Irs Free File Available Today Claim Recovery Rebate Credit And Other Tax Credits

- Do Your Taxes for Free with Free File – English | Spanish

IR-2021-15, January 15, 2021

WASHINGTON IRS Free File online tax preparation products available at no charge launched today, giving taxpayers an early opportunity to claim credits like the Recovery Rebate Credit and other deductions, the Internal Revenue Service announced.

Leading tax software providers make their online products available for free as part of a 19-year partnership with the Internal Revenue Service. There are nine products in English and two in Spanish.

As we continue to confront the COVID-19 pandemic, IRS Free File and certain other similar online tax preparation products such as MilTax Tax Services for the Military offered through the Department of Defense offers taxpayers a free way to do their taxes from the safety of their own home and claim the tax credits and deductions they are due, said Chuck Rettig, IRS Commissioner. We encourage eligible taxpayers to take a look at using Free File, MilTax and similar free online tax preparation products this year, to follow the lead of over 4 million people who took advantage of these free services just last year. An IRS tax refund is often the single largest payment families receive during the year. We know how critical that refund is, especially this year.”

IRS Free File online products are available to any taxpayer or family who earned $72,000 or less in 2020. MilTax online software will be available on January 19, 2021.

Will I Lose Out If I Cant Sign Up In Time To Get A Payment On July 15

No. Everyone who signs up and is eligible will receive the full Child Tax Credit benefits they are owed. If you sign up for monthly payments later in the year, your remaining monthly payments will be larger to reflect the payments you missed. If you do not sign up in time for monthly payments in 2021, you will receive the full benefit when you file your taxes in 2022.

How To Create An Signature For Your Pdf Document In Chrome

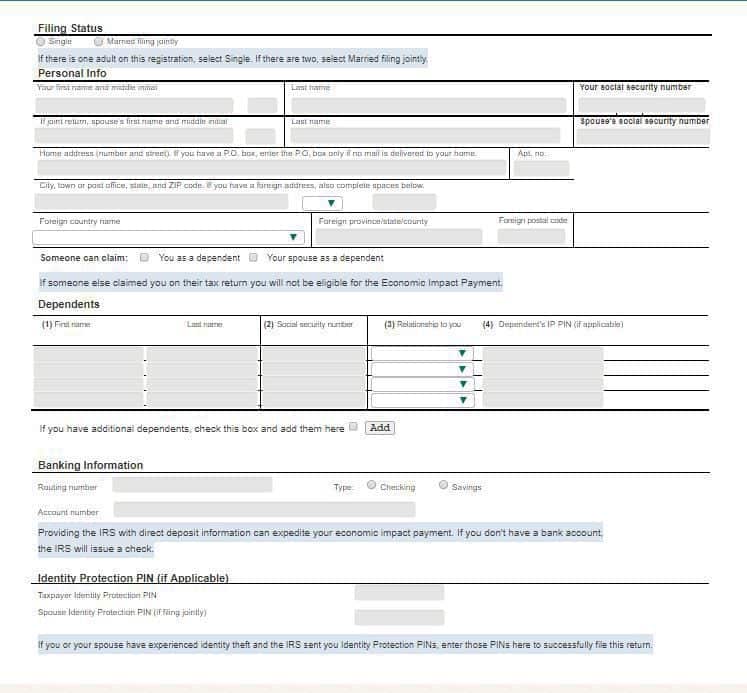

The guidelines below will help you create an signature for signing non filers’ stimulus in Chrome:

Once youve finished signing your printable non filer tax form check form, choose what you want to do after that save it or share the file with other parties involved. The signNow extension gives you a range of features to guarantee a much better signing experience.

Also Check: How Do I Get Another Stimulus Check

Who Should Use Thenon

This new tool is designed for people who did not file a tax return for 2018 or 2019 and who don’t receive Social Security retirement, disability , or survivor benefits or Railroad Retirement benefits. Others who should consider the Non-Filers tool as an option, include:

Lower income: Among those who could use Non-Filers: Enter Payment Info tool are those who haven’t filed a 2018 or 2019 return because they are under the normal income limits for filing a tax return. This may include single filers who made under $12,200 and married couples making less than $24,400 in 2019.

Veterans beneficiaries and Supplemental Security Income recipients: The IRS continues to explore ways to see if Economic Impact Payments can be made automatically to SSI recipients and thosewho receive veterans disability compensation, pension or survivor benefits from the Department of Veterans Affairs and who did not file a tax return for the 2018 or 2019 tax years. People in these groups can either use Non-Filers: Enter Payment Info option now or wait as the IRS continues to review automatic payment options to simplify delivery for these groups.

