What Does Irs Letter 6475 Look Like

These letters started going out in late January and say, Your Third Economic Impact Payment in bold lettering at the top. You can also find the terms Letter 6475 on the bottom at the very righthand corner.

Earlier in the program, the IRS sent out a Notice 1444-C that shows the third Economic Impact Payment advanced for tax year 2021. If you saved that letter last year, you can refer to it, as well.

If you received stimulus money at various points during the year, you might have more than one notice. Letter 6475 gives you a total dollar amount.

Theres Still Time To Get Payments

If you havent yet filed your tax return, you still have time to file to get your missed 2021 stimulus payments.

Visit ChildTaxCredit.gov for details.

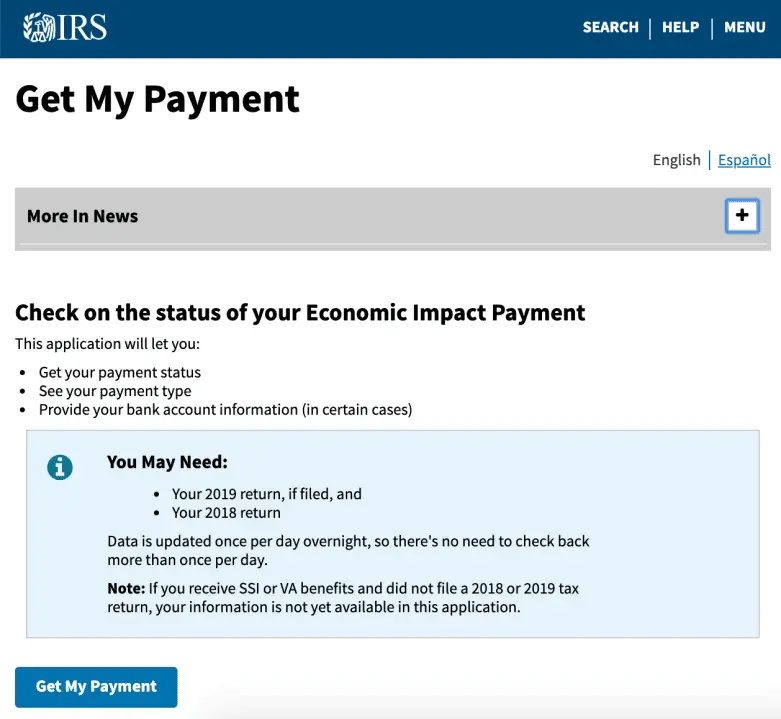

The IRS has issued all first, second and third Economic Impact Payments. You can no longer use the Get My Payment application to check your payment status.

Most eligible people already received their Economic Impact Payments. However, people who are missing stimulus payments should review the information below to determine their eligibility to claim a Recovery Rebate Credit for tax year 2020 or 2021.

Securely access your IRS online account to view the total of your first, second and third Economic Impact Payment amounts under the Tax Records page.

Stimulus Checks 202: State Relief Checks Tax Implications And More Of The Biggest Topics Of 2022

Although the federal government did not issue any economic impact payments aka stimulus checks in 2022, some states took it upon themselves to offer financial relief to eligible residents to offset the effects of inflation and rising gas prices. These inflation relief checks were issued in 17 states in 2022: California, Colorado, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Maine, Massachusetts, New Jersey, New Mexico, New York, Pennsylvania, South Carolina and Virginia. Payment amounts ranged from $50 to $1,050 for individuals, depending on the state and income level of the recipient.

See: States Whose Economies Are Failing vs. States Whose Economies Are Thriving

Given the tough economic times, its no surprise GOBankingRates readers looked for information on future stimulus payments they may be receiving, which states are offering inflation relief payments and when they might expect to receive these payments. These topics and more were among our most-read stimulus stories of the year.

Heres a look at the top 10 most-read stimulus stories of 2022.

Recommended Reading: What States Are Getting The Fourth Stimulus Check

When Should I Get My Payment

The IRS was given hard and fast deadlines to send the two rounds of Economic Impact Payments out to American families. The first round of payments had to be sent out by December 31, 2020. The second round had to be sent out by January 15, 2021.

What this means: If you have not received the first or second round of payments yet, then you will not be getting them in advance. The good news is that you can still do something to get these payments. Read below.

