Which Tax Year Is Used To Determine Whether I Qualify

The government looks to your 2019 or 2020 tax return to decide what your income level is. If you did not file a 2019 tax return, you will need to file a 2020 tax return to obtain your payment. Individuals have until May, 17 2021 to file a 2020 tax return. Victims of the winter storms that began February 11, 2021 may have an additional extension until July 15, 2021. To determine if you qualify, please click here.

Read Also: How To Pay Federal And State Taxes Quarterly

Up To $10200 Of 2020 Unemployment Compensation Per Worker May Be Tax

Section 9042 of the American Rescue Plan includes another potential benefit for individuals who received unemployment compensation for some or all of 2020. More specifically, provided a taxpayers AGI is less than $150,000, up to $10,200 of unemployment compensation received in 2020 will be tax free.

There are, however, a number of important nuances to consider with respect to this provision, including the following:

- It appears that the $150,000 AGI limit applies uniformly to all filing statuses.

- It appears that the $150,000 AGI limit is a true cliff threshold – A plain reading of the American Rescue Plan indicates that a taxpayer with $149,999 of AGI can have up to $10,200 of unemployment compensation excluded from their gross income. If, however, the same taxpayer earns just a single dollar more, the full amount of the unemployment compensation received in 2020 will be taxable.

- It appears that, in the case of joint filers, each spouse can receive up to $10,200 of unemployment compensation tax-free, permitting up to $20,400 for the household .

- The $150,000 AGI cliff phaseout now EXCLUDES unemployment compensation received when calculating total MAGI. The IRS recently revised its stance and issued new guidance after originally including unemployment compensation when calculating total MAGI.

Hawaii: $300 Rebate Payments

In June, Hawaiis legislature approved sending a tax rebate to every taxpayer. Taxpayers earning less than $100,000 per year will receive $300, and those earning more than $100,000 per year will receive $100. Dependents are eligible for the rebate, too.

Taxpayers who filed their 2021 state income tax returns by July 31, 2022, should have received their returns in September, and those who requested paper checks should have received them by October 31. Taxpayers who filed their returns after July 31 should receive their check up to 10 weeks after their return is accepted by the tax department.

You May Like: Social Security Beneficiaries Stimulus Check

Talk With A Kansas Attorney

Our experiencedfamily law andbusiness attorneys at Sloan Law Firm assist clients with questions relating to taxes, including coronavirus economic impact assistance and stimulus payments, as well as the child tax credit. With offices in Topeka and Lawrence, we help clients throughout Kansas. We invite you to contact us by calling or using our online contact form.

What Information Do I Need About My Stimulus Checks When I File My Taxes

When you received each of your stimulus checks, also known as an Economic Impact Payment, you should have received a Notice 1444. The notice has information about your stimulus check and should be kept with your important tax records like your W-2s or 1099s.

It is possible you received more than one Notice 1444 if you received more than one stimulus check payment. For the first stimulus check you should have received a Notice 1444 and for the second stimulus check you should have received a Notice 1444-B.

When you sit down to file your taxes, these Notice 1444s will be especially helpful if you were eligible, but didnt receive the first or second stimulus check or received only a portion of it. The notice includes information like the amount you were issued before any offsets in 2020, which you will need to claim the recovery rebate credit to get any additional stimulus dollars you are owed from the first and second stimulus.

For tax year 2021, you should have received a Letter 6475. This letter will have the total amount of your stimulus payment in 2021 . If you didnt get the full third stimulus amount you were eligible for, then you may be able to claim those dollars through the recovery rebate credit on your 2021 tax return.

This may seem complicated, but dont worry. TurboTax will guide you through claiming the recovery rebate.

Recommended Reading: Where Do I Cash My Stimulus Check

When Will I Receive This Money How Will The Payment Be Delivered

- The U.S. Treasury began depositing stimulus checks into bank accounts the last week of December and are continuing to do so.

- Once direct deposits are completed, the Treasury will begin distributing mailed payments in the form of a paper check or an Economic Impact Payment debit card to people whose bank account information was not on file.

- Please Note: Recipients may not receive their payment in the same form they did for the first round of stimulus payments.

- If you receive an EIP card in the mail, it will be in a white envelope from Economic Impact Payment marked with the U.S. Department of the Treasury Seal. Be careful not to throw the EIP card away. If you receive an EIP Card, visit EIPcard.com for more information.

When Will I Get My Stimulus Check

Californians who received money from either round of Golden State Stimulus payments were the first to receive direct deposits, which should have arrived before Oct. 25. The remainder of direct deposits were reportedly issued between Oct. 28 and Nov. 14. But if you changed your banking information since filing your 2020 tax return — or never set up direct deposit in the first place– you should expect to receive a Money Network debit card instead.