Social Security, SSDI and Railroad Retirement beneficiaries with qualifying dependents: These groups will automatically receive $1,200 Economic Impact Payments. People in this group who have qualifying children under age 17 may use Non-Filers: Enter Payment Info to claim the $500 payment per child.

Appendix Ii: Estimating The Outreach Population For Economic Impact Payments

Table 1 in this paper and Appendix Table 1 both rely on nationally representative survey data to estimate the number of individuals eligible for Economic Impact Payments while excluding those likely to receive those payments automatically because they filed federal income taxes or participate in federal benefit programs . The estimates are approximate and are affected by underreporting of income and benefits, recent changes in program participation, and other data limitations.

Data reflect the population, economy, and program participation patterns of 2015 through 2017 and are from CBPPs analysis of the Census Bureaus Current Population Survey Annual Social and Economic Supplement, adjusted to correct for underreporting of SNAP and SSI participation in the CPS using baseline data from the Transfer Income Model Version 3 . TRIM 3 is developed and maintained by the Urban Institute with primary funding from the Department of Health and Human Services Office of the Assistant Secretary for Planning and Evaluation . To improve the reliability of the state estimates, we average together three years of data , the most recent available from TRIM. We exclude immigrant families likely to be ineligible due to lacking a Social Security number.

Read Also: Where’s My Stimulus Money 2021

New Spanish Language Version Unveiled

IR-2020-83, April 28, 2020

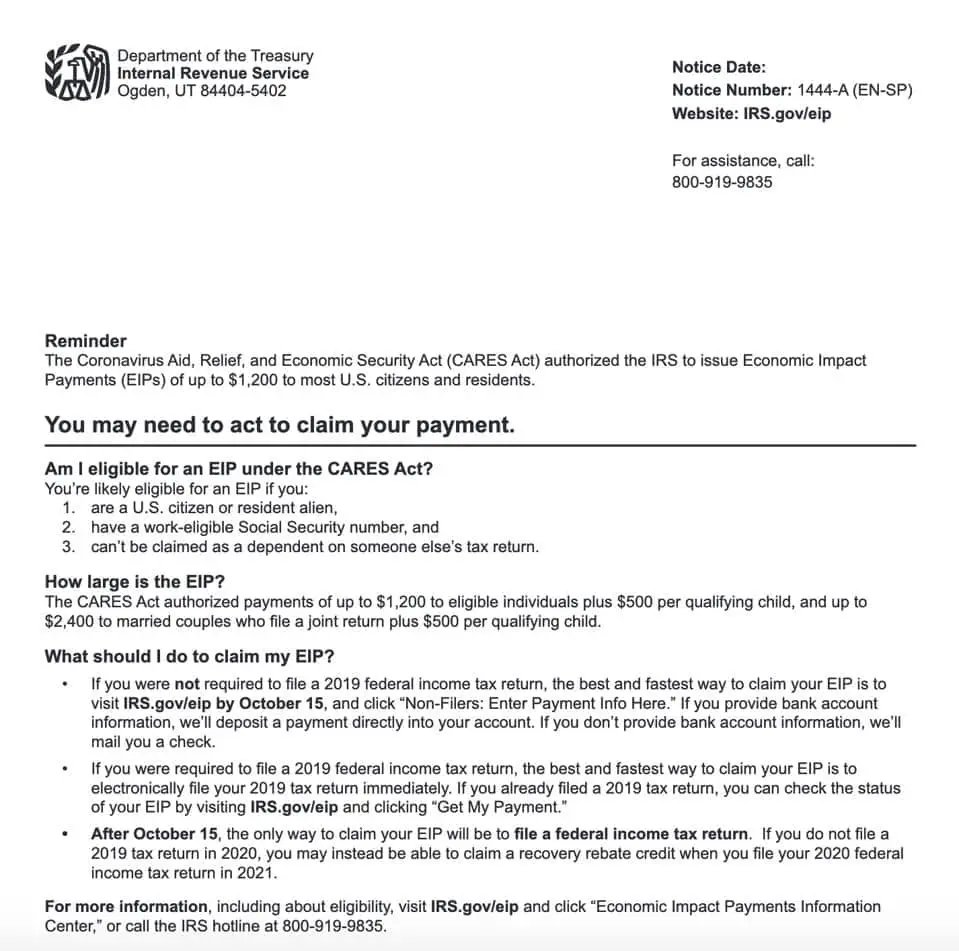

WASHINGTON The Internal Revenue Service today reminds low-income Americans to use the free, online tool Non-Filers: Enter Payment Info Hereto quickly and easily register to receive their Economic Impact Payment.