You May Like: I Did Not Receive Third Stimulus Check

Child Tax Credit Payments

There have been important changes to the Child Tax Credit that will help many families. The American Rescue Plan Act of 2021 expands the CTC for tax year 2021 only. The 2021 Child Tax Credit is up to $3,600 for each qualifying child.

Eligible families, including families in Puerto Rico, can claim the credit through April 15, 2025, by filing a federal tax returneven if they don’t normally file and have little or no income.

See the Advance Child Tax Credit 2021 webpage for the most up-to-date information about the credit and filing information. Families in Puerto Rico can check eligibility rules and find more information at Resources and Guidance for Puerto Rico families that may qualify for the Child Tax Credit.

You May Like: When Was The First Round Of Stimulus Checks Sent Out

How Do I Claim These Benefits

The IRS is urging people who believe they are eligible for the tax credits but haven’t filed a tax return to go ahead and file a return with the tax agency, even if they haven’t yet received a letter from the IRS. But the deadline for filing a return to claim these benefits is Thursday, November 17.

“The IRS reminds people that there’s no penalty for a refund claimed on a tax return filed after the regular April 2022 tax deadline,” the IRS said.

There are a few ways people can claim the benefits:

- File a return with Free File before November 17, 2022. Free File is available to people who earn less than $73,000.

- File a simplified 2021 tax return through GetCTC before November 15, 2022.

The IRS said it urges people to file their tax form electronically and to choose direct deposit in order to get their tax credits as soon as possible.

How Will The Irs Know Where To Send My Payment

The vast majority of people do not need to take any action. The IRS will calculate and automatically send the economic impact payment to those eligible.

For people who have already filed their 2019 tax returns, the IRS will use this information to calculate the payment amount. For those who have not yet filed their return for 2019, the IRS will use information from their 2018 tax filing to calculate the payment. The economic impact payment will be deposited directly into the same banking account reflected on the return filed.

Read Also: Get My Stimulus Payment For Non Filers

Alert: Highest Cash Back Card We’ve Seen Now Has 0% Intro Apr Until 2024

If you’re using the wrong credit or debit card, it could be costing you serious money. Our expert loves this top pick, which features a 0% intro APR until 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee.

In fact, this card is so good that our expert even uses it personally. for free and apply in just 2 minutes.

We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.The Motley Fool has a disclosure policy.

How Do I Manage My Plan To Avoid Default

In order to avoid default of your payment plan, make sure you understand and manage your account.

-

Pay at least your minimum monthly payment when it’s due.

-

File all required tax returns on time and pay all taxes in-full and on time .

-

Your future refunds will be applied to your tax debt until it is paid in full.

-

Make all scheduled payments even if we apply your refund to your account balance.

-

When paying by check, include your name, address, SSN, daytime phone number, tax year and return type on your payment.

-

Contact us if you move or complete and mail Form 8822, Change of AddressPDF.

-

Confirm your payment information, date and amount by reviewing your recent statement or the confirmation letter you received. When you send payments by mail, send them to the address listed in your correspondence.

There may be a reinstatement fee if your plan goes into default. Penalties and interest continue to accrue until your balance is paid in full. If you received a notice of intent to terminate your installment agreement, contact us immediately. We will generally not take enforced collection actions:

-

When a payment plan is being considered

-

While a plan is in effect

-

For 30 days after a request is rejected or terminated, or

-

During the period the IRS evaluates an appeal of a rejected or terminated agreement.

Read Also: How To Check Eligibility For Stimulus Check

I Have Not Received Any Stimulus Payment What Should I Do

Even though the Internal Revenue Service has issued first, second, and third stimulus payments to all the eligible Americans, still, if you have not received any stimulus payment, there is a way for you to do it now. IRS has launched a recovery rebate credit portal where you may be eligible to claim first, second, and third stimulus payments.

Social Security And Ssi: Could You Receive A Fourth Stimulus Check

US citizens in need of more financial aid

Inflation has dealt a hard blow to US citizens, many of whom are struggling to make ends meet as groceries and gas prices have skyrocketed this year.

Russias invasion of Ukraine hasnt helped either and older Americans are desperate for some help from the government through a potential fourth stimulus check.

