Why Else Havent You Received Your Stimulus Check

Aside from someone stealing the document and cashing it out, there are other reasons you may not have received your Economic Impact Payment. Here are some of them:

1. Youve recently changed your bank account

Sometimes, the IRS directs the stimulus check payments to your bank account. However, if youve recently switched banks, the organization may not have your details on file yet.

In this case, itll mail you a debit card or paper check. You may have to wait a few weeks to receive it.

2. You didnt file tax returns for 2019 and 2020

The IRS didnt require everyone to file their 2019 and 2020 tax returns. So, if you didnt do so, the IRS doesnt have the data to determine if youre eligible to receive a third stimulus check. It also cant calculate how much youll have to receive.

Youll likely receive the amount as a recovery rebate credit on your 2021 tax return when this happens.

All You Need To Know Is Yourself

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

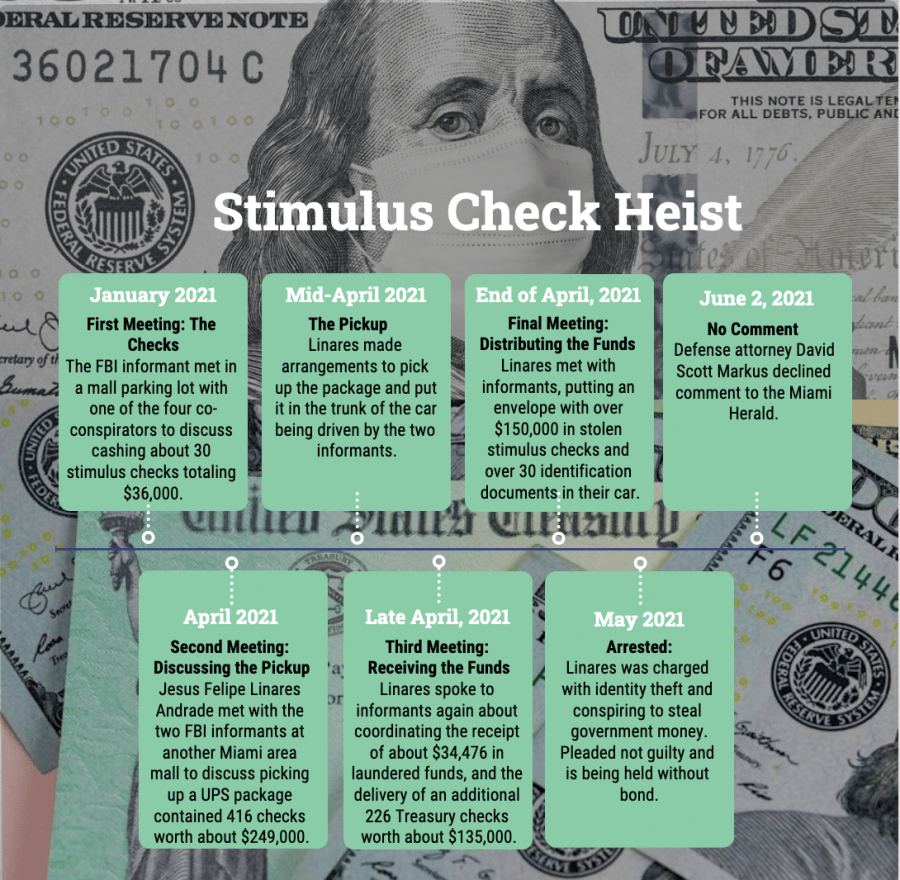

Stolen Stimulus Checks Creating Concerns For Consumers

HomeHelp CenterStolen Stimulus Checks Creating Concerns for Consumers

In May 2020, many consumers did not receive their stimulus check, leaving some wondering why. The Identity Theft Resource Center saw a sharp increase in stolen stimulus check cases. Now, the second round of checks is being sent out as part of a new stimulus package. Once again, the ITRC has seen a rise in people reaching out to the non-profit over stolen stimulus checks.

Not everyone who believes they had their stimulus check stolen finds that to be the case. In fact, there are a handful of reasons why people could still be waiting. With that said, some are legitimately stolen.

