Who Will Get A Stimulus Payment In 2022

The parents of newborns are eligible to receive payments up to $1,400 from the third and, as of right now, final round of stimulus checks issued in March.

To receive the payment, parents of the newborn child must file a tax return for 2021 in 2022 so they can receive the money in 2022.

Single parents earning up to $75,000 per year and couples making up to $150,000 per year are eligible to receive the full amount of the check.

However, even these parents of newborn children are not eligible for a fourth stimulus check in 2022.

Related stories about the stimulus:

Stimulus Payments : Your State Could Still Owe You A Check

South Carolina and Massachusetts are just two of the states issuing payments to taxpayers.

Dan Avery

Writer

Dan is a writer on CNETs How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

As the holidays roll in, we could all use some extra money. South Carolina has started issuing for up to $800 to eligible taxpayers. The income tax rebates were approved by state lawmakers as part of this years $8.4 billion budget, according to the state Department of Revenue, and payments will continue to go out through December.

South Carolina isnt the only state issuing residents tax refunds, though: Illinois is still sending out $50 and $100 rebates and Massachusetts began returning $3 billion in surplus tax revenue this month.

Your state could be sending out a rebate or stimulus check, too. Below, see if you qualify and how much you could be owed. For more on taxes, see if you qualify for additional stimulus or child tax credit money.

Mental Health In Schools

Mental health is very important. A mental health training program and a protocol for risk referrals for suicide must be adopted in North Carolinaâs K-12 schools. The plan must follow guidelines outlined by the State Board of Education. By the 2021-2022 school year, all school personnel should have completed mental health training.

Also Check: Is There Another Stimulus Check Coming For Seniors

If I Take The Advance Payment How Does This Affect Next Years Taxes

Good question, you guys. The biggest thing here is if your income increases in 2021, then you might get more money in the Child Tax Credit than you actually should get. Remember, guys, theyre basing the amount they think you should get on your 2020 tax return . So,if you or your spouse got a raise at work and it bumped you over the qualifying amount, the IRS doesnt know about it.

If youre super confused by all of this, youre not alone. The State of Personal Finance study found that 70% of parents who qualify for the Child Tax Credit money say theyre afraid to spend it because they dont know how it will impact their taxes next year. That totally makes sense, guysbut dont stay in the dark here. Its so important to be in the know about these changes and how they affect you.

With all these tax changes, its a good idea to call in the folks who live and breathe this stuff. If you want your taxes done the right way, check in with a RamseyTrusted tax pro. Theyre the experts who can walk you through this new Child Tax Credit change and how it impacts your money. And theyll help you make the right call on whether you should take the advance payments or leave them alone. They can also show you the best way to plan out your taxesyou know, so you dont end up with a huge scary bill or a crazy high refund. When it comes to your tax questions, leave it to the pros.

About the author

Rachel Cruze

Do You Have To File Taxes To Get A Stimulus Check 2021

The answer is yes, and no. If you cant file your 2020 tax return by 17 May, you can ask for an automatic tax filing extension to buy time until 15 October. This will give you more time but delay any payment that you could receive. Regardless, you will have to file to get any stimulus money that might be due to you.

Read Also: How Many Federal Stimulus Checks Were Issued In 2021

What If I Havent Gotten My Stimulus Check Yet

First, head over to the governments site and sign in to your account to check on your payment status. If it shows the stimulus check was issued to you but you havent gotten it yet, you can run a payment trace to track it down. If the check wasnt cashed, the IRS will reverse the payment, and youll be able to claim it on your taxes. You can do this through the Recovery Rebate Credit.

If the check was cashed , youll have to make a claim and go through a whole process to get your stimulus money. That really stinks. Sorry in advance if you fall into that category. But with any luck, they should be able to straighten things out for you.

Older Adults And Third Stimulus Checks: Eligibility Rules And What They Mean For You

The IRS continues to send batches of the third stimulus check. If you’re 65 or older, here’s what to know about qualifications, income, SSI, SSDI and retirement, and what to do if you’re still missing stimulus money from the first two checks.

Alison DeNisco Rayome

Managing Editor

Alison DeNisco Rayome is a managing editor at CNET, now covering home topics after writing about services and software. Alison was previously an editor at TechRepublic.

Shelby Brown

Staff Writer

Shelby Brown is a writer for CNET’s services and software team. She covers tips and tricks for apps, operating systems and devices, as well as mobile gaming and Apple Arcade news. Shelby oversees Tech Tips coverage and curates the CNET Now daily newsletter. Before joining CNET, she covered app news for Download.com and served as a freelancer for Louisville.com.

The IRS is in the middle of sending the next wave of third stimulus payments to those who are eligible for the payment. And if you’re age 65 or older, you receive Social Security benefits or you’re a veteran, you will likely receive a $1,400 check . It may be different, however, for individuals with “high” income levels from investments or other sources.

Read Also: Does Stimulus Check Affect Tax Refund

Can I Get A Stimulus Payment If Someone Claims Me As An Adult Dependent On Their Tax Return

Some older people may count as a dependent on someone else’s taxes, called a “qualifying relative.” For example, you may live with your children. In terms of stimulus check qualifications, the main tax filer would’ve had to claim you as a dependent on their tax form 1040.