The IRS has recently released a new Spanish language version of the tool to help even more Americans get their money quickly and easily.

“The IRS is working hard to find new ways for people who don’t have a filing requirement to receive their Economic Impact Payment,” said IRS Commissioner Chuck Rettig. “The Non-Filers tool is an easy way people can register for these payments. I appreciate the work of the Free File Alliance to quickly develop a Spanish-language version of this tool to reach additional people. This is part of a wider effort to reach underserved communities.”

The Non-Filers: Enter Payment Info Here tool is designed for people with incomes typically below $24,400 for married couples or less than $12,200 for single people. This includes couples and individuals who are homeless. People can qualify, even if they do not work. Anyone claimed as a dependent by another taxpayer is not eligible.

Usually, married couples qualify to receive a $2,400 payment while others normally qualify to get $1,200. People with dependents under 17 can get up to an additional $500 for each child.

Here are some questions and answers on the Non-filers tool:

Can I Update Payment Information Without Filing A Return

This unfortunately isnt possible at the moment. Non-filers could apply for Economic Impact Payments in November 2020 but the IRS now requires non-filers to file Form 1040 in 2021 tax season.

While you would need to track the status of your stimulus payment, you will need to track your refund. This is because you wont be getting a stimulus payment. Youre getting the recovery rebate credit which will be added to your refund.

From the start of the 2021 tax season, you can file a federal income tax return to provide the IRS with your payment information. This is the only way you can get your recovery rebate credit refunded to you.

The recovery rebate credit can be found on Form 1040 Line 30. Make sure to file taxes electronically so that you get your return processed a lot faster. This will enable you to get your refund a lot sooner. In other words, your stimulus payment.

Recommended Reading: Havent Got My Stimulus

Recommended Reading: First Second And Third Stimulus Checks

Whos Eligible For This Money From The Irs

Who are these 9 million people who could be eligible to get thousands of dollars from the IRS?

To be blunt, were mostly talking about low-income households. The IRS says people who werent required to file 2021 tax returns are typically individuals earning less than $12,500, or married couples who earned less than $25,000 last year.

But there are also higher-earning people who, for various reasons, havent gotten around to filing their 2021 taxes. However, the IRS is only mailing letters to people who appear to qualify for these tax credits but havent filed a 2021 tax return yet.

Which means if you dont hear from the IRS, theyre not trying to give you money, so youre not missing out on anything. Sorry.

Irs Stimulus Check Application For Non Filers 2022

Even though IRS is no longer paying any stimulus checks, yet to keep abreast with the IRS stimulus check application process, you can read this article section.

Those people who havent filed their taxes are mostly the ones covered under special government programs like the Social security benefit programs whereby an individual is not required to file taxes.

Under such circumstances, there is a high chance that non-filers have not received the money paid through the previous two stimulus checks for which they were eligible. But even now these people have a chance to claim their money. By filing their taxes before the 15th April deadline.

If users have not filed taxes for quite some time, they might be finding it difficult to do it. But off late, the government is trying to simplify the process.

Recommended Reading: Recovery Rebate Credit Third Stimulus

Theres Still Time To Get Payments

If you havent yet filed your tax return, you still have time to file to get your missed 2021 stimulus payments.

Visit ChildTaxCredit.gov for details.

The IRS has issued all first, second and third Economic Impact Payments. You can no longer use the Get My Payment application to check your payment status.

Most eligible people already received their Economic Impact Payments. However, people who are missing stimulus payments should review the information below to determine their eligibility to claim a Recovery Rebate Credit for tax year 2020 or 2021.

Securely access your IRS online account to view the total of your first, second and third Economic Impact Payment amounts under the Tax Records page.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Read Also: How To Cash My Stimulus Check

Complete Guide To Irs Stimulus Payments For Non

This post is an extensive guide to IRS stimulus payments for non filers. If you are a non filer and looking for payment through stimuluscheck, read the post for detail updates and guide.

As we know that some residents of the United States received a stimulus check in the first round. Stimulus Check second round is expected in the coming days.

Alert: Only provide information to IRS.gov. Do not provide information to the links not provide by/on IRS website.

Stay Safe and keep your information secure

Claiming This Money Wont Hurt Your Other Benefits

The IRS is stressing that if you claim these 2021 tax credits, it wont change whether youre eligible for other federal benefits for low-income households namely the Supplemental Nutrition Assistance Program , Supplemental Security Income , Temporary Assistance for Needy Families , or the Special Supplemental Nutrition Program for Women, Infants and Children .

So dont worry about that.

