Where Is My Third Stimulus Check

You can track the status of your third stimulus check by using the IRS Get My Payment tool, available in English and Spanish. You can see whether your third stimulus check has been issued and whether your payment type is direct deposit or mail.

When you use the IRS Get My Payment tool, you will get one of the following messages:

Payment Status, which means:

- A payment has been processed. You will be shown a payment date and whether the payment type is direct deposit or mail or

- Youre eligible, but a payment has not been processed and a payment date is not available.

Payment Status Not Available, which means:

- Your payment has not been processed or

- Youre not eligible for a payment.

Need More Information, which means:

- Your payment was returned to the IRS because the post office was unable to deliver it. If this message is displayed, you will have a chance to enter your banking information and receive your payment as a direct deposit. Otherwise, you will need to update your address before the IRS can send you your payment.

Things To Know About The 2021 Stimulus Payments

> > > To find out the status of your third stimulus , use the IRS Get My Payment tool .

Note: This post has been updated to reflect how people can still claim the 2021 stimulus payments if they havent received themeven though the standard timeframe for filing 2021 tax returns has passed.

On March 11, 2021, President Biden signed the American Rescue Plan into law, which provided essential financial relief to individuals and families along with COVID-19 relief to states and localities. One component of the package is a third round of stimulus payments. Despite wide news coverage about these payments, many have questions about whos eligible and how to receive them. The third round also has different eligibility rules than the first and second rounds of payments, which were distributed earlier.

Below are ten things to know about the third round of paymentsincluding information on filing your 2021 taxes if you missed any or all of your payment:

4. You dont need to have earned income to qualify. The full payment is available to those with little to no income. Even if you are making $0, you can still receive the full payment. The payments phase out starting at $75,000 for single filers. The phase-out rates are more restrictive than for the first and second round of payments, with individuals making $80,000 per year ineligible for any payment

*updated on May 2022

If I Owe Child Support Will I Be Notified That My Tax Return Is Going To Be Applied To My Child Support Arrears

-

Yes.You were sent a noticewhenyour case wasinitiallysubmitted for federal tax refund offset.The federal government shouldsend an offset notice toyouwhenyour stimulus rebate paymenthasactuallybeenintercepted. The noticewill tell youthatyourtax returnhas been applied toyour child support debtand to contactthe Child Support Divisionifyoubelieve this was done in error.

Also Check: File Taxes To Get Stimulus

Make The Cra Cash Benefits Earn Their Tax Bill

The above cash benefits are taxable. So before you get a huge tax bill, make the benefits earn their taxes. Invest some portion of the stimulus check in Telus International through the Tax-Free Savings Account .

The pandemic has accelerated the move to digital, and Telus International helps companies in their digital transformation. The company caters to high-growth verticals like tech and games, communications and media, eCommerce and fintech, healthcare, and travel and hospitality.

Its parent company Telus Corporation is Canadas second-largest telecom provider and offers a connectivity platform to individuals and businesses. This gives Telus International a wide customer base to tap. It has just started trading on the exchange in February with the potential to grow in the post-pandemic world.

This article represents the opinion of the writer, who may disagree with the official recommendation position of a Motley Fool premium service or advisor. Were Motley! Questioning an investing thesis even one of our own helps us all think critically about investing and make decisions that help us become smarter, happier, and richer, so we sometimes publish articles that may not be in line with recommendations, rankings or other content.

Fool contributor Puja Tayal has no position in any of the stocks mentioned. The Motley Fool recommends TELUS CORPORATION.

Does The Act Provide Student Loan Relief

The legislation does not provide much additional aid for students however it maintains President Biden’s earlier executive order stating that federal student loans will remain in forbearance through September 30, 2021. Although this federal relief is not applicable to private student loans, individual lenders may offer some sort of assistance at their discretion.

You can find further details about the American Rescue Plan, as well as the full text of the legislation, here.

