Avoid Mistakes That Will Delay Your Refund

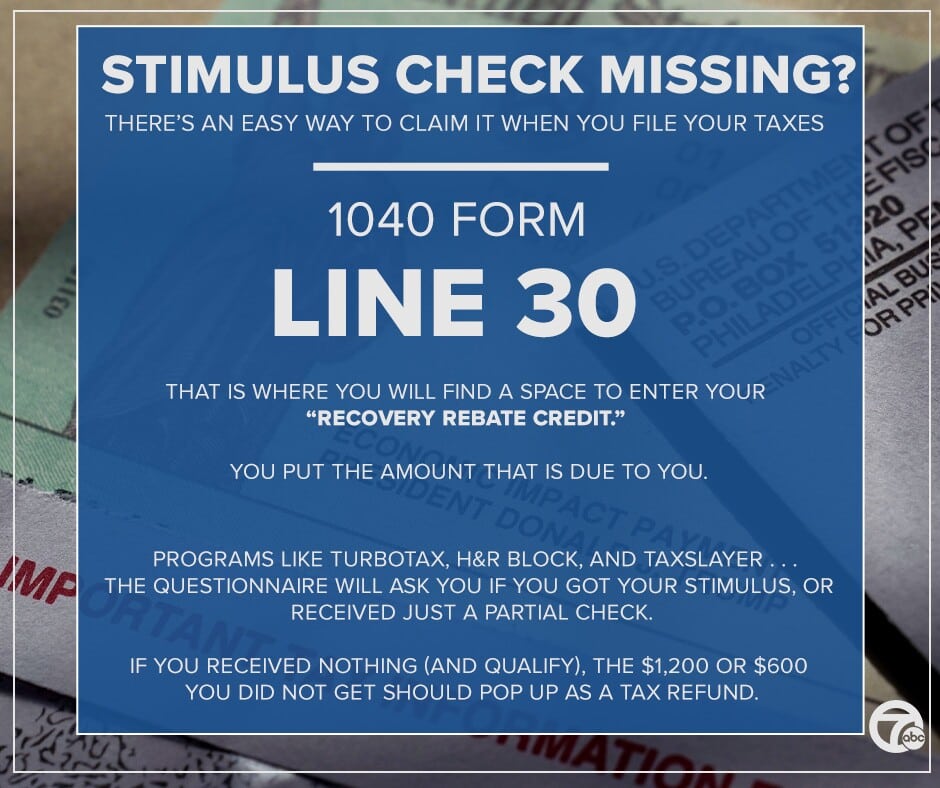

Simply claiming the recovery rebate credit won’t by itself delay the processing of your tax return or any tax refund. However, mistakes on your return including mistakes calculating the recovery rebate credit can slow things down and make you wait longer for your refund. Fortunately, though, you won’t necessarily lose out on the credit if you make a mistake on Line 30 of your Form 1040.

The IRS won’t calculate your recovery rebate credit or correct your entry if you enter $0 on Line 30 or leave it blank. The IRS will treat this as your decision not to claim the credit. However, if you make a mistake on the Line 30 amount , the IRS will calculate the correct amount of the credit, correct your tax return, and continue processing it.

The IRS won’t contact you before making a correction, and you won’t have to provide any additional information, but at least the IRS will send you a notice explaining any changes they make. This will also delay the processing of your return.

If you agree with the changes the IRS made, no response or action is required. If you disagree, call the IRS at the toll-free number listed on the top right corner of the notice.

What If Both My Spouse And I Have Itins And Our Children Have Ssns Can Our Family Get The Third Stimulus Check For Our Children

Yes. For the third stimulus check, any household member that has an SSN qualifies for a payment.

This is different than the first and second stimulus check, where at least one tax filer must have an SSN for the household to claim the stimulus checks. That adult with the SSN and any qualifying children with SSNs will get the stimulus checks.

You Can Still Qualify For Previous Stimulus Payments If Your Financial Situation Has Changed

For the first and second stimulus checks, the government looked at your 2018 or 2019 tax return to determine if you met the qualifications necessary to receive a payment, Brummond explains. For these first two payments, you were eligible for a full payment if you earned up to $75,000 a year as a single filer or up to $150,000 a year as joint filers.