A qualifying relative can be any age. To be counted as a qualifying relative on someone’s tax return, the person must meet four criteria. They…

- Don’t count as a qualifying child dependent.

- Live with the family member all year as a member of the household, or count as a relative who doesn’t have to live with the family member all year .

- Must have a gross income for the year of less than $4,200.

- Must have more than half of their support during the year come from the family member.

If you were a dependent on someone else’s taxes and were over the age of 16, you weren’t qualified for any stimulus money at all in the first or second round of stimulus checks. The new law, however, allows dependents of all ages to be eligible to add up to $1,400 to the household’s total payment.

There are a few reasons why some older adults may not have gotten a first or second stimulus check.

Should I Hold Off On Filing My 2020 Tax Return And What Happens If The Irs Uses 2019 Tax Information

It likely wont make a difference in the longer term other than to update dependent or payment data, but the IRS will only use your 2020 tax return data to determine eligibility for this round of stimulus checks if they have processed your return . If your 2020 return has not been filed and processing, they will use 2019 tax data for payment.

If your 2020 return is filed and/or processed after the IRS sends you a third stimulus check, but before July 15, 2021 the IRS would send you a second payment or require a repayment for the difference between what your payment should have been if based on your 2020 return and the payment actually sent based on your 2019 return.

Read Also: How To Find How Much Stimulus I Received

Read Also: Will We Be Getting Another Stimulus

Fourth Stimulus Check Update: How To Get Another $1400 Direct Payment

Some Americans will be eligible for a $1,400 stimulus check this year even if Congress doesnt pass any legislation for another round of checks.

Republicans and Democrats fought hard over the issue of stimulus checks after passing the first round in 2020, so most Americans have already received all the money theyre likely to get. However, some Americans will be able to claim additional payments when they file their taxes and they could be eligible for the full $1,400 payment.

One way Americans could be eligible for a full $1,400 payment is if they had a child in 2021. Why? Because the 2021 Economic Impact Payments were based on a persons 2020 or 2019 return. So, any eligible dependent that came into the family last year wouldnt have been included in the payment amount.

Those who have a child who qualifies for the Recovery Rebate Credit can claim the dependent when they file their 2021 tax return this year. To be eligible, the child must be under 19 at the end of the year unless theyre a student and a child, brother, sister, foster child, stepsibling, half-brother or half-sister or a descendant of any of them.

Unlike the first two rounds of payments, which limited dependent eligibility to just children, the third stimulus check made accommodations for dependents of all ages. So, a person who adds a parent or grandparent or another eligible dependent to their household could also be eligible for a $1,400 payment.

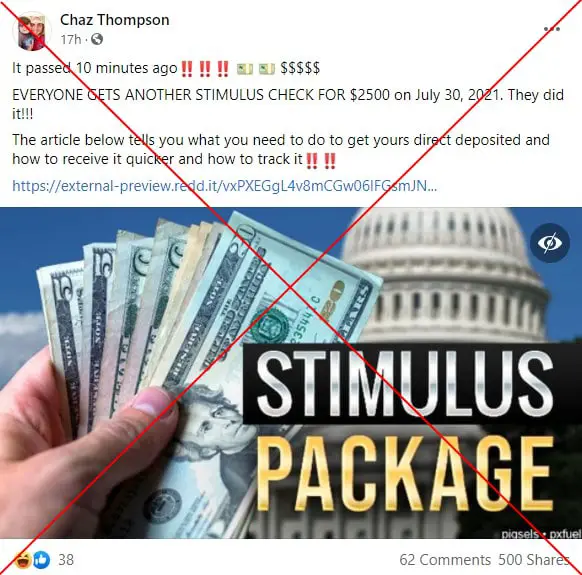

Stimulus Check Scams And Hoaxes

Of course, popular demand for widely distributed stimulus payments, and the confusing political maneuvering that goes into crafting stimulus bills, creates an information gap that’s easily exploited by scammers.

Even with the first wave of stimulus checks in 2020, we saw bogus email messages that pretended to be from the IRS, promising “an important update on your Covid relief fund.” But they just took you to phishing sites that wanted your Social Security number and other sensitive bits of information.

Following the second stimulus bill at the beginning of 2021, those email phishing attempts were joined by scam phone calls demanding your personal details so that you could be “cleared” to receive more stimulus checks.

In March, as President Biden’s American Rescue Plan was making its way through Congress, new phishing emails promised the moon: a $4,000 stimulus check, a boost in the minimum wage, free meals and, best of all, priority treatment that let you skip lines at COVID-19 vaccination sites.

Most recently, cruel pranksters have been passing around posts on Facebook that a fourth stimulus check worth $2,500 is coming by the end of July. Don’t believe it, and don’t believe the phishing websites that claim to register you for child-tax-credit advance payments.

In fact, most parents and legal guardians don’t need to do anything to get the payments they’ll just show up in your mailbox or bank account.

Recommended Reading: Is The Homeowners Stimulus Real

Are We Getting Another Stimulus Check In 2021

Whether we get another stimulus check in 2021 depends on how much momentum the proposals for more checks gain.

There are still some people who’ve not yet received the third stimulus check, but we’ve got a handy guide for what to do if you’re missing your stimulus check payment. It’s worth checking if you’re eligible for most recent stimulus check as it’s worth up to $1,400 per person.

The IRS has reported that taxpayers whose direct-deposit information is on file should have seen their payments reach their bank accounts in April. Those who are waiting on paper checks and debit cards can expect to receive their funds in the coming weeks.

If you have received the third stimulus check and feel it’s too low, then take a look at our guide to the stimulus check calculator as that can show you what your own eligibility looks like. Keep in mind that there are a few factors that will affect the amount you are due or have received.

Delaware: $300 Rebate Payments

Delaware sent relief rebate payments of $300 to taxpayers who filed their 2020 state tax returns. The one-time payment was possible due to a budget surplus. Couples filing jointly received $300 each.

Payments were distributed to most eligible Delaware residents in May 2022.

If youre eligible but didnt receive a rebate yet, you can apply online starting November 1. The application period will only last 30 days and will close on November 30, 2022.

Applicants must provide their Social Security number, active Delaware drivers license that was issued before December 31, 2021 and a valid Delaware residential mailing address. Payments will be sent out to qualifying applicants after the application period closes and all applications are reviewed.

Check your rebate status or get answers to frequently asked questions from the Delaware Department of Finance.

Also Check: Do We Supposed To Get Another Stimulus Check

A Timeline Of Past Stimulus Checks

The pandemic stimulus payments started nearly two years ago.

Stimulus checks were first deposited in the spring of 2020 when the COVID-19 pandemic was just beginning, driving up the unemployment rate and causing financial hardship for many. Individuals with income below $75,000 received $1,200 and couples earning below $150,000 received $2,400.

Special access for subscribers!

The Trump administration then in December 2020 $600 per individual taxpayer, $1,200 per married couple and an additional $600 for each child under the age of 17.

A third round came under the Biden administration in March 2021, giving $1,400 per individual and $2,800 per married couple, along with $1,400 per dependent this time regardless of age.

When Will The Third Stimulus Check Be Issued

The government started sending the third stimulus checks on March 12, 2021. The IRS continues to send third stimulus checks as people submit their information to the IRS either by filing a 2020 tax return or using GetCTC.org. The deadline to use GetCTC.org is November 15, 2021.

If you have your banking information on file, the IRS sent your payment via direct deposit. Otherwise, you will receive your payment as a check or debit card via mail. Mailed checks and debit cards may take longer to deliver.

If you dont fall into any of these categories, youll have to wait to receive your third stimulus check. You will need to file a 2020 federal tax return to get the third stimulus check or use GetCTC.org if you dont have a filing requirement.

You can also get the first and second stimulus check as the Recovery Rebate Credit on your tax return or GetCTC.org if you are eligible.

You May Like: Someone Stole My Stimulus Check

Read Also: Who Gets The Stimulus Checks

Federal Stimulus Checks Won’t Be Coming Before The Election

The current Congress is not going to provide another stimulus check. The last payment, authorized by the American Rescue Plan Act, was passed along party line votes through a special process called reconciliation. There is no further opportunity to pass legislation this way until after the election, and there is not broad enough support to get a bill through that would authorize a fourth payment.

Injured Spouse Claim And Spousal Claims

The IRS also stated that If you are married filing jointly and you filed an injured spouse claim with your 2019 tax return , half of the total payment will be sent to each spouse and your spouses stimulus check payment will be offset only for past-due child support.

There is no need to file another injured spouse claim for the payment. I have received dozens of comments on this this, so hopefully this answers the questions many have had based on official IRS guidance.

Note that if you were current with your child support payments at the time of the stimulus eligibility determination but fell behind afterwards due to a COVID-19 related job loss, you would still be eligible to get the full stimulus payment.

Updating Direct Deposit Information

This question has come up a lot in the hundreds of comments to this article. The IRS has setup a portal for individuals to provide their updated banking information to receive payments via direct deposit as opposed to checks in the mail.

The IRS does recommend that 2018 Filers who need to change their account information or mailing address, file 2019 taxes electronically as soon as possible. That is the only way to let us know your new information..

Recommended Reading: I Never Received Any Stimulus Check

Some Homeowners Are Also Entitled To Financial Relief

Some homeowners could also get financial help this month. This could come from the Homeowner Assistance Fund . The American Rescue Plan Act set aside almost $10 billion for homeowner relief, and more than 40 states have now set up HAF programs to facilitate the distribution of the funds. The funds will be distributed to the states by the Treasury Department.

Money from HAF can be used to help with mortgage payments, home insurance costs, utility expenses, or other âspecified purposes.â Those who are interested can check the Homeowner Assistance Fund website to find out if they are eligible and to learn how to apply for funding.

Between these state programs and HAF, millions could soon be entitled to money from the government to help them cope with the ongoing financial consequences of the COVID-19 pandemic. Be sure you understand how to claim your payments if you could be entitled to this important financial relief.