Recommended Reading: Will There Be Another Stimulus Check In California

What Is The Eligibility To Receive Stimulus Payment Issued By The Federal Government Of The United States

As per the instructions and passed rescue plan, the Eligibility to receive stimulus payment is different for each installment. In the second Stimulus payment, adjusted gross income Below $100,000 per year for individuals and $200,000 for couples were eligible for the stimulus. Now in the third phase, individuals with an adjusted gross income of up to 75,000 and couples earning up to 150,000 use dollars are eligible to receive a 1400 U.S. dollar check for each person in the family.

Why Did I Get More Than One Letter From The Irs About My Economic Impact Payments

After each of the three Economic Impact Payments is issued, the IRS mails a letter called a notice to each recipient’s last known address. This notice provides information about the amount of the payment, how the payment was made and how to report any payment that wasn’t received.

Keep any IRS notices received related to the Economic Impact Payments with other tax records.The IRS is unable to issue a copy of the notice if it is lost or never received, even though the payment was received. Taxpayers who don’t have their notices can view the amounts of the first and second Economic Impact Payments through their online account.

Some people who received an EIP debit card and still had not activated their card were sent a letter earlier this year reminding them to activate their card or to request a replacement if they accidently threw it away. See the FAQ about this reminder letter.

Also Check: I Want To Sign Up For The Stimulus Check

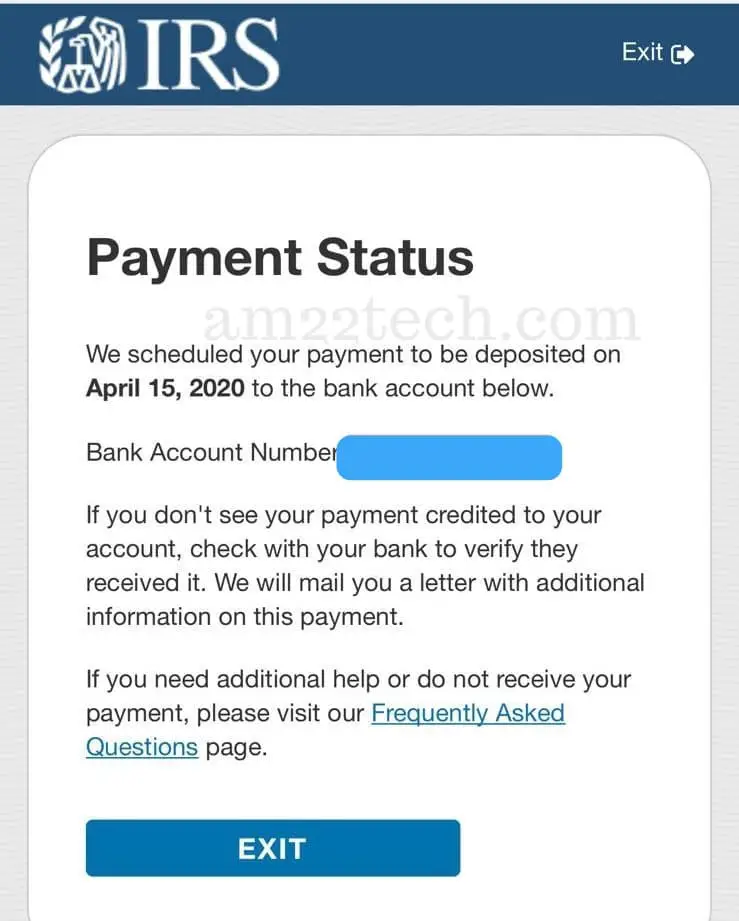

Find Out Which Payments You Received

To find the amounts of your Economic Impact Payments, check:

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page.

IRS EIP Notices: We mailed these notices to the address we have on file.

- Notice 1444: Shows the first Economic Impact Payment sent for tax year 2020

- Notice 1444-B: Shows the second Economic Impact Payment sent for tax year 2020

- Notice 1444-C: Shows the third Economic Impact Payment sent for tax year 2021

Letter 6475: Through March 2022, we’ll send this letter confirming the total amount of the third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need the total payment information from your online account or your letter to accurately calculate your Recovery Rebate Credit. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment.

