Who Doesnt Get A Check

Those without a Social Security number and nonresident aliens those who arent U.S. citizens or U.S. nationals and dont have a green card or have not passed the substantial presence test are not eligible for the direct payment.

Taxpayers with Individual Taxpayer Identification Numbers arent eligible for the payments.

Heres How Many Stimulus Checks Have Been Sent Out So Far

More than 1.1 million stimulus checks are on the way to Americans bank accounts.

Thats according to the Internal Revenue Service, which announced yesterday that, along with the Department of the Treasury and the Bureau of the Fiscal Service, it began processing the eighth batch of payments at the end of April. The latest round, which was officially disbursed on May 5, is valued at more than $2 billion.

More from Footwear News

The agency added that more than 585,000 payments went to eligible individuals for whom it previously did not have information to issue a check but who recently filed a tax return. The batch also included 570,000 plus-up payments or additional ongoing supplemental payments for those who have received payments based on their 2019 tax returns but are now qualified for a new or larger payment based on their recently processed 2020 tax returns.

About 600,000 payments were made via direct deposit payments, with the remainder on paper. The IRS shared that it would continue to make Economic Impact Payments on a weekly basis. Individuals who havent yet received their payment are encouraged to check its status using the Get My Payment tool.

Sign up for FNs Newsletter. For the latest news, follow us on , , and .

Also Check: How To Check Eligibility For Stimulus Check

Will My Third Stimulus Check Be Reduced

The number the IRS will look at is your adjusted gross income for 2020, which is your income without retirement contributions but before your standard or itemized deductions are taken out. You can find your adjusted gross income on line 11 of your Form 1040 of your 2020 tax return. If you havent yet filed your 2020 tax return, the IRS will use your AGI from your 2019 tax return.

Single people who make between $75,000 and $80,000 will have their checks reduced by 28% of the amount over $75,000, and married people who file joint returns and make between 150,000 and $160,000 will have their checks reduced by the same percentage of the amount over $150,000. Taxpayers who file as head of household and make between $112,500 and $120,000 will have their checks reduced by a similar percentage of the amount over $112,500. The $1,400 that parents receive for each dependent is subject to the same reduction.

This means that single people who earned $80,000 or more in 2020 dont qualify at all for the third stimulus checkcompared with $87,000 for the second stimulus check. Couples who earned $160,000 or more wont get a third stimulus check, down from $174,000 for the second stimulus check. And a family of four that earned $160,000 or more also wont receive a third stimulus check.

Read Also: When Was The Third Stimulus Payment Issued

Third Payments Differed From Previous Economic Impact Payments

The third payments differed from the earlier payments in several respects:

- Income phaseout amounts changed. Payments were reduced for individuals with adjusted gross income of more than $75,000 . The reduced payments ended at $80,000 for individuals and $160,000 for married filing jointly. People above these levels did not receive any payment.

- Payment amounts are different. Most families received $1,400 per person, including all dependents claimed on their tax return. Typically, this means a single person with no dependents received $1,400, while married filers with two dependents received $5,600.

- Qualifying dependents expanded. Unlike the first two payments, the third payment was not restricted to children under 17. Eligible individuals received a payment based on all of their qualifying dependents claimed on their return, including older relatives like college students, adults with disabilities, parents and grandparents.

You May Like: Irs Stimulus Check Tax Return

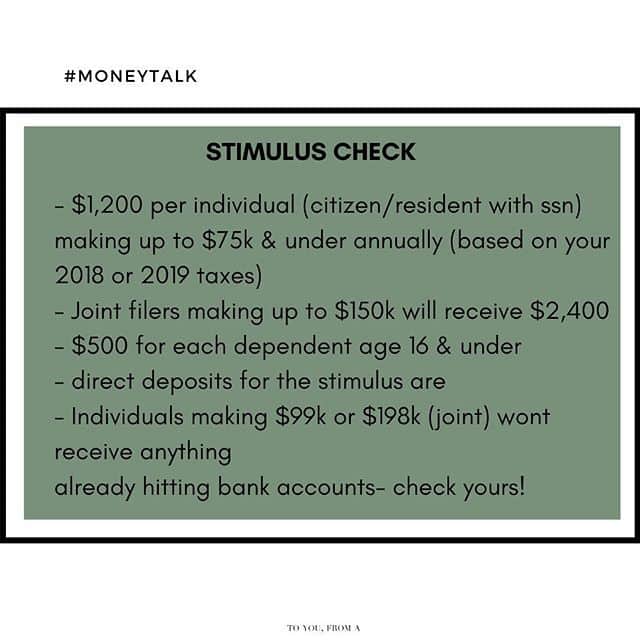

St Round Of Stimulus Checks: April 2020

It was specified in the CAREs Act that qualified tax-paying adults would get a check of up to $1,200 and their dependent children under the age of 16 would receive checks of up to $500 as part of a stimulus package .

