File Your Tax Returns Says Irs

Hes also encouraging taxpayers to file their tax returns as soon as possible if they havent already, even though the deadline to submit tax returns has been delayed to July 15 from April 15, so the IRS has up-to-date direct deposit information on file.

In this environment we dont want people to get checks, Mnuchin said. We want to put money directly in their account.

The document produced by the House committee indicates that the stimulus paymentsincluded in the $2.2 trillion economic rescue bill passed last week to combat the fallout of the coronaviruscould take months to circulate into the economy, potentially blunting the effect of a quick infusion of cash. Lawmakers have urged the IRS to process the payments quickly so that unemployed workers can use them to pay bills.

The law included payments of $1,200 for each adult earning as much as $75,000, or couples collectively making $150,000, plus $500 for each child under 17. Those amounts are reduced for people with higher incomes, and individuals with $99,000 in earnings get nothing, even if they have children.

The Treasury Department has said that Social Security beneficiaries who arent required to file a tax return dont need to do anything to receive their payment, but the House document indicates those who arent required to file taxes annually might want to submit a simple tax return and include direct deposit information if they want to receive their payments faster.

Recommended Reading: Irs.gov 2nd Stimulus Check

New Information For Kansans Who Have Representative Payees Who Live In Residential Facilities And/or Are Medicaid Recipientssee Full Information At The Bottom Of This Page

– Representative payees do NOT have legal authority over economic impact payments, as they are not Social Security benefits.

– The payments are NOT meant to be used by group homes or nursing homes for your care.

– This payment will NOT affect your current or future eligibility for Medicaid, SNAP, SSI, Subsidized Housing or TANF, as long as it is spent with the next year. See all new questions and answers at the bottom of this page or on page 3 of the PDF.

Can I File My Taxes With A Paper Return

Yes, however it is not recommended. If you have not filed your taxes yet and still need to, file electronically if possible. IRS processing of paper returns is delayed due to COVID-19. You can use GetCTC.org if you arent normally required to file taxes, and get support from the chat function on the site, where you can communicate with an IRS-certified volunteer to help you complete the form. GetCTC.org is available through November 15, 2021.

If you must file a paper return, you can download the tax forms from IRS.gov or use an online tax software program to complete your return and print it instead of filing electronically. If you need to file a paper return and do not have internet access, ask a trusted friend or relative for help.

Read Also: When Are The New Stimulus Checks Coming Out

How Can I Get Help Completing Getctcorg

All first stimulus checks were issued by December 31, 2020. If you didnt get your first stimulus check in 2020 or didnt get the full amount you are eligible for and you dont have a filing requirement, you can use GetCTC.org. GetCTC has a chat box that you can use to communicate with an IRS-certified volunteer to help you complete the form. GetCTC.org is available through November 15, 2021.

Amid High Costs $850 Relief Checks Are Being Sent To An Estimated 858000 Maine People

Maine people are grappling with the increased costs as a result of pandemic-driven inflation, ranging from higher energy costs to increased prices of everyday goods.

While the Governor cannot control the impact of COVID-19 on global markets, she can make sure that we deliver to Maine people the resources they need to deal with these higher costs.

To help, Governor Mills proposed giving back more than half the budget surplus to the taxpayers of Maine, in the form of $850 direct checks.

The Governors proposal was supported by the Legislature and $850 checks will be sent to an estimated 858,000 Mainers, for a total of $729.3 million returned to taxpayers.

Read Also: How To Find Out What Stimulus Checks I Received

What Beneficiaries Can Expect In 2023

On Oct 13, 2022, the SSA announced its annual changes to the Social Security program for 2023. Starting Jan. 1, 2023, more than 65 million Americans will receive an 8,7.% COLA to their Social Security benefits.

This represents the largest cost-of-living adjustment since 1981, due to a spike in inflation resulting from ongoing economic difficulties caused by the COVID-19 pandemic. In 2022, the increase was 5.9% and, prior to that, COLA averaged just 1.65% per year over the previous 10 years while inflation remained low.

According to estimates released by the SSA, this increase will amount to more than $140 for the average retired worker, raising their total benefits to $1,827 per month in 2023. Couples, meanwhile, will experience an averagebenefits increase of $238 to $2,753 per month.

Disability benefit average payments will increase $119 to $1,483 per month. Disabled workers with a spouse and one or more children will experience an average$133 increase to $2,972 per month. Lastly, widows and widowers will find their averagebenefits increasing by $209 to $2,616 per month. Notably, widowed mothers with a minimum of two children will receive an average$282 increase to $3,520.