You May Like: Congress’s Mortgage Stimulus Program For The Middle Class

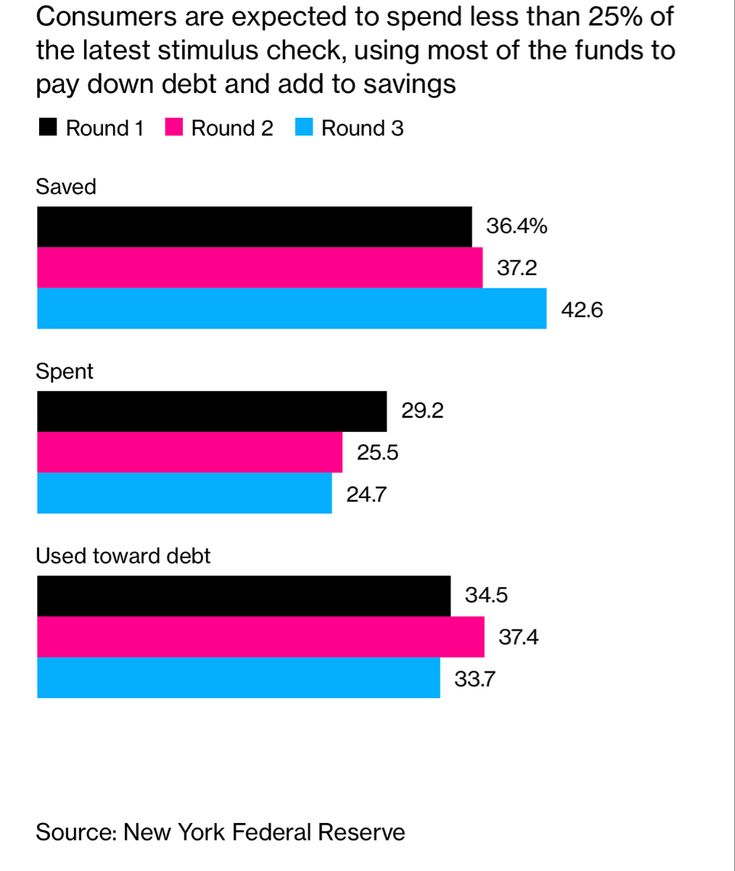

How Should I Spend My Stimulus Check

Millions of people all over the world were affected by this health crisis. It came out of seemingly nowhere and lasted far longer than anyone could have expected. Though things are slowly getting better, we are not completely out of the woods yet.

The economic relief payments received so far have been a help to some struggling families and a bonus to others who managed to get by easier. So what should you do with the stimulus check?

There are various smart things to do with the stimulus checks. Use them to:

- Help buy necessities: It may be smart to also start buying these essentials in bulk. Just be considerate and dont hoard.

- Build an emergency fund: Use the checks to build, rebuild, or increase your emergency fund. As weve seen, you never know what can happen and its best to be prepared.

- Pay off debt: Lower your monthly bills and free up available cash by paying off debt. Using either the snowball or avalanche method is effective.

- Support local businesses: Many businesses have shut down or been on the verge of it due to the public health crisis. If you have the money to spare, it would be generous to support them by shopping locally.

- Invest: Use the money to invest in yourself whether its starting your own business venture or saving towards retirement.

- Donate: Another great option is to donate part or all of your stimulus money to local charitable organizations and food banks.

How many stimulus checks were issued in 2020?How many stimulus checks were in 2021?

What If I Am Married To Someone Who Owes Child Support Will My Tax Return Be Applied To The Child Support Arrears They May Owe

-

Yes,unless you are eligible for relief. If youdo not owe child support butyouare married tosomeonewhoowes child support,you may need to file an Injured Spouse Claim and Allocation -Form 8379

-

In some instances, the IRS offsets a portion of the payment sent to a spouse who filed an injured spouse claim if it has been offset by the non-injured spouses past-due child support. The FAQ on the IRS stimulus FAQ www.irs.gov/coronavirus/economic-impact-payment-information-center website states: The IRS is aware that in some instances a portion of the payment sent to a spouse who filed an injured spouse claim with his or her 2019 tax return has been offset by the non-injured spouses past-due child support. The IRS is working with the Bureau of the Fiscal Service and the U.S. Department of Health and Human Services, Office of Child Support Enforcement, to resolve this issue as quickly as possible. If you filed an injured spouse claim with your return and are impacted by this issue, you do not need to take any action. The injured spouse will receive their unpaid half of the total payment when the issue is resolved.

