Do I Need To File My Taxes To Get A Stimulus Payment

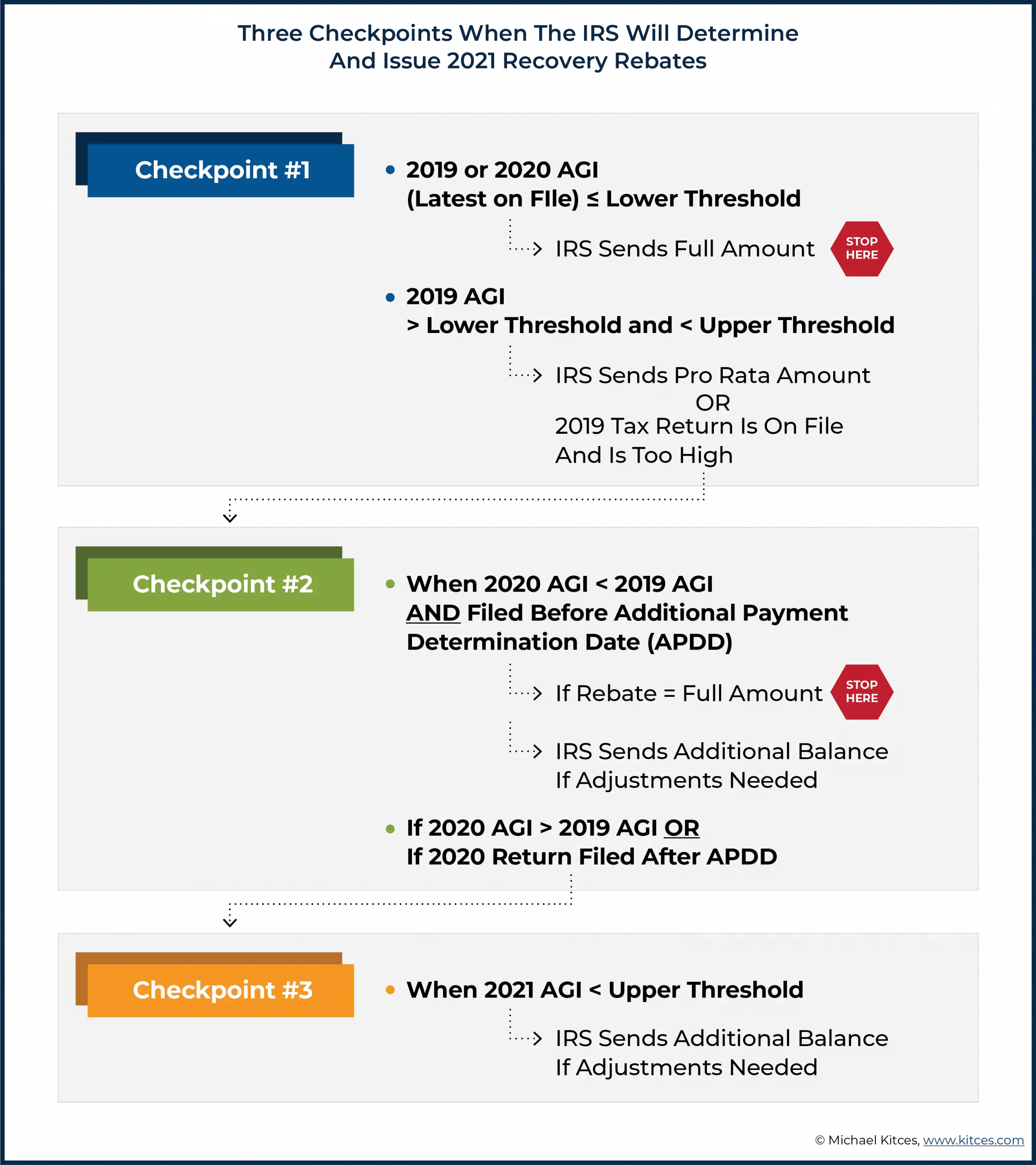

If you are required to file a tax return, the IRS will use information from your most recent filed tax return to issue your stimulus payment.

Here are the reasons you are required to file a tax return for tax year 2020:

- Taxpayers who earn income more than the IRS income filing threshold .

*Note: If you are single and 65+, thresholds are bumped up to $14,050 for 65+ or blind. If you are married filing jointly, 65+ thresholds are $13,700 for 65+ or blind.

- Self-Employed whose net income is $400 or more since they need to pay self-employment taxes on income of $400 or more

- Dependents with unearned income more than $1,100 and earned income more than $12,400

- You received an advance payment of the health coverage tax credit

- You owe taxes on an IRA or Health Savings Account

If are not required to file, you can use the TurboTax free Stimulus Registration Product to provide the IRS information needed so that you can receive a stimulus payment.