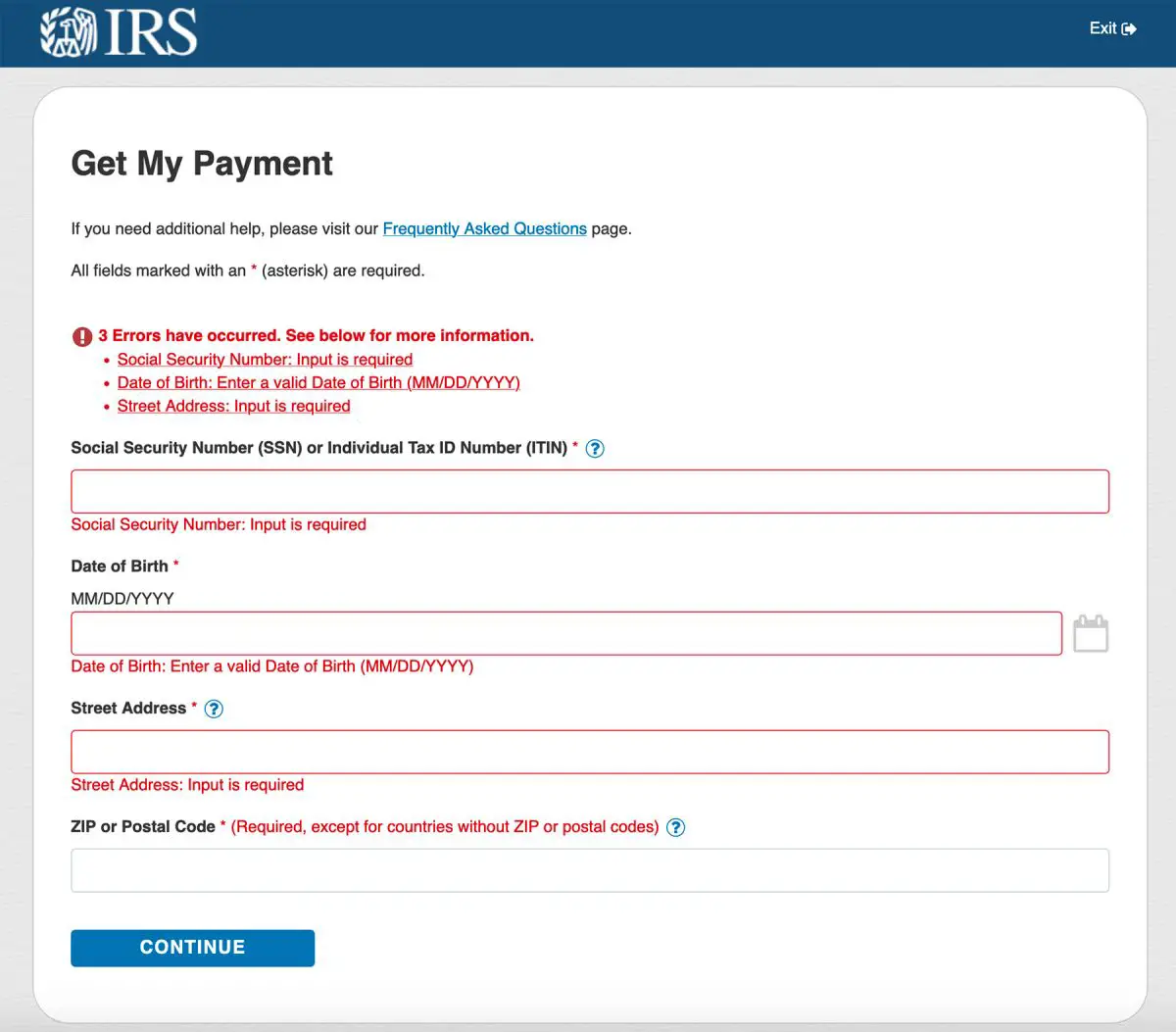

Why Am I Receiving An Error Message When Entering My Personal Information Or Tax Information

To ensure the information is entered correctly, please use the help tips provided when entering the information requested to verify your identity. If the information you enter does not match our records, you will receive an error message. Check the information requested to ensure you entered it accurately.

You may want to check your most recent tax return or consider if there is a different way to enter your street address . You may also verify how your address is formatted with the US Postal Service by entering your address in the USPS ZIP Lookup tool, and then enter your address into Get My Payment exactly as it appears on file with USPS.

If you receive an error when entering your Adjusted Gross Income , refund amount, or amount you owed, make sure you are entering the numbers exactly as they appear on your Form 1040 or tax transcript. If the numbers from your 2019 tax return are not accepted, try the numbers from your 2018 tax return instead.

