How Do I Update My Direct Deposit Information With The Irs To Receive My Stimulus Check

The IRS wont have your direct deposit information if you didnt provide it on your 2018 or 2019 tax returns, but you can use the IRS Get My Payment tool to check your payment status and confirm your payment type . If the IRS already has your direct deposit information and IRS Get My Payment tool shows your payment as pending or processed, you cannot use the tool to change your direct deposit information.

Do I Have To Pay Taxes On My Stimulus Payment

No. Since the stimulus check is considered a refundable tax credit, it is not classified as earned income. Hence not considered taxable income you will have to report in your 2020 tax return . It also wont affect your income for purposes of determining eligibility for federal government assistance or benefit programs.

This payment also does not have to be paid back if any over payment happens or your gross income in 2020 changes. This includes your income rising to above the qualifying thresholds. If you unexpectedly got the payment, congratulations! You get to keep it now.

Returning Incorrect Stimulus Check Payments

A few people have commented that a spouse, relative or child who died since they filed a 2018 or 2019 tax return received a stimulus check payment. The IRS has provided official guidance on this issue which states that any payments made to someone who died before receipt of the payment should be returned to the IRS in full. The exception to this is for payments made to joint filers and one spouse who had not died before receipt of the Payment, in which case, you only need to return the portion of the Payment made on account of the decedent

Also Check: Irs.gov Stimulus Check Sign Up

How Much Was The First Stimulus Check And When Was It Sent Out

The CARES Act was signed into law on March 27, 2020, and the first stimulus check, which maxed out at $1,200 per person , would have arrived as early as mid-April 2020, either as a paper check in your mailbox or via direct deposit into your bank account.

If you don’t have an IRS Notice 1444 and you know you received money from the first stimulus check via direct deposit, start your search in your April bank statements. If you still can’t find a record of receipt, use our first stimulus check calculator below to figure out how much you should have received. You can then find what you need to claim your money by logging into your tax account on the IRS website.

Recommended Reading: Will There Be Another Stimulus Check In California

If I Am Incarcerated Am I Eligible For The Stimulus Checks

Yes, if you are incarcerated you are eligible to receive the stimulus checks if you meet the other eligibility criteria.

Eligibility for first stimulus and second stimulus checks:

Eligibility for third stimulus check:

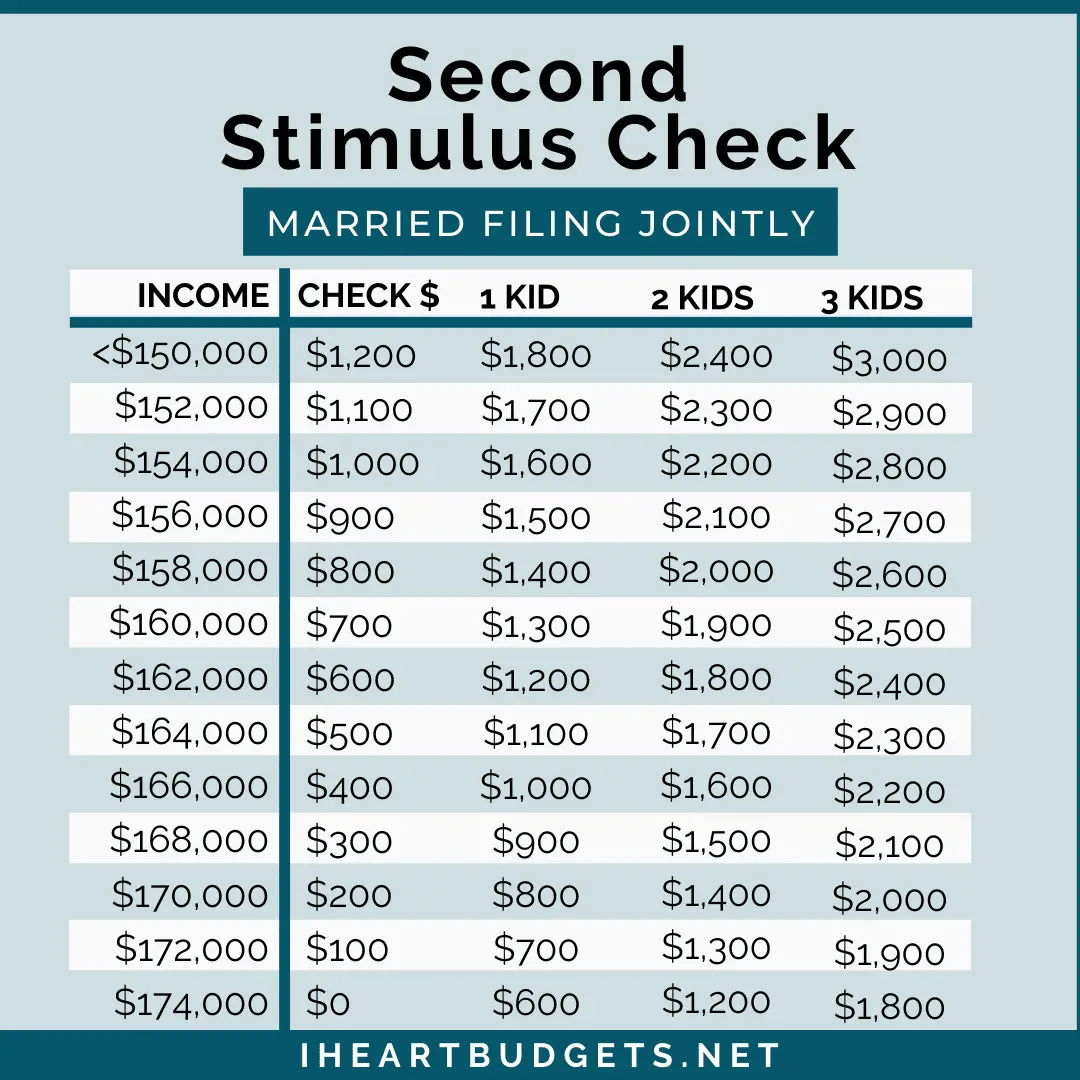

How Is The Third Stimulus Check Calculated

The stimulus plan mandates the treasury to rely on 2019 and 2020 tax returns to calculate how much you could get for the third round of stimulus checks.

Congress approved limits based on adjusted gross income ranges. This means that taxpayers making less than the minimum threshold could get the full stimulus check, while those earning above it get reduced payments until they are fully phased out at higher incomes.

You can find your AGI on IRS form 1040. This is calculated by subtracting deductions like student loan interest, health savings accountpayments, and contributions to a traditional IRA from your gross income.

By contrast, your gross income is the total amount of money that you made during the tax year, including wages, dividends, capital gains, rental property income and other types of revenue.

Your 2019 taxes had to be filed by July 15, 2020. And your 2020 taxes are due by the extended deadline of May 17. You can read more about when to file your tax returns for the third stimulus check, and other IRS requirements in two tax sections below.

Read Also: How To Track Third Stimulus Check

Do I Need To File My Taxes To Get A Stimulus Payment

If you are required to file a tax return, the IRS will use information from your most recent filed tax return to issue your stimulus payment.

Here are the reasons you are required to file a tax return for tax year 2020:

- Taxpayers who earn income more than the IRS income filing threshold .

*Note: If you are single and 65+, thresholds are bumped up to $14,050 for 65+ or blind. If you are married filing jointly, 65+ thresholds are $13,700 for 65+ or blind.

- Self-Employed whose net income is $400 or more since they need to pay self-employment taxes on income of $400 or more

- Dependents with unearned income more than $1,100 and earned income more than $12,400

- You received an advance payment of the health coverage tax credit

- You owe taxes on an IRA or Health Savings Account

If are not required to file, you can use the TurboTax free Stimulus Registration Product to provide the IRS information needed so that you can receive a stimulus payment.

What Is A Plus

A plus-up payment is basically just a bonus amount that you probably should have gotten the first time you filed your taxes. The IRS actually owes more money to some people based on their tax returns. If the IRS used your 2019 tax information to dish out your stimulus payment but your 2020 taxes show that it underpaid youyou might be in for a plus-up payment based on your income. But remember, this isnt for everyoneonly those who had a change in income or dependents would qualify for more stimulus money.

You May Like: Update On The 4th Stimulus Check

Stimulus Check: How Much Money Will You Get And When

The $2 trillion economic stimulus bill includes help for American families who are hurting financially due to the economic impact of the coronavirus. Most adults will receive $1,200 checks, plus $500 for each of their children. The massive relief package will funnel $290 billion in direct payments to individuals and families. Households are expected to get a check within weeks or months. That could provide a lifeline for the millions of Americans who have already been laid off or seen their income plunge as people hole up to avoid infection.

“Low- and middle-income households would receive about 68 percent of the payments,” noted Tax Policy Center senior fellow Howard Gleckman in a blog post. Here’s what to know about how the payments will work.

When Should I Get My Payment

The IRS was given hard and fast deadlines to send the two rounds of Economic Impact Payments out to American families. The first round of payments had to be sent out by December 31, 2020. The second round had to be sent out by January 15, 2021.