California taxpayers who didn’t set up direct deposit will receive special debit cards in the mail.

Cards will be mailed between Dec. 17, 2022, and Jan. 14, 2023, according to the Franchise Tax Board, which said it expects 95% of all MCTR payments — direct deposit and debit cards — to be issued by the end of 2022.

Keep in mind that some tax returns “require additional review,” the FTB said, according to KGET, which could delay your deposit or mean you’re getting a debit card instead. Below is an estimated payment schedule for various categories of recipients.

Don’t Miss: Where Is My 600.00 Stimulus Check

Stimulus Checks 202: How Many States Are Still Sending Checks

Plenty of states still have money to hand out in 2023

- Personal Finance.CalWorks Benefits 2023: Does CalWORKs pay for rent?

The landscape of US benefits at both federal and state level was completely changed in the wake of the COVID-19 pandemic, as millions of families were plunged into poverty or saw their earnings drop dramatically.

That led to the US government creating an array of stimulus packages for every state that could be distributed to the population to help to keep people and businesses afloat.

It is against many political principles in America to provide such wide-reaching welfare, but the pandemic represented a special case.

In many states, the stimulus has now run out, but in others that took longer to distribute the money there are still some that will be handing out in 2023. Here comes a look at all eight US states that are still giving out stimulus money in 2023.

Are Stimulus Checks Taxable Income

Neither of the two previous stimulus checks delivered in 2020 are considered taxable, according to the Economic Impact Payment Information Center on the IRS website:

the Payment is not includible in your gross income. Therefore, you will not include the Payment in your taxable income on your Federal income tax return or pay income tax on your Payment. It will not reduce your refund or increase the amount you owe when you file your 2020 Federal income tax return.

The payment will also not impact your income level for purposes of determining eligibility for federal government assistance or benefit programs.

If you havent received your stimulus money it will like come in the form of a tax credit, which means it will be wrapped up with your tax refund.

Read Also: What Percentage Of Your Paycheck Goes To Taxes

You May Like: Is Texas Giving Stimulus Money

If I Owe Child Support Will I Be Notified That My Tax Return Is Going To Be Applied To My Child Support Arrears

-

Yes.You were sent a noticewhenyour case wasinitiallysubmitted for federal tax refund offset.The federal government shouldsend an offset notice toyouwhenyour stimulus rebate paymenthasactuallybeenintercepted. The noticewill tell youthatyourtax returnhas been applied toyour child support debtand to contactthe Child Support Divisionifyoubelieve this was done in error.

