimulus Checks For 2021 Taxable

Also Check: When Will I Get My Stimulus

How Do I Get Help Filing A 2020 Tax Return To Claim My Eip

The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

Also, you can find Form 1040 and Form 1040 instructions on the IRS website. The instructions for the “Recovery Rebate Credit” are found on pages 57 – 59.

When Will The Third Stimulus Check Be Issued

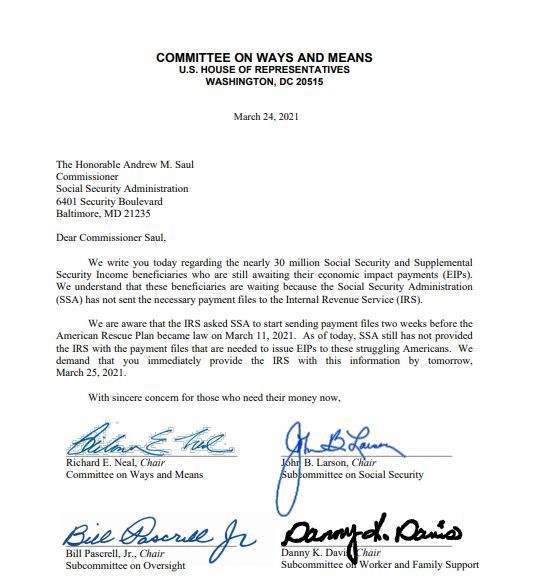

The government started sending the third stimulus checks on March 12, 2021. The IRS continues to send third stimulus checks as people submit their information to the IRS either by filing a 2020 tax return or using GetCTC.org. The deadline to use GetCTC.org is November 15, 2022.

If you have your banking information on file, the IRS sent your payment via direct deposit. Otherwise, you will receive your payment as a check or debit card via mail. Mailed checks and debit cards may take longer to deliver.

If you dont fall into any of these categories, youll have to wait to receive your third stimulus check. You will need to file a 2020 federal tax return to get the third stimulus check or use GetCTC.org if you dont have a filing requirement.

You can also get the first and second stimulus check as the Recovery Rebate Credit on your tax return or GetCTC.org if you are eligible.

Read Also: Where’s My Stimulus Payments

Changes Increase Electronic Payments Speed Relief To Americans Answers To Common Questions

FS-2021-05, March 2021

WASHINGTON The Internal Revenue Service and the Treasury Department are disbursing the third round of Economic Impact Payments to the public as rapidly and securely as possible.

These payments were authorized by Congress in the American Rescue Plan Act, enacted on March 11, 2021. For those who haven’t received a payment yet, here are answers to some common questions about this set of stimulus payments, which differ in some ways from the first two sets of stimulus payments in 2020, referred to as EIP1 and EIP2.

When Should I Get My Payment

The IRS was given hard and fast deadlines to send the two rounds of Economic Impact Payments out to American families. The first round of payments had to be sent out by December 31, 2020. The second round had to be sent out by January 15, 2021.

What this means: If you have not received the first or second round of payments yet, then you will not be getting them in advance. The good news is that you can still do something to get these payments. Read below.

You May Like: Status On 4th Stimulus Check

Will The Amount Of My Stimulus Checks Be Reduced If I Have Overdue Prison Debts Or Other Unpaid Debts

Yes, if you are claiming the first, second, and/or third stimulus check as part of yourRecovery Rebate Tax Credit, the payments are not protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . This means that if you receive your stimulus checks as part of your tax refund instead of as direct checks, they arenotprotected from garnishment and may be reduced.

There used to be protections on stimulus checks, but they no longer apply when claiming them on your tax return.

Read Also: Havent Got My Stimulus

Wheres My Third Stimulus Check

OVERVIEW

The American Rescue Plan, a new COVID relief bill, includes a third round of stimulus payments for millions of Americans. Get updated on the latest information as it evolves.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

A third round of stimulus checks is on the way for millions.

The American Rescue Plan, a new COVID relief bill, was signed into law on March 11, 2021. The bill includes a third round of stimulus payments for millions of Americans. We know these funds are important to you, and we are here to help.

If you are eligible, you could get up to $1,400 in stimulus checks for each taxpayer in your family plus an additional $1,400 per dependent. This means a family with two children could receive $5,600.

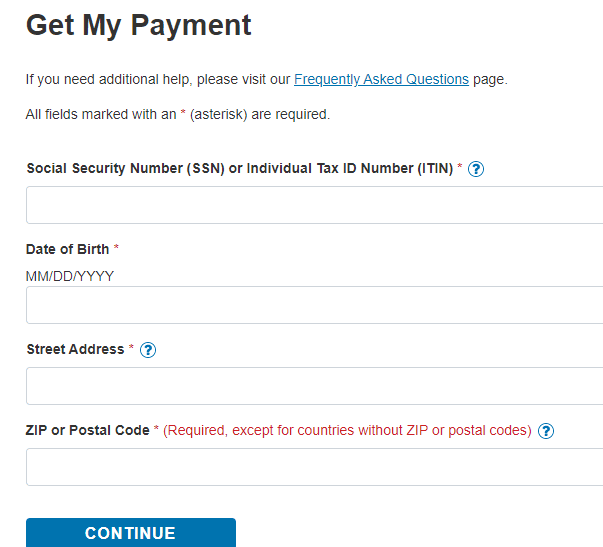

The IRS began issuing the first batch of stimulus payments, and they could arrive as early as this weekend , with more arriving over the coming week. Further batches of payments will arrive during the following weeks. If youre eligible, check the status of your stimulus payment and the way itll be sent to you by going to the IRS Get My Payment Tool, which will be live on March 15th.

