Questions And Answers About The First Economic Impact Payment Topic B: Requesting My First Economic Impact Payment

Q B1. I received a letter IRS Notice 1444-A from the IRS telling me I have to act to claim an Economic Impact Payment by October 15, 2020 but did not act. What should I do?

A1. If you didnt receive your first Economic Impact Payment, you may still be eligible to claim the 2020 Recovery Rebate Credit and must file a 2020 tax return to claim it. Receiving the letter is not a guarantee of eligibility for an Economic Impact Payment. For more information on eligibility requirements, see 2020 Recovery Rebate Credit on IRS.gov.

Q B2. I filed a 2019 tax return. What do I need to do to get my first Payment?

A2. If the IRS was unable to process your 2019 return and issue you the first Economic Impact Payment by December 31, 2020, you may be able to claim the 2020 Recovery Rebate Credit and must file a 2020 tax return to claim it.

Q B4. I havent filed my 2019 tax return but filed my 2018 return and already received my first Economic Impact Payment. Will filing a 2019 return affect my Economic Impact Payment?

A4. No. The IRS used the information from your 2018 tax return to calculate the first Payment amount since you hadnt filed your 2019 return yet.

If you didnt receive the full amount of the first Economic Impact Payment to which you believe you are entitled, you may be eligible to claim the 2020 Recovery Rebate Credit and must file a 2020 tax return to claim it.

First Round Of Cares Act Stimulus Checks: What Expats Should Know

Q. What did the CARES Act 2020 Coronavirus stimulus check mean for U.S. expats?

A. The CARES Act stimulus check expats got in 2020 was technically a 2020 tax credit in advance.

It was part of the CARES Act Coronavirus stimulus package, which was designed to help get the economy back on its feet while we navigate the COVID-19 pandemic. In it are a variety of benefits for both individuals and corporations to ease the financial burden of the shutdowns and shelter-in-place orders. For the average American, the main benefits are cash payments and a variety of other debt relief options. The amount each taxpayer got depends on a variety of factors.

Q. Did I qualify for a CARES Act stimulus check if I live overseas?

A. Yes, expats qualified for the CARES Act stimulus checks. You qualified if you fell within the income threshold, had a social security number, and filed taxes even if you lived overseas. If you didnt get it, you can still apply for it retroactively as a tax credit on your 2020 tax return.

Q. What is the Recovery Rebate Credit?

A. If you didnt get the full amount you were owed, you may be able to apply for the Recovery Rebate Credit. Any eligible individual who did not receive the full amount of the recovery rebate as an advance payment, also known as an Economic Impact Payment, can claim the Recovery Rebate Credit on a 2020 Form 1040 or Form 1040-SR.

Q. How much was the CARES Act stimulus check for?

Q. Did I have to pay back the amount I got?

A. No

What To Do If One Of The Three Stimulus Checks Hasn’t Arrived

About 15 days after the IRS sends out your check, you should receive a letter from the agency confirming the payment. When the first round of stimulus checks went out last year, that letter included two hotline phone numbers because thousands of agents were available to help. But with the second and third rounds of checks, the IRS changed its tune, and these phone numbers may be disconnected.

Here are common scenarios that might indicate you need to look into your stimulus payment:

- If you’re one of the millions of people who qualified for the first stimulus check but never got it.

- If your second stimulus check has still not arrived.

- If you got a letter from the IRS saying your third check was sent, but never received the payment. Or, if the IRS Get My Payment portal said your payment was sent, but you didn’t get it.

- If you got some of your stimulus money from any payment, but not all of it.

You should also confirm you’re qualified to get the stimulus payment, since not everyone who received a previous check is qualified this time. If you think it’s time to take action, read for more options.

Recommended Reading: What About 4th Stimulus Check

You Dont Qualify For A Stimulus Check Anymore

After much back and forth, the Democrats who control Congress agreed to a more targeted approach for this round of stimulus checks.

Individuals making more than $80,000 and couples earning over $160,000 get no money this time.

Previously, the cutoff thresholds were $100,000 for single taxpayers and $200,000 for couples filing jointly.