Those earning less than $75,000 were eligible for the payments, which were provided to those earning up to $99,000 . Individuals received their first stimulus payments on April 11 and 12, either by direct deposit into their bank accounts, paper checks mailed to them, or the Economic Impact Payment Card, a prepaid debit card delivered to them in late May or early June of last year.

Don’t Miss: Is There Anymore Stimulus Checks Coming

Who Is Eligible For The Second Economic Impact Payment

Generally, U.S. citizens and resident aliens who are not eligible to be claimed as a dependent on someone elses income tax return are eligible for this second payment. Eligible individuals will automatically receive an Economic Impact Payment of up to $600 for individuals or $1,200 for married couples and up to $600 for each qualifying child. Generally, if you have adjusted gross income for 2019 up to $75,000 for individuals and up to $150,000 for married couples filing joint returns and surviving spouses, you will receive the full amount of the second payment. For filers with income above those amounts, the payment amount is reduced.

Were Willing To Do It This Week

Congress was hoping to reach a coronavirus stimulus deal before breaking for a scheduled recess, which began August 10 and will last through September 8. While many lawmakers have returned home for the summer break, they will remain on 24-hour notice to return to Washington in case a deal is reached.

Treasury Secretary Steven Mnuchin expressed optimism Monday, saying Democratic leaders seemed willing to compromise.If we can get a fair deal, were willing to do it this week, Mnuchin said in an interview on CNBCsSquawk on the Street.

The Treasury secretary spoke after President Trump issued executive orders over the weekend to establish a payroll tax holiday, defer student loan payments through 2020, extend the federal protections from evictions, and provide additional unemployment benefits. But it remains to be seen whether or not the presidents orders will actually come to fruition. Thats because continuing these aid programs initiated as part of the CARES Act would require federal funding, which Congress controls.

Unemployment aid seems to be the major sticking point in negotiations. Lawmakers are at odds over how much extra federal unemployment to provide to jobless workers. Under the CARES Act, eligible Americans received an extra $600 per week until July 31. Democrats want to continue the extra $600 per week through January. Republicans have proposed reducing that to $200 per week through September, followed by 70% wage replacement through December.

Don’t Miss: When Was 3rd Stimulus Check Mailed

How Can I File My Taxes

If you know you need to file a 2020 tax return, you should do so as soon as possible to get your Economic Impact Payment and any tax refund that you are eligible for.

Online: If youre comfortable using computers and confident preparing your own taxes, consider using a free online tax software. MyFreeTaxes is an online tool that helps you file your taxes for free. You can use these online programs until November 20, 2021.

Was I Eligible To Get A Stimulus Check

You were eligible to get a stimulus check and should have gotten the full amount if you filed taxes and had an adjusted gross income of:

- up to $75,000 if single or married filing separately.

- up to $112,500 if you filed as head of household

- up to $150,000 if married and you filed a joint tax return.

Don’t Miss: When Were The Stimulus Checks Issued

Third Stimulus Check Calculator

President Biden signed the American Rescue Plan Act on March 11, 2021. Provisions in the bill authorized a third round of stimulus checks worth $1,400 for each eligible person , plus an additional $1,400 for each dependent. However, as with the first- and second-round payments, the third-round stimulus checks were reduced or eliminated for people with an income above a certain amount.

If you didn’t receive a third stimulus check, or didn’t receive the full amount, you can get any money you’re entitled to by claiming the recovery rebate tax credit on your 2021 tax return. If you’re wondering if you qualify for the credit, comparing what you should have received to what you actually received is a good place to start .

To see how large your third stimulus payment should have been, answer the three questions in the calculator below and we’ll give you a customized estimate.

If I Owe Child Support Will Mytax Return Be Applied Tomychild Supportarrears

-

Maybe.Federal law and regulationsdetermine when federal payments are intercepted and applied to child support arrears.

-

IfTANFhas been received for your child,thetotalamount of past due supportonall ofyourchild support cases must be at least $150

-

IfTANFhasnotbeenreceivedfor your child,thetotalamount of past due supportonall ofyour child support casesmust be at least $500

Also Check: How Much Was The Stimulus In 2020

When Will I Get The Stimulus Check

All first stimulus checks were issued by December 31, 2020. If you are missing your stimulus check or didnt get the full amount that you are eligible for, you can claim your first stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

Where Is My Third Stimulus Check

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page. IRS EIP Notices: We mailed these notices to the address we have on file.