What this means: If you have not received the first or second round of payments yet, then you will not be getting them in advance. The good news is that you can still do something to get these payments. Read below.

Recommended Reading: How Many Stimulus Checks Have Been Sent

You May Like: New Home Purchase Stimulus Program

All The Differences Between The Three Stimulus Checks And How They Affect You

Each round of stimulus payments has varied on the maximum amount per person and how many people qualify to receive the check. The second check was the least generous on both counts, and took 9 months to become law. However, it also made some groups of people eligible who weren’t before, while sticking with the status quo on other provisions that more-progressive lawmakers wanted to revise.

The new check changes the game again, becoming more generous in some spheres, as with dependents and families with mixed-status citizenship, while also finding its way to fewer people than perhaps even the second check — at least based on the new stimulus check formula.

Alert: Highest Cash Back Card We’ve Seen Now Has 0% Intro Apr Until 2024

If you’re using the wrong credit or debit card, it could be costing you serious money. Our expert loves this top pick, which features a 0% intro APR until 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee.

In fact, this card is so good that our expert even uses it personally. for free and apply in just 2 minutes.

Don’t Miss: What Was The First Stimulus Check Amount

More Money For Certain Families

One big change with third stimulus checks was that an extra $1,400 was tacked on to your payment for any dependent in the family. For the first- and second-round payments, the additional amount allowed $500 for first-round payments and $600 in the second round was only given for dependent children age 16 or younger. As a result, families with older children, including college students age 23 or younger, or with elderly parents living with them, didn’t get the extra money added to their previous stimulus payments. That’s not the case for third-round stimulus checks.

When Will The Payments Be Distributed

Payments are being distributed now. The first batch of direct deposit payments was delivered on March 17, and the first round of mailed checks were dated March 19.

Read More: Why Are Payments for Social Security Recipients Delayed? And Other Third Stimulus Check FAQs

The IRS has been sending payments in weekly batches. The seventh batch of payments began processing on April 23 with an official payment date of April 28. The agency also says this batch includes more than 730,000 plus-up payments, totaling over $1.3 billion.

Read Also: Is Texas Giving Stimulus Money

How Much Will My Stimulus Check Be For

The MCTR has been set up in three tiers based on the adjusted gross income on your 2020 California state tax return.

- Single taxpayers who earned less than $75,000 and couples who filed jointly and made less than $150,000 will receive $350 per taxpayer and another flat $350 if they have any dependents. A married couple with children, therefore, could receive as much as $1,050. This is the largest bracket, KCRA reported, representing more than 80% of beneficiaries.

- Individual filers who made between $75,000 and $125,000 — and couples who earned between $150,000 and $250,000 — will receive $250 per taxpayer, plus another $250 if they have any dependents. A family with any children could receive $750.

- Individual filers who earned between $125,000 and $250,000 and couples who earned between $250,000 and $500,000 would receive $200 each. A family with children in this bracket could receive a maximum of $600.

Why Are States Giving Out A Fourth Stimulus Check

It all started back when the American Rescue Plan rolled out. States were given $195 billion to help fund their own local economic recovery at the state level.1 But they dont have forever to spend this moneystates have to figure out what to use it on by the end of 2024, and then they have until the end of 2026 to spend all that cash.2That might sound like forever, but the clock is ticking here.

Some states have given out their own version of a stimulus check to everyone, and others are targeting it at specific groups like teachers. And other states? Well, they havent spent any of it yet.

Some states like Colorado, Maryland and New Mexico are giving stimulus checks to people who make less than a certain amount of money or who were on unemployment. So far, California is the only state to give out a wide-sweeping stimulus check.3 Other states like Florida, Georgia, Michigan, Tennessee and Texas are putting the money toward $1,000 bonuses for teachers.

Don’t Miss: Irs Tax Stimulus Checks Second Round

What If I Dont Receive A Third Stimulus Check

Those who dont file tax returns, including those who earn little income and recent college graduates, may have to wait until they file a tax return in April 2022 to get their stimulus rebate if they didnt file a tax return for 2020 taxes or submit non-filer information to the IRS last year. Married couples with incomes below $24,400 and individuals with incomes under $12,200 fall into this category.

The IRS is still updating its Get My Payment tool with new payment information. Once its loaded with up-to-date information, individuals can check when their stimulus payment went out. If you have any issue with getting your second or third payment, see our article on what to do if you havent received your stimulus check.

Filing a tax return for 2020. If you dont receive government benefits, and you didnt file a tax return for 2019 or 2020 taxes or submit non-filer information to the IRS by November 21, 2020, you may not automatically get a third stimulus check. You might need to wait to file a tax return for the 2021 tax year and request a Recovery Rebate Credit. You will fill in the amount you are owed on line 30 of IRS Form 1040 .

Stimulus And Relief Package 1

The first relief package, the Coronavirus Preparedness and Response Supplemental Appropriations Act, 2020, nicknamed Phase One, was signed into law on March 6, 2020, by President Trump. It allocated $8.3 billion to do the following:

- Fund research for a vaccine

- Give money to state and local governments to fight the spread of the virus

- Allocate money to help with efforts to stop the spread of the virus overseas

You May Like: What Stimulus Was Given In 2021

How Will Receiving A Stimulus Check Impact Seniors Financially

As we age, our incomes generally tend to decrease while our expenses often increase. This can make it difficult for seniors to make ends meet, especially in retirement. A stimulus check can help alleviate some of this financial strain by providing a much-needed infusion of cash.

For many seniors, receiving a stimulus check will be a welcome relief. It can help them cover essential expenses like groceries and utilities or allow them to catch up on bills that have been piling up. In some cases, it may even give them the financial cushion they need to avoid foreclosure or eviction.

In addition to the direct financial benefits, getting a stimulus check can also help reduce stress and anxiety levels during these already challenging times. For seniors who are struggling financially, the extra money can provide some much-needed peace of mind.

Will There Be A Fourth Stimulus Check From The Government

Some lawmakers pushed for a fourth stimulus check to help Americans who were struggling to rebuild after COVID-19 and its economic impact. But that stimulus never happened.

With the economy and jobs both on the upswing after the country started to reopen, another federal stimulus check didnt seem necessary. But some states took matters into their own hands and sent out a fourth stimulus check to their residents.

Read Also: Are Getting Another Stimulus Check

What Is A Stimulus Check

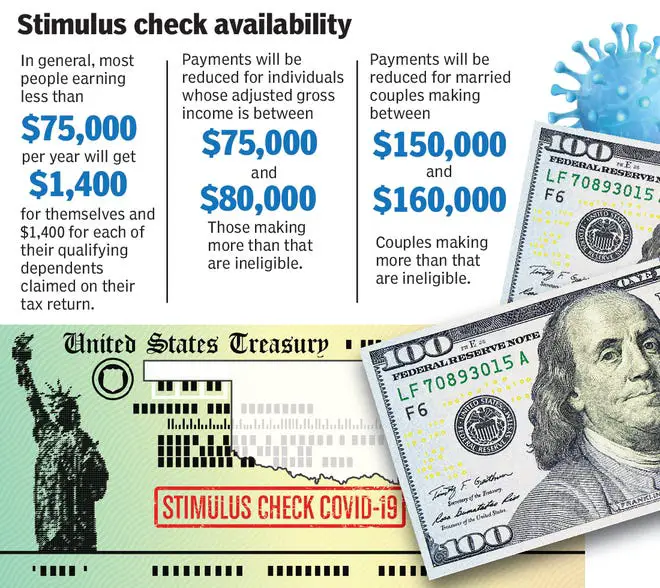

Stimulus checks are direct payments to American families that the U.S. government provided in response to COVID-19. Three stimulus checks have been paid out during the pandemic:

- The Coronavirus Aid, Relief, and Economic Security Act authorized the first check. It provided up to $1,200 per eligible adult and $500 per eligible dependent child.

- An additional stimulus check was authorized in December of 2020, providing up to $600 per eligible adult and dependent child.

- A third stimulus check of up to $1,400 per adult and dependent was made available by the American Rescue Plan Act on March 11, 2021.

Recommended Reading: How To Check If Received Stimulus Check

Indiana: $325 Rebate Payments

Indiana found itself with a healthy budget surplus at the end of 2021, and it authorized two rebates to its residents.

In December 2021, Gov. Eric Holcomb announced that Indiana taxpayers would get a $125 one-time tax refund after they filed their 2021 taxes.

Theres no income requirement. Residents must have filed a state tax return for the year 2020 by January 3, 2022, as well as a 2021 Indiana tax return by April 18, 2022, to be eligible. Payments started in May, according to the state.

Taxpayers who filed jointly could receive a single deposit of $250.

A second rebate was approved in August 2022 to grant another $200 per taxpayer.

Most taxpayers will receive their refunds by direct deposit and the second payments started rolling out in late August. If you changed banks or didnt have direct deposit information on file, you should have received a paper check.

Individuals who are only eligible for the $200 payment will not receive them at this time. They will have to file a 2022 tax return before January 1, 2024 to claim the credit.

For more information, visit the state Department of Revenue website.

Recommended Reading: How To Cash My Stimulus Check Without Id