To find out if you are eligible and how much you can expect, visit our stimulus calculator.

Don’t Miss: 4th Stimulus Check Texas 2021

What To Do If You Cant Find Your Stimulus Check

If your IRS online account shows that you should have received a stimulus payment, but you didnât get it, thereâs a chance it could have been lost in the mail. Or you might have thrown away the prepaid debit card you received.

If you lost your stimulus check or suspect it was stolen, you can request the IRS trace your payment. If the IRS determines your check hasnât been cashed, it will issue a credit to your account. It canât reissue your payment, but you can claim the payment on your 2021 tax return using the Recovery Rebate Tax Credit worksheet.

If a trace is initiated and the IRS determines that the check wasnât cashed, the IRS will credit your account for that payment. However, the IRS canât reissue your payment. Instead, you will need to claim the 2021 Recovery Rebate Credit on your 2021 tax return if eligible.

If you lost your EIP card, a prepaid debit card on which some individuals received their stimulus payment, contact card issuer MetaBank to request a replacement.

What Can The Irs Do For A Missing Stimulus Check

The IRS will do the following to process your claim, according to its website:

- If you didnt cash the check, the IRS will issue a replacement. If you discover the original check among your belongings, youre expected to return it as soon as possible.

- If you did cash or deposit the check, expect a claim package from the Bureau of the Fiscal Service, which will include a copy of the cashed check. Follow the included instructions. The bureau will review your claim and the signature on the canceled check before deciding whether it will issue a replacement. This is presumably to guard against stimulus check fraud.

Also Check: Where’s My 3rd Stimulus Payment

Youre A Member Of A Mixed

Under the CARES Act, U.S. adults with a Social Security number werent eligible for a stimulus check if they were in a mixed-status household, meaning one partner was undocumented or didnt have an SSN. A recent law change, however, scraps that rule. Now, individuals would be able to receive both payments retroactively meaning both the first and second stimulus payment for the taxpayers and qualifying children of the family who have work-eligible SSNs.

Youll want to reconcile that first amount with your Recovery Rebate Credit, if you didnt receive it.

You May Like: How To Get The 1400 Stimulus Check

How To Qualify For The Third Stimulus Payment If You Dont File A Tax Return

If you dont normally file a US tax return and youve missed the cut off to apply for a stimulus payment you can still qualify by entering your Social Security Number or Individual Tax Identification Number onto the non-filer tool on the IRS website.

The tool will require information about your income, your full address, contact details and bank account information. It can take 2-3 weeks for the for the IRS to process the information and send out a rebate confirmation once submitted.

Remember, just because you dont have to file a US tax return, it doesnt mean you cant. You can always file a US tax return and claim your missing stimulus payments.

Recommended Reading: Contact Irs About Stimulus Payment

Is There A Deadline To Get My Third Stimulus Check

If you will be filing a full tax return, you have until the IRS closes their tax filing software on November 20, 2021. After this date, you can still claim the third stimulus check in 2022 by filing your taxes for Tax Year 2021.

If youre not required to file taxes, the deadline to use GetCTC.org is November 15, 2022. You can get the Recovery Rebate Credit using GetCTC.org, a simplified tax filing portal for non-filers. GetCTC is an IRS-approved service created by Code for America in partnership with the White House and U.S. Department of Treasury. You can use the portal even if youre not signing up for the Child Tax Credit advance payments.

Will I Receive A Paper Check Or A Debit Card

Like the prior EIP1 and EIP2, most people will receive their payment by direct deposit, but some people will get either a check or debit card. The best way to find out which is to check the Get My Payment tool, available only on IRS.gov. People who don’t receive a direct deposit should watch their mail for either a paper check or a debit card. Treasury is issuing some payments using debit cards to speed delivery of the payments and reach as many people as soon as possible. The form of payment people receive for this third stimulus payment may differ from the prior EIP1 and EIP2.

Also Check: Updates On The 4th Stimulus Check

Access Your Tax Refund Quickly And Safely

If you think you may receive a refund, here are some things to think about before you file your return:

- If you already have an account with a bank or credit union, make sure you have your information ready including the account number and routing number when you file your tax return. You can provide that information on the tax form and the IRS will automatically deposit the funds into your account.

- If you have a prepaid card that accepts direct deposit, you can also receive your refund on the card. Check with your prepaid card provider to get the routing and account number assigned to the card before you file your return.

How Much Is The Third Stimulus Check

If you are eligible, you could get up to $1,400 in stimulus payments for each taxpayer in your family plus an additional $1,400 per dependent. That means that a family of four with two children could receive up to $5,600.

Remember, just because you are eligible, does not mean you are eligible for the full $1,400.

To find out if you are eligible and how much you can expect, visit our stimulus calculator.

Don’t Miss: Update On Fourth Stimulus Check