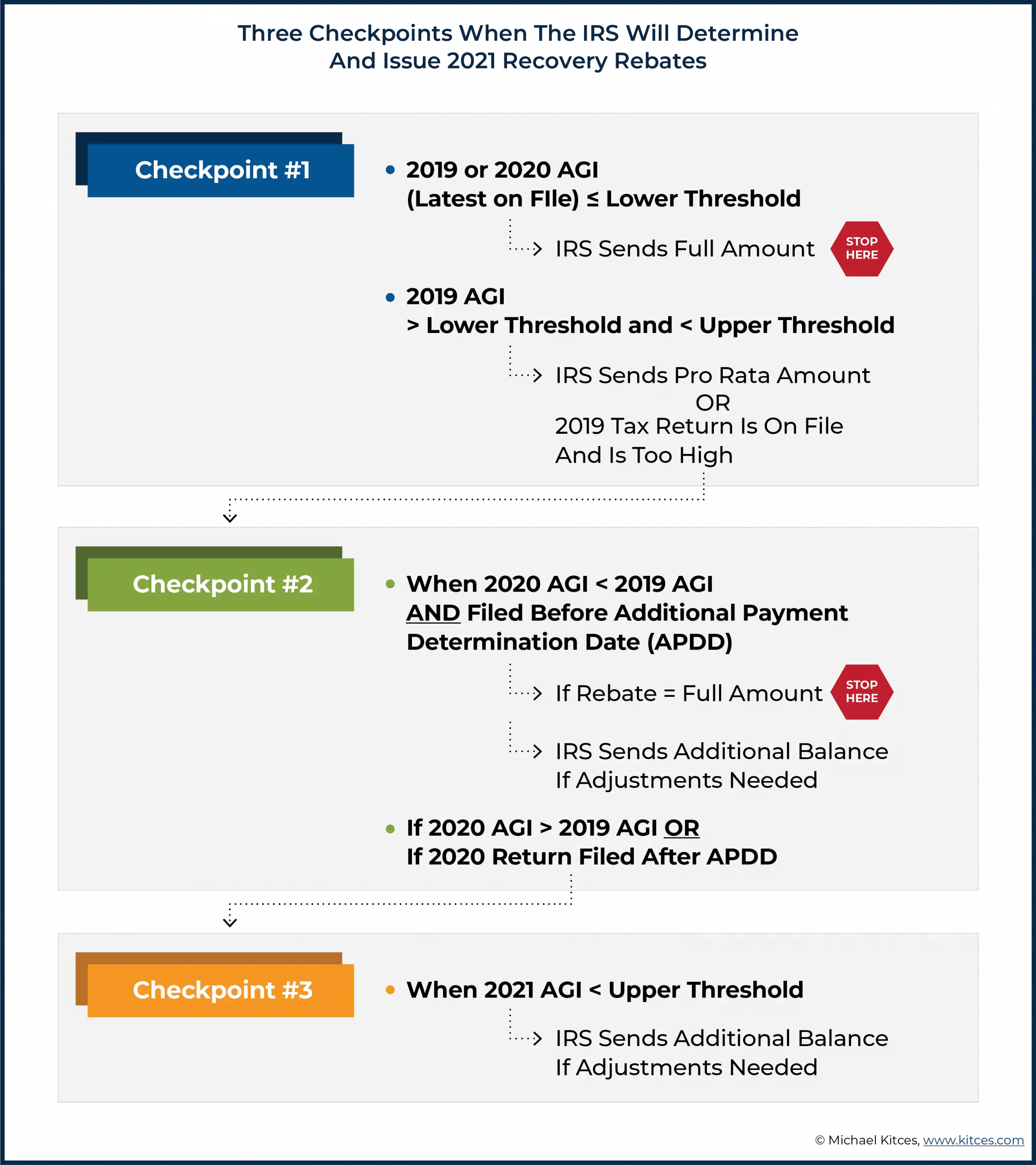

Recovery Rebate Paid Now Based On Prior Years Agi But Still A 2021 Credit

Given the changes to the way a taxpayers Recovery Rebate is phased out, it is more important than ever to understand the mechanics behind the way the Recovery Rebate is paid or potentially trued up on a clients income tax return at the end of the year.

Under the American Rescue Plan, there are as many as three checkpoints that the IRS will use to determine if an individual is entitled to a 2021 Recovery Rebate.

In some cases, a taxpayer may receive the full amount of the Recovery Rebate at Checkpoint 1 provided their 2019 or 2020 tax return is filed, and their AGI is equal to or less than the phaseout threshold, thereby essentially rendering the additional Checkpoints 2 and 3 meaningless .

Others will fail Checkpoint 1 and have to wait until the Additional Payment Determination Date in Checkpoint 2 , or until after they file their 2021 tax returns Checkpoint 3 to receive some or all of their 2021 Recovery Rebate. Still, others may receive portions of their 2021 Recovery Rebate at each of the three Checkpoints! And, of course, some high-income clients will not receive any Recovery Rebate at any Checkpoint.

Don’t Miss: Who Receives The Third Stimulus Check

Rhode Island: $250 Rebate Per Child

Rhode Island is sending a one-time payment of $250 per child, thanks to a state budget surplus.

Households can receive a payment for up to three dependent children, for a maximum of $750. Those children must have been listed as your dependents on your 2021 federal and state income tax returns.

Taxpayers must earn $100,000 or less to be eligible for the payment.

Child Tax Rebate check distribution began in October. Taxpayers who filed their 2021 state tax returns on extension by October 2022 will receive their rebates starting in December. You can check your rebate status on Rhode Islands Division of Taxation website.

Here Are Some Key Things To Know About This Tool And Who Can Use It

- Before using the tool, people must verify their identity by answering security questions.

- If the answers do not match IRS records after multiple attempts, the user will be locked out of the tool for 24 hours. This is for security reasons. Those who cant verify their identity wont be able to use Get My Payment. If this happens, people should not contact the IRS.

- If the tool returns a message of payment status not available, this may mean the IRS cant determine the persons eligibility for a payment right now. There are several reasons this could happen. Two common reasons are:

- A 2018 or 2019 tax return is not on file and the agency needs more information or,

- The individual could be claimed as a dependent on someone elses tax return.

Recommended Reading: How Much Was The First And Second Stimulus Check

Who Is Eligible For The Third Stimulus Check

While eligibility is similar to the first and second stimulus checks, there are differences. There are four primary requirements:

1. Income: The income requirements to receive the full payment are the same as the first and second stimulus checks. There is no minimum income needed to qualify for the payment. Households with adjusted gross income up to $75,000 for individuals will receive the full payment. The third stimulus payment starts to phaseout for people with higher earnings. The third stimulus checks maximum income limit is lower than the first and second stimulus check. Single filers who earned more than $80,000 in 2020 are ineligible for the third stimulus check.