In May, during the first wave of payments, the Federal Trade Commission reported that some stolen stimulus checks appeared to be from nursing home residents. Nursing homes in several states made residents sign over their stimulus checks. Other cases involved people committing physical mail theft, like this New York man who stole over $12,000 worth of stimulus checks. Some thieves went as far as stealing stimulus checks from postal trucks. The Chicago metro saw multiple postal trucks get broken into in April 2020.

No matter how stimulus checks are being stolen, it can be a headache for consumers and something law enforcement works to stop. If someone believes they are the victim of a stolen stimulus check, they should report it to the FTC and the IRS.

- Victims of a stolen stimulus check can go to IDTheft.gov and click Get Started

Also Check: How Can I Check For My Stimulus Payment

Send To Irs Mailing Address

Look on the front of the Treasury check to find the name of the city that determines the appropriate IRS mailing address. The name of a city, or its abbreviation, should be printed at the bottom of the check in front of the words, TAX REFUND. If the Treasury check is for a purpose other than tax refund, note that in your letter.

The IRS document, Topic 161 Returning an Erroneous Refund Paper Check or Direct Deposit located on the agencys website, lists the nine city names and the corresponding mailing addresses. You may also call the IRS at 1-800-829-1040, and ask for the correct mailing address for returning the expired check.

Recommended Reading: Did The Fourth Stimulus Package Pass

What To Do If Someone Steals Your Stimulus Check

Many people experience losing items in the mailsomeone may have misplaced, destroyed, or stolen them. This usually occurs in Amazon and eBay deliveries, which can be extremely frustrating. However, when it happens to your stimulus check, it can be devastating.

Criminals are smarter nowadays and can employ many ways of stealing your stimulus check. If you think someone else has claimed it, it pays to know what to do and how to protect yourself.

We know that stimulus checks are highly valuable, and you wouldnt want to lose the money forever. So, weve checked official government sources for the steps to take if you think someone has stolen them.

We also uncovered some tactics that criminals use to steal stimulus checks. If you want to learn the critical ways to avoid losing your money, read on to learn more.

You May Like: How Do I Get The First Stimulus Check

Mining For Pii Exposed During Recent Data Breaches

Banks, credit bureaus, and major tax preparation sites are hot targets for cybercriminals. These data breaches expose your personal information that scammers can use to commit identity theft and steal your tax refund.

The number of data breaches increased 68% from 2020 to 2021 , meaning thereâs a good chance your personal data has been exposed.

Why Havent I Gotten My Money Yet

Here are some common reasons why you may not have gotten your payment yet:

-

The IRS does not have your current address on file

-

The IRS does not have current banking/direct deposit information

-

The IRS does not know you or your dependents qualify because they have no records for you

-

Someone else claimed you or your children as a dependent

-

You have a designated payee

Also Check: California Stimulus 2022 When Will It Come

Postal Officials Urge Vigilance As Millions Of Payments Hit Mailboxes

Two New York City police officers in an unmarked vehicle spotted 31-year-old Feng Chen behaving suspiciously early one morning last month. The Brooklyn man was walking in and out of buildings in the borough’s Sunset Park neighborhood, carrying what looked like mail.

When an officer approached Chen, he discarded mail on the sidewalk. As the officers questioned him, they spotted more mail bulging from his jacket pocket.

AARP Membership $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

A search uncovered nine stolen Treasury Department stimulus checks worth more than $12,000, according to a criminal complaint. Other checks and credit cards also were recovered from the loot, the complaint said.

Chen was busted April 28, charged a day later with theft or receipt of stolen mail, and is staring at a maximum sentence of five years in prison. His federal public defender, Jan Alison Rostal, said she could not comment as the case is pending. While searching a New York Police Department database, the cops found a bench warrant for Chen from Manhattan, stemming from a prior case involving identity theft.

What If I Dont Have An Address

Shelters and other service providers, such as health care clinics and drop-in day centers, may allow you to use their address for tax purposes. Other agencies that offer homeless prevention services like a Community Action Agency or Salvation Army are also options. If you are not staying in a shelter or cannot find a service provider nearby, you can also use a trusted relatives or friends address. The IRS will deliver checks to P.O. boxes.

