Where Is My Second Stimulus Check

All second stimulus checks were issued by January 15, 2021. If you didnt get a second stimulus check by then , you can claim your second stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

You can request a trace of your stimulus check. You should only request a payment trace if you received IRS Notice 1444-B showing that your second stimulus check was issued or if your IRS account shows your payment amount and you havent received your second stimulus check.

Learn more about requesting a payment trace here.

Who Is Eligible For The Recovery Rebate Credit 2021

Single filers who had incomes between $75,000 and $80,000 in 2020 but had lower incomes in 2021 married couples who filed a joint return and had incomes between $150,000 and $160,000 in 2020 but had lower incomes in 2021 and head of household filers who had incomes between $112,500 and $120,000 in 2020 but had lower

Recommended Reading: Social Security Stimulus Checks Update

I Need Help Buying Food

I need help buying food.

There is extra money available for food. Find your states SNAP program.

or call: 221-5689

I have kids.

Start accessing this money by filing your taxes with the IRS.*

Read Also: Recovery Rebate Credit Third Stimulus

Was There A Third Stimulus Check

The vast majority of the third stimulus payments were automatically delivered to taxpayers bank accounts or via a check in the mail last spring. The payments were authorized by the American Rescue Plan in March 2021 and were meant to help people struggling financially because of the Covid-19 pandemic.

Q How Will I Get My Third Stimulus Check If Im An American Living Overseas

A. There are two ways overseas Americans can get their third stimulus payment: Direct deposit or through the mail.

You should get your check via direct deposit if you received your latest tax refund through direct deposit or if the IRS has your direct deposit info from the last round of stimulus checks and you havent filed yet this year.

You need to have an account with a U.S. bank in order to get direct deposit.

We recommend you update your address if you:

- Dont know what address is on file

- Have moved to a different address

- Want your check sent somewhere other than the address they have on file

In addition to Form 8822, Change of Address, you may be able to update your address via phone, through a written statement, or on your tax return. You can see the IRS most up-to-date address change info on the IRS website.

Q. What happens if I live abroad and my direct deposit payment is returned by my U.S. financial institution?

A. Once your payment is returned, the IRS will issue your payment by mail as a check or U.S. Treasury-issued debit card. Typically, IRS will reissue the payment by mail within two weeks. Once the payment is reissued, the IRS Get My Payment tool will update to reflect your payment status.

Q. What if my third stimulus check was for the wrong amount?

A. If you didnt receive the full amount of the third payment you were owed , there are two times when you may receive additional stimulus money:

You May Like: Are There Any Stimulus Checks Coming

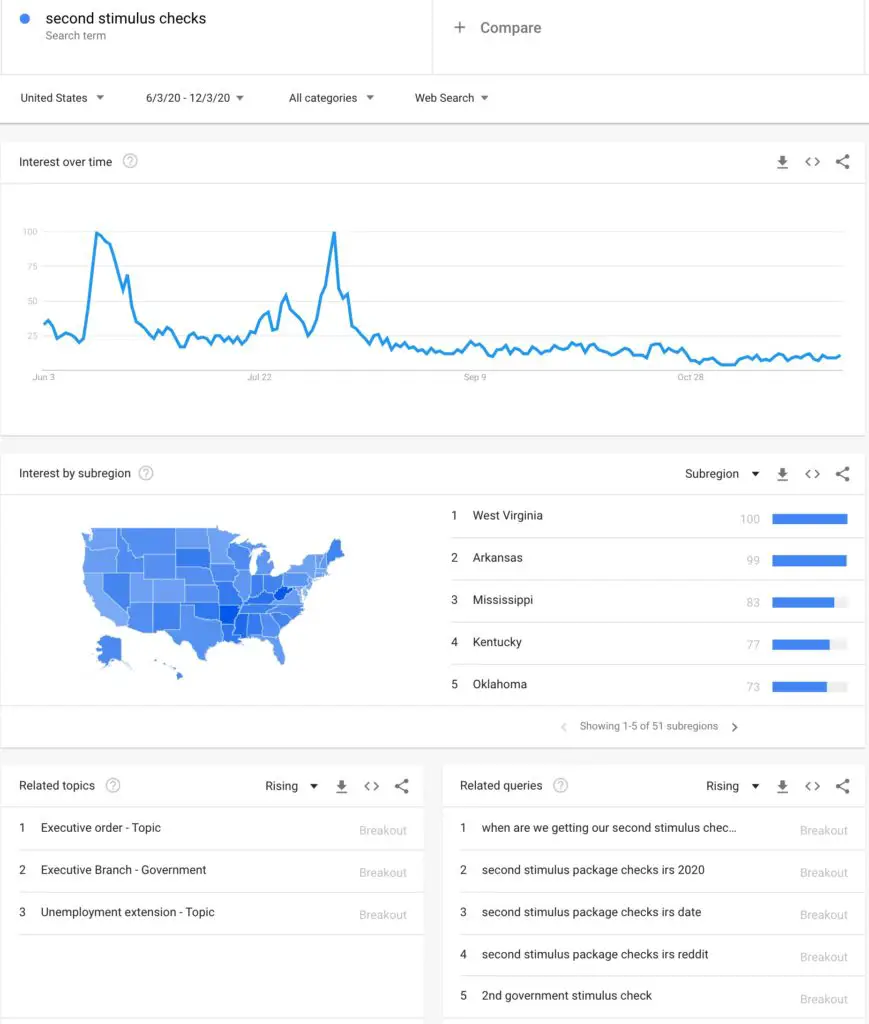

Will There Be A Second Round In May

It has become a common question if there will be a second round of stimulus checks in the month of May, as $1,200 might not cover the expenses for people who have lost their jobs or have faced additional financial obstacles in the past weeks.

Financial technology firm SimplyWise found that 63% of Americans will require a second stimulus check within the next three months to pay bills. Congress is working on a follow up to its first relief bill that should be completed by 4 May. With this information, the House could push to enact a second round of stimulus checks, or even a monthly payment system.

We could very well do a second round of direct payments, President Donald Trump said while answering press questions earlier this month. It is absolutely under serious consideration.

Also Check: Will I Get A Stimulus Check

Stimulus Checks: Direct Payments To Individuals During The Covid

GAO-22-106044

The federal government made direct payments to individuals totaling $931 billion to help with COVID-19. However, it was challenging for the IRS and Treasury to get payments to some people.

We found that nonfilers , first-time filers, mixed immigrant status families, and those experiencing homelessness were among those likely to have trouble receiving these payments in a timely manner.

We recommended that Treasury and the IRS tailor their outreach efforts to educate such people about their eligibility for these payments.

In 2020 and 2021, IRS and Treasury issued $931 billion in direct payments to individuals to ease financial stress due to the COVID-19 pandemic. However, some eligible Americans never received payments. We made recommendations to strengthen Treasury and IRSs outreach and communications efforts for the billions of dollars in similar tax credits IRS administers, such as the Earned Income Tax Credit.

You May Like: How Much 2021 Stimulus Check

Don’t Miss: Who Qualified For Stimulus Checks In 2021

Irs Statement About Second Economic Impact Payments

The IRS updated the Get My Payment tool with information related to the second round of Economic Impact Payments. There is currently heavy demand on the tool given the large number of payments going out and people using the tool.

While the IRS has been able to deliver the second round of Economic Impact Payments in record time, we understand there are many questions and we appreciate everyone’s patience during this period.

Here are answers to some common questions coming up related to Get My Payment and the second round of Economic Impact Payments.

I Didn’t Receive A Direct Deposit Yet Will I Get A Second Economic Impact Payment

Maybe. IRS updated Get My Payment on January 5, 2021 for individuals who are receiving the second Economic Impact Payment. Please review additional developments taking place that could impact your payment. If you checked GMP on or after January 5 and:

- GMP reflects a direct deposit date and partial account information, then your payment is deposited there.

- GMP reflects a date your payment was mailed, it may take up to 3 4 weeks for you to receive the payment. Watch your mail carefully for a check or debit card.

