Third Stimulus Check Calculator

President Biden signed the American Rescue Plan Act on March 11, 2021. Provisions in the bill authorized a third round of stimulus checks worth $1,400 for each eligible person , plus an additional $1,400 for each dependent. However, as with the first- and second-round payments, the third-round stimulus checks were reduced or eliminated for people with an income above a certain amount.

If you didnât receive a third stimulus check, or didnât receive the full amount, you can get any money youâre entitled to by claiming the recovery rebate tax credit on your 2021 tax return. If youâre wondering if you qualify for the credit, comparing what you should have received to what you actually received is a good place to start .

To see how large your third stimulus payment should have been, answer the three questions in the calculator below and weâll give you a customized estimate.

Impact Of The Coronavirus Stimulus Checks On The Economy

The emergence of the COVID-19 virus early in 2020 had a huge impact on this countrys economy, with federal and state agencies, as well as many private companies from different sectors, forced to stop their operations in order to preserve the health of their workforce and to prevent the spread of the virus. As a result, the unemployment rate suffered a substantial increase, reaching 14.7% in April 2020, the highest rate observed since data collection began in 1948. The high unemployment rate disproportionately impacted the nations communities of color and low-wage workers. Many households, mainly those with children, were unable to pay for their basic needs: food, housing, utilities, and transportation.

The second stimulus package, The Coronavirus Response and Relief Supplemental Appropriations Act of 2021, was signed by former President Donald J. Trump on December 27, 2020. It was a $900 billion package that included disbursements of up to $600 per household plus an additional $600 for dependent children ages 16 or under. As in the previous stimulus package, those individuals who earned up to $75,000 in 2019 received the full stimulus check, while a gradually smaller figure was provided to those with higher annual incomes, up to a maximum of $87,000.

Table 1. U.S. Households Spending Priorities with Coronavirus Stimulus Money

| Stimulus Program |

|---|

Dont Miss: New York Stimulus Check 4

Where Is My 2nd Stimulus Check

30. As with the first round of stimulus checks from the CARES Act, Americans can check the status of their payments at https://www.irs.gov/coronavirus/get-my-payment. The Get My Payment tool was reopened on Monday, and will confirm if the IRS has sent your second stimulus check, as well as your first payment.

Read Also: Amount Of Stimulus Checks 2021

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Are Stimulus Checks Effective

Since the ultimate goal of any stimulus package is to restore economic stability, inspire consumer confidence, and increase spending, stimulus checks have to be evaluated on those critera and compared to other forms of stimulus.

As an argument for direct payments over tax credits, a 2011 study by the National Bureau of Economic Research found that the direct payments of 2001 and 2008 were more effective at sparking spending than the withholding reductions. of 2009.

Of course, a complete analysis of the effectiveness of stimulus checks has to include their long-term impact on the federal deficit. A 2012 study by the Mercatus Center at George Mason University found that, from 1950 to 2011, per-capita government spending had increased significantly. Many economists question whether this spending is effective and, ultimately, whether economic stimulus payments result in returns that outweigh the costs.

You May Like: Is There Another Stimulus Check Coming For Seniors

Can I Provide The Irs With My Account Information

If you receive certain social security, retirement, disability, survivors, railroad retirement, or veterans benefits, your payment will be distributed in the same method as your benefits. Learn more to see if this applies to you.