Recommended Reading: How Many Stimulus Checks Have Been Issued In 2021

What To Do If Your Third Stimulus Check Is Lost Stolen Or Destroyed

If your third stimulus check is lost in the mail, or something else happens to it before you get it, you can ask the IRS to trace your payment. Here’s how it works.

It’s bad enough if a new sweater you ordered on Amazon gets lost in the mail but you’re really going to get mad if the post office loses your $1,400 stimulus check. What do you do then? Or what happens if your bank never receives your direct deposit stimulus payment from the IRS? Are you going to lose that money?

Fortunately, the IRS has a procedure to help. If your third-round stimulus payment is lost, stolen or destroyed, you can ask the IRS to perform a “payment trace” to see if your check was cashed or direct deposit misdirected. Ultimately, if everything goes smoothly, you’ll be issued a new payment. That’s the good news.

But there’s some less than thrilling news, too. First, you have to wait a certain period of time before starting the process, and then it’s going to take some time. So, you won’t get your stimulus money right away. Second, as with any government request, there’s a healthy list of procedures you must follow. Slip up on one of the steps, and you could find yourself in a bureaucratic black hole. But don’t worry. While dealing with the IRS can be intimidating, we’ll help you get through the process.

What Should I Do

Before you ask for a refund trace

If you asked for a direct deposit refund, double check the bank account information you provided to the IRS to be sure there were no mistakes on your tax return. The IRS assumes no responsibility for errors by you or your preparer. You should also check with your financial institution to make sure the mistake hasnt been at their end.

The Protecting Americans from Tax Hikes Act made the following changes, which became effective for the 2017 filing season, to help prevent revenue loss due to identity theft and refund fraud related to fabricated wages and withholdings:

- The IRS may not issue a credit or refund to you before February 15, if you claim the Earned Income Tax Credit or Additional Child Tax Credit on your tax return.

- This change only affects returns claiming EITC or ACTC filed before February 15.

- The IRS will hold your entire refund, including any part of your refund not associated with the EITC or ACTC.

- Neither TAS, nor the IRS, can release any part of your refund before that date, even if youre experiencing a financial hardship.

When can I ask the IRS to trace my refund?Direct deposit: The IRS generally direct deposits refunds within 21 days after receiving your tax return. If you dont receive your deposit within five days after the 21 days have passed, you can request a refund trace.

Paper check: If you dont receive your refund check within six weeks of mailing your tax return to the IRS, you can request a refund trace.

Also Check: Irs Stimulus Payments Phone Number

What Is A Payment Trace And How Do I Request One

A payment trace will show whether a check was cashed. It may not show what happened to your direct deposit or prepaid debit card, but requesting a payment trace will help prove to the IRS that you never received your payment.

Requesting a payment trace wont mean you get your stimulus payment sooner, howeverthe IRS cant reissue your payment, but you will be able to claim the Recovery Rebate Credit on your 2020 tax return.

If you file your 2020 tax return before the payment trace is complete, the IRS recommends you claim the missing amount via the Recovery Rebate Credit when you file. You may receive a notice saying your Recovery Rebate Credit was changed, but that adjustment will be made after the trace is complete and the IRS determines whether or not your payment has been cashed. You wont need to take any additional action to receive the credit.

Instructions for requesting a payment trace can be found on this IRS webpage, under Q F3.

Will I Get An Economic Impact Payment

If you meet the following four requirements, you likely qualify for the stimulus.

1. Income Limits: If you are filing as single with an adjusted gross income up to $75,000, married filing jointly with an AGI up to $150,000, or head of household with an AGI up to $112,500, you will receive the full payment. Above these income limits, the payment amount decreases 5 percent for every additional $100 of income up to $99,000 for a single adult, $136,500 for head of household, and $198,000 for a married couple.

If you have zero income you can still get the payment.

2. Age requirements: There is no age requirement for the stimulus check, however you cannot be someone elses dependent. Children must be under 17 to get the additional payment for them.

