What If I Dont Need To File A Tax Return And Didnt Get My Stimulus Check

If you are a nonfiler and would otherwise not be required to file a tax return, according to the IRS, you will need to file a Form 1040 or Form 1040-SR to claim stimulus payments if you are eligible in the form of a Recovery Rebate Credit.

No matter what your situation or how you want to file, TurboTax has you covered. With TurboTax you can do your taxes yourself, get help from an expert along the way or hand them off from start to finish to a dedicated tax expert.

What If I Already Filed A Return But Didnt Claim The Recovery Rebate

If you qualified for a recovery rebate credit but did not claim it on a 2021 return, the IRS says you will need to file an amended 2021 return.

If you filed the 2021 return electronically, you may be able to e-file Form 1040-X.

But if you filed a paper return, youd need to submit a paper version of Form 1040-X.

An important note: The IRS says do not file an amended return if you made a mistake and claimed the recovery rebate credit when you already received that money in 2021.

The IRS will correct the amount of the 2021 recovery rebate credit thats claimed if the records dont match. And youd receive a notice identifying the changes made.

And yes, that will delay processing the return. If the taxpayer agrees with the changes made by the IRS, no response or action is required to indicate they agree with the changes, the IRS said.

But if you disagree, youre going to need to call the toll-free number listed on the top corner of the notice of the problem.

ContactSusan Tompor: . Follow her on Twittertompor. To subscribe, please go to freep.com/specialoffer. Read more on business and sign up for our business newsletter.

How To Determine The Size Of Your Third Stimulus Check

To determine how much money you may get, start with the base amount of $1,400 if you’re single or $2,800 if you’re joint filers. Then add on $1,400 for any dependents.

Your credit may be reduced depending on your AGI. The amount is reduced if your AGI is more than $150,000 if you’re married filing jointly, more than $112,500 if you’re head of household, and more than $75,000 if you’re a single filer. You’ll receive no credit if your AGI exceeds $160,000, $120,000 or $80,000, respectively.

The IRS will also decrease your payout by the amount of your third stimulus check and any plus-up payments you got. Can’t remember the size? Check your mailbox. The government sent out Notice 1444-C and Letter 6475 with information about the total amount of your third stimulus check.

If you received a joint payment with a spouse, you each got your own letter showing half the total amount. If you can’t find the letter, you can visit your online IRS account and find details about your stimulus checks under the under the Tax Records section.

Remember: You have to put the right amount on your tax form if you want to get that extra money, especially given the recent turmoil at the IRS.

“If you don’t put any at all that you received or you put the incorrect amount, it’s going to hold up processing of your return” Greene-Lewis says.

Also Check: Is Texas Giving Stimulus Money

Who Is Eligible For The Recovery Rebate Credit

According to the IRS, most people who were eligible for the third round of payments have already received their stimulus checks but there are a few situations why someone might not have received it or received the wrong amount. For example:

-

You’re claiming a new dependent in 2021 .

-

Your marital status changed in 2021.

-

Your adjusted gross income from 2019 or 2020 was high enough to make you ineligible for a stimulus check, but your 2021 AGI is now lower and within the qualifying threshold.

-

You did not have a Social Security number but received one by the 2021 tax deadline.

Filing A Full Tax Return

Depending on your circumstances, you may want to consider filing a full tax return. There are a few reasons to consider this option:

To file a full tax return online go to MyFreeTaxes.com.

Read Also: How Many Irs Stimulus Payments In 2021

What You Need To Know About Your 2021 Stimulus Check

OVERVIEW

In response to the challenges presented by Coronavirus , the government is taking several actions to bolster the economy, such as offering expanded unemployment, student loan relief, sending stimulus checks and more.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

As Coronavirus continues to disrupt the U.S. economy, many have turned to the federal government for hope. To help provide relief in these unprecedented times, the Coronavirus Aid, Relief and Economic Security Act a $2 trillion stimulus package to help individuals, families and businesses was signed into law.

This relief will be taking many shapes over the coming months, such as:

- Widespread stimulus legislation, including efforts such as stimulus checks, mortgage relief for those adversely impacted by the economic slowdown, student loan interest relief, and more.

- The Federal Reserve has announced actions to stabilize and backstop the economy.

But how do some of these efforts work and who will they directly impact? Letâs take a look at the stimulus checks, how they work, who qualifies, how do you get one, and how your taxes will be affected.

Where Is My 2nd Stimulus Check

30. As with the first round of stimulus checks from the CARES Act, Americans can check the status of their payments at https://www.irs.gov/coronavirus/get-my-payment. The Get My Payment tool was reopened on Monday, and will confirm if the IRS has sent your second stimulus check, as well as your first payment.

Also Check: N.c. $500 Stimulus Check

Filing A Simple Return

To claim any recovery rebate or child tax credits that you are eligible for, you can file a simple return online by going to GetCTC.org. This online resource is both mobile friendly and available in Spanish.

Find Out Which Payments You Received

To find the amounts of your Economic Impact Payments, check:

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page.

IRS EIP Notices: We mailed these notices to the address we have on file.

- Notice 1444: Shows the first Economic Impact Payment sent for tax year 2020

- Notice 1444-B: Shows the second Economic Impact Payment sent for tax year 2020

- Notice 1444-C: Shows the third Economic Impact Payment sent for tax year 2021

Letter 6475: Through March 2022, we’ll send this letter confirming the total amount of the third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need the total payment information from your online account or your letter to accurately calculate your Recovery Rebate Credit. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment.

You May Like: Never Got First Stimulus Check

What Do I Do With The Stimulus Check Letter

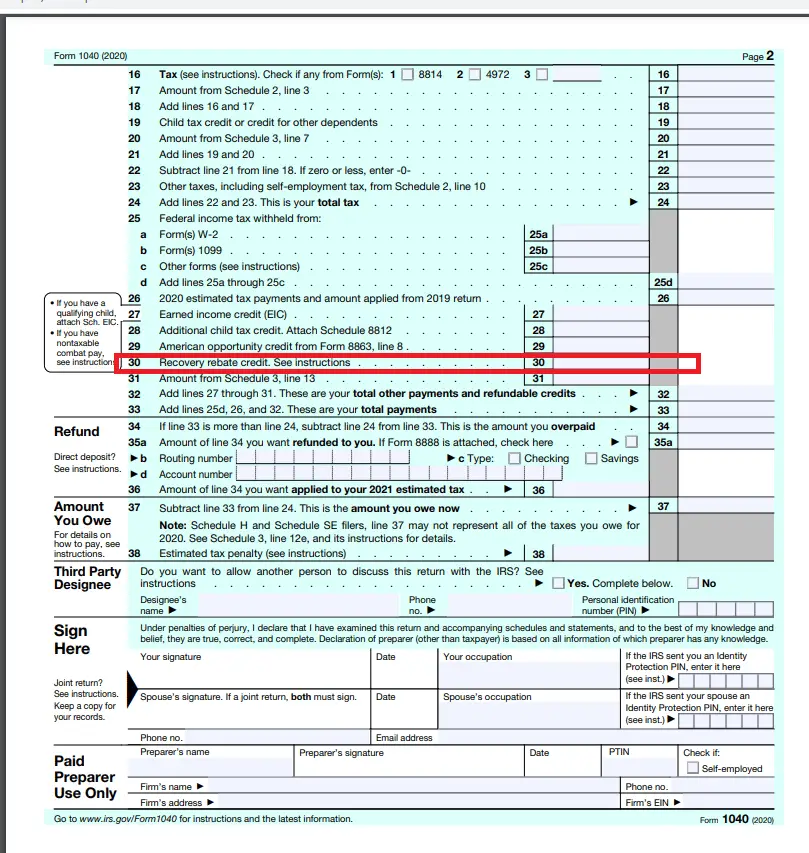

If you are using a professional tax preparer, give them Letter 6475 along with all of your other applicable tax documents. If you’re preparing your own return, use the amount shown in Letter 6475 in the Recovery Rebate Worksheet to determine if any credit applies. Then enter that credit on Line 30 of IRS Form 40.

The Recovery Rebate Worksheet is included in the instructions for IRS Form 1040 and calculated automatically by tax preparation software.

“Having the wrong amount on your return could trigger a manual review,” according to the H& R Block website, which could delay a refund for weeks.

How Much Money Will I Get

- Adults whose adjusted gross income is less than $75,000/year will get $1,400 for each adult, plus $1,400 for each dependent no matter how old they are. This applies to heads of households who make less than $112,500, as well.

- The IRS will use income information from your 2020 tax return if they received that return before sending your money. Otherwise they will use information from your 2019 tax return.

- If the IRS sends your payment based on a 2019 return and then your 2020 return says you qualify for more , they will send an additional payment to make up for the difference. To get the additional payment, you must file the 2020 tax return by 90 days from the filing deadline or September 1, 2021, whichever is earlier.

You May Like: Doordash Taxes For Drivers

Also Check: Did I Get The 3rd Stimulus

Is There A Deadline To Get My Third Stimulus Check

If you will be filing a full tax return, you have until the IRS closes their tax filing software on November 20, 2021. After this date, you can still claim the third stimulus check in 2022 by filing your taxes for Tax Year 2021.

If youre not required to file taxes, the deadline to use GetCTC.org is November 15, 2021. You can get the Recovery Rebate Credit using GetCTC.org, a simplified tax filing portal for non-filers. GetCTC is an IRS-approved service created by Code for America in partnership with the White House and U.S. Department of Treasury. You can use the portal even if youre not signing up for the Child Tax Credit advance payments.

Talk With A Kansas Attorney

Our experiencedfamily law andbusiness attorneys at Sloan Law Firm assist clients with questions relating to taxes, including coronavirus economic impact assistance and stimulus payments, as well as the child tax credit. With offices in Topeka and Lawrence, we help clients throughout Kansas. We invite you to contact us by calling or using our online contact form.

You May Like: When Were All The Stimulus Checks Sent Out

Extension To File Your Tax Return

If you cant file your federal income tax return by the due date, you may be able to get a six-month extension from the Internal Revenue Service . This does not grant you more time to pay your taxes. To avoid possible penalties, estimate and pay the taxes you owe by the tax deadline of April 19, 2022, if you live in Maine or Massachusetts or April 18, 2022, for the rest of the country.

Was I Eligible To Get A Stimulus Check

You were eligible to get a stimulus check and should have gotten the full amount if you filed taxes and had an adjusted gross income of:

- up to $75,000 if single or married filing separately.

- up to $112,500 if you filed as head of household

- up to $150,000 if married and you filed a joint tax return.

Also Check: Will There Be Another Stimulus Package

Who Is Eligible For The Rebate Credit Parents Of Babies Born In 2021 And More

Plenty of things could have changed in your life since you filed 2019 or 2020 federal income tax returns. If a new child joined the family in 2021, for example, youd want to claim the Recovery Rebate Credit to claim up to $1,400 owed for that child.

The parents would need to be able to claim the child as a dependent on their 2021 income tax return and qualify based on income limits for the credit.

Are Stimulus Checks Taxable

- 8:35 ET, Aug 8 2022

TAX season is in the rearview mirror, but many Americans took an extension that will allow them to file a 2021 tax return by October 17.

And many are wondering if stimulus checks received last year are subject to being taxed.

In 2021, millions of Americans received a stimulus check worth up to $1,400.

That was the third round of stimulus issued amidst the ongoing Covid pandemic.

The payment was in addition to the child tax credit payments that began in July 2021, offering up to $300 per month per child to qualified parents.

Some individual states also issued aid to residents and more states rolled out relief refund programs this year to help compensate for surging inflation.

Donât Miss: Contact Irs About Stimulus Payment

Don’t Miss: Status On 4th Stimulus Check

Why Did I Receive Irs Letter 6475

According to the IRS, Economic Impact Payment letters include important information that can help you quickly and accurately file your tax return, including the total amount sent in your third stimulus payment.

This could include “plus-up” payments, the additional funds the IRS sent to people who were eligible for a larger amount based on their 2019 or 2020 tax returns, or information received from the Social Security Administration, Department of Veterans Affairs or the Railroad Retirement Board.

Even though it is not taxable income, you still need to report any stimulus money on your IRS return. In 2020, the IRS received over 10 million returns that incorrectly reported stimulus money, according to IRS Commissioner Charles P. Retting, resulting in manual reviews and significant refund delays.

You may have already received a Letter 1444-C, which showed the amount you were paid and how it was delivered, but that’s not what you want to use to prepare your 2021 return.

Can I Claim A Stimulus Check For Someone Who Is Deceased

Yes. For the third stimulus check, people who have died on or after January 1, 2021, are eligible to receive the third stimulus check. However, for married military couples, the date of eligibility is expanded. If the person who died was a member of the military and died before January 1, 2021, the surviving spouse can still receive the third stimulus check, even if they dont have an SSN.

For the first and second stimulus check, the IRS has stated that people who died on or after January 1, 2020, are eligible to receive both payments.

If they didnt receive the stimulus payments or didnt receive the full amounts that they are eligible for, spouses or other family members can file a 2020 federal tax return and claim it as part of their tax refund or use GetCTC.org if they dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2021.

Also Check: Who Do I Contact About My Stimulus Check

What If I Owe Child Support Payments Back Taxes Money To Creditors Or Debt Collectors Or Federal Or State Debt

None of the three stimulus checks can be reduced to pay any federal or state debts and back taxes. Unlike the first stimulus check, your second and third stimulus check cannot be reduced if you owe past-due child support payments.

| Federal or State Debt | |

| Protected | Not protected |

If you are claiming the payments as part of your 2020 tax refund , the payments are no longer protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . In other words, if you receive your first or second stimulus checks as part of your tax refund instead of direct checks, it may be reduced.

What If My Mailing Address Changed Since I Received My Previous Stimulus Checks How Will I Get My Third Stimulus Check

If you are expecting to receive your third stimulus check by mail, it will be mailed to the last address you filed with the IRS. If your address has changed since then, there are different options you can take to make sure your stimulus check gets to you:

Option 1: File your 2020 federal tax return to update your address. If you havent filed your 2020 tax return yet, this is an easy way to update your address. File a tax return with your current address and your payment will be sent through the mail once the IRS receives your updated address.

Option 2: Provide your banking information in the IRS Get My Payment tool. If the post office was unable to deliver your stimulus check, it will be returned to the IRS. Two to three weeks after the payment has been issued, Get My Payment will display the message Need More Information. You will have the option to have your payment reissued as a direct deposit by providing your banking information.

If you dont provide your banking information, the IRS will mail your payment once your address is updated.

Option 3: Notify the IRS that your address has changed by telephone, an IRS form, or a written statement. It can take 4-6 weeks for the IRS to process your request.

Recommended Reading: How To Check On Stimulus Payment For Non Filers