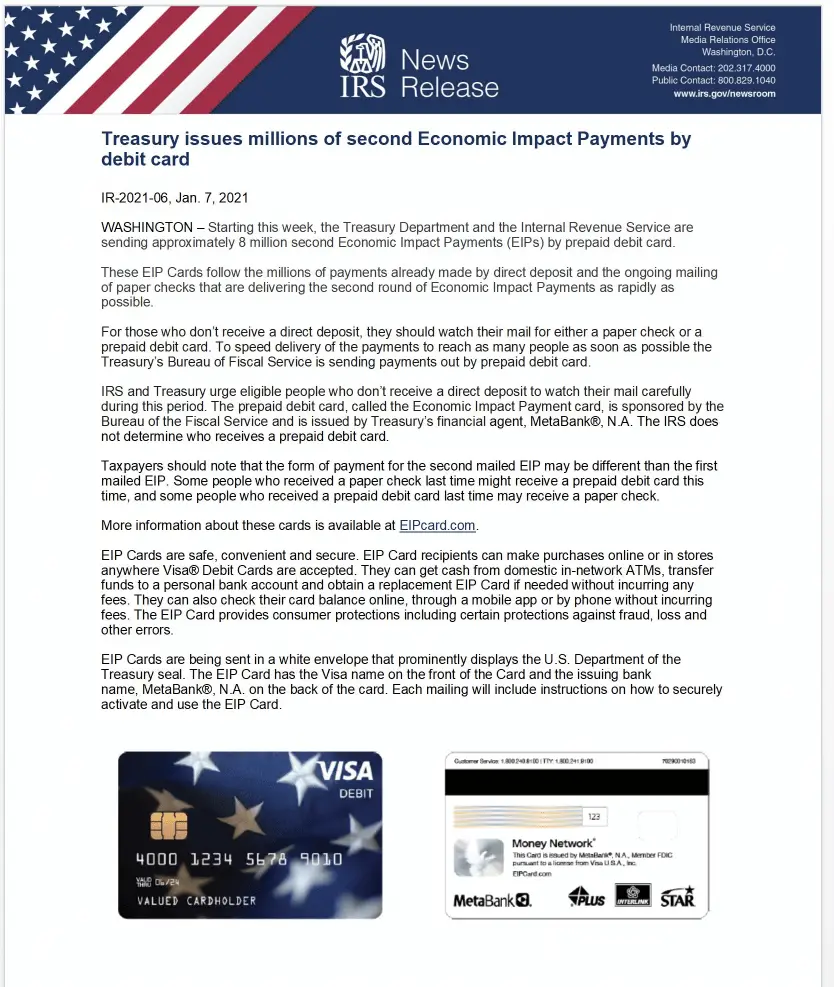

If you filed your taxes in 2018 or 2019 and owed taxes when you filed, you will receive a check or prepaid debit card in the mail. If you filed your taxes but received a refund that was directly deposited, you will receive the refund in the same account and will not be able to update this information at this time.

If you dont typically file taxes and you are providing your information to the IRS through their non-filers portal, you can provide your account information directly in the portal for direct deposit.

If you are being asked to provide banking account information and would like to receive payment on your own prepaid card, enter your cards direct deposit routing and account number directly in the portal. Check your account online or call the card provider to find out if your prepaid account is eligible to receive direct deposit, which is the fastest way to receive the payment.

The First Round Of Stimulus Checks

The first round of stimulus payments were authorized under the Coronavirus Aid, Relief, and Economic Security Act. In 2020, the IRS had issued 162 million payments totaling $271 billion. The Congressional Budget Office estimates that those first-round payments will eventually cost a total of $292 billion.

Those initial payments issued earlier in 2020 were $1,200 per person, or $2,400 for those filing jointly, plus $500 per qualifying child. The payments began phasing out at the same income levels as the current payments, but since the payments authorized under the CARES Act were larger, the maximum income levels to receive a payment were also larger:

- $99,000 for single taxpayers

- $136,500 for taxpayers filing as head of household

- $198,000 for married couples filing jointly

Don’t Miss: Ssi Get Stimulus Check 2022

What If I Dont Have A Bank Account

If you dont have a bank account, a paper check will be sent to the address you listed on your tax return.

Direct deposit is the quickest and safest way to get payments. Alternatives to receiving a paper check are opening a bank account or using a prepaid debit card. Once you get a card, you may need to contact the company directly to find the account and routing numbers needed for direct deposit. To find a bank, you can view this list of accounts offered by financial institutions that meet national standards. You can also use payment apps like CashApp, Venmo, or PayPal.

Do not provide the bank account information for someone else. Different names on the tax return and bank account will trigger a reject of the deposit, causing the IRS to send you a paper check which will delay the delivery of your payment.

Heres How Much Stimulus Money The Average American Has Received

by Lyle Daly | Published on Aug. 16, 2021

Image source: Getty Images

Americans at almost every income level have collected sizable stimulus funds.

Since the beginning of the COVID-19 pandemic, the U.S. government has offered different types of stimulus money, including checks and tax credits.

But how much stimulus money has the average American received so far? We know the answer thanks to research from the Institute on Tax and Economic Policy. According to that data, most Americans got over $3,000 in federal funds, and lower-income Americans benefited the most.

Also Check: Who Will Get Stimulus Checks

First Round Of Economic Stimulus Checks: April 2020

The CAREs Act included a provision for a round of stimulus payments eligible tax-paying adults received a check of up to $1,200 while eligible dependents under 16 years of age received $500 each .

The payments were made to everyone earning under the income limits, which were set at Adjusted Gross Income of $75,000 with the stimulus check value reducing in a tapered fashion up to a maximum of $99,000 . The very first stimulus checks were paid into people’s bank accounts over the weekend of the 11 and 12 of April, either via direct deposit into individuals bank accounts, paper checks sent through the post or in some cases, through a prepaid debit card, the Economic Impact Payment Card which were sent out in late May/early June last year.

What If My Spouse Or Ex

If you did not get all or some portion of your Economic Impact Payments you can file a 2020 tax return and claim these amounts on line 30 of the form. The IRS is referring to this as the recovery rebate and will allow you to claim any of the EIPs that you did not get in advance. You may get a denial letter from the IRS, but that is the opportunity to reply and explain your situation to the IRS. In this situation, Vermonters with a low income can contact us for help at the Vermont Low-Income Taxpayer Clinic by filling out our form or calling 1-800-889-2047.

Recommended Reading: Will We Be Getting Another Stimulus

What If I Didnt Get Some Or All Of My Stimulus Checks

If you think you are eligible and you did not get a check for you or your dependents, you can still get the money by filing your 2020 or 2021 taxes. You may be eligible for free tax preparation help from Maines CA$H Coalition.

If you do not usually file a tax return and didnt get your stimulus checks, you may still be able to file a tax return this year to get your stimulus checks. You should check with a tax professional. The IRS website also provides information about how to claim your stimulus checks if you didnt get them in 2020 or 2021. You can also call Pine Tree Legal Assistance.

Recommended Reading: Who Are Getting Stimulus Checks

Do I Need To File My Taxes To Get A Stimulus Payment

If you are required to file a tax return, the IRS will use information from your most recent filed tax return to issue your stimulus payment.

Here are the reasons you are required to file a tax return for tax year 2020:

- Taxpayers who earn income more than the IRS income filing threshold .

*Note: If you are single and 65+, thresholds are bumped up to $14,050 for 65+ or blind. If you are married filing jointly, 65+ thresholds are $13,700 for 65+ or blind.

- Self-Employed whose net income is $400 or more since they need to pay self-employment taxes on income of $400 or more

- Dependents with unearned income more than $1,100 and earned income more than $12,400

- You received an advance payment of the health coverage tax credit

- You owe taxes on an IRA or Health Savings Account

If are not required to file, you can use the TurboTax free Stimulus Registration Product to provide the IRS information needed so that you can receive a stimulus payment.

Don’t Miss: When Will South Carolina Receive Stimulus Checks

When Was $600 Stimulus Issued

When and how will the money be sent? Recipients may have seen a direct deposit pending in their bank account as early as December 29, but the funds became officially available . Paper checks or debit cards will be sent to those who don’t already have a bank account on file with the Internal Revenue Service.

What About Next Year

Depending on whether or not you had a child in 2021, you will be qualified for more money from the government. You will likely get $1,400 upon filing your 2022 taxes, according to Forbes and Insider. Not only will a $1,400 check come to new parents if they land in a certain income threshold, but there is also an expanded child tax credit that could come into effect. That means more money for you and your family just for expanding your family.