3. Taxpayer Identification Number :At least one tax filer must have a valid Social Security number . If you are married filing jointly, and one spouse has an SSN and one has an Individual Taxpayer Identification Number , the spouse with an SSN and any children with SSNs or an Adoption Taxpayer Identification Number can get the payment. If one spouse is an active member of the military, then both spouses are eligible for a stimulus check even if only one spouse has an SSN and the other spouse has an ITIN.

4. Citizenship or Residency: You must be a U.S. citizen, permanent resident, or qualifying resident alien.

You May Like: How To Apply For Homeowner Stimulus Check

Missing Economic Stimulus Payment

If your economic stimulus payment was supposed to be issued by direct deposit, the first thing to do is to check with your credit union or bank and make sure they didn’t receive a deposit from the government.

Next, you can request a payment trace on your payment if you received Notice 1444, or if the Internal Revenue Service’s Get My Payment site shows your payment was issued on a specific date, but you have not received it. IRS Notice 1444 is an official government letter you should have received confirming that your CARES Act stimulus payment has been approved and automatically deposited into your account. A trace on an Economic Impact Payment follows the same process as a trace on a tax refund, and to launch a trace, submit IRS Form 3911.

If you should have received a check or debit card and it is missing, first check its status on the IRS Get My Payment site if the Get My Payment site says you’re receiving a check, be aware that your payment may instead come as a debit card. If your payment was sent by checkor debit card, and it was either lost, stolen or destroyed, then you should still request a payment trace. For questions about Economic Impact Payments, you may check this IRS site or call the IRS stimulus check phone number at 919-9835.

Consider Taking The Following Actions

-

Contact any of the three credit reporting agencies and ask that a free fraud alert be placed on your credit report. Also ask for a free credit report. You only need to contact one of the three agencies because the law requires the agency you call to contact the other two.

-

TransUnion 1-888-909-8872

Once you have a fraud alert on your credit report place, a business must verify your identity before it issues new credit in your name. The alert remains active for a year and can be renewed by you for up to seven years.

-

Change the passwords, pin numbers, and log in information for all of your potentially affected accounts, including your email accounts, and any accounts that use the same password, pin, or log in information.

-

Contact your police department, report the crime and obtain a police report.

-

Go to the webpage of the Federal Trade Commission, report the ID theft and create an identity theft recovery plan: IdentityTheft.gov

A security freeze is different from a fraud alert. Once your report is frozen, the credit reporting agency cannot release it without your prior express approval . Under federal law, a security freeze is free, and obtaining one will not affect your credit score. To obtain a freeze, you must contact each of the credit reporting agencies and comply with their requirements. The agency must place the freeze within one business day, and if you request the freeze be lifted, they must do so within one hour. Learn more at their websites below:

Don’t Miss: Who Can Take Your Stimulus Check

How Much Does It Cost To Get A Rush Card

Find details and conditions for all fees and services in the cardholder agreement. RushCard ® Prepaid Visa ® Card is issued by MetaBank ®, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Card is serviced by Green Dot Corporation. A one-time fee of $3.95 or $9.95, depending on the plastic design you request for your Card.

What To Do If Your Stimulus Check Is Missing

The following instructions only apply if youve gotten confirmation that your payment has been sent, either from the Get My Payment tracker or through Notice 1444 in the mail .

If you arent sure whether youre eligible for a payment or if you need to take action to get one , check out this IRS FAQ.

If you havent been able to confirm that your payment has been sent using Get My Payment, try these nine hacks for tracking your check.

However, if you have confirmed that your payment has been sent and you still havent received it, youll need to initiate what the IRS calls a trace on your payment. But wait! You may need to give the IRS more time, especially if youre getting a paper check. You should only initiate a trace in the following situations:

- Direct deposits: More than five days have passed since the scheduled delivery.

- Paper checks: The check was mailed more than four weeks ago.

- Paper checks with a forwarding address: The check was mailed more than six weeks ago.

- Paper checks with a foreign address: The check was mailed more than nine weeks ago.

Keep in mind that if your check was sent to a bank account youve closed, the bank will reject the deposit and return it to the IRS. The IRS will usually process a paper check for you within two weeks, so you probably dont need to take further action.

You May Like: Second Stimulus Check Update 2020

You May Like: Check Status Of 4th Stimulus Check