Recommended Reading: Will We Be Getting Another Stimulus

Are They Already Sending Out The Stimulus Checks

The IRS on Wednesday said it is continuing to distribute federal stimulus checks to eligible Americans, with another 2.2 million payments issued as recently as July 21. Some of those payments include plus-up adjustments for people who received less money than they were entitled to in earlier checks.

Dont Miss: Government Stimulus Check For Homeowners

Not Too Late To File For A Payment

Most people should receive their $1,400 stimulus checks and plus-up payments, if theyre eligible, automatically, according to Erica York, economist at the Tax Foundation.

Payments that are still outstanding mostly represent people who are more difficult to reach, such as those who have no incomes or bank accounts, York said.

The IRS recently issued guidance for those who are homeless explaining that they may still qualify for stimulus check money, as well as the expanded child tax credit, even if they do not have a permanent address or bank account. Others may miss out on the earned income tax credit if they dont file.

The IRS is working to find hard-to-reach populations, but it is likely they wont get absolutely 100% of the people who may qualify, York said.

If you did miss that filing deadline this year, its not too late to file a return.Susan Allensenior manager for tax practice and ethics at the American Institute of CPAs

In the beginning of this year, for example, there were still an estimated 8 million outstanding stimulus checks from the CARES Act, which was passed in March 2020.

The good news is that its not too late to claim that money.

If you did miss that filing deadline this year, its not too late to file a return, said Susan Allen, senior manager for tax practice and ethics at the American Institute of CPAs.

You can still file and claim that refund, she said.

Whats more, you will not owe the IRS a late-filing penalty if you are due money back.

Don’t Miss: Create Irs Account For Stimulus Check

Can You Track Payment Status For Paper Checks

Yes. You can use the IRS Get My Payment app to check the status of your payment, including how the payment will be made. If you have previously given the IRS your direct deposit information and you are eligible for a payment, the app will say which bank account will receive the direct deposit. If you have not provide direct deposit information, the app will show that your payment is coming via paper check.

The Get My Payment app will also show you a scheduled delivery date, and say whether or not a payment is scheduled, the IRS says. If you are receiving a paper check, the date shown on the Get My Payment app will be the day its scheduled to be mailed, which is earlier than it will show up in your mailbox.

Take note that many people have been frustrated with Get My Payment, and for a variety of reasons their inquiries have resulted in Payment Status Not Available messages. But on April 26, after Get My Payment went offline briefly for maintenance, the IRS announcedsignificant enhancements to the app, and the agency encouraged people to try to use the tool again.

We urge people who havent received a payment date yet to visit Get My Payment again for the latest information, IRS Commissioner Chuck Rettig said in a statement. IRS teams worked long hours to deliver Get My Payment in record time, and we will continue to make improvements to help Americans.