View the chart below to compare income requirements for the first, second, and third stimulus checks.

| Income to Receive Full Stimulus Payment | First Stimulus Check Maximum Income Limit | Second Stimulus Check Maximum Income Limit | Third Stimulus Check Maximum Income Limit |

| Single Filer | |||

| $120,000 |

2. Social Security Number: This requirement is different from the first and second stimulus check.

Any family member that has a Social Security number or dependent can qualify for the third stimulus check. For example, in a household where both parents have ITINs, and their children have SSNs, the children qualify for stimulus checks, even though the parents dont.

See the chart below for further explanation of how this works.

Illinois: $50 And $300 Rebates

There are two rebates available to 2021 Illinois residents.

The first rebate is the individual income tax rebate, available for residents whose adjusted gross income is less than $200,000 per year . Each individual will receive $50, with an additional $100 per eligible dependent .

The second rebate is a property tax rebate, available for residents making $250,000 or less . The rebate is equal to the property tax credit you qualified to claim on your tax return, up to a maximum of $300.

The state started issuing rebates the week of September 12 it will take several months to issue them all, according to the Illinois Department of Revenue.

You May Like: Is There Another Round Of Stimulus Checks Coming Out

Who Is Eligible For A Third Stimulus Check

Some people may or may not be eligible for receiving a stimulus check. Among people that can expect this check include:

- Individuals with an $80,000 AGI or less

- Head of household with a $120,000 AGI or less

- Couples filing jointly with a $150,000 AGI or less

- Dependents of every age, if the guardian qualifies

- Families with mixed US citizenship

- US citizens who live abroad

- Citizens living on US territories

- Incarcerated people

- Non-citizens that pay taxes

Most people living in the US can indeed be expected to receive a stimulus check, provided they have US citizenship, have a visa, or at least pay U.S. taxes. With that in mind, certain categories are disqualified from receiving a stimulus check and this will precisely help you determine whether you are eligible for receiving it as well or not.

Eligibility is based on your adjusted gross income, and the amount of money that you receive will be calculated on the same basis.

Is There A Deadline To Get My Third Stimulus Check

If you will be filing a full tax return, you have until the IRS closes their tax filing software on November 20, 2021. After this date, you can still claim the third stimulus check in 2022 by filing your taxes for Tax Year 2021.

If youre not required to file taxes, the deadline to use GetCTC.org is November 15, 2022. You can get the Recovery Rebate Credit using GetCTC.org, a simplified tax filing portal for non-filers. GetCTC is an IRS-approved service created by Code for America in partnership with the White House and U.S. Department of Treasury. You can use the portal even if youre not signing up for the Child Tax Credit advance payments.

Also Check: Are People Still Getting Stimulus Checks

How Much Were The Stimulus Checks

The first round of stimulus checks were paid to people beginning in April 2020. Those checks were up to $1,200 per eligible adult and up to $500 for each dependent child under 16.

The second round of stimulus checks were paid to people beginning in December 2020. Those checks were up to $600 per eligible adult and up to $600 for each dependent child under 17.

The third round of stimulus checks were paid to people beginning in March 2021. Those checks were up to $1,400 per eligible adult and up to $1,400 for each dependent child, regardless of age.

Stimulus Checks: No Taxable Income Or Address

Q. Im a single person that has a valid SSN, but I do not file a tax return because I do not have any taxable income. What should I do if I didnt receive any stimulus money?

A. For the first two rounds of economic impact payments, the taxpayer will need to file a 2020 tax return with the IRS and claim the recovery rebate credit. Eligible taxpayers who did not receive the maximum amount of advance payments and taxpayers who missed receiving the first or second stimulus payments altogether can claim a credit on their tax return for the amount they qualified for but did not receive as an advance payment. For example, a single taxpayer who was eligible for but did not receive either economic impact payment would be eligible to claim a recovery rebate credit in the amount of $1,800 .

If this same eligible taxpayer did not receive the third economic impact payment, they should receive that from the IRS after their 2020 tax return is processed. Once the IRS processes the taxpayers 2020 tax return, the IRS will use the information from the 2020 tax return to determine eligibility for the third round of payments. In this case, if the IRS determines the taxpayer is eligible for the full third economic impact payment and no payment has been made to that taxpayer, the IRS will issue an additional $1,400 to that individual. The FAQs available on this IRS webpage help explain the process someone should follow in this situation to complete their tax return.

Also Check: Has The Stimulus Checks Been Approved