The payments that parents have received in 2021 and will continue to receive are actually advanced payments for 2022. Theres also a reason that youve only received half of the $3,600. Thats because Congress built into the stimulus package that parents would receive some now and some later. That later is in 2022. So youll be getting potentially $1,800 or $1,500 next year.

Read Also: Where’s My Stimulus. Gov

Was I Eligible To Get A Stimulus Check

You were eligible to get a stimulus check and should have gotten the full amount if you filed taxes and had an adjusted gross income of:

- up to $75,000 if single or married filing separately.

- up to $112,500 if you filed as head of household

- up to $150,000 if married and you filed a joint tax return.

Donât Miss: When Were The Stimulus Checks Issued

What If I Dont Have An Address

Shelters and other service providers, such as health care clinics and drop-in day centers, may allow you to use their address for tax purposes. Other agencies that offer homeless prevention services like a Community Action Agency or Salvation Army are also options. If you are not staying in a shelter or cannot find a service provider nearby, you can also use a trusted relatives or friends address. The IRS will deliver checks to P.O. boxes.

Read Also: How Do I Apply For The 4th Stimulus Check

Are Stimulus Checks Considered Taxable Income

The stimulus checks were paid based on information from your most recent tax return and will be reconciled in tax year 2020 to ensure you received the correct rebate amount.

- If you are underpaid based on your 2020 income you may receive more tax credit when you file your 2020 taxes.

- If you are overpaid, you dont have to pay it back.

For example, if you received $700 as an individual based on your 2019 return but when you file your 2020 tax return, it shows your income took a hit and you should have received a $1,000 stimulus check. You would receive an additional $300 credit on your 2020 return.

Let TurboTax keep you informed on the latest information on how taxes are impacted by COVID-19 relief including the most up-to-date information on tax filing deadlines, visit our Coronavirus Tax Center.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

Was There A 3rd Stimulus Check

The vast majority of the third stimulus payments were automatically delivered to taxpayers’ bank accounts or via a check in the mail last spring. The payments were authorized by the American Rescue Plan in March 2021 and were meant to help people struggling financially because of the Covid-19 pandemic.

Read Also: How To Sign Up For The Stimulus Check

What If I Get Government Benefits Will These Payments Count Against Eligibility Or Unemployment Insurance

Economic Impact Payments dont count against means-tested programs like SNAP, TANF, or Medicaid. The payments are not counted as income during the month they are received and the following month and they are not counted as a resource for 12 months.

You will receive the check regardless of your employment status. The check will not impact your eligibility for unemployment payments.

Can I File My Taxes With A Paper Return

Yes, however it is not recommended. If you have not filed your taxes yet and still need to, file electronically if possible. IRS processing of paper returns is delayed due to COVID-19. You can use GetCTC.org if you arent normally required to file taxes, and get support from the chat function on the site, where you can communicate with an IRS-certified volunteer to help you complete the form. GetCTC.org is available through November 15, 2021.

If you must file a paper return, you can download the tax forms from IRS.gov or use an online tax software program to complete your return and print it instead of filing electronically. If you need to file a paper return and do not have internet access, ask a trusted friend or relative for help.

Read Also: Irs Phone For Stimulus Checks

Can I Get A Stimulus Check If I Don’t Work

They don’t need to have a job,” the IRS writes. “For eligible individuals, the IRS will still issue the payment even if they haven’t filed a tax return in years.” The quickest way to receive a stimulus payment is via direct deposit. … Otherwise, payments will be mailed to the address provided on each return.

What Was The Second Stimulus Check Amount

What about the second stimulus check amount and dates? Congress approved another economic relief bill at the end of last year, and the second round of stimulus check payments began sending as early as Dec. 29, 2020. This payment capped out at $600 per person, and another $600 per qualifying child dependent.

Also Check: When Did The Stimulus Checks Go Out In 2021

Don’t Miss: I Want To Sign Up For The Stimulus Check