Also Check: Irs Wheres My Stimulus Payment

When Will You Get Your Money

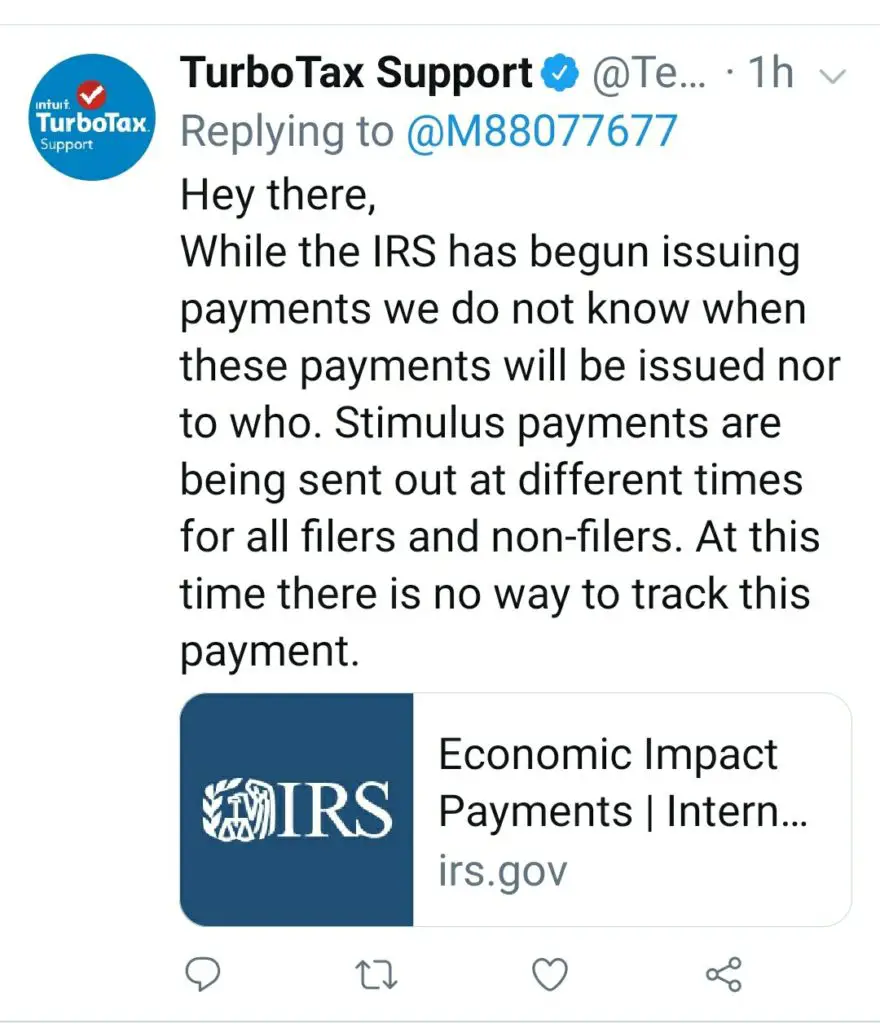

The exact date you’ll receive your money depends on your circumstances, but the IRS has already begun sending electronic payments to millions of Americans.

The speed with which you’ll receive your payment largely depends on how you filed your taxes. The IRS can distribute electronic payments quickly, but they must print and mail paper checks for some recipients, which takes additional time.

On April 15th, the IRS launched a portal to track the status of your stimulus payment. To track your payment, you’ll need your social security number, your birthday, your address and your zip code provided you filed your 2019 or 2018 tax return. If you are a qualified non-filer, there are additional links on the IRS’s website to input your information so you can still receive your check.

On April 2, Treasury Secretary Steve Mnuchin said that eligible Americans who have signed up for direct deposit payments should receive them within two weeks, a process which is already underway. A spokesperson for the Treasury Department expects 50 million to 70 million Americans to receive their checks via direct deposit by April 15, according to The Washington Post.

However, if you didn’t sign up for direct deposit when filing your tax return and require a paper check, you might experience some delays. In fact, because the government lacks banking information for millions of Americans, $30 million in paper checks won’t begin distribution until April 24, or longer.

You May Like: Form 1040 For Stimulus Check

What Is A Recovery Rebate Credit

The IRS has lots of different rules, regulations and terms that make things confusing for filers, but pay no attention to the man behind the curtain: The Recovery Rebate Credit is simply just another name for your stimulus check. And if you were one of the lucky Americans who received two EIPs with no problems, you technically just received an advance of that Recovery Rebate Credit.

Americans can claim that credit by filling out a new, special section on their 2020 Form 1040 or 1040-SR if theyre a senior. That also goes for taxpayers who normally dont have to file a tax return, according to the IRS.

