In 10 In The Us Has Unclaimed Money

NAUPA reports that 1 in 10 people in the United States has some kind of unclaimed check or property. Unclaimed property is reported to the state in which the business or organization resides. Therefore, it is common to have unclaimed property in various states, especially if you have moved to another state, adds the association.

Like the TikToker, the Office of the Fiscal Service of the federal government of the United States has recommended that citizens use the National Association of Unclaimed Property Administrators to make their inquiries. They have described it as an excellent resource for people.

How Much Is The Third Stimulus Check For Single Person

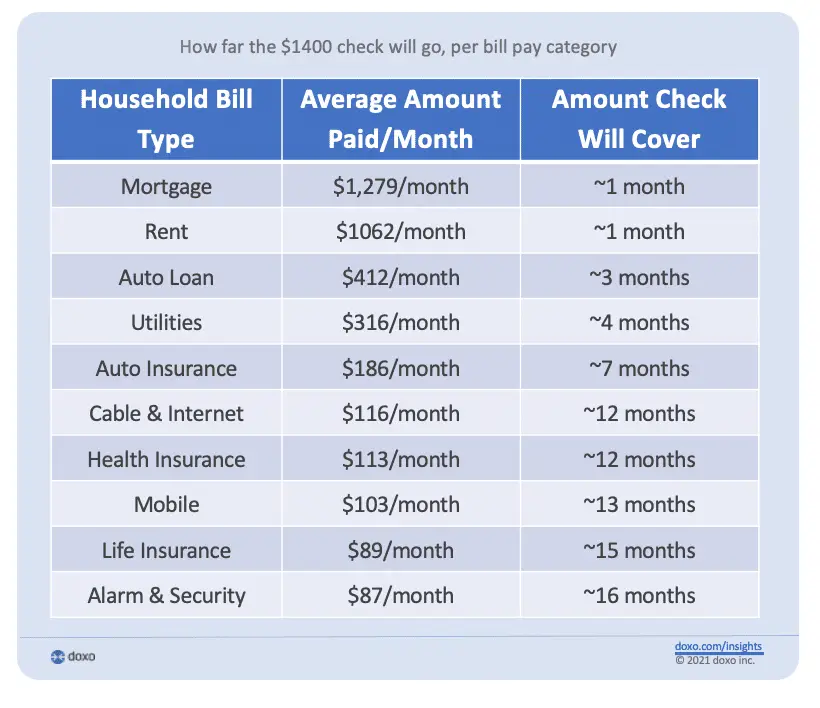

The maximum amount for the third round of stimulus checks will be $1,400 for any eligible individual or $2,800 per eligible couple filing taxes jointly. Each eligible dependent including adult dependents also will qualify for a payment of $1,400. That means a family of four could receive as much as $5,600 in total.

First Round Of Cares Act Stimulus Checks: What Expats Should Know

Q. What did the CARES Act 2020 Coronavirus stimulus check mean for U.S. expats?

A. The CARES Act stimulus check expats got in 2020 was technically a 2020 tax credit in advance.

It was part of the CARES Act Coronavirus stimulus package, which was designed to help get the economy back on its feet while we navigate the COVID-19 pandemic. In it are a variety of benefits for both individuals and corporations to ease the financial burden of the shutdowns and shelter-in-place orders. For the average American, the main benefits are cash payments and a variety of other debt relief options. The amount each taxpayer got depends on a variety of factors.

Q. Did I qualify for a CARES Act stimulus check if I live overseas?

A. Yes, expats qualified for the CARES Act stimulus checks. You qualified if you fell within the income threshold, had a social security number, and filed taxes even if you lived overseas. If you didnt get it, you can still apply for it retroactively as a tax credit on your 2020 tax return.

Q. What is the Recovery Rebate Credit?

A. If you didnt get the full amount you were owed, you may be able to apply for the Recovery Rebate Credit. Any eligible individual who did not receive the full amount of the recovery rebate as an advance payment, also known as an Economic Impact Payment, can claim the Recovery Rebate Credit on a 2020 Form 1040 or Form 1040-SR.

Q. How much was the CARES Act stimulus check for?

Q. Did I have to pay back the amount I got?

A. No

Don’t Miss: How Much Was The Stimulus Payments In 2021

What About Next Year

Depending on whether or not you had a child in 2021, you will be qualified for more money from the government. You will likely get $1,400 upon filing your 2022 taxes, according to Forbes and Insider. Not only will a $1,400 check come to new parents if they land in a certain income threshold, but there is also an expanded child tax credit that could come into effect. That means more money for you and your family just for expanding your family.

The payments that parents have received in 2021 and will continue to receive are actually advanced payments for 2022. Theres also a reason that youve only received half of the $3,600. Thats because Congress built into the stimulus package that parents would receive some now and some later. That later is in 2022. So youll be getting potentially $1,800 or $1,500 next year.

How Much Is The Stimulus Payment

Eligible individuals can receive a stimulus check of up to $1,400. Couples who file joint tax returns can receive up to $2,800. Families with dependents can receive an additional $1,400 per dependent. People who are American citizens but filing jointly with someone who is not a citizen will be eligible for the stimulus check. People without a Social Security number generally cannot get a check. Stimulus checks are not taxable.

Also Check: Check On Status Of Stimulus Check

How Much Was The Third Stimulus Check

The third stimulus check was $1,400 per adult and $1,400 per child.

$1,400 , plus

$1,400 multiplied by the number of dependents of the taxpayer for such taxable year.

-SEC. 6428B. 2021 RECOVERY REBATES TO INDIVIDUALS.

Individuals and families that made less than but not over the following amounts could receive a partial stimulus check:

- $160,000 for joint filing

- $120,000 for head of household

- $80,000 for single and other eligible individuals

The third stimulus check got sent out hours after it was signed with an official payment date of March 17th however, some individuals received it earlier from their bank.

Second Stimulus Check Calculator

Find out how much your second stimulus check will be using this handy tool.

You probably heard that you’ll be getting a second stimulus check from the IRS as part of the latest economic stimulus law passed by Congress. This time, the base amount will be $600 per eligible person . However, not everyone will get the same amount. If you’re married or have children under 17 years of age, your family could get a larger second stimulus check. On the other hand, if your income is above a certain level, your second stimulus check will be loweror you might not get a check at all.

To see how large your payment will be, answer the three questions in the calculator below and we’ll give you a customized estimate of your second stimulus check amount.

Also Check: Federal Mortgage Relief Stimulus Program

How To Claim A Missing Payment

You may be eligible to claim a Recovery Rebate Credit on your 2020 or 2021 federal tax return if you didn’t get an Economic Impact Payment or got less than the full amount.

It is important to understand that the Economic Impact Payments applied to different tax years. Depending on whether you missed the first, second or third payment, you will need to file either a 2020 or 2021 tax return to claim a Recovery Rebate Credit.

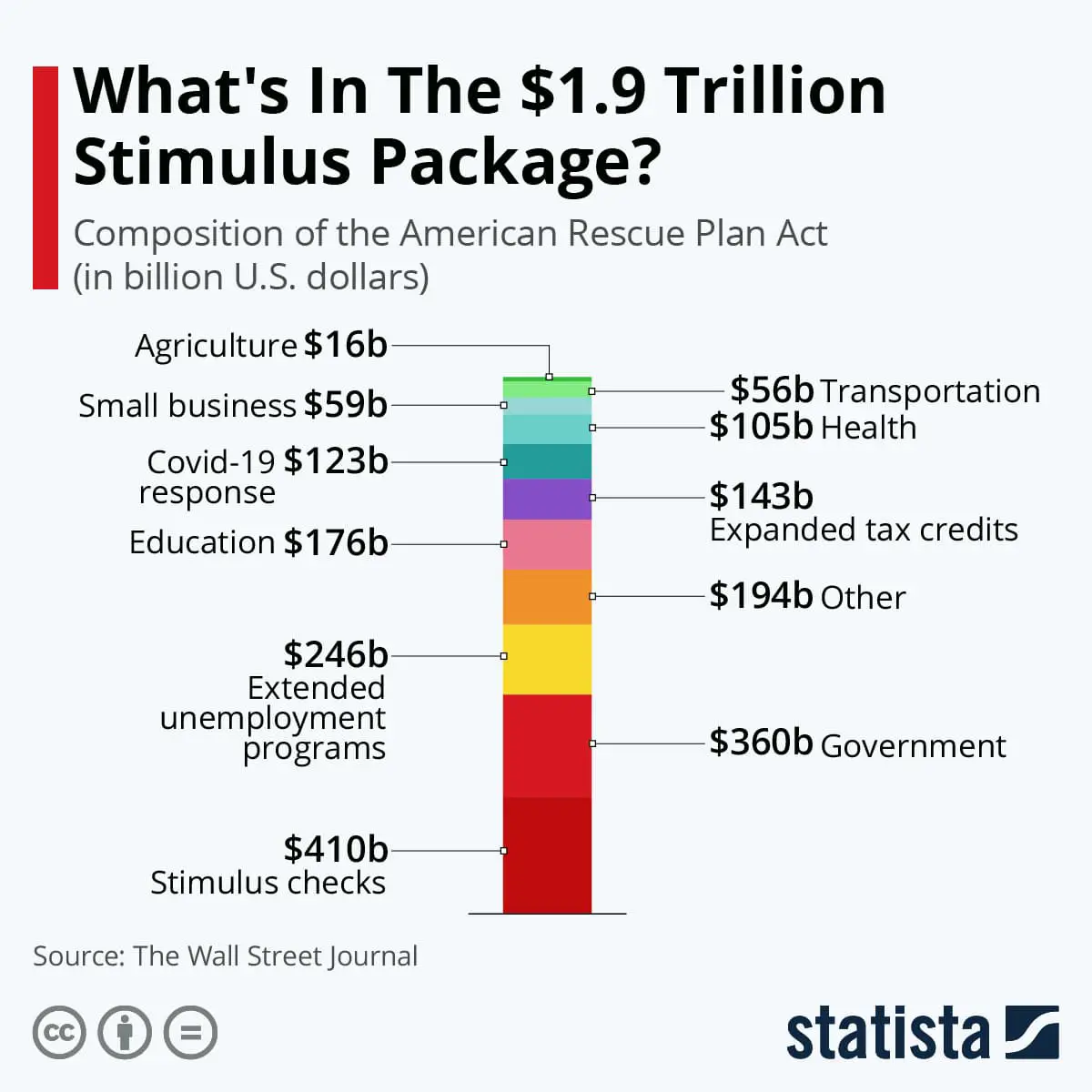

What Else Is In The Bill

The $1.9 trillion bill proposal is about more than just relief checks. Some of the other notable parts of the bill include:

- Funding for COVID-19 testing, vaccine distribution, and development of a COVID-19 tracking and warning system to monitor its variants and other biological threats.

- Extension of Pandemic Unemployment Assistance , Federal Pandemic Unemployment Compensation , and Pandemic Emergency Unemployment Compensation from March 14, 2021 to September 6, 2021. The FPUC unemployment benefits will continue to be $300 per week.

- Mandatory coverage of COVID-19 vaccines, administration of vaccines, and treatment under Medicaid and the Childrens Health Insurance Program .

- Support for a variety of emergency assistance and grant programs.

Certain parts of the original bill, like the minimum wage increase, were not included in the final version of the bill. Read more in the bill summary.

Read Also: When Do We Get The Next Stimulus Checks

Alert: Highest Cash Back Card Weve Seen Now Has 0% Intro Apr Until Nearly 2024

If youre using the wrong credit or debit card, it could be costing you serious money. Our expert loves this top pick, which features a 0% intro APR until nearly 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee.

In fact, this card is so good that our expert even uses it personally. for free and apply in just 2 minutes.

State And Local Aid $745 Billion

Non-public

$0.4 bil.

At the outset of the pandemic, governments used the funds largely to cover virus-related costs.

As the months dragged on, they found themselves covering unexpected shortfalls created by the pandemic, including lost revenue from parking garages and museums where attendance dropped off. They also funded longstanding priorities like upgrading sewer systems and other infrastructure projects.

K-12 schools used early funds to transition to remote learning, and they received $122 billion from the American Rescue Plan that was intended to help them pay salaries, facilitate vaccinations and upgrade buildings and ventilation systems to reduce the viruss spread. At least 20 percent must be spent on helping students recover academically from the pandemic.

While not all of the state and local aid has been spent, the scope of the funding has been expansive:

Utah set aside $100 million for water conservation as it faces historic drought conditions.

Texas has designated $100 million to maintain the Bob Bullock Texas State History Museum in Austin.

The San Antonio Independent School District in Texas plans to spend $9.4 million on increasing staff compensation, giving all permanent full-time employees a 2 percent pay raise and lifting minimum wages to $16 an hour, from $15.

Alabama approved $400 million to help fund 4,000-bed prisons.

Summerville, S.C., allocated more than $1.3 million for premium pay for essential workers.

What was the impact?

Also Check: How To Check On Stimulus Payment For Non Filers

The 2021 Stimulus Payment

On March 11, 2021, the American Rescue Plan was signed into law. It called for sending a third round of stimulus checks to Americans. The American Rescue Plan authorized a $1,400 stimulus payment to eligible people. Learn more about it on the IRS website. Most people already received their payments, which were based on income reported on their 2019 or 2020 tax return.

If you believe you did not get all or part of the $1,400 stimulus from the American Rescue Plan of 2021, you should claim this as a recovery rebate credit on your 2021 tax returnLearn where to get help filing your taxes.

How Much Was The 3rd Stimulus Check Del Momento

How do I track my $600 California stimulus check? The California Franchise Tax Board has a timeout panel for tax return and refund processing deadlines. Residents can also contact the board for further assistance with the $600 payment by calling 800-852-5711 or speaking to a representative on the website.

The IRS mailed paper checks or prepaid debit cards to individuals who did not provide their banking information. Mailed payments may be delivered in a different format than the first stimulus check. All second stimulus checks were issued by January.

Paper checks began mailing on Dec. 30, 2020, and the IRS mailed approximately eight million prepaid debit cards loaded with federal stimulus payments. Who qualifies for the Second Stimulus Check?

The total amount of the third stimulus payment is $1,400 per person and an additional $1,400 for each qualifying dependent.

Related

Don’t Miss: Franchise Tax Board Golden State Stimulus

Whos Eligible To Receive A Second Stimulus Check

Most American adults are eligible to receive a second stimulus check. There are some exceptions, though. Generally, nonresident aliens, anyone who can be claimed as a dependent on someone elses return, and people without a Social Security number wont receive a payment. Anyone who died before January 1, 2020, is not eligible to receive a second stimulus check as well.

Where Is My Third Stimulus Check

You can track the status of your third stimulus check by using the IRS Get My Payment tool, available in English and Spanish. You can see whether your third stimulus check has been issued and whether your payment type is direct deposit or mail.

When you use the IRS Get My Payment tool, you will get one of the following messages:

Payment Status, which means:

- A payment has been processed. You will be shown a payment date and whether the payment type is direct deposit or mail or

- Youre eligible, but a payment has not been processed and a payment date is not available.

Payment Status Not Available, which means:

- Your payment has not been processed or

- Youre not eligible for a payment.

Need More Information, which means:

- Your payment was returned to the IRS because the post office was unable to deliver it. If this message is displayed, you will have a chance to enter your banking information and receive your payment as a direct deposit. Otherwise, you will need to update your address before the IRS can send you your payment.

Also Check: Are They Sending Out Stimulus Checks

State Stimulus Checks: Who Is Getting A Payment In 2022

Residents in these states are getting stimulus checks. Find out when and who qualifies.

Dan Avery

Writer

Dan is a writer on CNETs How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

The Massachusetts State Legislature is working to pass a one-off tax rebate of $250 for eligible individual filers and $500 for eligible married couples who file jointly. If the bill clears both houses and is signed by Gov. Charlie Baker, payments could be sent out before the end of September.

Baker told reporters on July 8 that he will certainly sign the bill, but he hopes its just the start of more tax relief efforts, given that the cost of everything has gone up.

Massachusetts is just the latest state to address rampant inflation and the growing threat of recession with a plan to send a tax rebate check to eligible residents. The federal government issued three rounds of stimulus checks during the height of the pandemic. Its unlikely to send more this year, but at least 17 states have issued or are in the process of sending out rebate payments.

Do You Report Stimulus Check On Tax Return 2021

They letter explains that if you received advance CTC payments, you’ll need to report that amount in your tax return. … If you’re eligible for RRC, you’ll need to file a 2021 tax return to claim your remaining stimulus amount. You can check the Economic Impact Payment amounts by logging into your IRS online account.

Read Also: $600 Stimulus Check Not Received

Didnt Get The First And Second Payments

If you didnt get a first and second Economic Impact Payment or got less than the full amount, you may be eligible to claim the 2020 Recovery Rebate Credit and must file a 2020 tax return. Alternatively, eligible people who dont normally have to file a tax return and who didnt file a 2019 or 2020 tax return or use the Non-Filers tool for stimulus payments last year can use the Child Tax Credit Non-filer Sign-up Tool. You can still file after the tax deadline.

The Child Tax Credit Non-filer Sign Up tool allows you to provide the required information needed to deposit monthly payments of the advance Child Tax Credit directly into your bank account. The IRS will also use this information to calculate and send any resulting 2020 Recovery Rebate Credit and the third stimulus payment. Eligible people can expect separate payments for the Recovery Rebate Credit, the third Economic Impact Payment and the advance Child Tax Credit.

Get all the benefits youre entitled to under the law, including tax credits such as the 2020 Recovery Rebate Credit, the Child Tax Credit, and the Earned Income Tax Credit. Filing a 2020 tax return will also assist the IRS in determining whether someone is eligible for advance payments of the 2021 Child Tax Credit.

If you dont normally have to file a tax return, the online Non-filer Sign-up tool can help eligible families register for the monthly Advance Child Tax Credit payments.

Are Adult Dependents Getting Third Stimulus Checks

The new stimulus plan expands eligibility to adult dependents, including college students, elderly relatives and disabled adults.

The text of the plan redefines the term dependent according to section 152 of the tax code, which includes both qualifying children and adults: Section 152 provides that the term dependent means a qualifying child ) or a qualifying relative ).

While the plan pays out $1,400 for each qualifying dependent, families should keep in mind that the targeted lower income ranges exclude them if they earn over $160,000.

For reference, the second stimulus checks provided additional $600 payments for qualifying dependents under the age of 17. So a couple filing jointly with three eligible children could get a maximum second payment of $3,000 .

Under the first and second rounds of stimulus checks, children and adult dependents over the age limit could not get an additional payment, and they did not qualify for a stimulus check of their own either.

With the new stimulus plan, however, both joint filers and heads of household get an additional $1,400 payment for each dependent, regardless of age. The table below breaks down the third stimulus checks for heads of household with one dependent:

| Stimulus Checks for Heads of Household& 1 Dependent |

| AGI |

| $0 |

Don’t Miss: I Still Haven’t Gotten My Stimulus

Who Is Eligible For The Child Tax Credit 2021

Eligible Americans with income below $75,000, or married couples with income below $150,000, were eligible for the full amount of three rounds of stimulus payments that were made by the federal government in 2020 and 2021. Those stimulus income limitations also applied to the enhanced child tax credit although partial child tax credits were available for people with higher incomes.

Advance payments of the enhanced child tax credits were sent to people from July to December 2021. The monthly payments were up to $250 or $300 per child, for a period of six months.

Q How Much Will My Third Stimulus Check Be For

A. Your third stimulus check depends on your 2020 or 2019 income .

| Qualifying group | |

| An AGI of $150,500 or less | An AGI $160,000 or more |

| Dependents of all ages: $1,400 | $1,400 apiece, no cap — but only if caretakers make under the above limits |

| * This framework by the IRS was designed for taxpayers who are living and working in the U.S., so expats should ensure theyre looking at their AGI and not their gross income when determining their eligibility, especially if theyre claiming the foreign earned income exclusion. |

Additional Payments: If your third stimulus payment is based on their 2019 return and your 2020 return makes you eligible for a larger payment, the IRS will redetermine your eligibility and issue a supplementary payment later this summer.

You can estimate your own payment amount with H& R Blocks Stimulus Check Calculator.

Q. Will I have to pay back my stimulus check?

A. No, you will not have to pay back any amount of your Recovery Rebate Credit, even if you experience a pay hike in 2021.

Q. Will this round of stimulus checks affect my tax return this year?

Q. Will I owe tax on this third stimulus check in 2022 or have to pay it back?

A. No, the third stimulus payment is considered a 2021 tax credit , not income, so you will not need to pay taxes on it or pay it back.

Q. Do I need to sign up for the third stimulus check it or sign off on it?

Q. If I live abroad, when will I get my third stimulus check if I qualify?

You May Like: How To Claim 2021 Stimulus Check