Recommended Reading: How Much Was The Second Stimulus Check

Didn’t Get The Full Third Payment Claim The 2021 Recovery Rebate Credit

You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return.

Individuals can view the total amount of their third Economic Impact Payments through their individual Online Account. Through March 2022, we’ll also send Letter 6475 to the address we have on file for you confirming the total amount of your third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need this information from your online account or your letter to accurately calculate your 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment. All amounts must be considered if filing jointly.

Using the total amount of the third payment from your online account or Letter 6475 when preparing a tax return can reduce errors and avoid delays in processing while the IRS corrects the tax return.

Snap And Medicaid Agencies Can Reach About 9 Million Eligible People Not Receiving Automatic Payments

We estimate that approximately 9 million of the 12 million people who wont automatically receive the payments receive state- or county-administered benefits such as SNAP or Medicaid, a fact that underscores the key role for state government in reaching this group. They have low incomes and are among those who most need the payments to cover essential expenses. The payments for which they qualify, worth a combined $9 billion, represent a significant sum both individually and collectively. In Alabama and North Carolina, for example, their payments total an estimated $209 million and $324 million, respectively, or nine toten times the amount of basic cash assistance those states provide annually through their Temporary Assistance for Needy Families programs , our estimates suggest.

While many SNAP and Medicaid recipients file federal income tax returns and hence will receive their payments automatically, state agencies are the primary organizations able to reach those who dont file. State agencies are uniquely placed to use existing contact information to alert eligible people about the payments and connect them with services to help them obtain their payment.

As state agencies reach out to the 9 million people, the following groups would be useful targets for outreach efforts:

| TABLE 1 | |

|---|---|

| * | * |

Recommended Reading: Will There Be Another Stimulus Package

Remaining 12 Million Eligible People Have Very Low Incomes

By definition, the estimated 12 million people not receiving payments automatically have very low incomes because they arent required to file federal income tax returns. Only people with annual income above the following levels have a legal obligation to file a return for 2020: $12,400 for singles, $18,650 for heads of household , and $24,800 for married couples.

The 12 million group is predominantly non-elderly. Many senior citizens are receiving automatic payments because they receive Social Security, Railroad Retirement, SSI, or veterans pensions or disability benefits. Up to 1 million seniors, though, may be eligible for payments but do not receive them automatically.

The outstanding payments amount to roughly $12 billion nationally, which if delivered and spent would not only reduce hardship but also give state and local economies a much-needed boost.

What If I Dont Have A Permanent Address

You can receive monthly Child Tax Credit payments even if you dont have a permanent address. You can list a trusted address where you would like to temporarily receive your monthly checks, such as the address of a friend, relative, or trusted service provider like a shelter, drop-in day center, or transitional housing program.

Read Also: What Was The 2021 Stimulus Check

Nonfilers Are Likely Eligible To Get Both Of The 2020 Stimulus Checks

Most nonfilers fall below the income limits stipulated by each stimulus package and would be eligible for the full amount in each round — $1,200 per person under the 2020 CARES Act passed in March 2020, and $600 per person under the December 2020 stimulus bill. Find the full eligibility rules for each stimulus check here.

If you receive SSI or SSDI, you should have received at least a portion of both of those stimulus checks automatically — the IRS obtained the names of Social Security recipients and SSI beneficiaries from the Social Security Administration in the spring and made the payments to them automatically, according to Janet Holtzblatt, a senior fellow at the Urban-Brookings Tax Policy Center.

If either of your checks are missing, however, you’ll have to take the extra steps below.

The IRS started processing tax returns on Feb. 12. The federal tax return deadline was extended to May 17.

If You Didnt Get The Full Economic Impact Payment You May Be Eligible To Claim The Recovery Rebate Credit

If you didnt get any payments or got less than the full amounts, you may qualify for the credit, even if you dont normally file taxes. See Recovery Rebate Credit for more information.

The tool is closed and it will not be available for other payments including the second Economic Impact Payment or the Recovery Rebate Credit. Economic Impact Payments were an advance payment of the Recovery Rebate Credit. You may be eligible to claim the credit by filing a 2020 1040 or 1040-SR for free using the IRS Free File program. These free tax software programs can be used by people who are not normally required to file tax returns but are eligible to claim the credit.

If you submitted your information using this tool by November 21, 2020 or by mail for the first Economic Impact Payment, IRS will use that information to send you the second Economic Impact Payment, if youre eligible.

You can check your payment status with Get My Payment. Go to IRS.gov Coronavirus Tax Relief and Economic Impact Payments for more information.

Don’t Miss: How Many Stimulus Checks Should I Have Received