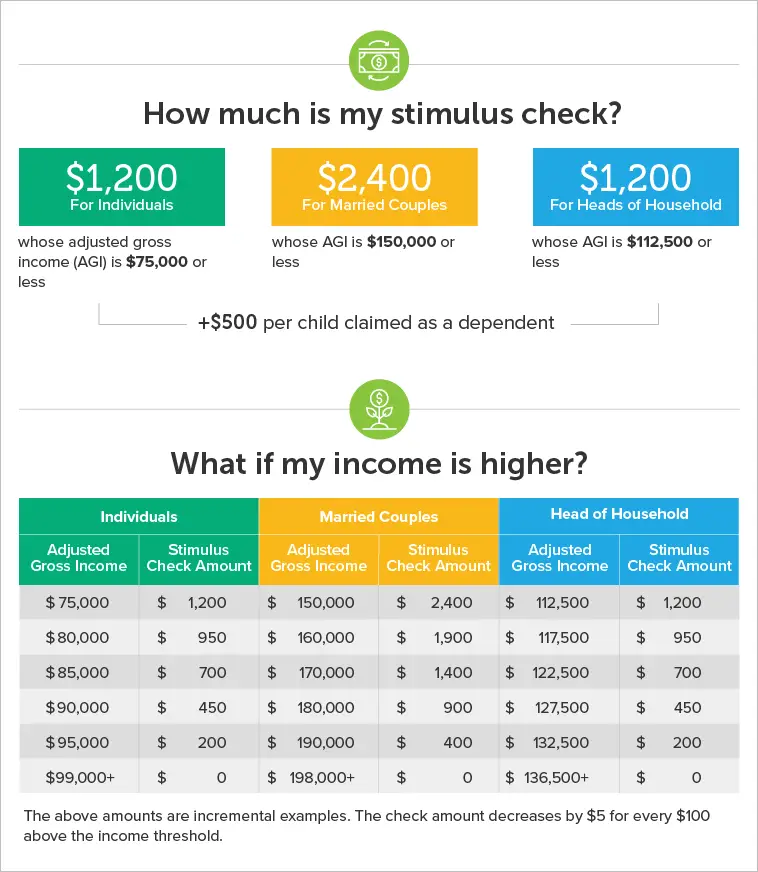

How Much Will My Stimulus Check Be

The amount of your stimulus checks varies depending on your family status and income.

The first stimulus check was worth up to $1,200 per eligible adult and $500 per dependent child under 17. Single adults received as much as $1,200. Married couples with no children got up to $2,400. Married couples with two children received up to $3,400.

If your income exceeds $75,000 as a single filer, $112,500 as a head of household, or $150,000 as a married joint filer, your check amount was reduced at a rate of $5 per extra $100 earned. So if you made $76,000 as a single filer, your check would be reduced by $50.

Eligibility phased out for single filers with incomes above $99,000, heads of household with incomes above $136,500, and married joint filers with incomes above $198,000 for their own payments. However, some still received dependent payments. Married joint filers with two children and $199,000 in income would lose their own $2,400 payments but receive $950 of the $1,000 in dependent payments.

The second check provided $600 per eligible adult and child dependent. The phase-out rules worked the same way. However, because the check was for a smaller amount, eligibility disappeared entirely at a lower income threshold. Singles with incomes above $87,000 received no payment. Nor did heads of household with incomes above $124,500 — unless they received some dependent funds. And married joint filers lost eligibility for their own payments at $174,000.

Also Check: Contact Irs About Stimulus Payment

Who Is Eligible For The Second Stimulus Check

Eligibility is primarily based on four requirements:

1. Income: The income requirements to receive the full payment are the same as the first stimulus check.There is no minimum income needed to qualify for the payment. Households with adjusted gross income up to $75,000 for individuals will receive the full payment. This stimulus payment starts to phaseout for people with higher earnings. The second stimulus check maximum income limit is lower than the first stimulus check. Single filers who earned more than $87,000 in 2019 are ineligible for the second stimulus check.

View the chart below to compare income requirements for the first and second stimulus checks.

| Income to Receive Full Stimulus Payment | First Stimulus Check Maximum Income Limit | Second Stimulus Check Maximum Income Limit |

| Single Filer | ||

| $136,500 | $124,500 |

2. Social Security Number: This requirement differs from the original eligibility for the first stimulus check. Originally under the first stimulus check, if you were married filing jointly, both spouses needed valid Social Security numbers . If one spouse had an Individual Taxpayer Identification Number , then both spouses were ineligible for the stimulus check. For married military couples, the spouse with an SSN could still get the stimulus check for themselves but not the other spouse with an ITIN.

Examples

Former first stimulus check rules:

Second stimulus check rules:

What If I Filed My Taxes Last Year Under My Previous Name And Have Changed My Name Since I Filed Those Taxes

If you file taxes and have not filed your 2019 taxes, you should file as soon as possible with your new name. Make sure your name is updated with the Social Security Administration.

If your stimulus check is written out to you under your previous legal name, you should still be able to deposit your check. However, you may need to speak with your bank and show your legal paperwork documenting your courtordered name change and old and new ID.

If you are cashing a check outside of a bank, bring your legal documents with you and try to call in advance to make sure that they dont have additional requirements to cash the check.

Also Check: How To Check If You Received 3rd Stimulus Check

How Do I Get My Stimulus Check

If youve filed a tax return for tax year 2019 or 2018 or submitted your information to the 2020 IRS Non-filer portal, you dont need to do anything. The IRS shouldve automatically sent your payment. Social Security recipients, including Social Security Disability Insurance , railroad retirees, and Supplemental Security Insurance and Veterans Affairs beneficiaries shouldve also automatically received a check.

All first stimulus checks were issued by December 31, 2020. If you are missing your stimulus check or didnt get the full amount that you are eligible for, you can claim your first stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or by using GetCTC.org if you dont have a filing requirement.

To use GetCTC.org, youll need a phone number or email address. Youll also need to provide your full name , mailing address, date of birth, Social Security Number, bank account information , 2019 Adjusted Gross Income , and details for any qualifying children you have.

9. What if I dont have an email address?