In addition to the COLA, several other major Social Security changes will go into effect in 2023:

Stimulus Check Arrival Dates For Ssi Ssdi Beneficiaries And Veterans

Federal beneficiaries who file a 2019 or 2020 tax return or used the Non-Filers tool in 2020 may have already received a stimulus payment or could get one in a future batch of checks being sent out by the government.

For almost everyone else, your payment could arrive on April 7 through direct deposit or on your Direct Express card. However, veterans who dont file taxes ordinarily will have to wait until mid-April, according to the IRS. People who have already filed a 2020 tax return this year to claim missing stimulus money may find that the IRS will likely use this information instead of your 2019 details if it has processed your latest return. Some people may need to file a 2020 tax return, even if they dont usually file, so the IRS has all the information needed to send payments to cover your eligible dependents.

Read Also: When Will The Stimulus Checks Be Sent Out

What You Should Do If Your Income Increased In 2020 Vs 2019

Undoubtedly, a whole separate camp of Americans saw their incomes rise in 2020 versus 2019, meaning they would no longer be considered eligible for a stimulus check if they were to submit their return today.

You could still wait to file your tax return and claim a stimulus check. The IRS wouldnt attempt to recoup that payment, and it also shouldnt open you up to any penalties or fines, according to the current text of the bill. Economic Impact Payments also arent considered taxable income.

But beware: You dont want to risk incurring late fees by waiting so long that you submit your tax return past the April 15 deadline .

Do Ssdi And Ssi Recipients Have To File A Tax Return

People who receive monthly SSDI or SSI checks who did not file a tax return in 2018 or 2019 are not required to do anything, including filing a simple tax return, unless they have dependents. For those without minor children or other dependents, the IRS will look at Form SSA-1099 benefit statements to get the information it needs to send out the payments automatically.

Parents who have children under 17 or other dependents, who receive monthly SSDI or SSI checks, and who did not file a tax return in 2018 or 2019, however, might need to file a tax return by May 17, 2021 to claim the Recovery Rebate Credit for their minor children or other dependents.

Recommended Reading: Qualifications For 3rd Stimulus Check

Rhode Island: $250 Rebate Per Child

Rhode Island will send a one-time payment of $250 per child, thanks to a state budget surplus.

Households can receive a payment for up to three dependent children. Those children must have been listed as your dependents on your 2021 federal and state income tax returns.

Taxpayers must earn $100,000 or less to be eligible for the payment.

Child Tax Rebate checks will be issued automatically starting in October 2022. Taxpayers filing their 2021 state tax returns on extension by October 2022 will receive their rebates starting in December.

Sign Up For Direct Deposit Or Update Your Information

Once you choose an option, the next question or an answer will appear below.

Select your payment for direct deposit:

Employment Insurance benefits and leave

Sign up or change your direct deposit information.

- Online:

- Find a Service Canada Office close to your home.

Goods and services tax / Harmonized sales tax credit or provincial equivalent

Sign up or change bank information for direct deposit for Canada Revenue Agency payments.

- Online:

- 1-8009598281

- In person:

- Most banks and financial institutions in Canada will be pleased to assist you in signing up for direct deposit for one or several of your Government of Canada payments.

- Complete this Canada Direct Deposit enrolment form and send it to the Receiver General for Canada at the address indicated at the bottom of the form.

Enrolling for this payment will automatically enrol you for any other Canada Revenue Agency payment you are entitled to receive /Harmonized sales tax credit or provincial equivalent).

Climate Action Incentive Payment

Sign up or change bank information for direct deposit for Canada Revenue Agency payments.

- Online:

- 1-800-959-8281

- In person:

- Most banks and financial institutions in Canada will be pleased to assist you in signing up for direct deposit for one or several of your Government of Canada payments.

- :

- Complete this Canada Direct Deposit enrolment form and send it to the Receiver General for Canada at the address indicated at the bottom of the form.