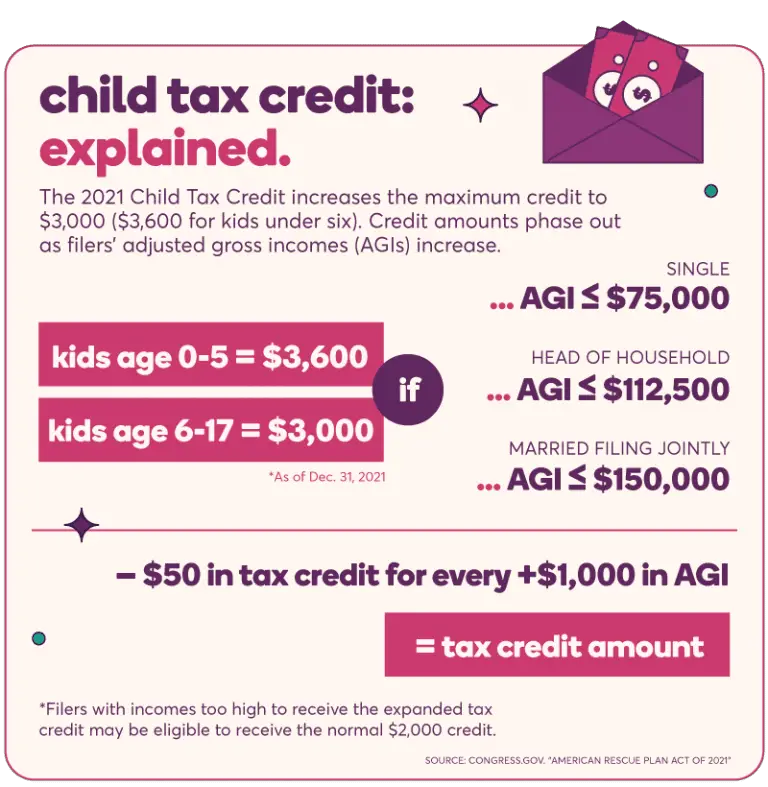

Will I Keep Getting The Expanded Credit Amounts And The Advance Payments Next Year

The American Rescue Plan enacted these historic changes to the Child Tax Credit for 2021 only. That is why President Biden and many others strongly believe that we should extend the increased Child Tax Credit for years and years to come. President Biden proposes that in his Build Back Better agenda.

Earned Income Tax Credit

More people than ever before will qualify for the Earned Income Tax Credit because of the recent expansion. For the first time, adults without kids at home are eligible for a credit worth up to $1,500. This includes people ages 19 24 and over 64 who work and werent eligible before.

In addition, many eligible families with children will get a slightly larger EITC. When you file your taxes in 2022, the credit is worth a maximum of $6,728.

Read What is the Earned Income Tax Credit? to learn about your eligibility, how much the credit is worth, and how to get it.

Also Check: When Did Stimulus 3 Go Out

Do I Need To File Taxes To Get Stimulus Check 2021

They letter explains that if you received advance CTC payments, you’ll need to report that amount in your tax return. … If you’re eligible for RRC, you’ll need to file a 2021 tax return to claim your remaining stimulus amount. You can check the Economic Impact Payment amounts by logging into your IRS online account.

Some Taxpayers Will Receive The Rebate By Direct Deposit And Some Will Receive A Paper Check

If you received a refund by direct deposit this year, youll likely receive your rebate by direct deposit in the same bank account, with the description VA DEPT TAXATION VATXREBATE. All other eligible taxpayers will receive their rebate by paper check in the mail.

- If you’ve moved in the last year and have a current forwarding order with the USPS, then your check will be forwarded to your new address.

- Were not able to update your bank account information. If the bank account where you received your Virginia refund by direct deposit is closed, call us at , and we can mark it as an invalid account. Youll receive your rebate by paper check in the mail.

You May Like: When Were All The Stimulus Checks Sent Out

Didn’t Get The Full Third Payment Claim The 2021 Recovery Rebate Credit

You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return.

Individuals can view the total amount of their third Economic Impact Payments through their individual Online Account. Through March 2022, we’ll also send Letter 6475 to the address we have on file for you confirming the total amount of your third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need this information from your online account or your letter to accurately calculate your 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment. All amounts must be considered if filing jointly.

Using the total amount of the third payment from your online account or Letter 6475 when preparing a tax return can reduce errors and avoid delays in processing while the IRS corrects the tax return.

How Much Were The Stimulus Checks

The first round of stimulus checks were paid to people beginning in April 2020. Those checks were up to $1,200 per eligible adult and up to $500 for each dependent child under 16.

The second round of stimulus checks were paid to people beginning in December 2020. Those checks were up to $600 per eligible adult and up to $600 for each dependent child under 17.

The third round of stimulus checks were paid to people beginning in March 2021. Those checks were up to $1,400 per eligible adult and up to $1,400 for each dependent child, regardless of age.

You May Like: Where’s My Stimulus Money 2021

What If My Spouse Or Ex

If you did not get all or some portion of your Economic Impact Payments you can file a 2020 tax return and claim these amounts on line 30 of the form. The IRS is referring to this as the recovery rebate and will allow you to claim any of the EIPs that you did not get in advance. You may get a denial letter from the IRS, but that is the opportunity to reply and explain your situation to the IRS. In this situation, Vermonters with a low income can contact us for help at the Vermont Low-Income Taxpayer Clinic by filling out our form or calling 1-800-889-2047.

What Phone Number Is 800 829 0922

If you want to call the IRS, make sure you call the right number: 800-829-0922. The letter says you have 60 days from the date of the letter to appeal or you can sue in federal court. You may want to hire a tax professional and you may qualify for low-income taxpayer clinics. They’re free or close to free.

Read Also: Get My 2nd Stimulus Payment

Golden State Stimulus Taxation

While individual states that offered stimulus checks may have different rules, the California Franchise Tax Board confirms on its website that the Golden State Stimulus payments are not subjected to state tax.

As with the federal stimulus payments, the Golden State Stimulus cannot be claimed as income.

Therefore, it cannot be claimed on an income tax return.

Can A Nursing Home Or Assisted Living Facility Take The Payment From Me

No. If you qualify for a payment, its yours to keep. If a loved one qualifies and lives in a nursing home, residential care home or assisted living facility, its theirs to keep. The facility may not put their hands on it or require somebody to sign it over to them. Even if that somebody is on Medicaid.

Recommended Reading: When Was The Third Stimulus Payment Issued

So Whos Eligible For What Exactly

Every year, millions of eligible taxpayers fail to claim tax credits that theyre eligible for. Various studies and reports say this is largely due to misperceptions about how hard it is to claim them, and whether people qualify for them.

All of those potential tax credits and things can be a lot to keep track of. Heres how it all shakes out:

You Must File A Return To Claim The Credit

It’s worth pointing out that the only way you can claim the recovery rebate credit is to file a 2021 tax return. This is true even if you’re not otherwise required to file a return . So, if you qualify for the credit, make sure you file a tax return this year.

For most people, tax returns for the 2021 tax year are due by April 18, 2022. If you can’t file by that date, request an extension to file your tax return, which will push your filing deadline to October 17. Depending on your income, you may even be able to file your tax return for free.

If you don’t remember how much you actually received last year as a third stimulus check, look at Notice 1444-C, which the IRS sent you last year. If you didn’t keep that notice , don’t worry there are other ways to get the information. The IRS should have sent you a Letter 6475 earlier this year that contains your third stimulus check amount. You can also get the amount through an IRS online account or by requesting a 2021 account transcript .

You May Like: Where Do I Put Stimulus Money On Tax Return

Who Qualifies For A Stimulus Check And How Much Will I Receive

According to the IRS, approximately 80% of Americans will be eligible to receive full or partial stimulus payments through the CARES Act. If you have an adjusted gross income of up to $75,000 , you should be eligible for the full amount of the recovery rebate.

For tax filers with income above these amounts, the stimulus payment decreases by $5 for each $100 above the thresholds. The stimulus check rebate completely phases out at $99,000 for single taxpayers, $136,500 for those filing as Head of Household and $198,000 for joint filers with no kids. Your eligibility will be based on information from your most recent tax filings .

Use our Stimulus Check Calculator to see if you qualify and how much you can expect.

Direct Deposit Vs Debit Card Stimulus Payments From California

If you filed your 2020 California tax return electronically and received a California tax refund by direct deposit, then you’ll generally receive your stimulus payment by direct deposit, too. You can also expect a direct deposit payment if you previously received a Golden State Stimulus payment in 2021 or early this year via that payment method.

Most other people who are eligible for a payment will receive a debit card in the mail for the appropriate amount. You will also get a debit card stimulus payment if you received a 2020 California tax refund by direct deposit but have changed banks or your bank account number since then. People who received an advance payment from a tax service provider or paid a tax preparer’s fee with a tax refund will also get a debit card in the mail.

If you get a debit card in the mail, you can activate the card online or by calling 1-800-240-0223.

Read Also: What Is Congress Mortgage Stimulus Program For The Middle Class

What If I Receive Social Security Or Supplemental Security Income

Not everyone needs to file to get a stimulus payment. If you receive Social Security retirement, disability or Railroad Retirement income and are not typically required to file a tax return, you do not need to take any action the IRS will issue your stimulus payment using the information from your Form SSA-1099 or Form RRB-1099 via direct deposit or by paper check, depending on how you normally receive your Social Security income.

If you receive Supplemental Security Income , you will automatically receive a stimulus payment with no further action needed. You will generally receive the automatic payments by direct deposit, Direct Express debit card, or by paper check, just as you would normally receive their SSI benefits.

If I Am The Custodial Parent And Im Currently Receiving Or Have Ever Received Tanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe. Federal law dictates how monies received by a state child support agencyunder the Federal Tax Refund Offset Program are distributed. In Texas, federal tax offsets are applied first to assigned arrears, or arrears owned by the state, and then to arrearages owed to the family. If there is money owed to the state in your case, the intercept stimulus payments up to the amount owed to the state will be retained by the state. The remainder of money will be sent to you, up to the amount of unassigned arrears owed to you by the noncustodial parent.The amount of the money you are entitled to receive will depend on a number of factors, including the amount of the tax refund intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears.You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted tax return.

Read Also: 4th Stimulus Check For Ssdi

When Can I Expect My Tax Refund In 2021

The IRS delayed their normal start day for processing tax returns to This means that getting refunds will also be delayed compared to previous years. The IRS indicates that using electronic filing will speed up processing.

The IRS also notes that those who have the Earned Income Credit and Additional Child Tax Credit can expect refunds to start being issued the first week of March for those who file their tax return as soon as processing starts in February.

Most taxpayers will receive their refund within 21 days of filing electronically, assuming there are no errors or other issues with their return.

It is important to note that although the start date for processing returns was pushed back, the end-date to file your return has not changedit is still April 15 for most taxpayers.

Is The Boosted Child Tax Credit Gone For Good

Not necessarily. Lawmakers are still fighting to bring back some version of the boosted credit — one that pays families on a monthly basis rather than forces them to wait to receive their money in the form of a tax refund.

But while lawmakers on different sides of the political spectrum seem to agree about the importance of making a boosted Child Tax Credit available, they disagree on how the rules should work. Some, for example, think there should be an income requirement attached to the credit. But that requirement might prevent some of the people who need that money the most from getting it.

Meanwhile, the Child Tax Credit itself has not gone away for 2022. Rather, it simply reverted to its former version. That means it will have a lower maximum value and only partial refundability, and it means those who want that money will have to claim the credit on a 2022 tax return that’s filed in 2023.

But for many families, having to file a tax return is a barrier to getting that money. And while the IRS does have tools and assistance programs available for lower earners who need help filing a return, we could see a lot of people miss out on this year’s Child Tax Credit because they find the process and idea of filing taxes too daunting.

Also Check: Who Qualified For Stimulus Check 2021

Unemployment Benefits And Form 1099

If you claimed unemployment benefits in 2021, then you should receive a Form 1099-G, Certain Government Payments from your state unemployment office by the end of January 2022. Your Form 1099-G will show the total amount of unemployment benefits you have received, along with any state and federal taxes you had withheld.

Unemployment benefits are considered taxable income, so you will need to report unemployment on your federal tax return.

If you received a Form 1099-G, but didnt claim unemployment benefits, then you may be a victim of identity theft and fraud. Contact your state unemployment office to report and correct this issue.

When Is The Deadline For Claiming Stimulus Or Child Tax Credit Money

The deadline for claiming your money depends on if you’re required to file a tax return or not. You’re generally not required if you file single and earn less than $12,550 per year.

You have until Tuesday, Nov. 15, to complete a simplified tax return to claim your missing stimulus or child tax credit money if you’re not typically required to file taxes. That’s roughly one month away. To help, the IRS is keeping the free file site open until .

If you filed a tax extension earlier this year or haven’t filed yet, your deadline to submit your tax return if you’re required to file was . That was also the last day to file Form 1040 to avoid a late-filing penalty.

If you were affected by one of the recent natural disasters, such as Hurricane Ian, you have until Feb. 15, 2023, to file. If you live in an area covered by Federal Emergency Management Agency disaster declarations, like Kentucky or Missouri, you have until to file.

You could soon miss out on your stimulus and child tax credit money.

Also Check: Is It Too Late To Apply For Stimulus Check

What Is The 2021 Stimulus Based On

The amount of the third-round Economic Impact Payment was based on the income and number of dependents listed on an individual’s 2019 or 2020 income tax return. The amount of the 2021 Recovery Rebate Credit is based on the income and number of dependents listed on an individual’s 2021 income tax return.

Claiming This Money Wont Hurt Your Other Benefits

The IRS is stressing that if you claim these 2021 tax credits, it wont change whether youre eligible for other federal benefits for low-income households namely the Supplemental Nutrition Assistance Program , Supplemental Security Income , Temporary Assistance for Needy Families , or the Special Supplemental Nutrition Program for Women, Infants and Children .

So dont worry about that.

Don’t Miss: Stimulus Check Lost In Mail