However, if your financial situation changed in 2020, you may have fallen below the income threshold that you surpassed in 2018 or 2019. So while you actually ended up qualifying for these stimulus payments in 2020, you may not have received them, since payments were based on your previous 2018 or 2019 returns. If this describes your situation, according to Brummond, you still can receive previous stimulus payments by applying for the Recovery Rebate Credit on your 2020 tax return, which will be “solely based on your 2020 income.”

“Common reasons why taxpayers may claim a recovery rebate credit include reduced income in 2020, a change in marital filing status, a change in the number of dependents,” Tax Adviser explains on their website. And for more up-to-date information, .

Don’t Miss: How Much Was The 3rd Stimulus Check Per Person

You Could Be Owed A Recovery Rebate Credit

The third round of stimulus checks to hit bank accounts was thanks to the Recovery Rebate Credit, and it was a bit different from the first two. This credit provided up to $1,400 per eligible recipient, including qualifying dependents. Here’s how to know if you were eligible for the full credit:

- You’re a single taxpayer and earned less than $75,000.

- You’re a married couple and earned less than $150,000.

- You’re a U.S. citizen or U.S. resident alien.

- No one else can claim you as a dependent on their tax return.

- You have a Social Security number and that SSN was issued before your 2021 tax return was due.

It’s estimated that millions of Americans who are due their Recovery Rebate Credit never received one. Furthermore, it’s quite possible that the letter you receive from the IRS is nothing more than an invitation to apply for what is rightfully yours.

Stimulus Payments: Find Tax Info You Need To See If You Get More

Use Letter 6475 or the IRS website to report your 2021 stimulus payments in order to qualify for more.

Peter Butler

How To writer and editor

Peter is a writer and editor for the CNET How-To team. He has been covering technology, software, finance, sports and video games since working for @Home Network and Excite in the 1990s. Peter managed reviews and listings for Download.com during the 2000s, and is passionate about software and no-nonsense advice for creators, consumers and investors.

Dan Avery

Writer

Dan is a writer on CNET’s How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

Your chance to file a 2021 tax return on time is running out — tax deadline day is Monday, April 18. It’s also your final chance to claim any additional stimulus payments you might be eligible for.

The American Rescue Plan provided third stimulus check payments last year of up to $1,400 for each adult and child. If you didn’t receive the full amount of your eligible money you’ll need to claim the recovery rebate credit on your 2021 federal tax return.

Also Check: Can You Claim Stimulus On 2021 Taxes

Who Isn’t Eligible For The Recovery Rebate Credit

If you received full stimulus payments, you aren’t eligible for any more cash. And you cant take the credit if someone else can claim you as a dependent.

Additionally, only U.S. citizens or resident aliens qualify for the recovery rebate credit. If you are a nonresident alien” someone who has not passed the green card test”you do not qualify for the credit.

You also are not eligible if you dont have a Social Security number. But if youre married and your spouse has an SSN, there are certain instances where you might still qualify for the credit even if youre not in the Social Security system.

Can You Be Claimed As A Dependent On Another Person’s 2021 Return

College grads and even high school grads who don’t go on to college and live on their own might be able to claim the recovery rebate credit if they qualify based on income and other requirements.

Someone who was a dependent in 2020 but is no longer a dependent in 2021, such as a 2020 graduate, might qualify for the recovery rebate credit and not realize it, Hetherwick said.

Yet this tax strategy for claiming the credit doesn’t work for everyone.

“If they were full-time students for more than four months and one day in 2021, then they are technically still a dependent in tax year 2021,” Hetherwick said.

If you can be claimed as a dependent on another person’s return, you cannot take the recovery rebate credit.

Various rules apply for parents who want to claim children, including that a child can be claimed as a dependent under age 19 or if the child is a full-time student and is under age 24. No age limit applies if the child is permanently and totally disabled.

Henry Grzes, lead manager for Tax Practice & Ethics with the American Institute of CPAs, said someone who was claimed on their parents’ return in 2020 but is no longer a dependent should look into whether they would qualify for the recovery rebate credit when they file their own return this tax season.

“They clearly might not pick that up,” he said.

Also Check: How Much Was 3rd Stimulus Check 2021

What Is The 2021 Recovery Rebate Credit

That’s the official name of the third round of stimulus checks authorized by lawmakers during the pandemic, providing up to $1,400 per eligible person, including qualifying children claimed on a tax return.