Income tax refund

Canadian

Don’t Miss: I Didn’t Get The 1400 Stimulus Check

Stimulus Check Payout Schedule

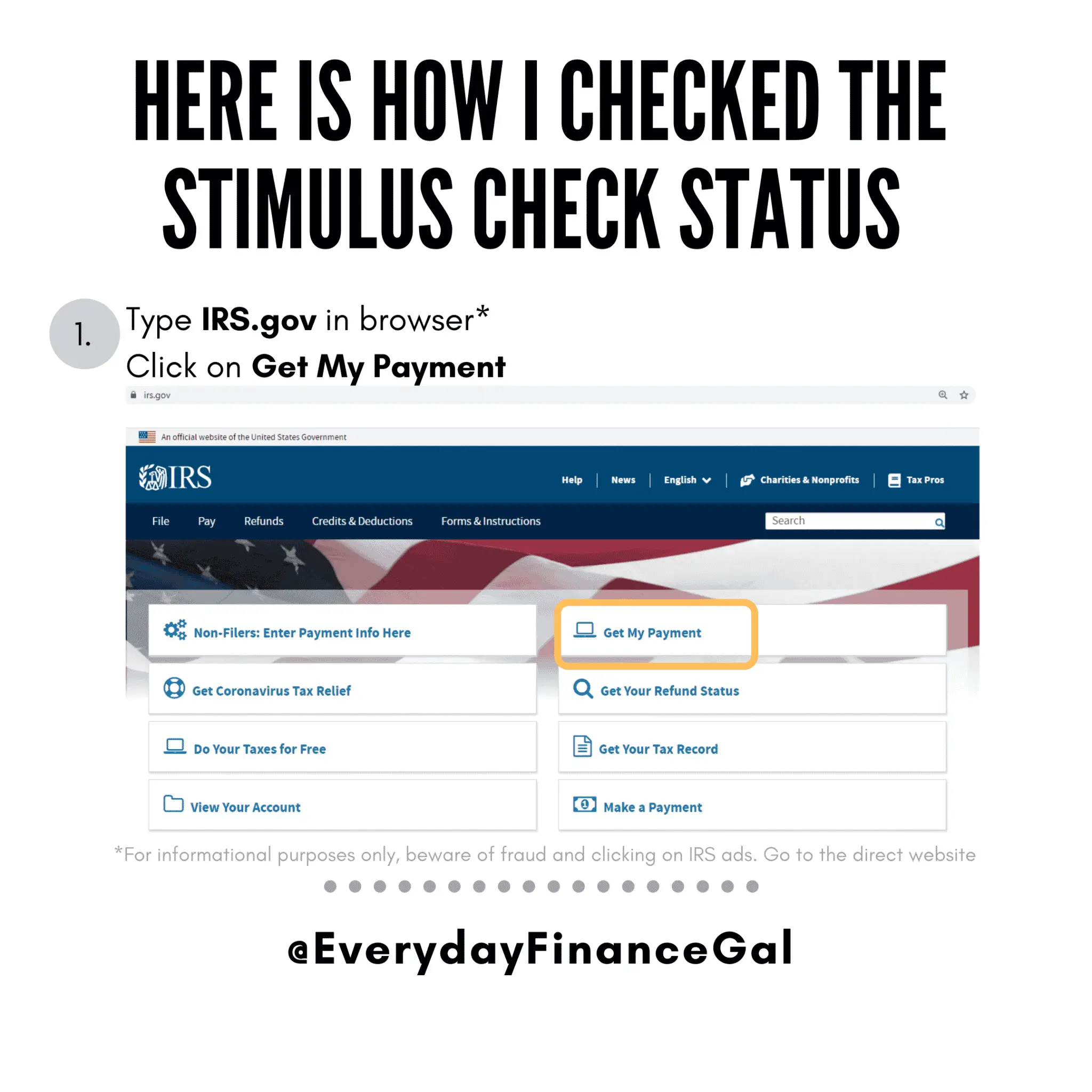

The IRS has confirmed that the distribution of economic impact payments has started and millions of Americans should have their stimulus check payment by now. Note that this will likely only apply to those receiving the payment via direct deposit . You can see the status of your stimulus check payment on the IRS Get My Payment portal.

- Direct Deposit payments will generally be deposited 2 to 3 days after the IRS confirms income eligibility for the payout.

- Physical checks will take at least 6 to 8 weeks to be mailed out.

Social Security Retirees and Disability recipients who are eligible for the payment will get the stimulus checks/payments deposited the same way they currently get their payments.

Given over 120 million Americans could be eligible for the payment, it will take a while to process the stimulus checks.

I Am An Ssi Or Ssdi Recipient And I Have One Or More Qualifying Dependent Children Under 17 What Do I Need To Do To Receive The Additional $500 Payment For Each Child

– If you are an SSI recipient, you have until MAY 5 to go to the following IRS page and click the non-filers: enter payment info here box at . You will need to create a user ID and password. After you submit your information, check your email for a message from Customer Service at Free Fillable Forms. It will either say that you submitted everything successfully, or it will tell you that there is an error and how to fix it.

– If you are an SSDI recipient, the deadline has passed to use this tool to enter your information. You will not receive the additional $500 per dependent child, but you can claim the $500 payments on a 2020 tax return.

Don’t Miss: Direct Express Stimulus Check Deposit Date March 2021

Will I Get An Economic Impact Payment

If you meet the following four requirements, you likely qualify for the stimulus.