Because of the speed at which the law required the IRS to issue the second round of Economic Impact Payments, some payments may have been sent to an account that may be closed or, is no longer active, or unfamiliar. If the second Economic Impact Payment was sent to a temporary account that is closed or is no longer active, the IRS is currently working with our tax industry partners on options to potentially get these payments to individuals as quickly as possible. More information will be shared when available. The IRS advises people that if they don’t receive their Economic Impact Payment, they should file their 2020 tax return electronically and claim the Recovery Rebate Credit on their tax return to get their payment and any refund as quickly as possible.

You May Like: Can I Still Get Stimulus Check

What If I Am Eligible For The Stimulus Checks But I Didnt File A 2019 Or 2020 Tax Return And Didnt Use The Irs Non

File your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

You can file a tax return even if you dont have a filing requirement to get other tax credits, such as the Earned Income Tax Credit.

If you didnt get your first or second stimulus check or didnt get the full amount that you are eligible for, file a 2020 federal tax return and claim them as part of your tax refund or use GetCTC.org if you dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2021.

Dont Miss: How Many Stimulus Checks Did We Get In 2020

How Is My Second Stimulus Check Calculated

The IRS relies on your tax return to calculate whether you qualify for the second stimulus check. So your eligibility was based on your 2019 tax returns, which you filed by July 15, 2020.

According to the text released by Congressional leaders, the COVID-19 relief bill notes those with an adjusted gross income over certain limits receive a reduced amount of money, with the checks phasing out entirely at higher incomes.

Your AGI is calculated by subtracting the deductions that you made during the tax year from your gross income .

Heres a quick breakdown of the AGI limits for the $600 stimulus checks:

- Single filer checks begin to phase out at AGIs above $75,000.

- Head of household checks start getting phased out at incomes over $112,500.

The IRS reduces stimulus payments by 5% for the total amount that you made over the AGI limit. This means that for every $100 that you make over the limit, your check goes down by $5. At high enough incomes, the checks phase out entirely. So if you earned over $87,000 as an individual taxpayer, $174,000 as a joint filer, or $124,500 as a head of household, you do not get a stimulus payment. The following calculator allows you to calculate your benefit amount:

This second round of stimulus checks is currently half the maximum amount of the first stimulus checks that were included in the CARES Act in March.

Also Check: Where Is My $600 Dollar Stimulus Check

Who Is Eligible For The Second Stimulus Check

Eligibility is primarily based on four requirements:

1. Income: The income requirements to receive the full payment are the same as the first stimulus check.There is no minimum income needed to qualify for the payment. Households with adjusted gross income up to $75,000 for individuals will receive the full payment. This stimulus payment starts to phaseout for people with higher earnings. The second stimulus check maximum income limit is lower than the first stimulus check. Single filers who earned more than $87,000 in 2019 are ineligible for the second stimulus check.

View the chart below to compare income requirements for the first and second stimulus checks.

| Income to Receive Full Stimulus Payment | First Stimulus Check Maximum Income Limit | Second Stimulus Check Maximum Income Limit |

| Single Filer | ||

| $136,500 | $124,500 |

2. Social Security Number: This requirement differs from the original eligibility for the first stimulus check. Originally under the first stimulus check, if you were married filing jointly, both spouses needed valid Social Security numbers . If one spouse had an Individual Taxpayer Identification Number , then both spouses were ineligible for the stimulus check. For married military couples, the spouse with an SSN could still get the stimulus check for themselves but not the other spouse with an ITIN.

Examples

Former first stimulus check rules:

Second stimulus check rules:

Former first and second stimulus check rules for military filers:

What Else Is Idme Used For Besides Setting Up An Irs Account

ID.me is an identity-proofing company launched in 2010 to support the US military in verifying the identity of service members. It was approved by the federal government as a credential service provider in 2014 and has since been used by a number of government agencies. The IRS launched a pilot program for ID.me in 2017 and has expanded the service greatly since.

Along with verifying identity for the IRS, ID.me is used by 27 states to access unemployment benefits and other programs, more than 500 retailers and federal agencies such as Social Security and Veterans Affairs. Once you have confirmed your identity with ID.me, you will have access to all of the state and federal online services that use it.