But rest assured: Receiving a stimulus check wont come back to bite you. The IRS says that the credit will only increase the amount you receive as a tax refund or decrease the amount you owe, rather than subtract from the refund youre entitled to. Your stimulus check also isnt considered taxable income.

What If I Have Not Received My Third Stimulus Check

Asked by: Astrid Becker

What do I do if I didn’t get my stimulus checks? In 2022, you can visit GetYourRefund.org to claim any stimulus checks you haven’t gotten. You will need to file a 2020 tax return to get the first and second stimulus checks and a 2021 tax return to get the third stimulus check.

Also Check: Irs Gov 3rd Stimulus Check

Your Stimulus Checks Arent Taxable

Itâs essential to understand that a stimulus payment is not taxable. The IRS has issued guidance stating that you do not need to include the amount in your gross income or pay taxes on the money.

Still, many people donât entirely grasp how stimulus payments affect their taxes.

âThe part that I think most do not necessarily understand is that the payment is technically an advance refundable tax credit,â says Hawkins.

The stimulus payments were advance tax credits because the IRS gave you money in advance of filing your tax return. The recovery rebate credit is considered a refundable credit, meaning it can reduce the amount of taxes you owe or generate a refund to you.

One final important point: Typically, if you receive more money from the IRS than youâre entitled to, you must repay the excess amount. But the recovery rebate credit works differently. If you received a stimulus payment based on your previous tax information but no longer qualify, based on your current tax return, you donât have to pay any stimulus money back.

How Are Social Security Payment Dates Determined

The Social Security Administration typically sends out payments on the second, third and fourth Wednesdays of each month. Which day you receive your check depends on your birthdate.

- If your birthday falls between the 1st and 10th of the month, your payment will be sent out on the second Wednesday of the month.

- If your birthday falls between the 11th and 20th of the month, your payment will be sent out on the third Wednesday of the month.

- If your birthday falls between the 21st and 31st of the month, your payment will be sent out on the fourth Wednesday of the month.

Payments for SSI recipients generally arrive on the first of each month.

Read more: Turning 67 in 2023? What to Know Before You Retire

Also Check: When Did The First Stimulus Check Go Out

Havent Received Your Stimulus Check Yet Here Are 5 Reasons Why

Why you may not have received your stimulus payment yet

Since the American Rescue Plan was signed into law on March 11, some 127 million Americans have each received a $1,400 stimulus check. Yet millions are still looking for their third stimulus payment.

If you have not yet received payment, there are several reasons why you are still waiting. Some of them you can do something about, but most are out of your control.

While the pace seems slow, about $325 billion has been distributed so far. Also, payments are being processed, deposits are being made into accounts and debit cards and paper checks are still being sent out, the Internal Revenue Service stated last week.

If you have not received your payment, here are a few reasons that may be causing a delay.

1. You get Social Security or VA benefits.

Thirty million Americans who receive Social Security or Veterans Administration benefits or those who get Railroad Retirement benefits are still waiting for a check.

They can blame Washingtons bureaucracy.

Last week, a letter was sent from the chairman of the House Ways and Means Committee to the head of the Social Security Administration demanding that the Social Security Administration share with the IRS information on who gets those benefits so that checks can be sent out to SSI, SSDI and VA recipients and those who get Railroad Retirement checks.

That transfer of information happened Thursday, clearing the way for the payments to begin to go out.

Getting A Missing Check Can Be Difficult But Worth The Trouble

by Adam Shell, AARP, February 4, 2022

Nobody wants to leave money on the table, especially a stimulus payment from the U.S. government that theyre eligible for but didnt receive. In late January the Internal Revenue Service announced that all third-round stimulus checks had been sent. But the IRS also noted that not all eligible Americans received the full amount theyre entitled to.

The good news? Theres still time to get whats owed to you.

Uncle Sam which issued 175 million third-round payments, totaling over $400 billion, through the end of 2021 reminded people that they can claim any remaining stimulus money theyre entitled to but didnt get by claiming the Recovery Rebate Credit on their 2021 income tax return.

The rebate, which comes as a tax credit of up to $1,400 per eligible person on your 2021 return, will either lower the amount of tax you owe or boost the size of your refund. The golden prize of a tax return is a tax credit, says Mark Steber, chief tax information officer at Jackson Hewitt, a tax preparation service. The Recovery Rebate Credit is a dollar-for-dollar tax-liability offset.

Recommended Reading: How Many Stimulus Checks Were In 2021

When Will I Get My Stimulus Check

Californians who received money from either round of Golden State Stimulus payments were the first to receive direct deposits, which should have arrived before Oct. 25. The remainder of direct deposits were reportedly issued between Oct. 28 and Nov. 14. But if you changed your banking information since filing your 2020 tax return — or never set up direct deposit in the first place– you should expect to receive a Money Network debit card instead.

California taxpayers who didn’t set up direct deposit will receive special debit cards in the mail.

Cards will be mailed between Dec. 17, 2022, and Jan. 14, 2023, according to the Franchise Tax Board, which said it expects 95% of all MCTR payments — direct deposit and debit cards — to be issued by the end of 2022.

Keep in mind that some tax returns “require additional review,” the FTB said, according to KGET, which could delay your deposit or mean you’re getting a debit card instead. Below is an estimated payment schedule for various categories of recipients.

How Much Stimulus Money Are You Going To Get

The amount of money that youre going to get back depend on what your last tax return was. If you havent filed yet this year, they will calculate on your 2018 filing. You can find out on 8b of the 2019 1040 federal tax form, according to Cnet. Taxes are not due yet, so if you havent filed, dont stress the due date has been moved to July 15th.

Stimulus checks are coming in just one sum, you can check the status on your application on the IRS website if youre not sure where your check is or if you qualify for one.

If you didnt get your stimulus check this week, here are a few reasons as to why, and what you can do about it. Keep reading to get that money!

Recommended Reading: How Much Are The Stimulus Checks

Recommended Reading: 4th Stimulus Check Texas 2021

Check The Irs Website

If youâve checked the eligibility requirements and believe you should have received the stimulus payment, you can use the Get My Payment tool on the IRS website to check on the status. Youâll need to enter your:

- Social Security Number

After confirming your identity, youâll see you when your money is being sent and if it will be arriving as a check, direct deposit, or debit card. If the payment has already been sent, youâll be provided with details like the date it was sent and the method.

The âGet My Paymentâ tool is updated once per day, so thereâs no need to check multiple times in the same day.

If the status is listed as ânot availableâ, that means your payment has not been processed yet or you are not eligible. As long as you meet the eligibility requirements, you can check later and the status should change and show the details once payment has been sent.

You may also see a âneed more informationâ message. In this case, you can enter your bank account details to receive the payment by direct deposit and get it faster.

What Was The Second Stimulus Check Amount

What about the second stimulus check amount and dates? Congress approved another economic relief bill at the end of last year, and the second round of stimulus check payments began sending as early as Dec. 29, 2020. This payment capped out at $600 per person, and another $600 per qualifying child dependent.

Read Also: Fourth Stimulus Checks Social Security

What To Do If You Have Not Received Any Of The 3 Stimulus Checks While Eligible For Payments

Americans who have not received stimulus payments under the three laws passed in Congress are most likely low-income non-filers and will have to do additional paperwork with the IRS.

If you are one of the Americans who have not yet received any of the three stimulus checks distributed by the federal government through the Internal Revenue Service while you were eligible, you are most likely among the low-income people for whom the agency does not have information to process the payment.

Many of the cases of beneficiaries who have not yet received coronavirus stimulus checks are low-income individuals who are not required to file IRS tax returns. This means that the agency does not have the information on file to process the so-called Economic Impact Payments for this population.

The agency has recommended in these instances that individuals file a tax return as soon as possible even if they are not required to do so and claim the amount or amounts owed for stimulus checks through a Refund Recovery Credit.

In cases where the IRS provided an underpayment or without the extra dependent credits, taxpayers can also claim this money through the referred credit on the return this year.

In fact, the IRS reported this week that it is processing payments applicable to tax returns of individuals who filed their tax information this season for the first time because of the above reason.

How To Claim The Mortgage Interest Deduction

- Step 1: Watch for communications from your lender or servicer in early 2022. You dont have to keep track of how much interest youre paying your lender or servicer takes care of that and will send you Form 1098. This should arrive near the end of January or sometime in early February, and should also include mortgage insurance premiums and any prepaid interest.

- Step 2: Do the math. Youll need to determine if itemizing your deductions will give you a larger sum than the standard deduction.

- Step 3: Hand your Form 1098 to your tax professional, or complete the Schedule A on Form 1040 on your own. All reported mortgage interest will be entered on line 8a, any unreported will go on line 8b and mortgage insurance premiums will go on line 8d.

Dont Miss: Can I Cash My Stimulus Check At Any Bank

Read Also: Stimulus Check Direct Deposit Set Up