If the information you enter does not match our records three times within 24 hours, you will be locked out of Get My Payment for 24 hours for security reasons. You will be able to access the application again after 24 hours. There is no need to contact the IRS.

You May Like: Are There Any Stimulus Checks Coming

Who Is Eligible For The Economic Impact Payment

Tax filers with adjusted gross income up to $75,000 for individuals and up to $150,000 for married couples filing joint returns will receive the full payment. For filers with income above those amounts, the payment amount is reduced by $5 for each $100 above the $75,000/$150,000 thresholds. Single filers with income exceeding $99,000 and $198,000 for joint filers with no children are not eligible. Social Security recipients and railroad retirees who are otherwise not required to file a tax return are also eligible and will not be required to file a return.

Eligible taxpayers who filed tax returns for either 2019 or 2018 will automatically receive an economic impact payment of up to $1,200 for individuals or $2,400 for married couples and up to $500 for each qualifying child.

Can I Request A Waiver For An Overpayment Debt Incurred During Covid

Date: December 31, 2020

Yes. Please and one of our employees will assist you. Under our rules, if you believe an overpayment was not your fault and you should not have to pay us back, you need to request a waiver of the overpayment debt. Certain debts may qualify for a streamlined waiver decision if:

- Your overpayment debt happened between March 1 and September 30, 2020 because Social Security did not process an action due to the COVID-19 pandemic and

- We identify the debt by December 31, 2020.

We developed instructions for our employees to process streamlined waiver requests. Although the are marked sensitive, this version has been redacted under the Freedom of Information Act for public release.

Recommended Reading: Ssi Payment Schedule 2021 Stimulus

Another Message On Irs Tracker

If youre getting the Need More Information message on the Get My Payment tracker, then the IRS hasnt received enough information to send your payment electronically.

If you havent received your stimulus check by mail, then again, youll need to claim a recovery rebate credit.

If youre getting the message Please Try Again Later, then youve been locked out of your account for 24 hours.

This might have happened because the information you entered didnt match IRS records, or youve tried to access the site more than five times in 24 hours.

Stimulus Checks And Direct Deposit

While Get My Payment allows you to give bank direct deposit information to the IRS, you cannot change bank information with the IRS if it already has an account for you on file. Why? As the IRS explains, “To help protect against potential fraud, the tool also does not allow people to change bank account information already on file with the IRS.” You also can’t change your form of payment if the IRS has already scheduled it for delivery.

If you haven’t filed your 2019 taxes , you might want to do that now. Many people can file federal tax returns for free, and tax-prep services like TurboTax and H& R Block are easy to use. The deadline for filing taxes in 2020 was moved from April 15 to July 15.

The Get My Payment app was designed for people who file federal taxes. The IRS has a separate spot online where non-tax filers, including many low-income earners, can enter their information to get stimulus checks for themselves and qualifying dependents.

Who gets stimulus checks first? The Treasury Department says that the first recipients of stimulus checks officially called “economic impact payments,” part of the $2 trillion CARES Act to provide economic relief amid the coronavirus pandemic were taxpayers who have already filed their 2019 tax returns and have provided direct deposit information to the IRS. Many of these payments began showing up in taxpayers’ bank accounts on Wednesday, April 15, or even earlier.

Promoted:

Also Check: Track My Golden State Stimulus 2

I Think The Amount Of My Economic Impact Payment Is Incorrect What Can I Do

If you did not receive the full amount to which you believe you are entitled, you will be able to claim the additional amount when you file your 2020 tax return. This is particularly important for individuals who may be entitled to the additional $500 per qualifying child dependent payments.

For VA and SSI recipients who don’t have a filing requirement and have a child, they need to use the Non-Filers tool on IRS.gov by May 5 in order to have the $500 added automatically to their $1,200 Economic Impact payment. We encourage people to review our “How do I calculate my EIP Payment” question and answer.

If I Am Incarcerated Am I Eligible For The Stimulus Checks

Yes, if you are incarcerated you are eligible to receive the stimulus checks if you meet the other eligibility criteria.

Eligibility for first stimulus and second stimulus checks:

Eligibility for third stimulus check:

Recommended Reading: Car Insurance ‘stimulus Check 2021