Read Also: Extra Stimulus Money For Social Security Recipients

I Used The 2020 Irs Non

Most likely, the IRS wasnt able to process your 2019 tax return or the information you submitted to the IRS Non-filer tool in time to issue your second stimulus check.

All second stimulus checks were issued by January 15, 2021. If you didnt get a second stimulus check by then , you can claim your second stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

Second Round Of $1200 Stimulus Checks Could Arrive In Five Groups Heres Which One You Are In

- 10:54 ET, Dec 4 2020

AS talks over the next relief package continues to gain momentum, there is still hope for a second round of stimulus checks.

If more checks are included in the package, the $1,200 payments could arrive in five groups.

Like the first round of checks, the IRS will likely follow the same procedure and send out checks by priority groups.

Here are the five IRS groups and find out which one you are in:

The five stimulus check payment groups we know about now

When the first round of checks were sent out during the spring, the IRS built a system and procedure to figure out who was owed a check and for how much.

The formula helped determine the size of your household’s total sum, but the schedule for sending checks may have felt deliberate to some.

Under the pressure to get out stimulus money fast, the IRS placed individuals under five different groups:

Direct deposit recipientes: People who already have their direct deposit information on file with the IRS or who provide that info when and if registration opens again should be first in line to receive a stimulus check.

Social security beneficiaries: With the first stimulus payment, many Social Security beneficiaries who had direct deposit information on file with the federal government received checks in the first week, though not always the first day.

People who receive their paper checks : The IRS began to mail checks about a week later to those without direct deposit data on file.

Also Check: Third Round Of Stimulus Check

What Comes Next

Congressional debates about a fourth stimulus check have all but evaporated, but some groups are still fighting for more direct stimulus relief for American families.

A new Omicron variety has led to an increase in vaccinations, with the US now distributing the third dosage to persons aged 16 and older.

Although the countrys economy has been disrupted, the relaxation of limitations has helped local and national enterprises recover from the epidemic. Businesses are still having difficulty finding enough workers despite the recent drop in unemployment. Two years after the epidemic began, the good news isnt good news for those who are still battling to lift their heads above water.

Recommended For You

How Do I Get It

- The stimulus payments will be processed by the IRS.

- If you have already filed a 2019 tax return, you will get the stimulus payment automatically. You will receive it in the same form as your tax refund. If you requested direct deposit, then the stimulus will be direct deposited. If you requested a paper check, then the stimulus will be mailed to the same address on your 2019 tax return.

- If you entered your information into the IRS non-filer portal earlier in 2020, you will get the stimulus payment automatically. You do not have to do anything.

- If you receive one of the following benefits, you will get the stimulus payment automatically. You do not have to do anything.

- Social Security

Don’t Miss: Recovery Rebate Credit Second Stimulus

How Much Money Will I Get

- Adults whose adjusted gross income is less than $75,000/year will get $1,400 for each adult, plus $1,400 for each dependent no matter how old they are. This applies to heads of households who make less than $112,500, as well.

- The IRS will use income information from your 2020 tax return if they received that return before sending your money. Otherwise they will use information from your 2019 tax return.

- If the IRS sends your payment based on a 2019 return and then your 2020 return says you qualify for more , they will send an additional payment to make up for the difference. To get the additional payment, you must file the 2020 tax return by 90 days from the filing deadline or September 1, 2021, whichever is earlier.

What Information Will You Need

To access the tool, youll be asked to provide a:

- Street address and

- Five-digit ZIP or postal code.

If you file a joint tax return, either spouse can typically access the portal by providing their own information for the security questions used to verify a taxpayers identity. Once verified, the same payment status is shown for both spouses. In some cases, however, married couples who file a joint tax return may get their third stimulus payment as two separate payments half may come as a direct deposit and the other half will be mailed to the address the IRS has on file. If that case, each spouse should check the Get My Payment tool separately using their own Social Security number to see the status of their payments.

If you submit information that doesnt match the IRSs records three times within a 24-hour period, youll be locked out of the portal for 24 hours . Youll also be locked out if youve already accessed the system five times within a 24-hour period. Dont contact the IRS if youre shut out. Instead, just wait 24 hours and try again.

You May Like: Will There Be Another Stimulus Check In California