1. Income Limits: If you are filing as single with an adjusted gross income up to $75,000, married filing jointly with an AGI up to $150,000, or head of household with an AGI up to $112,500, you will receive the full payment. Above these income limits, the payment amount decreases 5 percent for every additional $100 of income up to $99,000 for a single adult, $136,500 for head of household, and $198,000 for a married couple.

If you have zero income you can still get the payment.

2. Age requirements: There is no age requirement for the stimulus check, however you cannot be someone elses dependent. Children must be under 17 to get the additional payment for them.

3. Taxpayer Identification Number :At least one tax filer must have a valid Social Security number . If you are married filing jointly, and one spouse has an SSN and one has an Individual Taxpayer Identification Number , the spouse with an SSN and any children with SSNs or an Adoption Taxpayer Identification Number can get the payment. If one spouse is an active member of the military, then both spouses are eligible for a stimulus check even if only one spouse has an SSN and the other spouse has an ITIN.

4. Citizenship or Residency: You must be a U.S. citizen, permanent resident, or qualifying resident alien.

The Social Security Bridge Strategy

While waiting to claim your benefits to maximize them, you may want to consider a reverse mortgage to make ends meet.

According to Yahoo Finance, the average mortgage holder in the US has accessible home equity of $185,000.

This cash can be used by those who have to retire early so they dont have to claim benefits right away.

Don’t Miss: When Were The Stimulus Checks Issued

Social Security Cola Means More Help To Seniors

Among all the financial helps that we can find in Social Security, the COLA is one of the best. Thanks to the COLA, seniors who have a benefit will collect an extra 8.7% starting January 2023.

This increase is in addition to these stimulus checks. It is possible to receive everything together, so retirees dont have to worry about which of these increases they can receive. The COLA, moreover, is fully automatic, so if the average benefit of $1,666 will go to $1,810 starting next year.

What If My Stimulus Check Or Was Lost Destroyed Or Stolen

If the Get My Payment tool says your payment was direct-deposited, but the money doesnât show in your bank account after five days, first check with your bank. If the bank says it hasnât received a payment, you can request a payment trace.

To request a payment trace, call 800-919-9835 or fill out IRS Form 3911, Taxpayer Statement Regarding Refund.

Similarly, if the Get My Payment tool says your payment was mailed and you havenât received it, you can request a payment trace. The IRS will research what happened to your check if the check wasnât cashed, you will need to claim the Recovery Rebate Credit on your 2020 tax return. If the IRS finds that the check was cashed, youâll receive a claim package from the Treasury Department with a copy of the cashed check and instructions on filing a claim.

If you received your stimulus check by mail but then it was destroyed or stolen, make sure you request a payment trace. If you claim the Recovery Rebate Credit on your 2020 tax return without filing a payment trace, it will be denied, because the IRS will think that you already received the money.

Donât Miss: Never Got First Stimulus Check

Read Also: Fourth Stimulus Check Irs.gov

Will The Biden Plan Receive Bipartisan Support

Republicans and Democrats have been divided on how to handle Social Security, resulting in little reform of the program.

However, there are some components of Biden’s plan that Republicans are in support of, including increasing the payroll tax cap.

This would increase the maximum salary subject to Social Security taxes from $147,000 to $160,00.

According to one survey, this reform is supported by 88 percent of Democrats and 79 percent of Republicans, The Motley Fool reports.

The Biden Plan calls for reforms to Social Security to preserve and strengthen it.

The plan includes protecting widows and widowers from cuts in benefits.

Currently, beneficiaries’ payments are cut in half when a spouse dies.

Teachers also would not have to wait ten years to receive benefits and they would not be penalized for switching jobs.

Public sector workers that receive a pension would be able to claim Social Security under the new proposal.

What Happens If You Dont Receive Your Payment Or Only Receive A Partial Amount

If you havent received your payment yet, dont panic, although its easier said than done. Compared with the first round of stimulus checks, the IRS and Treasury Department have significantly shrunk the delivery timeline by weeks, if not months. However, the text of the American Relief Plan still gives both agencies until Dec. 31, 2021, to distribute all funds, meaning the last round of checks might not hit consumers mailboxes until January 2022.

Consider signing up for the U.S. Postal Services informed delivery service, so you know in advance of any mail youll be receiving on a given day. If the IRS says it already mailed your check but you didnt receive one, down the road you might also decide to order a stimulus check payment trace. You can arrange one by calling a hotline at the IRS or submitting a completed Form 3911, Taxpayer Statement Regarding Refund by mail or fax. But be prepared: This process can take weeks. The IRS may also ask that you sit tight for the time being in some cases, for a period as long as nine weeks.

Recommended Reading: How Much Stimulus Check 2021