That means a family of four could qualify up to $5,600 in stimulus money, assuming they earn under the income limit for the program. Under the law, the full amount is available to single taxpayers who earn less than $75,000 and married couples who earn less than $150,000.

Payments are gradually phased out for people who earn above those thresholds.

Did You Have A Baby In 2021

Busy moms typically don’t have an extra minute in their day to delve into all the latest tax rules. Parents and guardians who received some stimulus money last year also might not realize that the baby was left out of the picture.

The IRS put a notice on its website in late January that confirmed that parents of a child born in 2021 did not receive a third stimulus payment for a newborn.

Now you may be eligible to receive up to $1,400 for the child born in 2021 or welcomed through adoption or foster care in 2021 by claiming the recovery rebate credit. The recovery rebate credit also can apply if an adult became a qualifying relative in 2021 and was not a qualifying relative in 2019 or 2020.

Parents also should pay attention to the rules for claiming the child tax credit, which could further fatten a refund and be worth up to $3,600 per child.

Remember, all households did not get the same payment for stimulus money in 2021. A family of four might have qualified for up to $5,600. A single person could qualify for up to $1,400. Not getting stimulus money for an extra dependent matters.

Recommended Reading: Will There Be Any More Stimulus Checks

Who Might Qualify For The Recovery Rebate Credit

The income requirements for the recovery rebate tax credit are the same as for the stimulus payments. So if a stimulus check missed you or you received a partial payment, you may be eligible for additional cash if you file a federal tax return and claim the credit.

Note that if you determine the IRS issued you a stimulus check but it got lost, you should not file for the recovery rebate credit but instead ask the tax agency to trace the payment.

What Stimulus Is At Stake

The 2021 return addresses shortfalls with the third stimulus payment which was paid out from March through December last year was based on 2019 or 2020 tax return information. “Plus-up” payments were made last year to individuals whose advance payment was initially based on a 2019 return and who later filed their 2020 return that indicated that they qualified for more money.

Look for paperwork and confirmation to see what you were paid before assuming you didn’t get all you deserve.

Look for Notice 1444-C, which the IRS mailed out last year to show you how much was issued for the third stimulus payment.

On top of that, the IRS began issuing what it calls Letter 6475 late in January to help tax filers figure out how much they received for the third stimulus. Married couples filing a joint return received two letters.

You can skip reviewing the recovery rebate credit, for example, if you’re single and already received $1,400 plus another $1,400 for each dependent you had last year.

And you don’t qualify for the recovery rebate credit if you’re filing a joint return and you and your spouse received $2,800 and $1,400 for each dependent you had in 2021.

The IRS issued more than 175 million stimulus payments involving the third program, which added up to more than $400 billion to individuals and families nationwide in 2021.

More:IRS Letter 6475 can help you claim any extra stimulus cash owed: 5 things to know

Also Check: How Much Stimulus Check Are We Getting

What If My Mailing Address Changed Since I Received My Previous Stimulus Checks How Will I Get My Third Stimulus Check

If you are expecting to receive your third stimulus check by mail, it will be mailed to the last address you filed with the IRS. If your address has changed since then, there are different options you can take to make sure your stimulus check gets to you:

Option 1: File your 2020 federal tax return to update your address. If you havent filed your 2020 tax return yet, this is an easy way to update your address. File a tax return with your current address and your payment will be sent through the mail once the IRS receives your updated address.

Option 2: Provide your banking information in the IRS Get My Payment tool. If the post office was unable to deliver your stimulus check, it will be returned to the IRS. Two to three weeks after the payment has been issued, Get My Payment will display the message Need More Information. You will have the option to have your payment reissued as a direct deposit by providing your banking information.

If you dont provide your banking information, the IRS will mail your payment once your address is updated.

Option 3: Notify the IRS that your address has changed by telephone, an IRS form, or a written statement. It can take 4-6 weeks for the IRS to process your request.

How Do I Know If I’m Eligible For More Stimulus Money

All stimulus check payments ended on December 31, 2021. Most Americans received their full payments, but there are a few reasons why you may not have received as much as you are eligible for: If you had a baby or added qualifying children to your family in 2021, you’re due another $1,400 for each additional kid.