Also Check: How Much 2021 Stimulus Check

Also Check: Get My 2nd Stimulus Payment

Eligible Parents Of Children Born In 2021 And Families That Added Qualifying Dependents In 2021 Should Claim The 2021 Recovery Rebate Credit Most Other Eligible People Already Received The Full Amount And Wont Need To Claim A Credit On Their Tax Return

The third-round Economic Impact Payment was an advance payment of the tax year 2021 Recovery Rebate Credit. The amount of the third-round Economic Impact Payment was based on the income and number of dependents listed on an individual’s 2019 or 2020 income tax return. The amount of the 2021 Recovery Rebate Credit is based on the income and number of dependents listed on an individual’s 2021 income tax return.

Families and individuals in the following circumstances, among others, may not have received the full amount of their third-round Economic Impact Payment because their circumstances in 2021 were different than they were in 2020. These families and individuals may be eligible to receive more money by claiming the 2021 Recovery Rebate Credit on their 2021 income tax return:

- Parents of a child born in 2021 who claim the child as a dependent on their 2021 income tax return may be eligible to receive a 2021 Recovery Rebate Credit of up to $1,400 for this child.

- All eligible parents of qualifying children born or welcomed through adoption or foster care in 2021 are also encouraged to claim the child tax credit worth up to $3,600 per child born in 2021 on their 2021 income tax return.

The Third Round Of Stimulus Checks

The most recent checks were included in the American Rescue Plan, which was enacted on March 11, 2021. Eligible individuals will receive a payment of $1,400 , plus an additional $1,400 per eligible child. However, those payments phase out quickly for incomes above $75,000 for single taxpayers, above $112,500 for taxpayers filing as head of household, and above $150,000 for married couples filing jointly. Taxpayers would be ineligible for any payment, unless they have a qualifying child, above the following income levels:

- $80,000 for single taxpayers

- $120,000 for taxpayers filing as head of household

- $160,000 for married couples filing jointly

Similar to previous iterations of the payments, most taxpayers will receive the funds by direct deposit. For Social Security and other beneficiaries who received previous payments via debit card, they will receive this third payment the same way. Overall, such payments are expect to cost $411 billion through 2030 according to the Congressional Budget Office.

You May Like: Stimulus Check For Expecting Mothers 2022

I Used The 2020 Irs Non

Most likely, the IRS wasnt able to process your 2019 tax return or the information you submitted to the IRS Non-filer tool in time to issue your second stimulus check.

All second stimulus checks were issued by January 15, 2021. If you didnt get a second stimulus check by then , you can claim your second stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

Also Check: Do You Have To Claim Stimulus Check On 2022 Taxes

Stimulus And Relief Package 2

The second relief package, the Families First Coronavirus Response Act , or Phase Two, was signed into law on March 18, 2020. The law allocated a budget for relief that included the following:

- Providing money for families who rely on free school lunches in light of widespread school closures

- Mandating that companies with fewer than 500 employees provide paid sick leave for those suffering from COVID-19, as well as providing a tax credit to help employers cover those costs

- Providing nearly $1 billion in additional unemployment insurance money for states, as well as loans to states to fund unemployment insurance

- Funding and cost waivers to make COVID-19 testing free for everyone

Separately, on March 18, 2020, the Federal Housing Administration and the Federal Housing Finance Agency implemented foreclosure and eviction moratoriums for single-family homeowners whose mortgages were FHA-insured or backed by Fannie Mae or Freddie Mac. The eviction moratorium on FHA and other government-backed loans was extended to Sept. 30, 2021. Additionally, the FHFA announced on Sept. 24, 2021, that Fannie Mae and Freddie Mac would continue to offer COVID-19 forbearance to multifamily property owners who were experiencing a financial hardship due to the COVID-19 emergency.

Recommended Reading: I Didn’t Receive My Third Stimulus Check

Can I Claim A Stimulus Check For Someone Who Is Deceased

Yes. For the third stimulus check, people who have died on or after January 1, 2021, are eligible to receive the third stimulus check. However, for married military couples, the date of eligibility is expanded. If the person who died was a member of the military and died before January 1, 2021, the surviving spouse can still receive the third stimulus check, even if they dont have an SSN.

For the first and second stimulus check, the IRS has stated that people who died on or after January 1, 2020, are eligible to receive both payments.

If they didnt receive the stimulus payments or didnt receive the full amounts that they are eligible for, spouses or other family members can file a 2020 federal tax return and claim it as part of their tax refund or use GetCTC.org if they dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2021.

Stimulus Check For Sick Workers

As the pandemic is a healthcare crisis, a sickness benefit is mandatory. According to the World Health Organization, a person who tested COVID-19 positive should self-isolate for 14 days to ensure they do not spread the virus.

And if you are feeling sick, even then WHO recommends you to self-isolate so you cant infect others until the COVID-19 test result is out. The second wave of the pandemic in December aggravated the problem. There is a mutant virus scare, and you can get infected even if you have recovered from COVID-19 and developed antibodies.

Warren Buffetts rule applies here too, be fearful when others are careless. Hence, the CRA is giving $900 for 14 days in Canada Recovery Sickness Benefit for up to four weeks. You will get this benefit if you are sick or under quarantine and do not have sickness benefits from your employer.

Recommended Reading: How To Claim Stimulus Check 2021

How Do I Find Out How Many Stimulus Checks I Received In 2021

Asked by: Mr. Devante West

To find the amounts of your Economic Impact Payments, check: Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page.

How Much Was Each Stimulus Check

Each stimulus check ranged from $600 to $1,400 per adult and $500 to $1,400 per child.

Stimulus check eligibility: In order to receive the full amount of the payments, your adjusted gross income cannot be more than:

- $150,000 for a joint return,

- $112,500 for head of household

- $75,000 for single and other eligible individuals

Read Also: How Much Stimulus Check Are We Getting

Lessons For Future Policy

Policymakers should heed the lessons learned from the three rounds of EIPs to help prepare for and respond to future crises. For example, they should build on Treasurys automatic delivery capability so that when the next crisis hits, the federal government is well positioned to efficiently deliver automatic cash payments to as many eligible individuals as possible.They also should authorize, and fund, the IRS to analyze the performance of the Non-Filer tool and make necessary technological upgrades so it can be quickly repurposed in another crisis. And future stimulus payments should, from the start, include all population groups reached by the third round of EIPs as well as individuals who file taxes with ITINs.

There will be opportunities for other improvements in EIP design and delivery in a future crisis. For instance, the policy is dialable, both in the overall level of payments it provides and the degree to which it includes households who had higher incomes before the crisis hit.

If I Am The Custodial Parent And Im Currently Receiving Or Have Ever Received Tanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe. Federal law dictates how monies received by a state child support agencyunder the Federal Tax Refund Offset Program are distributed. In Texas, federal tax offsets are applied first to assigned arrears, or arrears owned by the state, and then to arrearages owed to the family. If there is money owed to the state in your case, the intercept stimulus payments up to the amount owed to the state will be retained by the state. The remainder of money will be sent to you, up to the amount of unassigned arrears owed to you by the noncustodial parent.The amount of the money you are entitled to receive will depend on a number of factors, including the amount of the tax refund intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears.You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted tax return.

You May Like: Is It Too Late To Apply For Stimulus Check

When Will The Third Stimulus Check Be Issued

The government started sending the third stimulus checks on March 12, 2021. The IRS continues to send third stimulus checks as people submit their information to the IRS either by filing a 2020 tax return or using GetCTC.org. The deadline to use GetCTC.org is November 15, 2021.

If you have your banking information on file, the IRS sent your payment via direct deposit. Otherwise, you will receive your payment as a check or debit card via mail. Mailed checks and debit cards may take longer to deliver.

If you dont fall into any of these categories, youll have to wait to receive your third stimulus check. You will need to file a 2020 federal tax return to get the third stimulus check or use GetCTC.org if you dont have a filing requirement.

You can also get the first and second stimulus check as the Recovery Rebate Credit on your tax return or GetCTC.org if you are eligible.