Likewise, if your income dropped considerably last year, you could also be owed more money.

If you believe that you are eligible for more stimulus money than you received in 2021, the best tax software will calculate your recovery rebate credit automatically and include the amount of additional money on line 30 of your IRS Form 1040.

If you want to calculate your potential recovery rebate credit yourself, use the Recovery Rebate Credit Worksheet as directed in the IRS instructions for Form 1040.

You May Like: How To Get Unclaimed Stimulus Checks

Can I Claim A Stimulus Check For Someone Who Is Deceased

Yes. For the third stimulus check, people who have died on or after January 1, 2021, are eligible to receive the third stimulus check. However, for married military couples, the date of eligibility is expanded. If the person who died was a member of the military and died before January 1, 2021, the surviving spouse can still receive the third stimulus check, even if they dont have an SSN.

For the first and second stimulus check, the IRS has stated that people who died on or after January 1, 2020, are eligible to receive both payments.

If they didnt receive the stimulus payments or didnt receive the full amounts that they are eligible for, spouses or other family members can file a 2020 federal tax return and claim it as part of their tax refund or use GetCTC.org if they dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2021.

What If Letter 6475 Says That I Received Money But I Didn’t

First, the IRS recommends that you check your bank account records for 2021 to make sure. They particularly advise looking for deposits from the IRS in spring or early summer.

Next, check your online IRS account. The info on the IRS website will be more up to date than Letter 6475, particularly if a payment was returned. If your online account says that you received stimulus payments, but you didn’t see the money, you should contact the IRS immediately to see if a payment trace is required.

Recommended Reading: Do We Supposed To Get Another Stimulus Check

Correcting A Mistake After The 2021 Tax Return Is Filed No Amended Return Needed

Individuals who made a mistake calculating the Recovery Rebate Credit and claimed an amount on line 30 for the 2021 Recovery Rebate Credit should not file an amended return. The IRS will correct the amount of the 2021 Recovery Rebate Credit and send a notice identifying the changes made.

If a correction is needed, there may be a delay in processing the return. If the taxpayer agrees with the changes made by the IRS, no response or action is required to indicate they agree with the changes. If the taxpayer disagrees, they can call the toll-free number listed on the top right corner of their notice.

When Will The Third Stimulus Check Be Issued

The government started sending the third stimulus checks on March 12, 2021. The IRS continues to send third stimulus checks as people submit their information to the IRS either by filing a 2020 tax return or using GetCTC.org. The deadline to use GetCTC.org is November 15, 2021.

If you have your banking information on file, the IRS sent your payment via direct deposit. Otherwise, you will receive your payment as a check or debit card via mail. Mailed checks and debit cards may take longer to deliver.

If you dont fall into any of these categories, youll have to wait to receive your third stimulus check. You will need to file a 2020 federal tax return to get the third stimulus check or use GetCTC.org if you dont have a filing requirement.

You can also get the first and second stimulus check as the Recovery Rebate Credit on your tax return or GetCTC.org if you are eligible.

Don’t Miss: Who Qualified For Third Stimulus Check

How To Calculate The Recovery Rebate Credit

Similar to the eligibility rules, calculation of the 2021 recovery rebate credit is generally the same as the calculation of third-round stimulus checks, except that they’re based on information from different sources. Third stimulus checks were generally based on information from either your 2019 or 2020 tax return, whichever was most recently filed when the IRS began processing your payment. If you didn’t file a return for either of those two years, the IRS sent a third stimulus check based on whatever information, if any, was available to it. In many cases, that information came from the Social Security Administration , Railroad Retirement Board, or Veterans Administration if you receive benefits from one of those federal agencies. However, the amount of your recovery rebate credit is based entirely on information found on your 2021 tax return.

As with the stimulus checks, calculating the amount of your recovery rebate credit starts with a “base” amount. For most people, the base amount for the 2021 credit is $1,400. For married couples filing a joint tax return, the base amount is $2,800 . Then you add on $1,400 for each dependent claimed on your 2021 return.

Finally, after the credit is reduced , you need to subtract the total third-round stimulus check and “plus-up” payments you received last year from the credit amount.

Here’s an example of how the calculation works: